Update: July 31, 2020

An individual entrepreneur, like legal entities, carries out commercial activities. One of the established customs of document flow between business entities is the use of printing. Previously, the presence of a seal for legal entities was a mandatory condition, but now it is a thing of the past. The entrepreneur was not required to have a seal. And at present, the seal of an individual entrepreneur is his personal prerogative. He has the right to have it or not to have it at his own discretion.

How to register an individual entrepreneur with the tax office, is a stamp required?

According to Art. 23 Civil Code of the Russian Federation and Art. 11 of the Tax Code of the Russian Federation, a citizen is registered as an individual entrepreneur in the prescribed manner and after that has the right to engage in relevant commercial activities.

Civil legislation does not directly answer the question of whether an individual entrepreneur registered in the prescribed manner should have a seal, i.e., it does not contain rules either obliging or prohibiting having a seal.

In order to turn from an ordinary individual into an individual entrepreneur, a citizen should submit an application (form N P21001 - Appendix No. 13 to the Order of the Federal Tax Service of Russia dated January 25, 2012 N MMV-7-6 / [email protected] ) and other necessary documents to the registration authority - the Federal Tax Service of Russia (Article 22.1 of the Federal Law of 08.08.2001 N 129-FZ, hereinafter referred to as Law No. 129-FZ).

Tax authorities within three days carry out procedures for registering the corresponding status and issue a document confirming its existence. In these procedures, the seal of an individual entrepreneur is not required.

The document confirming the status of an individual entrepreneur is the Entry Sheet of the Unified State Register of Individual Entrepreneurs in Form N P60009 (hereinafter referred to as Form No. 60009).

Form No. P60009 contains all the same information as the certificate, including:

- Full name of the entrepreneur;

- date of issue;

- name of the Federal Tax Service;

- date of entry in the Unified State Register of Individual Entrepreneurs;

- OGRNIP.

After registration, information that an individual has the status of an individual entrepreneur is entered into a special register (USRIP). Any interested person who wants to check whether a citizen has the appropriate status can obtain information about this from the Unified State Register of Individual Entrepreneurs.

However, an individual entrepreneur without a seal is not only registered, but also has the right to continue activities, because the legislation does not impose corresponding requirements on it.

However, as noted above, there is also no ban on the presence of a seal. Consequently, deciding whether an entrepreneur needs to have a seal is his personal prerogative.

There are often cases when an entrepreneur still has a seal. Registration of such an individual entrepreneur’s seal with the tax office or any other government agency is not required.

Seal of the organization (legal entity)

04/06/2015 The President of the Russian Federation signed Federal Law No. 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies,” which continues the ongoing reform of civil legislation on the abolition of seals, which determines that:

This is interesting: What is needed to apply for an old-age pension in the Republic of Belarus 2020

Clause 5 of Article 2 of Federal Law No. 14-FZ “On Limited Liability Companies”, stating it as follows: “The company has the right to have a seal, stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization. Federal law may provide for the obligation of a company to use a seal.

Seal of an individual entrepreneur and certain legal requirements

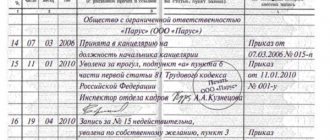

In practice, situations are possible when, for example, an employee is employed by an entrepreneur for the first time. In this case, the individual entrepreneur will have to create a work book for such an employee.

Instructions for filling out work books dated October 10, 2003 N 69 (hereinafter referred to as the Instructions) were previously drawn up in such a way that an individual entrepreneur without a seal could encounter problems with its application.

This Instruction requires that its title page contain the seal of the organization in which the work book was opened. The specifics of maintaining work books for individual entrepreneurs were not taken into account in this legal document, because Previously (during the adoption of the Instructions) they did not keep work books.

In 2020, changes were made to the Instructions, which oblige the stamp to be affixed only if it is available. This also applies to entrepreneurs.

Therefore, if the individual entrepreneur has a seal, it is affixed to the employee’s work book. If there is no seal, this requirement does not apply to the entrepreneur.

glavkniga.ru

LLC without seal

7. Forgery or forgery of a document, award, stamp, seal, form is: (1) complete preparation of a knowingly false document or complete production of a counterfeit award, stamp, seal, form; (2) a complete or partial change to an original document, award, stamp, seal, form (i.e.

To protect yourself from claims from future victims of scammers, you can advertise the theft in the media. For example, if people who stole the seal enter into agreements with third parties and receive money from them. And although it is unlikely that your ad will be read, in this case it will be easier to isolate yourself from claims. You can safely say that you have taken all possible precautions. This means that liability can be avoided.

Need for 2020

Printing is also necessary in some other cases.

- To open a current account . A current account is often necessary not only for legal entities, for which a seal is required by law, but also for individual entrepreneurs. In this case, a bank or other accounting institution may require the entrepreneur to have his own seal on the agreement. It depends entirely on the internal rules of the bank. In some cases, it is easier to get a seal than to choose a new bank with a convenient agreement.

- On the documents . When concluding contracts with commercial enterprises, the business partner may require the use of a seal. Especially when we are talking about documents such as a double warehouse receipt and pledge agreement or waybills when providing transport services. These actions are additional insurance for companies and are not prohibited by law.

- Employment history . If an individual entrepreneur intends to legally hire people, the presence of a seal is strictly required. When registering an employee using a work book, affixing a stamp is necessary and is specified in the registration rules.

- Sales receipt . The responsibilities of the entrepreneur-trader include issuing a document confirming the transfer by the buyer of a certain amount, upon the first request of the client. Such a document is called a sales receipt and is not valid without a stamp.

Work without stamp new law

It follows from this that the counterparty, when concluding an agreement, may require it to be sealed and refuse to cooperate with those who do not have a seal.

If the text of the agreement states that it must be affixed with the seals of the parties, then the absence of a seal will mean the invalidity of such an agreement in full accordance with clause 2 of Article 162 of the Civil Code of the Russian Federation. 2. Absence of the last registered before the entry into force of the Law

the revision of the charter of a joint-stock company or LLC, information about the presence of a seal means that the business company certainly had a seal and it is not a fact that it was destroyed.

Pros and cons for individual entrepreneurs

The pros and cons of having a personal seal depend on the type of activity of the entrepreneur. Even though it is not legally required, it still has a number of advantages that distinguish the entrepreneur from his competitors. Among the advantages:

- Additional protection of documentation from forgery by fraudsters - making an exact copy of a seal is more difficult than imitating someone else’s signature.

- When using a current account, it is better to use a personal seal in order to avoid nagging at a bank or other accounting institution.

- Large companies may require the individual entrepreneur to have a seal when concluding an agreement.

- Some clients may not know that a seal is not required for an individual entrepreneur, which may lead to mistrust or refusal to cooperate.

- The presence of a seal gives additional points to the presentability of the enterprise, which simplifies the conclusion of contracts with suppliers.

disadvantages to personal printing. Among them:

- After registration, the individual entrepreneur will be required to affix a stamp on all documents, which is not always convenient. You will always have to carry it with you, and documents with one signature will not be valid. In this regard, the individual entrepreneur cannot allow some of the documents to be unstamped due to carelessness and oversight.

- To produce and register a stamp, you need to use additional funds - about 1000 rubles, plus a stamp pad and paint, which are usually replaced approximately once a year.

Application area

It was clarified above that the presence of a stamp is necessary for certification of BSO, documentation in banking structures and papers establishing the right to carry out a certain type of occupation. In addition, upon receipt of the seal, the businessman acquires the obligation to endorse with it the documents with which he works due to the type of activity of the company. Such an accessory becomes an indicator of the respectability and reputation of the company . Most people perceive certification with a stamp positively - after all, it provides some guarantee of fulfillment of the obligations specified in the agreement.

Certification of documents with the company's seal increases the company's reputation and helps protect important papers from fraudsters

In the business environment, it is customary to officially seal existing agreements, so the presence of such an attribute helps strengthen the reputation of the enterprise. Keep in mind that lack of a stamp is often a reason for refusal to cooperate. In addition, the seal imprint replaces the mandatory indication of the entrepreneur’s details: initials, OGRNIP number, legal address of the company.

Let's summarize. Modern legislation allows an entrepreneur to work without this attribute. However, the reality of business relations with partners and the state in most cases makes such a solution impossible. Purchasing such a product allows you to protect yourself from fraud and strengthen the image of the enterprise. For this reason, qualified lawyers recommend that businessmen spend some time obtaining such a facsimile imprint - because its use will significantly simplify doing business.

Today there is no law that would oblige an individual entrepreneur to obtain a seal

In some situations, having a stamp will be a necessary necessity - for example, when drawing up personnel work books

If an entrepreneur acquires a seal, he is obliged to certify with it all documents related to his activities

A typical hand-made print for individual entrepreneurs has a minimal cost - its production will be about 500 rubles

List of requirements for filling the seal with information

Making a stamp will require a minimum list of documents - you need a passport, INN and OGRNIP Certification of documents with the company's seal increases the company's reputation and helps protect important papers from fraudsters

Registration of an individual entrepreneur's seal is not required by law, but these simple steps will help resolve potential conflict situations in favor of the entrepreneur

Today you can order a print of any type and configuration from specialized companies operating in every city in the country.

Individual entrepreneurs use round seals that leave a black or blue imprint

The legislative framework

Article 23 of the Civil Code of the Russian Federation gives permission to any citizen of the country to engage in private business.

The rights and obligations of an individual entrepreneur are the same as those of a legal entity, and the activity itself is regulated by the same laws. They are spelled out in paragraph 3 of the above-mentioned Article 23. However, Law No. 129-FZ states that a seal is not necessary for registering an individual entrepreneur with the state. But there are also other legal requirements that require the use of a stamp on certain documents.

Despite the fact that the exact requirements for the seal of individual entrepreneurs are not prescribed by law, we can conclude that they should be drawn up in accordance with the stamps of legal entities - in accordance with the Civil Code.

Therefore, when making custom prints, you should add the following information to them:

- full transcript of the full name of the private entrepreneur;

- its location;

- registration number from the OGRNIP certificate;

- TIN;

- signature - “Individual entrepreneur”.

Work individual entrepreneur without seal law

Although working without it, the individual entrepreneur does not break the law. But, if an individual entrepreneur does not work with legal entities, but confines himself to individuals, accepts only cash payments, and does not attract employees, then it is not worth spending money on making a stamp.

You can order the production of a stamp from any of the many companies offering this service. Upon receipt of the finished product, you will need to present your passport and individual entrepreneur registration certificate. This requirement is completely legal, since it excludes the possibility of ordering the seal of an organization or individual entrepreneur by persons who have nothing to do with them and can use them in illegal fraud.

Possibility of refusal

An individual entrepreneur has the right to legally refuse to make a stamp, but only in cases where situations do not oblige him to use a personal seal. These include:

- use of BSO;

- registration of documents for the transportation of inventory items;

- opening a personal account system in some banks and institutions;

- execution of powers of attorney to carry out actions on behalf of a private entrepreneur;

- registration of employees for work using a work book.

Since the law does not oblige an individual entrepreneur to have a personal stamp, he has the right to sue if he is denied the desired operation. The entrepreneur uses a signature on documents and in some cases, for example, on forms where space is left for printing, he puts an o, which stands for “without seal.”

Let's turn to the law

In order to thoroughly understand the issue, it is necessary to turn to primary sources, namely: to the legislative acts of the Russian Federation.

Currently, not a single law of the Russian Federation directly states that an individual entrepreneur is obliged to work with a seal. Moreover, there is a letter from the Federal Tax Service of Moscow dated February 28, 2006 No. 28-10/15239, which directly states the following:

The obligation of an individual entrepreneur to purchase and use a seal when carrying out his activities is not provided for by the current tax legislation.

Even though the letter was published over 10 years ago, it is still relevant in 2020. If you open an individual enterprise, then you decide for yourself whether you will make a seal or not. But know that the law does not oblige you to do this.

«>

How to work without printing

In the absence of a seal, the entrepreneur uses his signature and the designation “b/p” where the seal should be affixed. Any discrimination based on the lack of a stamp should not occur, although many clients and partners may indirectly force an individual entrepreneur to create a personal seal.

If employees are registered using work books or using sales receipts, the individual entrepreneur is still required to have a seal. But not every entrepreneur plans to hire workers or trade.

Cancellation of round seals for legal entities from 2020

Any legislative changes relating to the sphere of entrepreneurial activity always raise many questions among its participants. The recently adopted law abolishing the mandatory use of round seals in the work of legal entities was no exception.

This is interesting: State duty for filing an application with ASMO

The law affected only joint stock companies and LLCs. Therefore, all other businesses must still have a seal and use it in their activities. In particular, these include:

Registration requirements

There are two types of organizational seals - official stamps, which certify all documents, and additional stamps, with inscriptions such as “refused”, “approved” and so on. The standard print size for a private entrepreneur is considered to be 38-40 millimeters. It can be round, rectangular and triangular.

When ordering, you should consider the following questions :

- Should I choose regular or automatic printing? If there is a large amount of work, an automatic one is much more convenient, but also higher in price - therefore, if the amount of documentation is not too large, you can use an ordinary one.

- Which tool shape should you choose—round or rectangular?

- What material to choose for equipment - metal, plastic or wood?

- What design should I choose for the stamp? In addition to the requirements stipulated by certain rules, an individual entrepreneur has the right to display whatever he wants on his personal seal.

- Which print protection should I choose? There are a huge number of stamp protection options. Its inclusion slightly increases the cost of the final product, but this is the price of increased security.

- Which font should you choose for printing? Typically, samples are presented in the office where the products are manufactured, which makes the choice easier for the customer. However, if you wish, you can ask to develop your own and unique font for your printing.

Package of documents for ordering a personal seal:

- passport;

- order form with exact sketches and all the wishes of the customer, with his signature;

- a certificate indicating that the entrepreneur is included in the Unified State Register of Individual Entrepreneurs;

- TIN - original and photocopy.

Inscriptions that must be present on the seal:

- last name, first name and patronymic of the entrepreneur;

- mention that the entrepreneur is registered as an individual entrepreneur;

- state number of individual entrepreneur;

- TIN.

Printing on primary documents

Let's consider the need to affix a stamp on primary accounting documents. Let us recall that such a document, by virtue of clause 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ) must contain a list of mandatory details. These details are:

date of document preparation;

name of the economic entity that compiled the document;

content of the fact of economic life;

the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the accomplished event;

signatures of responsible persons indicating their last names and initials or other details necessary to identify these persons.

The list of details is closed, and the seal is not among them. This is confirmed by the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/ [email protected]

However, in practice, tax authorities pay close attention to those primary documents that do not have a seal. The favorite document of the tax authorities is the invoice.

It should be noted that until 2013, taxpayers had no choice in which form to draw up the invoice. The unified form No. TORG-12, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132, was mandatory for use. Starting from 2013, it is not necessary to use unified forms of documents; you can develop your own (Article 9 of Law No. 402-FZ). Most unified forms contained the abbreviation “MP.”

On this basis, the tax authorities concluded that if the invoices do not have the seller’s seal, then the buyer’s deduction of VAT is unlawful, and the costs of purchasing the goods should not be recognized for the purpose of calculating income tax.

But, as arbitration practice shows, the absence in primary documents of such details as a seal imprint does not deprive the buyer of the right to a tax deduction (resolution of the Federal Antimonopoly Service of the West Siberian District dated October 21, 2014 No. A70-13797/2013, FAS Far Eastern District dated January 29 .14 No. F03-6588/2013, FAS Moscow District dated 02.20.13 No. A40-46820/12-115-275, dated 4.05.12 No. A40-87365/11-75-372, dated 30.01 .08 No. KA-A40/14769-07).

Read more Constituent documents of a state institution

Thus, the absence of a stamp (even on unified documents, if the taxpayer continues to use them after 2013) on primary accounting documents does not deprive taxpayers of the opportunity to confirm the fact of a business transaction and, accordingly, accept VAT for deduction and take into account the costs of purchasing goods in tax accounting.

When checking the validity of reimbursement of expenses from the funds of the Federal Social Insurance Fund of the Russian Federation, the regulatory authorities do not recognize temporary disability certificates that are not certified by the seal of a medical institution as a minor violation. And on this basis, the Fund does not take into account “hospital” expenses (decision of the Arbitration Court of the Rostov Region dated October 2, 2012 No. A53-25090/2012, decisions of the Federal Antimonopoly Service of the Far Eastern District dated April 19, 2006, April 12, 2006 No. F03 -A51/06-2/778). And in some cases, the reason for refusing compensation for temporary disability benefits was incomplete details of the seal of the medical institution. And only in court was such a sick leave recognized as valid. Thus, in the decision of the arbitration court of the Tyumen region dated July 12, 2013, No. A70-3325/2013, the judges noted that the procedure for issuing certificates of incapacity for work (clause 56 of the order of the Ministry of Health and Social Development of Russia dated June 29, 2011, No. 624n “On approval of the procedure for issuing certificates of incapacity for work ") does not contain requirements regarding seal details, except that the seal must be round and belong to the medical organization that issued the certificate of incapacity for work.

Where to order and how much does it cost

To make a private stamp, you should contact any stamp manufacturing company you like. As a rule, they offer a wide range of necessary services.

The cost varies from 200 to 1000 rubles. It depends on the region of manufacture and the following factors:

- type - automatic or manual;

- size and shape;

- used materials;

- complexity of developing sketches;

- protection against counterfeiting;

- production time - urgent orders are, as a rule, somewhat more expensive than ordinary ones.

Typically, the company produces stamps in one business day, but it is also possible to complete an urgent order in a few hours. After creating a seal, you do not need to register : you can immediately start working. However, it must be remembered that after starting use, a seal should be affixed to all documents without exception.

You can learn more about IP printing in this video.

znaybiz.ru

A right, not an obligation Based on Article 23 of the Civil Code, Russian citizens have the right to engage in individual entrepreneurial activities without forming a legal entity. Paragraph three of this article states that individual entrepreneurs are subject to the rules of the Civil Code regulating the activities of commercial organizations - legal entities, unless otherwise follows from the law, the essence of the legal relationship or other legal acts.

No one explicitly obliges an individual entrepreneur to have a seal. If for legal entities its necessity is enshrined in special laws that regulate the activities of specific organizational and legal forms, then for individual entrepreneurs there is no direct indication of this in any legislative act. Thus, for state registration of an individual entrepreneur, a seal is not needed (Law No. 129-FZ), a bank account can also be opened without it, and it is not required to fill out tax returns and a book of income and expenses.

When an individual entrepreneur decides to use a seal, the law does not oblige him to enter it in the register of seals. However, when concluding all contracts, from now on he will have to put her imprint next to his signature.

But what about in practice? An individual entrepreneur can indeed conduct business without a seal - even to conclude contracts, only the signatures of the parties are sufficient. However, if you need to draw up a pledge agreement or a double warehouse receipt, a seal is already required.

Other by-laws also require it indirectly. So, as you know, the law allows individual entrepreneurs to hire workers. In this case, you cannot do without a seal - it must certify the employer’s signature in the work book. It will also be needed when providing services to the public using strict reporting forms without the use of cash register equipment. If the activities of an individual entrepreneur are related to the provision of transport services to the population, without a seal he will not be able to fill out a waybill so as to subsequently write off fuel and lubricants on it.

https://www.millmark.ru/publications/43.html

otvet.mail.ru

IP work without seal law

- You have employees registered under the Labor Code. Decree of the Government of the Russian Federation dated April 16, 2003 No. 225 states that all entries in work books are certified by the employer’s seal, and no distinction is made between legal entities and individuals.

- Preparation of strict reporting forms. Until June 2020, payment for services can be confirmed not with a cash register receipt, but with a form. Without the seal, the BSO is considered invalid.

- Issuing a cash receipt order. It is a primary document, therefore the presence of an imprint on it is considered strictly mandatory.

- You have decided to submit a quotation application for a government order. The document will not be accepted without a stamp.

- You are about to open a bank account. By law, a sample print is only required if the individual entrepreneur uses it. But according to established tradition, banks require the use of a seal, since the imprint plays an important role in identifying the client. And this is not a whim of the bank, but a security measure.

As for the duration of stamp production, the time frame here is up to three days. In some regions of the Russian Federation, this procedure is delayed up to a full working week. The exact timing of the order depends on the complexity of the accessory and the workload of a particular company. However, such enterprises offer entrepreneurs the opportunity to speed up this process by ordering urgent production. Such a service involves a 50% markup on the total cost of the product.

Why do you need an IP seal?

First of all, let's figure out why an individual entrepreneur needs this tool.

- An individual entrepreneur cannot open a current account without a stamp; to do this, he must be given a card with a sample stamp and signature. In the future, it will be needed in special cases, for example, when withdrawing funds through a checkbook.

- For many companies, the presence of a personal seal for partners is fundamental; this may be due to the company’s security policy. If a businessman does not have a stamp, then contracts will be denied.

- The seal is needed to provide strict reporting documents when working without a cash register; this rule is clearly stated in the law and its failure to comply may result in fines.

- If the company employs hired people, then the tool is necessary to confirm entries in their work books.

- The absence of a stamp may arouse suspicion among clients regarding the legality of the company’s activities, so it is easier to make one than to explain to ordinary people that the law does not insist on the presence of a stamp.

- Finally, printing provides additional protection for documents against forgery.

This video will tell you what IP printing is:

Legal requirements

Article 23 of the Civil Code allows citizens of the Russian Federation to carry out business activities without registering as a legal entity. All laws of the Civil Code apply to such entrepreneurs, unless otherwise provided by separate legislative acts. Therefore, the state allows individual entrepreneurs to work without a seal.

On April 6, 2020, the President of the Russian Federation signed Federal Law No. 82, which amended various documents and allowed the use of seals on a voluntary basis.

What is an IP seal and where to buy it, read the link.

How to work and certify documents without a seal

In accordance with Article 434 of the Civil Code, an agreement can be drawn up in any form suitable for transactions, if, by law, there are no fixed rules for this type of contact.

It is worth noting that after receiving a stamp, a situation is not allowed when one document is certified with both a seal and a signature, and the other has only a personal signature, even despite the fact that it is the main and mandatory one.

Each individual entrepreneur has employees who are counted in the average number of employees, and you will learn why this is necessary in this article.

Sometimes business partners will ask the entrepreneur for copies of the TIN and OGRNIP even before the start of cooperation, thus they receive confirmation of tax legal capacity.

What does the seal say?

To certify copies, the individual entrepreneur must write “the copy is correct,” indicate the position, sign and decipher it, and then indicate the current date. Documents of several pages are signed on the first and last sheets; for a tax report, each paper must be certified.

Feasibility of obtaining

We will determine the legal basis for the activities of entrepreneurs in a specific situation. When asked by most people who do not have a legal education whether an individual entrepreneur can work without a seal, the law gives a clear positive answer. This norm is enshrined in the letter of explanation from the tax authorities dated February 28, 2006 (N 28-10/15239). It is explicitly stated here that the individual entrepreneur is not obliged to use a facsimile imprint . In addition, in April 2020, a decision came into force to completely abolish the obligation of entrepreneurs to use a seal, even if they are the owners of a joint stock company. It turns out that a businessman has the right to use such an attribute solely at will.

Today there is no law that would oblige an individual entrepreneur to obtain a seal

However, some imperfect legislation and modern business realities force a newcomer to this field to end up with such an accessory. Experts list the following situations when a facsimile imprint is needed to certify papers:

- Registration of accounts in banking structures . The desire to receive a current account obliges the businessman to make a stamp. After all, without this attribute it is impossible to cooperate with banks in the required format, and withdrawal of funds and currency exchange operations will not be possible. Let's make a small remark. Opening an account for an individual entrepreneur is an optional procedure; accordingly, in such a case it is only the desire of the businessman himself.

- Cooperation with suppliers and sales market . Most companies today prefer to endorse interaction documents with a seal. Refusal of this rule by an entrepreneur who does not have a stamp results in the severance of working ties. After all, business partners value reliability and possible guarantees.

- Submission of reports . The choice of taxation in the form of UTII, a patent and some types of work on the simplified tax system imply the possibility of operating an enterprise without a cash register. BSOs are replacing checks here. Today, company owners using this right to conduct business are required by law to affix a seal to these forms. Violation of this provision entails a considerable fine.

- Use of hired labor . It’s a rare company that gets by without hiring staff. The businessman endorses the paperwork of employees, in particular, the work record book, with a seal. This is a mandatory requirement enshrined in law.

- Employment in the transport industry . The choice of activity related to transportation obliges the businessman to accompany the cargo with certain papers. Acceptance and delivery certificates, invoices, waybills must be signed and sealed by the carrier company. According to the current regulation, such documentation is invalid without an endorsement stamp.

In some situations, having a stamp will be a necessary necessity - for example, when drawing up personnel work books

Lawyers clarify that it is impossible to give a definite answer to the question of whether a seal is needed for an individual entrepreneur. Whether a businessman is required to have this accessory or not is determined solely in a specific situation. Here experts advise getting such an attribute - after all, it is impossible to foresee the likely development of your business. In addition, the stamp in some way guarantees protection from fraudsters, since forging a signature is much easier than imitating a company seal.

What should be on the seal

There are no specific requirements for appearance; only three things must be indicated: the full name of the businessman, OGRNIP and the phrase “Individual Entrepreneur” itself. The text, shape and design are chosen based on personal wishes, the company’s business ethics and in accordance with ethical standards.

When opening an individual entrepreneur, you need to collect a package of documents for its registration. The list of required documents can be found here.

There is one important limitation for a printed design - the coat of arms of the Russian Federation cannot be placed on it. In general, it is acceptable to use state symbols, but you will have to obtain special permission to do so.

Three main product shapes are allowed: round, triangular and rectangular.

Seal making process

Numerous companies accept orders for the production of seals. To obtain a stamp, you need to have a passport and a certificate of registration of an individual entrepreneur, TIN, an extract from the unified state register of individual entrepreneurs, and a notification from Rosstat. This set of documents does not allow those who have no connection with the organization or intend to use the received tool for scams to apply.

Changing the appearance of the seal does not need to be coordinated with anyone, because samples are not recorded in third-party organizations. The exception is the tax service, but this will be discussed separately. In addition, one businessman can have several stamps at once for different situations, for example, the main stamp and the “Paid” stamp.

The materials used are special odorless rubber, and the required text is applied to it with a laser.

What affects the cost

You will have to pay a certain amount of money for making a seal; its size depends on many factors: the dimensions of the product, equipment, logo, degree of protection against counterfeiting and production time.

Advantages of having a seal for an individual entrepreneur.

Many companies pay separately for logo and layout development. The standard production time for a stamp is three days, but for an additional fee it can be reduced to several hours.

What is the Unified State Register of Individual Entrepreneurs and how to get an extract from it, as well as why it is needed - read here.

For those who care about their image and strive to maintain a high status, there are premium stamps framed in expensive wood or metals.

Benefits of working with printing

- Entrepreneurs working with the public issue stamps in order not to work with cash registers. In this case, the fact of transfer of funds is confirmed by special forms with the organization’s stamp.

- If an individual entrepreneur works for government agencies, then a seal is also necessary. Applications for tenders and large purchases for the state must be confirmed with a stamp.

- It is beneficial for small or start-up organizations to hire students for the duration of their internship; in this case, a mandatory salary payment is not required for the work, but a seal is required to prepare all the necessary documents and reports.

- In some situations, there is a need to certify documents, and this can be done only in two ways: using a seal or with a notary. The first method will help you avoid very expensive procedures and save valuable time.

- The seal gives the right to issue powers of attorney, that is, thanks to it, an entrepreneur can appoint a proxy as his official representative at events, in courts, or when making transactions that you cannot attend in person.

- Finally, the stamp helps not only to open a current account, but also to cooperate with large banks that provide good guarantees. You can solve this issue without him, but it will take a lot of time and effort to achieve positive solutions.

When an individual entrepreneur needs to withdraw money from a current account, the question arises, how exactly to do this? Read the answer here.

Working without a seal - myth or reality

- the organization has independently developed the form of the primary document, and it requires a seal;

- the organization uses a unified form, which includes a seal.

- the organization applies standard mandatory forms established by authorized bodies (the Government of the Russian Federation, the Bank of Russia, etc.) on the basis of federal laws, and these standard forms require a seal.

Please note that refusal to work with a seal must be formalized through amendments to the organization’s charter; an administrative document from the manager is not enough in this case. When creating new legal entities, information about the absence of a seal can be immediately recorded in the constituent documents.

Registration of the seal with the tax authorities

There is no legal norm obliging the stamp to be registered with the tax office, but in some cases such a procedure is advisable.

The Tax Service does not maintain an official register of stamps, but nothing prevents an entrepreneur from obtaining his own stamp. To do this you need:

- write an application on a special form;

- present a document confirming your identity;

- photocopy the registration document;

- in some cases, they may be asked to leave a diagram and a seal impression.

If you become an individual entrepreneur, then you will need a current account, but opening it is not so easy. Detailed instructions can be found at the link.

In each region, such issues are resolved by local authorities. For example, in the Moscow Region, all stamps are recorded in the Moscow Registration Chamber, although registration occurs on a voluntary basis.

Why do you need an IP seal? See the answer in this video:

The date of production (or destruction) of the seal is entered in a special journal, its trace and the personal signature of the entrepreneur are left. Until 2002, all templates were submitted for approval before official production.

Thus, the need for an individual entrepreneur to have a seal depends to a greater extent on the personal desires and goals of a particular person rather than on laws and other regulations.

No one can force you to design your own stamp, but it is still recommended that you take your time to make this tool; sooner or later it may come in handy for signing profitable documents, and besides, it costs little money.

fbm.ru

Nuances of acquisition and use

A businessman who has decided that obtaining a stamp is a necessary factor in business development will immediately become interested in how to make a stamp for an individual entrepreneur, where to order it, and how much it costs to make this product. Let's look at the details of this procedure step by step. The production of such accessories is carried out by companies that have permission to carry out such activities. There are several similar enterprises in every city in the country. Finding the right company will make it easier to use the Internet or view advertisements in the local press.

The cost of the procedure will be from 500 rubles for a standard manual product and about one thousand for the production of an automatic variation. Here, many entrepreneurs recommend choosing the second option. This stamp is easy to use and lasts a long time. In addition, it has an attractive appearance, and the reliability of the housing is ensured by the polymer or metal from which the casing is made.

An important nuance for a newcomer to business will be the problem of whether it is necessary to register the seal of an individual entrepreneur with the tax office. Today this norm is possible only on a voluntary basis. In other words, an entrepreneur can do without such a procedure. However, here are aspects that play a decisive role for individual entrepreneurs. Registration of the seal with the fiscal service, the Registration Chamber or the register of the manufacturer will allow you to avoid many potential problems in the future . The presence of an officially certified stamp will protect the businessman from making claims based on documentation produced for fraudulent purposes - checking the original stamp with the presented sample proves the authenticity of the paper.

There is another topic that worries newly-minted entrepreneurs - if an individual entrepreneur has a seal, is he obliged to put it on? Here experts are unanimous in their opinion - the presence of such an attribute obliges a businessman to use a stamp on all internal company papers and other documents. An entrepreneur’s signature is also a mandatory addition to the documentation endorsement.

What the law says

According to Art. 23 of the Civil Code of Russia, citizens of Russia have the right to engage in entrepreneurial activities without forming a legal entity. They are subject to the rules of the Civil Code, which apply to legal entities, unless otherwise follows from legislative acts. Those. According to the law, an individual entrepreneur can work without a seal.

Also 04/06/2015 The President of the Russian Federation signed Federal Law No. 82-FZ. The essence of which is to introduce changes to various regulations that allow business entities to voluntarily use the seal.

This is also confirmed by the fact that a signature is not required to be certified with a seal:

- when registering an individual entrepreneur;

- when opening a bank account;

- when submitting reports;

- when maintaining a book of accounts and income.

However, in practice, the use of a seal when carrying out business activities is a very justified step. Let's figure it out further.

Why might a seal be needed?

- To certify entries in the work book. If an individual entrepreneur has hired employees, then in accordance with the instructions for filling out work books, the title page is stamped with the organization where the document was first filled out and the employee’s dismissal record is verified. However, given that the presence of a seal for an individual entrepreneur is not mandatory, businessmen get out of the situation in the following way: provide a certificate of absence of a seal.

- Art. 913 of the Civil Code of the Russian Federation provides for the mandatory use of a seal with a double warehouse receipt. This is the case when a businessman sells a product that is located outside the city or in another warehouse. At the same time, the office where the contract was concluded is located in the center, and the goods must be picked up in another place. The seal will confirm the conclusion of the transaction and the buyer’s right to pick up the paid goods according to the documents provided.

- This point is also interesting. Some primary documents have special stamp details, and according to the law, documents are accepted for registration only if all the required details are present. But the individual entrepreneur gets out of this situation in the following way: he puts the abbreviation “B/P” (without a seal) and certifies it with a signature.

- Printing is a tool for gaining and maintaining client trust. Some individuals may even refuse to work with you without a seal.

- Satisfying ambitions and giving credibility to documents.

- Protection of documents from forgery and other falsifications.

- If there is no cash register and strict reporting forms are used, that is, when providing services to the public, printing is required.

- If the contract concluded between the parties contains such a mandatory condition as certification by a seal, then in its absence the contract can be declared invalid.

- Sometimes it’s simply easier to purchase a seal than to constantly explain the reasons for its absence.

Canceling a seal: what an accountant should know

The seal has become an optional attribute of a legal entity (Federal Law dated April 6, 2015 No. 82-FZ). Which organizations are given the right to refuse printing? What difficulties await daredevils? How to treat incoming documents from third-party organizations without a seal, if previously it was mandatory on them?

Now the work to change business practices has received its logical continuation. Law No. 82-FZ on the abolition of the seal makes changes primarily to the laws on corporate organizations (LLC and JSC). The text of the amendments in both laws is essentially identical. Let's compare the “old” and “new” editions (the changes are highlighted in the Table).

Some questions about using printing

we have received to the question whether an individual entrepreneur can work without a seal . Yes maybe. But if he nevertheless decided to issue a stamp, then he does not need to register it anywhere, in particular, with the tax authorities either.

You can also use it as you wish. That is, this can be a one-time operation, for settlement with a special client, or even for a separate type of activity.

There is no need to put a stamp on everything, especially on those documents that were issued before its appearance. There is an opinion that if you have made or purchased a seal, now you must put it on all documents. However, there is no legislative support for this norm. If there is no obligation to have a seal at all, then there is also no obligation to use it everywhere. We recommend using the seal when concluding contracts, filling out strict reporting forms and other important documents. You must determine for yourself the most significant documents. Also keep in mind that if a controversial or conflict situation arises, and sometimes even during legal proceedings, the presence or absence of a seal on a document can play a significant role.

You can purchase a ready-made print or order a custom one. Mandatory details will include: your initials, individual number, state registration number, city, the phrase “individual entrepreneur”. If you wish, you can indicate any additional information on it. The seal must be round, and all information indicated on it must be clearly legible. You can also order your own logo for credibility.

biznesogolik.ru

What is the essence of the new rules

So, LLC (JSC) can now choose <1>:

- <or> society completely abandons the seal - then it is not placed anywhere;

- <or> society does not refuse the seal - then the seal is needed only where federal law requires it to be affixed (you can see the cases known to us in the table). In other situations, printing can also be used, but it is not necessary.

The choice made must be reflected in the charter.

Note that in some cases, federal law may not make the obligation to use a seal dependent on its availability in the organization. Then there is no right to choose - without a seal, the organization will not be able to work. Today, as an example, we can only name appraisers - a seal is needed on the property appraisal report <30>. In addition, it was proposed to supplement the Law on Valuation Activities with a provision on the obligation of appraiser organizations to have and use a seal.