Currently watching: 957

Accounting for finished products in production is carried out on account 43 “Finished products”.

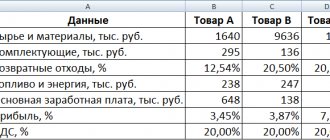

Finished products are assessed according to:

– actual production cost – the sum of all costs associated with the manufacture of products (collected in full only on account 20 “Main production”);

– according to standard (planned) cost - where deviations of the actual production cost for the reporting month from the planned (standard) cost are determined and separately taken into account.

General approach to finished goods accounting

According to the law, finished products are part of inventories intended for sale. Namely, the final result of the production cycle, assets completed by processing/assembly, the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents, in cases established by law (clause 199 of the Methodological Guidelines for Inventory Accounting, approved by order of the Ministry of Finance dated December 28. 2001 No. 119n).

By virtue of the Chart of Accounts for financial and economic activities and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), in accounting, transactions with finished products are reflected in the 43rd accounting account. It is intended to summarize information about the availability and movement of finished products.

Typically, accounting for the output of finished products is relevant for industrial, agricultural and other manufacturing enterprises.

The peculiarity of accounting for the production of finished products is that the balance on this account can only be in debit.

KEEP IN MIND

Features of accounting entries for finished products:

- finished products purchased for assembly (the cost of which is not included in the cost of manufactured products) or as goods for sale are recorded on account 41 “Goods”;

- the cost of work performed and services provided is not reflected in the finished product, and the actual costs for them as they are sold are written off from the production cost accounts to account 90 “Sales”.

How to write off selling expenses

In the first case, the costs of packaging and packing are included in the cost of goods as the costs of bringing them to a state in which they are suitable for use. Since such expenses arise after the goods have been capitalized, their value, reflected in account 41 upon receipt, changes. This does not contradict accounting legislation (clause

6

PBU 5/01), but with this approach, temporary differences will arise between accounting and tax accounting. The fact is that for calculating income tax, the costs of packaging and packing are indirect. When calculating the tax base, they are fully recognized in the reporting period in which the organization committed them (para.

3 tbsp. 320 of the Tax Code of the Russian Federation). In accounting, expenses recorded on account 41 are written off as goods are sold (Instructions for the chart of accounts).

https://youtu.be/UHB5b3xMtOs

The procedure for accounting for the cost of finished products

When accounting for finished products on synthetic account 43 at the actual production cost in analytical accounting, the movement of its individual items can be reflected at accounting prices (planned cost, selling prices, etc.) highlighting deviations of the actual production cost of products from their cost at accounting prices.

Such deviations are taken into account for homogeneous groups of finished products, which the organization forms based on the level of deviations of the actual production cost from the cost at the accounting prices of individual products.

The main entry with the cost of finished products is a write-off from account 43. In this case, the amount of deviations of the actual production cost from the cost at prices accepted in analytical accounting is determined by percentage. Namely, as the ratio of deviations for the balance of finished products at the beginning of the reporting period and deviations for products received at the warehouse during the reporting month to the cost of these products at discount prices.

The amounts of deviations of the actual production cost of finished products from their cost at accounting prices related to shipped and sold are reflected in the credit of account 43 and the debit of the corresponding accounts with an additional or reversal entry - depending on whether it is an overexpenditure or a saving.

Account 44 “sales expenses”

Debit 44 Credit 70 – wages accrued to the organization’s employees; Debit 44 Credit 69 – contributions have been accrued for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases; Debit 44 Credit 71 – travel and entertainment expenses are written off; Debit 44 Credit 97 – expenses that were previously included as deferred expenses are written off. Depending on the specific content of expenses in accounting, other entries are possible. Accounting: write-off to cost price At the end of the reporting period (month), write off the amount of expenses for the sale of goods accumulated on account 44 to the debit of subaccount 90-2 “Cost of sales”: Debit 90-2 Credit 44 - expenses are written off to cost of sales.

This procedure is provided for in the Instructions for the chart of accounts.

Examples of postings with finished products

| Operation | Account debit | Account credit |

| Revenue from the sale of finished products is reflected | 62 “Settlements with buyers and customers” | 90 “Sales”, sub-account “Revenue” |

| The cost of shipped finished products is written off | 90, subaccount “Cost of sales” | 43 |

| VAT charged on sales of finished products | 90, subaccount “VAT” | 68 “Calculations for taxes and fees”, subaccount “VAT” |

Commercial expenses associated with the sale of finished products are also written off:

| Dt 90, subaccount “Sale expenses” – Kt 44 “Sale expenses” |

Postings for writing off sales expenses

In this case, it is advisable to open an additional subaccount “Costs for the delivery of goods from suppliers” to account 44. An example of reflecting in accounting the costs of delivering goods from the supplier to the warehouse of the purchasing organization. Delivery costs are not included in the cost of purchasing goods. Torgovaya LLC is engaged in wholesale trade.

In February, revenue from the sale of goods amounted to RUB 1,200,000. (excluding VAT). The cost of unsold goods at the end of February is 450,000 rubles. According to the Hermes accounting policy, the costs of delivering goods from suppliers are distributed equally in accounting and tax accounting.

To account for these expenses, the subaccount “Costs for the delivery of goods from suppliers”, opened to account 44, is used. As of February 1, the balance of expenses for the delivery of goods is 20,000 rubles.

Features of reflecting expenses

The main differences apply to three types of organizations: manufacturing and agricultural, trading enterprises (or acting as intermediaries), construction companies that directly procure technical materials or structures.

The main difference in recording expenses between the listed types of organizations is related to the nature of their activities. For example, sales organizations would not use account 44 for packaging or shipping costs. At the same time, the costs of storing goods at the points of sale themselves will relate specifically to this type of enterprise.

The debit of account 44 is also used to reflect the costs of an employee’s business trip if it is related to the sales of finished goods (manufacturing organization) or the main activity (trade organization). Correspondence is carried out by debit and credit of account 71 when accruing travel expenses. When paying for travel expenses, posting Dt 44 Kt 76 “Settlements with various debtors and creditors” is carried out.

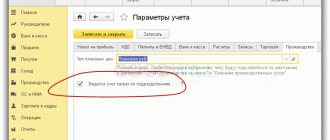

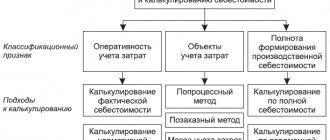

How are production costs recorded?

Modern production accounting, as a rule, includes accounting for costs and income according to the following analytics:

- by their types;

- by department;

- by type of product (product groups).

In various industries and industries, the object of cost accounting can be products, their parts, a group of homogeneous products, a separate order, the volume of production as a whole for the enterprise or in its individual sections. The choice and features of accounting objects are often determined by the specifics of the business.

All accounts that take into account production costs in transactions are active. Expenses of the main production are maintained on account 20, auxiliary - on account 23, general production and general business expenses - on accounts 25, 26.

At the end of the month, accumulated expenses on the debit of accounts 25 and 26 are transferred to the debit of accounts and/or, while the accounts are closed and have a zero balance. Account 28 takes into account defects in production, account 29 – servicing production.

Accounting for release using account 40

If the organization decides to use the account. 40, then finished products from production are debited to this account at actual cost (entry D40 K20 (23)). In account 43, products are accounted for at the planned cost (posting D43 K40).

Arose on the account. 40 deviation in cost is attributed to the account. 90 "Sales".

If the actual cost turns out to be higher than the planned cost, then a negative cost deviation arises, which must be written off from the credit account. 40 wiring D90/2 K40. A negative deviation indicates that there was an overrun in production and the technological process should be checked to find out what resulted in the overestimation of the actual cost.

If the actual cost turns out to be lower than planned, then a positive deviation (savings) is observed, which is reversed by D90/2 K40.

As a result of making entries to account for any deviations in the account. 40 is completely closed at the end of the month, and its balance becomes equal to 0.

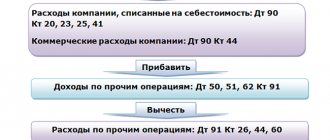

Concept, accounting and distribution of sales costs

Selling expenses (commercial, non-production) include the costs of selling products paid by the supplier.

Selling expenses include:

Costs for containers and packaging of products in finished product warehouses;

Costs for transporting products;

Other sales expenses.

Accounting for expenses for the sale of products is carried out on account 44 “Sales expenses”. The account is active, balance sheet calculation.

The debit of account 44 accumulates the amounts of expenses incurred by the organization related to the sale of products, works, and services. These amounts are written off in whole or in part to the debit of account 90 “Sales”: Dt 90 Kt 44.

In case of partial write-off, sales expenses are distributed between individual types of shipped products in proportion to their production costs; volume of products sold or in another way.

If only part of the manufactured products is sold in the reporting month, then the amount of sales expenses is distributed among the products sold.

Analytical accounting for account 44 is carried out by types and items of expenses in statement No. 15.

To distribute expenses, find the coefficient:

| amount of sales expenses cost of shipped products |

Example.

In the reporting month, the enterprise shipped finished products at production cost in the amount of 120,000 rubles.

Products sold for the amount of 85,000 rubles. Sales expenses for the month amounted to 50,000 rubles. Allocate selling expenses.

1. The distribution coefficient is found: Krasp. = 50,000 /120,000 = 0.4167.

2. Selling expenses for sold products are written off: D-t 90 K-t 44 - 85,000 x 0.4167 = 35417.

3. Selling costs for shipped products are determined: 50,000 - 35,417 = 14,583, or 35,000 x 0.4167 = 14,583.

Take part in fairs and exhibitions;

Hold a prize draw 11 etc.

2) distribute them between sold products and products remaining in the warehouse.

However, the costs of purchasing or producing prizes that the organization gives to winners during advertising campaigns are regulated. The amount of such costs for tax purposes cannot exceed 1% of the revenue that the organization received in the reporting period. This standard is established for all advertising expenses not included in the list of non-standardized expenses.

Example.

CJSC "Dar" sponsored the city holiday, donating 250,000 rubles.

Expenses for selling transactions are written off for sales

The cost of the batch is 500,000 rubles. (excluding VAT). Before selling granulated sugar at retail, the organization packages it in 1 kg plastic bags. For these purposes, Hermes purchased packaging bags for a total amount of 8,000 rubles. (excluding VAT). Other expenses for packaging and packing sugar amounted to 10,000 rubles. To account for packaging, a subaccount “Containers under goods and empty” (41-3) was opened for account 41 “Goods”; for accounting for goods, a subaccount “Goods in warehouses” (41-1) was opened. The following entries were made in the organization’s accounting: Debit 41-1 Credit 60–500,000 rub. – granulated sugar was capitalized; Debit 41-3 Credit 60–8000 rub. – plastic bags for packaging sugar were capitalized; Debit 44 Credit 41-3– 8000 rub. – the cost of packages used for packaging has been written off; Debit 44 Credit 70 (69, 76...) – 10,000 rub. – expenses associated with packaging and packaging of granulated sugar were written off.

Expenses for selling transactions written off to sales

In supply, sales, trading, other intermediary and other similar organizations, the following expenses can be reflected on account 44: for the transportation of goods; for wages; for the rental and maintenance of buildings and structures, equipment premises; for storage and processing of goods; for advertising; other expenses similar in purpose. The list of expenses and the procedure for their inclusion in the distribution costs of organizations is regulated by legislation and other regulations. In organizations that procure and process agricultural products (beets, milk, wool, leather raw materials, flax, livestock, poultry, etc.), the following expenses can be reflected on account 44: for the maintenance of procurement and receiving points; for the maintenance of livestock and poultry at bases and reception points.

Account 44 “Sales expenses” is intended to summarize information on expenses associated with the sale of products, goods, works and services.

In organizations that procure and process agricultural products (beets, milk, wool, cotton, leather raw materials, flax, livestock, poultry, etc.), account 44 “Sales expenses” can reflect, in particular, the following expenses: other expenses ; general procurement expenses; for the maintenance of procurement and receiving points; for the maintenance of livestock and poultry at bases and reception points.

The debit of account 44 “Sales expenses” accumulates the amounts of expenses incurred by the organization related to the sale of products, goods, works and services. These amounts are written off in whole or in part to the debit of account 90 “Sales”. In case of partial write-off, the following are subject to distribution:

In organizations engaged in industrial and other production activities - packaging and transportation costs (between individual types of shipped products on a monthly basis based on their weight, volume, production cost or other relevant indicators);

In organizations engaged in trading and other intermediary activities - transportation costs (between the goods sold and the balance of goods at the end of each month);

In organizations that procure and process agricultural products, debit accounts 15 “Procurement and acquisition of material assets” (expenses for the procurement of agricultural raw materials) and (or) “Animals for growing and fattening” (expenses for the procurement of livestock and poultry).

All other expenses associated with the sale of products, goods, works, services are charged monthly to the cost of products sold (goods, works, services).

Analytical accounting for account 44 “Sales expenses” is carried out by types and items of expenses.

Account 44 “Sales expenses” corresponds with the accounts

| by debit | on loan |

| 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 10 Materials 16 Deviation in the cost of material assets 19 Value added tax on acquired assets 23 Ancillary production 29 Service production and facilities 41 Goods 42 Trade margin 43 Finished products 60 Settlements with suppliers and 68 Settlements for taxes and fees 69 Social payments 70 Settlements with personnel 71 Settlements with accountables 76 Settlements with various 79 On-company 94 Shortages and losses from 96 Reserves for future periods 97 Expenses for future periods | 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 45 Goods shipped 76 Settlements with various debtors and creditors 79 On-farm payments 90 Sales 94 Shortages and losses from damage to valuables 99 Profits and losses by contractors insurance and ensuring payment of wages to debtors and creditors calculations of damage to valuables expenses |

Application of the chart of accounts: account 44

- Logistics expenses: accounting and taxation

On account 44 “Sales expenses” as part of distribution costs (selling expenses). Let's consider both methods of accounting for logistics costs using the example of expenses for... are included in the expenses of the current month and are taken into account in account 44 “Sales expenses”. In accounting, such expenses are reflected in account 44... by posting: Debit of account 44 “Sales expenses” To... - Accounting for advertising costs on the Internet under the simplified tax system “income minus expenses”

- Separate accounting of expenses and revenues when supplying products as part of the execution of state defense orders.

Distribution costs, that is, expenses reflected in account 44 “Sales expenses”. In this case, the contractor..., in particular, to account 44, for example: subaccount 1 “Expenses for the sale of goods within the framework of... state defense order 1”; subaccount 2 “Expenses for the sale of goods... 90-2-1 Credit 44-1 - expenses for the sale of goods under contract 1... are written off; Debit 51, subaccount “Separate account, open... - Security costs.

Accounting and tax accounting Accounts 20 “Main production”, 26 “General business expenses” or 44 “Sale expenses...”). . The amount of VAT presented by the contractor is reflected in the debit of the account... Bank statement on the current account Expenses for the protection of leased property According to... accounting is reflected in accounts 26 “General business expenses” or 44 “Sale expenses” in... correspondence on the credit of account 60... - Personal protective equipment in the workplace

The initial cost, which is the amount of expenses for its acquisition (in this case... property, is included in material expenses on the date of transfer of personal protective equipment... in the case of the debit of account 44 “Sales expenses” and the credit of account 10, subaccount 10...Reflects the repayment of the cost of issued workwear 44 “Sale expenses” 10-11 “Special equipment and... Reflects the repayment of the cost of issued workwear 44 “Sale expenses” 10-11 “Special equipment and... - How to register and record the sale of your own gift certificates for services

Cash receipts should reflect the sale of your own gift certificates for services, as well as... cash receipts should reflect the sale of your own gift certificates for services, as well as... gift certificates on an off-balance sheet account in the notional valuation (to for example, on account 006 or... /index.php?showtopic=782330. *(3) The costs of producing gift certificate forms can... be taken into account by the issuing organization as expenses associated with the sale). - Entertainment expenses for the purchase of alcoholic beverages: accounting and taxation

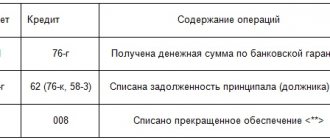

Are entertainment expenses for the purchase of alcoholic beverages reflected in account 26 “General business expenses”? Do they admit...? Are entertainment expenses for the purchase of alcoholic beverages reflected in account 26 “General business expenses”... by the debit of account 26 “General business expenses” or 44 “Sales expenses” (if... the organization is engaged in trading activities) in correspondence with the accounts... - Pledge.

Accounting and taxation of the Bank on a current account Insurance costs are recognized as another expense 91-2 76 ... accounting In accounting, the costs of insuring the pledged item are reflected by the pledgor in account 76 "... including the services of the auction organizer) are taken into account in account 44 “Sale expenses” with subsequent by writing off... to the debit of account 90, subaccount 90-2... “Cost of sales” (as expenses, directly... - Trademark and trademark: how to take into account?

And are intangible assets depreciated? As expenses for the creation (purchase) of a trademark and...: small businesses have the right to recognize expenses for the acquisition (creation) of objects that are subject to..., copyright contracts, etc.; expenses for remuneration of workers directly employed..., insurance premiums from these payments; expenses for the maintenance and operation of fixed assets... of the organization, they are reflected in the debit of account 44 “Sales expenses” and the credit of account 05. - The procedure for accounting for expenses for setting up an accounting program

for Reporting periods, the Chart of Accounts is assigned to account 97 “Expenditures of future periods”. However... services provided). The specified types of expenses are reflected in the debit of the cost accounting accounts (20 ... “General production expenses”, 26 “General business expenses”, 44 “Sales expenses” - depending on their purpose) in correspondence with the credit of the account ... - What exactly are entertainment expenses?

The following expenses can be classified as hospitality expenses: catering for delegations, as... can be included in hospitality expenses for renting a car for delivery... within the standard - 4% of labor costs for the reporting period (tax... in this case, entertainment expenses are taken into account on accounts 26 “General business expenses” or 44 “Sales expenses” in correspondence... with accounts: 60 “Calculations... - “Alcohol” license: accounting for

state duty Extension of validity) of a license for the retail sale of alcoholic beverages, the amount paid... To account for them, you should use account 44 “Sales expenses”, designed to summarize information about... expenses associated with the sale of products, goods, work... accounting under the credit of account 91 “Other income and expenses”, subaccount 91-... their actual payment, and expenses for paying taxes are taken into account as part of... these costs are included in expenses on the date of occurrence, that is, the date... - Does it make sense to divide costs into variable and fixed?

Constant and are attributed in total to complex accounts, and then according to... inventories) and are written off to account 20 “Main production” (see... Instructions for using the Chart of Accounts). The cost of work in progress and... are collected on complex accounts (cost items): 25 “General production expenses”, 26 “General business expenses”, 29 ... “Production and household maintenance”, 44 “Sales expenses”, 23 ... - How to establish in accounting the useful life of an advertising video

For planned purposes. The list of expenses that are expenses for the acquisition of intangible assets is given in ... ordinary activities using account 44 “Sale expenses” (clauses 4 ..., 5, 8 PBU 10/99 “Expenses ... organizations”, Instructions for using the Chart of Accounts accounting... by including in the income or expenses of the organization (prospectively): the period, in... the balance sheet "Intangible assets and R&D expenses. Answer prepared by: Expert... - How to reflect defects in accounting in the absence of employees’ fault

Norms of natural loss - to cost accounts and/or to sales expenses (20 “Main ... production”, 26 “General business expenses” ...; etc., 44 “Sales expenses” ); at the expense of the guilty persons; on the financial... results of the organization (account 91...

Using accounts

There is a special type of account that records finished products. Number 43 is used when it comes to the availability and movement of products. Account 41 – for the sale of finished products. The cost of work and services is easily recorded using so-called recordable units. Why is another count, designated 90, used? In some cases it is replaced by a 40 count, but this does not always happen.

Account 43 deserves a separate discussion. First, it takes into account products at cost. It is entered into the documents. When the goods are shipped, they are debited from the credit 43 account. Then all operations are transferred to 45. Sometimes they use documents with the number 90.

Count 40

This tool has its own characteristics:

- when fixing the cost of services and work, use debit;

- credit - when reflecting the same indicator, but normative;

- Most often, goods are written off from credit to debit.