Is it necessary to include the founding director in the “zero” SZV-M report if he does not receive any payments from his company? First, the Pension Fund’s letter No. 08-22/6356 dated May 6, 2016 stated what was needed. Even if the director did not enter into an employment contract with his organization.

But now the situation has changed dramatically. The Ministry of Labor and the Pension Fund issued letters stating that SZV-M for the founding director, who does not receive a salary and has not entered into an employment contract, does not need to be submitted at all. What to do now? What explanations should you follow? Let's figure it out.

Changing positions

The Pension Fund's letter No. 08-22/6356 dated May 6, 2016 clearly explained that even if an employment contract has not been concluded with the owner of the organization, the relationship between him and the company is an employment one. Therefore, it is required to submit the SZV-M report with at least one director.

Some accountants call such reporting “zero SZM-V”. They include the director in them and submit such a report every month. See “Zero SZV-M: is it necessary to submit it and how to fill it out.”

New clarification from the Ministry of Labor

However, in the letter of the Ministry of Labor dated 07/07/2016 No. 21-3/10/B-4587, signed by the Secretary of State - Deputy Minister A.N. Pudov, contains a completely different conclusion. In particular, officials agree that there are cases when general directors work without concluding employment contracts and do not receive any payments from organizations: But officials also add that insurers are obliged to SZV-M exclusively in relation to insured persons working in organizations for labor or a civil contract. And this also applies to directors who are the only founders.

Thus, it turns out that if the general director, the only founder, is not connected with the organization by an employment contract and does not receive any payments from the company, then the SZV-M alone can not be handed over to him at all? And there is no need to submit a “zero” report to SZV-M and include only the director in it? Yes, this is exactly the conclusion that follows from the commented letter.

At the same time, there is a caveat that if, nevertheless, an employment contract has been concluded with the director, then the director must be included in the SZV-M report every month. Even if the director does not receive any payments under this agreement.

Form SZV-M for director - sole founder

Yes, the SZV-M form for the sole founder acting as a director must be submitted monthly to the Pension Fund of the Russian Federation, regardless of the fact that an employment contract has not been concluded with him and no salary is paid to him. Let's tell you in more detail.

For whom is the SZV-M form filled out?

Form SZV-M “Information about insured persons” was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. It is compiled for each insured person working in the company and contains information about his SNILS, full name and tax identification number. The form is submitted monthly to the Pension Fund of the Russian Federation no later than the 15th day of the month following the expiration of the month (clause 2.2 of Article 11 of the Federal Law of 01.04.96 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, hereinafter - Law No. 27-FZ).

The list of insured persons is given in Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation.” Among them are persons working under an employment contract, including heads of organizations who are their sole founders.

Thus, the director - the sole founder - must submit the SZV-M form if he works under an employment contract. Let's consider whether the sole founder can be considered such a person if an employment contract has not been concluded with him.

Labor relations with the sole founder

The specifics of regulating the work of the head of an organization are established in Chapter 43 of the Labor Code of the Russian Federation. From its provisions it follows that an employment contract is concluded with the director, just like with any other employee. However, in Art. 273 of the Labor Code of the Russian Federation expressly states that the provisions of Chapter 43 of the Labor Code of the Russian Federation do not apply to the director, who is the sole founder of the company.

Rostrud believes that it is impossible to conclude an employment contract with the director - the sole founder (letters dated December 28, 2006 No. 2262-6-1, dated March 6, 2013 No. 177-6-1). Department specialists explain this by saying that an employment contract is an agreement between an employee and an employer (Article 56 of the Labor Code of the Russian Federation). And when the director is the only founder, he does not have an employer. Concluding an employment contract with oneself is impossible, since signing an employment contract by the same person on behalf of the employee and on behalf of the employer is not allowed.

According to Rostrud, the sole founder of the company must, by his decision, assume the functions of the sole executive body - director, general director, president, etc. And management activities in this case are carried out by him without concluding any contract, including an employment contract. Similar conclusions are contained in the letter of the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199.

The Ministry of Finance of Russia (letter dated March 15, 2016 No. 03-11-11/14234) also believes that an employment contract with the director - the sole founder - is not concluded, since one of the parties (the employer) is missing. With reference to the Determination of the Supreme Arbitration Court of the Russian Federation dated 06/05/2009 No. VAS-6362/09, the financiers indicated that in this case, labor relations with the director as an employee are formalized not by an employment contract, but by the decision of the sole founder.

As you can see, officials believe that an employment contract is not concluded with the director - the sole founder. But can he be recognized as working under an employment contract?

In the clarifications approved by order of the Ministry of Health and Social Development of Russia dated 06/08/2010 No. 428n, the position is expressed that the director - the only founder - refers to persons working under an employment contract. This is explained by the fact that, in accordance with Art. 16 of the Labor Code of the Russian Federation, labor relations that arise as a result of election to a position, appointment to a position or confirmation in a position are characterized as labor relations on the basis of an employment contract.

The courts also say that the director, the sole founder, is a person working under an employment contract. Thus, in resolution No. A45-6721/2010 dated 09.11.2010, the FAS of the West Siberian District considered the situation when the territorial body of the FSS of Russia refused to receive compulsory social insurance benefits to the director - the only founder. This was justified by the fact that such a director is not an insured person. However, the court, guided by the provisions of Art. 16 of the Labor Code of the Russian Federation, recognized the director as an employee with whom an employment relationship was concluded on the basis of an employment contract. A similar conclusion is contained in the resolution of the Far Eastern District dated October 19, 2010 No. F03-6886/2010.

So, in the absence of an employment contract with the director - the sole founder, he is still classified as a person working under an employment contract and, accordingly, is an insured person.

Obligation to submit form SZV-M

In a letter dated March 16, 2018 No. 17-4/10/B-1846, the Russian Ministry of Labor explained that the company is obliged to submit the SZV-M form in relation to all insured persons in labor relations with it, including heads of organizations that are the only participants (founders). The same conclusion is contained in the letter of the Pension Fund of the Russian Federation dated 06/07/2018 No. 08/30755.

And from the letters of the Ministry of Labor of Russia dated 07/07/2016 No. 21-3/10/B-4587 and the Pension Fund of the Russian Federation dated 07/13/2016 No. LCh-08-26/9856 it follows that reporting in the SZV-M form in relation to the director - the sole founder must be submitted regardless of the actual payment and other remuneration for the reporting period in his favor, as well as regardless of the payment of insurance premiums.

The courts also believe that the company is obliged to submit the SZV-M form for the director - the sole founder. An example is the resolution of the Central District Court of April 18, 2019 in case No. A14-1839/2018.

In this case, the territorial body of the Pension Fund of the Russian Federation held the company liable for untimely submission of the SZV-M form for the company’s employee - the only founder acting as a director. The fine was 500 rubles. (Article 17 of Law No. 27-FZ). Since the company voluntarily did not pay the fine, the territorial body of the Pension Fund of Russia went to court.

In court, the company insisted that it did not have an obligation to submit the SZV-M form, since the director, the only founder, did not receive a salary and no employment contract was concluded with him. But the court found these arguments unfounded, since in accordance with Art. 16 of the Labor Code of the Russian Federation, labor relations on the basis of an employment contract arise with an employee as a result of election to a position or confirmation in a position, as well as on the basis of the employee’s actual admission to work with the knowledge or on behalf of the employer. Therefore, the company is obliged to submit the SZV-M form for the director - the sole founder. It does not matter that he was not paid a salary.

Summarize. Labor relations with the sole founder are formalized by his decision to assume the functions of director of the company. At the same time, he is considered to be working under an employment contract and is classified as an insured person. This means that the company is obliged to submit the SZV-M form in relation to it.

Reaction of territorial divisions of the Pension Fund of Russia

The PFR central office sent Letter No. LCH-08-26/9856 dated July 13, 2016 to all its territorial divisions. That is, local funds are now required to be guided by the new position and no longer have the right to demand the presentation of “zero” SVZ-M.

Some territorial bodies of the Pension Fund of Russia have already responded to this. For example, the Pension Fund Office in the Leninsky district of Yekaterinburg, Sverdlovsk region, sent the following mailing to policyholders on July 27, 2016:

On August 3, the PFR branch for St. Petersburg and the Leningrad Region published information on its website that SZV-M is not giving up:

- if the organization does not conduct financial and economic activities, there are no employees with whom employment or civil law contracts continue to be valid in the reporting month, payments for which are subject to insurance contributions for compulsory pension insurance;

- to the sole founder performing the functions of a manager in an organization that does not carry out financial and economic activities (unless an employment or civil law contract has been concluded with such a founder).

What happens if you don’t pass the SZV-M

Information about insured persons in the SZV-M form is submitted monthly. The deadline for submitting such reports is no later than the 15th day of the month following the reporting month (Clause 2.2 of Article of the Federal Law of 01.04.96 No. 27-FZ). For violation of this deadline and for failure to provide information, a fine of 500 rubles is established. in relation to each insured person (Article Law No. 27-FZ).

Reporting in the form SZV-STAZH is submitted annually. The fine for failure to provide annual information about the length of service is 500 rubles. in relation to each insured person, and the fine for violating the procedure for submitting reports in electronic form is 1,000 rubles. This is spelled out in the new version of Article 17 of the Law on Personalized Accounting.

What if the company is active?

In practice, cases are common when an organization has no employees and the founding manager did not enter into an employment contract with himself. But thanks to the efforts of this director, the organization exists and, nevertheless, conducts financial and economic activities (in particular, reporting is submitted and there are movements in bank accounts). Is it then necessary to file a SZV-M for the director?

Please note: on the website of the OPFR for St. Petersburg and the Leningrad Region it is specified that SZV-M can not be submitted to the director only if financial and economic activities are not carried out.

But neither the letter from the Ministry of Labor nor the letter from the Pension Fund says anything about the fact that if, for example, there are movements in the accounts, then SZV-M must be handed over to the director. Moreover, these letters note that the object of taxation by insurance premiums arises only if there is a fact of payment of funds in favor of individuals. Here, for example, is an excerpt from a new letter from the Pension Fund of Russia:

Therefore, in our opinion, if the director did not enter into an employment contract “with himself” and does not receive any payments from organizations, then there is no need to submit an SZV-M.

But can it be that it carries out certain operations, enters into contracts, has transactions on accounts, and its only director is not even considered an employee and does not receive any salary? There is no answer to this question in the commented letters. Officials only noted that Rostrud should be in charge of clarifying this issue.

How to report to the Pension Fund about the founding director without salary

And we have already repeatedly given arguments in favor of the fact that concluding an employment contract is both possible and necessary. We will not repeat ourselves, since the article, in general, is not about that.

Note that many founders do not want to argue at all; they are quite happy with this point of view. They perceive the “impossibility” of concluding an employment contract as a “legal reason” not to pay themselves a salary.

After the introduction of SZV-M, a number of companies began to have difficulties submitting personalized pension reporting. Both the new monthly and the previous quarterly - individual information as part of the RSV-1 report. If an employment contract with the director - the sole founder - has been concluded and the company conducts financial and economic activities, then the company definitely needs to submit SZV-M and individual information for the director.

But if an employment contract has not been concluded with the director or financial and economic activities are not carried out, then there are doubts about the need to submit SZV-M and individual information for the founding director.

Let's consider these situations in more detail.

But the director does not receive a salary. Just because I decided so.

In practice, to fulfill this “desire,” the director goes on vacation without pay.

Answers to common questions about if the director does not receive a salary SZV-M how to submit

Question #1:

For what purpose is personalized accounting information submitted to the Pension Fund in the SZV-M form?

Answer:

Information transmitted through the SZV-M form helps the Pension Fund monitor working pensioners and their employment. This is being done because the indexation of pensions for working pensioners has been cancelled.

Question #2:

It turned out that the employment contract with the director of the sole founder of the LLC was valid for only 1 day of the reporting month, should I submit an SZV-M for this reporting period?

Answer:

Yes, one day is enough to submit information in the SZV-M form to the Pension Fund.

Should I submit a zero SZV-M in 2020 if activities are suspended?

First, let's consider a situation where a legal entity has temporarily ceased to operate, but the organization has employees or one employee who wrote a statement and went on leave without pay. In such a situation, the director of the LLC writes an order to suspend the activities of the company, indicating the reason for the suspension.

The reason may be any circumstances that led to a temporary cessation of activity, for example a financial crisis or the difficult financial situation of the company with high competition and low customer demand. In a situation where there is no activity, but there are employees with whom employment contracts have been concluded, it is necessary to submit reports on the personal account.

registration with the Pension Fund. This conclusion can be drawn if you read Federal Law 27 of April 1, 1996, which describes personalized accounting and Article 11 of which lists the persons for whom information is submitted. This legislative act does not indicate that there are differences between an employer carrying out economic activity and an employer who has temporarily ceased to operate.

Consider a situation where the sole founder is the director of the company. Most recently, the Pension Fund did not require such a director to submit a SZV-M report, but since March 2020, the position of the Pension Fund employees has changed. A Letter from the Ministry of Labor and Social Protection with number 17-4-10-B-1846 dated March 16, 2020 was issued.

The Ministry of Labor in this letter established the obligation of founders-directors to submit information for themselves even in cases where the employment relationship is not formalized in any way. The letter does not say anything about whether the company is in business or not. Thus, we can conclude that this rule applies to all founders-directors, regardless of whether the activity of a legal entity is carried out. This position was confirmed to us by calling the Pension Fund Hotline, informing us that it is necessary to submit the SZV-M, even if there is no activity.

If a company or individual entrepreneur decides to suspend operations for any reason, but employees continue to be on staff, accountants ask the question, do they need to submit a zero form in this case or do they need to report on all employees as usual?

The answer is that even if you are temporarily not conducting business, the obligation to submit the SZV-M remains. This is explained by the fact that the lack of payment of wages does not affect the status of workers as insured persons in the compulsory pension insurance system. This means that the employer is obliged to submit a monthly SZV-M report; in this case, the zero tax cannot be submitted even if there is zero reporting on other taxes.

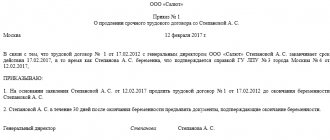

See a sample report below.

The director does not receive a salary SZV-M - why is it necessary to submit a report?

Let's remember who can legally be classified as insured persons participating in the Pension Insurance program. These include:

- citizens of Russia;

- foreigners and stateless persons temporarily or permanently residing in the Russian Federation;

- stateless persons and foreigners temporarily staying in Russia (Clause 1, Article 7 of the Federal Law of December 15, 2001 No. 167-FZ).

Important!

At the same time, highly qualified specialists from abroad are not among the persons insured by the Pension Fund (Federal Law No. 115-FZ of July 25, 2002).

According to the provisions of paragraph. 2 p. 1 art. 7 of the Federal Law of December 15, 2001 No. 167-FZ, the insured persons are, in particular:

- employees of enterprises with which an employment contract has been concluded;

- heads of companies who are at the same time founders (participants), members of an LLC, owners of LLC property, who work on the basis of an employment contract or GPA, the subject of which is the provision of services or performance of work.

What to fill in the zero SZV-M

https://www.youtube.com/watch?v=https:tv.youtube.com

The company cannot simply submit a blank settlement form. The form contains a number of details that must be filled out. These are sections 1, 2 and 3, which indicate the details of the policyholder, reporting period and type of form.

But in section 4 information about the insured persons is indicated, i.e. about employees. As a rule, even if a company does not have working personnel, there is a general director with whom an employment contract has been concluded. In this case, the question of whether or not to take the SZV-M zero does not arise. In section 4 you need to indicate the information of the general director and send the form to the Pension Fund of the Russian Federation.

SZV-M zero level for individual entrepreneurs: to pass or not

As a general rule, only employers are obligated to take SZV-M. Therefore, if an individual entrepreneur uses the labor of hired workers under an employment contract or under GPC agreements, then he is required to submit monthly SZV-M. The filling procedure in this case is the same as for the company.

However, if an individual entrepreneur works alone without engaging the labor of third parties or with other individual entrepreneurs, then he does not meet the conditions for filling out the SZV-M - he is not an employer. In this case, the individual entrepreneur does not need to submit either the zero calculation of SZV-M in 2020 or the completed one.