Information on the income of individuals from whom personal income tax is withheld is transmitted to the Federal Tax Service on a quarterly basis by the organizations and individual entrepreneurs paying them. Form 6-NDFL was approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450. Let us remind you that a new form has now been approved; you can read how to fill it out for 2020 here.

If a company or individual entrepreneur does not have employees and does not pay income and remuneration, then they do not bear the obligation to submit a zero calculation.

The document contains summary information:

- on the amount of income and deductions provided to taxpayers,

- on withholding tax on personal income.

Line 100 6-NDFL: how to fill out

The dates of actual receipt of income, which are indicated in line 110 by type of payment, are, in particular, the following:

- Salaries, bonuses and additional benefits to employees - the last day of the month for which the accrual was made.

- Vacation pay, financial assistance and sick leave benefits are the day they are paid.

- Payment to a resigned employee - the last day of work for which income was accrued.

- Income in kind – the day of its transfer to an individual.

- The material benefit from saving on interest is the last day of each month during the term of the loan agreement.

- Daily allowance over the established limit is the last day of the month of approval of the advance report.

Salary at the junction of periods

Salaries for the last month of the quarter are paid in the first days of the next. For example, for March - in April, for June - in July. How to reflect this in 6-NDFL?

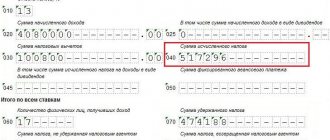

There is a letter from the Ministry of Finance dated March 18, 2016 No. BS-4-11/ [email protected] , which addresses this issue. Salary for March paid in April should be reflected in section 1 of the calculation for the 1st quarter. By analogy, salaries for June paid in July are reflected in section 1 of the half-year calculation . The entry is like this:

- on line 020 - the amount of accrued salary;

- on line 040 - the amount of calculated personal income tax.

to record the tax amount on line 070. The salary is paid in the next period, accordingly, and the tax must be withheld even then. If you reflect it in line 070 for the period for which the salary was accrued, there will be an error and a fine of 500 rubles under Article 126.1 of the Tax Code of the Russian Federation.

Note! A common mistake is to reflect tax on line 080 in such a situation. Since the personal income tax withholding date has not yet arrived, it cannot be reflected in this line.

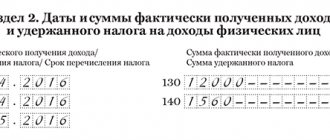

There is also no need to include this operation in section 2 This will be done in the next period . For example, if the June salary is issued on July 5, then section 2 of form 6-NDFL for the 9th month will look like this:

- on line 100 - 06/30/2019 (date of receipt of income in the form of salary - the last day of the month);

- on line 110 - 07/05/2019 (date of payment and withholding of tax);

- on line 120 - 07/08/2019 (personal income tax is transferred to the budget the next day, but 07/06 is Saturday);

- on line 130 - the amount of salary for June;

- on line 140 - the amount of personal income tax withheld from it.

6-NDFL line 110: what date to put

Line 110 6-NDFL indicates the day on which income tax was withheld. According to paragraph 4 of Article 226 of the Tax Code of the Russian Federation, personal income tax is withheld by the tax agent on the day the income is paid, but taking into account some nuances.

Line 110 indicates dates depending on the form of income:

- Wages, vacation pay, sick leave, financial assistance, final payment upon dismissal - the day they are paid to the employee.

- Income in kind, excess daily allowance and material benefit - the day of actual transfer of cash income from which tax is withheld.

Reflection of debts

Salaries for June were paid late - on August 20. What are the features when filling out 6-NDFL?

Typically, the day you receive income in the form of salary is the last day of the month. But if it is paid late, this rule does not apply. Therefore, the June salary received in August must also be reflected in August (letter of the Federal Tax Service dated 10/07/2013 No. BS-4-11 / [email protected] ). Section 2 for this operation in 6-NDFL for 9 months looks like this:

- on line 100 - 08/20/2019;

- on line 110 - 08/20/2019 (personal income tax withheld before payment);

- on line 120 - 08/21/2019 (the day following payment is the deadline for tax transfer);

- on line 130 - the amount of wage arrears paid in August (without reduction for deductions);

- on line 140 - the total amount of tax withheld (including applied deductions for June).

How to reflect vacation pay arrears? Employees who went on vacation in April received them only in May.

The date of receipt of income in the form of vacation pay is the date of their actual payment. Vacation pay arrears were repaid in May, say, on the 20th. Then you need to withhold personal income tax. It should be transferred to the budget no later than the last day of the month in which vacation pay was received . That is, no later than May 31. So section 2 would look like this:

- on line 100 - 05/20/2019 (date of actual payment of vacation pay arrears);

- on line 110 - 05/20/2019 (date of tax withholding);

- on line 120 - 05/31/2016 (the deadline for transferring personal income tax from vacation pay is the last day of the month).

In what cases is tax withheld from an individual’s income?

The main income from which personal income tax is withheld are wages, gifts to employees, etc.

Personal income tax on wages

In accordance with the Tax Code of the Russian Federation, information on wages in the report must be indicated no later than the deadline of the month for which the calculation is made. In this case, the payment of wages is possible not on the same day, but on the next one, that is, in the next month. Salary tax is withheld on the day when wages are issued to the employee (in cash or transferred to a card).

The advance payment is not subject to personal income tax; 6-NDFL only indicates the date of its payment and the amount.

The tax is calculated from the full amount of wages - from the one indicated at the end of the month. Thus, personal income tax is deducted from the same amount at the end of the term.

Personal income tax under a civil contract

When concluding a civil contract (civil contract) with an employee, the calculation is made based on the results of the work performed in accordance with the drawn up act. In this case, the time frame for calculation is established not by months, but by the provisions of the contract. If payment is made in several stages, then this will not be considered advances, which means each operation is subject to personal income tax. All data is subject to reflection in 6-NDFL. The following lines are filled in:

- calculus;

- retention;

- issuance;

- transfer to a government agency.

One of the features of such calculations is that the date of retention and issue must coincide, while calculation is possible earlier in time. Payment of tax to the budget is possible only after the due payment has been transferred to the contractor and the tax has been withheld.

Gift for employee

If we turn to the Tax Code of the Russian Federation, then almost any income of an individual is taxed. Income received in kind from an employer is no exception. Whether the value of the gift received is reflected in 6-NDFL will depend on:

- the value of the gift expressed in monetary terms;

- dates of receipt;

- Possibility of deduction of personal income tax.

It should be remembered that there are cases in which a gift is not subject to personal income tax. This is possible if the gift's value does not exceed 4,000 rubles . However, there are other factors that make it possible not to withhold tax on a gift. For example, an employer cannot withhold tax in a calendar year. In this case, the obligation does not transfer to the next year.

The date when personal income tax is calculated, the income in the form of a gift is received and the tax withheld may not coincide. Let's assume that an employee was given an electric kettle as a gift. With such a gift, tax will need to be withheld from your next salary. If the employer does not make any payments before the end of the calendar year, then personal income tax cannot be withheld from the income received.

The second section of 6-NFDL contains the following dates to fill out:

- page 100 – date of actual receipt of income (for example, if we are talking about payment of wages, then the last day of the billing month is indicated);

- page 110 – tax withholding date;

- page 120 – tax payment deadlines.

As a rule, the date of payment of tax to the budget is the day following the payment of remuneration. However, for individual payments, different conditions are established. For example, if we are talking about vacation or sick leave payments, then the tax should be transferred no later than the deadline of the month in which the payment was made (Read also the article ⇒ How to submit adjustments for 2-NDFL and 6-NDFL).

Tax payment deadline

The date on which the tax agent transfers personal income tax to the budget is no later than the day following the day the income is issued. However, if we turn to vacation pay and temporary disability benefits, then personal income tax is transferred to the budget no later than the last day of the month in which this payment was made. It should also be remembered that page 120 only indicates working days. This means that if the day that follows the day of payment of income (the last day of the month) is a weekend, then the next working day will be indicated as the tax payment date (Read also the article ⇒ How the tax office checks 6-NDFL).

Deadlines for submitting 6-NDFL in 2020

The report in Form 6-NDFL to the Federal Tax Service is submitted within the following deadlines:

- Until April 30, 2020 – for the 1st quarter of 2020;

- Until July 31, 2020 – for the first half of 2020;

- Until October 31, 2020 – for 9 months of 2020;

- Until April 1, 2020 – for 2020.

Important! In case of violation of the deadline for submitting 6-NFDL, the fine will be 1000 rubles for each month. If the information provided contains false information, the fine will be 500 rubles.

Despite the fact that the specified periods of fines may not be significant for the company, it should also be remembered that if there is a delay of more than 10 days, the tax authorities have the right to block the taxpayer’s current account. And this will be a more significant punishment for the company.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Date of reflection of payments on certificates of incapacity for work

After the employee has submitted a certificate of incapacity for work to the settlement group, this is the basis for calculating profit. Let's look at the situation using an example. The employee submitted his sick leave on April 21. The settlement group made the accruals, the payment was made on April 25.

Filling out fields 1 and 2 of section of the declaration will be:

- 20 – 6 000;

- 40 –780;

- 70 – 750;

- 100 – 21.04;

- 110 – 21.04;

- 120 – 30.04.

Amount of accrued income on sick leave in 6 personal income tax:

- 130 – 6 000.

Withheld income tax:

- 140 – 780.

An example of how vacation payments are reflected in reporting

Gift for a former employee

The employee retired, and after that he was given a valuable gift. Personal income tax cannot be withheld. How to make a calculation correctly?

In this case we are talking about income in kind. The date of actual receipt of such income is considered to be the day the gift is transferred . Let's say it's October 7th. As of this date, personal income tax must be calculated, and it should be withheld from any income in favor of this individual. But since no more payments are expected to be made to him, personal income tax will never be withheld.

In the annual 6-NDFL in section 1 we make the following entries:

- on line 020 - the price of the gift;

- on line 030 - non-taxable amount of 4,000 rubles;

- on line 040 - personal income tax amount;

- on line 080 - the amount from line 040, since the tax was not withheld until the end of the reporting year.

In section 2 , in lines 110 and 120, respectively, you need to reflect the date of tax withholding and the deadline for its transfer. But since it was not withheld, then in these lines you should indicate “00.00.0000” (letter from the Federal Tax Service dated 08/09/2016 GD-3-11 / [email protected] ). Section 2 will look like this:

- on line 100 - 10/07/2019;

- on line 110 - 00.00.0000;

- on line 120 - 00.00.0000;

- on line 130 - the price of the gift;

- on line 140 - 0 rubles.

Before March 1 of the next year, you must submit a 2-NDFL certificate with feature 2 to the Federal Tax Service.

Which day is considered the date of receipt of income for other payments, both cash and in kind?

For bonuses, sick leave, vacation pay, financial assistance above the established limit, payments in kind, the day of actual receipt of income is considered the date of their direct receipt in hand.

Note! Despite the fact that the date of receipt of income in the form of 6-NDFL cash and in-kind payments will be the day of their issuance, the deadline for paying the tax may not coincide (see the table below).

The only exception here is the calculation upon dismissal, when the date of disbursement of funds falls on the last working day. But if an employee decides to take a vacation before dismissal, then the following options are used:

- Date of receipt of vacation pay – day of issue;

- The date of receipt of the payment upon dismissal is the last working day before the vacation.

If the company issued vacation pay and dismissal benefits at the same time, then in the 6-NDFL certificate you will have to divide these amounts into two blocks, since the actual date of issue is different.

Date of actual receipt of income in 6-NDFL, registration procedure

The date of actual receipt of income for 6-NDFL is the date that you enter in line 100 of the specified form. It does not always coincide with the day when the money is deposited on the employee’s card or when he receives it at the cash register.

In salary reports for the 2nd quarter, take into account the changes that came into force in 2020. Experts from the magazine “Salary” summarized all the changes in 6-NDFL. Read how inspectors compare report indicators with each other. If you check them yourself, you will avoid clarifications and will be able to explain any figure from the report. See all the main changes in salary in a convenient presentation and special service.

Main changes in 6-NDFL for the 2nd quarter of 2020

Important! The date of receipt of income, the date of tax withholding and the deadline for transferring tax to 6-personal income tax are different days, although they may coincide.

What is considered the day of accrual of payments is specified in Art. 223 Tax Code of the Russian Federation. Also, explanations on this matter are contained in the letter of the Federal Tax Service of Russia dated November 13, 2015 No. BS-4-11/19829.

The date of receipt of funds, both tangible and intangible, may be:

- The last day of the month for which the payment is made;

- Directly the day the income is issued;

- Date of transfer of funds in kind.

The most important thing is not to confuse this number with the day when the employee receives money in person or from an ATM. It may be the same day, or it may be different.

Now let's move directly to form 6-NDFL. It includes Sections 1 and 2. Line 100, which reflects exactly the date of actual receipt of income, refers to Section 2. But it directly affects Section 1 indicators.

In Section 1, you disclose the amount of accrued funds on a cumulative basis from the beginning of the year. And if you accrued money in one reporting period, but paid the money in another, then this amount will be divided into two reports:

- In Section 1, you will include it by accrual date, which most often is the date the income was actually received;

- In Section 2 on the fact of deduction and payment of personal income tax.

This breakdown happens all the time where salaries are paid at the beginning of the next month, when an employee is fired or becomes ill (we will analyze each payment in detail below).

Page 100: what's included

In 6-NDFL, line 100 is located in the 2nd section, where the dates of receipt by individuals of remuneration, withholding and transfer of personal income tax, as well as the generalized amounts of income and taxes for all recipients by quarter are entered. The actual dates for receiving payments vary depending on their types and situations.

Let's look at the procedure for filling out line 100 in 6-NDFL and what does it include? This is a question asked by many accountants who have not figured out payment dates. According to the Procedure, which was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , in f. 6-NDFL on page 100 you need to enter the number when the individual actually received income in the amount reflected in page 130. But there are various situations when it is not the actual dates of payments that are entered into the report, but those on which payments must be made by law .

Due to the fact that there may be many transactions for the payment of funds to employees or individual contractors, records for the reporting quarter may not fit on one page. In this case, there may be more than one report page from page 100 - it is important to number them in order.

Is it possible to independently check the correctness of filling out lines 100 – 120?

To check form 6-NDFL, the Federal Tax Service has developed special control ratios, which can be seen in Letter dated March 10, 2016 N BS-4-11 / [email protected] The explanation says: the date indicated in line 120 (the deadline for transferring the tax to the budget), cannot be less than the date written in line 110 (tax withholding date). If such a contradiction is discovered, inspectors may accuse the tax agent of submitting false data and fine them 500 rubles for each incorrectly drawn up document. But such a discrepancy can be seen independently if you compare the records of the two columns, as shown in the picture.

Tax officials may suspect an employer of violating the law if the data from line 120 (the deadline for transferring tax to the budget) does not coincide with the date of transfer of personal income tax entered on the budget settlement card. The tax agent made an unintentional or deliberate mistake, and it is possible that he is trying to hide the fact of non-transfer of tax to the budget, the inspectors will conclude. The accountant will have five days to eliminate the shortcomings and explain how the errors got into Form 6-NDFL.

You can fill out 6-NDFL in online services on the websites of accounting software developers - Bukhsoft Online, My Business, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a small fee (up to 1000 rubles).

Tax withholding date

In line 120 of the second section of the calculation, the day is indicated - usually the last day for tax deduction. Inspectors are sure to pay attention to it, because the date set determines whether a violation has occurred. Also see “Filling out Section 2 in 6-NDFL”.

Please note: the deadline has changed in 2020! When receiving standard income, the last day is considered to be the day following their receipt.

EXAMPLE If salaries for September 2020 were issued to employees on October 10, the tax must be paid no later than October 11.

An exception is provided for the payment of sick leave and vacation money: in such cases, the deadline goes to the last day of the month in which they were paid. Moreover, only weekdays are taken into account.

When money is issued before a holiday or weekend, settlement with the budget is possible upon the first working day.

EXAMPLE LLC Solaris issued an advance payment to employees on December 29, 2020 in the amount of 287,000 rubles, and a final payment in the amount of 390,000 rubles. was taken on January 10, 2020. [What dates should I indicate] in the declaration for the first quarter in terms of income receipts and tax withholding?

Solution

- In the first section of the reporting, it is necessary to indicate the date on page 100 - December 29, 2016 (for RUB 287,000).

- On page 110 they write the date - 01/10/2017 for withheld funds in the amount of 88,010 rubles. ((287,000 rub. 390,000 rub.) × 13%).

- On page 120, informing about the deadline for personal income tax payment, they put 01/11/2017.

When determining the exact dates when filling out 6-NDFL, be sure to correlate your decisions with Art. 223 of the Tax Code and the above recommendations. They will help you prepare your tax returns correctly.

Also see “Recommendations for filling out Form 6-NDFL”.

If representatives of the tax authorities accuse the employer of providing data that does not correspond to each other, he will become a violator of the law. A discrepancy between the information from line 120 and the deadline for transferring personal income tax in the budget settlement card is unacceptable. It means that the taxpayer knowingly or inadvertently provides distorted reporting and tries to disguise non-payment of taxes to the budget.

To dispel the suspicions of regulatory authorities, the accountant will have a maximum of five days from the moment the violation is detected. During this time he must:

- Correctly correct the mistake.

- Provide an explanation of the reasons why inaccuracies were included in the document.