Home >> Questions about 1C >> Loans in 1C 8.3

Loans operated by an organization (entrepreneur), depending on the role it plays, can be of two types: loans issued and loans received . In this article we will consider issues related to the recording of loans issued .

An organization can issue a loan to the following persons: another organization (entrepreneur), its own employee, its own founder, an outside individual. Loan issuance operations begin with the execution of a loan agreement.

Loan agreement with an organization or third-party individual

To create a loan agreement in 1C Accounting 8.3, you need to add an agreement of the appropriate type to the list of agreements of the counterparty to whom the loan will be issued. To do this, in the sections panel, go to the “Directories” section and open the “Counterparties” directory. We open the counterparty we need (or create it), go to the “Agreements” tab and click the “Create” button.

In the window that opens, you need to indicate: our organization, counterparty, number, name of the agreement and its date.

In the contract type , select “Other”. Click the “Record” button.

Loan agreement with an employee of the organization

In 1C Accounting 8.3, if the chart of accounts proposed by the program is used, then accounting account 73.01 will be used for mutual settlements with an employee for issued loans. In accordance with the program settings, analytical accounting broken down by loan agreements is not maintained in this subaccount. Accordingly, if you use a chart of accounts pre-configured in 1C Accounting 8.3, then you do not need to create a loan agreement with an employee in the program. In 1C Accounting 8.3 (when using a standard chart of accounts), maintaining analytical accounting in the context of loan agreements with an employee is not provided.

The moment the borrower's obligations to the lender under the loan agreement arise will be the moment of transfer of funds to the borrower's current account or the moment of issuing cash to the borrower from the organization's cash desk. Thus, the documents for accrual of the principal amount of the loan (the so-called “body” of the loan) in 1C Accounting 8.3 will be: a bank statement and (or) an expense cash order.

How is the operation of issuing a loan to an employee completed?

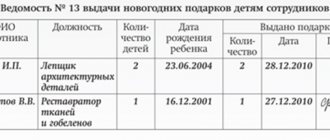

In the context of the topic under consideration, such situations most often occur.

Forwarder of XXX LLC Ageev N. submitted an application for a loan to pay for training at a university under a contract in the amount of 50,000 rubles. for a period of 1 year. The manager signed an application for an interest-free loan, which was then sent to the accounting department. After reviewing Chap. The accountant issued a loan to the employee in the amount of 50,000 rubles. on the terms of return in parts from wages.

It was decided to issue a loan from the founders in the amount of 100,000 rubles to the director of XXX LLC, Mukha V.P. for 6 months at 10%. To pay ch. The accountant received the following documents - a statement from V.P. Mukha, minutes of the meeting of the founders of the LLC. The money was transferred from the company's bank account to the recipient's salary card.

Accrual of a loan provided to an organization or a third-party individual

When transferring the loan amount to the current account of an organization (or a third-party individual) in the bank statement generated in 1C Accounting 8.3, in the “Type of transaction” column, you need to select the type “Issue of a loan to a counterparty”. In this case, in the “Settlements account” column, account 58.03 “Loans provided” will be automatically indicated. In the “Agreement” column, you need to indicate the loan agreement that we created for the counterparty at the previous stage.

In the column “Item of expenses” we indicate the DDS article “Provision of loans to other persons”.

Accrual of a loan provided in cash from the organization's cash desk

Similar to the accrual of a loan provided by non-cash method, in 1C Accounting 8.3 a loan issued from the organization’s cash desk . Only the document forming the accrual will be not a bank statement, but the “Cash Withdrawal” document (and the “Cash Expenditure Order” will act as a document - the basis for reflection in accounting).

In accounting, interest on a loan is accrued monthly in accordance with clause 16 of PBU 9/99 (see ConsultantPlus®). The reflection of interest on a loan provided in tax accounting is regulated by clause 4 of Article 328 of the Tax Code of the Russian Federation (see ConsultantPlus®).

Features of loan accounting

According to the terms of the agreement between the borrower and the lender, not only financial assets, but also material assets can be transferred into debt. For example, fixed assets of the organization, inventories, raw materials, finished products or goods, intangible assets and other property of the company.

Reflect the provision of a loan to another organization (entry) in the amount of financial assets issued or at the cost of transferred material assets. If the loan was issued in foreign currency, the accounting department is required to make entries in rubles.

Note that the conditions for issuing loans play a key role in accounting. In this situation, the first question that should arise for the lending company is whether the transferred funds are financial investments or not.

Conditions for recognizing borrowed funds as financial investments:

- the fact of transfer of assets on loan (property for temporary use) is documented, that is, the corresponding agreement is signed between the borrower and the seller;

- the lending company officially assumes the risks of non-payment and non-repayment of the loan (credit);

- the assets transferred into debt will bring economic benefits; the lending company plans to make a profit on interest for the transfer of assets for use to another company or individual.

If assets transferred as debt do not meet these three conditions, then they cannot be classified as financial investments. In this case, an interest-free credit (loan) agreement is concluded between the borrower and the seller.

Calculation of interest on loans in 1C 8.3

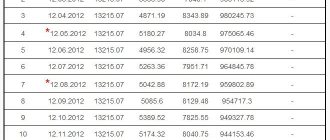

Interest on loans in 1C Accounting 8.3 is calculated in the “Operations” section, from the “Operations entered manually” tab, using the “Operation” document.

Create a new document “Operation”. We indicate the Debit account: for an organization - 76.09, for an outside individual - 76.10, for an employee - 73.01. We indicate the counterparty and the agreement (for the employee the agreement is not indicated). We indicate the Loan account - 91.01 and the income item. If the article we need is not in the list of articles, then it needs to be created by specifying “Item Type” - “Interest Receivable (Payable)”. In the “Amount” column, we calculate and indicate the amount of interest in proportion to the calendar days of using the loan in the current month. In the example below, the comment column contains formulas for calculating accrued interest on loans. This is convenient, since later, when viewing the document, you can always double-check the correctness of the calculation made.

The relations that arise between the organization and the founder in the process of the organization providing a loan to its founder have no connection with the rights and obligations of the founders enshrined in the organization’s Charter and in law. Thus, a loan to the founder in 1C Accounting 8.3 is also reflected as a loan provided to an organization or a third-party individual (depending on whether the founder is an organization or an individual).

Detailed description: - Loan agreement with an organization or third-party individual in 1C 8.3. — Accrual of a loan provided to an organization or a third-party individual in 1C 8.3. — Calculation of interest on loans in 1C 8.3.

Loan repayment in 1C Accounting 8.3 in non-cash form is formed by the bank statement “ Receipt to current account ”.

Posting accrued interest

Under the cash method, interest is calculated on the day the loan is issued. This is reflected by posting Debit 76, Credit 91-1. When accounting for interest using the accrual method, you should pay attention to the period for which the loan was issued under the agreement.

Interest on loans is calculated according to the formula:

Principal loan amount x rate per year: 365 (366) x number of calendar days of the period (for example, month)

Interest may also be a fixed amount, which is specified in the agreement.

If the lending period exceeds a year, interest is accrued at the end of each month until the end of the period during which the agreement to provide money is valid. When issuing a loan for a period of less than a year, interest is calculated on the final day when it must be returned to the lender.

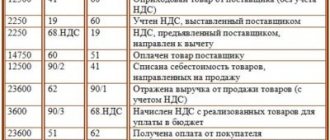

For an example of accounting entries, let's take the following data:

- One company received a loan from another in the amount of 2 million rubles.

- Period from September 30 to December 31.

- At an interest rate of 14.5% per year.

Accounting entries

| date | Action | Debit | Credit | Size | Documentation |

| September 30th | Getting a loan from a company | 51 | 66 | 2 million rubles | Agreement, bank extract |

| October 31 | Interest on loan agreement per month | 91 | 66 | RUB 24,778 | Agreement, certificate from accounting |

| November 30th | Interest on loan agreement per month | 91 | 66 | RUB 24,270 | Agreement, certificate-calculation |

Repayment of a loan provided to an organization or a third-party individual

When you select “Type of operation” - “Repayment of loan by counterparty”, account 58.03 is automatically indicated in the “Settlement account” column. In the “Income Item” column, you need to indicate the DDS article, whose “Movement Type” will be “Proceeds from the repayment of loans, from the sale of debt securities.” If this article is not in the list, create it. Let’s create it and call it “Receipt from loan repayments”. After creating a new DDS article, the program will offer to use it by default in certain operations. We agree that this article should be indicated in documents of this type.

Repayment of the loan in cash to the organization's cash desk

Repayment of a loan in cash to the organization's cash desk in 1C Accounting 8.3 is formed by the document “Cash Receipt” (and the “Cash Receipt Order” serves as the document that serves as the basis for reflection in accounting). We fill out the “Cash Receipt” document in the same way as we filled out the “Receipt to Current Account” documents. We indicate the same DDS article. In the “Printed form details” tab, in the “Bases” column, indicate the number and date of the loan agreement under which cash is deposited into the organization’s cash desk.

Civil relations

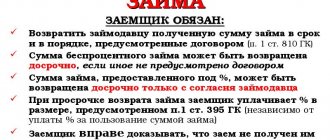

Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality . The loan agreement is considered concluded from the moment of transfer of money or other things (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The condition for providing a loan without paying interest for the use of borrowed funds must be fixed in the loan agreement (clauses 1, 3 of Article 809 of the Civil Code of the Russian Federation).

The debtor's obligation to repay the loan can be terminated by the creditor by forgiving the debt, if this does not violate the rights of other persons in relation to the creditor's property (clause 1 of Article 415 of the Civil Code of the Russian Federation). Note that gratuitous debt forgiveness is considered by the courts as a gift (Guide to Judicial Practice).

In this case, a gift agreement was concluded between the employee and the organization, providing for the gratuitous release of the employee from the obligation to the organization to repay the loan (Article 572 of the Civil Code of the Russian Federation). Since the donor is a legal entity and the value of the gift exceeds 3,000 rubles, the gift agreement is concluded in writing (clause 2 of Article 574 of the Civil Code of the Russian Federation). The gift agreement comes into force from the moment of its conclusion (signed by both parties) (clause 1 of article 425 of the Civil Code of the Russian Federation).

Receipt of interest on a loan provided to an organization or a third-party individual

The receipt of interest on a loan (repayment of interest on a loan) to the organization's current account in 1C Accounting 8.3 is generated by bank statement documents with the “Type of transaction” - “Other settlements with counterparties.” In the “Settlement account” column, the same account is indicated as when calculating interest on the loan of this counterparty. In the “Item of Income” column we indicate the DDS article with the “Type of movement” - “Receipts from dividends, interest on debt financial investments.” If such an article is not in the list, then it needs to be created.

Short-term and long-term loans

https://www.youtube.com/watch?v=ytadvertiseru

Accounting for loans in accounting depends on the time of use by the borrower. To make payments on short-term loans (issued for a period of up to 1 year), account 66 is used. For long-term loans (issued for a period of more than 1 year), account 67 is used. If it happens that long-term loans are repaid in less than 365 days, then they must be transferred to score 66.

Accounting for loans in accounting should be divided into analytics:

- by type of funds received;

- by sources of funds;

- for basic and additional costs.

Receipt of interest on a loan provided to an employee of the organization

When receiving non-cash interest on a loan from an employee of an organization, in the bank statement document, in the “Type of transaction” column, you must indicate “Other receipt.” In the “Settlement account” column we indicate 73.01. We cannot indicate the loan agreement since analytical accounting in the context of agreements is not maintained in this account. In the “Income Item” column we indicate the article we created “Receipt of interest on loans” (see the previous section).

Receipt of interest on a loan in cash to the organization's cash desk

The receipt of interest on a loan in cash to the organization's cash desk in 1C Accounting 8.3 is reflected in the document “Cash Receipt” (the basis document is the “Cash Receipt Order”). In the document “Cash Receipt”, the columns “Type of Transaction”, “Settlement Account”, “Income Item” are filled out in the same way as we filled them out in the document “Receipt to Current Account” for non-cash receipt of interest on the loan (see the previous section). In the “Bases” column we indicate information about the loan agreement on which interest is paid to the organization’s cash desk.

When creating documents reflecting the operations of issuing and repaying a loan, which we discussed above, the following transactions are generated in 1C Accounting 8.3:

- Accrual of a loan transferred to a third party by non-cash method.

- Accrual of a loan transferred to an employee of an organization by non-cash method.

- Accrual of a loan issued to a third party in cash from the cash register.

- Calculation of interest on a loan provided to a third party.

- Calculation of interest on a loan provided to an employee of the organization.

- Receipt into the current account of the “body” of the loan, repaid by the borrower - a third-party organization.

- Receipt of the “body” of the loan, returned by the borrower - a third-party organization in cash to the cash desk.

- Receipt of the “body” of the loan into the current account, repaid by the borrower - an employee of the organization.

- Receipt of interest on the loan transferred to the current account by the borrower - a third-party organization.

- Receipt of interest on the loan transferred to the current account by the borrower - an employee of the organization.

- Receipt of interest on the loan paid by the borrower - an employee of the organization in cash to the cash desk.

An interest-free loan should be considered separately, because its implementation in 1C 8.3 is significantly different from an interest-bearing loan. Distinctive features of the issued interest-free loan in comparison with interest-bearing ones are:

- The issued interest-free loan is not a financial investment

- When receiving an interest-free loan, the recipient receives material benefits from saving on interest

An interest-free loan is not a financial investment for the issuing party, because one of the mandatory conditions for recognizing a financial investment is not met, namely, the condition for receiving income from such an investment (according to paragraph 2 of paragraph 1 of Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n “On approval of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02″, see ConsultantPlus®).

The material benefit from saving on interest on the loan received arises in accordance with paragraphs. 1 clause 1 art. 211 of the Tax Code of the Russian Federation (see ConsultantPlus®). If an organization (or entrepreneur) issues an interest-free loan to an individual, then it has the responsibilities of a tax agent for personal income tax (NDFL) in relation to the material benefit of the individual.

Let's look at how these two conditions will affect an interest-free loan in 1C Accounting 8.3

What it is?

In accounting, a posting is an entry in a journal or computer about transactions carried out during a certain period. Accounting entries are recorded as a credit to one account and a debit to another. Companies can charge interest on issued loans; it is based on the profit accounting method.

The loan can also be interest-free, as decided by the loan officer. The Civil Code has a special chapter that describes the issuance procedure. For example, such an action must be recorded.

The lender gives the borrower a specified amount of funds or some things, and the borrower must pay back the amount or give things back in the same condition and quality.

The signed agreement must include the following points:

- Loan rate (if any).

- Return period.

- What is the return procedure?

- If the loan percentage is not written in the agreement, or it is not written there that the agreement is interest-free, then the amount of the interest will be determined at the NPL rate.

The loan size can be any, there are no restrictions on this.

Calculation of an interest-free loan provided to an organization or a third-party individual

The accrual of an interest-free loan in 1C Accounting 8.3, as well as the accrual of an interest-bearing loan, is carried out using a bank statement document. In the “Agreement” column we indicate the interest-free loan agreement. In the column “Settlement account” we do not indicate the account for accounting for financial investments ( account 58.03 ), but indicate the account for settlements with other debtors and creditors ( account 76.09 ) or, in the case of transferring a loan to an individual, the account for accounting for other settlements with individuals (account 76.09) count 76.10).

When reflecting the issuance of an interest-free loan in cash in 1C Accounting 8.3, we make similar changes to the “Cash Issuance” document we previously reviewed (when issuing an interest-bearing loan in cash). We indicate the interest-free loan agreement and settlement account 76.09 (or 76.10).

Tax nuances

Current legislation requires a written agreement. The requirements of regulations are such that when formulating an agreement, it is necessary to state in detail and clearly, without using ambiguous wording, the absence of interest in favor of the enterprise. Only in this case the company will not have to pay taxes after lending money to a person.

Personal income tax and an interest-free loan to an employee are closely related, since the second automatically entails the obligation to pay the first. The money can be used to purchase real estate. In this case, an individual has the right to contact the Federal Tax Service or the accounting department of the enterprise in which he is employed in order to issue a property deduction.

Article 809 of the code regulating civil relations within our country gives the right to provide workers with commodity or cash loans - at the discretion of those entering into an agreement. Article 812 of the same code of laws establishes the possibility of challenging the concluded agreement.

We invite you to familiarize yourself with a simple sample rental agreement for a parking space between individuals