Publication date: 01/15/2020

The patent tax regime is now quite popular among businessmen. Many of them are attracted by the opportunity to avoid paying some taxes, as well as the absence of the obligation to file patent declarations. But this system also has its own nuances.

Individual entrepreneur on a patent: what taxes to pay? What exactly is this system, and who benefits from it? What changes came into force this year for “patents”? What should you know to avoid losing your money? We'll tell you everything in the article.

Patent taxation system - what is it in simple words

This is a special regime with payment of tax at the time of payment for the patent.

The list of types of business that can be conducted on a patent is strictly limited. For each individual type of activity, its own patent is registered. It is issued for any period from 1 to 12 months.

By the way, here are the types of activities for individual entrepreneurs on a patent:

- Furniture repair;

- Photography services;

- Repair and production of knitwear, fur, leather products;

- Residential renovation;

- Veterinary services;

- Tutoring;

- Freight and passenger transportation;

- Renting out summer cottages and premises;

- Repair and maintenance of household appliances;

- Dry cleaning and laundries;

- Glazing of balconies and loggias;

- Hairdressing and cosmetology services;

- Installation, welding work, etc.

You will find a complete list in the Tax Code of the Russian Federation. Activities not included in this list cannot be carried out on the PSN; a different taxation regime must be chosen for it.

The patent also has this feature. It only applies within a specific municipality. And if you want to open a branch, for example, in another city, then a separate patent for it will have to be registered. The only exceptions are individual entrepreneurs engaged in cargo and passenger transportation, delivery and distribution retail trade, translation activities, software development, interior design, etc.

Another limitation for patent activities is the limited number of employees. Their maximum number for the tax period is 15 people. If this figure is exceeded, the entrepreneur drops out of the system.

Finally, only private entrepreneurs have the right to apply PSN. And if their annual income exceeds 60 million rubles, then the right to use the patent is lost.

Despite all these restrictions, PSN attracts many due to the simplicity of calculating the basic tax. Let's find out how it is calculated.

How is the basic tax on PSN calculated - a simple formula

Unlike other tax regimes, the level of income of individual entrepreneurs is absolutely not important for PSN. The tax is calculated based on the basic estimated income even when the patent is issued. In each municipality it is set individually for different areas of business. The price of a patent is equal to the amount of tax. It must be paid in this mode.

Here's how to calculate how much your patent will cost. For example, you are engaged in software development in St. Petersburg. The estimated income for your type of activity in the Leningrad region is set at 1,000,000 rubles. in year. Next we count. With a tax rate on PSN of 6%, you must pay 60,000 rubles per year. Those. your patent will cost 60,000 rubles. What is the big advantage of a patent?

You can choose its validity period yourself. If you choose a month, the tax amount will be 5,000 rubles. Very profitable, even compared to the simplified tax system.

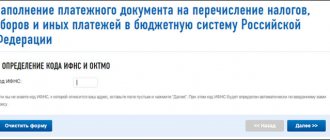

You can see the potential income level for your type of activity in a special document from your municipality. You can find it on the Federal Tax Service portal, find out in person at the tax office or contact the economics department of the local authorities. Next, multiply this amount by 6% and get the annual cost of your patent.

The laziest can simply use the calculator on the Federal Tax Service website. It will immediately calculate the tax for the selected period of time for your line of business for the specified municipality.

Here are the specifics of purchasing a patent:

- A patent purchased for a period of up to 6 months is paid before the end of this period;

- A patent purchased for 6-12 months - in parts. One third of it is paid within 90 days after purchase, the rest - until the document expires.

Another feature that some entrepreneurs are not aware of is that a patent is issued within one year according to the calendar. This means that when its validity period expires, for example, on December 12, you cannot buy a patent for the rest of the month. Those. the activity must be completed or reported under another regime.

In most cases, except for a tax of 6% of estimated income, there are no other taxes in this system. But there are exceptions. About them below.

What is income of an individual entrepreneur, and how to determine the amount of income?

This is the main question that must be answered before calculating the tax. Tax legislation does not always provide a direct answer to this question. Therefore, let us turn to the decisions of higher courts and clarifications of regulatory authorities.

pension contributions or compulsory pension insurance - 26,545 rubles; medical contributions or compulsory medical insurance - 5,840 rubles. The second change is in the calculation of pension contributions for individual entrepreneurs. In 2018, entrepreneurs must in a new way calculate the maximum for contributions to compulsory pension insurance from incomes over 300,000 rubles. By the way, the budget classification codes have also changed.

Individual entrepreneur on a patent: what taxes to pay with and without employees - complete list

Here are the taxes NOT payable on PSN, regardless of the presence of hired labor. Here they are:

- VAT (except for import of goods, etc.);

- personal income tax;

- Income tax;

- Property tax.

In addition, the patent tax system for individual entrepreneurs does not provide for filing declarations. There is also no need to maintain accounting. But you will have to keep a book of income accounting.

Other taxes are directly affected by the availability of hired labor.

Individual entrepreneur on a patent without employees: what taxes need to be paid? If there are no employees, the entrepreneur must pay:

- Patent cost in 2020;

- 26% in the Pension Fund (RUB 29,354);

- 5.1% for medical services (RUB 6,884);

- 2.9% in the Social Insurance Fund (optional payment);

- 1% of the excess amount for income that has crossed the border of 300,000 rubles.

Personal contributions must be paid until December 31, 2020. Tax on exceeding the maximum income threshold – until July 1.

And now about deductions for “patents” and employees. This group of entrepreneurs will be subject to reduced rates in 2020. For example, employees are only required to pay 20% contributions to the Pension Fund. However, when working as a landlord, as well as in the retail or catering industry, an individual entrepreneur transfers contributions on a generally accepted basis.

For yourself, traditional contributions to the Pension Fund, the Federal Compulsory Medical Insurance Fund and the above-mentioned 1% are subject to payment if the maximum amount of income is exceeded.

Now let's look at how social contributions are calculated. For the calculation, we take the validity period of the patent and the minimum wage, which reached 7,500 rubles in 2020.

| Insurance type | Formula | Maximum amount (in rub.) |

| Pension | 12 x 7,500 x 0.26 | 23 400 |

| Medical | 12 x 7,500 x 0.051 | 4 590 |

| Temporary disability | 12 x 7,500 x 0.029 | 2 610 |

It should be noted that when calculating the cost of a patent, sometimes they also use such physical indicators as rental area, number of transport units, hall area, etc.

By the way, speaking about individual entrepreneurs on a patent, what taxes should I pay in addition to those listed? If there is a taxable object, you must pay:

- Land tax;

- Property tax if the individual entrepreneur is its owner. No tax is imposed on property used in a business that the individual entrepreneur is not the owner of;

- Transport tax (on any vehicle registered to a businessman, regardless of the scope of its use).

The first two taxes are calculated by the Federal Tax Service. They must be paid by December 2, 2020 for 2020 and by December 1, 2020 for 2020.

An individual entrepreneur cannot reduce the tax burden by deducting contributions on a patent.

So, you have learned what taxes to pay as an individual entrepreneur on a patent. Now let's talk about reporting.

Insurance premiums for permanent residents

Foreigners can work on the territory of the Russian Federation either under an employment or civil service agreement, or as an individual entrepreneur. To temporarily carry out activities, a foreigner must have a work permit (if he arrived on a visa) or a patent (if a visa is not required). The period of temporary stay in Russia will determine the validity period of the corresponding document. This period may be extended.

We invite you to familiarize yourself with the Features and reasons for dismissal according to the Labor Code of the Russian Federation

For foreign citizens who permanently reside in the Russian Federation, the same insurance premiums are provided as for Russians. Accordingly, they are paid for:

- contributions to the Pension Fund tariff 22%.

- for health insurance in the amount of 5.1%.

- social insurance 2.9%.

- from accidents 0.6% or 0.2%.

For temporarily staying foreigners, there are their own rules for transfers, since highly qualified specialists are selected from among them, whose income under any of the contracts is not subject to any contributions, except for injuries. The income of other foreign workers registered under the contract will not be subject to contributions to compulsory health insurance, but will be subject to payments to compulsory health insurance and compulsory health insurance.

Tariffs for them will generally be equal to:

- on OPS - 22% on income not exceeding 876,000 rubles, and 10% on income above this amount;

- for OSS for disability and maternity - 1.8% from income not exceeding 755,000 rubles; contributions will not be accrued above this income.

https://www.youtube.com/watch?v=ytadvertiseru

At the same time, situations may arise for the contribution payer when he has:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee;

- possibility of using reduced tariffs;

- Contribution rates for injuries will depend on the type of activity carried out by the employer.

Reporting and deadlines for its submission for individual entrepreneurs on PSN in 2019

The accounting book is the only type of reporting for individual entrepreneurs without hired labor. The document helps to track income and notice that the threshold value of 60 million rubles is exceeded, when you can automatically “fly away” from the PSN.

There is no need to submit declarations. Personal contributions are traditionally paid by the end of the year.

But for “patents” and employees the situation is somewhat different.

In addition to registering himself as an employer no later than 30 days after concluding an agreement with the first employee, a businessman on a patent must keep accounting records and submit reports for employees. The due dates are indicated in the table.

As you can see, doing business with employees becomes somewhat more complicated. In order not to miss anything and not lose money, it is better to entrust accounting to specialists. This will free up your time and protect you from financial losses.

In addition, it is important to decide in advance whether a patent is beneficial for your type of activity. Thus, when comparing the PSN and the simplified tax system, many make erroneous conclusions about the tax burden.

Experts note that a patent is beneficial only for businesses with high turnover. In other words, if the real income is much higher than expected, then you should choose a patent as a special regime. If, on the contrary, it is better to give preference to the simplified tax system. A lower basic tax on a patent, in comparison with the simplified tax system, does not mean at all that the final amount of taxes, taking into account all deductions, will be less on the simplified tax system. Therefore, it is important to calculate everything in advance.

Here is the story of an entrepreneur who did not take these nuances into account.

Features of contributions for temporary residents

According to Russian legislation, foreigners who temporarily stay in the territory of our country are subject to the following types of insurance:

- Mandatory pension, regardless of what contract they work under, including individual entrepreneurs.

- OSS for disability and maternity when employed under an employment contract or of a civil law nature, but not for individual entrepreneurs.

- Compulsory medical insurance, regardless of the type of contract, including entrepreneurs, but not highly qualified foreigners.

- OSS on injuries when performing work under an employment or civil employment contract.

Thus, from the income of foreigners registered under an employment or civil process agreement, the employer is obliged to transfer all types of contributions provided for by law, as well as for the income of citizens of the Russian Federation. In 2017, insurance premiums for foreign citizens will be:

- for pension insurance - 22% on income that does not exceed 876,000 rubles, and 10% on income above this norm;

- for social benefits - for disability and maternity - 2.9% from income not exceeding 755,000 rubles, contributions are not charged in excess of this norm;

- for compulsory medical insurance - 5.1% of the entire amount of income.

In this case, the payer of contributions may also experience:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee;

- possibility of using reduced tariffs in accordance with the law

Real stories of entrepreneurs on PSN

“I have a shoe workshop. I earn an average of 3,000 rubles per day. I work alone. When I opened an individual entrepreneur, I thought that a patent would be the most profitable regime for me. After all, the annual tax, according to my calculations, was only 8,000 rubles. But I did not take into account that it is impossible to reduce taxes on the PSN by the amount of contributions.

As a result, I had to finish the patent until the end of its validity and pay all the taxes due. And they amounted to no more or less - 45,000 rubles per year, while under the simplified tax system I would have paid about 36,000. All this, while the cost of the patent is much lower than the tax on the simplified tax system. That's the math.

I concluded for myself that a patent, of course, is a profitable thing. But only for those whose income is a few times the cost of the patent, it also easily covers all insurance payments. Alas, this was not my case. What does this mean? Seven times o.

“Before opening a hairdressing salon, I chose the tax regime very carefully. After all, it directly depended on how much I would pay in taxes and what kind of reporting would need to be prepared. Without special knowledge, this was not easy. The abundance of information and not always clear calculations only made things even more confusing.

Then I turned to the accounting center for a free consultation. There they selected a tax system that was most beneficial for my activities - I patent. I was immediately pleased with the low tax and the opportunity to pay for a patent for any period.

My business is still at the beginning of its development and it’s too early to draw conclusions. But most likely I will turn to accounting services to keep personnel records. I think I can handle the rest myself.”

This was information about individual entrepreneurs on a patent: what taxes do you now know. If you liked the article, save a link to it on your page on any social network. Then up-to-date information will be at your fingertips at the right time. Also subscribe to our newsletter and receive the latest information about changes in the tax and accounting system completely free of charge.