Is it possible to use an intermediary agreement when determining the terms of delivery of goods?

Yes, it's possible. This right is granted to the parties by Article 421 of the Civil Code of the Russian Federation, which states that legal entities are free to enter into an agreement and can enter into an agreement, both provided for and not provided for by law, and the parties can also enter into an agreement that contains elements of various agreements (mixed agreement) . The relations of the parties under such agreements are subject to the rules on agreements, the elements of which are contained in a mixed agreement and, naturally, the terms of the agreement are determined at the discretion of the parties. You can use such an agreement if you need to avoid problems with input VAT paid as part of transportation costs. In this case, the supplier also becomes an agent in relation to the buyer, and the buyer, accordingly, becomes a principal. As a general rule, the agent receives remuneration for intermediary services, which is subject to VAT and income tax. Upon completion of the execution of the order, the agent is obliged to submit to the principal (buyer) a report on the execution of the order, to which copies of supporting primary documents must be attached.

CONTRACT WORK AT THE ENTERPRISE

The buyer's accounting records the cost of delivering goods intended for further resale to their own warehouse in two ways:

Transport costs in the estimate

Drawing up estimate documentation is typical for construction organizations. The development of transportation cost estimates is carried out in accordance with the norms of clause 4.59 of the Resolution of the State Construction Committee of March 5, 2004 No. 15/1. The amount of costs is affected by:

- type of vehicle used;

- shipping rates;

- location of points of poisoning and final destination;

- the distance to be covered to deliver the goods;

- other transportation conditions and characteristics of the group of goods.

Costs must be calculated based on the original delivery cost data per 1 gross ton. The coefficient for transportation costs in the estimate in the absence of regulatory information on the transportation of equipment is taken in the amount of 3-6% of the cost of the transported assets.

Transportation costs of an organization are taken into account by:

- assigning expenses to a separate account 15 “Procurement and acquisition of materials”, according to the supplier’s settlement documents;

- assigning delivery costs to a separate subaccount to account 41 “Goods”;

- direct (direct) inclusion of transport costs in the actual cost of goods.

Direct (direct) inclusion in the actual cost of goods is advisable in organizations with a small range of goods, as well as in cases of significant importance of individual types and groups of goods.

The specific option for accounting for transportation costs is established by the organization independently and is reflected in the accounting policy (clause 83 of Order of the Ministry of Finance of the Russian Federation of December 28, 2001 N 119n “On approval of Methodological Guidelines for Accounting of Inventories”).

Costs are included in sales expenses and are recorded in the debit of account 44 “Sales expenses”. These amounts are written off in whole or in part to the debit of account 90 “Sales”. In case of partial write-off, transportation costs are distributed between the goods sold and the balance of goods in the warehouse at the end of each month.

ACCOUNTING SUPPORT, MOSCOW

Both the accounting and tax accounting options must be enshrined in the organization’s accounting policies.

Accounting for inventory of goods sold

If the goods and materials are not related to purchased, but already sold goods, then the costs of their delivery can be taken into account in several ways:

- included in the cost of production;

- appear as a separate service provided independently of the implementation.

Most often, enterprises include TZR in the cost of goods. In this case, transportation costs for purchased goods are written off by posting: D90.02 - K44.2. Upon their subsequent sale, TZR (there will be a different amount of expenses) are written off according to the posting: D44.1 - K60, and VAT on them - D19 - K60.

It is noteworthy that tax accounting for transport costs for purchased goods allows you to take them into account in full as expenses when calculating income tax. Difficulties may arise due to determining the time of write-off. After all, direct transportation costs are included in the cost of products and are taken into account only during sales. Indirect ones are in no way related to the time of sales - they are taken into account immediately at the time of their occurrence.

Similar articles

- Accounting for transport costs in the estimate

- Transportation and procurement costs

- Calculation of transport costs - formula

- Accounting for receipt of fixed assets

- Registration price

The buyer, like the supplier, can choose how to reflect transportation costs:

- Transport costs are included in the cost of purchased goods. In this case, costs are taken into account in the period of sale of goods in the cost of which they are taken into account.

- Transport costs are not included in the price of the goods, but are taken into account as an independent type of direct costs. If at the end of the month not all purchased goods are sold, the organization needs to calculate the amount of transportation costs related to the balance of unsold goods (Article 320 of the Tax Code of the Russian Federation).

To document the expenses incurred, the buyer needs primary documents confirming transportation (invoice, copy of the act on the provision of transport services to the supplier, the supplier’s act for reimbursement of expenses (or an agent’s report)).

Thus, the cost of shipping a product can be a significant proportion of its cost. Recognition of transportation costs depends on the terms of the contract. In documents, the service for delivery of goods can be highlighted as a separate line or included in the price of the goods. But in order to avoid problems with regulatory authorities, in addition to this condition, it is necessary to provide for the moment of transfer of ownership of the goods, the party for delivery of the goods, as well as the procedure for payment and the cost of transportation costs.

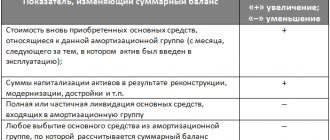

Tax accounting of transport expenses

The procedure for reflecting transport costs in tax accounting depends directly on the terms of the agreement with the supplier. According to Article 320 of the Tax Code of the Russian Federation, the amount of costs for delivery (transportation costs) of purchased goods to the warehouse of the taxpayer - the buyer of the goods are considered direct transport costs if these costs are not included in the purchase price of the goods. In supplier accounting, the procedure for reflecting transportation costs depends on the terms of the concluded agreement (see Table 1 on p. 48).