The article was presented at the request of the site by the magazine "Calculation". The full version of the article was published in the journal “Raschet” No. 5, 2020.

The Supreme Court of the Russian Federation issued Determination No. 307-ES19-5113 dated April 9, 2019, in which a loan issued to an individual entrepreneur was reclassified as income on which personal income tax must be paid.

A loan to a dependent party does not contradict either civil or tax laws. According to Russian laws, an entrepreneur is not prohibited from taking loans from affiliated companies and using the money at his own discretion.

When does personal income tax arise when issuing a loan?

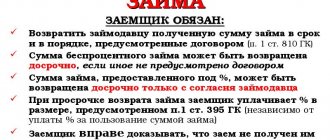

If an employee receives a loan from a company, he receives a material benefit if he pays interest on the use of funds at a rate that is lower than 2/3 of the refinancing rate for loans issued in rubles or 9% per annum for loans issued in foreign currency.

If an employee receives an interest-free loan, material benefits arise as long as the borrower uses the loan provided. If after some time the company forgives the employee's debt, for example, by executing a debt forgiveness agreement, he will have taxable income in the form of a material benefit. And this income is subject to personal income tax.

In accordance with paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, all income of an individual received both in cash and in kind, as well as income in the form of material benefits, are subject to personal income tax.

You must pay personal income tax at a rate of 13% on the amount of the forgiven debt.

Refund methods

The method of repayment of the loan must be specified in the agreement between the parties. Let's look at the most common options.

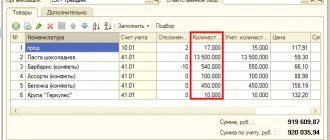

Product

The possibility of repaying debt with goods is stipulated in Article 409 of the Civil Code of the Russian Federation. You can repay the loan using the following types of products:

- A product produced by the company.

- Products purchased by the company for further sale.

The goods, within the framework of the law, are the property of the legal entity. Therefore, when it is transferred, the transaction will be considered a sale and income tax will have to be paid on the proceeds.

IMPORTANT! How to determine the quantity of products to repay the loan? Typically, the purchase price is used in calculations.

From current account to card

The required amount can be transferred to the lender directly to your bank card. The manager of the debtor company must draw up a document indicating the relevant transaction and its purpose (loan repayment). A transfer from a RS can be made not only to a card, but also to the lender’s RS. The choice of payment option depends on the convenience for both parties.

IMPORTANT! The translation must be supported by documents. This is required for accounting and tax purposes, as well as proof of transfer of funds.

Company property

Repaying a loan with the organization's property is subject to the same rules as covering a debt with goods. You will have to pay income tax on each payment, since the transaction will officially be considered a sale.

To make payments, you can use any fixed assets owned by the enterprise:

- Equipment, tools for manufacturing products.

- TS.

- Immovable objects.

The ratio of the loan amount to the fixed asset with which it is planned to repay the debt is determined jointly by both parties to the agreement. For example, the debtor can transfer to the founder a car, the cost of which, taking into account depreciation, is approximately equal to the amount of the debt.

IMPORTANT! You must remember to document the transaction. In particular, it is required to draw up a document on the write-off of fixed assets from the balance sheet of the enterprise to cover the loan. You will also have to pay tax, and therefore, after the payment has been made, a declaration of profit received is submitted.

Payment of dividends by providing a loan

There is no need to pay contributions on the amount paid to the employee as a loan. And personal income tax arises only if the loan is forgiven or when the loan agreement establishes the interest for using the loan below the refinancing rate (key rate) of the Central Bank of the Russian Federation.

As a result, the employee who received the loan is freed from the need to pay insurance premiums on this amount. And personal income tax can be “spread out” for a long period with minimal amounts. And you will have to pay personal income tax only if the debt is forgiven.

This scheme is very popular when paying dividends. Today, it would be more correct to say, it was popular.

Supreme Court ruling No. 307-ES19-5113 dated April 9, 2020 gives tax authorities the opportunity to reclassify any loan as employee income.

Taxation

Taxation on repayment of a loan to an executive is no different from taxation on payments to any other creditor. If the debt is repaid by the company's operating assets or its products, income tax is paid, since it is considered that an act of sale of the company's property is being carried out. After the transaction is completed, you will have to file a tax return. All transactions related to loan repayment must be supported by primary documentation for tax purposes. Due to the impossibility of full control, it is prohibited to pay the debt in cash.

The essence of the matter of recharacterizing a loan into dividends

Tax officials conducted an on-site audit, as a result of which they identified the provision of a loan to an interdependent person. The Federal Tax Service made a decision to charge personal income tax on the loan amount and impose penalties.

The individual entrepreneur asked the court to invalidate the decision of the Federal Tax Service to hold him accountable for committing a tax offense in terms of additional assessment of personal income tax and penalties. And also, in terms of bringing to responsibility provided for in Art. 122 and art. 119 of the Tax Code of the Russian Federation for failure to submit a personal income tax return in the form of a fine.

According to the tax inspectorate, the individual entrepreneur, being at the same time the founder of several LLCs, under loan agreements concluded with them, actually received income that was subject to legal qualification as dividends. The inspection concluded that the entrepreneur received an unjustified tax benefit. In addition, the individual entrepreneur was also charged with the fact that he took into account controversial transactions on the basis of formally executed loan agreements with organizations controlled by him. And the loan agreements themselves had no economic meaning.

The court sided with the tax inspectorate and recognized that the evidence presented (together) allows us to regard the funds received from the entrepreneur as dividends, and not a loan at all.

The court also recognized the justified conclusion of the inspectorate that in the situation under consideration the real actions of the entrepreneur were not related to his business activities, but were aimed at creating a scheme that would allow funds to be withdrawn to his personal accounts, mainly opened abroad, for the purpose of subsequent possession of them in for personal purposes and without any intention of returning money to the economic circulation of organizations.

How to write off a loan to the founder in accounting

OPTION 1. Increase in net assets.

This option is possible if the lender is a participant in your company with any share.

The participant decides to increase the company's net assets by terminating its obligation to him to repay the loan. When there is only one participant, this can be formalized by a decision, and if there is more than one participant, simply a statement on behalf of the participant. You can repay any loan amount in this way.

This operation does not give rise to either tax or accounting income, and it can be reflected in the following entry.

OPTION 2. Contribution to property.

This alternative is applicable if:

- The charter of an LLC provides for the obligation of participants to make contributions

- lender - a participant with a share of more than 50%. Moreover, since contributions must be made by all participants (in proportion to their shares), this option is more suitable for those companies with only one participant.

With this method, the participant, based on his decision, gives you money as a contribution to the property of your company. And you return them to him to repay the loan. This can also be done through the cash register. After all, restrictions on spending money from the cash register are established exclusively for proceeds from the sale of goods (works, services). In our case, it is not the proceeds that are spent, but the financial assistance of the participant, so it can be spent from the cash register for any purpose.

But remember, if the participant is an organization, then no more can be returned in cash from the cash desk under one loan agreement. For a larger loan amount, payments will have to be made through a current account and the bank will have to pay a commission for deposits and cash withdrawals.

The amount of the contribution of a majority participant with a share of more than 50% does not increase the income tax base. Receive financial assistance and repay the loan using the following transactions.

OPTION 3. Increasing the authorized capital.

This method is suitable if the lender is the only participant in the company. He may decide to increase the authorized capital by offsetting the right of claim against the company under the loan agreement against an additional contribution

If there are several participants, then implementing this option will be much more difficult. After all, the decision to increase the authorized capital is made by the participants at their general meeting, and at the same time they must resolve the issue of the size of their shares and the share of the participant-lender. In particular, they can

- agree (unanimously) that due to the additional contribution, the participant-lender will increase the size of the share (and its nominal value), and the size of their shares will decrease;

- also make additional contributions to the authorized capital so that the nominal value of the share increases for all participants, but its size remains the same (for such a decision, at least votes are required).

An increase in the authorized capital is subject to state registration, and therefore this is the most labor-intensive option. Moreover, it is not free, because you will have to pay state fees

There are advantages in this option only for participants (whether a company or an individual) who subsequently plan to sell their share. They will be able to reduce the income from its sale by the costs of making a contribution to the authorized capital and by increasing it. However, they cannot reduce the income from the sale of a share by the costs of increasing the company’s net assets or making contributions to its property (options 1 and 2).

Contributions of participants to the authorized capital are not taken into account for tax purposes. In accounting, this operation is reflected on the date of state registration of amendments to the charter.

If the lender is a subsidiary in which your company’s share is more than 50%, then in order to get rid of the debt without profit, it can forgive the loan debt. For this, it writes you a letter or you enter into an agreement. Any amount can be forgiven.

You can wait until the statute of limitations on your loan obligation expires and then write off the debt. That is, after 3 years from the date of expiration of the loan repayment period, you will include the loan amount in non-operating income as written off accounts payable. And the lender will be able to reflect these amounts in non-operating expenses as receivables that are impossible to collect

This option is suitable for friendly companies if the lender is an organization subject to the general taxation regime, and your company (or entrepreneur) applies the simplified tax system. The overall result of writing off the loan amount for two companies will be positive. For example, with a loan amount of 100 rubles. you, using the simplified tax system, will pay a tax of 6 rubles. (100 rub. x 6%) or 15 rub., (100 rub. x 15%) depending on the object of taxation. And the general lender, by including the loan amount in expenses, will save 20 rubles on income tax. (100 rub. x 20%).

In accounting, the borrower will reflect this operation with the following entry.

Most businesses sooner or later face the problem of lack of cash. To solve the problem, they most often resort to the help of the founder, who provides the company with the necessary amount for a loan.

Moreover, he has every right to lend money to his enterprise, and subsequently close the resulting debt by completing the forgiveness process.

How to write off and account for accounts payable on loans

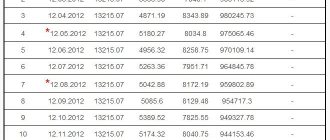

This is the situation. The organization's account contains accounts payable for loans received (account 67.3) and accrued interest (account 67.4).

How can you write off accounts payable for loans received and accrued interest so that there is no need to pay income tax?

How to reflect in the accounting and tax accounting of the Lender and our Borrower Organization transactions to write off accounts payable for loans received and accrued interest? To write off accounts payable for loans received and accrued interest without tax consequences, the following steps should be taken: 1.

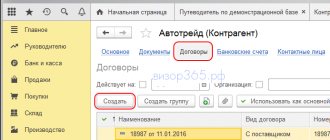

Transfer accounts payable to the founder - a legal entity.

2. The founder forgives the debt. In this case, debt forgiveness must be done in order to increase the net assets of your Organization. Let's consider the procedure for accounting and tax accounting of operations

Write-off of debt to the founder under a loan agreement

This agreement will not allow you to cancel the debt, but will give you the opportunity not to pay it without fear of any legal consequences.

The third method is the conclusion of an agreement in which the subject is the release of the borrower from the amount of debt obligations (this is a document issued by the borrower to the lender when receiving a loan) determined by the loan agreement.

In this case, the text of the agreement must contain a reference to Art.

415 of the Civil Code of the Russian Federation. The fact of signing this agreement terminates all legal relations between the founder and the debtor company regarding the loan.

Since this is a regular transaction, there are general registration requirements. When concluding a forgiveness agreement, certain rules must be followed. The agreement must be drawn up in simple written form.

We recommend reading: Benefits if an employee is a disabled pensioner

To avoid misunderstandings, the text of the agreement must contain the amount of debt obligations that are written off.

Requisites

The provision of an interest-free loan to the founder is formalized by a written agreement. Otherwise, it will be impossible to prove the fact of the operation and conduct transactions in accounting and accounting records. The agreement is drawn up and signed in two copies: one remains with the lender, the second with the borrower. The countdown begins from the moment the money is transferred. As confirmation, the borrower can write a receipt indicating the exact amount and date of the transaction. The document can contain any other conditions that do not contradict the law. There is no need to notarize the agreement, but this can be done if the parties wish. A debt repayment schedule is attached to the agreement.

prednalog.ru

As the Ministry of Finance interprets, an unrepaid loan can be written off as expenses (letter N 03-03-06/1/23763 dated April 24, 2020). Moreover, this rule applies to both interest-bearing and interest-free loans and assignment of claims.

Loan debts are written off as non-operating expenses when calculating corporate income tax.

Based on paragraphs. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, when calculating income tax, non-operating expenses include losses received by the taxpayer in the reporting (tax) period, incl. and the amount of bad debts. If the taxpayer creates reserves for doubtful debts, then the amounts not covered by the reserve funds are considered bad debt.

Based on clause 2 of Article 266 of the Tax Code of the Russian Federation, bad debts are debts for which the debt has expired or is impossible to repay due to the liquidation of the organization or an act of a government agency.

We recommend reading: The last payment under a loan agreement begins the limitation period

According to the general rules, the limitation period is three years from the date determined in accordance with Art.

Interest-free loan from the founder: postings

The amount received by the company is displayed as accounts payable. When funds are received, this liability item increases, and when funds are returned, it decreases.

When carrying out such operations, no income or expenses arise. Depending on the duration of the agreement, the interest-free loan from the founder is reflected in the accounts:

67 – if money is issued for 12 months or more;

66 – if the contract term does not exceed one year.

The loan amount is deposited into the cash register or into the current account. In order for the bank to carry out the second transaction, a stamped copy of the agreement will be required. Depositing funds into the cash register is formalized by a receipt order:

DT 50 – Kt 66, 67 – receipt of cash in the form of a loan to the cash desk;

DT 51 – CT 50 – funds are transferred to the current account. In the comments to the transaction, it is necessary to indicate that this is borrowed money.

If the loan amount includes VAT, then the following transactions are generated:

DT 58-3 (73-1), CT 68; DT 68, CT 68, VAT subaccount.

The return of the interest-free loan to the founder is formalized by an expenditure order. Funds received through the cash desk are transferred to the organization’s bank account.