When calculating depreciation, enterprises have the right to allocate part of the funds for capital investments in order to simultaneously include these amounts in expenses to reduce the amount of income tax liability. Such an operation is defined by the term “depreciation premium”. The maximum value for these activities is legally limited.

Assets owned by a business are divided into 10 categories for depreciation purposes. The division occurs according to the criterion of the duration of operation of objects. For such property, it is possible to spend funds in the form of investments with elements of capital re-equipment, clause 9 of Art. 258 of the Tax Code of the Russian Federation allows you to immediately take them into account in expenses in the amount of up to 30%.

IMPORTANT! The concept of bonus depreciation is applicable only to objects from the category of fixed assets, it does not apply to intangible assets.

The use of a tool such as bonus depreciation leads to a change in the depreciable cost. If you spend the maximum amount on completing the construction of an acquired property from among fixed assets, then depreciation will be charged not on the original value of the asset, but on 70% of the original value of this indicator. The use of this type of bonus must be specified in local regulations.

The order on accounting policies and the appendix to it regarding the depreciation bonus indicates the following information:

- the categories of property that are eligible for the premium are listed;

- the method can be aimed at changing the value of the initial cost or writing off the consumable part when carrying out reconstruction or modernization activities;

- a restriction is established for use in relation to objects that were supplied to the institution free of charge;

- the rules for attributing bonus amounts to indirect expenses are prescribed;

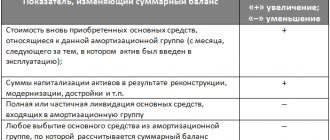

- features of changes in the total value of property for the purposes of subsequent calculation of depreciation in future reporting periods.

BY THE WAY! The depreciation bonus tools are allowed to be used in cases of linear and non-linear methods of calculating depreciation amounts.

In situations where an asset from among the fixed assets has been in use by the enterprise for less than 5 years and is subject to sale to a related party, it becomes necessary to restore the premium amount.

The valuation of objects in respect of which the application of a bonus was initiated is calculated by finding the difference between the value of the initial cost and the depreciation bonus. When the value of a set of fixed assets changes after investments have been made for capital refurbishment, the increase value is calculated by subtracting the applied premium from the total value of capital investments.

How to consolidate provisions on bonus depreciation in accounting policies

The amount of bonus depreciation accrued in the reporting/tax period is subject to accounting as part of indirect expenses (clause 3 of Article 272 of the Tax Code of the Russian Federation).

Expenses in the form of capital investments provided for in paragraph 9 of Art. 258 of the Tax Code of the Russian Federation are recognized as indirect expenses of the reporting/tax period, which, in accordance with Chapter 25 of the Tax Code of the Russian Federation, falls on the start date of depreciation or the date of change in the original cost (for modernization, etc.).

If the company acquired a fixed asset, then in accordance with clause 3 of Art. 272 of the Tax Code of the Russian Federation, the depreciation bonus must be written off as indirect expenses in the month in which the start date of depreciation of this fixed asset falls.

The calculation of depreciation for an object begins on the first day of the month following the month in which this object was put into operation (clause 4 of Article 259 of the Tax Code of the Russian Federation).

If a company calculates depreciation using the straight-line method, then in the month following the month the operating system was put into operation, both the first amount of accrued depreciation and the depreciation bonus are included in expenses.

Depreciation is charged on the cost reduced by the amount of capital expenses written off at a time (clause 9 of Article 258 of the Tax Code of the Russian Federation).

Depreciation of fixed assets 2020 in used and used ones: similarities and differences

In both types of accounting (both BU and NU), the cost of fixed assets is transferred to costs by calculating depreciation. The methods of this calculation and the procedure for their application are established by:

- for BU - clauses 18, 19 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n;

- for NU - clause 1 of Art. 259, art. 259.1, 259.2 Tax Code of the Russian Federation.

There are similarities in the calculation of depreciation between BU and NU in the following points:

- inclusion of the cost of fixed assets in expenses begins with the month following the month of commissioning, and stops with the month following the month of repayment of all this cost or the month of disposal;

- write-offs over the useful life, as a rule, are not suspended;

- the rules for applying one of the cost write-off methods are the same - linear;

- changes in the cost of fixed assets occur during reconstruction (or other similar processes: modernization, completion, partial liquidation);

- it is possible to revise the useful life if the technical characteristics of the operating system are improved due to reconstruction (or other similar processes).

For all other positions, discrepancies either exist or are allowed:

- There are different lists of fixed assets that are not subject to depreciation;

- the limit for inclusion in the OS is set in different amounts;

- The initial cost of the OS can be estimated differently;

- different estimates of useful life are possible;

- neither the number of cost write-off methods available for use during the useful life, nor the algorithms for calculating the monthly write-off amount for these methods (except for linear);

- the possibilities of applying the same method to a group of fixed assets, changing the method and using coefficients for the depreciation rate are assessed differently;

- the approach to accounting for revaluation results differs;

- In NU it is possible to write off part of the cost of the operating system at a time.

For more information about the comparison of depreciation rules in force in accounting and financial accounting, read the material “Rules for calculating depreciation of non-current assets.”

It is this opportunity to write off part of the cost as expenses to NU at a time and received the unofficial name of the depreciation bonus. There is no such option at BU.

This award is distinguished by the following characteristics (clause 9 of Article 258 of the Tax Code of the Russian Federation):

- applicability both to the cost of the operating systems themselves and to the costs of their reconstruction (or other similar processes);

- impossibility of application to intangible assets and to assets received free of charge (including as a contribution to the management company);

- the need to recognize in the month the start of depreciation or changes in the cost of the reconstructed fixed assets (clause 3 of Article 272 of the Tax Code of the Russian Federation);

- limited write-off amount: no more than 10% - for OS 1–2 and 8–10 groups;

- no more than 30% - for OS groups 3–7;

https://youtu.be/59XVlphcUis

Example

The accounting policy states that depreciation is calculated using the straight-line method for all depreciable property items. When making capital investments related to the acquisition of fixed assets, 10% of the amount of capital investments made is included in indirect expenses at a time.

In January 2020, Alpha purchased and commissioned a machine for the production of parts. The cost of the machine is 2,750 thousand rubles. (without VAT). Useful life 72 months. Depreciation begins on February 1, 2020.

February:

- Depreciation = (Original cost - Bonus depreciation) : Useful life

- Depreciation = (2,750,000 – 275,000) : 72 = RUB 34,375

In February, Alpha will take into account the depreciation bonus and amortization in income tax expenses, then (in March, April, May...) only depreciation will be taken into account, since the depreciation bonus is recognized at a time (in our case, this is February).

If a company calculates depreciation using a non-linear method, then the procedure for including the depreciation bonus in expenses is identical to the linear method (in the month following the month the operating system was put into operation). The purchased fixed asset, after its commissioning, is included in the corresponding depreciation group at its original cost minus the amount of the depreciation bonus.

Expenses in the form of bonus depreciation in cases of reconstruction (modernization) of fixed assets are recognized as expenses of the reporting/tax period in which the date of change in its initial value falls. In this case, the date of change in the initial cost is the date of completion of the relevant work, confirmed by the relevant document (Letter of the Ministry of Finance dated 06/09/2015 No. 03-03-06/1/33417, Letter of the Ministry of Finance dated 09/29/2014 No. 03-03-06/1/48511) .

The depreciation bonus is not provided for in accounting. If a taxpayer applies a depreciation premium to a fixed asset, this will lead to a difference between accounting and tax accounting data.

In the first month of depreciation in tax accounting, expenses will be higher, since in addition to depreciation, the depreciation bonus is also taken into account. Consequently, a taxable temporary difference arises, which leads to the formation of a deferred tax liability (DTL).

Dt 68 Kt 77 – IT accrued

As depreciation is accrued in accounting, IT will decrease, since the amount of accrued depreciation in accounting will exceed depreciation in tax accounting.

Dt 77 Kt 68 – on the last day of each month the amount of IT is reduced

It is important to note that bonus depreciation can only be applied in tax accounting. At the same time, it is recognized as part of indirect expenses in the month in which depreciation begins. That is, the property, after being put into operation as fixed assets, is included in depreciation groups at its original cost minus the depreciation bonus (paragraph 3, paragraph 9, article 258 of the Tax Code of the Russian Federation, paragraph 3, article 272 of the Tax Code of the Russian Federation). In other words, the premium amount does not apply to the initial cost of the operating system.

You can use the right to apply a depreciation bonus only when putting an object into operation, that is, if the object has been depreciating for some time, then the bonus cannot be applied (letter of the Ministry of Finance of Russia dated April 21, 2020 No. 03-03-06/1/22577) .

As for the premium applied to capital investments incurred in cases of completion, additional equipment, or reconstruction of a fixed asset, such a premium is recognized as an expense on the date of change in the initial value of the property (clause 9 of Article 258, clause 3 of Article 272 of the Tax Code of the Russian Federation).

note

There are categories of fixed assets for which the application of a premium would be unlawful. Such objects include fixed assets that were received free of charge or in payment for a share in the capital company, as well as those identified as a result of inventory.

Sometimes, under certain conditions, previously recorded bonus depreciation must be included in income. This occurs when the fixed asset is sold to a related party before the expiration of five years from the date of its commissioning. And, what is important, this must be done even if the fixed asset has been completely depreciated (clause 9 of Article 258 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 27, 2010 No. 03-03-06/1/490).

By the way, the above situation is the only one in connection with which there is a need to restore the depreciation bonus. If the OS is withdrawn for any other reasons, then the bonus is not restored (clause 9 of Article 258 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated April 13, 2020 No. 03-03-06/1/20848 (clause 1), dated September 28, 2012 No. 03-03-06/1/510, dated December 15, 2011 No. 03-03-06/1/827).

If the taxpayer understands that he is obliged to restore the premium, then he is obliged to include its amount in non-operating income in the reporting period in which he sells the fixed asset (clause 9 of Article 258 of the Tax Code of the Russian Federation).

EXAMPLE. RESTORING THE DEPRECIATION PREMIUM

An example of the restoration of depreciation bonus in the event of the sale of a fixed asset to a related party. On June 15, the organization put into operation a fixed asset (third depreciation group). The initial cost of the property was 700,000 rubles. The useful life is five years. When putting the operating system into operation, the company applied a depreciation bonus in the amount of 210,000 rubles. (30% of the original cost). On December 20 of the same year, the property was sold to a related party.

The organization included a depreciation bonus in the amount of 210,000 rubles in expenses in July and in income in December of the same year.

If an organization decides to use bonus depreciation, this should be reflected in its accounting policies. This must be done so that during the inspection there are no complaints from inspectors. At the same time, the accounting policy must provide for the procedure for calculating, the size, as well as the criteria for using the depreciation bonus, that is, to determine to which fixed assets the organization plans to apply it (all or individual objects) (letter of the Ministry of Finance of Russia dated April 21, 2020 No. 03- 03-06/1/22577).

But in accounting, the use of bonus depreciation is not provided. Therefore, there will always be discrepancies between accounting and tax accounting.

If the company does not apply PBU 18/02 “Accounting for corporate income tax calculations,” then these differences are not reflected in accounting.

If a company uses PBU 18/02, then in the month in which the depreciation bonus was taken into account as an expense in tax accounting, a taxable temporary difference (TDT) and the corresponding deferred tax liability (DTL) arise in the accounting records (clause 12 , 15 PBU 18/02).

In your accounting policy for corporate profit tax purposes, you must reflect the procedure for use, the amount of the depreciation bonus and the criteria according to which the depreciation bonus is applied to all or individual items of depreciable property (Letters of the Ministry of Finance of Russia dated April 21, 2015 N 03-03-06/1/ 22577, dated November 17, 2006 N 03-03-04/1/779).

See also: How to organize income tax accounting

A sample section of an accounting policy for tax accounting purposes, describing the procedure for applying bonus depreciation

— 10% of the original cost of fixed assets included in the first and second depreciation groups;

— 30% of the original cost of fixed assets included in the third to seventh depreciation groups;

- 10% of the original cost of fixed assets included in the eighth - tenth depreciation groups;

- 10% of costs for completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation, increasing the initial cost of fixed assets included in the first and second depreciation groups;

— 30% of costs for completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation, increasing the initial cost of fixed assets included in the third to seventh depreciation groups;

- 10% of costs for completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation, increasing the initial cost of fixed assets included in the eighth - tenth depreciation groups.

(Ground: clause 9 of article 258 of the Tax Code of the Russian Federation.)

received free of charge or for which you do not incur actual acquisition costs. For example, in cases of receiving OS in payment for a share in the authorized capital or shares, as well as when OS is identified as a result of inventory (clause 9 of Article 258 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 06/08/2012 N 03-03-06/1/295 (clause 2), dated December 29, 2009 N 03-03-06/1/829);

Application of PBU 18/02

In the accounting of the Organization in the first month of accrual of depreciation, the amount of expenses in the form of depreciation will be less than the expenses in tax accounting, which consist of tax depreciation and depreciation bonus.

In this regard, according to paragraphs 12, 15 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n, a taxable temporary difference arises in the organization’s accounting ( NVR) and the corresponding deferred tax liability (DTL), which is reflected in the credit of account 77 “Deferred tax liabilities” in correspondence with the debit of account 68 “Calculations for taxes and fees”.

Further, in accordance with paragraph 18 of PBU 18/02, as depreciation is accrued, the resulting NVR and the corresponding IT are reduced, since the amount of monthly depreciation deductions recognized in accounting will exceed the amount of accrued depreciation in tax accounting.

That is, on the last day of each month, IT decreases, which is reflected by an entry in the debit of account 77 and the credit of account 68 (Instructions for using the Chart of Accounts).

To correctly reflect the operation of applying depreciation bonus in relation to purchased equipment, we will carry out the necessary calculations: