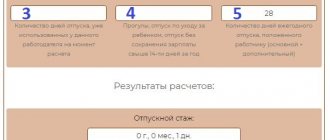

Using the calculator

The rules for calculating compensation provided for in Article 236 of the Labor Code of the Russian Federation apply not only to wages. The employer is obliged to compensate for delays in any payments due to employees in connection with the performance of their labor duties, namely:

- wages;

- redundancy benefits;

- vacation pay;

- compensation for harmful working conditions;

- maternity payments, etc.

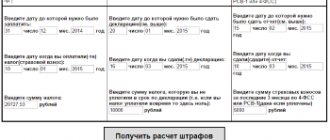

In accordance with the requirements of labor legislation, the calculator calculates compensation based on the key rate established by the Central Bank of the Russian Federation for the period of debt formation.

The key rate is a constantly changing indicator. For example, during 2020 alone it was changed four times. The calculator constantly monitors changes made by the Central Bank of the Russian Federation, and therefore its calculations will always be accurate provided that the user enters the correct payment delay period.

Compensation for delays is set by law at 1/150 of the key rate. The calculation will be made in accordance with the rate in effect during the period that you specify and for each overdue day. The delay period begins from the day following the day on which payment should have been made until the day of actual payment. If there was a change in the key rate during this period, the calculator will take this into account.

The amount owed will be considered the amount actually due for payment. That is, the amount of debt will be equal to the salary for the period of delay. If there is a two-month delay in salary equal to 25,000 rubles, the amount of debt will be equal to 50,000 rubles.

We calculate on our own

The legislation provides that monetary compensation for the fact of delayed wages should be accrued from the first day following the day on which wages should be paid. Even if this day is considered a non-working day. Calendar days are taken into account when calculating the number of days subject to compensation. Also taken into account is the day when the salary will be paid.

If the established day for issuing wages falls on a weekend or holiday, then its payment must be made the day before (that is, before the day off).

Using the formula

To calculate the amount due to an employee for late wages, you must use the formula:

Compensation for delay = amount of delayed salary x days of delay x 1/300 x refinancing rate

In 2020, this compensation payment formula does not change. The only thing is that the refinancing rate will change, so you should definitely monitor this indicator on the website of the Central Bank of the Russian Federation.

The amount of compensation may be increased if stipulated in the employment or collective agreement.

Example

The company has established salary payment dates:

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles. he was paid on the date of the advance. And the rest of his salary in the amount of 25,000 rubles was paid to him only on the 19th (instead of the 4th).

So, the delay period is 15 days. The key rate for calculating penalties in January 2020 is 10% - it must be expressed in fractions of a unit - 0.1. (There is information that the refinancing rate will decrease throughout the year, so this information needs to be monitored).

Compensation for delay: 25,000 * 15 * 1/300 * 0.1 = 125 rubles.

Let's take the same example, but assume that the amount of compensation is established in the employment contract and is 12%, which in shares is equal to 0.12.

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles.

he was paid on the date of the advance. And the rest of his salary in the amount of 25,000 rubles was paid to him only on the 19th (instead of the 4th).

So, the delay period is 15 days.

Compensation for delay: 25,000 x 15 x 1/300 x 0.12 = 150 rubles

It happens that an employer delays wages for more than 15 days. What if this delay occurs at the junction of calendar years? How to calculate in this case?

Example

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles.

he was paid on the advance date (November 18, 2020). And the salary in the amount of 55,000 rubles, suppose, was paid on January 18, 2017. Non-payment period: 27 days in December 2020 and 18 days in January.

The employment contract does not provide for compensation for delays, so we calculate at the refinancing rate. In 2020 it was 11%, and the key rate this year is 10%.

We count: (55000 x 27 x 1/300 x 0.11) + (55000 x 18 x 1/300 x 0.1) = 874.5 rubles.

As you can see, the amount of compensation depends on the number of days of delay, the current refinancing rate (or the percentage of compensation established by the employment contract).

Using an online calculator

To calculate compensation, you can also use an online calculator

compensation payments.

This calculator calculates the amount of compensation for delayed wages in accordance with Article 236 of the Labor Code of the Russian Federation and using current refinancing rates.

It's very easy to use. Just enter the salary data in the appropriate fields and click the calculate button.

For the convenience of calculations, you can use the online compensation calculator for delayed wages on our website.

Compensation options

Before you begin calculating compensation, you must be sure to familiarize yourself with the conditions written down in the employment or collective agreement. It is quite possible that the contracts provide for other compensation rates. The fact is that Article 236 of the Civil Code stipulates the minimum amount of compensation, while the employment contract may provide for higher percentages.

Please note: It does not matter to the employee why the payments were delayed. This could be the illness of the accountant or the dishonesty of the employer’s business partner, that is, the delay may occur through no fault of the employer. But this does not relieve him of the obligation to pay compensation.

Tips for the employer - what are the risks of delaying wages during the coronavirus period?

We have prepared for you a selection of materials that will help you understand the intricacies of calculating salary compensation and warn you about the possible dangers of salary delays that you did not know about or have forgotten:

| Question | Answer | Explanation | Details |

| Can an employer refuse to pay wages citing force majeure due to coronavirus? | Can not | Labor legislation does not contain such permission (Articles 22, 136, 236 of the Labor Code of the Russian Federation, etc.) | Employee and employer: rights and obligations |

| When should wages be paid during the period of self-isolation and suspension of activities? | At least every 15 days (Article 136 of the Labor Code of the Russian Federation). Specific dates are approved by an employment or collective agreement or a separate order | Self-isolation and lack of activity due to coronavirus does not affect the employer’s obligation to pay wages on time | Salary payment deadline for March and April 2020 |

| How can employees react to delayed wages? | Complain to the labor inspectorate, which will provoke an unscheduled inspection of the State Labor Inspectorate. Contact the court or prosecutor's office | subp. “b” clause 10 of the Regulation on supervision in the sphere of labor dated 01.09.2012 No. 875 | Where to complain about an employer |

| Apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments | clause 1 art. 7 of the Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)” | Bankruptcy of an employer for delayed wages | |

| Stop work if wages are overdue for more than 15 days (unless included in a special list) | Art. 142 of the Labor Code of the Russian Federation, clause 57 of the Resolution of the Plenum of the Supreme Court of March 17, 2004 No. 2 | Employer's financial liability for delayed wages | |

| What additional expenses will the employer have to bear if wages are delayed? | Each employee will need to be compensated for delayed wages. | Art. 236 Labor Code of the Russian Federation | Compensation for delayed wages: calculation |

| Employees should be paid the average salary for the entire period of absence from work if they warned the employer in writing about the suspension of work due to a delay in wages of more than 15 days | Art. 142 Labor Code of the Russian Federation | The procedure for calculating average earnings | |

| You may have to compensate workers for moral damages | Art. 237 Labor Code of the Russian Federation | Responsibility for salary delays in 2020 | |

| How will an employer be punished for delaying wages? | Administrative fines | Part 6, Part 7 Art. 5.27 Code of Administrative Offenses of the Russian Federation | Responsibility for salary delays in 2020 |

| Material liability | Art. 236 Labor Code of the Russian Federation | ||

| Criminal prosecution | Art. 145.1 of the Criminal Code of the Russian Federation | ||

| How will the employer suffer if wages are delayed due to an error in payment details? | The employer is obliged to pay compensation for delayed wages if the error was not the fault of the employee | Art. 236 Labor Code of the Russian Federation | Transfer of salary using incorrect details |

| Where will you get money to pay salaries if the company’s activities are suspended due to coronavirus? | Take advantage of government support (subsidies for wages, interest-free loans, etc.) | Measures of the Russian Government to support companies, citizens and the economy as a whole | How to get 12,130 rubles. for employee salaries due to coronavirus |

The employer is obliged to pay, but does not pay

Calculating compensation due to an employee is sometimes purely academic, especially when the employer is in financial trouble. That is, the employer knows that he owes, but is not going to or cannot pay the debt.

In this case, the employee has only one option - to court.

You can draw up a statement of claim yourself using tips from the Internet. The requirements of the statement of claim should include:

- collection of net wage arrears;

- recovery of compensation based on calculator calculations;

- recovery of moral damages (optional, upon request).

It is very important not to miss the statute of limitations, which for these categories of claims is shortened and is only three months. Article 392 of the Labor Code of the Russian Federation determines the beginning of the limitation period from the moment when the employee learned about the fact of the delay.

As a rule, the employee learns about the fact of a delay in payment on the day when the payment should have taken place according to schedule. However, there are exceptional cases when information is received late, for example, in the case of an employee’s illness, due to which he could not call work, could not clarify whether the money was transferred to the salary card, and did not contact any of his colleagues.

The delay in payment of severance pay begins to be calculated from the moment the employee was given the work book. In connection with the transition to electronic work books planned by the Government of the Russian Federation, perhaps we should expect changes in the Labor Code regarding the calculation of the delay in payments upon dismissal.

Advice! Remember that your employer is not going to play the role of a lamb in court. It is possible that he will try to prove that you missed the deadline for filing a claim. It's not that difficult to do. For example, provide testimony that the sick employee was notified of the delay in salary personally by the chief accountant. Therefore, it is best not to delay going to court, especially since labor disputes are not subject to state duty.

If the employer delays wages and does not transfer compensation for the delay

If the company voluntarily does not accrue and pay a penalty for late transfer of wages or final payment, you can file a claim with the court and obtain a court decision to collect a penalty from wages. It is necessary to indicate the amount of unpaid wages, the period of delay and calculate the amount of compensation to be collected. An employee can go to court within a year (Article 392 of the Labor Code of the Russian Federation).

The organization will be obliged to comply with the court decision that has entered into force. To speed up the receipt of funds, the employee can present a writ of execution to the bank where the organization is serviced (Article 8 229-FZ of October 2, 2007). Or you can transfer it to the bailiff service for collection.

Appeal to other authorities

It should be remembered that only a court can recover money from an employer. It is quite possible that you will be advised to file a complaint with the Prosecutor's Office or the labor inspectorate, and it is quite possible that these authorities will help you. However, please remember that:

- The prosecutor's office and labor inspectorates are extremely slow structures. The period for considering citizens' applications there is a month, but by the time you receive an answer, it may well take a month and a half.

- The orders of these authorities cannot oblige the employer to pay you.

- Contacting labor inspectorates does not suspend the running of the statute of limitations. If we assume that you waited a month and a half for the employer to pay voluntarily, then waited a month and a half for the inspectorate to wag its finger at the employer, then you have already missed the deadline for going to court.

- The court may recognize the missed deadline as valid due to the fact that you were waiting for a response from the labor inspectorate. Or maybe he won’t admit it. Just remember that the courts are overloaded with work, and every new lawsuit is a tragedy for the judge. Therefore, almost any judge will do everything possible to get rid of both you and your claim.

Documents attached to the application

The statement of claim will need to be accompanied by documents indicating, firstly, that you have an employment relationship with the employer, and secondly, documents confirming your claims.

Thus, in general terms, the list of attached documents should look like this:

- An extract from the work book, which can be obtained from the personnel service or from the accounting department of the enterprise.

- Employment contract.

- Interest calculations that you can do using the calculator.

- Optional documents, for example, indicating that you missed a deadline for a good reason or the costs of a lawyer that you are asking to recover from the employer.

- Copies of statements of claim at the rate of “one for the court, one for the defendant.”

When submitting an application, it would be useful to have an additional copy with you, on which the court employee will put a mark of acceptance.

Amount of compensation for delayed wages

Such compensation is calculated according to the following formula (Article 236 of the Labor Code of the Russian Federation):

The employer must pay compensation for the period of delay starting from the day following the established day of payment of wages until the day of its actual payment, inclusive. For example, employees should have received their salary on 03/06/2020, but the employer paid it only on 03/20/2020, respectively, in this case the number of days of delay will be 14 days (from 03/07/2020 to 03/20/2020 (inclusive)).

By the way, the employer has the right to increase the amount of compensation paid. This amount must be specified in the collective agreement, employment contract or in the LNA (Article 236 of the Labor Code of the Russian Federation).

What means

The article presents the following features and rules:

- the employer must provide compensation for delays in payment of wages, vacations, in the event of an employee being laid off or dismissed at his own request;

- if the employee is not paid on time, interest on the amount owed begins to accrue from the first day after the official dismissal (the last day);

- interest is accrued in the amount of 1/150 of the key rate established by the Central Bank;

- the rate is applied for each day of delay in payment;

- if part of the balance is paid, interest is charged only on the remaining debt;

- if the employment contract specifies other amounts of compensation, they are taken into account when calculating interest - in this case, Article 236 of the Labor Code of the Russian Federation is not involved in the calculations.

Interest for late payment will be accrued in any case - it may not be the employer’s fault. Often, such situations arise when the accounting department did not transmit information to the bank on time about the transfer of the calculated amount.

If management submitted an order to transfer wages to an employee upon dismissal or liquidation of an enterprise, the money was received by the bank, but the employees of the financial and credit institution did not make the transfer in a timely manner, the employer will not be held liable. Employees must clarify all questions with bank employees.

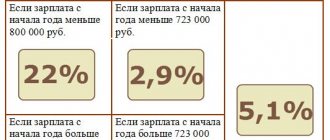

Compensation for delayed wages: insurance premiums

According to the Ministry of Finance, compensation for delayed salaries is subject to insurance contributions (Letter of the Ministry of Finance of Russia dated 03/06/2019 N 03-15-05/14477). However, the Supreme Court believes that compensation for delayed wages refers to compensation related to the employee’s performance of his work duties, which in turn are not subject to contributions (Decision of the Supreme Court dated 05/07/2018 No. 303-KG18-4287). But if you are not ready to take the dispute with the tax authorities to court, it is safer to charge contributions from compensation for delayed wages.

Basic concepts and comments

Unfortunately, situations where an employer refuses to fulfill its obligations to a subordinate, thereby violating his rights, are not uncommon, but this is not at all a reason to put up with it and not defend one’s own interests in the relevant authorities. But before filing a complaint, it would not hurt to familiarize yourself with the basic provisions of Article 236 of the Labor Code of the Russian Federation governing this issue.

In case of delay or refusal to pay benefits due under the Labor Code or contract, the employer is subject to penalties, which are added to the outstanding debt. Typically, the amount of the fine is determined at the rate of the Central Bank currently in effect and corresponding to 1/300 of the amount of the unpaid benefit. In this case, a kind of cumulative system is used, which makes it possible to take into account each subsequent day of downtime until the payment of monetary compensation and the penalty attached to it (this day also applies to settlement days).

The amount of compensation can be regulated upward in accordance with regulatory documents - a collective or labor agreement, as well as local acts adopted by the employer within its competence in full compliance with current labor legislation.

As for the timing, interest begins to automatically accumulate from the moment the employer fails to fulfill its obligations to the employee, that is, from the next day after the official dismissal.

https://youtu.be/O_Bjk1t1imc

If an employee does not receive severance or any other benefit through no fault of the enterprise, the obligation to repay the resulting debt still falls on the employer. All other provisions are given in Art. 236 of the Labor Code of the Russian Federation in the new edition with comments for 2017-2018. The main ones are:

- The amount, validity period and procedure for paying off financial liability for late payment of benefits are regulated by current labor legislation.

- The terms of payment of wages, vacation pay, compensation for unused vacation, maternity benefits are determined by Art. 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages.” Payments of severance pay and the procedure for calculating employees are regulated by another prescribed legal norm, which is Art. 140 “Terms of calculation upon dismissal.” To receive all the required payments, the employee does not need to write any statements addressed to management, since all accruals are carried out automatically based on the relevant orders. In this case, the employer undertakes to repay in one day not only the delayed wages or severance pay, but also the interest accrued during this period.

- If a fine has been imposed on an enterprise with corresponding obligations to repay the current debt (such actions are within the competence of the labor inspectorate), but the implementation of this decision is delayed, then the employee retains the right to file a complaint with the judicial authorities. If the claim filed by him is satisfied, the court must issue an appropriate order based on Art. 122, which can be used as an executive document.

- The article does not apply when disputes arise regarding the payment of compensation for overtime work and in some other situations that can be resolved amicably by employees and representatives of management positions of the enterprise.

- The employee always retains the right to demand indexation of the delayed amount due to inflation of the national currency and rising prices for essential goods.

- For some industries, separate rules for calculating benefits and interest for their delay are provided. Thus, when concluding tariff agreements, the recovery percentage can be much higher than the norm prescribed by law. If wages are delayed by 2 weeks or more, management pays compensation in the amount of average monthly earnings. If the delay does not exceed 15 days, then for each day it is necessary to collect at least 1/200 of the Central Bank rate established at the time of the delay.

- All deadlines for filing claims for repayment of the resulting debt are given in Art. 392 “Time limits for applying to court for resolution of an individual labor dispute.”

Starting from December 1, 2008 and to this day, a 13 percent annual refinancing rate is in effect at the rate of the Central Bank of the Russian Federation. It is this value that is used to calculate compensation for delayed wages under Art. Labor Code of the Russian Federation 236. At the same time, in Art. 233 “Conditions for the onset of material liability of a party to an employment contract” provides for certain exceptions, among which it is worth highlighting the imposition of debt obligations on the employer for the employee’s failure to receive benefits and compensation for the delay, regardless of the fault of the former.

Consequences of missing a deadline

If the statute of limitations is missed, the case will not be considered and the judge will make a decision to reject the claim without examining the circumstances of the case.

Therefore, if it happens that you missed the deadline out of laziness or ignorance of the law, then before filing a claim in court, take care of several things:

- Think about how you might motivate missing a deadline. To extend the period, the reason must be valid - illness, caring for a sick family member, funeral, wedding, administrative arrest, etc. But the reason will have to be confirmed. As an option, think about your chronic illnesses, run to the doctor, tell him that you have been feeling bad for two months now, but you have been patient, and let him write it all down in your chart.

- Indicate in the statement of claim that you are asking to reinstate the missed deadline for a valid reason.

- Attach to the claim documents confirming valid reasons for missing the deadline. Perhaps the court will believe you.

If you could not come up with a good reason, then there will be little chance of winning the case. However, you can still file a claim. And at the same time hope that the employer will not come to court and the decision will be made in his absence or that the employer will simply admit your claim.

Current legislation stipulates the following points for the calculation and payment of wages to employees:

- In accordance with Art. 37 of the Constitution of the Russian Federation, everyone has the right to remuneration for work not lower than the established minimum wage.

- Art. 21 of the Labor Code of the Russian Federation establishes that an employee has the right to timely and full payment of wages corresponding to his qualifications, complexity of work, quantity and quality of work performed.

- In Art. 136 of the Labor Code of the Russian Federation states that wages must be paid at least every half month. A specific date is prescribed in the internal labor regulations, collective or employment agreement, but no later than 15 calendar days from the end of the period for which it was accrued.

If the employer does not comply with the above points, he faces financial liability in the form of payment of compensation for delayed wages to the employee, as well as administrative and criminal liability.

We invite you to familiarize yourself with: Sample statement of claim for recovery of material damage from an employee

Monetary compensation is paid to employees of the institution in accordance with Article 236 of the Labor Code of the Russian Federation and must be equal to no less than 1/150 of the current rate of the Central Bank of the Russian Federation on the unpaid amount of wages. Compensation is accrued for each day of delay, starting from the day when the wages due to employees were actually absent. It should be noted that the accrual of monetary compensation does not depend on the presence or absence of the employer’s fault.

RK is the amount of compensation for late wages, SM is the accrual amount, DZ is the number of days of late wages.

Clause 3 art. 217 of the Tax Code of the Russian Federation provides that all types of compensation payments, including compensation for delayed wages, are not subject to personal income tax. Also, in accordance with Resolution No. 13AP-11744/2017 of the Thirteenth Arbitration Court of Appeal dated June 20, 2017, amounts of monetary compensation are not subject to inclusion in the base for calculating insurance premiums.

For the purpose of self-protection of labor rights, Article 379 of the Labor Code of the Russian Federation states that an employee has the right not to go to work if the delay in payment of wages is more than 15 days. In this case, the employee must notify the manager of his actions and receive confirmation of his notification. If the employer refuses to endorse the notice, then it can be sent by registered mail and confirmation will be a notification of its delivery.

Work may be stopped until the debt is fully repaid and resumed only the next day after the institution provides written notification of its readiness to repay the arrears of wages. Payment must be made on the day the employee returns to work. During the period of absence of the employee, his average earnings are retained.

Art. 142 of the Labor Code of the Russian Federation provides for cases when suspension of work is not allowed:

- when a state of emergency is declared;

- in organizations of the Armed Forces of the Russian Federation involved in ensuring the defense of the country and state security, emergency rescue, search and rescue, fire fighting, work to prevent or eliminate natural disasters and emergency situations;

- for civil servants;

- in organizations involved in servicing particularly hazardous types of production and equipment;

- employees whose work is related to ensuring the life of the population (energy supply, heating and heat supply, water supply, gas supply, communications, ambulance and emergency medical care stations).

The employer reserves the right to dismiss an employee if he does not show up for work after the institution has notified him of his readiness to pay the delayed wages in full. In this case, the basis for dismissing an employee cannot be partial payment of the organization’s debt. Also, the employee may not repeatedly notify the institution of his absence from work.

Late payment of wages and other amounts stipulated by labor relations entails a warning or the imposition of an administrative fine in the amount of:

- from 10,000 to 20,000 rub. – to officials.;

- from 30,000 to 50,000 rub. - for a legal entity.

If the institution is repeatedly charged with this offense, the amount of the fine changes to:

- from 20,000 to 30,000 rub. or suspension for a period of one to three years – for officials;

- from 50,000 to 100,000 rub. - for organizations.

Administrative liability arises when the employer is at fault. Also, if the institution was identified as the offender and the responsible persons were identified who were to blame for this violation, then, in accordance with Part 3 of Art. 2.1 of the Code of Administrative Offenses of the Russian Federation, both an organization and an official can be held accountable at the same time.

If the delay in payment of wages and other accruals due to an employee is associated with the employer’s selfish or personal interest, then in accordance with Article 145.1 of the Criminal Code of the Russian Federation, criminal liability is applied:

We invite you to read: Seizure of a land plot - innovations in 2020

- a fine of up to 120,000 rubles or the amount of wages for a period of up to one year;

- deprivation of the right to hold a position or carry out certain activities for a period of up to one year;

- forced labor for up to two years;

- imprisonment for up to one year.

If the organization has not made payments within two months of the accruals provided for by the employee’s labor relations, or has made payments of accruals below the minimum wage level for more than two months, then the employer faces:

- a fine in the amount of 100,000 to 500,000 rubles. or in the amount of wages for a period of up to three years;

- forced labor for up to three years with deprivation of the right to hold a position or carry out certain activities for up to three years;

- imprisonment for a term of up to three with or without deprivation of the right to hold certain positions or carry out specified activities for a term of up to three years.

If the failure to pay wages by the employer has resulted in grave consequences, then the following applies:

- a fine in the amount of 200,000 to 500,000 rubles. or in the amount of wages for a period of one to three years;

- imprisonment for a term of two to five years with or without deprivation of the right to hold an established position or carry out certain activities for a term of up to five years.

In accordance with Art. 14 of the Criminal Code of the Russian Federation, the employer faces criminal liability if the institution has funds and non-payment of wages based on selfish or personal interest.

Payment types

Not all employees of an enterprise have the right to apply for financial assistance under the Labor Code of the Russian Federation (Article 236), but only those who fall into certain categories. We are talking about the following persons:

- Employees working under any type of employment contract or fulfilling their duties in fact (in the latter case, the right to benefits and compensation is regulated by Article 66 “Form of the employment contract”, in which the key point is the employee’s access to his workplace, which implies further payment).

- Workers forced to perform their duties under any other contract created to disguise the employment relationship. If disputes arise regarding monetary payments, the concluded agreement will be automatically equated to a contract if any traces proving labor activity are identified.

In accordance with the current Art. 236 of the Labor Code of the Russian Federation with comments 2017, the dismissal of employees necessarily involves two types of payments - severance pay and compensation for unused vacation or individual days thereof.

However, the benefit options discussed in this legal regulation do not end there. So, this list also includes the following types of payments:

- wage;

- vacation pay;

- payment for temporary disability, which is carried out according to average earnings or tariff rates;

- children's (child care benefits up to one and a half years old);

- payment for downtime at work and failure to fulfill job duties due to a reason beyond the control of the employee;

- monetary compensation in the amount of the average salary for dismissal carried out illegally;

- payment for work services during a business trip;

- compensation for the exploitation of the employee’s personal belongings;

- other options.

In all of the above situations, the employee has the right to claim monetary compensation, however, the algorithm for calculating its amount may change significantly. In addition, each benefit option has its own deadline for the start of accrual of penalties.

https://youtu.be/J1ZE1GbZqBc

Deadlines for payment of wages

The terms of payment of wages are established at each enterprise independently and are prescribed in local regulatory documents. For example, the Regulations on remuneration or the Collective Agreement.

The terms of wages and advance payments must be specified in the employment contract without fail. This must be a specific number; you cannot specify a period.

Example

You can write: salary payment dates are the 1st and 16th of each month.

It is impossible to write: wages are paid from the 1st to the 4th and from the 16th to the 20th of each month.

But when setting the deadlines for paying wages on their own, the employer must remember that the Labor Code has restrictions. Two main ones:

- Salaries must be paid at least twice a month. In practice, this means that no more than 15 days should pass between the payment of wages and the advance, that is, if the salary was paid on the 1st, then the advance should be no later than the 16th.

- The deadline for payment of wages must be no later than 15 days after the end of the month for which it must be paid. In practice, this means that wages for the month of January can be paid on February 15, but no later. It can also be concluded from this that payment of the advance for the current month can be postponed to the last day of the month. This provision was introduced from October 2020.

If the employer sets the terms of cash payments different from those specified in the law, then this will also constitute a violation of the terms of payment of wages.

Accrual of penalties

Before calculating the interest on the delay of any type of benefit, it is necessary to clarify whether it actually happened, because each payment has its own deadlines. The following important nuances are meant:

- Salaries must be paid on a predetermined day or the weekdays preceding it if it falls on weekends or holidays. The next day is already allowed to be included in the calculation of penalties, as well as all subsequent ones, until the full payment of the benefit itself and the interest calculated for its delay is made.

- Vacation pay must be accrued no later than three working days before the start of the vacation.

- Severance pay is accrued on the employee’s last day of work, but only if he was at his workplace.

- If for some reason the employee does not show up to the company, then the salary is paid two days after his notice of resignation from his position.

The beginning of the delay will not be considered the day on which the payment is due, but only the next business day. If there really is a delay, then you can begin to calculate compensation for it.

https://youtu.be/0HLhSF5VITk

https://youtu.be/VmE7fBLstwI

Judicial practice under Article 236 of the Labor Code of the Russian Federation

Determination of the Supreme Court of the Russian Federation dated August 25, 2006 N 5-G06-82

Based on Art. Labor Code of the Russian Federation, the defendant is obliged to pay interest for the delay in payments due, as well as to pay compensation for moral damage in connection with the violation of their labor rights and moral suffering caused by these violations.

At the court hearing, representatives of military unit 01990 and military unit 93603 did not recognize the claim.

Determination of the Constitutional Court of the Russian Federation dated March 2, 2006 N 60-O

This list does not provide as an independent basis such as late payment of wages or other amounts due to the employee. The employer’s financial liability to the employee in such cases is regulated by a special norm contained in an article of the Labor Code of the Russian Federation, which was applied by the court in the applicant’s case.

Review of judicial practice of the Supreme Court of the Russian Federation

Ch. filed a lawsuit against the military unit where he is on pay, demanding compensation for losses caused by late payment of pay in the amount of 319 rubles 88 kopecks, which were calculated by him on the basis of an article of the Labor Code, which provides for the employer’s financial liability for violation of the established deadline for payment of wages.

Review of judicial practice, Appendix to the letter of the FSS of the Russian Federation dated March 21, 2005 N 02-18/07-2407

In accordance with Art. If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time Federation from unpaid amounts on time for each day of delay starting from the next day after the established payment deadline up to and including the day of actual settlement.

Determination of the Constitutional Court of the Russian Federation dated November 24, 2005 N 418-O

In his complaint to the Constitutional Court of the Russian Federation, N.S. Kolpakov asks to check the constitutionality of articles , , , , , , , , , , , , , , , , , and the Labor Code of the Russian Federation, pointing out that his constitutional rights are not violated by these - corresponding, in his opinion, to the Constitution of the Russian Federation - provisions of the Labor Code of the Russian Federation, but by the employer and the courts of general jurisdiction, which did not apply in his case those norms of the Code that were subject to application, and thereby denied him judicial protection. In addition, N.S. Kolpakov asks the Constitutional Court of the Russian Federation to interpret the article of the Labor Code of the Russian Federation, since he believes that it was incorrectly interpreted by the judicial panel for civil cases of the Moscow City Court when considering his cassation appeal.

Determination of the Constitutional Court of the Russian Federation dated February 21, 2008 N 74-О-О

ARTICLES AND ARTICLES OF THE LABOR CODE

RUSSIAN FEDERATION

The Constitutional Court of the Russian Federation, composed of Chairman V.D. Zorkin, judges G.A. Gadzhieva, Yu.M. Danilova, L.M. Zharkova, G.A. Zhilina, M.I. Cleandrova, A.L. Kononova, L.O. Krasavchikova, N.V. Melnikova, Yu.D. Rudkina, N.V. Selezneva, A.Ya. Plums, V.G. Strekozova, O.S. Khokhryakova, B.S. Ebzeeva,

Determination of the Supreme Court of the Russian Federation dated November 14, 2008 N 5-В08-84

Refusing to satisfy the plaintiffs' demands for the recovery of interest for violation of the established deadline for payment of funds, the court proceeded from the fact that the provisions of Art. The Labor Code of the Russian Federation should not be applied in this case, since there is a dispute between the parties about the right to receive compensation and other payments related to the termination of the employment contract.

Resolution of the Supreme Court of the Russian Federation dated March 26, 2010 N 72-AD10-1

According to the case materials, by resolution of the Chief State Labor Inspector of the State Labor Inspectorate in the Trans-Baikal Territory No. 803 dated May 18, 2009, the director of Poliprom LLC Ch. was brought to administrative responsibility under Part 1 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses, for violation of part 6 tbsp. , art. , art. Labor Code of the Russian Federation, expressed in untimely payment of wages, dismissal amounts, non-payment of monetary compensation for the employer’s violation of the established deadline for due payments to the employee of Polyprom LLC K. and was subjected to administrative punishment in the form of an administrative fine in the amount of 2000 rubles (vol. 1, pp. 64 - 65).

Resolution of the Supreme Court of the Russian Federation dated September 14, 2010 N 10-AD10-1

By the decision of the judge of the Leninsky District Court of Kirov dated November 30, 2009, left unchanged by the decision of the judge of the Kirov Regional Court dated January 12, 2010, the resolution of the head of the department of the State Labor Inspectorate in the Kirov Region dated October 30, 2009 was amended: paragraphs 1 were excluded from the resolution, 2, 3, 4, 5 and 6, which contain an indication of the absence in Land Management Bureau LLC of a Book for recording the movement of labor books and inserts in them, the absence of personal cards of the T-2 form, which is a violation of paragraphs 12, 40 of the Decree of the Government of the Russian Federation Federation dated April 16, 2003 N “On work books”; the fact that the organization’s employees, when hiring, do not familiarize themselves with local regulations directly related to their work activities; to the fact that the organization, in violation of articles and the Labor Code of the Russian Federation, has established deadlines for paying wages once a month until the 15th day of the month following the worked month, and in fact, wages are paid to the organization’s employees once a month; that, in violation of the article of the Labor Code of the Russian Federation, for the delay in paying wages to the organization’s employees for the period from January to September 2009, the organization’s administration did not accrue and pay monetary compensation; and also from paragraph 8 of the resolution the indication that the employee of the organization A.N. Chernyadyeva was excluded. and others were not accrued or paid the district coefficient for the period of work 2008 - 2009; the proceedings in the case of an administrative offense regarding these violations were terminated due to the absence of an administrative offense in the action of Land Management Bureau LLC; the amount of the penalty imposed on Land Management Bureau LLC in the form of an administrative fine was reduced to... rubles, the rest of this resolution was left unchanged.

Determination of the Supreme Court of the Russian Federation dated April 2, 2009 N 75-G09-3

October 10, 2007 Ilyin I.A. filed a lawsuit against the department of the State Courier Service of the Russian Federation in Petrozavodsk for the recovery of sums of money, namely, he asked the court to apply the regional coefficient and a percentage increase on the lump sum benefit paid to him, to recover from the defendant in this regard a sum of money in the amount of... rubles. , as well as the amount of payment for overtime work for the period from August 12, 2004 to August 12, 2007, with the accrual of interest on these amounts, provided for in Art. Labor Code of the Russian Federation. In addition, the plaintiff filed a petition to restore the missed deadline for claims for payment of money for overtime work for 2004, 2005 and 2006, indicating that he became aware of the non-accrual of payments in full only at the end of July 2007, the estimated He did not receive salary slips. Before this, he believed that all the time actually spent on work during daily duty and business trips was counted as working time.

1. Labor legislation establishes the financial liability of the employer in case of violation of the established deadline for payment of wages, vacation pay, calculation upon dismissal and other payments due to the employee.

2. For terms of payment of wages and vacation pay, see Art. 136 of the Labor Code, on payments upon dismissal - Art. 140 TK.

To receive monetary compensation, no prior written application to the employer is required. If he violates the established payment deadlines, the employer calculates monetary compensation taking into account the days of delay and pays it to the employee. Article 236 of the Labor Code of the Russian Federation obliges the employer to pay the due compensation simultaneously with the delayed wages. Consequently, monetary compensation for the entire time of delay in payment of wages until the day of actual settlement should not be paid later than the day when the employer paid the employee the delayed wages.

By Instruction of the Central Bank of the Russian Federation dated November 28, 2008 N 2135-U “On the amount of the refinancing rate of the Bank of Russia” (Bulletin of the Bank of Russia. 2008. N 69), the refinancing rate of the Central Bank of the Russian Federation from December 1, 2008 was set at 13.0% per annum.

An exception to the general conditions for the onset of material liability of a party to an employment contract, provided for in Art. 233 of the Labor Code is to impose on the employer the obligation to pay monetary compensation regardless of the presence of his fault, which increases the level of protection of the employee’s interests.

When considering a dispute that arose in connection with the employer’s refusal to pay interest (monetary compensation) to the employee for violation of the deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, it must be borne in mind that in accordance with Article 236 of the Labor Code of the Russian Federation the court has the right to satisfy the claim regardless of the employer’s guilt in the delay in payment of the specified amounts (clause 55 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 17, 2004 No. 2).

3. Imposing on the employer the obligation to pay the specified monetary compensation does not deprive the employee of the right to apply to the court for the issuance of a court order on the basis of Art. 122 of the Code of Civil Procedure, if a demand is made for the recovery of accrued but not paid wages to the employee. A court order (court ruling) issued to an employee to collect wages is also a document of execution.

4. The provision on payment of monetary compensation to an employee does not apply if a dispute has arisen between the employee and the employer about the right to receive this payment, for example, about payment for overtime work performed.

5. Securing the right of an employee to receive monetary compensation for the time of delay in payment of wages does not limit his right to index the amount of delayed payment in connection with the increase in consumer prices for goods and services (see Article 134 and commentary thereto).

6. In concluded industry tariff agreements, the amount of monetary compensation for delayed payment of wages is set at a higher amount compared to the law:

- the time of suspension of work in case of delay in payment of wages for a period of more than 15 days is paid in the amount of average earnings (Industry tariff agreement in the housing and communal services of the Russian Federation for 2008 - 2010, Industry tariff agreement for organizations and enterprises in the sphere of consumer services for the population for 2008 - 2010);

- The amount of compensation for each calendar day of violation of the established deadlines for the payment of wages or amounts due to the employee upon dismissal is set not lower than 1/200 of the refinancing rate of the Central Bank of the Russian Federation in effect on the day of the established payment deadline (Federal Industry Agreement on the Aviation Industry of the Russian Federation for 2008 - 2010 years).

If a collective or labor agreement determines the amount of interest to be paid by the employer in connection with the delay in payment of wages or other payments due to the employee, the court calculates the amount of monetary compensation taking into account this amount, provided that it is not lower than that established by Article 236 of the Labor Code of the Russian Federation. The accrual of interest in connection with late payment of wages does not exclude the employee’s right to index the amounts of delayed wages due to their depreciation due to inflationary processes (clause 55 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 17, 2004 No. 2).

7. For information on the deadline for going to court regarding the collection of accrued but unpaid wages, see the commentary. to Art. 392.

Based on the law, the management of the enterprise must count the resigning employee on the last working day. But since this does not happen, changes were made to the articles of the code to calculate compensation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!