The significance and role of the BCC in the system of budget regulation

The use of KBK budget classification codes is carried out on the basis of instructions approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

The instructions establish the structure, principles of purpose, general requirements for the procedure for the formation and application of the CBC and are mandatory for everyone. The instructions contain a budget classification of income, expenses and sources of financing of various budgets of the Russian Federation, which is used for maintaining budget accounting, generating budget and other reporting and includes the classification:

- budget revenues;

- budget expenditures;

- sources of financing budget deficits.

The codes of operations of the general government sector are enshrined in Order of the Ministry of Finance No. 209n dated November 29, 2017.

Budget revenues are replenished, among other things, by taxes and similar payments. They are quite varied, but each is assigned its own separate budget classification code, with the first three digits of the code indicating the payment administrator. The most common administrator code is 182, code of the Federal Tax Service of the Russian Federation.

How to fill out a payment order

Document number and date of preparation

Follow chronology when creating payment orders

Specify the type of payment transfer (by mail, electronically, telegraph) or leave the field blank if another type of data transfer is used

Amount (in words and numbers)

Write the amounts in words and numbers in the columns accordingly

Fill in the full name of the organization (maximum 160 characters)

Payer's personal account

Enter the twenty-digit number of a current personal account opened with a credit or financial institution

We fill in the full name of the banking, credit or financial organization in which the current personal account is opened

Bank identification code, fill out in accordance with the “BIC of the Russian Federation Directory”

Indicate the bank's correspondent account number, if available.

Recipient information block

Fill in the same information about the recipient, his bank and personal account

We put “01”, the value for this column is constant, approved by the rules of accounting in credit and banking companies in Russia

Leave these fields blank; specific instructions from the bank are required to fill out this information.

We indicate the order in accordance with the norms approved by civil legislation (Article 855 of the Civil Code of the Russian Federation)

You should enter the payment UIN if it is assigned for a specific type of transfer. If the organization pays independently, and not according to the stated requirement, then write “0”

Here, indicate for what and on what basis (documentation) the payment is made. The accountant can indicate the deadlines for fulfilling obligations under the contract or the deadlines for paying tax obligations, if necessary. Or establish a legislative reference establishing the basic requirements for carrying out calculations

Enter the TIN of the payer (60) and recipient (61) in these fields

Specify the checkpoint of the payer organization (102) and the recipient organization (103)

The block of fields 104–110 is filled in ONLY when transferring payments to the budget system of the Russian Federation and extra-budgetary funds

We fill it out only when making payments to the budget or customs duties (fees). The rules for filling out this detail are given in Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2018 No. 107n

We register the BC code in accordance with Order of the Ministry of Finance No. 132n dated 06/08/2018. Read more about the new BCC in the topic “Changes to the BCC since 2019: what is important for public sector employees and NPOs to know.”

Specify the code in accordance with the current OKTMO classifier. You can check the codes at the Federal Tax Service

The grounds are listed in paragraphs 7 and 8 of Appendix No. 2 of Order of the Ministry of Finance dated November 12, 2018 No. 107n, you need to enter the appropriate code:

- “TP - payments of the current year;

- “ZD - voluntary repayment of debts for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority;

- “BF - current payment of an individual - bank client (account holder);

- “TR - repayment of debt at the request of the tax authority;

- “RS – repayment of overdue debt;

- “OT - repayment of deferred debt;

- “RT - repayment of restructured debt;

- “PB - repayment by the debtor of debt during the procedures applied in a bankruptcy case;

- “PR - repayment of debt suspended for collection;

- “AP - repayment of debt according to the inspection report;

- “AR - repayment of debt under a writ of execution;

- “IN - repayment of investment tax credit;

- “TL - repayment by the founder of the debtor of debt during the procedures applied in a bankruptcy case;

- “ZT is the repayment of current debt during the procedures applied in a bankruptcy case.

If “0” is indicated in detail “106”, tax authorities will attribute the received money to one of the above grounds, guided by the legislation on taxes and fees

Indicate the period in which the employee incurred taxable income. When transferring personal income tax on vacation and sick pay, in this field you must indicate the month on which the day of their payment falls.

For example, “MS.02.2019”, “KV.01.2019”, “PL.02.2019”, “GD.00.2019”, “04.09.2019”

Indicate the number of the claim or other document on the basis of which we make the payment, with a brief explanation of the type of document (TR - demand, RS - decision on installment plan, etc.)

Enter the number of the document that is the basis (for example, an agreement)

This field is not required. Exception: transfer of fees for 2014 and previous periods

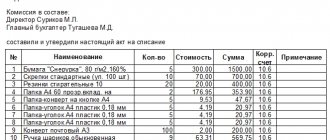

The finished document must be certified by the signatures of the head and chief accountant, as well as the seal of the institution.

KBK in payment in 2020

What is income for the budget, for taxpayers is payment to the state treasury of taxes and equivalent payments and insurance premiums (except for “injuries”). Therefore, each of them first goes to the accounts of the territorial body of the Federal Treasury and is classified there on the basis of the BCC.

For any taxpayer or tax agent, regardless of its organizational and legal form, it is very important to correctly fill out a payment order, since errors, for example, incorrectly filling out this field in a payment order, can lead to money being credited to the “wrong address.” The Federal Treasury may classify it as “unclarified.” This means that the payer has an unpaid obligation to the state, i.e., outstanding arrears, penalties, fines and other sanctions from the state, in this case to the payment administrator. This can be avoided if you indicate the budget classification code correctly.

Order No. 245n dated November 30, 2018, which amended the current guidelines for the application of the BCC, contains new budget classification codes:

- excise taxes New budget classification codes have been introduced for dark marine fuel, petroleum raw materials for refining, state duties for issuing excise stamps, etc.;

- a new BCC for a single tax for individuals on professional income, a fee introduced for self-employed citizens;

- codes for paying taxes on additional income from the production of hydrocarbons, calculated according to the norms of Art. 333.45 Tax Code of the Russian Federation.

Settlements by payment orders

Payments are used to settle accepted obligations and more. The following options are available for public sector employees:

- Payment of obligations to suppliers and contractors, advance payments are acceptable. Indicate the exact details of the accounts and agreement in the assignment. Do not fill in fields 104–110 and 101 and 22. Be sure to indicate VAT in the cost of goods, works, services, and if it is missing, write “Without VAT”.

- Payments for loans and borrowings in banking and financial institutions. Enter the details of the agreement (loan agreement) in field 24. Do not fill in fields 104–110, 101, 22.

- Transfers of wages, advances, vacation pay and benefits to employees of a budgetary institution. Pay attention to filling out the queue (cell 21), for salary indicate “3 (Article 855 of the Civil Code of the Russian Federation). The transfer deadlines specified in the collective agreement must be observed. Leave fields 22, 101, 104–110 blank.

- Advances for travel expenses for employees. Indicate the number of the basis document (estimate) in the purpose of payment. Do not fill in the fields to clarify tax payments.

- Transfer of insurance premiums, taxes, fees. Check that fields 104–110 of the form are filled out correctly. The BCC can be clarified with the Federal Tax Service or the Social Insurance Fund (for payments for injuries).

Let's look at the features of transferring taxes and insurance premiums using examples.

Insurance premiums

From 01/01/2017, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. To pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

Payment order details for OPS (20%) for June 2020:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

Corporate income tax

Sometimes it is necessary to distribute one tax at appropriate rates across different budget levels: federal and regional, for example, on profit.

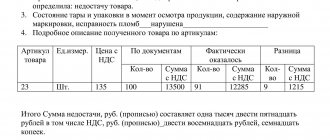

Suppose you need to pay tax in the amount of RUB 20,000.00 in 2020. (tax base amounted to RUB 100,000.00).

To do this, you need to generate two payment orders:

- to the federal budget the amount will be 3% - 3000.00 rubles;

- to the budget of a constituent entity of the Russian Federation - 17%, that is, 17,000.00 rubles. in the example.

Each budget level has its own budget classification code:

- to the federal budget - 182 1 0100 110;

- to the budget of a constituent entity of the Russian Federation - 182 1 0100 110.

Field code 104 of the order for the federal budget will contain the corresponding cipher.

For the regional one it will be different.

Current codes for corporate income tax on income received in the form of interest on bonds of Russian companies issued during the period 01.01.2017-31.12.2021.

KBK is the main type of data in field 104. What it should look like

BCC recorded in field 104 must be:

- 20-digit;

- identifying the administrator of budget income (the first 3 digits are responsible for this), income group (4th digit), type of income (5th and 6th digits), article and sub-item of income (7–11th digits), level the budget into which the income is credited (12th and 13th digits), the method of collecting income (14–17th digits), the economic type of income (18–20th digits).

If you provide KBK payments of a different structure in the corresponding details, the field will be considered filled in incorrectly.

We will consider the legal consequences of indicating an incorrect BCC a little later, but for now we will study the main sources of law that approve budget classification codes.

Payment of tax by an individual

Any citizen (payer) is forced to understand the CBC. This will be required to pay taxes such as land tax and personal property tax.

The basis for payment is a tax notice sent by the tax authority (clause 4 of Article 397 of the Tax Code of the Russian Federation). However, each payer must check whether the details are correct, including the budget classification code.

The KBK is incorrectly indicated on the payment slip: what to do?

Let us turn to clause 7 of Art. 45 of the Tax Code of the Russian Federation. If an error is discovered in the execution of a document for the transfer of a tax or other obligatory payment to the budget system, but no debt has been incurred for this tax, the taxpayer has the right to submit a free-form statement to the tax authority at the place of his registration that an error has been made. The application must be accompanied by documents confirming payment of the tax (i.e., transfer to the accounts of the Federal Treasury), with a request to clarify the details of the specified payment: its basis, type and affiliation, tax period or payer status. We wrote about this in detail in an article on how to offset or return overpayments on taxes.

What income code should I indicate on payments?

From June 1, 2020, in payments for salary transfers you must indicate one of three codes - Instruction of the Central Bank of the Russian Federation dated October 14, 2019.

| Code | Type of income |

| 1 | Salary, remuneration under a contract, bonuses, vacation pay, sick leave and other payments for which there are restrictions on deductions. |

| 2 | Child benefits, maternity benefits, alimony, daily allowances and other payments from which debts are not allowed to be withheld. |

| 3 | Compensation for damage to health and payments to victims of radiation and man-made disasters. Of these, only alimony and compensation for harm in connection with the death of the breadwinner can be withheld - Part 2 of Art. 101 of Federal Law No. 229-FZ. |

For other transfers, the income code is not indicated.

Submit reports in three clicks

Elba will take over the accounting. The service will prepare reports and send them via the Internet. Connections with banks and online cash desks will help you upload payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

When and how the “Code” field is filled in

The code field in the 2020 payment order is filled out differently, depending on whether the payer independently transfers funds to the budget or fulfills the request of the fiscal authority.

If the payer acts independently, sending an order for a transfer, then 0 is entered in the “Code” field. When a request to make payments to the budget comes from the fiscal authority, then in the payment order in this field the code must correspond to the UIN. This rule directly follows from clause 1.21.1 of Bank of Russia Regulation No. 383-P dated June 19, 2012, which states that the UIN must be included in the payment when it is assigned by the recipient of the funds.

Where to get UIN

The source of information on the UIN is the requirements for payment of taxes and penalties. Therefore, if you are not listed as a debtor for payments to the budget, then you will not have a UIN - as a detail for inclusion in the payment order, it will simply not be generated by the payee due to the absence of such a document as a demand from the fiscal authority.

Lira LLC did not pay the property tax on time, and therefore the fiscal authority sent a demand to this debtor, in which he indicated the UIN. When fulfilling the request and generating the payment, the accountant of Lira LLC transferred the UIN from the document sent by the fiscal authority to field 22.

Can a bank require a UIN?

Sometimes banking institutions simply oblige payers to fill in field 22 UIN when sending orders for payment to the budget. How legitimate is this demand?

It all depends on the basis of your payment. If you make a tax payment based on an independent calculation, then you simply have nowhere to get the value of the unique identifier, because no reference book for this detail exists and cannot exist, since the key word here is “unique”, i.e. unrepeatable. In this case, 0 is entered in field 22. But if the tax is paid at the request of the fiscal authority in which the UIN is indicated, then field 22 must be filled in, but the figure entered in it can correspond to either the UIN number or the value 0.

To avoid inaccuracies when paying taxes, we recommend that you read the material “Errors in payment orders for taxes .

What payments do banks accept?

Not only are tax agents confused with the method of filling out field 110, but bank employees also do not have clear instructions on which payments to accept. Some employees make payments using documents with “0” in field 110. Others, citing the law, require that the field be left blank or have a space in it. But for some there is no difference.

Attention! Even if there is insufficient funds in the tax agent’s current account, the bank employee must accept the payment with zero or completely blank line 110, but it will be executed only after the account has been replenished with a sufficient amount.

In order for the execution of a financial order to be carried out in accordance with all the rules, and for the money to reach the recipient on time, you should adapt to the requirements for payment documents and field 110 established by the bank servicing the enterprise.