“Personal Account of a Taxpayer of a Legal Entity” has a lot of functionality when working with it, and is also widely popular among similar taxpayers. The official website of the Federal Tax Service of the Russian Federation allows taxpayers to perform their direct duties through their Personal Account.

With the help of this service, you can carry out both small and larger tasks, which greatly saves your precious time. For example, you can get a certificate about your budget calculations in two clicks.

This service will become your right hand , since you no longer need to go to the inspection yourself or send your own courier. Many documents are now available in this personal account and requesting them is not difficult . More details about the capabilities of your personal account, how to register in it and how to use it - more on all this below.

Personal Area

FAQ

Technical support

Or use the link: https://lkul.nalog.ru/ Sometimes the site does not work via the link, try using this link: https://lkul.nalog.ru/

Important! Your personal account is intended only for Russian taxpayers.

What are the capabilities of your personal account?

Organizations that have access to their Personal Account are given the opportunity to have precise control over the state of their budget without leaving their workplace.

also have the opportunity to find out about your debts, submit various types of applications electronically, receive an extract from the register and much more.

In other words, your personal account is a great helper in saving your time, which will also help you avoid being absent from your workplace, and there is no longer any need to stand in long lines.

Currently, any company can create a personal account and start using it now. We invite you to familiarize yourself with the functionality of this service:

- You can quickly find out about your government debts and what payments you have already made;

- to receive an extract from the register electronically at any time

- Now you can send requests for a certificate of payment of taxes, fines, penalties and interest;

- Reconcile all payment documents with tax authorities;

- You can request a statement of all your payments;

- Also, your organization will be able to submit an application to clarify the payment if any errors were made in it;

- If your payment was paid more than the requested amount, then you can apply for recalculation;

- If changes have been made to your Unified State Register of Legal Entities, you will be able to send documents relating to these changes;

- Pay the taxes themselves;

- You can track the status of all applications and requests.

For the successful operation of your personal account, you need to prepare your computer for their joint work. To do this, you need to go to the official website of the Federal Tax Service and check. Make sure your operating system meets the requirements of this site.

Reference ! Before passing the verification, you need to click “Clear SSL” in your browser settings.

www.online-document.ru

And so, in order to legally work as a legal entity (organization), you need to register with the branch of the Federal Tax Service of the Russian Federation at the place of registration.

STEP 1. PREPARATION AND CHECKING THE PACKAGE OF DOCUMENTS

Pay special attention to the entered dates, as well as the correct spelling of personal and address information.

To do this you need the following documentation package :

1. Application for registration of an LLC (form P11001) - printed in one copy.

The application is signed directly at the tax office in the presence of all applicants.

To those founders who will not be able to personally attend the submission or receipt

documents, you must have your signatures certified by a notary. Stitch application sheets

no need.

2. Minutes of the meeting of founders (decision of the sole founder) - printed

in one copy. The minutes must contain the signatures of all meeting participants,

chairman, secretary (if there are legal entities among the founders of the LLC

additionally you need to affix their stamps). The decision only requires a signature

sole founder. If the protocol (decision) contains more than one

pages, then they need to be stitched.

3. Establishment agreement – drawn up if the LLC has two or more founders. In law

the agreement does not need to be submitted to the tax registration office, but, unfortunately, not in all Federal Tax Service Inspectors

they know about it, so in order not to waste extra time and nerves, take it with you.

The agreement is printed in several copies (one for the tax office and one for

each founder) and signed by all founders. If the document turned out

more than one sheet, it must be stitched.

4. Charter of the organization - printed in two copies. Sign and flash

There is no need for a charter page.

5. Application for switching to the simplified tax system - completed if you plan to use the simplified tax system.

The application is printed in two copies (if registration takes place in Moscow - in

three copies) and signed by the applicant.

STEP 2. PAYMENT OF STATE DUTIES

The state fee for registering an LLC is 4,000 rubles . Generate a receipt and

You can pay for it online using the service on the official website of the Federal Tax Service. Except

This means you can print out a receipt and pay for it at any convenient Sberbank branch.

Save the document confirming payment; you will need it when checking documents at

tax inspectorate.

Please note that the payment date in the state duty receipt must be later than the date of signing

minutes of the general meeting (decision of the sole founder). The point is that first always

a decision or protocol on the creation of an organization is made and signed, and only then

state duty is paid.

STEP 3. SUBMITTING DOCUMENTS

The final set of documents should include:

1. Application in form P11001 – 1 copy.

2. Minutes of the general meeting (decision of the sole founder) – 1 copy.

3. Establishment agreement – 1 copy.

4. Charter of the organization - 2 copies.

5. Original receipt of state duty with a note about payment.

6. Letter of guarantee from the owner of the legal address confirming it

intention to enter into a lease agreement with the company after registering the LLC.

7. Application for transition to the simplified tax system – 2 copies (for Moscow – 3 copies).

Documents must be submitted to the registering Federal Tax Service at the legal address of the company.

The address and contact details of your inspection can be found using this service.

All founders must be present when submitting documents (except in cases where

they have their signature certified by a notary). Each of them is a must have

yourself a passport . If the general director is not a founder (applicant), then he is not

It is obligatory to be present at the registration of the LLC.

If the founders submit documents for registration in person , it is necessary:

1. Hand over a set of documents to an employee of the Federal Tax Service.

2. In the presence of an employee, each founder should write his last name, first name, patronymic and

sign the application for LLC registration (form P11001).

3. Receive a receipt confirming the delivery of documents (with signature, seal and date,

when you need to come for the finished LLC documents).

4. Receive one copy of the notice of transition to the simplified tax system with the date, signature and seal

employee of the Federal Tax Service (he may be useful to you in the future if disputes arise

questions).

To submit documents through a representative or send by mail , it is necessary to certify and

submit an application from the notary in form P11001 (during this procedure you must

all founders with passports will be present). In addition, you will need minutes of the meeting.

(decision) and charter. Additionally, it is necessary to issue a collective certificate for the applicant

notarized power of attorney to submit and receive documents (refusal).

STEP 4. OBTAINING LLC DOCUMENTS

On the date indicated by the employee, you need to come to the tax office for ready-made

documents (from 2020, the registration period for an LLC should not exceed 3 working days ). To the applicant

You must have a passport and a receipt with you (the representative additionally needs

notarised power of attorney).

Note, if you cannot come to pick up the documents on the specified day, they will be sent by mail.

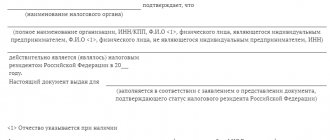

In case of successful registration, the inspector must issue the following documents:

1. Certificate of registration of the LLC with the tax office (with OGRN, INN, KPP number).

2. One copy of the bound charter with the mark of the registering authority.

3. Unified State Register of Legal Entities sheet.

Note, from January 1, 2020, the Federal Tax Service stopped issuing certificates of state

LLC registration. Instead of the specified document, the tax office draws up a Unified State Register of Legal Entities, which

has the same legal force as the previously issued certificate.

Be sure to check the information in the documents you receive. If errors are found

Immediately contact the employee who issued the documents to draw up a protocol of disagreements.

If errors were made due to the fault of the registering tax office, they must promptly and

free fix.

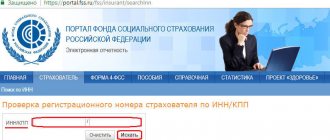

STEP 5. REGISTRATION WITH FUNDS

The tax office independently sends information about newly registered LLCs to

Pension Fund, Rosstat and other extra-budgetary funds. Certificates of registration with

funds must be given to you along with the constituent documents or sent by mail.

If this does not happen, you can personally visit the relevant fund and get

Required documents. This is not required by law, but information from these documents

You may find it useful in the process of entrepreneurial activity.

STEP 6. ACTIONS AFTER REGISTRATION

After registering an LLC, you must:

• Conclude an employment contract with the manager.

• Sign the order to take office.

• Compile a list of LLC participants.

• Contribute the authorized capital no later than 4 months from the date of registration of the LLC.

• Submit information on the average number of employees no later than the 20th

the month following the month in which the LLC was registered.

You may also need (depending on the activities of the LLC):

• Make a seal.

• Open a bank account.

• Purchase and register a cash register.

• Obtain a license.

Why having a personal account is convenient

A visit to the tax office is one of the unpleasant things that any manager must face.

For this purpose, a personal account was developed to avoid a personal visit, thereby saving a lot of time. Here are the main advantages of registering a personal account:

- Now you can get all the certificates and documents much faster ;

- It is simpler and easier for the Tax Service to process applications electronically than in written form;

- A high degree of protection for all transactions with an electronic signature, because it is almost impossible to forge it;

- Saving time and eliminating the need for a personal visit to the Federal Tax Service.

Hotline

Throughout the Russian Federation there is a single toll-free federal number 8 800 222‒2222.

A call to this number will resolve mass issues related to the work of the personal account of a legal entity or individual. Our staff will quickly consider your request, provide detailed advice, and provide all possible assistance.

If you encounter rudeness, rudeness, display of incompetence or signs of corruption, call the helpline 8 (495) 913‒00‒70. The service operates around the clock and strict anonymity is maintained.

Working with the tax authority online

- The head of his organization or his authorized representative will need to obtain KSKPEP - Qualified Electronic Signature Verification Certificate;

- Complete all required settings on the website nalog.ru;

- Draw up an agreement for the use of your Personal Account. Sign this agreement with your already received electronic signature;

- Indicate your email where you will be sent a letter with a link;

- When you follow this link, you will automatically activate your Personal Account.

Attention! When working in your personal account, a secure connection is used. If your browser gives an error when establishing a secure connection, then you need to install a certificate from the Main Certification Authority. It is located in the certificate repository on the Federal Tax Service website.

Errors when working with the personal account of a legal entity

When working with LC, sometimes failures occur in the form of unavailability of certain functions, the absence of a number of images or tabular data, or page underload. To resolve these types of issues, you will need to make a few changes. In particular, set the status to “disabled” in the additional security clause in the appropriate browser settings.

Personal account does not work on devices running Windows Server OS

Below are possible ways to eliminate the errors described above when using one of the versions of the Windows operating system and the Internet Explorer browser.

| Windows Server version | Fixing crashes |

| 2003 | We follow the sequence of steps: |

| 1. login via “Start”; | |

| 2. there we go to “Control Panel”; | |

| 3. Select “Add or remove programs” from the list; | |

| 4. further – “Add or Remove Windows Components”; | |

| 5. uncheck the box next to it. | |

| This will disable enhanced security. | |

| 2008 | Go to the “Server Manager” menu. There we select “Configure IE ESC”. Select a user category from the proposed options. It is recommended to specify “all users” (you can also select “administration only”). |

| 2012 | Having opened the browser menu, go to the “Manager” server, where we find the “IE Enhanced Security Configuration” item. Here we disable enhanced security for the “all users” category. |

The electronic digital signature component is not installed

If such an error occurs during the authorization process in the Personal Account, in order to prevent it in the future, you must log in using the link, then go through all the checks provided there, and only after that start using the portal functions.

Algorithm for registering a personal account on the Federal Tax Service website

So, if you have already gone through all the stages of gaining access to your personal account , then all you have to do is register it. This procedure is simple, as it does not require a personal visit to the inspection office.

To register in your Personal Account on the tax service website, you must go through a certain algorithm of actions:

- Connect the USB drive of the ES key (electronic signature) to your computer.

- Go to the website of the Russian Tax Service nalog.ru.

- Complete verification of compliance with the conditions for access to your personal account.

- Sign an agreement to provide access to your personal account with an electronic signature.

- Enter your email address and password information will be sent there.

- When prompted for a secret password , enter it.

- Click on the “next” button.

- Double-check that the information you provided is correct.

- Wait for the link to activate your personal account. She usually arrives within two hours.

- Start using your personal account.

Nuances of submitting documents for legal registration. faces

The specified documentation is submitted to the Federal Tax Service in paper form. The application filled out by the registering person is submitted in one copy. Documents containing many pages must be numbered and bound. The last page should contain a number corresponding to the number of pages.

Documents for registering a legal entity can also be sent to the tax authorities by mail. When sending a letter, indicate its value and be sure to attach a list of documents to be sent. If you personally brought the documents necessary for registering a legal entity, then you must be given a receipt indicating everything that was accepted from you.

If you decide to start a business, then registration with the tax authority will sooner or later become an urgent necessity. With the right approach, you can quickly collect all the necessary documents.

Login to your personal account

All stages of setting up and using a personal account are absolutely free for managers of various organizations. Organizations of different legal forms can use a personal account using a Qualified Electronic Signature. This provides an excellent opportunity to receive reliable and current information about the correct operation of your company in accordance with the legislation of the Russian Federation.

Logging into your personal account is done in two steps: Connecting a USB storage device for your electronic signature to your computer and passing the check on the Federal Tax Service website.

How to navigate your personal account

There are several sections in your personal account :

- General information . Here you can order an extract from the Unified State Register of Legal Entities;

- Accounting of legal entities. Here you can issue an extract from the register;

- Calculations with the budget. Here you will see all your existing debts and be able to pay them;

- Electronic document management. In this section you will see all your certificates, documents, etc. that you submitted. You will be able to control their execution status.

Requesting documents via the Internet on the tax website

If you need to create and send a request for information, then this function is offered by the user’s personal account. Select “Request Documents”.

How to obtain an extract from the Unified State Register of Legal Entities

In the “Request for documents” menu, find the item “Request for an extract from the Unified State Register of Legal Entities”.

Some of the data will fill in on its own. After filling out the remaining lines, click “Submit”.

How to print acts and reconciliations

To receive an extract as a pdf file that can be printed, go to “Submitting applications” in the list of tabs at the top of the screen and then “Information about documents...”.

Rules for obtaining an electronic signature key

Not every electronic signature key is suitable for using your personal account .

To obtain it you need a special certificate , which you can only obtain in one of the accredited centers. Centers are accredited only by the Ministry of Communications.

In order to order a key from this center, you need to make sure that it suits you. To do this, on the official website of the Ministry of Communications, you can find the Center that suits you in a specific list.

Important! This electronic signature key is issued only to the head of the organization or his authorized representative. Also, this key must contain information about the organization: TIN, full name of the head, location address.

At first glance, it may seem that the procedure for obtaining a personal account looks very complicated and confusing, but as soon as you start filling out all the necessary documents, you will understand that there is nothing complicated here. In the future, you will understand what conveniences it will provide you.

https://youtu.be/vSgWBDBgasc

Registration of an NPO at the home address of the founder

Home / Articles / Registration of an NPO at the home address of the founder

Published: 04/15/2018

Registration of any organization at a specific address is its integral feature and a prerequisite for inclusion of a legal entity in the state register. The Law on Non-Profit Organizations established provisions according to which the location of an NPO is determined by its state registration address. And the address of a non-profit organization must be indicated in its constituent documents.

According to the Civil Code of the Russian Federation, Art. 54, paragraph 2, the location of a legal entity is determined by the place of its state registration on the territory of the country by indicating the name of the corresponding locality. That is, there is no need to specify the full address of its registration in the charter of a non-profit organization. It is enough to indicate the name of the locality where the organization is registered. The advantage of this option of indicating the address is that there is no need to change the charter of the NPO in terms of the provisions on the location in cases of change of address within the boundaries of one city, town, or other locality.

But we must not forget the following. When filling out form P11001, the exact address of the non-profit organization must be indicated, which includes, accordingly, not only the name of the subject and locality, but also the number of the house, building, apartment or office.

Quite often, when opening an NPO, the question arises: is it possible to register an organization at the home address of its founder? The answer is yes, registration at the founder’s home address is possible. This is confirmed, in particular, by the laws on state registration and non-profit organizations. And the law “On charitable activities and charitable organizations” in Art. 9 directly states that it is not permitted to refuse state registration of a charitable organization because a citizen has provided it with a legal address at his home address.

According to regulatory requirements, as part of the set of documents for state registration of a non-profit organization, it is necessary to provide information about the address of the permanent body of the non-profit organization at which communication with it is carried out. In this case, the type of data provided depends on the type of registration - initial registration or change of legal address.

So, if the founder has just created an NPO and registers it at his home address, when submitting an application to the regulatory authority P11001, he only needs to provide a copy of his passport data, thereby confirming that the legal address of the non-profit organization is his registration address. There is no need to provide any additional documents.

When changing the legal address of an NPO and transferring it to the home address of the founder, when filling out form P14001, it is necessary to submit to the regulatory authority documents substantiating the ownership of the premises located at the declared address. This could be, for example, an extract from the Unified State Register. You will also need a copy of the lease agreement concluded between the owner of the premises and the non-profit organization. The following must be taken into account. If, according to Rosreestr data, the owner owns only part of the premises (for example, both spouses own an apartment in equal shares), then written consent will be required from his other co-owners to register an NPO at their home address.

Back to articles

Similar articles:

Requirements for the name of a non-profit organization

The name of a non-profit organization is one of its main individualizing features. It is enshrined in the charter of the NPO, its registration and other corporate documents. It also distinguishes the organization from many others in the relevant field of activity.

More details

Inspections of NPOs by the Ministry of Justice

After state registration of a non-profit organization, you must remember that its activities can be checked.

More details

Preparation of NPOs for inspection by the Ministry of Justice

Earlier, in the article, we talked about what kind of inspections the Ministry of Justice carries out in relation to non-profit organizations and when they are appointed. In this material, we will consider the main points that NPOs need to pay attention to when preparing for an inspection by the Ministry of Justice.

More details