Repair, reconstruction and modernization of the OS

During operation, organizations have to bear costs to ensure the functioning of fixed assets. The ways in which these costs are reflected in accounting depend on their essence, so it is important to define concepts such as modernization, reconstruction and repair:

- According to paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, modernization includes work that results in a change in the technological or service purpose of a fixed asset, as well as an increase in its capacity, performance, or the appearance of new qualities.

- Reconstruction is a reorganization of the operating system, which improves the results of its work, allows you to increase the variety of products produced, improve their quality or quantity. Also, the Tax Code of the Russian Federation uses the concept of “technical re-equipment”, which is associated with the use of the latest technologies and automation of production.

NOTE! These two concepts are united by the fact that as a result the fixed asset acquires improved performance or new functions.

- During repairs, technical and economic indicators do not improve, but remain the same. Its essence comes down to eliminating faults that have arisen or replacing worn parts.

ConsultantPlus experts explained how major repairs differ from reconstruction and modernization. If you have access to K+, proceed to the Typical Situation. If you don't have access, get trial access to the system for free.

See also “The workshop is turning into a warehouse and office - is this a renovation or reconstruction?” .

According to clause 14 of the accounting regulations “Accounting for fixed assets” PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, and clause 2 of Art. 257 of the Tax Code of the Russian Federation, the costs of modernization, reconstruction, technical re-equipment and other changes of this kind (we will further use the word “modernization” to refer to them) increase the initial cost of fixed assets.

Unlike modernization expenses, expenses for repairs of fixed assets do not affect the value of property and are classified as other expenses in tax accounting (Clause 1, Article 260 of the Tax Code of the Russian Federation). In accounting, repair costs are included in the maintenance costs of the unit in which the fixed asset is operated.

Modernization of OS when applying the general taxation regime

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and Methodological guidelines for accounting of fixed assets (approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), and when reflected in tax accounting - Chapter 25 of the Tax Code of the Russian Federation.

According to the rules established by the listed acts, changes in the initial cost of fixed assets at which they are accepted for accounting are allowed in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction may increase the initial cost of fixed assets of such an object if, as a result of modernization and reconstruction, the initially accepted standard performance indicators (useful life, power, quality of use, etc.) of such fixed assets are improved (increased). Similar rules are established for tax accounting.

The useful life in accounting must be revised if, as a result of reconstruction or modernization, there has been an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset item. If the useful life of a fixed asset in accounting increases, it can also be increased for tax accounting purposes, but only within the limits established for the depreciation group in which such a fixed asset was previously included.

In the 1C: Accounting 8 program, the “OS Modernization” document is used to reflect the increase in the initial cost of fixed assets for accounting and tax accounting, as well as to change their useful life. Let's consider the method of reflecting an increase in the value of a fixed asset using an example.

Example 1

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 60 months. Depreciation is calculated using the straight-line method in both accounting and tax accounting. In May of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization expenses (both for accounting and tax purposes) amounted to 1,500 rubles. (excluding VAT). This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company. The useful life did not change as a result of modernization.

Construction objects

Before increasing the cost of a fixed asset, it is necessary to first collect the costs associated with its modernization at the construction site. To accumulate such costs, account 08.03 “Construction of fixed assets” is intended, which allows you to conduct analytics on construction projects, cost items and construction methods. In our case, we should create a construction object for which the costs of upgrading the computer will be collected. It is convenient to enter the name of the construction project the same as that of the fixed asset for which costs are accumulated. This will make it easier to find and increase the visibility of analytical information.

Collection of modernization costs

Goods purchased from third-party suppliers are registered using the document “Receipt of goods and services” with the transaction type “purchase, commission”. In our example, on the “Products” tab of this document, you should fill in information about the memory module being registered. Since the module is intended for equipment modernization, it can be taken into account on account 10.05 “Spare parts” (see Fig. 1).

Rice. 1

Services for installing a memory module can be reflected in the same document, on the “Computer” tab. This can be done using the “Demand-invoice” document (see Fig. 2).

Rice. 2

As a cost account, you need to specify the construction project accounting accounts with the corresponding analytics for accounting and tax accounting. In our example, this will be invoice 08.03 with the same analytics that were used when registering services for installing a memory module:

- Construction objects: Computer;

- Cost items: cost accounting item for modernization of fixed assets;

- Construction methods: Contract.

When posting the document, a posting will be made relating the cost of the memory module from the credit of account 10.05 to the debit of account 08.03. As a result, all costs for upgrading the computer will be collected in account 03/08.

Increase in initial cost

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document, with the help of which the amount of such costs will be transferred from the construction site to the fixed asset.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset. The selected event when posting a document is entered into the information register “Events with fixed assets”. Using this register, you can obtain information about all events that occurred with the fixed asset by setting up the appropriate selection. The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized. To do this, it is convenient to use the “Selection” button located in the command panel of the tabular section. In our example, the main tool “Computer” is being upgraded (see Fig. 3).

Rice. 3

After selecting fixed assets in the “OS Modernization” document, you can automatically fill in the remaining columns of the tabular section based on the program data. To do this, click on the “Fill” button in the command panel of the tabular part of the document, and select “For OS list” in the drop-down menu.

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site. After the accounting accounts for construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button in the “OS Modernization” document and the corresponding fields will be filled in automatically by the program.

After filling out the document, you can print out the acceptance certificate for repaired, reconstructed, modernized fixed assets (form No. OS-3).

When posting, the “OS Modernization” document transfers the amount of costs from the credit of the construction projects accounting account to the debit of the fixed assets accounting account. In our example, the following postings will be made:

Debit 01.01 Credit 08.03 - in the amount of 1,500 rubles.

The corresponding entry will be generated in tax accounting.

Features of calculating depreciation after modernization...

...for accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

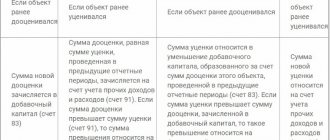

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows - see diagram.

Scheme

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

...for tax accounting purposes

The procedure for calculating depreciation after modernization for tax accounting purposes differs from how it is accepted in accounting. The rules for calculating depreciation in tax accounting are established by Article 259 of the Tax Code of the Russian Federation.

Starting from the month following the month in which the modernization was carried out, the changed original cost and useful life are used to calculate depreciation.

In our example, starting from June 2005, the amount of depreciation deductions for tax accounting purposes will be 358.33 rubles. (21,500.00: 60).

It remains to add that after the expiration of its useful life, the cost of the computer in tax accounting will not be fully repaid, since over 60 months the depreciation amount will be 21,399.80 rubles. (333.33 x 4 + 358.33 x 56).

The remaining 100.20 rubles. will be included in the depreciation amount calculated in the 61st month of using the computer.

Modernization of fixed assets - postings

According to clause 42 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines), account 08 “Investments in non-current assets” is used to account for modernization costs.

Read about how to account for fixed assets worth less than 100 thousand rubles here.

Upon completion of the work, the costs are included in the cost of the fixed asset or are accounted for separately on account 01 “Fixed assets” in the subaccount “Modernization of fixed assets”.

OS modernization is reflected in postings as follows:

- Dt 08 Kt 10, 60, 69, 70, 76 - modernization costs are collected;

- Dt 01 Kt 08 - when modernizing a fixed asset, this posting indicates an increase in its original cost.

For organizations with a large number of assets, it is also important to pay attention to analytical accounting.

To break down existing investments in non-current assets by type, a separate sub-account “Modernization costs” is opened on account 08 for the OS being modernized. On account 01 it is convenient to create a separate sub-account, where only objects that are in the stage of modernization will be listed, for example, “Fixed assets for modernization”.

When transferring fixed assets for modernization, the posting for their internal movement will be as follows:

Dt 01 subaccount “Fixed assets for modernization” Kt 01 subaccount “Fixed assets in operation”.

Accounting for OS modernization: postings

Issuing an order for modernization allows you to open analytics on account 08 to collect costs in relation to each of the OSes being updated. You can link this analytics either to subaccount 08.3 (intended for accounting for construction costs) or to another subaccount opened in account 08 specifically to reflect renovation costs. The allocation of a separate sub-account will not fundamentally affect the structure of accounting entries for the modernization of the operating system.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

The analytics created on account 08 will include all costs associated with updating the facility, regardless of which method (contract, business or mixed) the work is carried out.

The collection of costs when upgrading the OS is reflected by the posting: Dt 08 Kt 10 (60, 69, 70, 76).

Upgrade costs may apply to more than one item at a time. In this case, when assigning costs to account 08, they should be distributed between these objects. You need to choose the basis for distribution yourself, securing the choice in the accounting policy.

For the period of modernization (especially if it exceeds 12 months), it is better to transfer the OS to a special sub-account within account 01.

Collection of costs stops at the moment of execution of the acceptance certificate for the modernized facility. The amount of expenses reflected in it should increase the initial cost of the upgraded OS. The following operation is formalized by posting: Dt 01 Kt 08.

If the object was accounted for in a special subaccount of account 01 for the period of renovation work, then you will first need to make a reverse posting within account 01.

Depreciation of the upgraded OS in accounting ceases only if the period of renovation work exceeds 12 months (clause 23 of PBU 6/01). The rules for choosing the month from which depreciation will stop and then continue will have to be written down in the accounting policy, since PBU 6/01 does not establish them. A guideline can be tax accounting rules that tie the termination/continuation of counting to the 1st day of the month occurring after the event that caused the corresponding need (clauses 6, 7 of Article 259.1, clauses 8, 9 of Article 259.2 of the Tax Code of the Russian Federation).

Depreciation should continue to be calculated based on the new cost of the fixed assets and taking into account the change in useful life, if this period was revised upon acceptance from modernization (clause 20 of PBU 6/01). For the linear method, this will mean the need to write off the remaining value of the object (determined taking into account the investments made in it) over the remaining useful life (taking into account its adjustment). With other methods of calculating depreciation, write-off amounts will have to be recalculated taking into account the specifics of their determination for each method.

For fully depreciated operating systems that have undergone modernization, a new useful life must be established in order to write off the modernization costs that formed the new value of the object during it.

The nature of the entries reflecting depreciation after the modernization of fixed assets will not change. They will continue to be recorded monthly: Dt 20 (23, 25, 26, 29, 44) Kt 02.

Modernization of depreciated fixed assets

OSes that are already fully depreciated and have a residual value of zero are often upgraded. There is no specific guidance in the regulations on how modernization costs should be taken into account in such a case. So you should proceed similarly to the general principle:

- In accounting, increase the initial cost by the amount of modernization costs. The residual value will be equal to the amount of modernization costs.

- Review the JPI, estimating how much longer the facility will be used, taking into account the work performed.

- Calculate annual depreciation based on new data.

How to take into account the modernization of a fully depreciated operating system in tax accounting, read here .

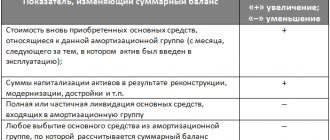

Change in the value of fixed assets

A change in the original or revalued value of objects registered under account 01 “Fixed Assets” can be made in the following cases:

-reconstruction, modernization, restoration, other similar works;

-revaluation carried out in accordance with the law;

- other cases established by the legislation of the Republic of Belarus.

Change in the value of fixed assets during reconstruction

Reconstruction includes the reconstruction of existing fixed assets, associated with the improvement of production and increasing its technical and economic indicators and carried out under the project for the reconstruction of fixed assets, in order to increase production capacity, improve quality and change the range of products.

But in practice, not a complete reconstruction may be carried out, but completion, additional equipment, partial liquidation or modernization of the facility.

In this case, it should be determined that work on completion, additional equipment, and modernization includes work caused by a change in the technological or service purpose of equipment, a building, structure or other object of depreciable fixed assets, increased loads and (or) other new qualities.

We should not forget that both reconstruction and modernization can be components of an organization’s overall plan for technical re-equipment.

Technical re-equipment includes a set of measures to improve the technical and economic indicators of depreciable property or its individual parts based on the introduction of advanced equipment and technology, mechanization and automation of production, modernization and replacement of obsolete and physically worn-out equipment and (or) software with new, more productive ones.

In other words, if the costs incurred to improve the condition of a fixed asset by improving machinery and equipment, extending the useful life of fixed assets contributed to the efficiency of their use, increasing productivity, then they should increase the book value of fixed assets.

Costs for the restoration of fixed assets are reflected in the accounting records of the reporting period to which they relate. At the same time, the costs of modernization and reconstruction of an object of fixed assets may increase after their completion the initial cost of such an object, if as a result of modernization and reconstruction the initially adopted standard performance indicators (useful life, power, quality of application, etc.) are improved (increased) object of fixed assets.

It is necessary to take into account that when the initial cost of fixed assets increases (decreases) in cases of completion, retrofitting, reconstruction and partial liquidation, costs are written off to the debit of account 08 “Investments in non-current assets” and the credit of the corresponding accounts for writing off expenses (10 “Materials”, 69 “Calculations for social insurance and security”, 70 “Settlements with personnel for wages”, etc.), accounting records do not reflect the use of a source of financing for capital investments .

After completion of all work performed and execution of the acceptance certificate - transfer of repaired, reconstructed and modernized objects (form N OS-3), costs are written off to the debit of account 01 “Fixed assets” and the credit of account 08 “Investments in non-current assets”.

Example . On August 1, 2014, the company Temp CJSC entered into an agreement with EVM LLC to carry out work to improve the characteristics of the computer assigned to the sales department of Temp CJSC. This computer was purchased on August 30, 2012, work began on August 21 and was completed on August 30, 2014.

The contractor replaced the computer's memory module with a more advanced module, and additional parts were also installed. The initial cost of the fixed asset was RUB 5,000,000. The cost of work to improve it is 1,500,000 rubles. without VAT.

The depreciation accrued on the computer before its restoration amounted to RUB 1,800,000.

The work carried out was qualified by the management of Temp CJSC as computer modernization work. The initial cost of the computer was increased by the cost of the work performed. The cost of the fixed asset, taking into account modernization, amounted to 4,700,000 rubles. (5,000,000 – 1,800,000 + 1,500,000).

After the work was carried out at Temp CJSC, an acceptance certificate for the modernized fixed asset was drawn up according to standard form No. OS-3.

However, not only the costs of reconstruction and modernization are the costs of restoring fixed assets. These costs also include repair costs. These expenses, in accordance with clause 20 of Instruction No. 26, are written off to cost accounts in the month of their recognition (documentation).

The costs of repairing leased fixed assets are also included in the cost of products, goods, works, and services, but the terms of the lease agreement should also be taken into account. Thus, the tenant’s obligation to carry out major repairs must be stipulated in the lease agreement, since if this issue is not resolved, the costs of this type of repair of fixed assets cannot be taken into account for tax purposes.

Carrying out work on the reconstruction and modernization of a leased fixed asset, with the consent of the lessor, is reflected in the lessee's accounting as part of capital investments.

Separable made by the tenant to the leased property are his property, unless otherwise provided by the lease agreement. If the tenant has made improvements at his own expense and with the consent of the landlord that cannot be separated without harm to the property, the tenant has the right, after termination of the contract, to reimburse the cost of these improvements, unless otherwise provided by the lease agreement. Thus, the inseparable improvements made are not the property of the tenant and will be transferred to the lessor at the end of the lease agreement.

In accounting, such a transaction is reflected as follows.

Debit 08 Credit 60 - reflects the cost of work on modernizing the leased fixed asset;

Debit 76 subaccount “Settlements with the lessor” Credit 08 - the cost of work on the inseparable improvement of the fixed asset was transferred to the lessor.

Fixed assets registered under account 01 “Fixed Assets” are valued at their original or revalued cost.

At the same time, according to the legislation of the Republic of Belarus, the revalued value of fixed assets is formed when a revaluation of fixed assets, unfinished construction and uninstalled equipment is carried out on January 1. The results of such revaluation are reflected in the accounting records under loan 83 “Additional capital” and form the “Revaluation Fund”.

Meanwhile, accounting rules establish other cases of changes in the initial cost:

1) assessment to the current (market) value of objects used in business activities, but having a “zero” book value.

For such objects, a permanent depreciation commission carries out technical diagnostics of the objects and, based on the results of assessing its actual physical wear and tear, makes an additional assessment. The newly formed depreciation cost cannot be lower than the cost of those materials, parts, assemblies, spare parts, and assemblies that make up the object. In other words, the minimum cost of a revalued fixed asset cannot be lower than the cost of scrap ferrous and non-ferrous metals and other waste, which can be sold after the object is liquidated;

2) assessment of fixed assets previously used by another legal entity and received free of charge.

The value of fixed assets received free of charge is changed if there is no residual value.

In the accounting of organizations, the gratuitous receipt of fixed assets is reflected by the following entries:

Debit of account 08 “Investments in non-current assets”

Credit to account 98 “Future income” (sub-account “Gratuitous receipts”) - reflects the market value of the fixed asset received free of charge;

Debit of account 08 “Investments in non-current assets”

Credit to accounts 60, 70, 69 - expenses for delivery and installation of fixed assets are reflected;

Debit account 01 “Fixed assets”

Credit to account 08 “ Investments in non-current assets” - the received fixed asset was put into operation.

In commercial organizations, as gratuitously received property is used in business activities in the reporting period (when depreciation is calculated on non-current assets), its value is recognized as non-operating income.

This means that when calculating depreciation on fixed assets received free of charge, the organization makes the following accounting entries:

Debit accounts 20, 23, 25, 26, 44

Credit to account 02 “Depreciation of fixed assets” - reflects the accrual of depreciation on fixed assets received free of charge;

Debit of account 98 “Deferred income” (sub-account “Gratuitous receipts”)

Credit to account 91 “Other income and expenses” (sub-account “Other income”) - part of the market value of fixed assets received free of charge is included in non-operating income.

Thus, in accordance with the new Chart of Accounts, account 98-2 “Gratuitous receipts” is used to record the value of gratuitously received assets until they are recognized as income of the organization.

| NOTE! If an organization receives a fixed asset item free of charge for its further sale, then it should: issue an order (instruction) on the procedure for use, i.e. preparation for liquidation of an object; in the act of acceptance and transfer of a fixed asset object, it is necessary to indicate in what condition the object is (complete, emergency, etc.); reflect in the accounting records the placement of the object in account 08 “Investments in non-current assets”. |

3) assessment of unaccounted for fixed assets identified during the inventory.

If the inventory reveals fixed assets that have not been in operation, then organizations evaluate them at market value with capitalization to the debit of account 08 “Investments in non-current assets” and the credit of account 91 “Other income and expenses” in accordance with Instruction No. 26.

If fixed assets identified during inventory were previously in use, they are reflected in accounting taking into account the depreciation of these fixed assets.

Example. During the inventory in 2020, the organization identified fixed assets (computer equipment) that had been received earlier but not capitalized; the market value of the manufacturing plant was 10,000,000 rubles.

2. Available documents for computer equipment confirm the date of its acquisition in April 2012 and, in accordance with this, it was possible to charge depreciation until the inventory date in the amount of 50% of the cost, or in the amount of 5,000,000 rubles.

3. In accounting, transactions for the capitalization of unaccounted for computer equipment must be reflected as follows:

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”

K-t 91 “Other income and expenses” - in the amount of 10,000,000 rubles;

Dt 91 “Other income and expenses”

K-t 02 “Depreciation of fixed assets” - in the amount of 5,000,000 rubles;

Dt 01 “Fixed assets”

Kt 08, subaccount “Purchase of fixed assets” - in the amount of 10,000,000 rubles.

Tax accounting for modernization of fixed assets

According to paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, modernization costs increase the initial cost of fixed assets, which continues to be repaid by depreciation.

Make sure you correctly distinguish between fixed asset repairs and upgrades for income tax purposes. Get trial access to K+ for free and proceed to expert explanations.

Example 2

On 04/05/2020, the organization modernized the machine. The cost of the work performed by the contractor was 130,000 rubles.

The useful life has not changed. The work lasted less than a year, depreciation was accrued all the time.

The initial cost of the object is 900,000 rubles. It belongs to the 3rd depreciation group. SPI - 5 years (60 months).

For tax accounting purposes, the monthly depreciation rate will be: 1 / 60 × 100% = 1.6666%.

Monthly depreciation amount: 900,000 × 1.6666% = RUB 15,000.

Initial cost of the modernized facility: 900,000 + 130,000 = 1,030,000 rubles.

In tax accounting, the amount of depreciation per month after modernization: 1,030,000 × 1.6666% = 17,167 rubles.

The Tax Code of the Russian Federation also provides for the possibility of increasing the useful life of an operating system if, after modernization, it can be used longer than the established period. According to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, it is possible to increase the SPI within the depreciation group to which the fixed asset belongs. If the SPI is equal to the upper limit of the depreciation group, it cannot be increased after modernizing the fixed asset.

You will learn about other nuances of tax accounting of fixed assets from the article “Procedure for tax accounting of fixed assets.”

Documenting

The decision to modernize fixed assets must be formalized by order of the head of the organization, which must indicate:

- reasons for modernization;

- timing of its implementation;

- persons responsible for modernization.

This is explained by the fact that all operations must be confirmed by primary documents (Article 9 of the Law of December 6, 2011 No. 402-FZ).

If an organization does not carry out the modernization of fixed assets using its own resources, it is necessary to conclude a contract agreement with the contractors (Article 702 of the Civil Code of the Russian Federation).

When transferring a fixed asset item to the contractor, issue an act of acceptance and transfer of the fixed asset item for modernization. It can be compiled in any form. If the fixed asset is lost (damaged) by the contractor, the signed act will allow the organization to demand compensation for losses caused (Articles 714 and 15 of the Civil Code of the Russian Federation). In the absence of such an act, it will be difficult to prove the transfer of fixed assets to the contractor.

When transferring a fixed asset for modernization to a special division of the organization (for example, a repair service), you should draw up an invoice for internal movement in form No. OS-2. If the location of the fixed asset does not change during modernization, no transfer documents need to be drawn up.

Upon completion of modernization, an act of acceptance and delivery of modernized fixed assets is drawn up, for example, in form No. OS-3. It is filled out regardless of whether the modernization was carried out economically or by contract. Only in the first case, the organization draws up the form in one copy, and in the second - in two (for itself and for contractors). The act is signed by:

- members of the acceptance committee created in the organization;

- employees responsible for the modernization of fixed assets (or representatives of the contractor);

- employees responsible for the safety of fixed assets after modernization.

After this, the act is approved by the head of the organization and it is transferred to the accountant.

If the contractor carried out the modernization of a building, structure or premises, which relates to construction and installation work, then in addition to the act, for example, in form No. OS-3, an acceptance certificate in form No. KS-2 and a certificate of the cost of work performed and costs in form No. KS-3, approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

Results

Important points when accounting for OS modernization are the separation of the concepts of “repair” and “modernization” and the organization of convenient analytical accounting. It is also necessary to take into account the differences in accounting and tax accounting for the modernization of fixed assets, which will require the accountant to take action to ensure the correct reflection of temporary differences.

Read more about all the nuances of fixed asset accounting in this article.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

- Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Fundamental differences

The main difference between repair and reconstruction is that the purpose of the former is preventive measures, the elimination of minor damage and malfunctions in order to protect and premature wear of fixed assets. As a result of any repair, the purpose of the fixed asset object, its technical and economic indicators, technological or service purpose do not change, product quality does not improve, and production space does not increase.

The purpose of the reconstruction is to improve the initially adopted standard indicators of the functioning of the fixed asset object, to increase the capacity and useful life.

Thus, when distinguishing between the reconstruction and repair of fixed assets, the change in technical and economic indicators, technological or service purpose, and the acquisition of new qualities play a decisive role. This conclusion is confirmed by letters from the Ministry of Finance of Russia dated April 22, 2010 No. 03-03-06/1/289, dated March 24, 2010 No. 03-03-06/4/29.

Important point

The cost of the work performed cannot be a determining factor for distinguishing between repair and reconstruction. Letter of the Ministry of Finance of Russia dated March 24, 2010 No. 03-03-06/4/29.