A bank card with sample signatures is a document that certifies sample signatures of persons authorized to handle the account.

The card is required to open a current account in most credit institutions in the country. In it, authorized persons enter samples of their personal visas for further use of the account. This document is filled out by all applicants, regardless of their legal status and legal form. The form is used not only in the bank, but also to certify signatures in other organizations or even government agencies: for example, the signature card for the Treasury in 2020 is also widely used.

In civil legal relations, when concluding contracts and carrying out active interactions to fulfill obligations, a form is required to certify the source of certain orders and other documents. In this case, the parties have the right to use the card for the counterparty. This is a rational and justified decision.

Functions

Employees of a credit institution, the Treasury, and representatives of the counterparty should be aware that a visa is issued only by an authorized person. To do this, a sample is initially formed, which contains the original hand-written autograph. Often, the use of an account and interaction with a counterparty is carried out under a power of attorney from a manager or individual entrepreneur, so such identification is necessary.

So the functions are as follows:

- certifying;

- informational.

Recently, most transactions are carried out using electronic payments, through client-bank systems, but most banks continue to insist that such a form must be filled out. Despite the fact that Bank of Russia Instruction No. 28-P dated September 14, 2006 on the procedure for opening and closing accounts, which introduced a card with sample signatures, has been canceled and is not in effect, the form itself is still in use.

Front side

Reverse side

Where can I get the form? It is not necessary to separately request it from the credit institution, signature cards for the bank in the appendix to the article. Usually the form is printed on a special format that simplifies use, but Central Bank instruction No. 153-I states that any option is allowed. The main thing is that the necessary details are present. Thus, it is allowed to print the form and purchase a ready-made printed document.

What is the card for?

There is a standard form for the document 0401026. It is approved by banking instruction No. 153-I. However, it is permissible to use the form established by the internal rules of a particular bank.

Why do you need a card with sample signatures and seal impressions? To obtain a current account:

- for current transactions for an individual;

- for the needs of individual entrepreneurs;

- for the needs of a legal entity;

- to open a deposit.

Courts, bailiff units, notaries, law enforcement agencies - all these organizations also need current accounts to operate. Therefore, you will need a card with sample signatures and seal impressions.

Forms produced by a printing house, as well as those printed independently on a printer, are acceptable for use. The card is issued to the client at the bank or can be obtained independently (for example, downloaded from the Internet from the website of a financial institution).

Is a seal imprint required?

In connection with the introduction of relevant changes to the legislation on Companies (joint-stock and limited liability companies), they have the right, but not the obligation, to use a seal. Many individual entrepreneurs have been working without a seal for a long time. Thus, a seal impression is required if its presence is specified in internal local acts. If a company or individual entrepreneur operates without a seal, the credit institution does not have the right to insist on the production of a seal for affixing an imprint. Thus, the signature card for legal entities does not always contain a seal impression.

Main functions of the card

The main purpose of the sample card is quite simple:

- In order to carry out transactions from a current account, a bank employee needs to make sure that it is carried out by an enterprise or individual entrepreneur, or rather, its representative - a person who has the right to sign on the main documents.

- A payment document is an important order for the bank from the client. If the latter has a seal, he is obliged to place it on such a document next to the signatures of the responsible persons. To make a payment, the operator must also make sure that the client who owns the account wants to make the payment.

- The operator must take precautions when accepting payments on paper or electronically, issuing transfers, etc., to prevent the use of fraudulent schemes. He is obliged to accept the payment document, then compare not only sample signatures, but also the client’s seal, before making a transaction on any account. Unless he sees a 100% match, according to internal bank instructions, he has every right to refuse the client to use funds.

But there are some exceptions. So, for example, starting from April 2020, small enterprises such as LLCs and JSCs, as well as individual entrepreneurs, received, under Law No. 82, the opportunity to operate without round seals. They need to spell out this provision in internal regulations. If the bank client does not have a seal, but together with the sample signature card, he submits a copy of his regulatory document to the bank.

Design rules

There are general design rules:

- Filling is done only with blue or purple ink;

- when filling out on a computer, you must make sure that the bank will accept this option;

- the use of facsimile signatures is unacceptable;

- errors, corrections excluded;

- details of the organization are indicated;

- The seal imprint is clear and easy to read;

- in the “Account Owner” field, write the full name of the enterprise or the surname, first name, patronymic of the individual entrepreneur, also in full, on the back - full name. abbreviated.

Damaged forms are destroyed. Sometimes the bank requests that the sample signature card be provided in two copies - an original and a photocopy. The latter is done by a specialist from a credit institution or company that opens an account by agreement. If a second copy with original visas is required, registration is carried out according to standard rules.

Special cases

A card with sample signatures and seal impressions is provided to the bank not only when opening a current account. There are a number of other cases:

- replacing one of the signatures;

- seal replacement;

- loss of seal;

- changes made to full name the person recorded on the card;

- changes in the name of the organization;

- changes in the organizational and legal form of the organization;

- suspension of powers of a management body;

- termination of powers of the management body.

A sample signature and seal on the card is necessary so that the bank employee has the opportunity to reconcile with the details specified in the payment document. If discrepancies are identified, the bank will not accept the document. Movements on the current account will not be possible.

Procedure, conditions for registration and use of bank cards by clients

This document is drawn up to conduct financial transactions with assets that are placed in the accounts of both legal entities and individual entrepreneurs. To issue a card, use the prescribed form. Fill it out according to the model, again provided for by the Instructions of the Central Bank of the Russian Federation. It is important when preparing this document to strictly follow the rules established by the Central Bank for filling out the fields. You can view a sample form, the approved form of this document with sample signatures, on our resource in the “Samples of Documents” subsection.

You have the opportunity to download a bank card and then fill it out yourself. Then everything is simple - it is submitted to the bank along with other documents for opening an account. Without its registration, any banking transactions on the account are impossible for the client. Let us clarify that this document can be prepared by both the bank and clients. Its obligatory condition is strict compliance with the sample special form for OKUD, which is established by the appendix to the Central Bank Instructions.

You can fill out the card by hand (with black, blue, purple ink) or using a computer. Facsimile signatures are not acceptable when filling out this document. The bank will not accept signature cards that differ from the established sample in a different location or number of fields. Please note that an arbitrary number of lines in a bank card is permissible only in limited cases, specifically predetermined by the Central Bank Instructions. Interlinear translation of fields into other languages is also quite acceptable on a card.

Rules for filling out a card with sample signatures and seal imprint for Sberbank according to form 0401026

Operations carried out with current accounts are carried out by responsible persons. This is what a leader is. His powers begin from the moment the accounts are created and end after they are closed.

Before each transaction, the signatures of the authorized person are verified with the card containing the samples. The document format is the same for everyone. It is fixed by instructions issued by the Bank of Russia.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

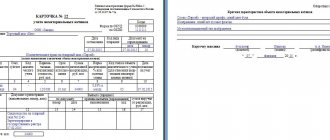

Card form

2. Or a form for a card of sample signatures and a seal imprint according to the internal form of a bank or other organization (it necessarily includes all the details of form No. 0401026 according to OKUD (see above)).

To date, there is no single, mandatory sample card.

Banks, as well as other organizations that use the card in their activities, can use templates developed within the institution or use form No. 0401026. The form is convenient in that it contains all the necessary points and parameters; there is no need to rack your brains about drawing up your own form.

However, if the bank considers it insufficiently informative (for example, it requires a TIN, KPP, OKPO, OKVED codes, etc.), it can take the path of creating a card independently.

Document overview

If an organization opens several current accounts in one banking institution, it may limit itself to filling out one card (provided that the same persons will have access to the accounts). If current accounts are opened in different banks, then, of course, in each case you will have to fill out a separate card.

The document in question consists of 3 parts:

- the first is filled out by the general director of the enterprise or his representative, specifically authorized to do so by a power of attorney;

- the second (certifying signature certification) - a notary or bank employee;

- the third is a bank employee.

To make payments with funds that are in bank accounts, it is necessary to issue a card with a seal and sample signatures of an individual entrepreneur or officials of a legal entity who have the right to sign documents.

The rules for issuing a bank card are clearly regulated by the relevant instructions of the Central Bank of Russia.

- Bank card blank, pen, stamp

To fill out a bank card, use a typewriter with black font (you can use a computer printer) or a pen with black, blue or purple ink.

A facsimile signature cannot be used to fill out the card. In the “Account Owner” field, enter the full name of the legal entity (separate division) in accordance with the state registration certificate.

If the card is filled out for an individual, please indicate your last name, first name, patronymic, date of birth, and details of your identity document. If you are engaged in private practice (notary, lawyer), indicate the type of activity.

In the “Location (place of residence)” field, indicate the address of the permanent executive body of the legal entity or its separate division, the address of the actual place of residence of the individual (individual entrepreneur). In the “Tel.

Do not make any entries in the Bank Mark field. Here, after assigning a number to the bank account, a mark is placed on the acceptance of the card by the person who is granted such right. Also leave the “Other notes” field blank (it is filled in by the credit institution).

On the back of the bank card, in the “Short name of the account holder” field, indicate the short name of the legal entity recorded in the registration certificate, and if it is absent, the full name.

The individual client enters his last name, first name and patronymic, as well as an indication of the type of activity. In the “Position” field, indicate the positions of persons who have the rights of first or second signature. If you are filling out the card as an individual, leave this field blank.

In the “Last name, first name, patronymic” field, indicate the full last name, first name, patronymic of the persons entitled to the rights of the first or second signature. In the “Sample signature” field, persons who have the rights of the first or second signature put the signature opposite their last name.

In the “Date of filling out” field, indicate the date the bank card was filled out.

In the “Client Signature” field, the head of the legal entity must put a handwritten signature, and in the case of issuing a card for an individual, an individual entrepreneur or a person engaged in private practice.

In the “Term of office of persons temporarily enjoying the right to sign” field, indicate the term of office of persons established by the client’s administrative act. In the “Sample of seal imprint” field, enter a sample of the seal (if available). The print must be clear.

If desired, notarize the authenticity of the handwritten signatures of persons having the right of first or second signature. A bank card can be issued without notarization in the presence of an authorized bank employee.

- Rules for drawing up (filling out) a card with sample signatures and a seal imprint (bank card)

- Sberbank signature card

A card with sample signatures and seals is the main document for an organization to open a bank account.

The form of the card was approved by Bank of Russia Instruction No. 28-I dated September 14, 2006 and was assigned OKUD code 0401026.

- – card form;

- - seal.

You can fill out the card by hand, with black or blue ink, or using a computer.

Sample signatures are made on the form in your own hand; facsimile signatures are not allowed. The right to sign may belong to the first person of the company - its director or any authorized person by proxy.

The right of the second signature, as a rule, belongs to the chief accountant of the organization or a person authorized to conduct accounting. It is not always only the manager and accountant who are given the right to sign; these can also be the founders of the company.

Sample signatures are placed in the presence of a notary or an authorized representative of the bank. If the signature is certified by a bank representative, then the following scheme applies: the identities of the persons indicated on the card and their powers are established on the basis of the constituent documents.

In case of adding new signatures, replacing the last name, first name, patronymic of the persons indicated on the card, or if the name of the organization, its organizational and legal form changes, a new card must be provided to the bank.

You also need to provide documents that confirm the authority of the persons indicated on the card and identification documents.

If the change in the bank account number is due to legal requirements, the bank itself can change the data in the “Bank account number” and “Bank mark” fields of the card. If the right of first and second signature is granted to persons not indicated on the card, a temporary card must be provided.

The card with sample signatures and seals is valid until the bank account agreement is terminated, the deposit account is closed, or until it is replaced with a new card.

How to draw up an organization card If you contact a bank using a checkbook, then in order to receive funds you must correctly fill out the bank check. Errors and omissions are unacceptable here, as they lead to immediate refusal to receive money.

In this regard, you must be careful when filling out and strictly follow the instructions. Use a ballpoint pen or black, purple, or blue ink to fill out the bank check.

You cannot use several different pastes to enter data, so make sure you have enough ink in advance. Enter the name of the check drawer in the top fields of the check.

If its owner is an enterprise, then the name of the company is indicated, otherwise the surname, first name and patronymic of the owner. Next, enter your account number. Be careful as it contains a lot of numbers. Enter the check amount in words and numbers.

If there are empty spaces left, they are carefully crossed out with two lines so that no one can enter extra amounts. Start writing your last name, first name and patronymic completely from the very beginning on the corresponding lines, then cross out the rest of the space with a double line.

This is necessary so that no one can add their last name and receive a sum of money for you. Place your signature on the bank check that matches the sample card in the bank. Fill out the back of the bank check.

Here you must indicate the purpose of the expenses for which the specified amount is withdrawn. For example, for wages for January or for household needs. Mark the document that verifies the identity of the recipient of the amount of money on the bank check. For example, if a passport is presented, you must indicate its series and number, as well as the date and place of issue.

Enter all the necessary information on the counterfoil of the check and give this document to the bank teller. Receive the specified amount of money and a cashier's check stub, which must be kept for three years. A card from the METRO hypermarket chain may be interesting because it allows you to make a number of purchases at lower prices than in other stores.

- – copies of the constituent documents of an enterprise or entrepreneur (a complete list for each type of client is presented on the company’s website), certified by the seal of the organization or individual entrepreneur;

- – power of attorney for all representatives, including the entrepreneur or head of the enterprise;

- – passport of an entrepreneur or representative of an organization and its copy certified by a seal.