How to fill out Form 23 PFR

Form 23 of the Pension Fund of the Russian Federation is now in use; it has been in force since February 2016 and is called “Application for the return of the amount of overpaid insurance premiums, penalties, and fines.” It was approved by resolution of the Pension Fund Board of December 22, 2015 No. 511p.

Funds that were overpaid by an organization (IP) to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund can only be returned upon the payer’s statement about the resulting overpayment. If a fund employee has identified a paid surplus, the Pension Fund must inform the policyholder about this within 10 days. After which a joint reconciliation is carried out, in which each party reflects its data. Based on its results, the overpayment will be confirmed, or an updated calculation will be required.

To return overpaid funds to the Pension Fund, you must prepare an application in paper or electronic form by filling out Form 23 of the Pension Fund (the form can be downloaded below).

An application is submitted to the territorial branch of the Pension Fund of the Russian Federation at the place of registration of the payer of contributions within three years from the date of payment of the amount that resulted in the overpayment. In turn, fund employees make a decision on this application no later than ten working days from the moment they receive an application for the return of the overpaid amount. If the decision is positive, the excess amount will be returned within 1 month. If the Pension Fund fails to comply with the established deadlines, the payer must be returned the amount of the overpayment along with the accrued percentage of the penalty for each day of delay.

Filling out documentation: features

The form is currently new and valid as of 2016. The documentation is now called “an application for the return of the amount of insurance premiums paid in excess.” The form is approved by a special legislative decree of the Russian Federation dated December 22, 2015. Refunds can only be made if the payer submits an application. If an employee of the Pension Fund of the Russian Federation has discovered an excess of overpayments, a notification is generated for the policyholder within 10 days. As part of these events, each party is reconciled and detailed data is displayed.

Details of the Social Insurance Fund and Pension Fund for payment of insurance premiums 2017

Form 23 of the Pension Fund of the Russian Federation is filled out in accordance with the established algorithm; downloading it is not difficult. The application is submitted to the territorial fund at the place where the payer is actually registered. No more than 3 years must pass from the moment the overpayment occurs until filing. Pension Fund employees then raise the issue and make a decision on further actions; these measures are given no more than 10 working days from the date of receipt of the application form. If a positive decision is made, the amount is returned within 30 days; if the fund does not comply with the due deadlines, a penalty is assigned for each late day of payment, issued to the payer of contributions along with the principal amount.

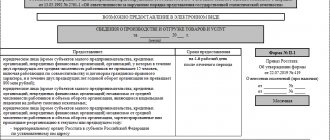

A sample of filling out Form 23 of the Pension Fund of the Russian Federation is as follows:

https://youtu.be/xY_IvrHw_04

If there is a debt to the Pension Fund

If an organization or individual entrepreneur has a debt to the Pension Fund, it will be repaid from the overpaid amount. That is, the Fund will first reconcile your payments, then the amount of arrears will be deducted from the amount of your overpayment. And the remainder (if anything remains) will be returned to the policyholder.

However, you will not always get your money back. It is impossible to return the surplus if it was deposited and paid in the RSV-1 form and distributed to the individual accounts of employees. In this case, an offset may be made against future payments by the policyholder.

In Form 23 of the Pension Fund of the Russian Federation, the form contains the payer’s data, the name of the overpayment amount and the details for which the refund will be made.

How to fill out

The form is quite large, but it is quite easy to fill out. In the table with the transfer, you must select from the list the overpayment for which type of deduction was formed by ticking the desired item.

And of course, it is necessary to provide information to identify the person, affix the signature of the authorized manager and a seal (if the organization has one).

Recommendations for filling out the application form:

- the addressee is the head of the division of the Russian Federation PR under whose jurisdiction the taxpayer is located. You can simply find out from specialists or on the official website;

- it is necessary to indicate the full name of the legal entity and last name, first name, patronymic - for an individual entrepreneur;

- Taxpayer details are necessary for his accurate identification. In the “KPP” and “TIN” fields, experts recommend entering the data of the policyholder, not the bank, but since there are no official clarifications on this matter, and there are doubts, it is better to clarify this information at the territorial branch of the Pension Fund. In the “OKTMO” field the code for the location of the policyholder is entered;

- The amounts requested for refund are indicated in the table.

The pension fund will consider the application and, if the decision is positive, will accrue amounts based on the information received.

The application can be submitted within three years from the date of payment. The Fund must make a decision on return or refusal within 10 working days from the date of receipt of the application and transfer the amounts within a month. If this deadline is violated, penalties are provided. If the policyholder has a debt to the fund, the overpaid amount is credited against it. It is impossible to return funds indicated in personalized reporting if they have already been allocated to the individual accounts of the insured persons; they can only be offset against future payments.

Where to send

In accordance with information from the Pension Fund itself, from January 1, 2017, it is the Pension Fund of the Russian Federation that has the right to make decisions on the return of overpaid contributions based on the application of the policyholder.

Form 23-PFR is recommended; when filling it out, you should take into account that since 2020, the administration of these payments is carried out by the Federal Tax Service. Such changes occurred after a special chapter 34 was added to the second part of the Tax Code. Thus, it is the tax office that controls the correctness of deductions and calculations. All accountants are already accustomed to the fact that reporting, in accordance with Art. 30 of the Tax Code of the Russian Federation, sent to the Federal Tax Service. It is to the tax office details that insurance premiums are deducted. However, since in the end the funds are sent to the Pension Fund, an application for the return of the overpayment must be sent to the fund branch at the place of registration.

Rules for filling out form 23-FSS of the Russian Federation

There are a few important things to keep in mind when filling out the form.

- Firstly, any errors when specifying the organization’s details can lead to very unpleasant consequences, so you need to pay especially close attention to them.

- Secondly, when demanding the return of money, it is necessary to indicate its purpose (i.e., put the amount exactly in the cell to which it belongs).

- And the third important point: if an application to the fund is submitted not by the applicant personally, but by his representative, detailed information about him must be entered in a special section of the application.

If everything is more or less clear with the TIN, KPP and other parameters, then many people have difficulty with the line called “OKATO code” (stands for All-Russian Classifier of Objects of Administrative-Territorial Division). Today, it is necessary to put the OKTMO code in this line (in other words, the All-Russian Classifier of Municipal Territories), which can be found, for example, on the tax service website.

The application is drawn up in two copies, one of which is transferred to the specialist of the extra-budgetary fund, and the second, as potential evidence, remains in the hands of the payer. In this case, the employee of the institution is obliged to stamp both documents.

Below is an example of filling out Form 23-FSS of the Russian Federation - Application for the return of amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation.

Why do you need the STD-PFR form?

Against the backdrop of the transition of all employers to maintaining work records in electronic format, the development and approval of additional document forms was required. They are necessary for recording personnel movements, as well as issuing work history to employees. After all, citizens who have switched to the new accounting format will not be able to freely look at the records in their employment records and transfer them to the new employer upon employment.

In turn, one of them was the STD-PFR form. Which is an extract from the Pension Fund for the entire period of a person’s work since the introduction of electronic books. It, in fact, duplicates the functionality of classic labor documents and is provided to various institutions upon request.

The STD-PFR form may be needed for:

- Familiarization of the employee with records of his work activity for the entire period of work;

- Employment;

- Registration of a foreign passport;

- Obtaining a loan or mortgage;

- Registration of social benefits;

- If it is not possible to obtain a similar document from the employer.

Where to go to get a refund of overpaid contributions

Since 2020, the functionality for monitoring the completeness and timing of payment of insurance premiums has been divided between the departments of the Federal Tax Service and insurance funds. The table below provides information on where the payer should contact to return the overpayment that occurred before and after 01/01/2017.

| Type of insurance premiums | Reporting period | |

| Until 01/01/2017 | After 01/01/2017 | |

| Pension insurance | To return an overpayment of pension contributions that arose for reporting periods before 01/01/17, the payer must contact the Pension Fund of Russia | Questions regarding the refund of overpayments on insurance premiums that arose after 01/01/17 must be directed to the territorial body of the Federal Tax Service at the place of registration |

| Temporary disability insurance | The FSS is responsible for the refund of overpayments on disability contributions for reporting periods before 01/01/17 | |

| Compulsory health insurance | An application for a refund of overpayment of health insurance premiums for reporting periods before 01/01/17 should be submitted to the Compulsory Medical Insurance Fund | |

Let's look at an example. On 04/12/2020, the accountant of Frank LLC discovered an error in the DAM for March 2020, as a result of which contributions to the Pension Fund for the specified period were overpaid.

Since the reporting period for the overpayment is before 01/01/2017 (March 2016), to return the overpayment, the accountant of Frank LLC should contact the Pension Fund at the place of registration.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Subtleties of documentation

Form 23 of the Pension Fund of the Russian Federation (the form can be downloaded on the website) contains current data: Taxpayer (name of the organization, its address and contact details, checkpoint, tax identification number); the amount that was overpaid follows the contact information about the payer, fines, penalties and penalties relate to it, they are determined by an algorithm within the framework of the current law; the size of the indicators and the direction of their movement - Pension Fund, Social Insurance Fund, Federal Migration Service and so on, followed by the numbers of personal and correspondent accounts, information on the full names of responsible persons, signatures; at the end there is direct data about the payer’s representative - the person paying the insurance premiums, confirmed by a signature and company seal. Thus, compiling and completing the form is a simple task if you follow the basic requirements and algorithm. Competently filling out the form guarantees the absence of problems and difficulties with current legislation.

Procedure for the return of overpaid insurance premiums to the Social Insurance Fund

To get a refund of overpayments on insurance premiums in 2020, you need to take into account some changes:

- Applications for the return of overpaid amounts for contributions for the period before 01/01/2017 should be submitted to the Social Insurance Fund. And the refund will be carried out by the tax authority (Article 21 of the Federal Law No. 250-FZ);

- Before returning the overpayment, the tax service checks for any arrears of federal taxes, since insurance premiums are equal to federal payments. For contributions made before 01/01/2017, the overpayment is returned to the fund.

The application can be completed by hand or typed on a computer. You can send an application in the following ways:

- Personally;

- Electronically via the Internet;

- Through your representative.

Also, the law does not limit the right of an organization to use overpaid funds at its own discretion. For example, you can return a certain percentage of the overpayment, and with the rest of the amount pay off fines, arrears, you can save some for future payments, etc.

If the overpayment has already been used to pay off fines, then only the remaining difference between the overpayment and the paid fines can be returned. If the money was spent to pay for future contributions, then you can return it in full without any problems.

How to submit an application for refund of overpayment of insurance premiums

The basis for the return of an overpayment of insurance premiums is the payer’s application to the regulatory authority (FSS/PFR/MHIF or Federal Tax Service - depending on the period in which the overpayment occurred) with a completed application.

The application form depends on which body the payer applies to. Below we will consider the features of filling out an application when applying for a refund of an overpayment to the Social Insurance Fund, the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund and the Federal Tax Service.

Application for refund of overpayment after 01/01/2017

If an overpayment occurs for the period after 01/01/2017, in order to return the funds, the payer must submit an application to the Federal Tax Service (KND form 1150058).

The application form can be downloaded here ⇒ Application for refund of taxes and fees.

When filling out the document, the following information is included in the application:

- Federal Tax Service code;

- information about the applicant (company name/full name of individual entrepreneur);

- overpayment code (3 – insurance premiums; 1 – overpaid amount);

- amount of overpayment;

- taxable period;

- KBK, OKMTO code;

- details for transferring funds;

- date of application.

The completed application is considered valid if it has the signature of the head and the seal of the organization.

Subtleties of documentation

Form 23 of the Pension Fund of the Russian Federation (the form can be downloaded on the website) contains current data: Taxpayer (name of the organization, its address and contact details, checkpoint, tax identification number); the amount that was overpaid follows the contact information about the payer, fines, penalties and penalties relate to it, they are determined by an algorithm within the framework of the current law; the size of the indicators and the direction of their movement - Pension Fund, Social Insurance Fund, Federal Migration Service and so on, followed by the numbers of personal and correspondent accounts, information on the full names of responsible persons, signatures; at the end there is direct data about the payer’s representative - the person paying the insurance premiums, confirmed by a signature and company seal. Thus, compiling and completing the form is a simple task if you follow the basic requirements and algorithm. Competently filling out the form guarantees the absence of problems and difficulties with current legislation.

In the course of paying arrears, insurance contributions and fines to the Pension Fund, various types of overpayments may arise. The procedure for dealing with them is determined by the individual case: sometimes this overpayment is offset, and sometimes it is returned. To obtain the right to claim a refund of the overpaid amount, Form 23 of the Pension Fund of the Russian Federation is used. Together with it, the insurance company applies to the Pension Fund of the Russian Federation with the submission of a corresponding application stating that the excess amount spent must be returned.