Payment of wages in cash - legal regulation of the issue

Russian legislation quite strictly defines the procedure for paying wages to workers - both in cash and in non-cash form. At the same time, this issue is regulated by a fairly large number of individual provisions of various regulatory documents and acts, which first of all should be familiarized with Russian employers and workers who are interested in observing their rights from the point of view of the law. Thus, the legal basis for various legal requirements is provided by the following provisions:

- Article 131 of the Labor Code of the Russian Federation considers the forms in which salaries should be paid to Russian citizens. The standards require the payment of earned funds either in cash or in kind, and the volume of the latter cannot be more than 20% of total earnings. Salaries are paid only in national currency, with the exception of remuneration for employees abroad and their business trips.

- Article 136 of the Labor Code of the Russian Federation prescribes a specific procedure for the payment of funds earned by workers. According to it, wages can be paid either at the place of work, that is, in cash, or by transfer to an account specified by the employee in a credit institution.

- Federal Law No. 161 dated June 27, 2011. This law regulates the activities of the special Russian national payment system “MIR”. In particular, some provisions of this law indicate the mandatory use of this system when paying employees of budgetary institutions, as well as when paying state benefits.

- Federal Law No. 173 dated December 10, 2003. This regulatory act regulates the procedure for recording and conducting foreign exchange transactions, which may also include the payment of wages due to a non-resident, which implies a certain restriction on the issuance of it in cash in 2020.

The above regulations are basic and are valid throughout the Russian Federation. However, in addition to them, the issue of issuing wages in cash may be regulated by other additional legal acts in certain situations related to the special nature of the activity, industry or region.

Non-cash (IP)

The procedure for issuing wages by bank transfer to an individual entrepreneur

The employee can choose the bank to receive his salary. To do this, he needs to write a statement.

Individual entrepreneurs have no obligation to maintain cash discipline and draw up cash orders/

Step 1. Transfer money from the account to cards marked “Salary for March 2020 from individual entrepreneur L.V. Ivanov” (example)

Samples of payment orders for salaries and taxes and the Free Business Pack program for their formation.

Step 2. Using the simplified tax system for income-expenses or OSNO, classify wages as expenses in the KDiR

Step 3. Ask to sign the pay slip

Salary is issued according to payslip

Always. This is stated in Labor Code Article 136. It is drawn up in free form. In the payslip, it is necessary to indicate all the “white” payments that the employee is entitled to.

The employee signs the payslip once a month upon final payment.

Paying salaries in cash – is it prohibited or not in 2020?

Directly in the standards of Russian legislation there are no restrictions on the payment to citizens of the Russian Federation of their wages in cash. Thus, the employer establishes the general procedure for paying wages in the internal documents of the organization, and also necessarily reflects this fact in the employment contract with the employee - wages can be paid either in cash or by crediting funds to the employee’s bank account.

At the same time, if the employer ensures payment of wages in cash in 2020, he must also follow a certain procedure - certain restrictions are imposed on the source of funds, the time of settlements with the employee and the procedure for processing accounting entries and cash orders during the issuance of wages.

This article deals exclusively with the payment of official wages in cash. Payment of salary in cash is prohibited in 2020 if he is given a gray salary or black salary - such actions are considered a violation of the law in any case, regardless of the circumstances. Although, despite the presence of strict government prohibitions, the practice of issuing part of the salary in cash “in an envelope” still takes place and is quite widespread7.

In general, the employer is obliged to comply with the established procedure for issuing wages in accordance with the individual employment contract, collective agreement or other local acts of the organization. Thus, if they provide for the payment of wages only in non-cash form, the employer cannot pay employees in cash without their consent. However, despite the fact that the legislation does not establish clear prohibitions for the majority of workers, there are a number of categories of workers for whom there is a ban on payment in cash.

Social contributions for employees and payroll taxes

The employer is obliged to transfer 13% personal income tax for the employee, as well as contributions from his own pocket to the Pension Fund, FFOMS, TFOMS, Social Insurance Fund. These deductions depend on the tax regime and type of activity. You can get the calculation here: Salary and insurance premium calculator Calculation of salary, sick leave and personal income tax for a certain period.

Step 4. Ask to sign the pay slip

Salary is issued according to payslip

Always. This is stated in Labor Code Article 136. It is drawn up in free form. The payslip must indicate all the “white” payments that the employee is entitled to.

The employee signs the payslip once a month upon final payment.

Using this online service for individual entrepreneurs and small companies or this online service for organizations, you can conduct tax and accounting on the simplified tax system and UTII, generate payment slips, 4-FSS, SZV, Unified Settlement 2020 and submit any reports via the Internet, etc.( from 250 rubles/month). 30 days free. For newly created individual entrepreneurs, now the first year on the Premium tariff is a gift (free).

Who is prohibited from paying wages in cash?

According to the legislation regulating foreign exchange transactions, these include all payments and transfers of funds and rights to alienate them between residents and non-residents of the Russian Federation. This includes payment of wages to foreign citizens or stateless persons, even when they are fully officially employed in the Russian Federation and in accordance with the requirements of Russian law. Accordingly, the legal regulation of such relationships is subject to additional restrictions of currency legislation, which oblige employers to conduct all payments with foreign employees exclusively in non-cash form.

Accordingly, in 2020 it is prohibited to pay wages in cash to foreigners without the possibility of circumventing such a ban. Even if the employee himself desires to receive funds through the company’s cash desk, the employer cannot ignore the restrictions established by law.

But besides this category of employees, there are others who are subject to additional restrictive standards. Thus, changes from July 1, 2020 prohibit the payment of wages in cash to employees of budgetary institutions and civil servants in general cases - it is allowed only if it is impossible to ensure non-cash payments to such employees.

Non-cash payments with all employees of budgetary institutions, as well as with persons in the municipal or public service, should be carried out exclusively through the use of the national payment system. A similar approach has been used since July 2020 to ensure the safety of workers’ personal data and state security. But if an employee from the above category does not have the opportunity to receive funds by non-cash means, he may demand payment of wages in cash. For example, if in his locality there are no places where a bank can issue funds without a commission, or if there are religious beliefs that prevent the use of payment cards and accounts. And he cannot be denied satisfaction of such a need.

Employees of budgetary institutions or civil servants can independently choose a credit organization to whose account their salaries will be transferred, provided that this organization works with the national payments system and can provide the opportunity to withdraw earned funds without commissions and restrictions.

Why is a salary card better than cash?

Using bank cards to transfer and receive wages is beneficial for both the employer and the employee. Firstly, it simplifies the work of accountants: they do not need to receive money from the bank, and then count it out personally for each employee, signing statements and other papers - salaries can be transferred to all employees at once with just a click of a couple of buttons.

The same applies to the employee himself: he does not need to stand in line at the cash desk - the salary is automatically transferred to his bank account (card). The benefits of using a salary card do not end there - with its help you can not only save, but also increase your money.

For example, when paying by card, most banks return cashback (up to several tens of percent of the cost of a product or service), and also charge interest (on average, 3-7% per annum) on the account balance every month or once a quarter. At the same time, the cost of servicing some of them is zero (you can familiarize yourself with the best salary cards and choose the one that will be beneficial to you). In addition, if you need a loan, the bank will be more loyal to you if you are its payroll client.

Date of issue of earnings through the cash register

The terms for paying wages through the cash register do not differ from the terms for non-cash transfers to employees’ bank cards. The law does not establish the exact date for the issuance of funds, but the deadline is fixed - no later than 15 calendar days from the date on which the salary accrual period ended.

Thus, no later than the 30th day of the current month, employees must be given an advance payment, and the remainder must be issued in the month following the billing period, no later than the 15th day.

These rules apply equally to all employers. Even if employees of their own free will want to shift deadlines or receive earnings in the form of one monthly amount, it is illegal to do so.

If the salary payment date falls on a weekend or holiday, it should be issued on the previous day.

Procedure and terms of payment of wages

By law, the employment contract specifies only the amount of the employee’s salary, and all other conditions of his working relationship with the employer, namely methods of payment of funds, amounts of advance payments, coefficients, are determined by the provisions of collective agreements, additional agreements or clauses in the staffing table. At the same time, internal corporate documents do not contradict federal and regional laws, otherwise they will be declared invalid.

Labor legislation requires employers to pay salaries to employees of enterprises at least twice a month, and according to the new rules, the period of time between the issuance of funds should not exceed 15 calendar days. These norms do not apply to certain categories of citizens who perform federal service, for example, contract employees in the Ministry of Defense - they are paid once a month. The number of payments may be more than two; many organizations have established an internal procedure according to which employees receive wages weekly.

Important points

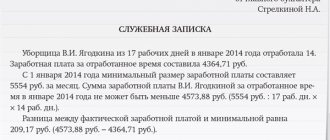

If an organization pays wages in cash, then certain standards should be taken into account. Thus, the period for paying wages from the cash register is strictly limited. The maximum period is five working days. However, the management of the enterprise has the right to shorten this period. Such a decision will have to be enshrined in a separate regulatory act.

All cash transactions, including payment of wages through the cash register, must be documented with appropriate documentation, both primary and accounting. The organization is obliged to determine which forms will be used in processing cash transactions. It is permissible to use standardized forms or develop your own forms. Approve all forms in the accounting policy (in the appendix) or in a separate order.

conclusions

Payment of wages is one of the most pleasant moments of working life. Receipt of funds can be carried out in cash or non-cash.

Each employee has the right to independently choose the most suitable option for him. If desired, he can contact his manager to change the method of receiving his salary.

All the nuances concerning this topic are reflected in Article 136 of the Labor Code of the Russian Federation. All actions of the employer and employee must be carried out on the basis of current legislation.

The procedure for issuing money to employees from the cash register in accordance with the payroll

Regardless of which accounting document the money will be issued from the cash register, the entire procedure will be identical.

| Algorithm of sequential actions of a cashier | Process details |

| Preparation of payroll T-53 for payments (other accounting document of a similar purpose) | The payment document in T-53 format must be filled out properly and signed by the chief accountant and the head of the organization. When finished, it is handed over to the cashier. |

| Checking the T-53 statement by the cashier | The person responsible for issuing money (cashier) checks the received statement for compliance with the standard sample, all amounts and cash available in the cash register, and the presence of all signatures |

| Payment of wages to employees in accordance with the prepared statement T-53 | Money is issued to each employee who is indicated in the statement upon presentation of a passport (other identification document). The sequence of actions of the cashier will be as follows: · reconciliation of the passport data (other presented document) with the data recorded in the statement; · calculating the amount of cash to be issued; · issuing the calculated amount of money to the employee; · affixing the employee's signature on the statement opposite his/her name for receiving a salary |

| Issuance of salary by proxy | Produced in a similar manner. But opposite the salary recipient’s surname, the cashier writes down the initials of his authorized representative, who is tasked with collecting the money. Next, an entry is made “by proxy”. The power of attorney is subsequently attached to the statement |

| Escrow of unpaid money and closing statements | If wages are not paid on time, the cashier will deposit the unpaid amounts as follows: · a stamp is placed opposite the full name of the employee who was not paid; · a note “deposited” is made next to it; · the deposited amount is recorded in words and figures; · cashier signs; · after closing the statement is transferred to the accountant |

Payment of money according to the payroll is made during the time designated by the head of the organization. Typically this is 5 working days. The countdown starts from the day the money is received from the bank. Exceeding the generally established deadline of five days is prohibited.

After closing the payroll, based on the results of payments, an order (RKO) is drawn up, the details of which are written down in the payroll. The main purpose of a cash order is to display the amount issued to employees. The date of its registration is the last day of payment of salaries. The payroll is an appendix to the cash register. Accordingly, the original statement data must also be recorded in the order.