Calculator to calculate the new vacation period after maternity leave

The duration of maternity leave is 140 days or 4 months 20 days, which is rounded up to 5 full months.

With an annual duration of 28 days, each month is allotted 2.33 days (28/12), therefore, during maternity leave for pregnancy, a woman is allotted 2.33 * 5 = 11.65 days. But the employee can continue working without going on maternity leave. Receive compensation and benefits Pregnant working women, according to legislative norms, have the right to a break from work for 140 days (196 days for multiple pregnancies), 70 (86) of which are provided before delivery, and 70 (110) after.

How to calculate the period of work after leaving maternity leave?

The only thing I don’t understand is how did you get the date April 14? Email Password is someone else's computer

Right. Taxes. Business

- Made in St. Petersburg

© 1997 - 2020 PPT.RU Full or partial copying of materials is prohibited; with agreed copying, a link to the resource is required. Your personal data is processed on the site for the purpose of its functioning.

If you do not agree, please leave the site. Class Collapse Top

Legal advice Help from experienced lawyers and attorneys Expert advice Solving accounting and legal issues in the professional community Best specialists More than one answer You can ask a question for free here and now Personal question from a private person (labor disputes, social services)

Calculate the new vacation period after maternity leave online

In particular, it states that the time when the employee did not actually work, but in accordance with the law, retained his place of work, is subject to recording. Maternity leave falls under this condition, since it relates to a period of temporary incapacity for work during which the employee retains his place of work (Art.

According to Article 260 of the Labor Code of the Russian Federation, this category of employees is entitled to a paid rest period, the duration of which cannot be less than 28 days. In some cases, this period may be increased, but it cannot be reduced under any circumstances. In addition, when calculating the days of allotted leave, days unused before maternity leave, accrued to her before she went on sick leave for pregnancy and childbirth, can be taken into account. Also, days off are calculated for 140 days during which the woman was on maternity leave. The period of child care does not give the right to another vacation, since it is not included in the vacation period.

Vacation days calculator

Important

How many days are required, how to calculate vacation pay? For women on maternity leave, Article 260 of the Labor Code of the Russian Federation provides for the possibility of receiving annual paid leave immediately after the end of maternity leave for pregnancy or child care. Is rest really required, what conditions must be met, and how to calculate the number of days off? See the article below for answers. CONTENT:

- Is it allowed under the Labor Code of the Russian Federation?

- How to count days? During pregnancy sick leave

- While working before going on maternity leave

- Example

- Example

Is it allowed under the Labor Code of the Russian Federation? The decree is a long period combining:

- Sick leave for pregnancy and childbirth lasting 140 days.

- Child care up to 3 years old.

Usually the first smoothly flows into the second.

Calculator to calculate the new vacation period after maternity leave

Days excluded from the vacation period shift the end of the employee’s working year (Letter of the Ministry of Labor of Russia dated October 18, 2016 N 14-2/B-1045). For example, an employee was hired on April 11, 2016. From 09/05/2016 to 09/23/2016 he took unpaid leave.

Immediately after returning to work, Nekrasova turned to the head of the company to arrange annual paid rest time. In accordance with the legislation of the Russian Federation and the internal documentation of the organization, a woman is entitled to leave of 28 days. The calculation period in this case is the period of time from November 22, 2013 to November 21, 2014. Calculation: The first action that needs to be taken to calculate vacation pay is to determine the amount of income received for the year. The formula given above is used for this. It is assumed that in this example, the amount of total income for the specified period reached 500,000 rubles.

How to take a vacation after maternity leave in 2020

Vacation Every year, an enterprise operating on an official basis is obliged to provide employees with time for rest - annual paid leave. If an employee has been absent for a long period of time due to being on maternity leave, then the calculation of vacation pay for the next vacation has a number of features. Below are the necessary formulas and examples of calculations. Table of contents:

- How to calculate the days after leaving maternity leave?

- What billing period should I use?

- Calculation of average earnings?

- Vacation formula for annual holidays

- Example for 2020

- Useful video

Often, employees whose maternity leave is coming to an end turn to their employer to arrange annual rest time immediately after returning to work.

Free legal assistance

Thus, the next working year after leaving parental leave will be: November 26, 2015-November 25, 2016. Second situation: When hired, the employee’s working year was 09/23/2012-09/22/2013, which includes parental leave until the child reaches the age of 3 years, which is not included in the length of service giving the right to basic leave, thus it is necessary to shift the working year to this period 09/23/2013-03/03/2014 - this period is 05 months and 11 days. 08/19/2015-03/07/2016* is a composite working year for which the employee is entitled to 28 calendar days of leave upon completion of maternity leave.

Pregnant working women, according to legislative norms, have the right to a break from work for 140 days (196 days for multiple pregnancies), 70 (86) of which are provided before delivery, and 70 (110) after. If complications arise during pregnancy or childbirth, the law allows for an additional extension of leave. After the birth of a child, the mother takes leave to care for the baby, which lasts until he is 1.5 years old. It can be extended up to 3 years. In the article we will tell you about the next vacation after maternity leave in 2020, and we will give examples of calculating vacation payments. Going on vacation is a woman’s right, but not her responsibility, that is, if she wants to continue working, the employer cannot force her to rest. He is also not allowed to shorten the period of maternity leave, regulate it in any way, or completely cancel it.

Enter the site

RSS Print

Category : Labor legislation Replies : 656

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. ...Next. → Last (66) »

| olga [email protected] Belarus, Minsk Wrote 15 messages Write a private message Reputation: | |

| Please tell me how to calculate the working year for a maternity leave after leaving maternity leave: previous working year 02/26/2005-02/25/2006, 07/03/2006-04/09/2008-maternity leave!!! Help, I'm completely confused!!!! | |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Oksana (guest) | #2[27672] August 15, 2008, 8:31 am |

Notification is being sent...

| olga [email protected] Belarus, Minsk Wrote 15 messages Write a private message Reputation: | #3[27788] August 15, 2008, 1:03 pm |

Notification is being sent...

| Thorn [email hidden] Belarus, Minsk Wrote 9 messages Write a private message Reputation: | #4[84218] May 25, 2009, 11:04 |

Notification is being sent...

I am a beginner HR manager with virtually no experience. I immediately apologize if I slow down a little or ask what you think are stupid questions. Thanks for understanding.| Guest (guest) | #5[84275] May 25, 2009, 1:47 pm |

Notification is being sent...

| Ciardi [email hidden] Belarus Wrote 23477 messages Write a private message Reputation: 3447 | #6[84291] May 25, 2009, 2:39 pm |

Notification is being sent...

| Alesya [email protected] Belarus, Minsk Wrote 3 messages Write a private message Reputation: | #7[85799] June 1, 2009, 13:03 |

Notification is being sent...

| Ciardi [email hidden] Belarus Wrote 23477 messages Write a private message Reputation: 3447 | #8[85869] June 1, 2009, 15:48 |

? (07/06/2003-07/05/2004??) 3. From what date was social leave issued?

for child care

(not on pregnancy and childbirth) I want to draw the moderator's attention to this message because:

Notification is being sent...

| Alesia [email protected] Belarus, Minsk Wrote 34 messages Write a private message Reputation: | #9[191605] June 14, 2010, 9:34 |

Notification is being sent...

| Alesia [email protected] Belarus, Minsk Wrote 34 messages Write a private message Reputation: | #10[191690] June 14, 2010, 12:43 |

Notification is being sent...

« First ← Prev. ...Next. → Last (66) »

In order to reply to this topic, you must log in or register.

Vacation after maternity leave: period, calculation

The employee did not work during the reporting period. Calculation will be carried out based on the accrued salary before the birth. The amounts of maternity and vacation pay will not change compared to the first option. But there is one nuance that is worth paying attention to. Enterprises index salaries annually. After a 1.5 or 3 year break, the salary will increase significantly. Therefore, it makes sense to work for a couple of months (then a new period will be taken for vacation calculations), and then go on vacation.

This is interesting: Composition of the boundary plan to clarify unified land use

A pregnant employee is entitled to 140 days of rest: half before giving birth and the rest after. Next, maternity leave is provided for 1.5 years with the possibility of extension up to 3 years. The countdown begins from the 30th week of pregnancy, if a woman is expecting twins - from the 28th. In the second case, rest is provided for 86 days before and 110 days after childbirth. For all these periods, a monetary payment is due (Articles 255, 256 of the Labor Code of the Russian Federation). But the employee can continue working without going on maternity leave. The benefit amount is significantly less than the salary level, so many mothers work until childbirth and return immediately after. The employer has no right to reduce, regulate or even cancel maternity leave.

Rules for calculating vacation pay after maternity leave

Dividing this number by 12 months, we get 28,000, and dividing the resulting figure by 29.3, we get the daily average of 955.6 rubles. We multiply this total by the number of days of rest, that is, by 30, and we get 28,669 rubles. Citizen Kotelnikova will be paid vacation pay after her maternity leave with this amount.

In Art. 255 and 256 of the Labor Code of the Russian Federation states that a pregnant employee is guaranteed 140 calendar days of paid leave, one might even call it temporary disability. This period is divided into two halves: 70 days before the birth itself and the same amount after it. If the pregnancy is multiple, then the woman is allowed to go on maternity leave 2 weeks earlier, and after giving birth, another 40 days are added to the required 70 days, that is, in total she is entitled to 194 legal paid days. In case of any complications during childbirth, another 14 days are added to 140 days.

Leave after maternity leave: example of determining the billing period

Especially for such cases, the legislation provides for a special procedure for determining the calculation period for vacation pay. Thus, as the calculated period, you need to take the period of time preceding the calculation period and equal to it in duration (clause 6 of the Regulations, approved by Decree of the Government of the Russian Federation dated December 24, 2020 No. 922, letter of the Ministry of Labor of Russia dated November 25, 2015 No. 14-1/B- 972).

In a situation where an employee is going on vacation after a long break from work, the entire pay period consists of the time that needs to be excluded. How to determine the calculation period for leave after maternity leave in such conditions?

Situation 1: another leave was granted immediately after maternity leave

Article 260 of the Labor Code of the Russian Federation provides guarantees for women when establishing the priority for granting annual paid leave. In particular, before or immediately after maternity leave, or at the end of parental leave, a woman, at her request, may be granted annual paid leave, regardless of her length of service with a given employer.

The employee has been working in the institution since 2020. From January 14, 2019 to May 31, 2019, she was on maternity leave. Immediately after it, the woman submitted an application for another paid leave from 06/01/2019.

In this case, the general rules established by clauses 4, 5 of Regulation No. 922 apply. The period from 06/01/2018 to 05/31/2019 should be considered as the estimated period. In this case, it is necessary to exclude from the calculation period the time the employee is on maternity leave, as well as the amounts accrued for this period.

If we assume that in the period from 06/01/2018 until the onset of maternity leave, the employee did not have days to be excluded from the calculation period, the number of calendar days that must be taken into account when calculating the amount of vacation pay will be 217.39 days. (7 months (number of full months in the billing period) x 29.3 days + 13 days (number of calendar days in January) / 31 days x 29.3 days).

Example 2.

The employee has been working in the institution since 2020. From 01/14/2017 to 05/31/2017 she was on maternity leave, and from 06/01/2017 to 07/14/2019 - on maternity leave. On July 15, 2019, the woman planned to start work, but applied for another paid leave.

In the case under consideration, since the employee had no earnings during the 12 months before the next vacation (the time spent on maternity leave is excluded from the calculation period), it is necessary to use the norms of clause 6 of Regulation No. 922: the average earnings are determined based on the amount of wages actually accrued to the employee for the previous period equal to the calculated period, that is, for the period from 01/01/2016 to 12/31/2016 (Letter of the Ministry of Labor of the Russian Federation dated November 25, 2015 No. 14-1/B-972).

Calculator for calculating the new vacation period after maternity leave

If a woman immediately went to work after sick leave, then she has no excluded periods, and the billing period will be 12 calendar months before the month of registration of the next vacation. If a woman went to work after caring for a child, then she had no income in the previous 12 months.

- Calculation of the number of vacation days unused before maternity leave is calculated according to the rules set out here.

- Determining the number of days allotted for sick leave lasting 140 days - 11.65 days of regular leave are allotted.

- Addition of the above amounts.

sovetnik36.ru

https://youtu.be/NwcwN6WKWBY

Having returned to work, she asked her employer when she could be granted annual paid leave (see Table 2). Table 2 Work Annual paid leave Maternity leave Parental leave up to 3 years of age Work From 01/20/2009 to 06/24/2009 From 06/25/2009 to 07/22/2009 From 07/23/2009 to 12/09/2009 From 12/10/2009 to 01/10 .2012 From 02.10.2012 5 months. 5 days 28 k. days. 140 k.d. (4 months 18 days) — — Despite the fact that the woman has not worked for this employer for six months, she may be granted annual paid leave upon her application (Part.

3 tbsp. 122 of the Labor Code of the Russian Federation). Info Calculating the number of days of annual leave required involves the implementation of certain stages: Calculation of the number of vacation days unused before maternity leave - calculated according to the rules set out here. Determining the number of days allotted for sick leave lasting 140 days - 11.65 days of regular leave are allotted.

How to calculate the vacation period after maternity leave

Quote (natalia_1505): The length of service that gives the right to annual basic paid leave includes leave under the BIR, but parental leave is not included (Article 121 of the Labor Code of the Russian Federation). this means the next period will be: 02/02/2012-02/01/2013 -28 k.d.

This is interesting: How to Correctly Register or Register at an Address

Because If your employee was on maternity leave, this period should be excluded. Accordingly, the end of the theoretical period needs to be shifted by a period. 02.02.2013-01.02.2014 - this period should exist, BUT .. care leave “lives” in it, which needs to be excluded. 09/30/2013 to 09/27/2015 child care leave. - this is 728 days by which the end of the working period needs to be shifted, i.e. add these days to 02/01/2014. We get, 01/29/2016.

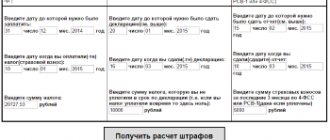

How to calculate days of unused vacation - filling out the fields

The online calculator has five lines to reflect the initial data:

- 1 - the first date is the day of employment with this employer. Enter the date in digital form - two digits for the date, two for the month, four for the year. You can enter the day manually, or select it on the calendar that appears when you click on the line.

- 2 - the second date is the day on which the calculation of non-vacation leave is carried out, for example, the moment of dismissal of an employee or another. You can also enter the date in the correct format manually or select it from a calendar.

- 3 - the third line is intended to reflect the number of rest days taken during work with the employer in this organization; you should add up all periods of annual leave and indicate the resulting number in line 3.

- 4 - the fourth line is necessary to indicate the number of days excluded from the vacation period; the law provides for periods that do not give the right to paid rest, these include maternity leave, time off at your own expense (only those that exceed 2 weeks per year), absence from work without good reason. You should count the total number of such days and enter the resulting number in line 4.

- 5 - the fifth line is the duration of paid leave in days, in general it is 28 days, but sometimes this parameter can change. If you are in doubt about the duration of your vacation, look at the employment contract, where this duration is always specified in the appropriate clause.

After filling out the indicated five lines of the calculator, you will receive the answer: the indicator of vacation experience and the number of unused days of rest.

Vacation experience is the time spent working in a specific organization, which provides the right to paid rest. Each month allows the employee to rest 2.33 days (if the year is 28 days).

Example of online calculation of days not taken off

We will calculate the unused days of employee Potapov in connection with his dismissal from work.

Data for calculations:

Potapov was accepted into the company on September 10. 2020, and quits on November 25. 2019.

During my work I managed to take two vacations of 28 days each.

In the period from 10 Sep. 2020 to 09 Sep. 2020 took 28 calendar days off at his own expense.

Fill in the lines of the online calculator:

- 1 - click on the line and find the date 09/10/2016;

- 2 - similarly click on the second field and find 11/25/2019;

- 3 - indicate 56 (28 + 28);

- 4 - we contribute 14 (during the first working year, Potapov took 28 days off at his own expense, 14 of which are not included in the vacation period);

- 5 - leave 28.

As a result of the calculations, we obtain a vacation period of 3 years, 2 months and 2 days, and the duration of unused vacation = 32.67 days.

32.67 days can be rounded, but only up to 33 days.

Formulas and rules

Sometimes it is important not only to calculate the required value in an online calculator, but also to understand where such numbers come from.

The annual duration of leave is granted to an employee not for the calendar year of work, but for the working year - from the date of hiring.

This point imposes certain features on determining length of service:

- first, the first working year is taken from the date of employment, the completion date is determined taking into account unaccounted periods - this is 12 full calendar months of service;

- then the second year is taken, the date of its completion is determined - this is another 12 months;

- further calculations are carried out by working years until the date of calculations arrives;

- the result is the length of service in months. Remaining days less than 15 are discarded, days 15 or more are rounded up to a full month.

In the case of calculating unused vacation, you should proceed in the following order:

- Calculate the length of service (from the date of acceptance into the organization to the day of calculations, inclusive). If there are periods that are not included, they should be skipped, postponing the end of the working year.

- Determine how many days of vacation are due for each full month worked (divide the annual duration by 12).

- Multiply the number of months of service by the number of vacation days provided in one month - as a result, we get the total number of vacation days that the employee earned during his work.

- To determine days not taken off, subtract those already used from the total duration from step 3.

Example:

Let's continue the example given above and calculate unused vacation for it without using an online calculator.

Period for calculating length of service: 09/10/2016 - 11/25/2019:

- 1 working year - from 09.10.2016 to 09.23.2017 (the end date was shifted by 14 days due to the vacation at one’s own expense) - 12 months. length of service;

- 2nd working year - from 09/24/2017 to 09/23/2018 - 12 months;

- 3 working year - from 09/24/2018 to 09/23/2019 - 12 months;

- 4 working years - from 09/24/2019 to 11/25/2019 - 2 months. 2 days - rounded up to 2 months.

The length of service is = 12 + 12 + 12 + 2 = 38 months.

For each month it is supposed to = 28 / 12 months. = 2.33 days of rest.

For a vacation period of 38 months, the allowance is = 38 * 2.33 = 88.54 days. (may round up to 89 days)

Since 56 days were used, it was not used on the date of dismissal = 89 - 56 = 33.

Calculate the vacation period after maternity leave calculator

Tell me, did I calculate everything correctly? The employee got a job on 03/01/07, vacation 28 cal. days for 07-08 I took a full day off for 08-09 I took 7 days off 11/24/08-04/12/09 I was on maternity leave. a new working period began - 09-10 from 04/13/09-09/30/09 I was on maternity leave (5 months and 20 days) 10/01/09 I went back to work.

Help me calculate the vacation period: annual leave for the period of work from 01.11.2020 to 31.10.2020 - 36 k.days - 07.06.2020 to 10.08.2020 annual leave for the period of work from 01.11.2020 to 02.09.2020 - 30 k.days - 17.03. 2020 to 04/15/2020 B/L according to take. and childbirth - 140 k.d. - from 04/16/2020 to 09/02/2020. Vacation up to 1.5 years from 09/03/2020 to 12/11/2011. Vacation up to 3 years from 12/12/2011 to 06/11/2013. Early exit from the d/o on 11/01/2012. How to correctly calculate vacation and the period for which it is granted? Thank you in advance.

Online calculator for calculating the shift in the end of leave after maternity leave

To determine the end of the working year, which began on 02/01/2012, 1 month and 29 calendar days must be counted from the moment the woman returns to work at the end of maternity leave, that is, from 09/25/2015. The last day of the working year, which began on 02/01/2012, will be 11/22/2015.

Important Let's change the conditions of the example.

Example. Determination of vacation experience if the working year ended during maternity leave / condition / Let's use the conditions of the previous example, changing them as follows. The next working year for the employee is from 11/01/2011 to 10/31/2012. / solution / The sequence of actions is as follows.

STEP 1. Determine how many vacations the employee is entitled to.

- We pay for northerners to go on vacation, No. 15 Rules for northern vacation, No. 14 I was going on vacation but ended up on sick leave, No. 13, 2015.

Unauthorized leave = dismissal?, No. 24

How to calculate the new vacation period after maternity leave calculator online

An employee cannot stay away for more than 2 years in a row, even at his own request (or for two years it cannot be shorter than 15 days), for which his employer will be punished. You can get an answer to your question by calling the numbers ⇓ Moscow, Moscow region, call ext.

In this case, it does not matter at all whether the employee starts working immediately after 28 days or continues to take care of the child. The benefit for the mother is that immediately after maternity leave she will receive the extra 40% of her average income in the form of benefits up to 1.

How to calculate a new vacation period after maternity leave calculator

Pregnant working women, according to legislative norms, have the right to a break from work for 140 days (196 days for multiple pregnancies), 70 (86) of which are provided before delivery, and 70 (110) after. If complications arise during pregnancy or childbirth, the law allows for an additional extension of leave. After the birth of a child, the mother takes leave to care for the baby, which lasts until he is 1.5 years old. It can be extended up to 3 years. In the article we will tell you about the next vacation after maternity leave in 2020, and we will give examples of calculating vacation payments.

On May 10, 2020, the employee returned to her workplace after the birth of her child. On this date, she left a statement in the name of her boss about going on annual leave after maternity leave. She will rest from June 11, 2020 to July 7, 2020. Let's calculate vacation pay: Duration of vacation - 28 days. The woman worked out the previous reporting period in full. She earned 388 thousand rubles.

Vacation after maternity leave: procedure for calculating vacation pay and design features

Calculation of leave after maternity leave begins with the submission of an application to the head of the enterprise. The document must indicate the employee’s personal data, her position and the desired number of vacation days. The release date is not indicated - it must be calculated and entered into the application by the company's HR department.

Sometimes there are situations where an employee has never received a salary for the entire time she was officially employed by the company. This is possible if, immediately after signing the employment contract, the employee went on maternity leave, and then on maternity leave. In this case, to calculate vacation pay, the employer is obliged to use the information on monthly earnings that was specified in the employment contract.

Calculate the vacation period after maternity leave calculator

Sick leave has been open since November 22, 2014. Immediately after returning to work, Nekrasova turned to the head of the company to arrange annual paid rest time. In accordance with the legislation of the Russian Federation and the internal documentation of the organization, a woman is entitled to leave of 28 days. The calculation period in this case is the period of time from November 22, 2013 to November 21, 2014. Calculation: The first action that needs to be taken to calculate vacation pay is to determine the amount of income received for the year. The formula given above is used for this. It is assumed that in this example, the amount of total income for the specified period reached 500,000 rubles. Next, you need to determine the average daily earnings. It is calculated as follows: SDZ = 500,000 / 12 months / 29.3 = 1422 rubles. Then, of course, the action is carried out - determining the amount of vacation pay.

This is interesting: Characteristics of a child from parents examples

If a woman immediately went to work after sick leave, then she has no excluded periods, and the billing period will be 12 calendar months before the month of registration of the next vacation. If a woman went to work after caring for a child, then she had no income in the previous 12 months. In this case, you can replace the period with an earlier one - taken 12 months before the start of the maternity leave. The right of replacement is stated in Decree of the Government of the Russian Federation dated December 24, 2020 N 922 (as amended on December 10, 2016). Calculation of average earnings? An equally important role when calculating the vacation amount after leaving maternity leave is played by the average daily earnings. Thus, the employee’s working year after leaving maternity leave is not always equal to the calendar year; its length increases due to the shift by the number of days of maternity leave. The beginning of this working year is the day following the end of the previous working year, in which all vacation days were used, and the end is the end day of the next working year, increased by the number of days of parental leave. In your case, parental leave lasted 1 year 3 months. 19 days (from December 29, 2014 to April 17, 2016). The working year in which the employee went on this leave began on 06/01/2014 and ended on 09/19/2016. The next working year begins on September 20, 2016.

Calculation of the vacation period after leaving maternity leave: online calculator, sample application

Based on the norms set out in Article 256 of the Labor Code of the Russian Federation, one of the legal representatives of the child (mother, father or other relative), who is on legal leave to care for him, can, at his own request, interrupt his vacation at any time and resume work (according to part 2 Article 256 of the Labor Code of the Russian Federation).

An application for leaving maternity leave is issued in order to notify the employer of the employee’s intention to return to his position, which remains with him until the child reaches 3 years of age. Such a statement must necessarily indicate:

- Desired date of return to work.

- Preferred work schedule.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call :

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free!

The application serves as the basis for the employer to order the termination of the employee’s maternity leave.

Calculation of the vacation period after maternity leave

According to the legislation of the Russian Federation, an employee returning to work from maternity leave can receive a vacation of 28 calendar days at any time, even without working the required 6 months in the reporting year.

Calculation of leave after maternity leave begins with the submission of an application to the head of the enterprise. The document must indicate the employee’s personal data, her position and the desired number of vacation days. The release date is not indicated - it must be calculated and entered into the application by the company's HR department.

Rest should be provided to a woman returning from maternity leave, regardless of how much she worked at the enterprise before the maternity leave, and also without relying on the company’s vacation schedule.

How to determine the billing period

Vacation pay is calculated based on all payments received by the employee for the last year worked.

In normal situations, the year preceding the vacation is taken for calculation, however, for employees returning from maternity leave, this type of calculation is not suitable.

This is explained by the fact that the benefits received by the woman cannot be used to calculate vacation pay, and she did not receive a salary during the reporting period.

Information for calculating the payments due to the employee will be taken from the period when she was still working (before going on maternity leave). The amount will remain unchanged, even if it has decreased significantly due to inflation.

Sometimes there are situations where an employee has never received a salary for the entire time she was officially employed by the company. This is possible if, immediately after signing the employment contract, the employee went on maternity leave, and then on maternity leave.

In this case, to calculate vacation pay, the employer is obliged to use the information on monthly earnings that was specified in the employment contract.

To calculate vacation pay, the following data is used:

- Wage.

- Bonuses for length of service.

- All types of compensation for hazardous production and working conditions.

- Bonuses received for fulfilling job duties and fulfilling plans.

Non-work related bonuses, travel allowances, and compensation are not used to calculate vacation pay.

The procedure for paying vacation pay after interruption of maternity leave

Payment of vacation pay is made in accordance with the standard scheme, in which, to determine the required amount, the total amount of the employee’s earnings is divided by 12, and then the resulting number is again divided by 29.3. The number obtained as a result of these actions must be multiplied by the number of days of rest provided. The resulting number will be the amount of vacation pay that the company is obliged to pay to the employee.

The timing of payment is established at the legislative level: according to the regulations, the benefit must be transferred to the citizen’s account no later than 3 working days before the start of the vacation period.

What you need to know about leaving maternity leave early

Parents or legal representatives of a child who are on parental leave should be aware of the specifics of leaving maternity leave early:

- A decree is a right, not an obligation, of citizens ; therefore, employees are not required to notify the company’s management in advance about early exit and obtain permission.

- To interrupt maternity leave, it is enough to write a statement addressed to the manager indicating the desired date from which the woman will begin performing work duties.

- This statement will serve as the basis for an order to stop paying benefits for a child up to one and a half years old, as well as to begin calculating wages.

Sample documents: the application form for leaving a leave of up to one and a half years can be viewed here, the application for leaving a leave of up to 3 years is here.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call :

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free!

Source: https://pravo.team/trudovoe/otpusk/posle-dekreta.html

How to calculate the new vacation period after maternity leave calculator

If a woman did not actually receive income or did not work throughout the entire billing period, an equal number of months worked previously is taken for calculations. Legislative acts on the topic It is recommended to study the following documents: Art.

The boss refuses, based on the fact that the employee has too little work experience. In this situation, the employee’s work experience does not play a role, and she has the right to demand calendar leave in any amount.

How to calculate the vacation period after maternity leave

If leave is granted immediately after maternity leave, then the application should be written three days before the end of the maternity leave. This usually happens when a woman decides to quit immediately after the end of her vacation. This will allow you to extend your work experience by several weeks.

In particular, it states that the time when the employee did not actually work, but in accordance with the law, retained his place of work, is subject to recording. Maternity leave falls under this condition, since it refers to a period of temporary disability during which the employee retains his place of work (Article 255 of the Labor Code of the Russian Federation). The legitimacy of this position is confirmed by the information letter of the Ministry of Labor of Russia and the Pension Fund of the Russian Federation dated November 4, 2002 No. 7392-YuL/LC-25-25/10067, as well as paragraph 4 of Article 5 of the International Labor Organization Convention of June 24, 1970 No. 132. In addition, maternity leave, unlike parental leave, is not included in the list of periods that should be excluded when calculating the length of leave (Article 121 of the Labor Code of the Russian Federation).

Situation 2: another leave was granted a month after maternity leave

Suppose the employee did not take advantage of the right to take another leave immediately after maternity leave, but went on annual paid leave two weeks, a month (two, three months) after the end of maternity leave. How to calculate average earnings in this case?

The employee has been working in the institution since 2020. The chronology of the events that interest us is as follows:

from 01/14/2017 to 05/31/2017 – maternity leave;

from 06/01/2017 to 05/14/2019 – parental leave;

05/15/2019 – date of return to work;

from 08/05/2019 to 08/17/2019 – regular paid leave.

In this case, after returning to work, the employee worked for less than 3 months. We believe that it is necessary to apply the general procedure for determining the billing period (12 full months preceding the month in which the employee goes on vacation, that is, the period from 08/01/2018 to 07/31/2019). Since most of the billing period falls during maternity leave, the number of days taken into account when calculating vacation pay will be small: 74.67 days. (17 days / 31 days x 29.3 days (May) + 2 months x 29.3 days (June, July)).

This is important to know: Application for preferential leave: sample for northerners

Example 4.

Suppose an employee went on vacation 2 weeks after leaving maternity leave:

from 01/14/2017 to 05/31/2017 – maternity leave;

from 06/01/2017 to 05/14/2019 – parental leave;

05/15/2019 – date of return to work;

from 05/27/2019 to 06/23/2019 – regular paid leave.

In the case under consideration, the calculation period is from 05/01/2018 to 04/30/2019. Since all this time is excluded from the calculated time, clause 6 of Regulation No. 922 should be applied, according to which the period before maternity leave (from 01/01/2016 to 12/31/2016) should be taken as the calculated time.

Leave after maternity leave: shift of working year

The second method is based on the rules for calculating and confirming the insurance period to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved. Order of the Ministry of Health and Social Development of Russia dated 02/06/2020 N 91. According to the rules, every 30 calendar days are converted into full months, and every 12 months into full years. For those who are more experienced, this method saves time and effort, but it does not take into account the different days in the months, as well as the number of days in February. Moreover, it is controversial, because Parental leave clearly does not apply to temporary disability. Most often (not always), the final result differs by 1-2 days compared to the first method and this is, in principle, allowed. If the results are very different, it means that somewhere in the calculation an error has crept in.

Any of these methods has the right to life, each personnel officer decides independently which way to count, because no one forbids using both at will and comparing the results obtained.

On work leave after maternity leave. How to calculate vacation pay?

After the end of parental leave until the child reaches the age of three (hereinafter referred to as child care leave), the employee is granted labor leave. Let's look at how parental leave affects the calculation of vacation pay.

From vacation to vacation, without starting work...

Let's consider a situation where a worker is granted labor leave immediately after the end of maternity leave.

For example:

— labor leave was granted from 04/06/2020;

— parental leave lasted from 06/11/2017 to 04/05/2020;

— it was preceded by maternity leave from 02/05/2017 to 06/10/2017.

As a general rule, vacation pay is calculated based on the salary accrued to the employee for the 12 calendar months preceding the month the vacation began <*>.

In our situation, leave was granted in April 2020. We take into account the 12 previous months: from 04/01/2019 to 03/31/2020. However, during this period the employee had no income due to the fact that she was on maternity leave.

In the event that an employee was released from work with partial or no pay during the entire 12 months preceding the month of going on leave, a special rule applies: the billing period is shifted by 12 months <*>.

We act according to the rule and consider the next 12 months: from 04/01/2018 to 03/31/2019. Here the situation is repeated. We shift by one more period - from 04/01/2017 to 03/31/2018. From April 1 to June 10, the employee was on maternity leave, and from June 11 - on parental leave. As you know, wages are not saved during these social holidays <*>. It is necessary to shift the billing period again. We are moving to the period from 04/01/2016 to 03/31/2017. During this period, the employee has earnings.

Let's take a closer look at this period. Throughout March 2020, the employee was released from work without saving her earnings (she was on maternity leave). For this reason, March is excluded from the calculation. In February, the employee has several working days, since maternity leave began on the 5th. In this case, the accrued salary must be compared with the salary for full months. If the salary for February is lower, this month is also excluded from the calculation <*>.

After excluding months with incomplete earnings from the calculation period, the average daily earnings are calculated. The amount of wages accrued for the remaining months is divided by the number of these remaining months and by 29.7 <*>.

Let us pay attention to one more point. Due to the fact that parental leave is extended over a long period, the calculation period (12 months) is shifted several times. During this time, the tariff rate of the first category (if applied) or the tariff rate (tariff salary) of the employee (if the tariff rate of the first category is not applied), the base rate (for employees of budgetary organizations), the base salary (for civil servants) could increase. In such a situation, one should not forget about the need to “modernize” the wages accepted for calculating vacation pay <*>. Adjustment factors are calculated by dividing the size of the tariff rate (tariff salary), tariff rate of the first category, salary, base rate, base salary established in the month in which the average earnings are paid by its (his) size in effect in the months taken for calculation average earnings <*>.

On vacation in the month of leaving maternity leave...

Consider the following situation.

After the end of maternity leave, the employee began work on 04/06/2020, and went on labor leave on 04/29/2020.

In this situation, as in the first, the employee has no income in the 12 months preceding the month the vacation began (from 04/01/2019 to 03/31/2020). The reason for his absence is the same: release from work without pay (parental leave). Consequently, the calculation of average earnings will be similar. We shift the billing period until it includes at least one month in which the employee worked and received wages. Thus, the billing period will be the same as in the first case.

On vacation in the month following the month of starting work...

Situation.

After the end of maternity leave, the employee began work on 04/06/2020, and went on labor leave on 05/04/2020.

In this case, the billing period is from 05/01/2019 to 04/30/2020. From May 2020 to March 2020, the employee was on maternity leave and had no salary. These months are excluded from the calculation. There is one month left in the billing period - April. However, it is incomplete: from the 1st to the 5th, the employee was on social leave without pay.

In a situation where there is not a single full month in the billing period, a special procedure for calculating average daily earnings is applied.

This calculation procedure involves the following steps <*>:

1) the hourly salary is determined. The salary (if necessary, taking into account an adjustment factor) accrued for the pay period is divided by the number of hours actually worked during this period. Please note that in this calculation only those payments accrued for time worked and work performed . Average earnings, if they were maintained during the billing period, are not included in the salary;

2) the average monthly salary is calculated. To do this, the hourly salary is multiplied by the average monthly number of estimated working hours (in 2020, with a five-day working week - 169.3 hours (2032 hours / 12 months), with a six-day working week - 168.8 hours (2026 hours / 12 months) );

3) average daily earnings are determined. The average monthly salary is divided into 29.7 days.

Let’s say in our situation in April the employee worked 136 hours, for which she received a salary of 822 rubles. The tariff salary did not change in April and May (the first category rate does not apply).

We perform the calculations as follows:

— hourly salary 6.04 rubles. (822 rubles / 136 hours);

— average monthly salary 1022.57 rubles. (RUB 6.04 x 169.3 hours);

— average daily earnings 34.43 rubles. (RUB 1,022.57 / 29.7 days).

If you worked on maternity leave...

Let's consider the situation.

From 02/05/2017 to 06/10/2017, the employee was on maternity leave.

From 06/11/2017 to 04/05/2020 she was granted maternity leave.

Since 01/01/2020, the employee has been working as an internal part-time worker.

Labor leave has been granted since 04/06/2020.

Let's figure out whether the calculation of vacation earnings accrued during the period of parental leave is taken into account, and whether it is necessary to shift the calculation period.

An important point is that an employee can only work part-time during care leave <*>.

Calculation of average earnings at the main place of work and part-time work is carried out separately <*>.

In this situation, when calculating vacation pay at the main place of work, the calculation period will have to be shifted, since for the entire 12 months preceding April 2020, the employee was on maternity leave and had no earnings. The 12-month period is shifted until it includes at least one or more months in which the employee worked and received wages. As a result, the calculated period will be from 04/01/2016 to 03/31/2017 (see the situation “From vacation to vacation, without starting work...”).

When calculating vacation pay at a place of work on a part-time basis, earnings for the period from 01/01/2020 to 03/31/2020 are taken into account.