Formula for calculating residual value

The residual value is the difference between the original cost of fixed assets and accrued depreciation (clause “b”, paragraph 54 of the Guidelines for accounting for fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n):

OS = PS – SA,

Where:

OS - residual value of fixed assets;

PS is the initial cost of the OS;

CA - depreciation accrued as of the date of calculation of the residual value.

For information on how depreciation can be calculated in accounting, read the article “Methods for calculating depreciation in accounting.”

Purpose of fixed asset accounting

In accordance with paragraph 6 of the Guidelines, asset accounting pursues the following goals:

- accumulation of actually incurred costs associated with their acceptance into the accounting process;

- correct documentation and reflection of operations on their movement within the established time limits;

- determination of reliable results obtained from their sale and other disposals;

- calculation of actual costs incurred associated with their maintenance;

- ensuring proper control over the safety of assets accepted for the accounting process;

- analysis of the effectiveness of their use;

- obtaining information about the operating system necessary for disclosure in reporting.

If there was a revaluation of the OS...

Organizations have the right to reassess the cost of fixed assets once a year (clause 15 of PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, clause 43 of the Methodological Instructions):

- original;

- current, if revaluation has already been carried out previously.

Recalculation of the cost of fixed assets should be carried out at the end of the reporting annual period (subclause 3, clause 3 of the appendix to the order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n, clause 3 of this order, clause 15 of PBU 6/01).

The residual value of revalued fixed assets is calculated not taking into account the original cost, but taking into account the current or replacement cost of fixed assets obtained after revaluation (clause “b”, paragraph 54 of the Methodological Instructions):

OS = BC – SA,

Where:

OS - residual value of fixed assets;

ВС - current (replacement) cost of these fixed assets;

CA is the amount of accrued depreciation.

To learn about what revaluation is and why it is needed, read the material “Why is revaluation of fixed assets necessary?”

Fixed Asset Retirement Rate: Definition

Fixed assets of companies that are no longer suitable for operation and generating economic benefits are written off as expenses - retired. All cases of disposal of fixed assets are specified in the text of clause 29 of PBU 6/01. And the economic indicator characterizing the dynamics of decline in indicators for fixed assets is the retirement rate of fixed assets.

The retirement ratio of fixed assets is the ratio of the cost of retired fixed assets to the cost of existing assets at the beginning of the period.

What is the residual value of the property?

The residual value is usually called the value of the property, which is calculated as the difference between its original price and the amount of accrued depreciation. It provides an understanding of the real price of the asset as of the reporting date.

This indicator is calculated not only to determine the tax base, it is also used for making management decisions, as it characterizes the degree of depreciation of fixed assets. Based on the results of the study, the organization’s management decides whether to continue to operate the facility, repair it, replace it, or modernize it.

Correct analysis also plays an important role in accounting. In practice, inexperienced accountants often make mistakes by confusing the market price and the residual price. As a result, they get an incorrect result.

An example of calculation and analysis of the fixed asset retirement rate

Let's consider the hypothetical LLC “Tsarevich Korolevich”. The following information was obtained from the company's balance sheet:

| Information from the balance sheet | Amount (rubles) |

| Cost of fixed assets at the beginning of the period | 100 000 000 |

| Cost of fixed assets put into operation during the period | 25 000 000 |

| Cost of retired fixed assets | 15 000 000 |

Let's carry out the necessary calculations:

- OSOCP = 100,000,000 + 25,000,000 – 15,000,000 = 110,000,000 rubles (total cost of objects at the end of the period).

- KVOS = 15,000,000: 100,000,000 = 0.15 (disposal ratio in shares)

- KVOS = 0.15 x 100% = 15% (disposal rate as a percentage)

- KOOS = 25,000,000: 110,000,000 = 0.23 (update coefficient in shares)

- KOOS = 0.23 x 100% = 23% (renewal coefficient as a percentage)

Let us carry out a basic analysis of the obtained value of the fixed asset retirement ratio:

KVOS < KOOS - this inequality indicates that in Tsarevich Korolevich LLC there is an increase in the value of assets for the enterprise as a whole or for a group of fixed assets selected for analysis. This has a positive effect on the activities of the LLC - judging by the indicators, the company’s management is modernizing equipment and expanding production.

Features of the calculation

The calculation of the indicator is carried out not only in order to correctly determine the tax base. It is also used to:

- property transactions;

- processing loans in which fixed assets act as collateral;

- calculating the amount of insurance compensation;

- restructuring or bankruptcy.

The indicator is calculated using the algorithm:

OS=PS-SA

Where:

- OS - residual cost;

- PS - initial price;

- CA - the amount of deductions to the depreciation fund as of the date of calculation.

This formula is considered the simplest; its application does not require special knowledge and does not require additional calculations.

In practice, another calculation algorithm may be used, but not often. It is usually used when it is necessary to determine the remaining price of fixed assets whose service life depends on production volumes:

OS=(PS-AP)-AOхn

Where:

- OS - residual cost;

- PS - initial price;

- AP - the amount of payments to the depreciation fund (total);

- AO - the amount of transfers to the depreciation fund (monthly);

- n is the number of months during which the property was used for production purposes.

To calculate the indicator, it is necessary to determine in advance the amount of deductions to the depreciation fund. For this, various methods are used (nonlinear, linear, declining balance, calculation by the sum of the number of years; production).

When making calculations, some accountants simultaneously calculate the liquidation value. If all actions are performed correctly, the value of the first indicator will be higher.

Sale and write-off of property

In some cases, a company has to sell property that has not served its full life. Selling it at residual cost is not always possible. If a decision is made to set the selling price lower than the residual cost, the company will incur losses.

In accounting, in such situations, the loss is reflected instantly. The legislation of the Russian Federation does not provide any restrictions for this. In parallel with this, a loss from the sale of property is also formed in tax accounting. It is applied to other expenses in parts (not completely) over a certain period of time. Typically, this period is equal to the difference between the planned service life of the sold fixed asset and the actual one. Inexperienced accountants may expense a loss immediately and in full. As a result, the amount of tax costs will be significantly overestimated, which is a mistake.

Residual cost is an indicator that gives an understanding of how much the value of the property has changed over the period of its operation. It is used in accounting to display information, and in tax accounting to determine the legal framework. And in management - to assess the condition of fixed assets and make decisions on their further operation or the advisability of repairs (replacement).

An example of calculating renewal and retirement coefficients

Let's imagine a hypothetical company, Terminator Metal LLC, whose main activity is metalworking. The following information regarding the company's fixed assets is known:

| Information from the balance sheet | Amount (rubles) |

| Total cost of all fixed assets | 75 200 |

| Cost of worn-out fixed assets at the beginning of the period | 14 600 |

| Cost of new fixed assets put into operation in the current period | 11 800 |

| Cost of retired fixed assets (reason: complete depreciation, disrepair) | 8 800 |

Let's carry out the necessary calculations:

- Let's calculate the value of fixed assets as of the end of the reporting period (we find the sum of the total value of all property at the beginning of the period and the amount of newly accepted objects, then subtract the value of the written-off property): 75200+11800-8800=78200 rubles.

- Update ratio: 11800 : 78200 = 0.15 (15%).

- Attrition rate: 8800 : 75200 = 0.12 (12%).

Definition

The definition of “residual cost of fixed assets” means the cost of fixed assets, which can be calculated by determining the difference between the initial cost of an object and its direct depreciation at the time of operation.

It is necessary to revaluate fixed assets, since the cost of assets must fully correspond to market values.

The balance sheet has a special line, “Revaluation of non-current assets”, in which the indicators of the revaluation should be entered.

Is it necessary to reassess?

Carrying out revaluation allows you to clarify the replacement cost of fixed assets and thereby bring it to market characteristics.

For example, in the process of an organization purchasing equipment worth 100,000 rubles exactly a year ago, the calculated depreciation was about 5,000 rubles. For this reason, 95,000 rubles must be displayed in the corresponding balance sheet line “Key assets”. In other words, residual cost.

If new equipment appears on the market, then it will be possible to sell the purchased equipment only for a maximum of 80,000 rubles. The revaluation carried out allows us to take into account the market price of the equipment (meaning 80,000 rubles), as well as to fully respect the reliability of all information without exception in the process of generating financial statements.

Revaluation can be carried out by the company on a voluntary basis. Moreover, it can only be performed in relation to those fixed assets that are owned by the organization.

The frequency of such revaluations should not exceed once a year.

The revaluation process is carried out by recalculating the original and current costs, including the available depreciation amount, which is accrued over the period of use of a particular object.

Basic Rules

Without exception, all fixed assets that are owned by the organization may be subject to revaluation. At the end of the check, the current cost is considered as the original cost.

The results obtained are entered into the generated financial statements of previous years, and are used in the process of collecting information regarding the balance in the accounting records for January of the reporting calendar year.

How to determine

Residual cost is defined as the difference between the original cost of a property and depreciation calculated over the full period of its use.

In other words, to be able to make the necessary calculations, use the following formula:

OS = IS – Rap, in which

OS - residual cost, IP - initial cost, Rap - the amount of available depreciation for the entire period of use of the object.

The residual value, which was calculated using the specified formula, can be called otherwise - the historical price. This is largely due to the fact that it is determined by actual costs, which are directly related to the acquisition and further reconstruction and modernization of a particular object, without taking into account total depreciation.

From the formula you can additionally derive another one, namely:

Rap = IS – OS

All calculations regarding total depreciation can be made using the specified formula.

Thanks to this, a kind of depreciation calculation algorithm is formed. At the end of each calendar year, representatives of the accounting department re-evaluate the fixed assets, and the residual cost is additionally determined.

Upon completion of the procedure

As noted earlier, companies can revaluate personal fixed assets no more than once a year.

Please note: until the beginning of 2011, revaluation could only occur at the beginning of the reporting period.

After appropriate adjustments have been made to the legislation of the Russian Federation, the residual cost is determined with mandatory consideration of the price received upon completion of the revaluation, and not taking into account the original amount.

The residual cost in such a situation is calculated using the following formula:

OS = TC – Ca, in which

OS is the residual cost, TC is the current price, Sa is the amount of depreciation charges.

It is important to remember that during the calculation process, errors and inaccuracies are unacceptable, since the final result will be unreliable.

How to calculate the residual value of property - reflected in transactions

How to calculate the residual value based on correspondence accounts:

- When valuing fixed assets, the formula involves finding the difference between the value of account balance 01 (debit) and account balance 02 (credit).

- When finding the residual value of an object or group of objects from the category of intangible assets, the balance formed in the credit of account 05 is subtracted from the balance of account 04 (debit value).

If the residual value is written off as a result of the sale, the entry assigns the proceeds to other income:

- D91 - K01 at the time of writing off the residual value;

- D02 – K01 for writing off depreciation on a sold object.

The residual value of an asset is the cost of an asset after depreciation has been calculated during the period of use. You can learn more about how the residual value of fixed assets is determined from this article.

The residual value is calculated as the difference between the primary price of the property and the depreciation accrued over the period of its use. That is, to carry out calculations, use the following formula:

- Ос – residual price;

- Ps – initial price;

- Sa – the amount of accrued depreciation for the entire period of use.

The residual price calculated using this formula can also be called historical cost. It is calculated based on actual expenses that are associated with the purchase and with future reconstructions and upgrades of the operating system, without taking into account the amount of accumulated depreciation.

From the formula above, another formula can be extracted:

A company can calculate the amount of accumulated depreciation using this formula.

This produces the following algorithm for calculating depreciation. At the end of each year, accounting employees revaluate fixed assets, calculating their residual price. Using the last formula, they calculate the new depreciation amount.

Write-off and sale below OS

Most organizations are forced to sell fixed assets that are not used during their work activities. They are often sold at a price that is significantly lower than the residual cost. In other words, the sale incurs losses.

In accounting, this loss can be recognized instantly; there are no restrictions for this situation. At the same time, in tax accounting, the resulting loss from the sale of fixed assets must be included in other costs not immediately in full, but in parts over a certain period.

This period can be calculated as the difference between the useful life of the fixed asset and the actual time period until the sale.

This rule is clearly stated in paragraph 3 of Art. 268 of the Tax Code of the Russian Federation. Based on this, in the period when there was a fact of sale of an incompletely depreciated fixed asset, organizations will be forced to recognize a smaller amount as expenses for tax purposes than directly in the accounting itself.

If this is ignored, then this fact will be considered a gross violation: tax accounting expenses will be overestimated, which will entail an underestimation of taxable income.

Example

Let's consider a specific situation. In September 2014, the organization sold equipment they were not using.

The values are as follows:

- initial price - 540,000 rubles:

- useful life – 6 years;

- depreciation period - 2 years;

- residual cost at the time of sale – 360,000 rubles;

- the equipment was sold for a total amount of 295,000 rubles, including VAT - 45,000 rubles.

Based on this, the loss on sale is:

295,000 – 45,000 – 360,000 = 110,000 rubles.

It is worth noting that not only in accounting, but also in tax accounting, by mistake the loss was recognized in full for the period of sale. In other words, in September 2014.

Because of this, the authorized person did not display the operation for the sale of equipment with the fact of loss in the corresponding Appendix No. 3 to sheet 02 of the income tax return directly for 9 calendar months of 2014.

But in fact, in tax accounting, this loss can be included in the list of financial expenses from the beginning of October 2014 for 2 years ((6 years - 2 years) * 12 calendar months).

In simple words, you need to write off monthly taxable income in the direction of decreasing taxable income for a specified period of 2 thousand 291 rubles (110,000: 48 months).

Based on this, due to an error, the amount of tax expenses for the month of October turned out to be significantly overestimated - by 110,000 rubles.

Let's assume that the error was identified at the end of November 2014, at the moment when the income tax return for 9 calendar months had already been generated. Due to the fact that in the declaration the amount of financial costs was significantly overestimated (by 110,000 rubles), the income tax for 9 calendar months turned out to be underestimated by 22,000 rubles (110,000 * 20%).

In addition, if an organization uses PBU 18/02, it is imperative to make clarifications in accounting, namely:

Debit 09 Credit 68 subaccount “Calculations for income tax” - 22,000 rubles - the deferred available tax asset is displayed. Debit 68 subaccount “Calculations for income tax” Credit 09 – 916 rubles – the fact of payment of part of the deferred tax asset for October-November 2014 (for several months) is displayed.

The training course for calculations according to RAS is presented below.

https://youtu.be/9dT1vHVasS4

There are different ways to value property. Some are used in accounting, others in financial reporting. Let's talk about the procedure for calculating the residual value of fixed assets.

What value is considered residual?

Fixed assets (FPE) are accepted for accounting at the original price, which includes all costs of acquiring and bringing the object to readiness for its use.

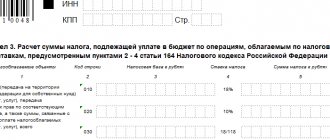

Non-refundable taxes are included in acquisition costs if the person is not the payer. For example, purchasing equipment worth RUB 120,000. (including VAT RUB 20,000) will require the following postings:

| Dt | CT | Sum | Operation |

| For activities subject to VAT | |||

| 100 000 | The investment in the purchase of the OS is reflected | ||

| 20 000 | Provided VAT by the seller | ||

| 100 000 | Putting the OS into operation | ||

| For activities not subject to VAT | |||

| 120 000 | The investment in the purchase of the OS is reflected | ||

| 120 000 | Putting the OS into operation | ||

The initial price of an asset is reflected in the debit of account 01:

- in the first case it is 100,000 rubles;

- in the second – 120,000 rubles.

If a property is revalued, its value becomes replacement value.

The cost of fixed assets is repaid by depreciation, which is summed up under the credit of account 02. The procedure for calculating depreciation of fixed assets is given in PBU 6/01.

In some cases, the book value (residual) value of the object is of interest. To do this, calculate the residual value, reducing the initial (or replacement) price of the object by accumulated depreciation.

Valuation of fixed assets in accounting

The valuation of fixed assets is the monetary value in which they are reflected in accounting. In current accounting, there are three types of assessment:

- initial cost;

- current (replacement) cost;

- residual value.

Initial cost . Fixed assets are accepted for accounting at their original cost, which depends on the method of receipt of the asset into the organization and is determined by:

- for objects purchased for a fee (new and used) - at the actual costs associated with the acquisition, construction and production, excluding VAT and other refundable taxes, except in cases provided for by the legislation of the Russian Federation (clause 8 of PBU 6/01 and Clause 24 of the Guidelines for Accounting for Fixed Assets).

Actual costs for the acquisition, construction and production of fixed assets consist of:

- purchase price (amounts paid in accordance with the contract to the supplier (seller), as well as for delivery of the object and bringing it into a condition suitable for use);

- amounts paid under construction contracts and other contracts for the performance of work;

- amounts paid for information and consulting services related to the acquisition of fixed assets;

- customs duties and customs fees;

- non-refundable taxes, state duties paid upon acquisition of fixed assets;

- remuneration to intermediaries through whom the fixed asset was purchased;

- other costs directly related to the acquisition, construction and production of fixed assets.

The actual costs of acquisition, construction and production of fixed assets do not include general and other similar expenses, except for cases where such expenses are directly related to the acquisition, construction and production of these objects.

- for objects manufactured by the organization itself - at the actual costs associated with the production of these fixed assets. Production costs are taken into account and formed in accordance with the cost accounting procedure for the relevant types of products manufactured by the organization (clause 26 of the Guidelines for accounting for fixed assets);

- for objects made as a contribution to the authorized (share) capital of the organization - in the amount agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation (clause 9 of PBU 6/01 and clause 28 of the Methodological guidelines for accounting for fixed assets );

- for objects received by the organization under a donation agreement (free of charge) - based on the current market value on the date the object was accepted for accounting as an investment in non-current assets (clause 10 of PBU 6/01 and clause 29 of the Guidelines for accounting for fixed assets ). In this case, the current market value is understood as the amount of money that can be obtained from the sale of this asset on the date of its acceptance for accounting (clause 29 of the Methodological Guidelines for Accounting for Fixed Assets).

Sources of information for determining the current market value can be:

- trade organizations (price list data);

- manufacturing plants (data on prices for similar fixed assets received in written form);

- state statistics bodies, trade inspectorates (responses to requests in writing);

- Media and special literature;

- expert opinions (for example, appraisers);

- for objects received under barter agreements (agreements providing for the fulfillment of obligations (payment) in non-monetary means) - at the cost of transferred or to be transferred values, based on the price at which in comparable circumstances the cost of similar values is determined (clause 11. PBU 6/ 01 and paragraph 30 of the Guidelines for accounting for fixed assets).

If the value of assets transferred or to be transferred cannot be determined, then the initial cost of fixed assets received under exchange agreements is determined based on the cost at which, in comparable circumstances, the organization could purchase similar objects.

- for objects received under property trust management agreements - at a cost determined in accordance with Order of the Ministry of Finance of the Russian Federation dated November 28, 2001 No. 97n “On approval of instructions for reflecting in the accounting records of organizations operations related to the implementation of a property trust management agreement” ( Clause 31 of the Guidelines for Accounting for Fixed Assets).

- for unaccounted for objects discovered during the inventory of assets and liabilities - based on the current market value determined as of the date of the inventory (clause 36 of the Methodological Guidelines for Accounting for Fixed Assets).

In accordance with clause 12 of PBU 6/01, regardless of the method of receipt of fixed assets into the organization, their initial cost increases by the amount of costs for delivery and bringing the object to a state suitable for its use (storage, installation costs).

Based on paragraph 4, clause 5 of PBU 6/01, assets worth up to 40,000 rubles. may, at the organization's choice, be taken into account as part of:

- fixed assets;

- inventories.

The corresponding decision must be enshrined in the order on the accounting policy of the organization for accounting purposes (clause 7 of PBU 1/2008).

The initial cost of fixed assets may change in the case (paragraph 2, paragraph 14 of PBU 6/01):

- completions; — retrofitting; — reconstruction; — modernization; — partial liquidation; - revaluation.

Replacement cost is the cost of similar fixed assets in modern conditions of reproduction, at modern prices and technology, i.e. the cost of all costs for the acquisition (construction) of property objects, including costs of transportation, installation, etc. at current market prices and tariffs on a specific date.

Over time, the initial cost may deviate from the replacement cost due to high inflation rates, rising production costs, market conditions, etc. If the deviation becomes significant, the initial cost is revalued and brought to the replacement level. This is necessary so that the organization can generate capital investments through depreciation charges for an equivalent replacement of means of labor (renovation). In addition, the greatly undervalued value of the organization’s property compared to the real price level leads to a distortion in the valuation of assets in the balance sheet

In accordance with paragraph 43 of the Methodological Guidelines for Accounting for Fixed Assets, the current (replacement) cost of fixed assets is the amount of money that must be paid by the organization on the date of revaluation if it is necessary to replace any object.

Information on the current (replacement) cost of fixed assets must be documented. To determine it, you can use the following data:

- trade organizations (price lists);

- manufacturers (information on prices for similar products in written form);

- state statistics bodies, trade inspectorates (responses to requests in writing);

- Media and special literature;

- technical inventory bureau (assessment);

- expert opinions.

Residual value is the cost of fixed assets taking into account accrued depreciation. This indicator is determined by subtracting the amount of depreciation from the original (or replacement) cost. This type of valuation shows the value of a fixed asset that has not yet been transferred to finished products (work performed, services rendered).

Valuation of fixed assets at residual value is necessary for drawing up a balance sheet, identifying the financial result from the disposal of the organization’s property, as well as determining its quality condition.

The residual value is calculated using the following formula:

Accountants in their accounting work also use such a concept as book value . This is the cost of fixed assets that are listed on the company’s balance sheet in a mixed valuation:

- at historical cost - objects that have not yet been revalued; - at replacement cost - objects that have already been revalued.

Formula for calculating residual value

Mathematically, calculating the residual value of an asset is quite simple; only 2 indicators are used:

Residual value = Original (replacement) cost – Accumulated depreciation.

Please note: the original cost is taken into account if revaluations have not been carried out. If there is a replacement cost after revaluation, only this is taken into account for calculation.

This method of calculating residual value can be rewritten into the “language” of accounting balances:

Residual value = Balance Dt 01 – Balance Kt 02.

When determining the amount of depreciation, the accountant should take into account that account 02 accumulates depreciation accrual not only for fixed assets, but also for objects in account 03 “Profitable investments in tangible assets.” Such investments include those operating systems that are provided for temporary possession or use for a fee.

Therefore, during the calculations, the credit balance of account 02 is reduced by the amount related to the objects of account 03. When compiling the balance sheet, fixed assets and investments are reflected at the residual value and in different lines (1150 and 1160, respectively).

Calculation of the retirement rate of fixed assets (balance sheet formula)

Important! The balance sheet reflects information about fixed assets at their residual value, and when calculating the asset disposal ratio, the initial cost of the property is taken into account. Therefore, it will not be possible to use information from the balance sheet in calculations - the formula must include data from account 01 of the Balance Sheet.

This is the formula for calculating the value of the fixed asset retirement ratio, based on balance sheet data:

Using information from the old balance sheet, the formula would look like this:

So, to calculate the coefficient of disposal of fixed assets, we substitute the turnover of account 01 into the subaccount “Disposal of fixed assets” into the numerator of the fraction, and put the balance of account 01 for all fixed assets as of the beginning of the reporting year into the denominator.

Residual value: calculation examples

We will calculate the book value of property in different situations.

Calculation of residual value of equipment

When compiling the annual balance sheet of an organization that has production equipment, the following data is taken into account:

- the initial cost of the fixed assets was RUB 2,300,600;

- the total amount of accumulated depreciation of fixed assets is RUB 900,800;

- depreciation on rental property – RUB 200,700.

First, let’s determine the amount of equipment depreciation taken into account:

900,800 – 200,700 = 700,100 (rub.) – accumulated depreciation on production equipment.

The residual value of fixed assets, which will be reflected on line 1150 of the balance sheet as of December 31, will be:

2,300,600 – 700,100 = 1,600,500 (rub.).

Methods for calculating average annual cost

To calculate the average annual cost, you can use one of several methods. In this case, the choice of method depends mainly on the purposes of the calculation and the required accuracy of the result obtained.

Without taking into account the month of input-output of fixed assets (formula)

If special accuracy is not required, then the average annual cost can be determined by the formula:

S-st (avg) = (S-st (n.g) + S-st (k.g))/2,

where C-st (n.g), C-st (k.g) – the cost of fixed assets, respectively, on January 1 and December 31 of the year for which the calculation is being made.

In this case, the cost as of December 31 is calculated using the formula:

S-st (k.g) = S-st (n.g) + S-st (enter) – S-st (select),

where C-st (input), C-st (select) – the cost of fixed assets, respectively introduced and written off during the year.

In all of the above calculations, the book (residual) value of the fixed assets should be used.

Taking into account the month of input-output of fixed assets (formula)

If you need to get a more accurate calculation, you should take into account the month when the asset was entered or written off. Here, several formulas can be used to calculate the average annual cost.

The most common formula used in calculating indicators of the use of fixed assets (capital productivity, capital intensity, etc.):

S-st (avg) = S-st (n.g) + M1/12 × S-st (enter) – M2/12 × S-st (select),

where M1 and M2 are the number of full months that have passed, respectively, from the date of entry and write-off of fixed assets until the end of the year.

Average chronological formula: S-st (avg) = [(S-st (1n.m) + S-st (1k.m))/2 + (S-st (2n.m) + S-st (2k. m))/2…+(S-st (Nn.m) + S-st (Nk.m))/2] /12,

where S-st (1n.m), S-st (2n.m),...S-st (Nn.m) – the cost of fixed assets at the beginning of the 1st, 2nd, Nth month, respectively;

S-st (1k.m), S-st (2k.m),...S-st (Nk.m) – the cost of fixed assets at the end of the 1st, 2nd, Nth month, respectively.

The formula used to calculate the average annual cost for calculating corporate property tax:

S-st (av) = (S-st (n1) + S-st (n2) +…+ S-st (nn) + S-st (k)) /13,

where S-st (n1), S-st (n2)…S-st (nn) is the residual value of fixed assets on the 1st day, respectively, of the 1st, 2nd...nth month of the tax period;

S-st(k) – residual value of fixed assets as of the last day of the tax period (as of December 31 of the year for which the tax is calculated);

13 – the number is obtained by adding one to the 12 months of the tax period.

When calculating advance payments for 3, 6 and 9 months, the denominator of the calculation formula will be obtained by summing the unit with 3, 6 and 9 months, respectively.

The calculation of the residual value of fixed assets using this formula does not include the value of assets, the tax base for which is determined as their cadastral value.