Answers to common questions

Question No. 1.

Does the head of the company have the right to refuse to provide an employee with leave after going on maternity leave, since part of the annual leave has already been received previously? Yes, it's legal. A woman is required to work for a certain period of time, on the basis of which she earns the right to part of the calendar leave in advance. And after the onset of a new period, the employee can ask for further rest.

https://www.youtube.com/watch?v=ytdeven-GB

Question No. 2. When granting calendar leave, are absenteeism, maternity leave and other additional periods of unpaid rest longer than 2 weeks taken into account?

No, these periods of absence from work are not taken into account when assigning the next rest.

By law, an employee who has returned from maternity leave can take days of unused rest. According to Art. 260 of the Labor Code of the Russian Federation, work days off are provided before or after a woman goes on sick leave due to pregnancy. Vacation can also be taken for the next working year if:

- At the time of registration of sick leave, the employee worked part-time. Calculation is carried out for the time worked before the start of the rest.

- If there is unused vacation left over the previous period. Based on the application, these days can be considered child care leave.

Vacation immediately after maternity leave and the next one are taken to be identical concepts. Sick leave for childbirth is included in the length of service, but rest to care for a baby is not. The next leave after leaving maternity leave can be obtained according to the schedule, taking into account the time worked, or it can be added to the previous sick leave.

Determining average earnings after maternity leave - which period should be taken into account?

If a woman immediately went to work after sick leave, then she has no excluded periods, and the billing period will be 12 calendar months before the month of registration of the next vacation. If a woman went to work after caring for a child, then she had no income in the previous 12 months. In this case, you can replace the period with an earlier one - taken 12 months before the start of the maternity leave. The right of replacement is stated in Decree of the Government of the Russian Federation of December 24, 2007 N 922 (as amended on December 10, 2016). back to contents Calculation of average earnings? An equally important role when calculating the vacation amount after leaving maternity leave is played by the average daily earnings.

When to go on annual leave: before or after maternity leave?

But a woman who recently gave birth did not work for 140 to 194 days. These maternity days will be included in the worked period, so you don’t have to worry about the average. The period of rest for pregnancy and caring for a baby up to the age of one and a half years will certainly be included in both work and insurance.

These payments do not include the following amounts:

- one-time bonuses;

- one-time payments;

- income from the turnover of labor shares and from deposits;

- various types of compensation (for business trips, unused vacation, etc.);

- bonuses and rewards for victories in competitions and competitions;

- royalties for literary works;

- subsidies for food, travel, etc.;

- holiday and anniversary payments.

Sick leave is paid for with temporary disability benefits, and since maternity leave is temporary disability, sickness time will not be paid. However, if the period of sick leave extends beyond the scope of maternity leave, then the days of exaggeration due to officially confirmed illness will be paid by the enterprise, taking into account the average earnings and the length of the insurance period.

All vacation amounts must be paid no later than 3 days after signing the vacation order. If payments are delayed for some reason, this is considered a violation of the law.

The vacation amount is calculated based on average earnings calculated for the last year worked. Every day of the calendar month is counted. If an employee did not use her annual period of release from work duties before going on maternity leave, then it can be reimbursed both in kind, that is, in additional days, and in money. Cash compensation is added to the total amount of vacation pay.

In general, vacation funds are calculated in accordance with the employee’s average earnings for the last pay period.

A woman who was on maternity leave did not work for part of this time, so difficulties arise in determining compensation.

How is vacation pay calculated in this case? Maternity days are counted as time worked. Both the length of service and the insurance period include the time during which the employee was on maternity leave.

So, after leaving maternity leave and taking leave, the following values will be taken into account in the calculation:

- salary amount;

- bonuses paid on an official basis;

- additional allowances;

- regional coefficient;

- funds paid to an employee during the period when he maintains his average earnings.

Moreover, when determining the amount of vacation funds after leaving maternity leave, the following are not taken into account:

- payments that are one-time in nature, for example, for fulfilling the obligations of an absent employee;

- compensation due for unused vacation;

- travel allowances;

- premiums paid for rational proposals;

- payments due for organization anniversaries or holidays;

- allocated social support measures, for example, for transport costs and food.

Example

Employee Didova N.D. On August 11, 2020, she returned from leave taken in connection with pregnancy and childbirth. On the same day, she drew up an application addressed to the employer requesting leave from August 12 to September 8, 2020. Its duration is exactly 28 days.

She worked out the billing period in full, and the amount of accruals is 400,000 rubles.

How are they calculated? To calculate average earnings, you will need to divide this amount by 12 months (the length of the billing period), and then divide by a factor of 29.3. The resulting value (1,137 rubles) is multiplied by the duration of the vacation (28 days) = 31,836 rubles. This amount is payable to the employee.

If vacation funds are accrued incorrectly, this will attract the attention of the Labor Inspectorate.

If the employee independently made the calculation and the final figure differs from what was calculated by the accounting department, then you can make a corresponding request indicating the recalculation.

Unpaid funds must be compensated.

If the deadlines are not met, the employer is obliged to pay compensation.

Its size for each day of delay should not be less than 1/300 of the refinancing rate established by the Central Bank of the Russian Federation.

If an employer refuses to pay vacation money to a woman who has returned from maternity leave and plans to take annual leave, she has the right to file a claim to resolve the issue in court.

The calculation of vacation pay after maternity leave in 2020 is carried out on a general basis. Staying on maternity leave is also taken into account when making calculations.

According to Article 19 of the Labor Code, all working citizens have the right to paid rest in the amount of 28 days every year. This is called calendar leave. When is such a rest due? Six months or a year after signing the employment contract.

By the way, the more difficult the working conditions, the longer the vacation (for example, for residents of the Far North). And teachers rest for three months, but only during the summer holidays.

Choosing a rest time outside of the schedule is allowed to the following persons:

- under 18 years of age;

- pregnant and postpartum women;

- women after maternity leave;

- other categories established by law.

Without good reason and the consent of the employee, no employer can call him to the workplace. Recently, it is increasingly proposed to divide annual leave into two parts - twice for two weeks. This offer is also beneficial for young mothers who take the first 14 days before maternity leave, and the remaining days after.

If the number of paid vacation days for two years is less than 15 days, this is a violation of the law and leads to the manager being held accountable, as it harms the employee’s health.

An employee who has gone on maternity leave is assigned a position and place of work. Instead, the employer can hire another employee temporarily, until the end of the period of leave during pregnancy and childbirth (OBiR), as well as child care. The only exception will be the liquidation of the organization.

Is vacation due if it has already been used in a given period? Oddly enough, yes. In this case, rest is provided for the next period. When a woman's maternity leave comes to an end and she decides to quit, the funds paid in advance will be deducted.

Preferably no later than three days before the end of the maternity period for vacation. Moreover, if before pregnancy she worked in several places, then the application is written in all organizations.

We invite you to read: How can the director of an LLC resign at his own request?

Such a document is drawn up in a standard form. It must indicate the reasons for leave and refer to articles from the Labor Code.

Leave after maternity leave can be taken in the amount of:

- take a full vacation - all 28 days;

- half of the rest period;

- 56 or 84 days - take all unused vacation periods before maternity leave.

A woman is entitled to annual leave even before completing six months of work experience, even if it is officially a few days.

If, after maternity leave, a young mother, instead of taking another vacation, decides to quit, she will be awarded monetary compensation instead of vacation pay.

The provisions for granting annual leave after maternity leave are stated in Article 260 of the Labor Code.

Vacation pay calculation

If a woman takes another leave to care for a child, then the calculation of vacation pay after the maternity period will occur differently. After all, she might not have worked for more than three years, where do we get information about wages?

It is important to know that the total length of service and the length of service that subsequently provides the basis for the next vacation are two different concepts. Work experience includes periods of pregnancy, childbirth and child care.

By law, the period for child care is not included in the calculation of leave. Therefore, when calculating the amount of future payment, the accountant takes into account the working time before the sick period according to the BiR.

Data for calculation

All working citizens who work officially have the right to take paid leave once a year. The duration of rest is 28 days (longer if the employee is engaged in hazardous work, or if management allows longer rest), for teachers - about 2.5 months due to student holidays.

The law allows you to divide the vacation period into 2 parts and take them off at different times of the year, then you will not have to work 12 months. If the employer provides for a longer vacation than required by the Labor Code, he must formalize the new conditions by order or addition to the collective agreement.

How are vacation pay calculated after maternity leave?

Each employee can take paid leave after 6 months of work. You can go on vacation before the end of six months by agreement with your employer. The vacation schedule is drawn up taking into account the wishes of the employees of the department or other unit. The schedule is approved by management. Without observing this schedule, a woman who plans to return from maternity leave has the right to take official leave. By agreement with the employer, she can take leave before or after maternity leave. This procedure is also possible if she has already taken annual leave. The employer in this situation provides her with rest in advance, that is, for the next reporting period. If a woman was on vacation, granted to her in advance, and then decided to leave her job, part of her vacation funds is deducted from her dismissal payments.

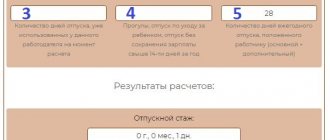

Calculation of annual leave after maternity leave occurs in the standard way. The algorithm of actions is specified in Article 139 of the Labor Code of the Russian Federation. When calculating, you need to correctly determine the following indicators:

- number of vacation days;

- billing period;

- average annual earnings;

- vacation pay.

According to the provisions of the Labor Code of the Russian Federation, a woman who has returned from maternity leave has the exclusive right to receive annual leave immediately. She must be given a vacation period of 28 days; in some situations, these days can be extended in time, but not reduced. In addition, when calculating the allotted rest time, days unused before maternity leave, accrued to the woman before going on sick leave for pregnancy and childbirth, can be taken into account.

The number of days of annual leave is calculated as follows:

- Vacation days unused by the employee before maternity leave are calculated.

- The days due for sick leave lasting 140 days are calculated.

- The amounts add up to each other.

The duration of maternity leave is 140 days, which corresponds to 4 months and 20 days. These days are rounded up to 5 months. With an annual leave duration of 28 days, 2.33 days are allotted for each month. We multiply this figure by 5, it turns out 11.65 days. Typically, the employer rounds these days to 12.

In the process of calculating the money a woman is due for her vacation, you need to pay attention to the billing period. According to the Labor Code of the Russian Federation, the billing period is 12 months

This year precedes the annual vacation period. An employee who returned to work after maternity leave without working for 140 days, which were provided to her by law and up to 3 years to care for an already born child. The actual duration of a woman’s maternity leave depends on the nature of the birth and the number of children born.

Sick leave for pregnancy and childbirth is included in the billing period. Does not include parental leave. Based on this, when calculating average earnings, payments accrued to the employee’s bank account during this time are taken into account. If, after the expiration of the sick leave, a woman immediately went to work, then she does not have any excluded periods. Therefore, the calculation period is 12 months before the month of registration of the annual paid vacation. If a woman did not return to work after 3 years, that is, after maternity leave, then she had no income in the previous year. Therefore, the calculation should be based on the 12 months preceding the start of her maternity leave.

The amount of average earnings per day also plays an important role in the process of calculating vacation pay. The calculation of average earnings includes the following indicators:

- the amount of salary that was received during the billing period;

- bonuses, allowances, surcharges.

IMPORTANT: If the company has increased salaries, then indexation is carried out. Income not subject to accounting:

Income not subject to accounting:

- vacation pay;

- one-time bonuses;

- payment for business trips;

- one-time benefits;

- subsidies;

- prizes received as a result of winning competitions;

- bonuses that were paid to employees for the holiday;

- benefits for caring for a disabled child.

The calculation procedure is standard. The amount of income for the billing period is determined. All accrued indicators are added up. The number of days actually worked by her is determined. If the month is worked in full, then the number of days is equal to the coefficient 29.3. If the month is not fully worked, then the number of days is calculated as calendar days worked, which are divided by the total number of calendar days, multiplied by 29.3.

Formulas for calculation:

Average earnings = income / number of full days X 29.3 + number of days in partial months

Calculation of vacation pay for annual holidays:

Vacation pay = average earnings X days of vacation

Legislation

A pregnant employee is entitled to 140 days of rest: half before giving birth and the rest after. Next, maternity leave is provided for 1.5 years with the possibility of extension up to 3 years. The countdown begins from the 30th week of pregnancy, if a woman is expecting twins - from the 28th. In the second case, rest is provided for 86 days before and 110 days after childbirth.

For all these periods, a monetary payment is due (Articles 255, 256 of the Labor Code of the Russian Federation). But the employee can continue working without going on maternity leave. The benefit amount is significantly less than the salary level, so many mothers work until childbirth and return immediately after. The employer has no right to reduce, regulate or even cancel maternity leave.

The main document regulating the right of employees to leave is the Labor Code. It also prescribes how vacation pay is calculated after maternity leave. But it is important to understand that this regulation applies only to officially employed workers. Therefore, if an employee works for a “gray” salary or without a contract at all, you shouldn’t count on a full maternity leave, much less a vacation after it.

The main attention should be paid to articles 122, 124, 256 and 260. Knowledge of the rights will help women feel more confident in front of the employer, and not allow their legally guaranteed opportunities and means to be violated. From the point of view of legislation, the workplace during parental leave is retained by the employee and is included in her work experience.

If you have already had a vacation in advance, there are no free days for previous years, then you will have to work 6 months before going on annual paid leave (less than that, if you can come to an agreement with your boss). Thus, there are 3 timing options:

- immediately after maternity leave (if the right to leave in advance was not used before the birth);

- 6 months after starting work;

- at any time by agreement with the employer.

Situation 2: another leave was granted a month after maternity leave

Suppose the employee did not take advantage of the right to take another leave immediately after maternity leave, but went on annual paid leave two weeks, a month (two, three months) after the end of maternity leave. How to calculate average earnings in this case?

The employee has been working in the institution since 2020. The chronology of the events that interest us is as follows:

from 01/14/2017 to 05/31/2017 – maternity leave;

from 06/01/2017 to 05/14/2019 – parental leave;

05/15/2019 – date of return to work;

from 08/05/2019 to 08/17/2019 – regular paid leave.

In this case, after returning to work, the employee worked for less than 3 months. We believe that it is necessary to apply the general procedure for determining the billing period (12 full months preceding the month in which the employee goes on vacation, that is, the period from 08/01/2018 to 07/31/2019). Since most of the billing period falls during maternity leave, the number of days taken into account when calculating vacation pay will be small: 74.67 days. (17 days / 31 days x 29.3 days (May) + 2 months x 29.3 days (June, July)).

This is important to know: Is it possible to take vacation from Saturday or Sunday with a five-day work week?

Example 4.

Suppose an employee went on vacation 2 weeks after leaving maternity leave:

from 01/14/2017 to 05/31/2017 – maternity leave;

from 06/01/2017 to 05/14/2019 – parental leave;

05/15/2019 – date of return to work;

from 05/27/2019 to 06/23/2019 – regular paid leave.

In the case under consideration, the calculation period is from 05/01/2018 to 04/30/2019. Since all this time is excluded from the calculated time, clause 6 of Regulation No. 922 should be applied, according to which the period before maternity leave (from 01/01/2016 to 12/31/2016) should be taken as the calculated time.

How to calculate the days after leaving maternity leave?

According to the standards established by this Legislation of the Russian Federation, after maternity leave, a woman has the right to immediately receive annual leave.

According to Article 260 of the Labor Code of the Russian Federation, this category of employees is entitled to a paid rest period, the duration of which cannot be less than 28 days. In some cases, this period may be increased, but it cannot be reduced under any circumstances.

In addition, when calculating the days of allotted leave, days unused before maternity leave, accrued to her before she went on sick leave for pregnancy and childbirth, can be taken into account.

Also, days off are calculated for 140 days during which the woman was on maternity leave. The period of child care does not give the right to another vacation, since it is not included in the vacation period.

Calculating the number of days of annual leave required involves several steps:

- Calculation of the number of vacation days unused before maternity leave is calculated according to the rules set out here.

- Determining the number of days allotted for sick leave lasting 140 days - 11.65 days of regular leave are allotted.

- Addition of the above amounts.

The duration of maternity leave is 140 days or 4 months 20 days, which is rounded up to 5 full months.

https://www.youtube.com/watch?v=ytadvertiseen-GB

You can round up to 12 days at the request of the employer.

For women on maternity leave, the Labor Code of the Russian Federation provides an additional guarantee in the form of paid leave if she goes on it immediately after the end of maternity leave.

You can also go on vacation before maternity leave - details here.

This right is specified in Article 260 of the Labor Code of the Russian Federation.

If the right to paid leave under Article 260 of the Labor Code of the Russian Federation has already been used before the start of the maternity leave, then after its end you can ask for leave only on a general basis - on the basis of the vacation schedule or in agreement with the employer.

An important point: annual leave should begin immediately after maternity leave. Between them, a woman should not go to work.

If the employee has begun work duties, then the guarantees of Article 260 of the Labor Code of the Russian Federation no longer apply to her.

An employee can go on annual leave immediately after maternity leave only at her own request; management does not have the right to oblige her to do this.

If a woman submits such an application, the employer has no right to refuse.

He must issue an order and calculate vacation pay.

When submitting an application, it is advisable for the employee to take into account that, by law, the employer must pay vacation pay 3 days before the start of the vacation.

To fulfill this requirement of the Labor Code of the Russian Federation, it is better to submit an application in advance, and not on the last maternity day.

The Labor Code does not say exactly how many days of vacation can be requested from the employer. However, it is said that annual paid rest is provided regardless of length of service.

From this we can conclude that a woman has the right to apply for an annual duration of 28 days. It does not matter whether she has worked enough for this, or whether she has enough vacation experience.

If there are fewer unused days, the rest are provided in advance. A woman does not receive this rest as a gift; she must work it off in the future.

If she is paid vacation pay in advance, and she, having returned to work, quits without working, then the employer will have to withhold the overpayment from her calculation upon dismissal.

However, according to the law, no more than 20% can be withheld. The woman can deposit the rest of the money into the organization’s cash desk by agreement.

Perhaps the woman has a sufficient number of unused vacation days, then there is no need to take anything in advance; unused days are provided.

According to the law, maternity leave also gives the right to rest and is included in the vacation period. For 140 days of maternity sick leave, a woman receives 12 days of paid leave.

Maternity leave is not included in the vacation period and does not provide the right to rest.

If at the end of her maternity leave an employee submits an application for paid leave of 28 days under Article 260 of the Labor Code of the Russian Federation, then the employer should first calculate how many unused days the woman has and how many need to be provided in advance.

We suggest you read: Who can you complain to Rospotrebnadzor? Claim.

To calculate the length of unused rest, you need to follow these steps:

- Step 1. Calculate the total number of vacation days due for the period of work from the date of employment until the start of maternity leave (each working year entitles you to 28 days).

- Step 2. Subtract the days already used before the start of maternity leave from the resulting duration.

- Step 3. Add the number of vacation days allotted for the period of sick leave for pregnancy and childbirth (140 days is 5 full months, 5 * 2.33 = 11.65 days allotted for maternity leave under the BiR). Maternity leave for up to 3 years does not provide vacation days.

- Step 4. Calculate the number of days that need to be provided in advance.

Let's consider a situation where, after finishing her vacation to care for the baby, the mother decides to take a calendar leave without starting her duties. In such a situation, you need to remember your rights and benefits. Legislation has come to the protection of young mothers. But employers can still refuse to provide time off.

An employee can take her next vacation after maternity leave at any time. It is enough to simply write an application addressed to the director. There are often situations when an employee worked for several years before maternity leave without rest. Having become pregnant, she has the right to take all days off at once.

Maternity leave begins from the date of birth indicated on the certificate. If a young mother does not plan to stay at home with her child, she can take regular leave for the first time. It is also possible for a woman to quit her job immediately after maternity leave. In this case, she is entitled to compensation for unused vacation. She can also replace the period after maternity leave with paid rest, and then quit.

Let's consider what periods are included in the length of service for providing employees of enterprises with vacations:

- Sick leave for the BiR is included in the work experience.

- Maternity leave time is not taken into account in the length of service.

So, the next annual leave according to the vacation schedule, which will come after maternity leave (when its days were not added to the rest before childbirth or to the leave to care for a newborn), is given to the woman taking into account the time she worked in the company.

And the need for leave, which the employee asked to be provided immediately after returning from maternity leave (or the employer suggested doing so), may lie in the fact that she is not yet able to return to the workplace because of the new employee who was hired in her place. If an employee works part-time while on maternity leave, receiving benefits and wages, she will retain her right to take annual leave.

It turns out that the woman spent the entire reporting period outside of work, which means that payments will be calculated on the basis of the amounts accrued to her before the birth of the child. The amounts of maternity benefits and vacation payments do not change compared to the first option. However, it is worth considering that organizations carry out salary indexation every year.

Therefore, after one and a half and three years of being on vacation, employees’ incomes will increase significantly. So you should go back to work for a few months. A new period of time will be taken as the calculation period. And when the woman goes on vacation, the benefit will be calculated based on her earnings for these couple of months, which significantly increases it.

Parental leave starts from the first day of the baby’s life and lasts 1.5 years, then the mother has the right to extend it for another similar period until the child turns 3 years old. Annual leave following maternity leave is assigned to an employee based on her written application addressed to the head of the organization.

| Before maternity leave | After maternity leave |

| To calculate vacation pay issued for annual vacation, the average income of the employee is taken, calculated on the basis of the salaries actually paid to her for the previous 12 months. The number of maternity days is taken from the sick leave. For employees whose work experience exceeds six months, the rate is 100% of average monthly earnings. The calculation period is equal to the previous 2 years of work; accordingly, if a woman has been working in the company for many years, the next vacation does not affect the amount of the benefit. | After a woman has a baby, she is entitled to an allowance to care for him until he is 1.5 years old. It is calculated as 40% of average monthly income, if the calculation is made for an incompletely worked month - as 40% of earnings multiplied by 30.4. Payment for calendar leave is approximately 60% higher than the benefit for caring for a newborn. Holidays for accounting and accounting are not taken into account in the settlement period and do not affect the amount of payments. |

In general, vacation pay is calculated based on average earnings for the previous working year. The money is paid 3 days before the employee goes on vacation. The amount paid depends on:

- salary amount,

- issued bonuses, allowances, various additional payments,

- accrued benefits,

- annual indexations,

- remuneration based on work results,

- regional coefficients.

The amount of vacation pay is not affected by:

- one-time payments,

- interest, dividends,

- money donated for anniversary

- food subsidies,

- royalties for literary works,

- cash prizes for participation in competitions,

- compensation payments for business trips.

CO = SVV: 12: 29.4 * KDO,

- where CO is the amount of vacation pay,

- СВВ – the sum of all payments,

- KDO – number of days of rest,

- 12 is the number of months in a year.

The woman was on maternity leave and returned to work on February 5, 2013. From February 19, 2013, she went on annual leave for 12 calendar days. Let's calculate vacation pay for 10 working days (i.e. 80 working hours):

- Let's calculate the average income of a woman (divide the amount actually paid by the number of hours worked).

- Let us multiply the result by the average monthly number of working hours (167.3 for the year in question).

- Daily earnings are calculated by dividing the average monthly income by 29.7 (constant value).

- The result must be multiplied by the number of days of annual leave.

Vacation after maternity leave: period, calculation

Maternity leave begins from the date of birth indicated on the certificate. If a young mother does not plan to stay at home with her child, she can take regular leave for the first time. It is also possible for a woman to quit her job immediately after maternity leave. In this case, she is entitled to compensation for unused vacation. She can also replace the period after maternity leave with paid rest, and then quit.

Let's consider a situation where, after finishing her vacation to care for the baby, the mother decides to take a calendar leave without starting her duties. In such a situation, you need to remember your rights and benefits. Legislation has come to the protection of young mothers. But employers can still refuse to provide time off.

Regular vacation

Each officially employed employee of the organization is provided with 28 days of paid rest (Chapter 9 of the Labor Code of the Russian Federation). This period may be extended if the person works in hazardous conditions. Separately, the legislation provides for extended leave for teachers during the summer holidays. The employer can independently increase the duration of vacation of subordinates, but not reduce it.

Changes are made by additions to the collective labor agreement or by issuing separate orders. If an employee is on vacation, the boss cannot recall him without good reason. Moreover, the employee must agree to go to work early. Very often, employees are asked to divide their annual leave into two equal parts. This option does not contradict the law and is convenient for all parties.

When is it allowed to take after maternity leave?

It is necessary to distinguish between the following types of rest periods that an employee is entitled to count on under current labor legislation:

| Paid annually | Every employee, regardless of gender, profession and family circumstances, has the right to an annual vacation, during which he retains his average earnings. The standard duration is 28 days annually, for some groups of workers it is longer. |

| Unpaid | Provided at the request of the employee without retaining his earnings. |

| For pregnancy and childbirth - BiR | It is provided to pregnant women in the last stages of pregnancy and lasts from 140 to 194 days, depending on the complexity of the birth and whether the citizen gave birth to one or more children. Issued with a sick leave certificate. |

| Child care - Swelling or maternity leave | Provided to an employee, male or female, in connection with the need to care for a newborn until he reaches three years of age. Premature exit from Swelling is allowed. |

Article 260 of the Labor Code of the Russian Federation resolves the question of whether it is possible to take leave immediately after maternity leave: yes, immediately after leaving parental leave, an employee has the right to take annual paid leave. For its provision, work experience is not taken into account - six months of experience is not mandatory. Speaking about when leave is due after leaving maternity leave, it is important to remember that the employee will receive such leave provided that he did not use it before or after sick leave for pregnancy and childbirth.

In addition to the freedom to choose when to take leave after maternity leave, the employee has the right to independently determine the duration of such rest she needs: she has the right to use the full duration established by the employer, which is usually 28 days.

How to calculate vacation pay?

The general rule is that vacation pay is calculated based on the average income for the last year worked. But the problem is that the employee did not work for approximately 140 days. How to calculate vacation after maternity leave?

https://www.youtube.com/watch?v=ytcreatorsen-GB

The amount of compensation is affected by:

- salary level;

- bonuses, allowances and additional payments received;

- regional coefficient;

- remuneration based on performance results;

- receiving benefits;

- indexing.

Doesn't matter:

- one-time payments;

- travel compensation;

- prizes for winning places in competitions;

- literary royalties;

- food subsidy;

- funds received for the anniversary;

- interest and dividends.

The calculation process is carried out according to the standard scheme. The sum of all payments is divided by 12 and then by 29.4. The resulting number is multiplied by the number of days of rest. This will be the amount of vacation pay. The benefit is paid within the time limits established by law, that is, three days before the vacation.

In general, the calculation is based on the employee’s income for the last 12 months. In the case of a maternity leaver, the difficulty is that she is on maternity leave for the entire billing period and has no income.

Clause 6 of Resolution No. 922 states that if the entire billing period consists of an excluded period (maternity leave is one), then an earlier 12 months can be taken.

That is, in the case of a maternity leave, you need to take 12 calendar months that precede the start of maternity leave for pregnancy and childbirth.

We invite you to read: Is a holiday included in vacation? Explanations from lawyers

Earnings include all payments related to wages. Benefits, travel allowances, sick leave, maternity pay, and vacation pay are not taken into account.

The formula calculates the average earnings for 1 day, which is multiplied by the duration of rest.

If a month of the billing period is fully worked out, then it is considered to have 29.3 days. If the entire year is worked, then the billing period consists of 12 * 29.3 days.

Calculation example

Petrova has been working since April 10, 2020, sick leave according to the BiR began on October 8, 2020.

She returns from maternity leave on December 15, 2020 and immediately goes on vacation for 28 days.

The monthly salary is 25,000 rubles.

In July 2020, I was on annual leave for 28 days, for which I received vacation pay of 24,000 rubles, salary this month = 1,000 rubles.

Calculation:

- The billing period is from 12/01/2018 to 11/30/2019 - this time consists of maternity leave to care for a child, so it is replaced by 12 months before sick leave - from 10/01/2015 to 09/30/2016.

- Earned in the billing period: 25,000 * 11,1000 = 276,000.

- The billing period has 11 full months and one (July) incomplete. In July worked = 3 * 29.3 / 31 = 2.84 days.

- Vacation pay = 276,000 / (11*29.3 2.84) * 28 = 23,768.22 rubles.

Paid leave must be provided to any employee who has signed an official Employment Agreement. The maximum duration of vacation is 28 days. But you need to take into account many nuances. This is especially true for maternity leave related to pregnancy.

Vacation after a 1.5 or 3 year break The employee did not work during the reporting period. Calculation will be carried out based on the accrued salary before the birth. The amounts of maternity and vacation pay will not change compared to the first option.

https://www.youtube.com/watch?v=ytabouten-GB

But there is one nuance that is worth paying attention to. Enterprises index salaries annually. After a 1.5 or 3 year break, the salary will increase significantly. Therefore, it makes sense to work for a couple of months (then a new period will be taken for vacation calculations), and then go on vacation.

How to receive payments from the day of birth of the baby? You need to collect a complete package of documents for the child, contact the accounting department at your place of work, and apply for a one-time benefit in connection with the birth of a baby. The document itself should indicate that the payment should be scheduled from the date of birth of the child.

Vacation after a 1.5 or 3 year break The employee did not work during the reporting period. Calculation will be carried out based on the accrued salary before the birth.

Enterprises index salaries annually. After a 1.5 or 3 year break, the salary will increase significantly. Therefore, it makes sense to work for a couple of months (then a new period will be taken for vacation calculations), and then go on vacation. How to receive payments from the day of birth of the baby? You need to collect a complete package of documents for the child, contact the accounting department at your place of work, and apply for a one-time benefit in connection with the birth of a baby. The document itself should indicate that the payment should be scheduled from the date of birth of the child.

What period is taken to calculate the next vacation?

The calculation period for vacation pay is the time equal to the year that precedes the month the annual vacation begins. It is during this time that the accounting employee calculates the average daily earnings to pay for rest days.

The procedure for calculating vacation pay consists of determining several indicators:

- billing period and average income of a specialist during this time;

- actual days worked in the period;

- average daily earnings and total vacation pay.

The law establishes the calculation period for annual leave - 12 calendar months before the month of its registration.

Months from the 1st to the last (full) are taken into account, the current one is not taken into account.

This procedure is established for each worker, regardless of the position held and the period of registration of the employment relationship.

Labor activity events excluded from the calculation period (clause 5 of the Regulations):

- days maintaining average earnings, except for days for feeding a child;

- vacations - how they are taken into account;

- temporary disability due to illness or pregnancy - how sick leave affects vacation pay;

- downtime due to the fault of the employer or reasons beyond his control;

- additional days off to care for a disabled child;

- other cases of release from work while maintaining earnings (business trip) - how business trips affect vacation.

The exclusion of the above days is accompanied by the exclusion of the corresponding payments in total earnings.

In addition, social benefits and funds not related to wages (material assistance, travel, food, housing and communal services) are deducted from the average income.

If worked for more than a year

When an employee’s working time at a particular enterprise is more than 1 year, the last 12 calendar months are considered the calculation period (clause 4 of the Regulations).

If less than a year

If less than a year has passed since the employee was hired, and a leave order was signed for him, then the estimated period is taken to be the actual time worked in the organization from the date of hire to the day preceding the month the leave was issued.

A worker can use the right to rest after 6 months; this situation is quite common. If the first month of work is not a whole month, days worked are rounded up to a full month if half or more days are worked in it.

If less than a month

For 1 year, the employee is entitled to leave in accordance with Labor legislation for a period of 28 days. For 1 month worked, he has the right to rest 2.33 days.

A month is taken into account if it contains at least half of the days worked.

If the days worked are not equal to a whole number, then rounding is carried out in favor of the employee. The Ministry of Health and Social Development allows the rounding of days worked upward at the discretion of the company director; rounding down is prohibited.

How long is it calculated after maternity leave?

When calculating vacation pay, situations sometimes arise when the calculation period consists of time that should not be taken into account when calculating.

In such cases, vacation pay is calculated from the amounts accrued for the previous worked period equal to the calculated period (clause 6 of the Regulations).

This may arise when taking leave after maternity leave. The 12 months preceding parental leave should be taken into account.

If less than 1 year has been worked before the start of maternity leave, then the actual time of work is considered.

If there is no earnings in the previous period, earnings for the current month are taken into account.

Examples

The employee, who was on leave to care for her baby, returned to work on 02/05/13. From 02/19/13 she took 12 kd. recreation. Calculation of vacation after maternity leave for 10 working days (80 hours) will be carried out according to the following algorithm:

- Average hourly earnings are determined by dividing the actual accrued amount by hours worked.

- The resulting value is multiplied by the average monthly number of hours. For 2013, this value was 167.3 hours.

- Income per day is calculated by dividing the average monthly earnings by a constant value of 29.7.

- The resulting figure is multiplied by the number of calendar vacation days.

For 10 working days, the employee was credited 23,000 rubles.

Average hourly earnings: 23,000 / 80 = 287.5 rubles.

Average monthly income: 287.5 * 167.3 = 48,098.75 rubles.

Earnings per day: 48098.75 / 29.7 = 1619.49 rubles.

Total payment amount: 1619.49*12 = 19433.83 rubles.

The employee began work on May 10, 2015 after the birth of the baby. On the same day, she wrote an application for leave after maternity leave for the period from 06/11/15 to 06/07/15. Let's calculate the amount of the benefit. Duration of rest - 28 days. The reporting period (05/01/2014 - 04/30/15) has been fully worked out. The amount of salary accruals is 400 thousand rubles.

Let's calculate the average income: 400,000 12 months. 29.3 = 1137 rub.

The benefit amount will be: 1137 * 28 = 31826 rubles.

If the employee did not actually have accrued wages or the entire pay period consists of excluded days, then the average earnings are calculated based on the income received for the previous months of work, equal in number to the calculated ones.

An example of calculating vacation pay after maternity leave

Secretary-referent Prigozhina M.S. started working at Alfa-M LLC on August 4, 2014. She was on labor leave from November 16, 2015 to March 28, 2016, and on maternity leave from March 29, 2016 to November 12, 2018. Before going on leave for the BiR Prigozhina M.S. Once I took a vacation for 14 calendar days. Now she wants to take another 14 calendar days off from November 13, 2018.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

This means that for the purposes of calculating vacation pay, Prigozhin M.S. worked 16.07 days in July 2020. ((31 days – 14 days) / 31 days x 29.3 days). Then the total number of days worked in the billing period is 338.37 days. (11 months x 29.3 days + 16.07 days).

Nuances

Let's consider a situation in which an employee returned from maternity leave in May 2014 and immediately took another leave. In total, she was absent for 140 days before giving birth and a year after. For the purposes of calculating vacation pay, the actual income received for the period from May 2012 to April 2013 should be taken into account.

If an employee started work in April and takes a new vacation in May, the benefit is calculated based on the income for the days actually worked in April. If the employee received any other benefits during the base period (for example, for part-time work), benefits should be calculated based on these amounts (including income for days worked). Payments received from other employers are not relevant.

The procedure for calculating vacation pay upon completion of maternity leave

Vacation pay payments are calculated based on average earnings in the billing period. For women on maternity leave, everything becomes more complicated, because they do not work for a long period of time. Then the days spent on vacation are counted as if the employee was performing her duties while at work. This time is included in the length of service.

After the allotted time for maternity leave, the woman goes to work and writes an application for paid days. The leave will take into account:

- amount of payment;

- availability of bonuses;

- allowances;

- regional coefficient;

- payments for the period while maintaining the average income.

During the calculations, one-time bonuses will not be taken into account, since only those payments that are specified in the contract are taken into account.

In addition, when paying vacation pay after maternity leave, the following will not be taken into account:

- one-time payments related to the replacement of an employee;

- compensation provided for days not taken off;

- business trips;

- incentives for improvement proposals;

- holiday payments;

- funds received by the employee in the form of financial assistance.

Typical design mistakes

Mistake #1. A woman asks her employer to grant her another vacation immediately after the end of her maternity leave. The boss refuses, based on the fact that the employee has too little work experience.

In this situation, the employee’s work experience does not play a role, and she has the right to demand calendar leave in any amount.

Mistake #2. Upon returning from leave to care for a child under 3 years old, the employee wrote an application to begin work in order to begin her job duties.

The law does not provide for any special procedure for returning to work after parental leave.

Leave after maternity leave: example of determining the billing period

For employees whose work experience exceeds six months, the rate is 100% of average monthly earnings. The calculation period is equal to the previous 2 years of work; accordingly, if a woman has been working in the company for many years, the next vacation does not affect the amount of the benefit.

After a woman has a baby, she is entitled to an allowance to care for him until he is 1.5 years old. It is calculated as 40% of average monthly income, if the calculation is made for an incompletely worked month - as 40% of earnings multiplied by 30.4.

Payment for calendar leave is approximately 60% higher than the benefit for caring for a newborn.

An example of calculating vacation pay after maternity leave

Secretary-referent Prigozhina M.S. started working at Alfa-M LLC on August 4, 2014. She was on labor leave from November 16, 2015 to March 28, 2016, and on maternity leave from March 29, 2016 to November 12, 2018. Before going on leave for the BiR Prigozhina M.S. Once I took a vacation for 14 calendar days. Now she wants to take another 14 calendar days off from November 13, 2018.

This means that for the purposes of calculating vacation pay, Prigozhin M.S. worked 16.07 days in July 2020. ((31 days – 14 days) / 31 days x 29.3 days). Then the total number of days worked in the billing period is 338.37 days. (11 months x 29.3 days + 16.07 days).

This is important to know: Child care leave for a military man