The procedure for paying vacation pay

Pay for your vacation no later than three days before it starts.

At the same time, the Labor Code does not prohibit paying vacation pay earlier (Part 9 of Article 136 of the Labor Code of the Russian Federation). Situation: on which days should the three-day period for payment of vacation pay be counted - calendar or working days?

Calculate the deadline for payment of vacation pay based on calendar days.

After all, if the Labor Code does not directly indicate which days to count for a particular period, it is necessary to proceed from the calendar.

This procedure also applies to the deadline for the payment of vacation pay, since Article 136 of the Labor Code of the Russian Federation does not directly indicate which days to take into account. Therefore, count both working and non-working days - holidays, weekends. That is, all calendar days. Moreover, if the end of the term falls on a non-working day, then make the payment the day before - on the last working day.

This procedure is provided for in Article 14 of the Labor Code of the Russian Federation, similar conclusions are expressed in the letter of Rostrud dated July 30, 2014 No. 1693-6-1.

Situation: is it possible, at the request of an employee, to pay him vacation pay after he returns from vacation?

Answer: no, you can't.

Labor legislation does not allow this. The organization is obliged to pay vacation pay to the employee no later than three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). And the Labor Code of the Russian Federation does not contain any exceptions to this provision related to the desire of the employee.

Expenses for additional vacation

In general, the duration of basic paid leave is 28 days. Is it legal to include payment for additional vacations in income tax expenses? Yes, if the right to additional vacation time is enshrined in law.

Dangerous moment

The employer has the right to independently establish additional holidays if they are not provided for by law (Article 116 of the Labor Code of the Russian Federation). At the same time, it is impossible to recognize expenses when calculating income tax if excess leave is provided on the basis of a collective agreement. This is directly stated in the Tax Code.

Expenses for paying additional vacations provided under a collective agreement (in excess of those provided for by current legislation) to employees, including women raising children, are not taken into account when determining the tax base (clause 24 of Article 270 of the Tax Code of the Russian Federation).

You can only take into account the costs of additional rest for employees who are legally entitled to extended leave. At the same time, it will not be superfluous if, in the vacation application, each of them refers to a legal norm that gives the right to additional days of rest. First of all, these are articles 116–118, 321, 335 of the Labor Code. In addition, there are a number of federal laws, for example dated February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas”, and resolutions, for example the Government Decree RF dated December 30, 1998 No. 1588, etc.

Responsibility for late payment of vacation pay

Attention: failure to comply with the payment deadline for vacation pay may be regarded as a violation of labor law requirements. For this violation, the labor inspectorate may fine the organization or its officials.

The responsibility is as follows:

- for officials of the organization (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine from 1000 to 5000 rubles;

- for an organization – a fine from 30,000 to 50,000 rubles.

Repeated violation entails:

- for officials of the organization (for example, a manager) - a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years);

- for entrepreneurs – a fine from 10,000 to 20,000 rubles;

- for an organization – a fine from 50,000 to 70,000 rubles.

Such liability measures are established in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

An employee who has not been paid vacation pay in a timely manner may request that annual leave be postponed to another time (Part 2 of Article 124 of the Labor Code of the Russian Federation, Clause 2 of the ruling of the Constitutional Court of the Russian Federation dated June 23, 2005 No. 230-O).

If vacation pay has been calculated and paid, but the employee cannot go on vacation due to an emergency situation at work, issue a recall from vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation).

Reserve for vacation pay

Since 2011, organizations have been required to create a reserve for vacation pay in accounting, since upcoming expenses for vacation pay are recognized as an estimated liability (clause 8 of PBU 8/2010, letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107). Accordingly, all vacation pay (including for transferable vacation) is written off in accounting at the expense of the created reserve. An exception is provided only for small businesses, provided that they are not issuers of publicly offered securities (clause 3 of PBU 8/2010). Such enterprises have the right not to create a reserve for vacation pay and assign vacation pay directly to current cost accounts.

If vacation is granted in advance...

In accordance with Art. 122 of the Labor Code of the Russian Federation, paid leave must be provided to employees annually. Moreover, the right to use vacation for the first year of work arises for the employee after six months of his continuous work with this employer. By agreement of the parties, paid leave may be granted to the employee before the expiration of six months. That is, in some cases, the employer has the right to grant leave before the employee has worked the corresponding period for which the leave is granted. This is the so-called vacation in advance. No accruals are made for such payments (vacation pay) in the vacation reserve accounts.

Obligations to accrue vacation pay in the current reporting period, if the employee did not actually work the period for which vacation pay was accrued, are reflected (clause 302 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06-10/62943):

– on the debit of account 0 401 50 000 “Deferred expenses” (the corresponding analytics is selected); – on the credit of account 0 302 00 000 “Settlements for accepted obligations.”

Accounting: no reserve is created

If a reserve is not created in accounting, then reflect the accrual and payment of vacation pay as follows:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

- vacation pay accrued.

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (account 70).

Make similar entries if the vacation is rolling (that is, it begins in one month and ends in another). In this case, the accountant will not have to distribute vacation pay by month.

This is explained as follows.

Since 2011, expenses incurred by the organization in the reporting period, but relating to subsequent reporting periods, may not be reflected in the balance sheet as deferred expenses (in a separate line). They are shown in the balance sheet in accordance with the conditions for asset recognition established by accounting regulations. And they are subject to write-off in the manner established for writing off the value of assets of this type.

Such rules are established by paragraph 65 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

In this regard, account 97 “Deferred expenses” is not used in all cases in which it was used previously. This account can be used provided that the corresponding amounts are expressly named as deferred expenses in the current accounting regulations. Or amounts are accounted for in account 97 if they meet the following criteria:

- the organization incurred expenses, while the counterparty did not have counter-obligations to it (otherwise a receivable is recognized, not an expense);

- these expenses do not form the value of tangible or intangible assets;

- expenses determine the receipt of income over several reporting periods.

Vacation pay accrued in the current month for the next month are not considered deferred expenses, since such expenses do not lead to the receipt of income in several reporting periods (clause 19 of PBU 10/99) and affect the financial result of the period in which they were incurred . Consequently, in accounting, vacation pay does not need to be distributed between the months in which the vacation fell, that is, they should be taken into account at a time upon accrual.

An example of how vacation pay is reflected in accounting. Vacation starts in one month and ends in another. The organization is a small business entity and does not create a reserve for vacation pay.

In June 2020, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Vacation duration is 28 calendar days: from June 16 to July 13, 2020. Vacation pay was paid to the employee on June 11, 2020.

For the billing period - from June 1, 2014 to May 31, 2020 - Kondratyev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The accountant accrued vacation pay in the amount of: 1024 rubles/day. × 28 days = 28,672 rub.

including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June 2020:

Debit 44 Credit 70 – 28,672 rub. – vacation pay was accrued to Kondratiev for June and July.

We take into account “carrying over” vacation pay

There are no provisions in the Tax Code that allow companies to recognize in the income tax base the expenses for “carrying over” vacation pay in full during the period of their accrual and payment to the employee, and not defer it until the month the vacation actually begins.

According to the Russian Ministry of Finance, “carryover” vacation pay should be taken into account in proportion to the vacation days falling within each reporting period. Judicial practice is developing in favor of companies 09.23.2015 Author: Yulia Fufaeva, Deputy Head of the Audit Department

In the field of accounting and taxation, there are a number of eternal questions to which the Ministry of Finance of Russia and the Federal Tax Service of Russia have been giving the same answers for many years, and the problems are not only disappear, but new ones appear. One of these questions is how a company can correctly take into account the costs of employee vacations carried over to another reporting (tax) period and charge insurance contributions to extra-budgetary funds and personal income tax from the vacation pay amounts. In this article we will consider how to carry out such operations in accounting and tax accounting and avoid claims from controllers.

Tax accounting of expenses for rolling holidays

The Ministry of Finance of Russia explains (letter of the Ministry of Finance of Russia dated 01/09/2014 No. 03-03-06/1/42, dated 07/23/2012 No. 03-03-06/1/356, dated 06/14/2011 No. 07-02-06/107, dated December 23, 2010 No. 03-03-06/1/804), that in tax accounting vacation pay accrued for annual paid leave is included in expenses for the purpose of calculating the income tax base in proportion to the vacation days falling on each reporting period. In support of this conclusion, the department refers to the rules according to which:

- expenses for wages saved for the duration of the vacation provided for by the legislation of the Russian Federation are taken into account (clause 7 of Article 255 of the Tax Code of the Russian Federation);

- under the accrual method, expenses are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment (clause 1 of Article 272 of the Tax Code of the Russian Federation);

- Labor costs are recognized as an expense on a monthly basis based on the amount determined in accordance with Article 255 of the Tax Code (clause 4 of Article 272 of the Tax Code of the Russian Federation).

As can be seen from the letters, the Russian Ministry of Finance, when arguing its position, uses the general provisions of the Tax Code, since this legislative act does not provide for a special norm for recognizing expenses for transferable holidays.

According to the requirements of the Labor Code, payment for vacation is made no later than three days before its start (Article 136 of the Labor Code of the Russian Federation). The entire amount of vacation pay must be paid to the employee in a lump sum, regardless of how many months the vacation period falls. At the same time, Rostrud explains that Article 136 of the Labor Code refers specifically to calendar days, and not to working days (letter of Rostrud dated March 22, 2012 No. 428-6-1).

It turns out that the accountant must accrue and issue vacation pay to the employee immediately before the start of the vacation, and in tax accounting recognize expenses gradually, so as not to quarrel with the tax authorities.

Some companies still recognize expenses for “carrying over” vacation pay in the income tax base immediately in the month of their accrual. During the inspection, inspectors charge companies additional penalties for the fact that, in fact, when, in the inspectors’ opinion, earlier recognition of expenses occurs, the base in the month of payment of vacation pay is understated.

In arbitration practice, there is a case where the court supported the tax authorities in favor of the idea of distributing expenses among the months for which “carrying over” vacation pay was accrued (regulatory Federal Antimonopoly Service of the Northern Territory of November 16, 2007 No. F07-26619/07).

However, for the most part, judges, referring to Article 136 of the Labor Code, indicate that vacation pay expenses are included in the calculation of the income tax base in the month of their accrual and payment to the employee (no later than 3 calendar days before the start of the vacation) (permanent FAS ZSO dated December 26, 2011 No. F04-6983/11, dated December 1, 2008 No. F04-7507/2008(16957-A46-15)). Let us note that in some cases, arbitrators give a more general formulation: the tax base includes wages retained during vacation for employees in the month in which they were accrued (regulatory Federal Antimonopoly Service of the North-West District dated November 16, 2007 No. A56-39310/2006, Federal Antimonopoly Service of the Moscow Region dated June 24 .2009 No. Ф05-3829/09).

Thus, judicial practice is in favor of companies. But, of course, a position that involves including “carrying over” vacation pay into expenses in the month they are accrued and paid to the employee is risky. Disputes with tax authorities cannot be avoided.

Accounting for expenses on rolling holidays

As for accounting, according to PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n), companies (with the exception of small businesses that are not issuers of publicly placed securities) securities, as well as socially oriented non-profit organizations) must create reserves for vacations (reservation of an estimated liability). An estimated liability is recognized in an amount that reflects the most reliable monetary estimate of the costs required to settle this liability. The most reliable estimate of expenses is the amount necessary directly to fulfill (repay) the obligation as of the reporting date or to transfer the obligation to another person as of the reporting date (clause 15 of PBU 8/2010). The amount of vacation pay for an employee, to which he is already entitled as of the reporting date, must be reserved by posting DEBIT (20, 26, 44) CREDIT 96. PBU 8/2010 does not provide for the breakdown of vacation pay amounts accruing for two months into parts corresponding to the number of days vacation every month (clauses 15, 21 PBU 8/2010).

If an employee goes on another vacation for which a reserve was previously created, the accrual of vacation pay will be reflected at the expense of the previously created reserve (DEBIT 96 CREDIT 70). At the same time, in accounting, the expense should be recognized at a time for the entire amount of vacation pay, and in tax accounting - in those months to which the actual vacation time relates (which is the least safe from the point of view of possible claims from inspectors). That is, temporary differences are formed according to the rules of PBU 18/02 “Accounting for calculations of corporate income tax” (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n), and, accordingly, a deferred tax asset (hereinafter referred to as DTA) is formed in account 09 in the amount of 20 percent of the amount of the expended reserve. At the time of actual accrual of vacation pay expenses, tax accounting reflects the recognition of the amounts of previously accrued VAT in the amount of 20 percent of the amount of expenses in tax accounting.

If the amount of the reserve is insufficient (for example, the employee was given vacation days “in advance”) or the company for some reason does not create a reserve, the costs of repaying the obligation will be recognized in the general manner (clause 21 of PBU 8/2010) (DEBIT 20, 26 , 44 CREDIT 70).

According to the Regulations on accounting and reporting (clause 65 of the Regulations on accounting and financial reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), costs incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the accounting balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type. But since the cost of vacation pay does not entail the company receiving any economic benefits in the future, they do not meet the conditions for asset recognition and are included at a time in the current period expenses in the accrual period. Moreover, with regard to the recognition of expenses in accounting, the Ministry of Finance of Russia agrees that the accounting rules do not define the requirement for the distribution of a company’s costs for paying employees’ vacations depending on the number of vacation days falling on a particular reporting period (month, quarter, year) and the organization itself makes a decision on this issue, taking into account the requirements of regulatory legal acts on accounting (letter of the Ministry of Finance of Russia dated December 24, 2004 No. 03-03-01-04/1/190). Consequently, the expense for the entire amount of unreserved vacation pay in accounting can be recognized at a time, regardless of how many months the employee’s vacation occurs. The expense will be reflected for the entire amount of accrued vacation (in the month of payment of vacation pay). In tax accounting, the expense will be recognized in the month when this vacation actually took place. That is, in this case, temporary differences are formed.

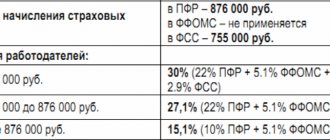

Insurance premiums from “carrying over” vacation pay

Vacation pay is subject to insurance contributions (Article 7 of Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ)). Insurance premiums must be calculated at the time of accrual of vacation pay (Part 1, Article 11 of Law No. 212-FZ). In this case, vacation pay is included in the base for calculating the amount of insurance premiums for the month as a whole (Part 3, Article 15 of Law No. 212-FZ). That is, the entire amount of accrued vacation pay in the month of accrual will be subject to insurance premiums (at a time), regardless of which months it relates to.

For the purposes of calculating income tax, expenses based on the amount of calculated insurance premiums are recognized as part of other expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). In this case, the date of expenses in the form of amounts of taxes (advance payments for taxes), fees and other obligatory payments is the date of their accrual (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). Accordingly, expenses for the amount of accrued insurance premiums for tax accounting purposes are recognized on the date of their accrual, regardless of which months the vacation period belonged to. The Russian Ministry of Finance completely agrees with this (letter of the Russian Ministry of Finance dated December 23, 2010 No. 03-03-06/1/804).

For accounting purposes, the entire amount of accrued insurance premiums will also be recognized in the period of their accrual, since these expenses will not meet the conditions for recognizing them as an asset, just like the amount of accrued vacation pay.

Only if reserve amounts for vacations are created in accounting, there will be no expense, provided that such a reserve is sufficient to pay vacation pay, the expenditure of the reserve funds is reflected, since when creating the reserve, the amounts of insurance contributions were also taken into account (DEBIT 96 CREDIT 69).

Personal income tax on “carryover” vacation pay

The question of qualifying vacation pay (as a kind of salary or an independent type of income for an individual), which was controversial until recently, has now ceased to be such.

The essence of the problem was that the current legislation does not give a clear answer regarding the qualification of vacation pay for personal income tax purposes. If you remember the tax rules, they talk about receiving (transferring) income. Thus, a tax agent company is required to transfer the amounts of calculated and withheld personal income tax no later than one of two dates: the day of actual receipt of cash from the bank for payment of income or the day of transfer of income from the tax agent’s account to the employee’s account (clause 6 of Art. 226 of the Tax Code of the Russian Federation).

The Presidium of the Supreme Arbitration Court of the Russian Federation put an end to the disputes on the issue under consideration (Regulation of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11 (hereinafter referred to as the Resolution)). He took the side of the Ministry of Finance of Russia and the Federal Tax Service of Russia (letters of the Ministry of Finance of Russia dated March 6, 2008 No. 03-04-06-01/49, dated January 24, 2008 No. 03-04-07-01/8 (sent to the Federal Tax Service of Russia for information to lower tax authorities letter of the Federal Tax Service of Russia dated February 13, 2008 No. ShS-6-3/ [email protected] )) in favor of the fact that the personal income tax tax base is formed precisely when income is paid, that is, in relation to “carrying over” vacation pay - in the month when they are paid to the employee (Subclause 1, Clause 1, Article 223 of the Tax Code of the Russian Federation), from their entire amount, regardless of which months of actual vacation they belonged to.

After the publication of the Resolution, the financial and tax departments, apparently, considered it necessary to once again recall their position regarding the period of transferring personal income tax to the budget from vacation pay (letter of the Ministry of Finance of Russia dated 06.06.2012 No. 03-04-08/8-139 (letter of the Federal Tax Service of Russia dated 06/13/2012 No. ED-4-3/ [email protected] sent to lower tax inspectorates for use in their work, 06/14/2012 posted on the website https://www.nalog.ru in the section “Explanations of the Federal Tax Service, mandatory for application by tax authorities” organs")).

With regard to the calculation of personal income tax from the amount of “carrying over” vacation pay, there is one more subtlety regarding the provision of a standard personal income tax deduction to the employee. Here the question arises: when paying vacation pay immediately for the current and next month, is it necessary to simultaneously provide a standard tax deduction for the next month or only for the month when vacation pay is paid?

According to the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, voiced in the Resolution, it can be concluded that an employee has the right to receive a deduction both when paying him vacation pay and when receiving wages at the end of the month. However, when providing a standard deduction in the middle of the month (when paying vacation pay), the company runs the risk that after accruing wages at the end of the month, the permissible income limit is 280,000 rubles (determined for the purpose of providing the deduction on an accrual basis from the beginning of the year) (clause 4 of Art. 218 of the Tax Code of the Russian Federation) at the end of the month will be exceeded. We believe that in this case it is safer for the company to provide the standard deduction once (at the end of the month when calculating wages for this period).

If we are talking about a vacation that falls over two months, the standard personal income tax deduction for rolling vacation pay is provided in each month separately (letter of the Ministry of Finance of Russia dated May 11, 2012 No. 03-04-06/8-134).

Let us consider the contradictions described above and their solution using practical examples, analyzing the accrual of “carrying over” vacation pay using the example of December, since here we are talking about the recognition of expenses in different reporting (tax) periods.

Many employees write an application for vacation, which begins immediately after the end of the New Year holidays (that is, the first days of vacation are already in January of the next year) or on the last working days of December.

EXAMPLE 1

The employee wrote an application for leave from December 30, 2014 to January 13, 2015. Minus holidays falling during the vacation period, its duration was 4 calendar days.

The amount of vacation pay was accrued and paid to the employee no later than 3 calendar days before the start of the vacation - December 29, 2014.

The calculation period was the previous 12 calendar months (from December 2013 to November 2014 inclusive). The employee's salary for these months is known. The accountant calculated the average earnings (it amounted to 2,350 rubles for 1 calendar day). The amount of insurance premiums from vacation pay amounted to 2820 rubles.

In addition, the employee has the right to receive a standard personal income tax deduction for 1 child in the amount of 1,400 rubles. per month.

Vacation pay. The following entries were made in accounting in December 2014:

— if a vacation reserve was previously created, its expenditure is reflected:

DEBIT 96 CREDIT 70

– 9400 rub. (2350 rubles × 4 days) - spending the reserve for 4 days of employee vacation;

— if for some reason the reserve was not created or the employee was allowed to go on vacation “in advance”, the following entry is made:

DEBIT 20 (23, 25, 26, 44) CREDIT 70

– 9400 rub. (2350 rubles × 4 days) - reflects the cost of paying vacation pay for 4 days of vacation.

In tax accounting, expenses are distributed as follows:

— in December 2013, expenses were recognized for 2 calendar days of vacation (December 30 and 31) in the amount of:

2350 rub. × 2 k. days. = 4700 rub.

This amount was recognized as labor costs on the 2014 tax return;

— in January 2020, expenses were recognized for 2 calendar days of vacation (January 12 and 13), also in the amount of 4,700 rubles.

This amount was recognized as part of labor costs according to the tax return for the first quarter of 2020.

Insurance premiums were accrued in December 2014 immediately from the entire amount of vacation pay, entries were made (for convenience, we will reflect in the example the accrual of insurance premiums as a total amount without breaking down by type of insurance premium):

— if a vacation reserve was previously created, its expenditure is reflected:

DEBIT 96 CREDIT 69

– 2820 rub. (9400 rubles × 30%) - spending the reserve to pay vacation pay in terms of insurance premiums;

— if for some reason the reserve was not created or the employee was allowed to go on vacation “in advance”, the following entry is made:

DEBIT 20 (23, 25, 26, 44) CREDIT 69

– 2820 rub. (RUB 9,400 × 30%) - insurance premiums accrued for vacation pay are included in expenses.

Personal income tax was also accrued in December 2014 on the entire amount of vacation pay. With regard to personal income tax, the creation of a reserve for vacations does not play any role, since this tax is calculated and always withheld from the employee’s income. The provision of a standard tax deduction is clearly allocated to the months in which the vacation falls. In December 2014, an accountant analyzed whether the employee was entitled to a standard tax deduction. The employee’s income since the beginning of the year exceeded 280,000 rubles, so no deduction was provided. Here's the wiring done:

DEBIT 70 CREDIT 68.1

– 1222 rub. (9400 rubles × 13%) - personal income tax is charged on vacation pay.

In January 2020, an analysis was also carried out to determine whether the employee is entitled to a standard tax deduction. As of the end of January 2020, the employee’s income has not yet exceeded 280,000 rubles. The deduction was provided in January 2015 when calculating personal income tax on accrued wages for working days of that month.

PBU 18/02. If previously a vacation reserve was created in accounting and, accordingly, the formation of a deferred tax asset (DTA) was recognized in the amount of 20% of the reserve amount (DEBIT 09 CREDIT 68.4 - reserve amount × 20%), then at the time of actual accrual of expenses in tax accounting recognition of the amounts of previously accrued tax in the amount of 20% of the amount of expenses in tax accounting was reflected. The following entries were made in accounting:

— in December 2014:

DEBIT 68.4 CREDIT 09

– 940 rub. (RUB 4,700 × 20%) — recognition of ONA in December is reflected;

— in January 2020:

DEBIT 68.4 CREDIT 09

– 940 rub. — reflected ONA’s recognition in January.

If the vacation reserve was not created, then, in fact, due to the gap in the time of recognition of expenses in accounting (expenses were taken into account in December 2014 in full) and tax accounting (part of the expenses was recognized in December 2014, and part was transferred to January 2015), the organization has formed deductible temporary differences (based on the amount of expenses transferred in tax accounting to January 2015), which lead to the formation in December 2014 of the amount of OTA from the amount of expenses recognized in tax accounting only in January 2015. At the same time, the following entries were made in accounting:

— in December 2014:

DEBIT 09 CREDIT 68.4

– 940 rub. (RUB 4,700 × 20%) - OTA is reflected from the amount of expenses that will be recognized in tax accounting in January 2020;

— in January 2020:

DEBIT 68.4 CREDIT 09

– 940 rub. - SHE admitted.

EXAMPLE 2

The employee wrote an application for leave from 01/12/2015 to 01/13/2015 (the duration of leave is 2 calendar days). The amount of vacation pay had to be accrued and paid no later than 3 calendar days before the start of the vacation, but this date actually fell on non-working days of the New Year holidays. Therefore, vacation pay was issued to the employee on the last working day before the New Year holidays - December 31, 2014. Let us note that the law does not prohibit issuing the amount of vacation pay earlier than 3 days before the vacation.

For vacations falling in January 2020, the calculation period was the previous 12 calendar months (from January 2014 to December 2014 inclusive). That is, the accountant could only accrue vacation pay when the employee’s salary for December 2014 was already known.

Let's assume that the average earnings were 2,400 rubles. for 1 calendar day. The amount of insurance premiums from vacation pay amounted to 1,440 rubles.

The following entries were made in accounting in December 2014:

— if a vacation reserve was previously created, its expenditure is reflected:

DEBIT 96 CREDIT 70

– 4800 rub. (RUB 2,400 × 2 days) - spending the reserve for 2 days of employee vacation;

— if for some reason the reserve was not created or the employee was released on vacation “in advance”, the posting is reflected:

DEBIT 20 (23, 25, 26, 44) CREDIT 70

– 4800 rub. (2400 rubles × 2 days) - reflects the cost of paying vacation pay for 2 days of vacation.

In tax accounting, expenses amount to 4800 rubles. recognized in January 2015 and as part of labor costs according to the tax return for the first quarter of 2020.

In this case, insurance premiums were accrued immediately from the entire amount of vacation pay in December 2014, the following entries were made:

— if a vacation reserve was previously created, its expenditure is reflected:

DEBIT 96 CREDIT 69

– 1440 rub. (4800 rubles × 30%) - spending the reserve to pay vacation pay in terms of insurance premiums;

— if for some reason the reserve was not created or the employee was allowed to go on vacation “in advance”, the following entry is made:

DEBIT 20 (23, 25, 26, 44) CREDIT 69

– 1440 rub. (RUB 4,800 × 30%) - insurance premiums accrued for vacation pay are reflected in expenses.

Personal income tax is also accrued immediately from the entire amount of vacation pay in December 2014. In relation to personal income tax, the creation of a reserve for vacation does not play any role, since personal income tax is calculated and always withheld from the employee’s income. Wiring done:

DEBIT 70 CREDIT 68.1

– 624 rub. (RUB 4,800 × 13%) - personal income tax is charged on vacation pay.

PBU 18/02. If previously a reserve for vacations was created in accounting and, accordingly, the formation of a deferred tax asset in the amount of 20% of the reserve amount was recognized (DEBIT 09 CREDIT 68.04 - reserve amount × × 20%), then at the time of actual accrual of expenses in tax accounting in January 2020 reflected the recognition of amounts of previously accrued tax in the amount of 20% of the amount of expenses in tax accounting. The following entries were made in accounting:

in January 2020:

DEBIT 68.4 CREDIT 09

– 960 rub. (RUB 4,800 × 20%) - recognized by ONA.

In conclusion, we will say that the most optimal option would be to introduce clarifications into the provisions of the Tax Code, which would make it possible to recognize expenses in tax accounting based on the amounts of “carrying over” vacation pay during the period of their accrual and payment to the employee, and not defer these expenses until the month of actual vacation, and , accordingly, to bring closer the recognition of expenses in accounting and tax accounting. But this will be useful only for companies that are small businesses, because they have the right not to create a reserve for vacations, therefore, the moment of recognition of expenses for “carrying over” vacations in accounting and tax accounting for such companies will finally coincide.

For other companies, the mandatory creation of reserves for vacation pay amounts in accounting will still not allow these expenses to be recognized equally and will continue to create temporary differences.

Current accounting

Post:

Comments

Accounting: reserve is created

If an organization creates a reserve for vacation pay, then do not include the amounts of accrued vacation pay in the expenses of the current month. Reflect the accrual of vacation pay and contributions for compulsory insurance in accounting using the following entries:

Debit 96 subaccount “Reserve for vacation pay” Credit 70

– vacation pay is accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Pension Fund for the insurance part of the labor pension”

– pension contributions were accrued from the reserve to finance the insurance part of the labor pension from vacation pay;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions”

– social insurance contributions from vacation pay are accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Federal Compulsory Medical Insurance Fund”

– contributions for health insurance to the Federal Compulsory Medical Insurance Fund of Russia from vacation pay were accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases”

– contributions for insurance against accidents and occupational diseases from vacation pay are accrued from the reserve.

Reflect the payment of vacation pay by posting:

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (accounts 70 and 96).

The procedure for reflecting vacation payments in accounting accounts

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Vacation pay paid from the reserve fund | ||||

| 20 | 96 | 395 000,00 | A reserve has been formed for vacation pay | Accounting information |

| 09 | 68 | 79 000,00 | Accrual of deferred tax asset 395,000 x 20% = 79,000 | Accounting information |

| 96 | 70 | 28 976,00 | Vacation pay is accrued to an employee of the company | Payroll and accounting certificate |

| 96 | 69 | 8 692,80 | Insurance premiums accrued for the amount of vacation pay | Payroll |

| 68 | 09 | 7 533,76 | Deferred tax assets are partially repaid (28976 + 8692.80) x 20% = 7533.76 | Accounting information |

| 70 | 68-NDFL | 3 766,88 | Personal income tax withheld 28976 x 13% = 3766.88 | Payroll |

| 70 | 50 (51) | 25 209,12 | The company employee was paid vacation pay 28976 – 3766.88 = 25209.12 | RKO, (payment order) |

| Vacation pay paid in accordance with the general procedure (clause 21 of PBU 8/2010), which does not provide for their payment from the formed “reserve” | ||||

| 20 (23, 25, 26, 29, 44) | 70 | 32 578,00 | Vacation pay accrued to an employee of the company | Payroll and accounting certificate |

| 20 (23, 25, 26, 29, 44) | 69 | 9 773,40 | Insurance premiums accrued for the amount of vacation pay | Payroll |

| 99 | 68 | 6 515,60 | Permanent tax liability accrued 32578 x 20% = 6515.60 | Accounting information |

| 70 | 68-NDFL | 4 235,14 | Personal income tax withheld 32578 x 13% = 4235.14 | Payroll |

| 70 | 50 (51) | 28 342,86 | The company employee was paid vacation pay 32578 – 4235.14 = 28342.86 | RKO, (payment order) |

| Accrual of vacation pay at the expense of the formed reserve and in advance (the required period has not yet been worked out) | ||||

| 96 | 70 | 16 855,00 | An employee of the company was accrued vacation payments at the expense of the created reserve. The total amount of vacation pay is 33,710 rubles. 33,710: 2 = 16,855.00 | Accounting information |

| 20 (23, 25, 26, 29, 44) | 70 | 16 855,00 | The second part of vacation pay has been accrued | Accounting information |

| Early termination of vacation | ||||

| 20 (23, 25, 26, 29, 44) | 70 | 28 400,00 | The employee has accrued vacation pay | Accounting information |

| 20 (23, 25, 26, 29, 44) | 70 | 5 071,43 | Reversal of excessively accrued vacation pay28400: 28 days. x 5 days = 5071.43 | Accounting information |

| Paid insurance premiums and personal income tax are also subject to reversal | ||||

- Account 96 in accounting: Reserves for future expenses

- Postings for creating a reserve for doubtful debts in accounting

- Account 63 in accounting: Provisions for doubtful debts

- Account 69 in accounting: postings, subaccounts and examples for dummies

Vacation pay for rolling vacation

Situation: how to reflect in accounting the accrual of vacation pay from the reserve for rolling vacation (starts in one month and ends in another)?

The full amount of accrued vacation pay must be written off against the amounts of the previously created reserve. The fact that the leave is transferable from one month to another does not matter.

The reserve for vacation pay is an estimated liability (clause 5 of PBU 8/2010). It is reflected in accounting as of the reporting date. Its value represents the “virtual” debt of the organization if it had to simultaneously accrue and pay vacation pay to all employees. This debt includes both the vacation pay itself and the amount of taxes and contributions that must be paid to the budget from it.

This procedure for creating an estimated liability is provided for in paragraph 15 of PBU 8/2010.

At the time of payment of vacation pay to the employee, part of the estimated liability will be repaid. According to the rules of labor legislation, vacation pay is paid to the employee no later than three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Consequently, regardless of whether the vacation is transferable from month to month or not, the estimated liability is repaid in full when vacation pay is paid. This means that when accruing vacation pay to a specific employee, the previously created reserve must be reduced by their full amount. There is no need to break the vacation into parts in order to write off the obligation in parts corresponding to the number of vacation days in each month.

This follows from the provisions of paragraphs 5 and 21 of PBU 8/2010. An exception is the situation when the amount of the reserve turned out to be insufficient to write off accrued vacation pay at its expense.

An example of how accrual of vacation pay is reflected in accounting using the created reserve for vacation pay. Vacation starts in one month and ends in another

In June 2020, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days - from June 16 to July 13, 2020. Vacation pay was paid to the employee on June 11, 2020.

For the billing period - from June 1, 2014 to May 31, 2020 - Kondratyev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The total amount of vacation pay is: 1024 rubles/day. × 28 days = 28,672 rub.

Including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June:

Debit 96 subaccount “Reserve for vacation pay” Credit 70 – 28,672 rubles. – vacation pay was accrued to Kondratiev for June–July.

What accounts are the main workers' vacation pay placed on?

Vacation payments in any variety (for main, additional vacation - according to the Labor Code of the Russian Federation, corporate - according to the collective agreement), as well as compensation for unused vacation are reflected in the accounting registers in the same way as calculating employee salaries using:

1. accounts for displaying costs (used when accounting for vacation situationally):

- 20 - if vacation pay is accrued to the employee at the main production;

- 23 - if vacation pay is assigned to an employee in auxiliary production;

- 08 - if the accrual is made to employees installing (constructing) the OS;

- 25 - if the calculation is carried out with production employees whose salaries cannot be taken into account in the cost of certain products;

- 44 - if vacation pay is assigned to an employee of the sales department;

- 26 - if vacation pay is accrued to the management of the company;

- 96 - if vacation pay is accrued from reserves.

2. Accounts for accounting settlements with employees:

- 70 — calculations for wages;

- 50 (51) - payment of vacation pay through the cash register or by card.

Vacation pay is subject to insurance contributions, and personal income tax is withheld from them, and therefore accounts are used to record them: 69 and 68.

Example.

The accountant of Smiley LLC was accrued vacation pay in the amount of 25 thousand rubles. The accounting records reflect the following entries:

Dt 26 Kt 70 - 25,000 rub. — vacation pay accrued;

Dt 70 Kt 68.1 - 3,250 rub. — personal income tax withheld (25,000 × 13%);

Dt 26 Kt 69 (according to subaccounts) - 7,550 rubles. — insurance premiums are calculated from vacation pay (25,000 × 30.2%).

Download the accounting chart of accounts here.

ConsultantPlus experts explained in detail how to calculate and record study leave. Get trial access to the system and proceed to the calculation example.

At the same time, the algorithm for accounting for vacations between enterprises that maintain simplified accounting and those companies (large and medium-sized) that are required to maintain full records differs. Let's study the difference in vacation accounting by such companies.

Use our online calculator to avoid mistakes when calculating your vacation pay.