Updated calculation of insurance premiums - Kontur.Accounting

If discrepancies are justified, it is recommended to attach an explanation to the calculation.

ATTENTION! If errors in the DAM did not lead to an understatement of the tax base for contributions and do not relate to the personal data of employees, an update on the DAM for the 1st quarter of 2020 does not need to be submitted.

Deadlines for filing an adjustment DAM: what to pay attention to? A common situation is when errors and inaccuracies are discovered by the payer himself after submitting reports to the Federal Tax Service.

2 tbsp. 81 of the Tax Code of the Russian Federation). If after, then penalties should be assessed and paid.

- Handwriting is done in blue, black or purple ink.

- Text data is entered in capital block letters.

- The following are not allowed: edits using a proofreader, printing calculations on both sides of the pages, fastening sheets with a stapler or any other similar method.

- “0” is placed in the place of the missing sum (numeric) indicator; in other cases, dashes are added (when filling out the form manually).

- Printing is done in Courier New font with a height of 16 to 18 points.

- Data is entered from left to right, from the first position.

- Cost indicators in sections, as well as in attachments to the first section, are recorded in rubles and kopecks.

- The procedure for filling out the new calculation form and the requirements for its preparation are described in detail in the above-mentioned Federal Tax Service order No. ММВ-7-11/ in attachment 2 (hereinafter referred to as the Federal Tax Service Procedure).

Deadlines for submitting adjustments

Organizations and individual entrepreneurs, if errors are detected in the primary DAM, must make adjustments and submit an updated report according to the rules of Art. 81 Tax Code of the Russian Federation. If data for 2020 is adjusted, the report is submitted to the tax service, if for 2020 and the periods preceding it, to the Pension Fund.

The corrective calculation must be submitted in the form that was used at the time of submission of the primary report (clause 1.2 of the Procedure for filling out the DAM, approved by the Federal Tax Service of the Russian Federation by Order dated October 10, 2016 No. ММВ-7-11 / [email protected] - Procedure): for 2020 The year of the DAM is specified on the KND form 1151111; for 2020 and earlier, adjustments are made to the RSV-1 Pension Fund.

It is also necessary to submit an updated DAM if the base for the previous period has been recalculated downward. The recalculation amount is not reflected in the current period because, as of October 2020, a report with negative amounts is considered to be inconsistent with the format.

Policyholders submit the initial calculation of insurance premiums to the Federal Tax Service on the 30th day of the month following the 1st quarter, half year, 9th month. and year (clause 7 of article 431 of the Tax Code of the Russian Federation). If you submit an adjustment before the 30th, it is considered submitted on the day the clarifying DAM is submitted (clause 2 of Article 81 of the Tax Code of the Russian Federation).

Submitting an adjustment that increases the insurance premiums payable relieves the policyholder from liability if the report is filed before the tax authority learned about the understatement of premiums or ordered an on-site audit for the period of adjustment. Before submitting the amended report, the policyholder must pay the debt on insurance premiums and penalties (clauses 3, 4 of Article 81 of the Tax Code of the Russian Federation).

If the Federal Tax Service discovered errors in section 3 of the primary DAM or found a discrepancy between the summary amount of contributions and contributions for insured persons, the report must be resubmitted within a specific time frame. When sending a notification about the need to adjust the calculation electronically, the deadline for submitting the report is 5 working days from the date of sending the notification, when sending it on paper - 10 working days.

Irina Smirnova

Submit adjustments in a few clicks in the Kontur.Accounting cloud service. Use the support of our experts and use the service for free for the first 14 days.

Correcting errors in the third section

If errors in the primary DAM are not related to the recalculation of the contribution base, then an updated calculation must be submitted taking into account the situation. The personal details of the insured person are entered incorrectly. Errors in full name and SNILS are corrected as follows:

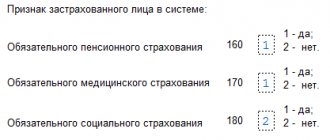

- In the “Adjustment number” field of section 3, the serial number of the clarification is entered, in the lines Full name and SNILS (subsection 3.1) data from the primary DAM is reflected, in subsection 3.2 a “two” is entered in lines 160-180 and “zero” in 190–300.

- At the same time, another third section with the correction number “0” is filled out for the same insured individual, the correct full name and SNILS are entered in subsection 3.1, and the amounts are entered in subsection 3.2.

Errors in the following fields of subsection 3.1 are corrected in the usual manner: TIN, date of birth of an individual, citizenship, gender, code of the type of identification document, its details, the attribute of the insured person OPS, compulsory medical insurance and compulsory social insurance.

Corrections in the specified fields are made by including in the corrective calculation section 3 with the correct data and current indicators of subsection 3.2 - the correction number, except “0”, but the same serial number as in the primary DAM.

An extra employee is indicated in the calculation. In this case, the clarification includes section 3, which contains information about excess individuals. In this section: a correction number other than “0”; in subsection 3.2 “zeros” are entered. At the same time, the data in section 1 is corrected.

The employee was not included in the calculation. In this situation, the adjustment contains section 3 with information about non-included individuals with a zero adjustment number (primary information). If necessary, the data in section 1 is clarified.

Part of the calculation with line “040” Features of entering information into line “040” Basis Section 1 The proper BCC for compulsory payments for health insurance for the period from 2017 is recorded: 182 1 0213 160, 182 1 0213 160 (when paying a fixed amount of IP);

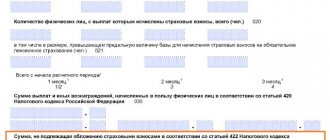

According to the written code in line “040”, compulsory medical insurance contributions will be calculated. Federal Tax Service Procedure, part 5, clause 5.6 Subsection 1.1. attachment 1 first section The line contains the total indicators: payments not subject to compulsory health insurance contributions in accordance with Art. 422 of the Tax Code of the Russian Federation (compensations, state benefits, etc.

); made and documented expenses related to the extraction of income from the author's order and other sources (in accordance with clause 7.6 of the Procedure); expenses that do not have documentary evidence, but are accepted for deduction in accordance with Art. 421, p.

9 of the Tax Code of the Russian Federation on an accrual basis. The procedure of the Federal Tax Service, part 7, clause.

The calculation for the current reporting period does not reflect the amount of recalculation made for the previous period.

When filling out calculation line indicators, negative values are not provided (section II “General requirements for the procedure for filling out the Calculation” of the Procedure).

Beginning with 9-month reporting, files containing negative amounts will be considered inconsistent with the format.

Such changes were made by the Federal Tax Service to the xml file schema. And those who submitted calculations for the first half of the year with negative amounts will have to submit an updated calculation for the first quarter (the tax authorities are sending out the relevant requirements). Let’s say that in July they recalculated vacation pay for June to an employee who quit. The result was a negative basis and assessed contributions.

It is necessary to submit to the Federal Tax Service an updated calculation for the six months with reduced amounts, and in the calculation for 9 months, take this into account in the columns “Total from the beginning of the billing period.” Sample of filling out line 040 in section 1 of the calculation (2018) Example 2.

Filling out line “040” of section 3 of the calculation of insurance premiums of Project JSC, reporting on general mandatory contributions for the first quarter of 2020, constitutes a calculation.

In the third section, the policyholder must enter individual information about the employee Valery Aleksandrovich Tikhomirov.

Along with personal information (TIN, SNILS, date of birth, passport data, characteristics of an insured employee in the system, citizenship) and other mandatory information in the section, you must indicate the serial number of the data entered. The policyholder in his capacity uses the taxpayer’s personnel number - “2”. If the policyholder subsequently discovers incorrect data regarding Tikhomirov V. in the prepared reports.

A., then he will need to prepare a clarifying version of Section 3 with changed data for this employee.

→ Accounting consultations → Insurance premiums Current as of: January 15, 2020 We talked about the form of Calculation of insurance premiums submitted to the tax office from 2020 in our consultation. We will tell you how to make adjustments to the calculation of insurance premiums in 2020 in this material.

Procedure for adjusting the Calculation of insurance premiums In what case is it necessary to adjust the Calculation of premiums in 2020? If an organization or individual entrepreneur has discovered that in the Calculation of insurance premiums they submitted, for any reason, the amount of contributions payable was underestimated, it is necessary to submit an updated Calculation to the tax office (clause 1, 7, Article 81 of the Tax Code of the Russian Federation).

It is necessary to fill in the necessary data in subsections 3.1 and 3.2 of the updated calculation without indicating an adjustment.

- When excluding erroneous information from the calculation. The section should be marked as corrective; subsection 3.1 indicates the person whose data is subject to correction. In subsection 3.2, lines 190–300 are filled with zero values.

- In the event that it is necessary to change information about an employee or the amount of contributions in the report. It is necessary to exclude erroneous information in the manner specified in paragraph 2 and add the changed data by entering it in section 3 without instructions for adjustment.

- ATTENTION! If errors are detected in the DAM for previous periods, a corrective calculation is created on the form that was in effect during the period being corrected. The clarification should also be submitted to the body that administered the contributions in the adjusted period.

The adjusted version must contain all sections of the reporting form previously submitted to the Federal Tax Service, but with the amendments made.

The updated version of the calculation must also include a third section with the individual data of those insured workers in respect of whom changes were made.

The expert’s opinion and recommendation on filling out the mandatory fields of the new calculation for insurance premiums of the Federal Tax Service of the Russian Federation regarding the issue of drawing up and submitting calculations for insurance premiums touched upon the topic of the procedure for filling out its updated version in Letter No. BS-4-11/ dated 01/10/2017.

Filling out the updated calculation

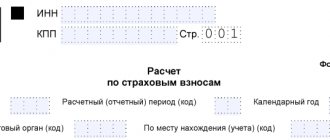

The adjusted DAM differs from the primary one in that an adjustment note is made in certain fields.

In the initial calculation, the adjustment number is marked “0” on the title page, and the submission of an amendment is reflected by the serial number of the amended report - 1,2,3, etc.

For example, the corrective DAM number “1” means that the change is being made for the first time. Line 010 of the third section of the report is filled in similarly.

The clarifying calculation is completed taking into account the following provisions:

- all sheets of the DAM that were presented in the primary report are filled out, except for section 3, taking into account changes;

- Personalized accounting data (section 3) is filled out only for individuals for whom the data is being adjusted;

- Only new indicators are indicated (not the amounts by which the data in the primary report decreased or increased, but new ones).

Source: https://vannacity.ru/vznos/sdelat-korrektirovku-razdela-rascheta-strakhovym-vznosam/

RSV for the 3rd quarter of 2020 - sample filling

Has a new form been introduced? When and what changed in her for the last time? For which reporting period should the new calculation form be used? Where can I download a free RSV form in an easy-to-fill out format? How to fill out the DAM for the 3rd quarter of 2020: a sample form, as well as links for downloading, are in this material.

The previous year was marked by a multitude of changes in Russian legislation regarding the administration, calculation and reporting deadlines for insurance premiums.

Such changes in laws always lead to changes in accompanying forms, forms, declarations and similar documents.

In the case of insurance premiums, a number of reports submitted to the Pension Fund and social insurance were replaced with one single social insurance fee.

The form of calculation of insurance premiums does not remain unchanged. Back in 2017, the Federal Tax Service prepared a draft order to amend the calculation form. This draft order stipulates that it will come into force from the beginning of the year. However, the draft order still remains only a draft and has not entered into legal force. Therefore, the previous form and procedure for filling it out apply.

RSV: new form

The next reporting period has ended and it is necessary to submit the DAM for the 3rd quarter. 2019. The new form has not been approved and the calculation must be submitted using the form introduced by the order of the Federal Tax Service of Russia dated 10.10.2016 No. ММВ-7-11/ [email protected] This form is current.

calculation of insurance premiums for the 3rd quarter of 2020 (Form for KND 1151111) in PDF format

or

download for free in Excel.

The calculation form contains three sections. The most voluminous is the first section, devoted to calculations. However, if the organization has a large number of employees, then section 3 will be larger, containing personalized information about the insured persons.

The form includes:

- General information about the policyholder.

- Calculation of pension insurance contributions (subsection 1.1).

- Calculation of medical insurance premiums (subsection 1.2).

- Calculation of social insurance contributions.

- Costs for social insurance contributions such as temporary disability and maternity.

- Information about payments that were financed by the federal budget.

- Personalized information about insured persons.

In order to correctly calculate contributions, you must use the rates that were current at the time of calculation. For compulsory pension insurance it is 22%, for compulsory health insurance – 5.1%, and for compulsory social insurance – 2.9%.

Not all policyholders are required to complete the second section. It applies only to heads of farms or peasant households.

Section 3 contains information about each insured person for whom contributions are calculated and paid by the enterprise.

The data contains personal information and includes calculations for individual and total amounts.

Along with the sections, a title page must also be filled out, on which information about the organization, the number of sheets and information about the reporting period are indicated. Each calculation page indicates the policyholder’s TIN and KPP.

Procedure for filling out and submitting the RSV

Detailed instructions for filling out the calculation with all attachments are given in the order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. You can download these instructions at the end of the page.

Damage to calculation pages and correction of entries in it are not allowed. When filling out on paper, you must use block letters written in black or blue ink.

If the calculation is filled out on a computer, then when it is subsequently printed on a printer, it is allowed that there is no framing of the acquaintances and dashes for unfilled (empty) acquaintances.

In general, the rules for registration are practically no different from the preparation of other documents intended for submission to the tax service. It is allowed to submit the calculation in two versions: on paper or in electronic form.

But the first option is allowed only to organizations with up to 25 employees inclusive, as stated in Article 431 of the Tax Code of the Russian Federation. In this case, the payment can be brought in person or sent by registered mail.

A very important point in the calculation is that the data in section 1 and section 3 match. If a discrepancy is detected, the tax authorities will not accept the report.

There is no difference in terms of submission deadlines in what form the reports are submitted. For the written and electronic versions, one deadline is established - the 30th day of the month following the reporting period (Article 431 of the Tax Code of the Russian Federation). In 2020, these terms were distributed as follows:

- For the first quarter – April 30.

- For the half year - July 30.

- For 9 months – October 30.

- For 2020 – January 30, 2020.

Sample of filling out the calculation of insurance premiums for the 3rd quarter of 2019

Below is the calculation of insurance premiums for the 3rd quarter of 2019: a sample filling for an organization on the general taxation system.

filling out the calculation of insurance premiums for Ⅲ sq. 2020 for organization in pdf format.

We use the following as initial data for the calculation:

The average number of employees of the organization was 12 people. One of the employees is A.V. Kukushkin. - works in difficult conditions related to list 2, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10. This fact is reflected in section 3 on page 15

Organization in Ⅲ sq. paid for 4 sick leaves for 16 days of illness.

In the third quarter The following payments were made:

- in July, payments in total: 250,000 rubles, including those not subject to insurance contributions - 4,000 rubles.

- in August, payments in total: 250,000 rubles, including those not subject to insurance contributions - 8,000 rubles.

- in September, payments in total: 250,000 rubles, including those not subject to insurance contributions - 0 rubles,

- Total for the Ⅲ quarter: 750,000 rubles, including non-insurance contributions - 12,000 rubles.

The amounts of accrued insurance premiums are reflected in the table:

Insurance premiums To the Pension Fund, rub. To the Social Insurance Fund, rub. To the FFOMS, rub.

| TOTAL, including for: | 162360 | 21 402 | 37 638 |

| July | 54120 | 7134 | 12 546 |

| August | 53240 | 7018 | 12 342 |

| September | 55000 | 7250 | 12750 |

According to the additional tariff for financing the insurance part of the labor pension (6%), the following is accrued:

Last nameTo the Pension Fund of the Russian Federation at an additional tariff

| Kukushkin, in total, including for: | 5400 (90000 x 6%) |

| July | 1800 (30000 x 6%) |

| August | 1800 (30000 x 6%) |

| September | 1800 (30000 x 6%) |

The company incurred expenses for compulsory social insurance (RUB):

| Month | Types of expenses | Sum | Reimbursed by the Federal Insurance Service of Russia |

| July | Sick leave benefit | 1500 | 0 |

| August | Sick leave benefit | 2500 | 0 |

| September | Sick leave benefit | 3500 | 0 |

| Total for Ⅲ sq. | 7500 | 0 |

The amount of insurance contributions to the social insurance fund to be paid was:

| Month | Amount, rub. |

| July | 5634 (7134 – 1500 + 0) |

| August | 4518 (7018 – 2500 + 0) |

| September | 3750 (7250 – 3500 + 0) |

| Total for Ⅲ sq. | 13902 (21402 – 7500 +0) |

A sample calculation of insurance premiums is presented for 9 months and reflects payments and accruals for the period January-September.

Please note that, as an example, section 3 is completed for only three employees, but when submitting the report, it must be completed for all insured persons.

An example of filling out a calculation of insurance premiums for a year is as follows:

More Example of calculation of insurance premiums for 9 months of 2020. Sample of filling out a UTII declaration to the Federal Tax Service for Ⅲ sq. 2020

When filling out the calculation of insurance premiums, you need to take into account the budget classification codes (KBK) for 2020.

You can view the new CBC for insurance premiums for 2020 here.

Source: https://www.yourbuhg.ru/strah-vznosy/raschet-strah-vznosam-2017-primer-zapolneniya.html

https://youtu.be/N4qtX_hXMPU

Adjustment of calculation of insurance premiums in 2020: rules, sample

A corrective calculation for insurance premiums is submitted if an error is discovered in the main report. There are some rules for filling out such reports, which will be discussed in the article.

You can fill out the RSV in the Bukhsoft program. It's fast and free.

Fill out RSV online

How to submit an adjustment for calculating insurance premiums

A clarification on the calculation of insurance premiums is submitted when errors were made when filling out the initial report. If indicators for 2020 and earlier years are adjusted, then the amended report will need to be submitted to the Pension Fund. If we are talking about adjusting periods starting from 2020, then a new calculation is submitted to the tax authority at the place of registration.

In Art. 81 of the Tax Code of the Russian Federation describes cases when no sanctions are imposed on the taxpayer when submitting an updated calculation. This applies to situations:

- submission of an amendment in which contributions payable will become less than in the primary report;

- submitting an update before the deadline for submitting the main calculation expires;

- submitting a clarification in case of an independently identified error before scheduling an on-site tax audit (in this case, the penalty for contributions must be paid before submitting the clarification if the payment deadline has already arrived);

- submitting a clarification in case of an independently identified error, if the tax authorities did not notice this error during an on-site audit.

According to paragraph 5 of Art. 81 of the Tax Code of the Russian Federation, the updated calculation is submitted to the tax authority on the form that was in force at the time of submission of the initial calculation for the same period.

The maximum deadline for submitting an updated calculation is not established by law. But the tax authority can set such a period if it itself has identified an error in the calculation. In this case, the tax authorities’ request indicates the number of days within which the amended calculation must be submitted.

The corrective report is sent to the same Federal Tax Service to which the initial calculation was submitted. At the same time, the correction number is indicated on it. We will show you how to do this below.

Corrective calculation of insurance premiums: how to fill out correctly, adjustment number

The only difference when filling out the updated calculation from the primary one is that in certain fields it is necessary to note that the calculation is corrective. On the first sheet, in the “ adjustment number ” field, when submitting the initial calculation, 0 is indicated, but when submitting an update, this field should contain the serial number of the amended report.

The field of the same name in Section 3 with personalized accounting data is filled in similarly .

When filling out the adjusted calculation, you should be guided by the regulatory document that approved the report form that was in force in the period for which the adjustment is submitted. This document also contains recommendations for filling out the form.

When filling out the adjustment, you should remember that:

- all necessary sheets of the form are filled out, even if the information on them does not differ from the initial calculation;

- section 3 on personalized accounting is filled out only for those individuals affected by the changes;

- all columns indicate new indicators (not the values by which the primary calculation indicators need to be reduced or increased, but new ones).

The date next to the manager’s signature must be current.

Sample adjustment of calculation of insurance premiums. Error correction

Below is a sample of correcting errors in the calculation of insurance premiums using the example of a report from which you will learn how to make adjustments. The sample shows only those fields whose completion differs from the completion when submitting the initial report.

Let us remind you that if the clarification is submitted for periods preceding 2020, then the form will be different, and such a report will be submitted to the Pension Fund.

How to adjust the title page:

How to adjust section 3 of the contribution calculation:

Penalty for errors in calculation

There is no penalty for adjustments. The main thing is to submit the corrective report within the deadlines established for submitting the ERSV.

If this is not done, then fines will be charged for a single calculation of contributions (clause 1 of Article 119 of the Tax Code of the Russian Federation). The fine is 5% of the amount of contributions for each month of delay.

For example, the calculation was not submitted or was not accepted by the tax authorities. The amount of contributions in the calculation is 1 million rubles. For each full or partial month, the company will give 50,000 rubles. (1 million x 5%).

Subscribe to “Simplified” for six months, and read for 12 months!

best promotion is valid until December 16th

when subscribing to the magazine “Simplified” -

an annual subscription at the price of six months.

Hurry up to pay

the bill

. Gift for subscription - the book “Simplified. Annual report 2019.”

December 16 is the last day of the promotion

Source: https://www.26-2.ru/art/351610-korrektirovka-rascheta-po-strahovym-vznosam-2019

In what order are adjustments carried out?

Information on how to fill out and submit an adjustment for contributions can be found in the order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] , which approved the calculation form itself. And also the procedure for filling it out.

The general main rule: when drawing up an ERSV adjustment, you must use the form of the form that was in force in the period being corrected (clause 5 of Article 81 of the Tax Code of the Russian Federation). Let us remind you that this procedure applies to all reporting forms for the Federal Tax Service. So far, since 2017, one form from the above order has been used.

Do not reflect the results of the recalculation in the report for the current period (letter of the Federal Tax Service of Russia dated August 24, 2017 No. BS-4-11/16793).

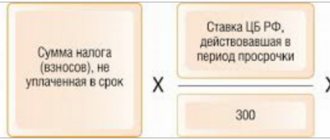

If an adjustment is submitted in connection with an understatement of the taxable base and, as a result, the amount of insurance premiums payable, then first, before submitting adjustments, it is necessary (clauses 3 and 4 of Article 81 of the Tax Code of the Russian Federation):

- transfer the amount of underpayment to the budget;

- pay penalties. These are considered according to the rules of General Article 75 of the Tax Code of the Russian Federation. That is, for each day of late payment. Moreover, if the arrears arose after September 30, 2020, penalties for delays of more than 30 days are calculated based on 1/150 of the refinancing rate of the amount of the arrears, as for the first 30 days. In cases where the delay is small, namely less than 30 days, or if the arrears arose before October 1, 2020, penalties are calculated based on 1/300 of the refinancing rate.

Updated calculation of insurance premiums

Quantity July 31, 2017

In 2020, a new report appeared for employers - calculation of insurance premiums.

When filling out the new form, according to tax officials, policyholders made many mistakes. Therefore, the letter of the Federal Tax Service dated June 28, 2017 No. BS-4-11 / [email protected] describes the procedure for correcting them.

When do I need to submit an updated calculation?

According to Art. 81 of the Tax Code, an amendment must be submitted if errors were found in previously submitted reports that led to an underestimation of the base for contributions.

Tax officials propose to correct other errors in the next period.

In practice, errors often occur that do not lead to arrears in contributions. However, they can only be corrected by submitting an updated calculation. For example, a company mistakenly assessed contributions for compensation in exchange for milk for an employee engaged in hazardous work. After this, the person suddenly quit. This situation will not allow the excess to be deducted in the next period.

Thus, an updated calculation is submitted both in case of underestimation of the base for contributions, and in case of other errors.

Composition of the updated calculation

In the updated calculation, you need to include those sections and applications that were in the primary report, but with the correct data.

The exception is personalized section 3. It must be filled out only by those individuals in respect of whom changes are being made. It will not be a mistake if you duplicate the correct personalized information with the adjustment flag “0”.

Thus, the calculation adjustment and personal data numbers may differ.

Incorrect indication of personal data

It is better to clarify errors in the indication of personal data of insured persons. This is done as follows. Section 3 must be completed twice. First you need to reset the erroneous information, and then bring in the correct information from scratch.

It looks like this step by step:

- Add section 3. In subsection 3.1. We indicate personal data - exactly from the original calculation, in subsection 3.2. We put zeros in all places. The adjustment number in this section is indicated “1–”.

- We add section 3 again. In it we indicate the correct personal data and information. The correction number is “2–”.

Example. In the initial settlement for the insured person Sidorova E.Yu. Incorrect passport information was indicated, as well as the amount of insurance premiums.

You need to fill out an updated calculation of insurance premiums. In this case, the adjustment number “1” is indicated on the title page of the calculation. Section 1 is filled in with the correct data and amounts. Section 3 is filled in as follows:

|

filling out the adjustment calculation

Extra individuals

When including extra people in the initial calculation, you must add section 3 with an extra individual and reset the information. Similar to stage 1 if personal data is entered incorrectly. >>>

Lost people

If information on the employee is not included in the primary calculation at all, then section 3 on the lost person is added to the clarification. In this case, the correction number in section 3 is indicated “0—”. After all, personalized information about a given person is being submitted for the first time.

If numerical indicators are clarified or data on lost persons are added, adjustments are made to section 1 of the calculation.

Example. Former employee Sidorova E.Yu. was included in the primary calculation by mistake, and, conversely, Denisov I.S. was not included.

It is necessary to fill out the adjustment RSV. In this case, the adjustment number is indicated on the title page of the calculation. For example, “2” means the second correction for the billing period. Section 2 indicates summary information for the policyholder as a whole. Section 3 should display the following.

|

filling out the updated calculation

Another way to correct personal data

When clarifying Section 3, you can include only those information in relation to which changes need to be made.

In this case it is indicated:

- the same serial number of the individual that was in section 3 of the primary calculation;

- the adjustment number is equal to +1 to the previous individual information for this person.

This method has revealed several disadvantages in practice. For example, control relationships between sections “walk” or there is a need to track the continuous numbering of information.

Therefore, in our opinion, the option described above is preferable. If, nevertheless, the calculation is corrected in this way, we recommend that you attach explanations to the clarification.

Otherwise, tax authorities may simply get confused.

Deadlines for submitting clarifications

If the error is discovered independently, then when submitting the clarification, the policyholder needs to pay the missing amount of contributions and calmly submit the calculation. In this case, officials will not be able to fine you.

Updated calculation of insurance premiums

In 2020, a new report appeared for employers - calculation of insurance premiums.

When filling out the new form, according to tax officials, policyholders made many mistakes. Therefore, the letter of the Federal Tax Service dated June 28, 2017 No. BS-4-11 / [email protected] describes the procedure for correcting them.

Online magazine for accountants

We also believe that section 3 should be formed for the general director, the only founder with whom the employment contract has been concluded. After all, such persons are also named in paragraph 2 of paragraph 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance”. Therefore, they should fall under section 3. Even if they did not receive any payments from their own organization in the last three months of the reporting period.

Of course, it is necessary to formulate section 3 for persons in whose favor in the last three months of the reporting period there were payments and remunerations under employment or civil contracts (clause 22.1 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2020 No. MMV -7-11/551).

How to submit an adjustment under the RSV: hot questions and examples of filling out

The corrective form is submitted only if the original one is accepted. If the original report received a refusal to accept it, you need to correct the shortcomings and resend the original one.

The corrective form always includes Section 1 with appendices 1 and 2 (or Section 2 in the case of peasant farms). The presentation of other sections and applications depends on the situation. Let's look at the most common scenarios.

If employee data does not need to be adjusted

In this case, the report includes only data on the organization with the adjustment number on the title page. There is no need to include employee data in the report. To remove employees from the report, uncheck them in Section 3.

If Section 1 is in automatic calculation mode, be sure to update the list of employees. For example, Kontur.Extern calculates amounts for all employees in the list, regardless of whether they are selected or unchecked. Check the box only for those employees who should be included in the adjustment report.

Also, in some systems, for example in Externa, amounts for employees and for the organization are reconciled only in the original report. To check the adjustment, use the following algorithm.

Algorithm for checking a corrective report

- Remove the correction number from the title page, if it is there.

- Update the list of employees in Section 3.

- Set the fields in Section 1 applications to automatic mode.

- Check the relevance of the data in previous periods.

- If the data is not up to date, download reports in pre-import mode into the service.

- Run the scan. Correct errors if any.

- Put the correction number on the title page.

- Generate and send a report.

If you report through Kontur.Extern, the task is simpler. The system will warn you if you try to send a report with the details of a previously sent report.

Here are some tips:

- If the Federal Tax Service has accepted the initial report and you want to send an adjustment, the system will tell you which number you need to indicate.

- If the initial report has not yet been accepted, Extern will inform you that it is too early to send the adjustment and will advise you to wait for a response from the Federal Tax Service.

- If the primary report is rejected, Extern will warn you that before sending the adjustment you must submit the primary report with number = 0.

Reporting through another system? Connect to Extern with a 50% discount (not valid in all regions).

Catch a discount

If you need to adjust data on employees in Section 3 (except for full name and SNILS)

On the title page, indicate the correction number (for example, “1–,” “2–,” and so on). According to the filling procedure, include in the form only those employees for whom you need to correct the data.

For each employee, indicate the adjustment number, keeping the serial numbers. Unused numbers can be added to new employees.

Please note: checks in the service work for all employees only if the title has an adjustment number = 0. To check the report, use the above algorithm.

Please indicate the correction number on the title page. For example, “1–”, “2–”, etc. Then create two employee cards and send them in one calculation:

- With incorrect SNILS, zero (deleted) Subsection 3.2 and adjustment number “1”. In lines 160-180, indicate the sign “no”.

- With the correct SNILS, correct amounts in Subsections 3.2.1 and 3.2.2, adjustment number “0” and a new serial number of the employee (not previously used).

If the error in the full name and SNILS was formatted and last quarter it was possible to send a report with it, but now it is not (for example, numbers and dashes in the full name, spaces at the end of the full name, incorrect SNILS), check with the inspector what to do.

Example 1: SNILS is not the same, but real

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-002 13, Ivanov Ivan Ivanovich with SNILS 001-001-001 12 was indicated. Both SNILS numbers exist and can be loaded into the Federal Tax Service database.

To prepare the adjustment, we create two employee cards. The first is with an error that needs to be corrected, the second is with data that should be in the report.

On the first card in Section 3, tick Ivanov Ivan Ivanovich with SNILS number 001-001-001 12. In his card:

- Specify a non-zero adjustment number;

- In lines 160-180, mark “No”;

- Remove section 3.2.

In the second card in Section 3, tick Ivan Ivanovich Ivanov with SNILS number 001-001-002 13. In his card:

- specify the correction number = 0;

- Fill in the correct information for the remaining positions.

Example 2: non-existent SNILS

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-001 12, Ivanov Ivan Ivanovich @ was indicated! with SNILS 001-001- 002 18.

Such SNILS should not pass the check for the control ratio, and the full name should not be checked according to the scheme. The Federal Tax Service should not have accepted such a report. If this happens, contact the inspector for clarification.

If you forgot to include an employee in the original report

Include the forgotten employee in the adjustment form with the adjustment number in the employee card = 0. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee and are indicated as they should be throughout the organization).

Please note that each time you send a new correction, you must put a new number on the title page.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Importing data from 2-NDFL 5.06. Zero RSV in no time. Free for 3 months.

Register

If an employee was included in the original report by mistake

Submit the adjustment to this employee by deleting Subsection 3.2 from his card. In lines 160-180, indicate the sign “no” and reduce the number of insured persons in lines 010 of Appendices 1 and 2. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee, that is, they are reduced.

This way you will reset the data on it in the Federal Tax Service database. We advise you to coordinate further actions with the inspection.

If you included one employee instead of another

Both employees must be included in the corrective report:

- Unnecessary - with zero (removed) Subsection 3.2 and adjustment number “1”. In lines 160-180, indicate the sign “no”.

- Required - with correct data, correct amounts in Subsections 3.2.1 and 3.2.2 and adjustment number “0”.

Section 1 with Subsections 1 and 2 needs to be adjusted: subtract the amounts of the erroneously added employee from the total amounts of the organization and add the amounts for the employee who was forgotten to be included.

If the right to apply a reduced tariff has been acquired/lost (recalculation of contributions from the beginning of the year)

In the clarifying calculations for previous reporting periods in Appendix 1, indicate the new tariff code (08/02). Change the contribution amounts in Section 1 and Appendices 1 and 2 to Section 1 to take into account the new tariff.

All employees must be included in the corrective report. In each employee’s card, indicate an adjustment number other than 0, maintaining the serial numbers of the employees. In Subsection 3.2.1 you need to indicate two categories of the insured person (NR and PNED):

- the old category with zero amounts.

- a new category with the correct amounts.

Source: https://kontur.ru/articles/5615

Adjustment of the DAM in 2020

If you discover that a previously submitted calculation was submitted with errors that led to an underestimation of the amount of contributions payable, you will need to submit an adjustment. In accordance with the norms of clause 1 stat.

122 of the Tax Code, identification of arrears by control authorities leads to the collection of a fine in the amount of 20% of the amount of non-payment. If you independently correct the report and submit clarifications, the sanction does not apply (clause 1 of Art.

81 NK).

Therefore, the corrective DAM must be submitted if errors in the original calculation led to the organization underpaying contributions to the budget.

If inaccuracies caused, on the contrary, an overpayment, tax legislation does not oblige you to submit an amendment.

But it is better to bring the taxpayer’s data in line with the data of the Federal Tax Service so that, if necessary, you can easily make offsets or refunds of overpaid amounts.

In addition, in some situations it is necessary to re-submit the calculation even if the amounts of contributions to be accrued are correctly indicated. So, according to paragraph 7 of Art. 431 reports are considered not submitted in the following cases:

- Entering erroneous personal data on an employee - in section. 3 incorrectly entered or completely missing SNILS codes, INN, and the employee’s residential address.

- Identification of inaccuracies in numerical indicators - for example, in the amount of the taxable base or in payments to an individual, as well as in the amount of calculated contributions to section. 3.

- The discrepancy between the general values of the numerical indicators in Sect. 3 for the enterprise as a whole with those specified in subsection. 1.1, 1.3 App. 1 to section 1 information.

- Discrepancy between the total amount of accrued contributions for compulsory pension insurance from the base within the limit (for all employees in section 3) with the amount of compulsory pension insurance contributions for the enterprise as a whole, specified in subsection. 1.1 App. 1 to section 1.

Note! In the above situations (according to clause 7 of Article 431 of the Tax Code), the re-sent calculation is not corrective. Since the primary document was rejected by the tax authorities, which means it cannot be considered sent.

In what cases will there be no sanctions for the payer of contributions if the DAM adjustment is not submitted (according to Article 81 of the Tax Code):

- If errors did not lead to underpayment of contribution amounts (clause 1).

- If the regulatory deadline for submitting the calculation has not yet expired (clause 2).

- If the taxpayer managed to independently submit an update before the expiration of the time between the deadline for submitting the DAM and payment of contributions - provided that the tax office did not have time to request clarification or schedule an on-site inspection (clause 3).

- If all deadlines are missed, liability does not apply provided that the taxpayer pays the amounts of arrears and penalties on time (clause 4).

RSV for the 1st quarter of 2020

How to fill out an adjustment according to the DAM in 2020

According to the requirements of the tax authorities, the clarification is submitted to the Federal Tax Service at the taxpayer’s registered address (clause 5 of Article 81 of the Tax Code). In this case, the corrective calculation is drawn up on the form that was in effect during the period of changes.

When submitting an adjustment, the serial number of the clarifications is placed on the title page of the form, starting with “1–”, then “2–”, etc. A similar number is affixed to section. 3 (page 010). The value in the period code must correspond to the billing period for which the company submits the DAM.

The corrective information is provided in the corrective form and incorrect information is excluded. When entering data, pay special attention to the preparation of section. 3. This sheet is not submitted to all employees, but only to those for whom corrections are made. All other pages that have already been submitted earlier are obligatory.

Below are examples of making clarifications.

Example 1 – filling out the DAM adjustment if there are errors in the personal data of an individual

Let's say you made mistakes in the employee's personal data in section. 3. What do you mean? Such information includes everything specified in subsection. 3.1 – Full name, personal identification number, tax identification number, passport details, etc. Let’s assume that the employee’s last name is inaccurate. The correction procedure is as follows:

- The correction number on the title of the document is “1”.

- All previously presented sheets, including sections and appendices, are filled out in the same way as the initial calculation. Exception - Sec. 3.

- Sec. 3 (in 2 copies) is re-submitted only to the employee for whom the last name was incorrectly indicated: The first copy of section. 3 is filled in like this. In subsection 3.1 indicates incorrect data. In subsection 3.2 “0” is placed on all lines.

- Second copy of sec. 3 is filled in like this. In subsection 3.1 the correct data is indicated. In subsection 3.2 the amounts of payments and other charges are indicated.

Example 2 – filling out the DAM adjustment if there are errors in the amount of accruals in section. 3

Let's assume that all information about employees is correct, but there are errors in the payment amounts. In this case, the correction number is also placed on the title. Other sheets are specified in accordance with the corrections. Sec. 3 is submitted to those employees for whom there are inaccuracies. In this case, 1 copy of Sec. 3 (with subsections), where the correct information is entered.

Example 3 – filling out the DAM adjustment if there are other errors

If in personal data and numerical indicators section. 3 everything is correct, but there are errors in other pages of the report, how to make adjustments? According to the filling rules, only those sheets that contain inaccuracies need to be clarified. Sec. 3 in this situation is not resubmitted provided that the correct information on employees is entered in the initial calculation.

How to clarify the data in section 3

- first, the data that was reflected in the initial “incorrect” calculation is entered into the corresponding lines of subsection 3.1, and in subsection 3.2, zero values are entered on lines 190-300;

- then another subsection 3.1 is filled in, but with the correct data, and subsection 3.2 reflects the corresponding amounts of payments and contributions.

Example 1

The procedure for correcting the total indicators of Section 3 depends on what errors were made in the initial calculation:

- If the insured person was not included in the initial calculation at all, Section 3 is filled out for him, and at the same time the summary indicators of Section 1 are adjusted.

- If an individual included in the initial calculation by mistake needs to be excluded from the calculation, the initial data on him is “zeroed” by filling out subsection 3.2. zero indicators. At the same time, the summary indicators of Section 1 are also decreasing.