Briefly about the features of PSN

The mode is intended only for individual entrepreneurs, the validity period is from 1 to 12 months. PSN replaces several taxes at once, and its amount is fixed. Can be used for 63 types of work.

Important! All information about PSN is indicated in Chapter 26.5 of the Tax Code of the Russian Federation.

The restrictions for obtaining a patent are as follows: no more than 15 employees for an individual entrepreneur, profit not exceeding 60 million rubles per year, and payment must be received by the Federal Tax Service within the required time frame. It is not prohibited to purchase a patent for several types of activities.

The cost can be calculated using the following formula: amount = 6% * potential income of an individual entrepreneur. As is clear, 6% is the tax rate on a patent. Potential income is set by regional authorities, and it can change every year.

To switch to this tax regime, an individual entrepreneur must submit an application to the Federal Tax Service. Its form is determined by law by order of the Federal Tax Service of Russia dated July 11, 2017 No. ММВ-7-3/ [email protected] This is form No. 26.5-1, according to KND - No. 1150010. It can be filled in by hand with a black pen in block letters, placing dashes in empty cells, or you can do it on a computer, including in a special program.

Requirements for filling

Now let's look at each of these documents separately and how exactly you need to fill out the application in 2020.

Petition

There is no specific template for the application, however, when filling it out, the following data should be taken into account:

- the document must be addressed to the Migration Department;

- The paper must indicate the number and series of the patent that is being issued for the first time or is being reissued.

The paper must also contain:

- Full name, place and date of birth;

- what citizenship is the person;

- series and passport number.

The application will also require information about the employer. If the employer is an individual, then indicate:

- FULL NAME;

- information about passport data, including when and by whom it was issued;

- the place where the passport is registered.

If we are talking about individual entrepreneurs, then indicate:

- name of the employer's organization;

- legal address of the organization;

- TIN.

For employers-individual entrepreneurs of private lawyers and notaries - everything is the same, except for the legal address. The document will also need to include the date of the document, the employer’s signature and seal.

Employment contract

The document will need to indicate the full name of the foreigner, the full name and name of the employer's organization.

Information about a citizen must contain the following data:

- FULL NAME;

- place and date of birth;

- citizenship and passport details;

- the place where he resides permanently in Russia;

- TIN.

If we talk about information about the employer, then in relation to individuals the following must be indicated:

- FULL NAME;

- citizenship, as well as information about where and when the citizen was born;

- data taken from the passport;

- information about where the citizen is registered and where he currently lives;

- TIN;

- telephone for communication.

Employers of legal entities will need to indicate the following information in the employment contract:

- what is the name of the organization (full data);

- OGRN;

- the address where the legal entity is registered and where the organization is actually located;

- TIN and checkpoint.

If we are talking about individual entrepreneurs - private practicing lawyers or notaries, then the employment contract specifies the following data:

- What is the full name of the organization;

- OGRN;

- Address;

- TIN;

- data from the passport.

Also, the employment contract must indicate where and when it is registered.

Fill out the application

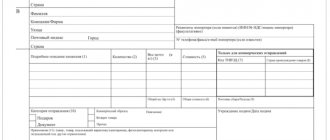

The form consists of 5 pages, such as:

- title page with personal data of the individual entrepreneur and the desired duration of the patent;

- a sheet for information about the planned activity;

- a sheet with information about the place where the individual entrepreneur will work (if the individual entrepreneur will work in a place other than his registration);

- a sheet with information about those vehicles that will be used to transport passengers or goods (for those who have chosen such an activity);

- a sheet with data on those objects that will be used in business, for example, for renting, trading, organizing public catering facilities (for those individual entrepreneurs who have chosen such an activity).

The first two pages will be mandatory for all individual entrepreneurs. And the other three only if the individual entrepreneur has chosen the appropriate areas of business.

Attention! In the sample, we filled out all 5 sheets of the form.

Sheet 1

- First, fill out the line with the Taxpayer Identification Number (TIN), the number will need to be indicated on each sheet.

- We indicate the tax authority code. It consists of 4 digits. You can find your code here.

- We write your full name. Separate lines are provided for last name, first name and patronymic.

- We enter the OGRNIP number. He is indicated in the citizen’s state registration certificate as an individual entrepreneur.

- Then fill in the following information about your place of residence: postal code, district, city, village, street, house, apartment. Everything here is extremely simple.

- We decide for what period we are filing a patent and write the number in the appropriate field. The period must not exceed 12 months. Next to it we indicate the date from which it is planned to begin activities on the PSN.

- We enter the number of sheets of the application and attachments to it.

Below you need to fill out the left block. It is intended to confirm the entered data. Here you need to indicate:

- code "1" or "2". “1” - if filled out by the individual entrepreneur himself, “2” - if filled out by a representative of the individual entrepreneur;

- Full name - only for the representative;

- phone number;

- signature, date;

- the name and details of the paper that certifies the authority of the representative (most often this is a power of attorney).

The lower right block will have to be filled out by an employee of the Federal Tax Service.

Sheet 2

Here you need to enter the TIN again and indicate the name of the activity that the individual entrepreneur plans to engage in. Below you need to enter the code for this activity.

Next, we note whether our activities will be carried out with or without the involvement of employees. In the first case we put “1”, in the second “2”. If hired workers are planned, then we note their average number. Otherwise, set “0”. Then we note the tax rate.

If the rate is reduced, you must provide a link to the legislative norm of the constituent entity of the Russian Federation where it is applicable.

Sheet 3

We fill it out if you plan to conduct business outside your place of registration. On this sheet we also indicate the TIN and sheet number.

Next, enter the following information in the appropriate fields:

- code of the subject of the Russian Federation where the individual entrepreneur will work;

- Federal Tax Service code at the place of business of the individual entrepreneur;

- postcode;

- again the code of the subject of the Russian Federation;

- address (everything is simple here).

If you intend to conduct business in several places, you need to fill out a form for each of them. There are three such blocks on the sheet.

Sheet 4

It is filled out if the individual entrepreneur intends to work using vehicles in the field of transporting goods or passengers. All types are listed in paragraphs. 10, 11, 32 and 33 and paragraph 2 of Art. 346.43 Tax Code of the Russian Federation. Such a sheet will need to be filled out for each vehicle.

Sample application for obtaining a labor patent in the year

, retail trade and catering services (clauses 45-48 clause 2 of article 346.43 of the Tax Code of the Russian Federation). It is intended to indicate information for each of the places of activity on the “patent”. If there are many such places, fill out the required number of sheets A, while the code of the subject of the Russian Federation (Appendix No. 2 to the Procedure) is placed only on the first of them, and for the remaining sheets a dash is placed in these fields.

It is not allowed to indicate more than one subject of the Russian Federation in one application.

Line 010 is not filled in if there is no specific address for the activity. Sheet B of the 2019 patent application form.

intended for individual entrepreneurs providing services and transportation by water transport.

Application form for re-registration of a patent in 2020: sample application, deadlines for re-obtaining

Moreover, the patent should be issued no later than a month after the border was crossed and the temporary residence address was registered.

https://youtu.be/NJtEO2ulH5g

The foreigner must receive a notification about this from the Main Directorate for Migration Affairs.

In order to re-register a patent, you do not have to leave Russia.

It is important to collect documents and submit them to the relevant authorities ten days before the patent expires.

It should be understood that the extension process is beneficial not only to the employee who came from abroad - it is also beneficial to the employer.

Let's give an example.

How to fill out an application for a work patent?

October 19, 2020 Information

254 March 28, 2020 Important services

360 Checking the existence of grounds for not allowing foreign citizens and stateless persons to enter the territory of the Russian Federation through the Ministry of Internal Affairs of Russia.

How to check the entry ban for foreign citizens. January 08, 2019 Adaptation

222 Can drivers with a driver’s license (driving license) from Uzbekistan, Tajikistan, Kyrgyzstan, Kazakhstan, Belarus and Armenia drive a vehicle in Russia.

November 28, 2020 Adaptation

227 Migration card is a document containing information about a foreign citizen or stateless person entering the Russian Federation.

Patent for foreign citizens in 2020

Moscow dated November 26, 2014 No. 55 4,500 Knowing how much it costs to obtain a patent for foreign citizens in Moscow is not enough, because

In addition to the permitting document, the registration process involves payment for other services required to legalize employment.

The calculated price of a patent for work in Moscow is no less than 11,600 rubles and it is valid when obtaining a work permit only in the city of Moscow.

Here you should understand that payment for services when drawing up a document is required once for 12 months.

Where to download and how to fill out a patent application form for individual entrepreneurs

When switching to PSN, a person stops paying the following taxes, but only in the part that relates to the patented type of activity: We recommend you study! Follow the link:

- personal income tax;

- VAT (except for customs VAT on imports and export VAT).

- Property tax;

If income from sales is received in several areas of business, including those falling under other tax systems, then the exemption from payment of the listed taxes does not apply to them.

Before you start filling out an application for a patent system for individual entrepreneurs in 2020, you should carefully weigh all the benefits and advantages of this form of taxation in each individual situation personally.

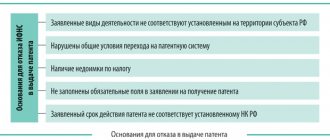

Documents submitted to the state inspection to obtain a patent for an individual entrepreneur in 2020 may be returned to the applicant, and approval may be denied in the following cases:

- The form is filled out incorrectly; a sample patent application for individual entrepreneur 2019 is given in the article below.

New application form for a patent to a foreigner

There is no requirement to indicate your specialty on the application form submitted to the MMC in the village of Sakharovo (the rule applies only to migrants arriving to work in the city of Moscow).

It is important that you can work with the obtained permit in the profession (specialty) recorded in it. By order of August 14, 2019

No. 635 of the Russian Ministry of Internal Affairs approved new forms of applications necessary for registration, re-registration, issuance of a duplicate of a patent, as well as amendments to the information contained in the patent.

Patent Application 2019

It actually confirms the employer’s intentions to continue the employment relationship with this employee and notifies the relevant authorities about this.

An individual has the right to draw up, on the basis of a patent, not only employment contracts, but also contracts for the performance of work.

In this case, compliance with the civil law features of such an agreement is required.

According to clause 2 of Article 13.3 of the Federal Law dated July 25, 2002 No. 115 “On the legal status of foreign citizens in the Russian Federation,” within 30 days after arriving on the territory of the Russian Federation, a foreigner must submit the following documents for a patent to the Ministry of Internal Affairs of the Russian Federation:

- migration card (purpose of visit - work);

- certificate of passing a medical examination;

- a certificate confirming the fact of passing an exam on knowledge of the Russian language, Russian history and Russian legislation;

- a certificate of registration of a foreigner at the place of stay;

- one photo measuring 3x4 cm

A foreign citizen will have to provide these documents for a work patent if he is applying for it for the first time.

Application for a patent for individual entrepreneurs in 2020 - form 26.5-1

Completing the first two pages of the application is mandatory for everyone, but pages 3, 4 and 5 are for certain types of activities. Rules and requirements to consider when completing the new Patent Application Form 26.5-1:

- Fill out both by hand and on printing devices.

- When filling out Form 26.5-1 handwritten, use ink of the following colors: blue, purple, black.

- Filling in on printing devices using Courier New font, font size 16-18.

- A separate patent application is completed for each type of activity.

- This application is printed on one side.

New application form for registration as an individual entrepreneur, form 2019 - Calculation of a patent for an individual entrepreneur, what are the payment terms, detailed calculations, calculation examples - Step-by-step instructions on terminating the activities of an individual entrepreneur in 2019-2019.

Patent application template for foreign citizens 2019

According to Russian legislation, migrants who come to Russia from visa-free countries to work must obtain a patent.

https://youtu.be/8YKCjMLbwTE

To do this, within 30 days you need to submit an application to the local authority of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs. An application form for a patent to a foreign citizen is issued when applying to the migration department. The form is a questionnaire on two A4 sheets.

The structure of the document can be divided into three blocks:

- Detailed information about the applicant.

Important Terms The validity period of a patent is always from one month to twelve. The patent can also be extended for the same time period.

As a rule, in practice it takes about a month, since in addition to the response, it is also necessary to collect the entire package of documentation.

A patent is a special document that is required for the implementation of labor activities on the territory of Russia by citizens of those states that have the right to visit the territory of our country in a visa-free regime.

Source: https://rusdolgi.ru/obrazec-zajavlenija-dlja-poluchenija-trudovogo-patenta-v—godu-29860/

Application for a patent for 2019-2020 (Form 26.5-1)

The patent tax system (PTS) is one of the most popular and convenient. To switch to it, you must fill out and submit to the Federal Tax Service an application for a patent for 2019-2020 in form 26.5-1.

In our material today we will talk about the advantages of PSN, the procedure for filling out an application for the use of this taxation system, and the validity period of a patent.

At the bottom of the page you can find patent applications for 2019-2020 and a sample of filling out form 26.5-1.

Advantages and disadvantages of PSN

At the moment, PSN is the most convenient taxation system due to the low administrative and tax burden on entrepreneurs who use it. Its main advantages are as follows:

- minimum amount of reporting. More information about reports on PSN can be found here;

- The cost of a patent cannot be calculated independently. This is done by employees of the Federal Tax Service. However, here we have published a calculation of the cost of a patent, for those entrepreneurs who need to determine whether it will be profitable to work on this system;

- a patent can be taken out for a period of 1 to 12 months, which eliminates the need for overpayment if the activity will be conducted for less than a year;

- an entrepreneur on PSN is exempt from paying personal income tax, VAT and property tax;

- A recent advantage of PSN was also that until July 1, 2019, entrepreneurs using PSN were exempt from the obligation to use cash registers. However, now they are obliged to apply it on a general basis.

Unfortunately, there are some drawbacks:

- Not all entrepreneurs can apply this taxation system. The full list of activities that allow the use of PSN is listed in paragraph 2 of Art. 346.43 of the Tax Code of the Russian Federation and published here;

- An individual entrepreneur on PSN can have no more than 15 employees;

- annual revenue should be no more than 60 million rubles.

Where and how to apply?

To register for PSN or switch to this system, you must submit an application in form 26.5-1 to the Federal Tax Service. The form was approved by order of the Federal Tax Service of the Russian Federation dated July 11, 2020 No. ММВ-7-3/589 @. You can do this in one of the following ways:

- Personally.

- Through a representative.

- By registered mail.

- If you have an electronic signature key, you can submit an application for a patent in 2019-2020 through the Personal Taxpayer Account of Nalog.ru.

If the application is submitted simultaneously with the documents for registration of the individual entrepreneur, then the PSN will be applied from the moment the certificate of registration of the individual entrepreneur is issued.

If an individual entrepreneur plans to conduct business at his place of residence, an application for PSN must be submitted to the Federal Tax Service at his place of residence. If the activity will be carried out in a region different from the region of residence, then the application must be submitted to the Federal Tax Service of the region where the activity will be carried out.

Procedure for filling out the document

The new patent application form consists of five pages. For all activities, the first three pages must be completed. Then, if you provide transport services, you must additionally fill out sheet A. For retail trade and catering or when renting out premises, in addition to the first three mandatory pages, fill out sheet B. When providing services, only the first three pages are filled out.

The document is filled out in the following order:

On the first page, the full name, INN and OGRNIP of the individual entrepreneur, residential address and code of the Federal Tax Service to which the individual applied with the application are indicated. The date from which the individual entrepreneur begins to apply the patent and the period of its validity (from 1 to 12 months) are also indicated. At the bottom of the first sheet the number 1 or 2 is placed, depending on whether the individual entrepreneur fills out the document personally or his authorized representative. Next, a stamp (if available), date and signature are affixed, and a contact telephone number is indicated.

On the second page, the corresponding type of activity and the identification code of the type of business activity established by law of the constituent entity of the Russian Federation are written down.

The identification code consists of six digits:

- the first two digits are selected from the Tax Code of the Russian Federation, Article 346.43, paragraph 2, in accordance with the type of activity;

- the second two digits are the code of the subject of the Russian Federation;

- the next two digits are the serial number of the type of activity defined in the regional Law on the application of PSN.

For example, for the city of Sevastopol when providing hairdressing services, the identification code is 039203. This is how the identification code is determined, according to the instructions. But when personally filling out and sending the application for the application of the patent, the inspector corrected the identification code in the application, saying that the last four digits are the code of the Federal Tax Service, to which the application for the application of the PSN is submitted.

Therefore, we advise our readers to contact their Federal Tax Service when determining the identification code. For some unknown reason, very often local Federal Tax Service Inspectors act contrary to the requirements of the instructions for filling out forms.

Then it is indicated whether the individual entrepreneur plans to work independently or with the involvement of hired workers. In the second case, the average number of employees must be indicated. The following indicates a tax rate of 6% (or less: a number of regions have adopted laws on the application of a reduced PSN rate).

The final paragraph of the second page is a link to the norm of the Law of the subject of the Russian Federation. In this paragraph, you must write the number and date of the local Law that adopted a certain tax rate for the patent.

On the third page, the location of the activity is indicated, the OKTMO code and address are filled in.

The fourth page (Sheet A) is necessary for those individual entrepreneurs who use vehicles . Depending on the type of vehicle that the individual entrepreneur will use, the numbers 01 are placed in line No. 010; 02; 03; 04:

01 – freight transport; 02 – passenger transport; 03 – water passenger transport; 04 – water freight transport.

There you must also indicate the identification number, make, registration plate, carrying capacity and number of seats of the vehicle.

The fifth page (Sheet B) must be filled out by those individual entrepreneurs who plan to generate income using the premises , for example, engage in trade or rent out the premises. The codes of the type of object and the characteristic of the object are entered in the corresponding columns. The corresponding codes are given in the footnotes at the bottom of this sheet.

Application for a work patent to a foreign citizen: sample, how to fill out the form

An application for a patent for a foreign citizen to work is completed by migrants in accordance with the new standards regulated by Federal Law No. 357-FZ.

The law determines the ability of foreigners arriving in Russia from visa-free countries to engage in legal labor activities on the basis of a patent.

According to the new rules, a patent is issued for a period from one calendar month to one year after submitting documents and an application for a patent to the local division of the migration service of the Main Migration Service of the Ministry of Internal Affairs of the Russian Federation.

The current norms of Russian migration legislation stipulate that a migrant who entered the Russian Federation from a visa-free country for the purpose of further employment is required to apply for a patent within 30 days from the date of entry into the country.

Before submitting an application to the migration department, a foreigner will have to apply for a form from the local passport and visa service, or download the current, that is, the new 2020 model (see Appendix 1 to the order of the Ministry of Internal Affairs), form for issuing a patent to a foreign citizen from the website of the regional department of the Main Directorate for Migration. Ministry of Internal Affairs to arrange it in advance.

Application form for a patent to a foreign citizen

The body responsible for issuing patents is the Main Directorate for Migration of the Ministry of Internal Affairs.

It is important that the issued patent is valid in the subject of the Russian Federation in which it was issued. Therefore, do not look for where it seems faster and easier, as you think, to obtain a document. To obtain it, apply to the migration department in the territory of only the region in which you plan to work.

The form is a questionnaire on two A4 sheets. The structure of the document consists of information blocks that the applicant, a foreign citizen, fills out based on his personal data and documents.

- Personal information about the applicant is filled out either by the applicant or his official representative, acting under a notarized power of attorney.

- In addition to the completed form, you will be asked for a color photo (size 30 x 40 mm).

- The second sheet contains official notes: about checking documents and entering information about the issued patent, which are filled out and certified by the signature of the responsible official.

The form form may vary slightly depending on the subject of the Russian Federation.

- Fill out the form only in Russian.

- The use of technical means is allowed.

- When filling out the form by hand, write in legible handwriting without abbreviations or abbreviations.

- Corrections, cross-outs and mistakes should not be allowed.

- All fields of the questionnaire must correspond to the information from the attached documents.

The form is issued free of charge. You can fill out an application in advance by downloading a new version of the form from the website of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs for the region in which employment is planned.

https://youtu.be/1YJk2teYwds

A foreign citizen must submit documents for a patent in person no later than 30 days after entering Russia, otherwise he will have to pay a fine of 10 to 15 thousand rubles. The application is considered within 10 days, after which a patent is issued or a written reasoned refusal to issue is issued.

How to fill it out correctly

To fill out the form correctly, look at the sample patent application in PDF for 2020, filled out correctly. Please note that the applicant fills out the part with data on:

- personal information (indicating last name, first name, patronymic if available);

- current citizenship and place of residence;

- details of the identity document;

- migration card data;

- your TIN, if available.

After checking the submitted set of documents, the official makes a note of acceptance, assigns a registration number and signs the application. The decision made is reflected in the resolution and recorded at the bottom of the application with information about the issued patent for the work. The information is certified by the signature of the responsible person.

Documents to be filled out correctly

Attached to the application

- passport, with translation into Russian, notarized;

- migration card, which reflects the “Purpose of the visit” work and contains a mark on the passage of border control;

- documents on registration at the place of residence;

- color photo;

- voluntary medical insurance agreement;

- honey. certificates confirming the absence of diseases dangerous to others;

- certificate of passing the Russian language test.

On our website Migrant-reg.ru you can submit a patent application form.

Source: https://migrant-reg.ru/blank-zaiavleniia-vydacha-patenta-inostrantcu.html

Validity period and payment procedure for a patent for 2019-2020

In accordance with paragraph 5 of Art. 346.45 of the Tax Code of the Russian Federation, a patent can be issued for a period of 1 to 12 months . If it is necessary to extend the validity of a patent, it is necessary to submit a new patent application for an individual entrepreneur for 2019-2020.

If the patent is taken for a period of less than six months , then it must be paid in the amount of the entire amount of tax specified in the patent no later than the expiration date of the patent.

If the patent is taken for a period of more than six months , then a third of the cost of the patent must be paid within the first ninety calendar days from the date of application of the PSN, the remaining 2/3 of the cost of the patent must be paid until the expiration of the patent.

Until 2020, if the deadline for payment of the cost of the patent was violated, the right to apply the PSN was lost. In 2019-2020, even if you do not have time or forget to pay for the patent within the deadline established by law, the Federal Tax Service will charge a fine, but the patent will not be canceled, and you will be able to continue to use the PSN.

What awaits patent entrepreneurs in 2020

The tax amount is calculated using the formula: Tax = Taxable base x 6%. The tax base is an approximate value that is established by type of activity and assumes the maximum amount of income for 12 months. For 2020, the coefficient by which income is indexed has not yet been established; in 2020 it is equal to 1.481.

Individual entrepreneurs on PSN in retail trade and catering with hired employees are required to use the cash register from January 1, 2020; a deferment from July 1 is available only without employees. The deadline for installing a cash register is 30 days from the date of concluding the first employment contract with the employee.

We recommend that you read: Weekends for holidays in 2020

Refusal to issue a patent

The Federal Tax Service is obliged to issue an individual entrepreneur a patent or a notice of refusal to issue it within five days from the date of receipt of the application. Refusal is possible in the following cases:

- PSN does not apply to the types of activities declared by the individual entrepreneur;

- The individual entrepreneur indicated an invalid patent validity period;

- The individual entrepreneur lost the right to use the PSN before the expiration of its validity, and the application was submitted in the year of loss of this right;

- The individual entrepreneur did not pay the additional amount for a patent received earlier;

- The individual entrepreneur did not fill out all required fields in the application.

Sample of filling out an application for a patent to a foreign citizen

Russia is a country where the majority of foreign citizens go to work. Labor migration has a significant impact on the social and economic life of foreign citizens: according to statistics, a large volume of money transfers is carried out from Russia to foreign countries.

According to the legal status of a foreign citizen located on the territory of the Russian Federation, he can be classified as one of the following groups:

- Temporarily staying foreign citizens;

- Temporarily residing foreign citizens;

- Permanently resident foreign citizens.

A temporarily staying foreign citizen is a person who arrived on the territory of the Russian Federation with a visa or in a manner that does not require a visa, who received a migration card and does not have a temporary residence permit and does not have a residence permit.

The length of stay in the Russian Federation on a visa is determined by the validity period of the visa. The period of stay under the visa-free procedure is up to 90 days, which can be increased to one year if the foreign citizen enters into an employment contract or civil contract and has received a work permit or patent.

Note: The limitation on the period of temporary stay of a foreign citizen who arrived in a visa-free manner on the territory of the Russian Federation does not apply to foreign citizens who were involved in labor activities as highly qualified specialists, as well as those working for individuals.

A temporary resident foreign citizen is a person who has received a temporary residence permit in the territory of the Russian Federation.

The period of temporary residence in the Russian Federation is three years.

A note about temporary residence is included in the identity document. Extension of the period of temporary residence is not provided for by law. A permanent resident foreign citizen is a person who has received a residence permit.

The residence permit is valid for five years. Upon expiration of the residence permit, it can be extended at the request of a foreign citizen for another five years. The number of extensions of the residence permit is not limited.

https://youtu.be/gMtY3JADxJg

A foreign citizen permanently residing on the territory of the Russian Federation does not require a visa to enter the Russian Federation; a migration card is optional.

A foreign citizen must work in Russia according to the profession, specialty, position, type of labor activity that is indicated in the work permit or patent. Later, from January 1, 2020, instead of work permits, work under a patent .

Note: until 2020, foreign citizens who arrived in Russia for the purpose of working in organizations or individual entrepreneurs were issued a work permit. And those who came to work for citizens to help with personal needs were issued a patent.

After significant changes were made from January 1, 2020 to the legislation of the Russian Federation, which regulates the labor of foreign citizens, they began to issue a patent to all foreign citizens, regardless of where they plan to carry out their labor activities.

Foreign citizens who have received a work permit should not replace it with a patent, because they will be valid until the expiration of their validity period for which they were issued, or until they are cancelled.

So, in order to carry out labor activities on the territory of the Russian Federation, a foreign citizen must obtain a patent. Let's look at it in more detail.

What you need to know about a patent

- To obtain a patent, you must pass an exam on knowledge of the Russian language, Russian history and the fundamentals of Russian legislation.

- A patent is issued for a period of 1 to 12 months.

If a patent is granted for one month, it can be repeatedly extended up to twelve months. The total validity period of a patent cannot exceed twelve months from the date of issue of the patent.

Before the expiration of the twelve month period, the patent must be reissued ten days.

- The patent must be obtained within 30 calendar days from the date of entry into the country.

The entry into the country is marked on the foreign citizen’s migration card, where work is noted as the purpose of the visit. For missing this deadline, a foreign citizen is subject to administrative liability in the form of a fine of 4-5 thousand rubles.

- The patent expires if the foreign citizen has not made an advance payment for personal income tax (NDFL). In this case, the day of termination of the patent will be the day following the last day of the period for which the advance payment was paid.

This is a kind of “patent cost”. A foreign citizen is required to pay a monthly advance payment for the patent in the form of personal income tax. This amount is approved annually by the state.

There is a base rate approved by the Tax Code of the Russian Federation, which is adjusted by a dilator coefficient established by the Ministry of Economic Development. This will be the federal (minimum) cost of the patent. The minimum patent value is then multiplied by the regional coefficient.

Each region has its own coefficient and it depends on the regional characteristics of the labor market. Each region of the Russian Federation sets its own regional coefficient annually.

- If the patent has expired, the employer must suspend the foreign citizen from work for up to two months. Two months are given for the restoration and renewal of a patent by a foreign citizen. If within two months a foreign citizen does not restore or extend the patent, then the employer dismisses him after one month from the date of the occurrence of the relevant circumstances, with a corresponding entry in the work book.

Note: If the patent is not restored or extended for some reason, then the foreign citizen is obliged to leave the territory of the Russian Federation after fifteen days from the date of expiration of the patent.

Fill out the form below. Current lawyers will contact you within 15 minutes regarding your question.

Patent application form for individual entrepreneurs

For 2020, the document template remains the same (you can download it below). Individual entrepreneurs who wish to switch to the use of a patent tax system must submit an application to the tax office that has jurisdiction over the territory of the planned “patent” activity. Patent application form 26.5-1 is submitted 10 working days before the start of work on the PSN (clause 2 of Article 346.45 of the Tax Code of the Russian Federation). This means that for an individual entrepreneur who submitted an application, for example, on 10/02/2018, the start of work on a patent is possible from 10/16/2018, unless the entrepreneur specifies a later date in the application.

The new application for a patent is valid from September 29, 2017. The form is filled out for one of the 63 types of “patent” activities specified in paragraph 2 of Art. 346.43 of the Tax Code of the Russian Federation, as well as in respect of which the law of the subject has introduced a patent system. Having received the application, tax authorities must issue a patent or refuse it within 5 days.

The development of a new application form is due to the need to include public catering services provided through public catering without customer service areas into the “patent” types of activities. Also, the OKTMO code was removed from the application form.