The calculator allows you to calculate the amount of penalties that are charged if insurance premiums are not paid on time. This online calculation is useful both for those payers who wish to independently pay penalties due to a delay in payment, and for those who want to check the correctness of the tax penalty amount due to failure to pay contributions on time. You can calculate penalties for non-payment of taxes in this online calculator.

Legislation on the calculation of penalties

The rules for determining the amount of penalties for insurance premiums in the Federal Tax Service are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, which contains two formulas for calculating this value. Both of them are based on the fact that the amount of debt is multiplied by the number of calendar days during which there was a delay in insurance premiums. In addition, the resulting value must be multiplied by the bet, which has 2 values:

- 1/300 refinancing rate of the Central Bank of the Russian Federation

It is used by individuals and individual entrepreneurs (without taking into account the number of days of overdue payment) and legal entities with a delay of no more than 30 calendar days;

- 1/150 refinancing rate of the Central Bank of the Russian Federation

It is used only by legal entities when payments are overdue for more than 30 calendar days.

The rules for determining the amount of penalties for insurance contributions to the Social Insurance Fund (“for injuries”) are regulated by Art. 26.11 Federal Law of July 24, 1998 No. 125-FZ. The penalty is calculated using the same formula using 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

The value of the Central Bank refinancing rate is taken to be the one in effect at the time of the overdue debt. If the rate changed in one calculation period, then it is necessary to divide the calculation into several formulas, each of which will have its own refinancing rate.

Tax calendar

The procedure for calculating penalties is determined by Article 75 of the Tax Code of the Russian Federation.

Paragraph 1 of this article provides that a penalty is recognized as a sum of money that a taxpayer must pay in the event of payment of due amounts of taxes later than the deadlines established by the legislation on taxes and fees. Simply put, if you are late in paying your taxes, penalties will be charged on the debt. The number of days overdue for penalties on taxes is determined from the day following the due date for payment of the tax, and to the day preceding the day of its payment (clauses 3, 4 of Article 75 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 07/05/2016 N 03-02-07 /2/39318). That is, if the tax debt was paid, say, on February 15, 2020, then February 14 should be taken into account when calculating penalties. The payment date (15th) does not need to be included in the calculation.

Let's give an example of calculating tax penalties.

Example. Katyusha LLC transferred personal income tax in the amount of 156,800 rubles from wages for December 2016, paid to employees on January 10, 2017, to the budget on January 24, 2017.

The number of days of delay is 12 (from 01/12/2011 to 01/23/2017). The refinancing rate (key rate) of the Bank of Russia during the period of delay was 10%. See “Refinance Rate: 2020.” The amount of penalties for late payment of personal income tax will be 627.20 rubles. (RUB 156,800 x 10% / 300 x 12 days).

A similar procedure for calculating penalties should be applied to other taxes (for example, VAT, property tax, simplified tax system, etc.).

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?”

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

Deadlines for paying taxes and insurance fees, filing tax returns and reports.

The day indicated in the Tax Code is the last day for tax payment. The wording “before” or the adverb “no later” is not important (letter of the Ministry of Finance dated April 30, 2019 No. 03-02-08/32422) and (Supreme Court ruling dated October 16, 2018 No. 304-KG18-7786).

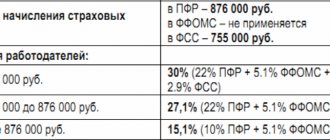

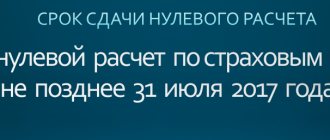

TaxTax payments under the simplified tax system (once a quarter): Q1. - until April 25Q2 - until July 25th quarter - until October 25th quarter — until April 30 (for individual entrepreneurs) until March 31 (for organizations) You can generate a zero simplified tax system and send it to the Federal Tax Service online using this service. Moreover, you can do this absolutely free of charge. UTII tax payments (once a quarter): I quarter. - until April 25Q2 - until July 25th quarter - until October 25th quarter - until January 25 Personal income tax payments (13%) (once a year): until April 30 Payments Income tax (once a quarter): Q1 - until April 28Q2 — until July 28th quarter - until October 28th quarter - until January 28 VAT payments (once a quarter):Q1 - until April 202nd quarter - until July 20th quarter — until October 20 IV quarter - until January 20 From 2020, VAT returns must be submitted by the 25th. But the payment deadline is still until the 20th. Personal income tax 13% for employees (until the 15th of the next month) | Pension FundFixed payment to the Pension Fund of Individual Entrepreneurs (paid once a year, until December 31) in 2020 - 36,238 rubles (for income up to 300 tr. per year and 1% of income from amounts over 300 tr.) , in 2020 - 32,385 rubles (for income up to 300 tr. per year and 1% of income from the amount over 300 tr.) See IP Payment Calculator Contributions to the Pension Fund for mandatory pension insurance (paid monthly no later than the 15th day of the next calendar month) For employees: 26% (or 18% for preferential activities (production, construction, education, IT)) for OSNO, simplified tax system, UTII ( 20% (or 12% for preferential ones) for insurance 6% for the funded part; if 1966 and older, if older - all for insurance), FFOMS 3.1% for OSNO, simplified tax system, UTII, TFOMS 2.0% for OSNO, USN, UTII. The pension penalty also needs to be broken down into a penalty for the insurance and savings part, FFOMS, TFOMS See: Salary and Pension Fund contribution calculator (free) In this case, you can try to reduce the fine and sue. For example, the company reduced the fine by 2 times, citing the fact that the report was overdue by a small number of days (see resolution of the Moscow District Arbitration Court dated April 1, 2016 No. A41-30902/2015). The Pension Fund itself cannot reduce fines, only through the courts. | FSSPayment to the Social Insurance Fund: Q1. — until April 15, 2nd quarter. — until July 15, 3rd quarter. — until October 15, quarter IV. - until January 15 Completed sample 4-FSS 2015. See: Salary and Social Insurance Contributions Calculator (free) |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 16 | 17 | 18 | 19 | ||

| 21 | 22 | 23 | 24 | 26 | 27 | |

| 28 | 29 | 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 16 | 17 | |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 2 | 3 | |||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 16 | 17 | |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 16 | 17 | 18 | 19 | 21 | ||

| 22 | 23 | 24 | 26 | 27 | ||

| 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 16 | 17 | 18 | 19 | |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 16 | |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 16 | 17 | 18 | 19 | 21 | ||

| 22 | 23 | 24 | 26 | 27 | ||

| 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 16 | 17 | 18 | |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 16 | 17 | 18 | 19 | ||

| 21 | 22 | 23 | 24 | 26 | 27 | |

| 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 16 | 17 | |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 16 | 17 | 18 | 19 | |

| 21 | 22 | 23 | 24 | 26 | ||

| 27 | 28 | 29 | 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 16 | |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 16 | 17 | 18 | 19 | |

| 21 | 22 | 23 | 24 | 26 | ||

| 27 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 16 | 17 | |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 16 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 2 | 3 | 4 | 5 | |||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 16 | 17 | 18 | 19 | |

| 21 | 22 | 23 | 24 | 26 | ||

| 27 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 16 | |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| 31 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 16 | 17 | 18 | 19 | 20 | |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 16 | 17 | 18 | |

| 19 | 21 | 22 | 23 | 24 | ||

| 26 | 27 | 29 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 |

| Tue | Wed | Thu | Fri | Sat | Sun | |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 16 | 17 | 18 | 19 | 20 | |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 |

We invite you to familiarize yourself with: The Law on Insurance of Personal Credits

in red - holidays and weekends, green - shortened days, black - days of reports and payments.

According to clause 3 of Article 45 of the Tax Code of the Russian Federation, the obligation to pay tax is considered fulfilled by the taxpayer from the moment of presentation to the bank of an order to transfer funds from the taxpayer’s account to the budget system of the Russian Federation to the appropriate account of the Federal Treasury (from the account of another person if he pays tax for the taxpayer ) in the bank if there is a sufficient cash balance on the day of payment.

It often happens that for some reason taxes or advance payments were not paid on time. This article provides a calculator of tax sanctions according to the key rate; it is necessary when calculating the amount to be transferred to the budget. We will look at calculating penalties using an online calculator using the example of delays in advance payments under the simplified tax system.

Note: You always first need to pay additional tax and late fees, and then submit the amendment.

1st situation. The due date for tax payment has been missed. In this case, you need to transfer overdue tax payments, as well as penalties, as quickly as possible. According to Article 75 of the Tax Code of the Russian Federation, the amount of penalties is calculated on a calculator based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay in paying the tax amount.

Additional accrued tax and late fees must be reflected in accounting. If we are talking about the simplified tax system, then the simplified tax and penalties do not need to be reflected in tax accounting, since they are not included in the list of expenses under the simplified tax system.

For example, advance payments for “simplified” tax must be made no later than the 25th day of the month following the expired reporting period. That is, for the first quarter the advance must be transferred no later than April 25, for the first half of the year - no later than July 25, and for 9 months - no later than October 25. This follows from paragraph 2 of Article 346.19 and paragraph 2 of paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation.

Note: If the 25th falls on a weekend or non-working holiday, the payment deadline is postponed to the next working day (clause 7

Art. 6.1 Tax Code of the Russian Federation

).

2nd situation. Advance payments under the simplified tax system were transferred on time, but its amount was underestimated due to an error in the calculations. Then there is also a tax arrears and the obligation to pay penalties to the budget.

If you find yourself in one of the listed situations, pay off the debt as quickly as possible so that the accrual of sanctions stops. Because penalties are accrued until the entire amount of the debt is paid. Penalties on the amount of arrears will also need to be transferred (paragraph 2, paragraph 3, article 58 of the Tax Code of the Russian Federation).

There is no penalty for late payment of advance tax payments (paragraph 3, paragraph 3, article 58 of the Tax Code of the Russian Federation). Such a sanction can only be imposed for non-payment of the tax itself, that is, this means the transfer of a “simplified” tax at the end of the year (Article 122 of the Tax Code of the Russian Federation).

According to the general rules, the Federal Tax Service has the right to impose a fine on an organization (IP) for late payment (incomplete payment) of tax. The fine is levied in the amount of 20% of the arrears (Article 122 of the Tax Code of the Russian Federation). What to do if the taxpayer independently discovers a tax arrears:

- Calculate the amount of penalties.

- Transfer the amount of arrears and penalties to the Federal Tax Service account.

- Submit an updated declaration.

We invite you to familiarize yourself with: Medical insurance for traveling abroad

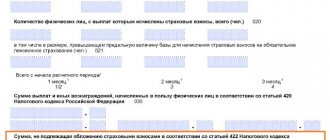

Formulas for calculating penalties for insurance premiums

To calculate penalties for insurance premiums, the following formulas are used:

- if penalties are calculated by individuals, individual entrepreneurs and legal entities (if the delay is up to 30 days)

| Penalty amount | = | Debt amount | * | Number of calendar days of delay | * | 1/300 refinancing rate |

- if penalties are calculated by legal entities (if the delay is more than 30 days)

| Penalty amount | = | Debt amount | * | Number of calendar days of delay | * | 1/150 refinancing rate |

An example of calculating penalties for insurance premiums

Perspektiva LLC had arrears in insurance premiums for August 2020 in the amount of 25,000 rubles. The company was supposed to transfer the contributions no later than September 17, 2018 (the deadline was postponed due to the fact that the 15th falls on a day off), but paid them only on November 9, 2018. It is necessary to calculate the amount of the accrued penalty based on the refinancing rate, equal to 7.5%.

| Amount of penalty (18.09.-17.10.) | = | 25 000 | * | 30 | / | 300 | * | 7,5% | = | RUB 187.50 |

| Penalty amount (18.10.-08.11.) | = | 25000 | * | 22 | / | 150 | * | 7,5% | = | RUB 275.00 |

TOTAL total amount of debt = 187.50 + 275.00 = 462.50 rubles.

Important! The day on which the debt was transferred is not taken into account in calculating the penalty.

Correspondence on reflecting penalties in accounting

To reflect penalties on insurance premiums in accounting, the following correspondence is drawn up:

Dt 99 Kt 69 - the amount of penalties accrued;

Dt 69 Kt 51 - the amount of the penalty has been paid.

The posting date for the accrual of penalties depends on who is calculating the amount:

- date of the calculation certificate, if the company independently calculates the amount of the penalty;

- date of the request or decision, if the Federal Tax Service makes a decision to accrue penalties on the debt.

Read about the rules for generating a payment order for the transfer of penalties on insurance premiums in this article.

The video material provides information on filling out the “payment form” to pay the penalty:

How to pay?

If, when transferring a tax or contribution, you made a mistake in the KBK or other details that did not prevent the money from “falling” into the account of the Federal Tax Service, then arrears do not arise. There is no right to charge penalties. You just need to clarify the payment.

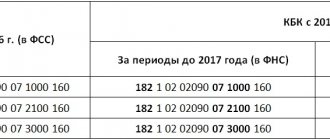

To pay a fine or penalty, it is enough to pay a regular payment, like a tax, but at the same time replace 1 or 2 digits in the BCC. For example, the simplified tax system is 182 1 0500 110 (initial).

KBK for transferring penalties (we change the 6th and 7th digits on the right in KBK) for tax 182 1 0500 110 - for payment of penalties, 182 1 05 01011 01 2200 110 - for interest.

KBK for transferring a fine (change the 7th digit on the right in KBK) for tax - 182 1 0500 110