Representatives of the clothing industry name the following risk factors associated with their activities:

1. Decrease in purchasing power of the population.

2. Fall in revenue growth rates.

3. Increase in the cost of products.

4. Increase in the cost of fabric and materials due to rising exchange rates.

5. The need to reduce wages.

6. Dismissal of personnel.

7. Reducing production volumes.

8. Reducing the volume of investment in production.

9. Strengthening the supervision of regulatory authorities.

Some of these risks directly concern personnel (clauses 5, 6), therefore, analysis of funds for wages is an important component of risk management and ensuring the functioning of the enterprise.

PRODUCTION COSTS

Let's find out the share of labor costs in production costs. To do this, we will use the table. 1.

| Table 1. Production costs | ||||||||

| No. | Index | 2016 | 2015 | Deviation | Changes 2020 to 2020, % | |||

| amount, thousand rubles | beat weight, % | amount, thousand rubles | beat weight, % | amount, thousand rubles | beat weight, % | |||

| 1 | Material costs | 90 300 | 21,5 | 94 700 | 23,0 | –4400 | –1,5 | –4,6 |

| 2 | Labor costs | 176 700 | 42,1 | 176 400 | 42,8 | 300 | –0,7 | 0,2 |

| 3 | Contributions for social needs | 52 290 | 12,5 | 51 940 | 12,6 | 350 | –0,1 | 0,7 |

| 4 | Depreciation | 6980 | 1,7 | 8700 | 2,1 | –1720 | –0,4 | –19,8 |

| 5 | Other costs | 93 160 | 22,2 | 80 140 | 19,5 | 13 020 | 2,8 | 16,2 |

| Total | 419 430 | 100 | 411 880 | 100 | 7550 | 0,0 | 1,8 | |

In 2020, production costs increased only by 7,550 thousand rubles. (1.8%) compared to 2020, which is explained by the strict austerity regime. Labor costs remained flat at 42.8% of total costs in 2020 and 42.1% in 2020.

NOTE

Labor costs always have a significant share in production costs

The low share of material costs (90,300 thousand rubles, or 21.5% of the total volume) with the high cost of fabric, accessories and other materials is explained by the structure of the products :

- 20% of the company’s total capacity is the production and sale of its own products under its own brand;

- 80% of the total capacity are contract manufacturing services (work using customer materials).

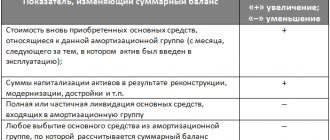

3) Grouping costs depending on production volume

Depending on the change in the volume of production, the following types of costs are distinguished:

- variables;

- fixed (conditionally fixed) expenses.

Variable costs change in proportion to changes in production volume.

These include the costs of raw materials, materials, fuel and electricity for technological needs, wages of piece workers.

Fixed (conditionally fixed) costs either do not change or change slightly due to changes in production volume.

These include fuel costs for heating buildings, other utilities, electricity for lighting premises, wages of temporary workers, administrative and management personnel, depreciation, etc.

ANALYSIS OF INDICATORS

For a better understanding of the production situation, consider the indicators in Table. 2.

| Table 2. Indicators related to personnel remuneration | ||||||

| No. | Index | Calculation | 2016 | 2015 | Deviation | |

| absolute | relative, % | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Accounts payable to personnel for wages, thousand rubles. | 8220 | 9520 | –1300 | –13,7 | |

| 2 | Reserve for vacation pay, thousand rubles. | 6930 | 10 400 | –3470 | –33,4 | |

| 3 | Volume of production, thousand rubles. | 265 000 | 265 500 | –500 | –0,2 | |

| 4 | Revenue from sales of own products (services), thousand rubles. | 422 870 | 418 900 | 3970 | 0,9 | |

| 5 | Gross profit from sales of own products (services), thousand rubles. | 166 600 | 156 800 | 9800 | 6,3 | |

| 6 | Profit from sales of own products (services), thousand rubles. | 20 480 | 12 430 | 8050 | 64,8 | |

| 7 | Payments in connection with remuneration of employees, thousand rubles. | 263 130 | 252 800 | 10 330 | 4,1 | |

| 8 | Average headcount, people. | 695 | 695 | |||

| 9 | Number of employees at the end of the year, people. | 680 | 710 | –30 | –4,2 | |

| 10 | Average monthly salary of workers for January-December 2020 in textile and clothing production (state statistics), thousand rubles. | 16,9 | ||||

| 11 | Product output, units | 250 700 | 265 800 | –15 100 | –5,7 | |

| 12 | Personnel productivity (per year), thousand rubles/person. | page 3 / page 8 | 381,3 | 382,0 | –0,7 | –0,2 |

| 13 | Personnel productivity (per year), units/person. | page 11 / page 8 | 360,7 | 382,4 | –21,7 | –5,7 |

| 14 | Cash flow per employee per month, thousand rubles/person. | page 7 / page 8 / 12 | 31,6 | 30,3 | 1,2 | 4,1 |

| 15 | Revenue per employee, thousand rubles/person. | page 4 / page 8 | 608,4 | 602,7 | 5,7 | 0,9 |

| 16 | Gross profit per employee, thousand rubles/person. | page 5 / page 8 | 239,7 | 225,6 | 14,1 | 6,3 |

| 17 | Profit from sales of own products per employee, thousand rubles/person. | page 6 / page 8 | 29,5 | 17,9 | 11,6 | 64,8 |

| 18 | Accounts payable to personnel for wages per employee, thousand rubles/person. | page 1 / page 9 | 12,1 | 13,4 | –1,3 | –9,8 |

| 19 | Reserve for vacation pay per employee, thousand rubles/person. | page 2 / page 9 | 10,2 | 14,6 | –4,5 | –30,4 |

| 20 | Efficiency of funds invested in labor costs for production personnel | |||||

| 20.1 | by revenue | page 4 / page 2 (table 1) | 2,39 | 2,37 | 0,02 | 0,78 |

| 20.2 | by gross profit | page 5 / page 2 (table 1) | 0,94 | 0,89 | 0,05 | 6,07 |

| 20.3 | by profit from sales of own products | page 6 / page 2 (table 1) | 0,12 | 0,07 | 0,05 | 64,48 |

In lines 1–11 of the table. 2 reflects the general financial and economic indicators of the company, pp. 12–20 - performance indicators related to funds for remuneration of personnel and the personnel themselves.

The average number of employees has been the same for two years - 695 people. At the same time, at the end of 2020, the number of personnel is 680 people, which is an increase of 30 people. (4.2%) less than the previous year.

Accounts payable to personnel for wages at the end of 2020 decreased compared to 2020 by 1,300 thousand rubles. (13.7%), reserve for vacation pay - by 3,470 thousand rubles. (33.4%). The rate of decline of these two indicators is higher than the rate of decline in the number of personnel, which indicates a drop in the level of wages, an increase in the number of inexperienced workers with low salaries, and hidden downtime (free vacations, part-time work).

Accounts payable to personnel per employee (page 18) as of 01/01/2017 is 12.1 thousand rubles, which is lower than the indicator of payments related to wages (31.6 thousand rubles), by 19.5 thousand rubles, or more than twice (the amount based on wages for half of December, since the advance payment for this month has already been paid). Therefore, the indicator of wages payable is not critical.

Payments related to wages ( an indicator from the cash flow statement) increased by 10,330 thousand rubles. (4.1%). Accordingly, cash flow per employee averages 31.6 thousand rubles. per month. This indicator reflects the amount of wages, vacation pay, bonuses, and does not contain salary taxes. Conventionally, we can assume that 31.6 thousand rubles. is the average monthly salary of one company employee.

According to government statistics, the average monthly salary of workers for January-December 2020 in textile and clothing production is 16.9 thousand rubles. The company’s indicator exceeds the industry average by 14.7 thousand rubles. (87%). This is an important positive factor in overcoming the risk of staff dismissal.

EFFICIENCY

Let's consider a group of efficiency indicators per employee (pages 15–17 of Table 2). To calculate these indicators, the entire staff (average headcount for the company) was taken, and not just the main workers or workers in general.

Notes

- In modern conditions, a production worker will not be able to perform his functions without equipment adjusters, programmers, technologists, accounting, managerial and commercial personnel.

- In difficult economic conditions, the role of enterprise employees who are not included in the category of workers increases: it is important to find and sign a profitable contract with a contract manufacturing customer, ensure a given sales volume at points of sale of their own products, order materials at a favorable price, save on other costs, and correctly calculate and pay taxes, etc.

- Products that are manufactured by workers and lying in a warehouse by themselves will not ensure the flow of funds.

An important detail: if necessary, the economist can calculate identical indicators (pp. 12–20) for the main workers (seamstresses, cutters, etc.), as is common in classical analysis.

The company is experiencing interesting positive dynamics . In 2020 compared to the previous year:

- Revenue from the sale of own products per employee increased slightly - by 5.7 thousand rubles. (0.9%);

- gross profit per employee increased by 14.1 thousand rubles. (6.3%);

- profit from sales of own products increased by 11.6 thousand rubles. (64.8%) and amounted to 29.5 thousand rubles. per person.

Conclusion : one employee brings the company 29.5 thousand rubles a year. arrived.

Positive dynamics, when the rate of profit growth exceeds the rate of revenue growth, is the result of:

- reduction of business expenses (the company has introduced an economy regime, closed unprofitable points of sale);

- reducing costs associated with a decrease in exchange rate differences.

Now let’s look at the performance indicators of funds invested in labor costs for production personnel (20.1-20.2 Table 2). Each ruble invested in labor costs for production personnel (176,700 thousand rubles) brought in 2020:

- RUB 2.39 revenue is almost the level of 2020;

- RUB 0.94 gross profit - exceeds the 2020 level by 0.05 rubles. (6.07%).

In difficult conditions, an increase of 6.07% is a positive result, which indicates the effective use of funds for remuneration of personnel .

The gross profit indicator exceeds the revenue indicator (6.07 to 0.78%), which indicates not only the effective spending of funds on labor costs, but also the optimization of commercial, administrative and other expenses. The lack of growth in revenue performance indicators is explained by limited production volumes.

4) Grouping costs in other ways

Depending on the period of occurrence and attribution to cost:

- current period expenses;

- Future expenses.

According to the degree of feasibility:

- productive expenses;

- non-productive expenses (losses) are expenses associated with the manufacture of defective products and the subsequent correction of defects.

Subscribe to our newsletter and receive guaranteed discounts on education, including business courses! People often read with this material: articles in the Business Directory section on the Aspect portal

VOLUME OF PRODUCTION

Spending on labor costs should be analyzed in comparison with the volume of finished products (Table 3).

| Table 3. Product output | |||||

| Index | 2016 | Deviations | Implementation of a plan, % | ||

| fact | plan | units | % | ||

| Product output - total, units. | 250 700 | 265 750 | –15 050 | –5,7 | 94,3 |

| Release of products under own brands, units. | 57 850 | 54 300 | 3550 | 6,5 | 106,5 |

| Share of own products | 23,1 | 20,4 | 2,6 | 12,9 | 112,9 |

In 2020, the company’s work was planned as follows: 20% - own products, 80% - contract production. In total, it was planned to produce 265,750 products, including 54,300 products under its own brand (women's business suit).

During 2020, the company adjusted its production program several times. Reason : the contract manufacturing customer (Fashion-Style LLC) did not fulfill the contractual obligations to ensure the stated production capacity. The customer company did not deliver enough raw materials for 31,600 units of women's business suits, which is equivalent to 1.5 months of downtime at the sewing enterprise's production capacity.

Thanks to the measures taken by management, the staff was increased by 25 thousand units. As a result, the production plan for 15 thousand women's suits was not fulfilled due to understaffing and the absence of workers due to being on sick leave.

Based on the results of work in 2020, the sewing company produced 250,700 women's business suits. This is 94.3% of the plan. The plan for the production of suits under its own brand was exceeded by 3,550 units. (6.5%). The share of own products in the total volume of manufactured products is 23.1%.

In 2020, 265,800 women's business suits were produced, which is 15,100 units more than in 2020. The drop in output (5.7%) is explained by a violation of the contractual obligations of Fashion-Style LLC. Given the continuing decline in demand for women's business suits in the middle price segment, such a percentage drop in output is not critical. It can be assumed that the level of staff utilization is maintained under unfavorable macro- and microeconomic conditions.

Conclusion: it is necessary to conclude contracts for tailoring services with alternative customers, which will increase the workload of personnel and increase the efficiency of spending funds on labor costs.