Who reports

All insurers, that is, legal entities and entrepreneurs with employees, are required to submit calculations for insurance premiums, SZV-M and SZV-STAZH. The DAM must be submitted even if the company did not conduct business during the reporting period and no payments were made to individuals.

Submit RSV in electronic or paper form. If the company has more than 25 employees, the form is sent electronically; if there are fewer than 25 employees, the report can be prepared on paper.

KBC for a fine for late submission of SZV-M in 2020

That is, the minimum is only 500 rubles. - will be in a situation where you only have one single director (aka founder) listed in your report. Even if the director does not have an employment contract and does not receive a salary, he is in any case an insured person (PFR letter No. LCH-08-24/5721 dated March 29, 2020).

If there is an official decision on a fine, but you do not agree with it, you can challenge it in court. In particular, you can try to reduce the total size of the sanction. Although the legislation does not provide that the fine for late submission of SZV-M can be reduced due to mitigating circumstances. In principle, there is no mechanism for reducing the fine.

For reports not submitted on time

According to Article 119 of the Tax Code of the Russian Federation, the penalty for failure to submit RSV 1 is 5% of the amount of contributions not paid on time, payable on the basis of a calculation for each full or partial month of delay. There is an upper limit limiting the amount of sanctions - 30% of the specified amount. The lower limit is 1000 rubles. If all contributions were transferred on time, the violator will get off with a fine of 1,000 rubles. In addition, according to Article 15.5 of the Code of Administrative Offenses of the Russian Federation, a fine of 300 to 500 rubles is provided for officials.

How to cancel a fine for failure to submit insurance premium payments

https://youtu.be/Nq8rua3KRyk

Last year, the Federal Tax Service itself ordered inspectors to reduce fines many times over. The service sent an internal letter to the regions (available to UNP), in which it explained to inspectors when and by how much to reduce the fine for tax violations.

In order for the fine to be reduced, mitigating circumstances must be cited. If there is at least one such circumstance, inspectors are obliged to reduce the fine by at least half (clause 3 of Article 114 of the Tax Code of the Russian Federation). The code does not explain what to do if there are several circumstances.

The Federal Tax Service provides its own “formula” for penalties. The outcome depends on the number of arguments the company presents.

For one mitigating circumstance, the Federal Tax Service proposes to reduce the fine by half, for two circumstances - four times, for three - six times.

If you follow the tax authorities’ formula, the number of arguments must be multiplied by two. The result shows how many times the fine will be reduced.

For example, you can ask for an eightfold reduction in the fine if the company has four mitigating circumstances:

- the company failed to submit its declaration on time for the first time;

- only one day late;

- the chief accountant fell ill;

- the budget was not affected by the delay.

See the list of mitigating circumstances below. These arguments are taken into account by the courts when they make decisions in favor of companies and reduce fines. Inspectors should also take these circumstances into account, then there will be fewer legal disputes, the Federal Tax Service expects.

When will the tax authorities reduce the fine?

- The company submitted the declaration with a slight delay of one to three days.

- The company itself corrected the error in the declaration without forcing the inspectors.

- Previously, the company did not commit any violations during its entire operation.

- The budget was not affected by the error.

- The company is financed by the budget or conducts socially significant activities.

- Difficult financial situation. The company faces bankruptcy if it pays the entire fine.

- The chief accountant or director fell ill.

- The size of the fine does not correspond to the severity of the violation.

https://youtu.be/4jKYxYGoWW4

Companies most often managed to reduce fines only in court (resolutions of the arbitration courts of the Moscow District dated 02.02.2016 No. F05-19847/2015, of the West Siberian District dated 01.12.2015 No. F04-25916/2015). Now there are more chances to get your money back without going to arbitration.

Companies may not be limited to the list provided by the Federal Tax Service, because the list of mitigating circumstances is open (clause 3 of Article 112 of the Tax Code of the Russian Federation). Give as many arguments as possible, then you can defend more money.

Last year, the Federal Tax Service itself ordered inspectors to reduce fines many times over. The service sent an internal letter to the regions (available to UNP), in which it explained to inspectors when and by how much to reduce the fine for tax violations.

The Federal Tax Service provides its “formula” for penalties. The outcome depends on the number of arguments the company presents.

For one mitigating circumstance, the Federal Tax Service proposes to reduce the fine by half, for two circumstances - four times, for three - six times.

See the list of mitigating circumstances below. These arguments are taken into account by the courts when they make decisions in favor of companies and reduce fines. Inspectors should also take these circumstances into account, then there will be fewer legal disputes, the Federal Tax Service expects.

Have a question? Our experts will help you within 24 hours! Get answer New

For errors in calculations and personal data

If the company has made the calculations correctly, but is in no hurry to make deductions, penalties are provided for this case. If the insurer grossly violated the calculations - underestimated the calculation base - then, according to Article 120 of the Tax Code of the Russian Federation, a financial penalty is provided in the amount of 20% of the amount of unpaid deductions, but not less than 40,000 rubles.

If the report contains inaccurate personal data of employees, such reporting is considered not provided. To prevent this from happening, you should especially carefully fill out the fields for Full Name, SNILS and Taxpayer Identification Number.

Please note that it is possible to avoid penalties. After receiving the report, tax officials conduct an audit. If any errors are identified during it, the policyholder is sent a corresponding notification. If the report was submitted electronically, the violator is given 5 days from the date of receipt of the notification to correct the errors. If the document was submitted on paper, then 10 days are allotted from the date of sending the notification.

Fine for late submission of reports to the Pension Fund in 2020

According to Article 4 of the same law, if the last day on which reports must be submitted falls on a non-working weekend or state official holiday, in this situation the deadline for sending the report is postponed to the first working day after this weekend.

Back in January last 2020, the board of the Russian Pension Fund adopted a resolution, the purpose of which was to simplify the calculation of insurance contributions. The system included rules for calculating mandatory contributions to pension insurance and mandatory medical insurance for individuals of the Russian Federation. The reporting form received the identification number RSV-1 PFR.

What does the Pension Fund fine for?

In addition to penalties from the Federal Tax Service for delays and errors, there is a fine for late submission of reports to the Pension Fund: we are talking about reports such as SZV-M and SZV-STAZH. The fine for SZV-STAZH is 500 rubles for each insured person. Errors in the document or the entry of not all employees will also cost 500 rubles for each employee. Providing a document in paper form instead of an electronic one will cost 1,000 rubles.

As for SZV-M, the fine for late submission of a report to the Pension Fund is 500 rubles for each employee. Failure to provide information about the insured person or submission of false information is punishable by the same amount. The fine for failure to submit a report to the Pension Fund is also 500 rubles for each employee. This is stated in Article 17 of Federal Law 04/01/1996 No. 27-FZ.

Responsibility for violations

The insured, which can be either an organization or a private entrepreneur, may be held accountable by regulatory authorities. In such cases, fines may be assessed if the reporting was not provided at all or if the document was submitted with a significant missed deadline.

In addition, administrative financial sanctions in the amount of up to 500 rubles may be imposed on the heads of organizations. This is done only if deadlines are missed. Within this framework, it is important to keep in mind the fact that individual entrepreneurs cannot be fined in accordance with the norms of current legislation.

As for administrative protocols on relevant violations, they must be drawn up exclusively by authorized representatives of the Pension Fund. The grounds for such a requirement are contained in Article No. 28 of the current Code of Administrative Offenses of the Russian Federation.

Article 28. Actions (inaction) of legal representatives of the organization

It is worth noting that accountants may encounter certain difficulties when preparing a new report form. Situations when information will be included in an outdated form cannot be excluded. If this happens, the tax authorities will not accept the reporting for consideration and will provide it to the company or entrepreneur to correct the shortcomings.

A situation may also occur in which the authorized services refuse to accept the new form approved by order of the Federal Tax Service. If this happens. It is important for each company to take care of the execution of the old RSV-1 form. It is worth noting that in 2020, reporting of this type continues to be submitted to the Pension Fund of the Russian Federation even despite the fact that control over insurance premiums has passed to the Federal Tax Service of the Russian Federation.

Online magazine for accountants

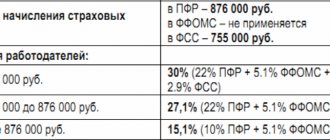

- Pension Fund (22%) - 13,200.00 rubles each,

- Compulsory medical insurance (5.1%) – 3060.00 rubles each,

- FSS (2.9%) – 1740.00 rubles each.

The monthly salary of an accountant, O.P. Pugovkina, is 40,000 rubles. From January 2020 to March 2020 insurance premiums charged for each month:

- Pension Fund (22%) - 8800.00 rubles each,

- Compulsory medical insurance (5.1%) – 2040.00 rubles each,

- FSS (2.9%) – 1160.00 rubles each.

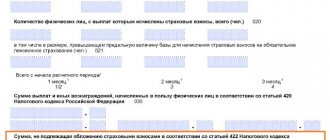

In the overall result, Betta LLC accrued to I.V. Smirnov and O.P. Pugovkina.

for the 1st quarter: 300,000 rubles. The total amount of contributions of Betta LLC for the 1st quarter: Pension Fund (22%) - 22,000.00 rubles, compulsory medical insurance (5.1%) - 5,100.00 rubles, social insurance (2.9%) - 2,900.00 rubles. Example No. 2 At the company X LLC in the first quarter of 2020.

This error must be corrected

- Incorrect organization phone number

- The calculation will not be accepted if the contributions to compulsory health insurance for each insured person in the amount do not coincide with the total amount of the specified contributions

- How can I correct errors in the report? To correct various errors in the report you must:

- To correct an error in an employee’s SNILS, you must indicate the serial number of the adjustment “001” on the title page, also attach section No. 1, as in the initial calculation, and this will also include section 3, filled out for the employee in whose SNILS there was an error. It is worth paying attention that for the same employee you must attach a copy of the insurance certificate, TIN and passport.

We invite you to read: What benefits are a war veteran entitled to during burial in Belgorod?

Important: the updated section No. 3 in relation to other employees who have not made mistakes does not need to be submitted.

- TIN of an individual (line 060);

- date of birth of the individual (line 110);

- citizenship (country code) (line 120);

- gender of the individual (line 130);

- ID document type code (line 140);

- details of the identity document (series and document number) (line 150);

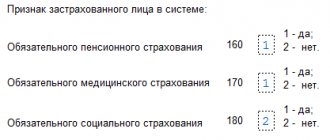

- a sign of an insured person in the system of compulsory pension (line 160), medical (line 170) and social (line 180) insurance.

To correct errors in this information, include in the updated calculation section 3 with the correct personal data of the person for whom the corrections are being made, and with the correct indicators in subsection 3.2 - with an adjustment number different from “0”, but with the same serial number (line 040), as in the primary calculation.

Fine statistics

Failure to provide statistical reporting results in administrative liability under Article 13.19 of the Code of Administrative Offenses. The fine is collected from officials of the organization. The fine amount is from 3,000 to 5,000 rubles.

In addition, the organization may be required to compensate for damage resulting from the need to correct the data of consolidated statistical reporting. This is stated in Article 3 of the Law of the Russian Federation of May 13, 1992 No. 2761-1 “On liability for violation of the procedure for submitting state statistical reporting.”

Editorial board of the magazine "Glavbukh"