Cost in accounting is a concept that can be interpreted in several ways. We will find out which ones exactly from this publication.

Cost accounting: economic interpretation

The concept of cost in accounting legislation

Cost accounting: main tasks of an accountant

Registration of transactions with cost accounting objects within the cost price

Costing: classification of methods

Progressive and process-by-process methods of cost accounting

Order-based and piece-by-piece cost accounting methods

Boiler cost accounting method

Standard cost accounting method

Application when accounting for the cost of accounting accounts

Results

Cost accounting: economic interpretation

In economics, cost is usually understood as the total cost of a company to produce goods, provide services, or perform work. The costs in question are most often classified as:

- to material ones;

- those related to wages;

- depreciation;

- those related to the sale of goods, services or works.

Each of the noted expense categories can be represented by a large number of items.

Cost as an economic category is classified into 3 types:

- workshop;

- production;

- complete.

The first type of cost includes costs that are associated with the production of goods in a specific workshop (as an independent structural unit of the company).

The production type of cost includes, firstly, workshop costs, and secondly, expenses:

- general economic;

- related to losses from marriage;

- others that are related to the production of goods in the workshop, but are not related to the activities of the workshop.

The full cost includes the production component, as well as expenses that:

- related to the sale of goods;

- relate to administrative;

- are classified as commercial.

Different interpretations of cost in accounting are also reflected in regulations governing the field of accounting. Let's study them.

PBU 10/99

5. Expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is participation in the authorized capital of other organizations, expenses for ordinary activities are considered expenses the implementation of which is related to this activity.

Expenses, the implementation of which is associated with the provision for a fee for temporary use (temporary possession and use) of one’s assets, rights arising from patents for inventions, industrial designs and other types of intellectual property, and from participation in the authorized capital of other organizations, when this is not the subject of the organization's activities are classified as operating expenses.

Expenses for ordinary activities are also considered to be reimbursement of the cost of fixed assets, intangible assets and other depreciable assets, carried out in the form of depreciation charges.

6. Expenses for ordinary activities are accepted for accounting in an amount calculated in monetary terms equal to the amount of payment in cash and other forms or the amount of accounts payable (taking into account the provisions of paragraph 3 of these Regulations).

If payment covers only part of the recognized expenses, then the expenses accepted for accounting are determined as the sum of payment and accounts payable (in the part not covered by payment).

6.1. The amount of payment and (or) accounts payable is determined based on the price and conditions established by the agreement between the organization and the supplier (contractor) or other counterparty. If the price is not provided for in the contract and cannot be established based on the terms of the contract, then to determine the amount of payment or accounts payable, the price at which, in comparable circumstances, the organization usually determines expenses in relation to similar inventories and other valuables, works, services is accepted. or providing for temporary use (temporary possession and use) of similar assets.

6.2. When paying for purchased inventories and other valuables, works, services on the terms of a commercial loan provided in the form of deferred and installment payment, expenses are accepted for accounting in the full amount of accounts payable.

6.3. The amount of payment and (or) accounts payable under contracts providing for the fulfillment of obligations (payment) not in cash is determined by the value of goods (valuables) transferred or to be transferred by the organization. The cost of goods (valuables) transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the cost of similar goods (valuables).

If it is impossible to determine the value of goods (valuables) transferred or to be transferred by the organization, the amount of payment and (or) accounts payable under contracts providing for the fulfillment of obligations (payment) not in cash is determined by the value of the products (goods) received by the organization. The cost of products (goods) received by the organization is established based on the price at which similar products (goods) are purchased in comparable circumstances.

6.4. In the event of a change in the obligation under the contract, the initial amount of payment and (or) accounts payable is adjusted based on the value of the asset to be disposed of. The value of the asset to be disposed of is determined based on the price at which, in comparable circumstances, the entity would normally determine the value of similar assets.

6.5. The amount of payment and (or) accounts payable is determined taking into account all discounts (discounts) provided to the organization in accordance with the agreement.

6.6. The amount of payment is determined (decreased or increased) taking into account the amount differences that arise in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units). The amount difference is understood as the difference between the ruble estimate of the actual payment made, expressed in foreign currency (conventional monetary units), calculated at the official or other agreed rate on the date of acceptance of the corresponding accounts payable for accounting, and the ruble estimate of these accounts payable, calculated at the official or other agreed rate. other agreed rate on the date of recognition of the expense in accounting.

7. Expenses for ordinary activities form:

expenses associated with the acquisition of raw materials, materials, goods and other inventories;

expenses arising directly in the process of processing (refinement) of inventories for the purposes of production, performance of work and provision of services and their sale, as well as sale (resale) of goods (expenses for the maintenance and operation of fixed assets and other non-current assets, as well as to maintain them in good condition, commercial expenses, administrative expenses, etc.).

8. When forming expenses for ordinary activities, their grouping should be ensured by the following elements:

material costs;

labor costs;

contributions for social needs;

depreciation;

other costs.

For management purposes, accounting organizes the accounting of expenses by cost items. The list of cost items is established by the organization independently.

9. For the purpose of generating an organization’s financial result from ordinary activities, the cost of goods, products, works, services sold is determined, which is formed on the basis of expenses for ordinary activities recognized both in the reporting year and in previous reporting periods, and carryover expenses related to the receipt of income in subsequent reporting periods, taking into account adjustments depending on the characteristics of production, performance of work and provision of services and their sale, as well as the sale (resale) of goods.

At the same time, commercial and administrative expenses may be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities.

10. The rules for accounting for costs of production, sale of goods, performance of work and provision of services in the context of elements and articles, calculation of the cost of products (work, services) are established by separate regulations and Methodological guidelines for accounting.

The concept of cost in accounting legislation

Why does an accountant need to take into account such an indicator as cost in the course of his work? Among the main documents of accounting (as one of the final results of accounting) is the profit and loss statement of the company. In accordance with the requirements reflected in clause 23 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n), it must reflect the cost of goods, services and work.

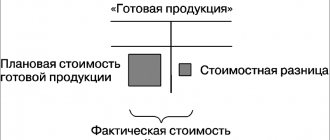

There is also a mention of cost in other accounting regulations. Thus, in paragraph 5 of PBU 5/01 (order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n) it is stated that the actual cost is the indicator by which inventories are recorded. And in paragraph 59 of the Order of the Ministry of Finance No. 34n dated July 29, 1998 it is stated that finished products should be registered at their cost. But what should the cost be from the point of view of accounting legislation?

First of all, we note that there can be several types of accounting costs. Clause 59 of Order No. 34n of the Ministry of Finance, in particular, mentions the cost:

- actual;

- normative (or planned).

Products, services and work actually supplied to the counterparty (but for which revenue is not recognized) are recorded, in accordance with paragraph 61 of Order No. 34n, in accounting also at cost - actual, standard or planned. Moreover, this cost includes costs reimbursed under the contract and associated with:

- with production;

- implementation.

Clause 9 of PBU 10/99 talks about the need, when calculating financial results, to determine the cost of goods, services and works sold based on expenses for ordinary activities, which:

- reflected in accounting for the current reporting period, as well as previous expenses;

- are reflected in accounting in relation to income in periods that follow the current one, taking into account amendments due to the peculiarities of doing business.

The corresponding expenses for core activities in accordance with clause 8 of PBU 10/99 can be presented:

- material costs;

- labor costs;

- insurance contributions to state funds from salaries;

- depreciation;

- other costs.

In turn, commercial and administrative expenses in accordance with clause 9 of PBU 10/99 can also be reflected in accounting for the current reporting year.

Let us note that the profit and loss statement, which is prepared in accordance with PBU 4/99, is not intended to reflect data on commercial and administrative expenses as part of the cost price.

In addition, the following classification of expenses that form the cost is used in accounting (and reflected in some industry regulations):

- direct (related to a specific type of manufactured product);

- indirect (related to several types of manufactured products).

However, in practice, the division of expenses into direct and indirect is more often used not in accounting, but in tax accounting and is actively used to optimize taxation (Article 318 of the Tax Code of the Russian Federation).

Costing systems

Product costing

Not a single author of textbooks and monographs on management accounting ignores the topic of product costing, and this is no coincidence. The expression “product cost” itself means the amount that the product cost the organization (“itself”), how much these products cost the organization, how many expenses the organization incurred in order to obtain these products. It is not without reason that they say that costing is one of the main methods of cost management.

In order to effectively manage an organization, it is not enough just to ensure a flow of income; you also need to create a flow of expenses in such a way that the financial result always remains positive. And here, in the matter of forming the flow of expenses, two aspects should be highlighted. The first aspect can be conventionally called monetary and financial; it concerns the question of what and how to spend money in the production of products - we will touch on this issue only superficially. The second aspect is accounting and information, it relates to the methods of presenting information in periodic reporting, external and internal, and this section is devoted to it.

It is worth noting here that, despite the widespread use of the term “cost”, the calculation of this indicator is only an accounting and management task. Neither international financial reporting standards nor the Tax Code of the Russian Federation contain the concept of cost and therefore do not regulate its calculation in any way. Thus, the decision on whether or not to calculate the cost and how to do it remains with managers and accountants-analysts. When solving these issues, one should be guided not only and even not so much by considerations of expediency, but first of all by the principle of economy. Accounting and analytical work (and cost calculation in the first place) for an organization is quite an expensive pleasure; it requires considerable financial and human resources. Whether or not to invest these resources determines the benefit that the organization (possibly!) will receive from carrying out this activity.

The core of management accounting is information relating to the cost of products produced and sold. In order to determine how much it cost us to produce and bring this product to the consumer, we must first agree in what form we want to see the result of our calculations and what types of expenses are related to this product and which are not. These issues can be resolved through the choice of a cost calculation system.

6.1. The essence of calculation

Wonderful Russian accountant R.Ya. Weizmann distinguished two types of cost calculation: the total cost of production and the cost of each unit of output. Within the framework of financial accounting, the cost of production is determined first of all, and only then the accountant (if anyone asks him about it) divides the result by the number of costing units.

The accountant-analyst operates from the other end - he determines the cost per unit of output, and then uses the resulting result to determine the financial result or level of performance or for other purposes appropriate to the management problem that faces him. This process of generating a list of costs for any type of product is called costing.

Costing is a system of economic calculations of the cost of a costing unit within the scope of cost accounting. The end result of costing is costing - a list of costs necessary to bring one costing unit to a certain target state. If we are talking about the cost of a unit of production, the calculation will be a list of the costs that must be incurred for its production; when analyzing the efficiency of the organization’s branch network, it will be a list of the costs necessary for the branches to perform their main functions (production, sales representation, etc. ).

The content and form of all procedures within the framework of management accounting are determined by a specific management task or area of accounting. The calculation process is no exception: both the list of costs and the rules for calculating the value of each calculation item depend on the goals of such a procedure. The cost of the same costing unit for pricing purposes and for determining the performance of a production unit will be different. If the purpose of management assessment is to determine the effectiveness of the implementation of various functions of the enterprise, the result of the calculation will look completely different than when developing a system of material incentives for management.

The fundamental point for calculation is the choice of calculation unit

, which, in turn, depends on the direction of accounting. When calculating the cost for the purpose of estimating inventories, pricing or analyzing the profitability of different types of products, the unit of production (piece, pack, square meter, etc.) is chosen as the costing unit during the analysis. for example, the effectiveness of the activities of various structural units - such units themselves (branches, divisions, etc.).

It should be noted that when assessing the cost of products, the accountant will have to decide one more fundamental question - whether to calculate the cost of only sold

products or all

finished products

. An accountant preparing financial statements will undoubtedly follow the first path; an accountant-analyst must first consider the purpose of such calculation.

Discussing the essence of calculation, one cannot fail to note the following features.

- The list of costs that need to be included in the calculation is somewhat arbitrary. For example, it is debatable whether a portion of non-manufacturing overhead costs should be included in unit costs. And the inclusion of overhead costs also depends on the chosen calculation method (by full or variable costs).

- The value of each calculation item is influenced by the choice of method for estimating the corresponding indicator. For example, the choice of method for calculating depreciation will affect the amount of depreciation charges as part of the cost price, and the choice of the inventory valuation method will affect the amount of cost of finished products. Although from the point of view of common sense, if we are talking about the same machine and the same supplies, this seems strange. But this ability to vary the valuation of items is a feature of accounting as a whole.

- All calculation units are not identical to each other. We are not talking here about the production of unique products for special orders - this is obvious to them. In mass production, even in the manufacture of high-tech products with strict requirements regarding their technical characteristics, standards allow certain variations in these characteristics (so-called tolerances), but in the manufacture of simple products of mass demand, the difference between individual units can be noticeable to the naked eye - variations in shades of materials, quantities are possible auxiliary materials, packaging, etc. In the service sector, even standardized products look different for different clients (for example, imagine the same haircut done on straight and curly hair). Obviously, the cost of different units in such cases can be considered the same only with a certain degree of convention.

- Methods for separating costs by reporting periods and methods for forming reserves will also affect the amount of cost, although neither one nor the other has a direct relationship to a specific costing unit.

- The degree of completion of work in progress in the process of assessing its value is determined with a large degree of convention, which provides ample opportunities for varying the assessment of work in progress, and, consequently, the financial result of the period.

- Even greater opportunities for variation in the performance indicator (now we are talking about the performance of individual segments of the organization and the profitability of products) are provided by freedom in choosing the bases for the distribution of indirect (overhead) costs.

- Calculating costs in industries where one technological process generates several types of products, as well as where the final result is not deterministic, but appears with a certain probability, presents a significant difficulty. The actual cost of an individual product in these cases simply does not exist. Cost can only be determined as a result of multi-step assumptions.

- Cost implies a monetary value. However, if different cost components are denominated in different currencies (that is, if the product uses components purchased with foreign currency), the cost expressed in one currency will fluctuate with the rate of the other. But no changes occur to the product itself at this time!

From all of the above it follows that calculating the cost of products, despite such a boring name, is a very creative process that requires from the accountant-analyst not only broad knowledge, but also a fair amount of intuition, not just high qualifications, but also the ability to compromise, as well as the talent to choose from a variety of alternatives the most suitable at the moment.

6.2. Classification of calculation methods

The costing method is usually understood as a set of analytical cost accounting methods that provide the ability to attribute costs to a selected costing object (costing unit) and determine the cost of this unit.

The classification of calculation methods can be carried out on several independent grounds. The most informative and, probably, therefore widely used in practice are classifications based on three criteria (Fig. 6.1):

- on the efficiency of cost accounting;

- on the completeness of inclusion of costs in production costs;

- by cost accounting objects.

Rice.

6.1. Approaches to cost accounting and cost calculation Within the first classification, two approaches are distinguished depending on when the calculation is carried out: after the end of the reporting period, the actual cost

, if the calculation is carried out according to planned data and standards,

the standard cost

. Standard cost can serve as the basis for a budgeting system, which we will consider in Part 4 of our publication. In other sections, where this is not specifically noted, we will talk about actual cost and actual expenses.

Based on the completeness of inclusion of costs in production costs, calculation methods are distinguished by full costs (when overhead costs are included in the assessment of manufactured products and, accordingly, inventories) and by variable costs (when only variable production costs are involved in the assessment of inventories).

The list of methods that meet the first and second classification criteria is exhaustive, but regarding classification by accounting objects, everything is not so simple. Traditionally, domestic textbooks on cost accounting use as the basis for classification objects determined by the features of the technological process - an order (with a single production method), a process (in continuous production) and a redistribution (in discrete technological processes for the production of mass products). These objects correspond to order-by-order, process-by-process and per-distribution methods. In some cases, additional methods are considered, for example, batch (operational) costing, and also, usually unrelated to this classification, cost accounting by function (ABC-Costing).

In our opinion, the basic point in constructing this classification is the choice of a generalized accounting object, which is fundamentally irreducible to any other objects and to which we apply our own approach. In Fig. 6.1 there are three approaches to calculation depending on what is the object of accounting:

- custom costing (accounting object and costing object - order);

- process-by-process calculation (accounting object - a process or its part, redistribution, calculation object - a unit of product);

- calculation by function (accounting object is a function of the organization, calculation object is a unit of product).

Each of the named approaches corresponds to a method of the same name, and all other methods of cost accounting and calculation of product costs are developed within the framework of one of these approaches. So, for example, batch costing is a type of order-by-order costing, and the incremental method is a development of the process-by-process method. Moreover, in practice, each of the named methods and approaches is very rarely implemented in its pure form. In most cases, there are forms of calculation combined within the same classification, due to the characteristics of the economic activities of a particular organization.

Cost accounting: main tasks of an accountant

Thus, the concept of cost in the legislation regulating accounting is given in several interpretations. When solving any problems related to cost accounting, the accountant carries out:

- registration of business transactions for expenses that form the cost;

- cost calculation (determining the cost of relevant objects);

- the use of accounting accounts to reflect transactions on transactions within the framework of accounting for cost objects.

Let's study the features of these areas of work of an accountant in more detail.

Registration of transactions with cost accounting objects within the cost price

In order to reflect business transactions on expenses that form the cost, various accounting registers are used. Their list and structure are formed by the accounting department in such a way that:

- the accountant had the opportunity to trace the relationship of expenses belonging to different categories (for example, those associated with the production of specific goods, services, works and those associated with the payment of employees);

- the accountant had the opportunity to summarize the relevant expenses in order to reflect the cost in the consolidated reporting documents for the structural unit or the company as a whole.

Based on the characteristics of the organization of production processes in a particular company, one or another accounting object is selected. It could be:

- a certain type of product (service, work);

- batch of products;

- production stage;

- another object determined based on the specifics of production at a particular enterprise.

The practical significance of the correct classification of accounting objects lies in its subsequent application within the framework of cost calculation - the procedure for determining the amount of expenses that make up the cost.

Let's study its essence in more detail.

Costing: classification of methods

The procedure for calculating cost in accounting is not defined at the level of industry-wide legal acts, but a number of industry regulations (including, in particular, Soviet standards) recommend the use of the following cost accounting methods:

- cross-cutting (in particular, process-by-process);

- custom-made (in particular, product-based);

- boiler room;

- normative.

These methods are proposed in the following sources:

- “Basic provisions for planning at industrial enterprises”, approved by the State Planning Committee, the State Committee for Prices, the Ministry of Finance, the Central Statistical Office of the USSR on July 20, 1970;

- Order of the Ministry of Agriculture of the Russian Federation “On Methodological Recommendations for Accounting in Agricultural Organizations” dated 06.06.2003 No. 792;

- Order of the Ministry of Industry of the Russian Federation “On approval of the Methodological Regulations for Accounting at Chemical Complex Enterprises” dated January 4, 2003 No. 2.

Let us study the specifics of the methods enshrined in the noted sources of law in more detail.

Classification of methods for accounting for production costs and calculating costs

To begin with, let’s determine what the correct construction of a cost accounting methodology (hereinafter referred to as CM) can provide, who needs it and why.

The following management KM priorities can be identified:

- checking the correct flow of the production cycle;

- collecting information on costs to analyze them and find ways to optimize them;

- making decisions by management on other cost management issues.

The objects of KM and cost calculation most often differ. The first of these is the basis on which costs are sorted. The object of KM can be the place of its origin, the center of responsibility, the type or group of products, the type of resources. The second is the type of product (work, service), semi-finished products, products at different stages of readiness. To distinguish between the concept of knowledge management and the concept of cost calculation, we propose to consider a diagram.

The sequence of reflecting and calculating costs and costs consists of accounting (steps 1–5) and cost accounting (steps 4–6). These steps are interconnected, and their implementation provides data for cost management. At the moment, the literature on management accounting describes a large number of methods for cost accounting and calculating product costs. A unified generally accepted systematization has not yet been created for them. All these methods were developed to solve various management problems and are often classified according to the following criteria:

1. For UZ objects:

- process-by-process

- transverse,

- custom.

The process-by-process method will be discussed below, and about the process-by-process and order-by-process method, read the articles on our website:

- “Transitional method of cost accounting - essence and features”;

- “Custom method of cost accounting and costing”.

2. In terms of completeness of the ultrasound:

- full cost system

- system of incomplete (partial) costs.

3. In terms of efficiency of KM and control:

- actual cost method,

- standard cost method.

Some methods are losing their relevance due to the failure to provide complete and correct information on costs and costs. An example of this is the boiler method.

Progressive and process-by-process methods of cost accounting

The cross-cutting method is most often used in mass and large-scale production, which is characterized by the use of raw materials that are subject to several stages of processing - redistribution. Moreover, after each redistribution - not counting the one that leads to the formation of a finished product - a semi-finished product is obtained, which in principle has a commercial value (and therefore can be sold externally).

The method under consideration most often involves accounting for costs within each structural division of the company in relation to specific production processes. Production costs of divisions in which redistribution of semi-finished products received for further processing are carried out are formed from internal costs in these divisions, as well as the cost of semi-finished products (if they are accounted for).

The fact is that the company can keep records of the corresponding semi-finished products or not keep it. In the first case, movements in redistributions are not reflected in accounting registers (but can be recorded in management - most often in physical terms). In the second case, the movement of semi-finished products is recorded in registers at accounting prices, sometimes at planned or actual costs.

The process-by-process method is a subtype of the step-by-step method. It is used in enterprises characterized by short production cycles, a minimum number of work-in-progress items, and a small range of manufactured goods. The main object of accounting in the process method is the stage of product release, corresponding to the volume of work performed by a specific division of the company, or the full cycle of product release if it is produced by one division (or the company as a whole - if it has only one workshop).

Methods for calculating cost in management accounting

Costs as an object of accounting: definition, behavior and classification Read more: Features of the production (technological) process in printing activities

1.3 Methods for calculating costs in management accounting

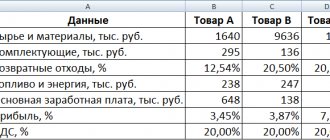

One of the most important tasks of management accounting is calculating the cost of production. The cost of production is the monetary expression of the costs of its production and sale. The cost of products (works, services) of an enterprise consists of costs associated with the use in the production process of products (works, services) of natural resources, raw materials, materials, fuel, energy, fixed assets, labor resources, as well as other costs for its production and sale .

The cost of production is a qualitative indicator that concentrates on the results of the organization’s economic activities, its achievements and available reserves. The lower the cost of production, the more labor is saved, the better the use of fixed assets, materials, fuel, the cheaper production costs the enterprise [5, p. 99].

Profit depends on the level of production costs. The lower the cost of manufactured products, the higher the competitiveness of the enterprise, the more accessible the manufactured products are for buyers or the services provided for customers, the more tangible the economic effect from the sale of products (provision of services, performance of work) [38].

In financial and management accounting systems, approaches to the formation of product costs are different [5, p. 100]. In management accounting, the cost price is formed so that the manager has a complete picture of costs. Therefore, in this accounting system, various methods for calculating costs can be used (depending on what management problem is being solved). Even costs that are not included in the cost of products (works, services) in financial accounting can be included in the calculation.

Information on costs collected within the framework of financial accounting allows, ultimately, to generate profit from the sale of products, works, and services for the enterprise as a whole. The cost of each product, work, service in this accounting system is not shown at all or is calculated on average. Within the entire enterprise, accounting and write-off of costs can be carried out correctly from a tax point of view, but information about the structure of individual types may be distorted. For financial accounting purposes, this picture is quite acceptable. However, reliable information about the cost structure is important for the enterprise itself - the enterprise gets the opportunity to influence it, that is, manage its costs. It is this information that should be generated in the system of not only management, but also financial accounting [5, p.100].

Depending on what costs are included in the cost of production, the following types are distinguished in the domestic economic literature:

– workshop – direct costs and general production costs characterize the costs of the workshop for the manufacture of products;

– production – shop cost and general business expenses; indicates the costs of the enterprise associated with the production of products;

– full cost – production cost increased by the amount of sales costs. This indicator integrates the total costs of the enterprise associated with both production and sales of products.

This approach somewhat contradicts the International Financial Reporting Standards, according to which the production cost should include only production costs: direct labor costs, direct material costs and general production costs, and the total cost consists of production costs, sales and administrative (general) expenses [5, c. 100–101].

In modern economic literature, calculation is defined as a system of economic calculations of the unit cost of individual types of products (works, services). During the calculation process, production costs are compared with the quantity of products produced and the cost per unit of production is determined. The task of calculation is to determine the costs that accrue per unit of their carrier, that is, per unit of products (works, services) intended for sale, as well as for domestic consumption.

Calculation allows you to study the cost of specific products obtained in the production process. Calculation of the cost of products (works, services) can be divided into three stages. At the first stage, the cost of all manufactured products as a whole is calculated, at the second - the actual cost for each type of product, at the third - the cost of a unit of production, work performed or service rendered [5, p. 103].

Modern calculation underlies the assessment of the implementation of the plan adopted by the enterprise or responsibility center. It is necessary to analyze the causes of deviations from planned cost targets. Data from actual calculations are used for subsequent cost planning, to justify the economic efficiency of introducing new equipment, choosing modern technological processes, taking measures to improve product quality, checking construction projects and reconstruction of enterprises [5, p. 104].

The object of calculation (cost carrier) is understood as the types of products (works, services) of an enterprise intended for sale on the market.

According to the objects of cost accounting, there are process-by-process, step-by-step, order-by-order methods, as well as a method of accounting (calculating) costs by function. From the point of view of the completeness of the costs taken into account, it is possible to calculate full and incomplete (“truncated”) costs. Depending on the efficiency of accounting and cost control, a distinction is made between the method of accounting for actual and standard costs.

The accounting and calculation method is chosen by the enterprise independently, since it depends on a number of private factors: industry, size, technology used, product range, etc., in other words, on the individual characteristics of the enterprise. In practice, these methods can be used in various combinations [5, p.108].

1. Process method. The process-by-process method of calculation is used in the extractive industries (coal, gas, oil, logging, etc.) and in the energy sector. In addition, it can be used in processing industries with the simplest technological production cycle (for example, in the cement industry, asphalt production plants, etc.).

All of the above is characterized by a mass type of production, a short production cycle, a limited range of products (services provided), a single unit of measurement and calculation, and the complete absence or insignificant size of work in progress. As a result, the manufactured product (service provided) is both an object of cost accounting and an object of calculation [5, p. 109 – 110].

2. Transverse method. Progressive costing is used in industries with serial and flow production, when products pass in a certain sequence through all stages of production, called redistributions. As a rule, these are production facilities where physico-chemical and chemical methods of processing raw materials are used, and the process of obtaining products consists of several technological stages. In these cases, the object of calculation becomes the product of each completed processing stage, including those processing stages in which several products are simultaneously produced.

The essence of the transfer method is that direct costs are reflected in current accounting not by type of product, but by production stages (stages), even if in one processing stage it is possible to obtain different types of products. Consequently, the object of cost accounting is usually a processing stage, which is understood as a part of a technological process (a set of technological operations) that ends with the receipt of a finished semi-finished product, which can be transferred to the next processing stage or sold externally. As a result of the sequential passage of the starting material through all stages, the finished product is obtained [5, p. 114].

Features of the transversal accounting method are:

– organization of analytical accounting for synthetic account 20 “Main production” for each processing stage;

– generalization of costs by redistribution regardless of individual orders, i.e. calculating the cost of production of each stage as a whole;

– write-off of costs for the calendar period, and not for the time of production of the order.

Cross-cutting calculation is used in industries with complex use of raw materials, where the production process is characterized by the presence of separate stages of the technological cycle with independent technology and production organization, for example in the chemical, cement, metallurgical, cotton and other industries [5, p. 115].

3. Custom method. The custom costing method is used in the manufacture of a unique or special-order product. In industry, it is used, as a rule, in enterprises with a single type of production organization. Such enterprises are organized to produce goods of limited consumption.

The scope of application of the custom accounting method is also small-scale industrial enterprises that are organized to produce products required by the consumer in small quantities. The essence of this method is as follows: all direct costs (costs of basic materials and wages of main production workers with accruals for it) are taken into account in the context of established costing items for individual production orders. The remaining costs are taken into account at the places of their occurrence and are included in the cost of individual orders in accordance with the established distribution base (rate) [5, p. 128–129].

The object of cost accounting and the object of calculation in this method is a separate production order, which is understood as a client’s request for a certain number of specially created or manufactured products for him. The type of order is determined by an agreement with the customer, which specifies the cost paid by the customer, the procedure for payment, transfer of products (works, services), and the deadline for completing the order. Until the order is completed, all related costs are considered work in progress. If the order is represented by a single product, then its cost is calculated by summing up all costs. If the order provides for the production of several products or batches, then by summing up the costs, the cost of manufacturing the entire batch is obtained. To determine the cost of one product, total production costs are divided by the number of units in the batch.

Cost accounting for individual orders begins when the order is opened. “Open an order” means filling out the appropriate order form (or work order for fulfilling the order). This document is located in the accounting department, is compiled in 1 copy and contains the following information [5, p. 130]:

– type of order (for one’s own needs or one-time or consolidated contracted from outside). Costs for one-time orders are taken into account and reflected within one reporting period. Long-term or consolidated orders consist of periodically renewed or a number of small orders. Cost accounting for such orders is associated with the distribution of costs between several reporting periods;

– order number (individual code). It distinguishes this order from others in production during the reporting period;

– order characteristics (brief description of the work required to complete the order);

– performer (section performing the work);

– order execution time;

– the month in which the costs of the order are taken into account (distributed).

After this, the accounting department begins to receive primary documents on the consumption of materials, the calculation of wages, losses from defects, wear and tear of special devices and tools associated with the production of this order, i.e. about direct costs. Each document contains an order number.

Accounting for cost accounting for each order opens a requirement - an invoice. As the order progresses, the order book accumulates information about the costs of direct materials, direct labor, and factory overhead costs associated with its production. Thus, the order card is the main accounting register in the conditions of the order-by-order method of calculation.

The order of accounting in the terms of the order-by-order method of cost calculation is carried out on account 20 “Main production” on which analytical accounting is organized for each order, i.e. the number of analytical invoices per invoice must correspond to the number of orders currently placed at the enterprise.

Direct costs of materials in accordance with the received primary documents are written off to the corresponding orders and reflected in the debit of account 20 “Main production”. Direct earnings also apply to qualifying orders. In this case, a problem arises with the distribution of indirect costs (depreciation, rent, costs of lighting, heating, etc.) between individual production orders completed during the reporting period, because it is necessary to plan the price of the order and agree on it with the customer during the reporting period, when the total amount of indirect costs is not yet known [5, p. 131].

The management of the enterprise needs data on the expected cost of the order to determine the price before the order is executed. The customer also needs prompt information about the possible price in order to choose an inexpensive contractor [5, p. 131]. In practice, they usually go the other way: indirect costs are distributed among individual orders in advance, using budget rates (preliminary standards) for the distribution of expected indirect costs.

Thus, the cost of production is the costs of its production and sale expressed in monetary terms. In the conditions of transition to a market economy, the cost of production is the most important indicator of the production and economic activity of an organization. Accounting for production costs and cost calculation is the most complex and responsible area of accounting work. Calculation is a comprehensive system of economic calculations of production costs for output and unit costs of individual types of products, works, and services.

From this we can conclude that the accounting and calculation methodology is chosen by the enterprise based on the individual characteristics of the enterprise. In practice, it is possible to use process-by-process, step-by-step or custom methods.

CHAPTER 2 Methodological foundations of management accounting and cost calculation in publishing and printing activities

Costs as an object of accounting: definition, behavior and classification Read more: Features of the production (technological) process in printing activities

Information about the work “Organization of strategic management accounting at an enterprise”

Section: Accounting and Auditing Number of characters with spaces: 151855 Number of tables: 7 Number of images: 1

Similar works

Management accounting as an element of the financial management system of an enterprise and options for its organization

34640

0

3

... -costing in the strategic management accounting system should have a strategic connotation. The strategic management accounting system must follow the changes of the times. 2. Organization of management accounting at the enterprise 2.1 The role of management accounting and options for its organization The need for a scrupulous selection of indicators that would characterize the effectiveness ...

Organizational aspects of management accounting

80678

0

1

... and an effective (effective) management accounting system at the enterprise, it is necessary to determine the methodological and organizational foundations for organizing accounting. 1.2. The main aspects of the organization of management accounting The main organizational aspects of management accounting in the national economy are not regulated by law, but are built on the basis of legal requirements...

Problems of organizing management accounting at an enterprise

57681

0

0

... there is no analysis of its production activities. The assessment of the economic condition is carried out based on actual data, when it is no longer possible to influence them. 2.3 Problems of organizing management accounting in the Communication Salons Group of Companies and possible ways to solve them The head of an enterprise who wants to have complete and reliable financial information about his business, as well as an economist who provides his ...

Integrated system in management accounting

67695

1

0

... and to other accounting circuits. In the case where the management circuit is primary for the company, the following options for integration with accounting are possible. integrated system with management and accounting contours (primary management); integrated system with additional copying and transfer of the accounting circuit. In addition, a middle option is possible, when part of the primary ...

Order-based and piece-by-piece cost accounting methods

The custom method is most often used by small companies that produce small series of goods, provide repair services, and piece assembly of certain products. The object of cost accounting in this case is a specific order for which the company produces a product or provides a service. The cost of the accounting object is determined in accordance with the agreement between the company and the customer.

If a product is produced within the framework of a long technological cycle, cost accounting can be carried out, similar to a step-by-step scheme, based on the completion of a certain stage of production (assembly, packaging), upon which a ready-to-use part or semi-finished product is formed (which in this case become objects of accounting ).

The item-by-item method is used if a company (or its division) produces the same product in large quantities, in series. It involves determining the cost of a unit of goods based on the average cost of its production within the reporting period.

Standard cost accounting method

The essence of the normative method is the use of established norms and standards for cost accounting purposes. Most often it is used in enterprises that produce different types of goods, which are presented in a large range.

This method involves taking into account production costs for the production of various types and groups of goods in relation to specific divisions of the company. Costs are usually classified as follows:

- to comply with norms and standards;

- those that are recorded in values above and below the norms and standards.

The considered cost accounting method involves the accounting department and other responsible departments of the organization solving the following tasks:

- preliminary regulatory calculation - based on established cost standards (in kind or in value terms);

- taking into account adjustments to applicable norms and standards in the process of production optimization;

- determining the correlation between adjustments to norms and standards and production performance;

- recording deviations of actual costs from norms and determining their causes.

Norms and standards used for cost accounting purposes can be established:

- taking into account the provisions of regulatory legal acts (for example, those that determine or significantly influence the standards for wages, the credit burden on the enterprise);

- in intercorporate agreements (for example, on the rental of premises, on tariffs for utility services, on licensing fees);

- in local regulatory sources (for example, determining the consumption rates of raw materials or materials, production, formation of overhead costs).

The next task of an accountant whose competence is cost accounting is to reflect business transactions on expenses that form the cost in accounting accounts.

Let's take a closer look at the features of these accounts.

PBU 10/99 “Organization expenses” (Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n)

Approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 106n

As amended: December 30, 1999 N 107n; 03/30/2001 N 27n; 09.18.2006 N 116n; 11/27/2006 N 156n; 10.25.2010 N 132n; 08.11.2010 N 144n; 04/27/2012 N 55n; 04/06/2015 N 57n.

The text of the document corresponds to the publication on the official website of the Ministry of Finance of Russia www.mimfin.ru

Accounting Regulations

PBU 10/99

Organization expenses

I. General provisions

1. These Regulations establish the rules for the formation in accounting of information on the expenses of commercial organizations (except for credit and insurance organizations) that are legal entities under the legislation of the Russian Federation.

In relation to these Regulations, non-profit organizations (except for state (municipal) institutions) recognize expenses for business and other activities.

(as amended by Orders of the Ministry of Finance of Russia dated December 30, 1999 N 107n, dated October 25, 2010 N 132n)

2. Expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the emergence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property).

3. For the purposes of these Regulations, the following assets are not recognized as expenses of the organization:

in connection with the acquisition (creation) of non-current assets (fixed assets, construction in progress, intangible assets, etc.);

contributions to the authorized (share) capitals of other organizations, acquisition of shares of joint-stock companies and other securities not for the purpose of resale (sale);

paragraph excluded. — Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n;

under commission agreements, agency and other similar agreements in favor of the principal, principal, etc.;

in the order of advance payment of inventories and other valuables, works, services;

in the form of advances, deposits to pay for inventories and other valuables, works, services;

to repay a loan received by the organization.

For the purposes of this Regulation, the disposal of assets is referred to as payment.

4. The expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into:

expenses for ordinary activities;

other expenses;

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

paragraph excluded. — Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n.

For the purposes of these Regulations, expenses other than expenses for ordinary activities are considered other expenses.

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

II. Expenses for ordinary activities

5. Expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, expenses for ordinary activities are considered expenses the implementation of which is associated with this activity.

In organizations whose subject of activity is participation in the authorized capital of other organizations, expenses for ordinary activities are considered expenses the implementation of which is related to this activity.

Expenses, the implementation of which is associated with the provision for a fee for temporary use (temporary possession and use) of one’s assets, rights arising from patents for inventions, industrial designs and other types of intellectual property, and from participation in the authorized capital of other organizations, when this is not the subject of the organization's activities are classified as other expenses.

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

Expenses for ordinary activities are also considered to be reimbursement of the cost of fixed assets, intangible assets and other depreciable assets, carried out in the form of depreciation charges.

6. Expenses for ordinary activities are accepted for accounting in an amount calculated in monetary terms equal to the amount of payment in cash and other forms or the amount of accounts payable (taking into account the provisions of paragraph 3 of these Regulations).

If payment covers only part of the recognized expenses, then the expenses accepted for accounting are determined as the sum of payment and accounts payable (in the part not covered by payment).

6.1. The amount of payment and (or) accounts payable is determined based on the price and conditions established by the agreement between the organization and the supplier (contractor) or other counterparty. If the price is not provided for in the contract and cannot be established based on the terms of the contract, then to determine the amount of payment or accounts payable, the price at which, in comparable circumstances, the organization usually determines expenses in relation to similar inventories and other valuables, works, services is accepted. or providing for temporary use (temporary possession and use) of similar assets.

6.2. When paying for purchased inventories and other valuables, works, services on the terms of a commercial loan provided in the form of deferred and installment payment, expenses are accepted for accounting in the full amount of accounts payable.

6.3. The amount of payment and (or) accounts payable under contracts providing for the fulfillment of obligations (payment) not in cash is determined by the value of goods (valuables) transferred or to be transferred by the organization. The cost of goods (valuables) transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the cost of similar goods (valuables).

If it is impossible to determine the value of goods (valuables) transferred or to be transferred by the organization, the amount of payment and (or) accounts payable under contracts providing for the fulfillment of obligations (payment) not in cash is determined by the value of the products (goods) received by the organization. The cost of products (goods) received by the organization is established based on the price at which similar products (goods) are purchased in comparable circumstances.

6.4. In the event of a change in the obligation under the contract, the initial amount of payment and (or) accounts payable is adjusted based on the value of the asset to be disposed of. The value of the asset to be disposed of is determined based on the price at which, in comparable circumstances, the entity would normally determine the value of similar assets.

6.5. The amount of payment and (or) accounts payable is determined taking into account all discounts (discounts) provided to the organization in accordance with the agreement.

6.6. Excluded. — Order of the Ministry of Finance of Russia dated November 27, 2006 N 156n.

7. Expenses for ordinary activities form:

expenses associated with the acquisition of raw materials, materials, goods and other inventories;

expenses arising directly in the process of processing (refinement) of inventories for the purposes of production, performance of work and provision of services and their sale, as well as sale (resale) of goods (expenses for the maintenance and operation of fixed assets and other non-current assets, as well as to maintain them in good condition, commercial expenses, administrative expenses, etc.).

8. When forming expenses for ordinary activities, their grouping should be ensured by the following elements:

material costs;

labor costs;

contributions for social needs;

depreciation;

other costs.

For management purposes, accounting organizes the accounting of expenses by cost items. The list of cost items is established by the organization independently.

9. For the purpose of generating an organization’s financial result from ordinary activities, the cost of goods, products, works, services sold is determined, which is formed on the basis of expenses for ordinary activities recognized both in the reporting year and in previous reporting periods, and carryover expenses related to the receipt of income in subsequent reporting periods, taking into account adjustments depending on the characteristics of production, performance of work and provision of services and their sale, as well as the sale (resale) of goods.

At the same time, commercial and administrative expenses may be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities.

10. The rules for accounting for costs of production, sale of goods, performance of work and provision of services in the context of elements and articles, calculation of the cost of products (work, services) are established by separate regulations and Methodological guidelines for accounting.

III. other expenses

11. Other expenses are:

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

expenses associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets (taking into account the provisions of paragraph 5 of these Regulations);

costs associated with the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property (subject to the provisions of paragraph 5 of these Regulations);

(as amended by Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n)

expenses associated with participation in the authorized capitals of other organizations (taking into account the provisions of paragraph 5 of these Regulations);

expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products;

interest paid by an organization for providing it with funds (credits, borrowings) for use;

expenses related to payment for services provided by credit institutions;

contributions to valuation reserves created in accordance with accounting rules (reserves for doubtful debts, for depreciation of investments in securities, etc.), as well as reserves created in connection with the recognition of contingent facts of economic activity;

(paragraph introduced by Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n)

paragraph excluded. — Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n;

paragraph excluded. — Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n;

fines, penalties, penalties for violation of contract terms;

compensation for losses caused by the organization;

losses of previous years recognized in the reporting year;

amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

exchange differences;

the amount of asset depreciation;

(as amended by Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n)

transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

(paragraph introduced by Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n)

other expenses.

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

Note: The numbering of paragraphs corresponds to the changes made by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n.

13. Other expenses are also expenses that arise as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization of property, etc.).

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

14. For accounting purposes, the amount of other expenses is determined in the following order.

14.1. The amount of expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products, as well as participation in the authorized capital of other organizations, with provision for a fee for temporary use (temporary ownership and use) of the organization's assets, rights arising from patents for inventions, industrial designs and other types of intellectual property (when this is not the subject of the organization's activities), interest paid by the organization for providing it with funds for use, as well as expenses associated with payment for services provided by credit institutions are determined in a manner similar to that provided for in paragraph 6 of these Regulations.

14.2. Fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused by the organization are accepted for accounting in amounts awarded by the court or recognized by the organization.

14.3. Accounts receivable for which the statute of limitations has expired and other debts that are unrealistic for collection are included in the organization's expenses in the amount in which the debt was reflected in the organization's accounting records.

14.4. The amounts of asset depreciation are determined in accordance with the rules established for the revaluation of assets.

(as amended by Order of the Ministry of Finance of Russia dated March 30, 2001 N 27n)

15. Other expenses are subject to crediting to the organization’s profit and loss account, unless a different procedure is established by law or accounting rules.

IV. Recognition of expenses

16. Expenses are recognized in accounting if the following conditions are met:

the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

the amount of expenditure can be determined;

there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity. There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of an asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

Depreciation is recognized as an expense based on the amount of depreciation charges, determined on the basis of the cost of depreciable assets, useful life and the methods of depreciation adopted by the organization.

17. Expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of the expense (monetary, in-kind and other).

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

18. Expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity). If an organization that has the right to use simplified methods of accounting, including simplified accounting (financial) statements, has adopted a procedure for recognizing revenue from the sale of products and goods not as the rights of ownership, use and disposal of products supplied, goods sold, work performed, services rendered are transferred service, and after receipt of funds and other forms of payment, then expenses are recognized after the debt is repaid.

(as amended by Orders of the Ministry of Finance of Russia dated November 8, 2010 N 144n; 04/27/2012 N 55n; 04/06/2015 N 57n)

19. Expenses are recognized in the income statement:

taking into account the relationship between expenses incurred and revenues (correspondence between income and expenses);

by their reasonable distribution between reporting periods, when expenses determine the receipt of income over several reporting periods and when the relationship between income and expenses cannot be clearly defined or is determined indirectly;

for expenses recognized in the reporting period when the non-receipt of economic benefits (income) or receipt of assets becomes determined;

regardless of how they are accepted for the purposes of calculating the taxable base;

when obligations arise that are not caused by the recognition of the corresponding assets.

V. Disclosure of information in financial statements

20. As part of the information on the accounting policy of the organization in the financial statements, the procedure for recognizing commercial and administrative expenses must be disclosed.

21. In the profit and loss statement, the organization's expenses are reflected subdivided into the cost of goods sold, products, works, services, selling expenses, administrative expenses and other expenses.

(as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

21.1. If the financial results report identifies types of income, each of which individually constitutes five or more percent of the organization’s total income for the reporting year, it shows the portion of expenses corresponding to each type.

(as amended by order of the Ministry of Finance of Russia dated 04/06/2015 No. 57n)

21.2. Other expenses may not be shown in the income statement in relation to related income when:

(as amended by Orders of the Ministry of Finance of Russia dated September 18, 2006 N 116n; 04/06/2015 No. 57n)

the relevant accounting rules provide for or do not prohibit such recognition of expenses;

expenses and related income arising as a result of the same or similar fact of economic activity are not significant for characterizing the financial position of the organization.

22. At least the following information is also subject to disclosure in the financial statements:

expenses for ordinary activities by cost elements;

change in the amount of expenses not related to the calculation of the cost of products, goods, works, services sold in the reporting year;

expenses equal to the amount of deductions in connection with education in accordance with the rules of accounting for reserves (forthcoming expenses, estimated reserves, etc.).

23. Other expenses of the organization for the reporting year, which, in accordance with the accounting rules, are not credited to the profit and loss account in the reporting year, are subject to disclosure in the financial statements separately.

Application when accounting for the cost of accounting accounts

Costs that form the production cost of goods, services and work are most often reflected in accounting registers using accounts:

- 20 (for operations within the main production);

- 23 (for operations supplementing the main production);

- 26 (for transactions corresponding to indirect costs);

- 28 (to account for production losses due to defects).

Sometimes accounts are also used for cost accounting:

- 21 (if the company produces not only goods ready for use or consumption, but also semi-finished products);

- 25 (if the company has costs for operations that are separate from operations within the main production and complementary to it, but at certain points become associated with them).

These accounts most often correspond to:

- with a score of 10 (to reflect transactions on write-off of raw materials and materials into production);

- with accounts 69, 70 (to reflect operations to include personnel salaries in production costs, as well as contributions to insurance funds);

- with accounts 02, 05 (to reflect depreciation).

For example, by posting Dt 20 Kt 10, the fact of writing off materials for production is reflected, and posting Dt 20 Kt 70 reflects the accrual of salaries to employees.

If a company produces semi-finished products, then account 21 can also be a corresponding account. Thus, the fact of transfer of semi-finished products for further production can be reflected by posting Dt 20 Kt 21.

Accounting for finished products based on their cost indicators is carried out, as a rule, using account 43, corresponding to such accounts as 20, 90. For example, the receipt of goods at the warehouse is reflected by posting Dt 43 Kt 20, and if the products were sold, posting Dt is used 90 Kt 43.

What are expenses, or PBU 10/99 - what is it about?

PBU 10/991, without exaggeration, can be called one of the most amazing and strange documents of the entire system of normative regulation of accounting. Accounting for costs associated with the production and sale (sale) of products and the formation of the cost of products (works, services) are one of the main areas of accounting in organizations in the sphere of material production. This means that the need for detailed regulatory regulation of this branch of accounting is obvious. However, the way this is done through PBU 10/99 can only cause bewilderment.

Accounting for an organization's expenses has very significant industry-specific features that cannot be unified and taken into account in a single regulatory act adopted at the level of the Russian Ministry of Finance. Therefore, in almost all sectors of the sphere of material production and trade, at one time, regulatory documents were developed and adopted regulating the specifics of the formation of costs (in trade - distribution costs).

It is no secret that almost all regulations and by-laws developed by the Russian Ministry of Finance and industry ministries and departments are, to one degree or another, based on the requirements of the Basic Provisions for Planning, Accounting and Calculation of Product Costs at Industrial Enterprises2 (hereinafter referred to as the Basic Provisions). Despite the fact that more than 37 years have passed since the adoption of this document, the legislative and regulatory framework governing economics and accounting has changed, most of the recommendations contained in the Basic Provisions remain relevant.

Before moving on to the commentary on the norms of PBU 10/99, let us clarify: of all the countries that use IFRS, only in domestic practice has a standard been adopted and is in force that exclusively regulates the recognition of expenses. In the entire IAS system, in relation to expenses there are only a few rules of general content established at the CRP level (and not a separate standard or at least separate rules in several standards).

Of course, it was assumed that when creating PBU 10/99, developers would have to rely on domestic experience. In other words, use a presentation style that is understandable to the average user without additional explanations and comments (in particular, the Basic Provisions).

It seemed that the absence of Western analogues would make the developers’ speech more coherent and meaningful. But it didn't come true. The developers pretended that they were translating from something there and adapting something there, which means that the text of the Regulations should be more similar to the texts of previously adopted PBUs (for example, PBU 9/993), and not to the text of normal instructions for an accountant . Moreover, due to the reasons described, the method that can be used in relation to other PBU does not work: translate it again into the original language, evaluate the authenticity of the translation, and then translate it again into Russian, but this is understandable. There is nothing to compare with...

The very first significant norm (clause 2) can lead to bewilderment - the very definition of expenses: “An organization’s expenses are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of reducing contributions by decision of the participants (property owners).”

Firstly, to remember what economic benefit is, you will need to consult dictionaries or other translated sources. Secondly, if we read the definition literally, it turns out that expenses (as a decrease in benefits) must necessarily lead to a decrease in the organization’s capital. Here there is a strong feeling that the developers of PBU 10/99 did not see the balance sheet, and read the textbook on accounting theory only in an abbreviated and simplified version.