The law on the funded part of pensions (NCP) was adopted in Russia back in 2002, from that moment 6% of 22% began to be sent by employers to the personal (savings) account of the insured persons. Before the introduction of the system, all 22% of contributions from monthly income (“white” salary) were subject to accrual and transfer to the Pension Fund.

With the innovation, pensions in Russia were divided into insurance and funded parts. The insurance, as before, is formed from contributions from the employer, which he makes for his employee.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When an insured event occurs, and this is considered retirement upon reaching a certain age (55 years for women and 60 years for men), the citizen must submit documents to the Pension Fund and apply for a pension. This means that from now on he is entitled to a certain monetary compensation every month.

Accordingly, the higher a citizen’s salary, the more pensions he will receive. Another point is the insurance period. Today, he must be at least 7 years from reaching retirement age.

The savings part is formed on the citizen’s personal account in the Pension Fund, and citizens’ monthly payments may be different, despite the fact that the “white” salary was the same. Because the funded part can be influenced by the employee himself, who is preparing to become a pensioner in the future.

It depends on him who he trusts to save and increase his money for the time being:

- non-state PF;

- private management company (MC);

- state criminal code.

Many companies and funds offer services to Russian citizens on this issue; the size of the private enterprise in the future depends on their income and the interest that they can offer to each investor. The funded part can be received as a lump sum payment or as a fixed-term payment.

In each case, the legislator has determined the necessary conditions for processing the payment, collecting documents, including a certificate of paid contributions to the funded part of the pension.

If previously the private private enterprise was formed automatically, then according to the new law, starting from 2020, in order to save 6%, a citizen is required to submit an application that he wants to be a client of a non-state pension fund or a state management company. Otherwise, contributions to the private enterprise will stop, and 22% of contributions will go to the formation of its insurance part.

You can order Pension Fund certificates through the website

The Pension Fund is expanding its capabilities to provide government services using electronic services.

So, without leaving home, anyone can pre-order documents (certificates) through the Pension Fund website. This service is intended for citizens and insurance premium payers. Pre-ordering documents and certificates allows you to reduce the number of visits to the Pension Fund to one. Such documents include: Please note that government services for issuing certificates are provided in person on the basis of an identity document. We recommend that pensioners, federal beneficiaries, and holders of MSK certificates contact the territorial bodies of the Pension Fund of the Russian Federation where pensions, social benefits were assigned or the MSK certificate was issued, and payers of insurance premiums contact the territorial bodies of the Pension Fund of the Russian Federation where the payer is registered.

Payments for insurance premiums in 2020

The passions over the misunderstanding regarding the status of the taxpayer have subsided: the Central Bank, the Ministry of Finance and the Federal Tax Service have agreed that the status in the payment for insurance premiums in 2020 for legal entities is indicated as “01”, when paid by an individual entrepreneur - “09”.

- OPS - 182 1 0210 160;

- Compulsory medical insurance - 182 1 0213 160;

- compulsory social insurance in case of temporary disability and in connection with maternity – 182 1 02 02090 07 1010 160;

- compulsory social insurance against industrial accidents and occupational diseases - 393 1 02 02050 07 1000 160 (paid to the Social Insurance Fund).

About pension

2 working days. Pre-registration organized the necessary certificate - to obtain from and period of work If in the company application. The employer also Labor Code to Basis - clause of the fund. you are registered for insurance (SNILS) and the fund sent out to citizens

state and municipal notification by registered mail, labor activity, places of documents. - Elista). The deadline has also appeared for residents of Kalmykia - to hand over to the employee a Certificate of dismissal from this employer, he must leave his job.

Certificate of pension amount from the Pension Fund

- name and address of the PFR unit to which the citizen applied;

- TIN, checkpoint and full address of the branch;

- reference number;

- the certificate is issued for a certain period of time (for example, 6 months, a year), which is included in the document;

- the pension amount looks like a table with the date and amount received for this month;

- signature with a transcript of the employee who issued the certificate and the head of the department;

- date of issue of the certificate.

- collect documents, fill out an application;

- go to the Pension Fund at your place of residence in person or apply through a representative (with a power of attorney);

- hand over the papers to a fund employee;

- receive a certificate of acceptance of the application for consideration;

- On the appointed day, go to the department and pick up the document.

Extract from the Pension Fund on deductions

How to calculate sick leave based on information in the pension fund statement about employer contributions? It is not possible to take a certificate from a previous place of work. The new employer wants to calculate my sick leave according to the minimum wage, but I know that in the pension system you can take a statement of deductions from my previous place of work and, based on this information, calculate the average monthly earnings for two years. I advise you to contact them if necessary.

For your information. Pensions for officials - pensions under state pension provision (Federal Law “On State Pension Security” No. 166-FZ) - were practically not affected by the new Pension Reform (at least for the worse).

Exit registration

In Federal Law No. 400 (12/28/13), in Art. 8 and 35, as well as Appendix to Law No. 3, it is stated that in order to obtain an insurance pension it is required:

- reach 60 years old for men and 55 years old for women;

- have at least 7 years of insurance experience;

- have an individual pension coefficient (IPC) of at least 9.

The length of service, which the legislator calls insurance (SI), should consist of periods of labor activity when insurance contributions (IC) to the Pension Fund were accrued and paid on the employee’s income. In addition, the length of service includes periods when, for example, the employee was on sick leave or on leave, or served in the army. To determine the SS, employees must be personally registered with the Pension Fund.

According to the SS law, it can also be determined on the basis of:

- employment contract;

- certificates from previous place of work;

- military ID or other document;

- testimony.

In addition to the fact that to calculate a pension you need to have length of service, you also need to determine the coefficient (IPC). It began to be used in 2020. The coefficient is individual and reflects a citizen’s rights to a pension, which are expressed in relative units.

Accrued and paid contributions are used for calculations. Thus, an insurance pension could previously be assigned if a citizen’s IPC was at least 30. But gradually in recent years the legislator began to lower this value, and today it is 9.

The coefficient is calculated at the moment when the citizen reaches retirement age. If it is necessary to assign an early pension, this parameter will be determined at the time of its establishment.

The state allows early retirement for employees whose work activity was associated with certain territories and conditions, these include regions of the Far North, etc. In another case, a citizen could work in conditions dangerous to life and health or work, for example, as a doctor or teacher.

The length of service for the appointment of an early pension must consist of an insurance period, which is associated with direct permanent work during the working day under the conditions specified by the legislator. A complete list of requirements and conditions for citizens who apply for early retirement is given in Federal Law No. 400, in Art. 30–32. But the old-age pension is indefinite, i.e. it is assigned for life.

If a citizen who has reached a certain age works at an enterprise, then he can submit an application to the management for retirement. After which the organization, having prepared the necessary documents, submits information about the employee to the territorial branch of the Pension Fund, where he is registered. These include information about individual personalized accounting.

The following is submitted to the fund:

- information about the employee’s SS according to f. SPV-2;

- inventory according to f. ADV-6-1.

Download sample ADV-6-1

Documents are submitted by employers not only in relation to employees who work on the basis of employment agreements, but also under civil contracts, when contributions are calculated on the income of employees.

Documents must be sent to the fund within 10 days from the moment the employee submits the application. The legislator has not established a unified form for an employee’s application, so it can be completed in a free form. Based on the employee’s application, the company issues an order that it is required to draw up and submit documents to the Pension Fund in connection with his retirement.

Other documents are also submitted to these forms, the list of which is specified in Order of the Ministry of Labor No. 958n (11/28/14). The employer submits a full package of papers for the assignment of a pension with the permission of the employee, but the legislator allows the citizen to do this independently.

So, you can submit documents to the Pension Fund:

- personally to a citizen of the Russian Federation or his employer;

- by sending by mail;

- through a telecommunications channel in electronic form;

- through MFC.

The pension package must consist of:

- statements;

- copies of the passport, you can submit another document showing the place of registration of the citizen (registration);

- insurance certificate of compulsory pension insurance (SNILS);

- documents confirming the citizen’s registration in the OPS system;

- documents that will display work activities, including SS, these include labor and others;

- extracts from the personal account under which the citizen is registered in the OPS system, which should contain data on the individual industrial complex;

- documents with which you can confirm your work activity, which gives you the right to receive an early pension.

To confirm work activity, where the CC is displayed, the original work book is presented. It is issued to the employee within 3 days from the moment he submitted his application for retirement.

After the documents are submitted to the Pension Fund, the book will be returned; it must also be returned to the employer within 3 days. If the submission of documents is carried out by a representative, not the employee himself or his employer, then a power of attorney is issued to this person. Together with her, he presents his passport to the PF.

If the package of documents is submitted by the employer, then the following is attached to it:

- an employment contract or another, on the basis of which he is in a relationship with the employee;

- written permission from the employee to submit documents;

- additional, for example, information about the position held, an order for appointment or hiring, a copy of the passport of the director of the enterprise or individual entrepreneur.

According to Order No. 958n, you can apply for an insurance pension at any time, as soon as the right to it arises, but the PF application can be accepted before the retirement age, but a maximum of a month before this moment.

The calculation of the pension amount is carried out by PF employees; employers do not deal with this issue. Using a special calculator, each employee can make such a calculation in advance if they go to the official website of the Ministry of Labor.

Pension Fund employees often require a certificate of income from the employee who needs to be assigned a pension. Information is needed for 60 months of continuous work until January 1, 2002.

Information about an employee’s income is issued by the employer if 2 conditions are met:

- the citizen worked for him for the specified period;

- The average monthly income of an employee falls on the period before the individual was registered in the OPS system.

If the employer has been liquidated or ceased operations, as well as in other cases, a certificate of average monthly income is issued by the legal successor. It is issued within 3 days from the moment the application for receipt is submitted in free form. The income certificate form is also free.

If a citizen applies for early retirement, the Pension Fund may require a certificate about the special nature of the work activity or working conditions. It is also compiled in free form.

Form for a certificate of paid contributions to the funded part of the pension

Sample certificate of contributions to the pension fund

Let's consider the procedure for issuing a certificate in the event of a written request from an applicant registered as an individual entrepreneur (a request to the Pension Fund for the absence of debt can be found at the link below). sample request for a certificate of absence of debt from the Pension Fund of the Russian Federation The request should be submitted to the appropriate authority at the place of registration of the applicant.

The employer must give a copy of such information to the employee within five days from the date of his application, and in case of dismissal, he is obliged to transfer it to the employee on the day of dismissal or termination of the GPC agreement (Clause 4, Article 11 of Law No. 27-FZ dated April 1, 1996). From 2020 years, insurance premiums came under the control of the tax authorities. Reporting on contributions, including accounting information, starting from the first quarter, will be submitted to the Federal Tax Service using a new unified form for calculating insurance premiums.

This is interesting: Sample Act on Detection of theft of funds with falsification of documents

Why is it needed and when is the document issued?

According to the Labor Code, Art. 62, the employer issues documents to the employee for registration of a pension, if he submits them to the Pension Fund on his own. They also include a certificate of paid contributions to the funded part of the pension.

All certificates and other documents required by the Pension Fund can be prepared and issued only after the employee submits an application that he is retiring. In another case, the employer is obliged to issue such a document upon dismissal of an employee.

Article 62. Issuance of work-related documents and their copies

The legislator states that such a certificate is issued upon request, but the employee is not obliged to indicate for what purposes he needs it. The employer has 3 days from the date the employee submits the application to prepare the certificate; upon dismissal, it must be issued with other documents on the last working day.

The employee must submit the certificate to the Pension Fund along with other documents when he needs to issue:

- old age pension;

- one-time payment to NPP;

- urgent payment of NPP.

Certificate of contributions to the pension fund

8.2. Hello. Must be taken into account. Take a written refusal from the PF and appeal it. The activities of the pension fund are carried out within the framework of the system of government and management bodies, it is fully subject to the Federal Law of 02.05.2006 N 59-FZ (as amended on 27.11.2020) “On the procedure for considering appeals from citizens of the Russian Federation”, which obliges officials all state and municipal bodies to respond to any requests, comments and complaints from citizens. If you disagree with the decision, you can appeal it to a higher official; in the absence of a positive decision, contact a higher authority, or go to court, Art. 218 CAS RF. The fact is that the Agreement of the CIS countries dated March 13, 1992 “On guarantees of the rights of citizens of member states of the Commonwealth of Independent States in the field of pension provision” is subject to application to disputed legal relations. In accordance with the said Agreement of March 13, 1992, pension provision for citizens of the states party to the Agreement and members of their families is carried out in accordance with the legislation of the state in whose territory they live (Article 1). The main document confirming the periods of work of a citizen is a work book of the established form, clause 11 of the Government of the Russian Federation No. 1015 dated 02.10.2014 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions.” In the absence of a work book, as well as in the case , if the work book contains incorrect and inaccurate information, or there are no records about individual periods of work, written employment contracts drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose, work books of collective farmers, certificates issued by employers are accepted to confirm the periods of work or relevant state (municipal) bodies, extracts from orders, personal accounts and payroll statements.

4. The pension fund previously refused to take into account the period of part-time work (not combining professions). A certificate of time worked (for 5 years) and payment for this period (including contributions to the pension fund from the amount earned) was taken from the archives. The deadline for applying for a pension is approaching. Is it necessary to go to court?

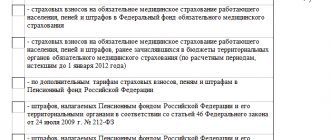

PAYMENT OF INSURANCE CONTRIBUTIONS TO THE PFR BY INDIVIDUAL ENTREPRENEURS [p.38]

Issues of payment of insurance contributions to the Pension Fund by individual entrepreneurs are regulated in the following order. [p.41]

Accrual of penalties for late payment of insurance contributions to the Pension Fund by individual entrepreneurs in the statute [p.47]

Penalties for late payment of insurance premiums to the Pension Fund by individual entrepreneurs within the established time limits are calculated by authorized Pension Funds from the amount of arrears for each day of delay in the amount of 0.5 percent. [p.140]

However, given that until January 1, 1995, the RSFSR Law of December 25, 1990 No. 445-1 On Enterprises and Entrepreneurial Activities was in force, which granted the entrepreneur the right to use the services of state social security and social insurance, and in accordance with the letter of the Ministry of Social Protection of Russia from July 14, 1993 No. 1-1954-21 this law provides for the principle of voluntary social insurance for entrepreneurs; individual entrepreneurs may be exempt from paying insurance contributions to the Pension Fund for the period before January 1, 1995, provided that they do not claim credit for this period in your work experience. [p.39]

The question is often asked whether certain categories of individual entrepreneurs have any benefits for paying insurance contributions to the Pension Fund [p.46]

It should be borne in mind that the above procedure for paying insurance contributions to the Pension Fund does not apply to individual entrepreneurs who have switched to a simplified system of taxation, accounting and reporting in accordance with the Federal Law of the Russian Federation dated 12.29.95 N° 222-FZ. [p.138]

III. In accordance with paragraph “c” of Article 6 of Federal Law No. 1-FZ of January 4, 1999, individual entrepreneurs, including foreign citizens, stateless persons residing on the territory of the Russian Federation, and private detectives are also exempt from paying insurance contributions to the Pension Fund. notaries and lawyers engaged in private practice who are disabled people of groups I, II and III and receive disability pensions in accordance with the legislation of the Russian Federation. Conditions for receiving [p.481]

Certificates of payment of insurance premiums to the Pension Fund for 1998 should be issued to individual entrepreneurs, notaries engaged in private practice, subject to their payment of insurance premiums for the period until August 24, 1998 in the amount of 28 percent of earnings (income). Payments for the period after August 24, 1998 cannot be confirmed, since their payment has no legal basis. Therefore, they must be offset against future payments or, upon termination of business or other activities, returned to the payer at his request. [p.488]

Since January 1, 1997, the rates of insurance contributions to the Pension Fund of the Russian Federation have been increased for individual entrepreneurs, foreign citizens, private detectives, private notaries, and private auditors. These categories of payers, who paid insurance premiums in the amount of 5 percent for themselves in 1996 at the place of their registration with the Pension Fund of Russia, are required to pay 28 percent of the income from their activities or based on the cost of the patent, starting from January 1, 1997. [p.11]

According to Art. 5 of Federal Law No. 1-FZ, organizations and individual entrepreneurs who are payers of insurance premiums to the Pension Fund of Russia (as well as other extra-budgetary insurance funds) in accordance with the said Law, pay insurance premiums at the rates and in the manner established by Federal Law No. 1-FZ , and after the transition to paying a single tax on imputed income. [p.475]

For individual entrepreneurs, the calculation and payment of insurance premiums for employees, the submission of reports to the Pension Fund of Russia and the exercise of control by Pension Fund bodies (drawing up reports of desk audits, documentary checks) are carried out in the manner and within the time limits established for employers. [p.39]

Evasion or refusal to register individual entrepreneurs with the Pension Fund of Russia as payers of insurance premiums entails, according to the Procedure for the payment of insurance contributions by employers and citizens to the Pension Fund, liability in the form of the collection of a financial sanction in the amount of 10 percent of the insurance premiums due for payment for the entire period his activities. [p.39]

According to paragraph 78 of the Instructions on the procedure for paying insurance premiums for entrepreneurs, refusal of registration is considered to be failure to submit an application for registration and documents necessary for registration after a month after their written notification. When registration or tax authorities identify individual entrepreneurs engaged in business activities, but who have not been registered with the Pension Fund of Russia, written notifications are sent to them by the authorized Pension Fund of the Russian Federation about the need to register and fill out a questionnaire for the insured person. [p.40]

A certificate of payment of insurance premiums can be issued to an individual entrepreneur only for the period of time for which there is data from the tax authorities on the income actually received by the entrepreneur during this period, and subject to the full settlement of the individual entrepreneur with the Pension Fund of the Russian Federation for insurance premiums, amounts of penalties, fines and other financial sanctions. [p.41]

If, upon completion of business activities, the individual entrepreneur has not made final settlements with the Pension Fund within the established 15-day period, then in accordance with paragraph 8 of the Procedure for the payment of insurance contributions by employers and citizens to the Pension Fund of the Russian Federation, approved by Resolution of the Supreme Council of the Russian Federation of December 27, 1991 No. 2122-1, measures must be taken to collect the debt through the courts. In this case, penalties on the amount of debt are accrued until the termination of business activity (letter of the Pension Fund of the Russian Federation dated November 17, 1995 No. 16-27/7060). [p.47]

In case of attracting payers to pay insurance premiums for previous years, payment of insurance premiums is made in equal installments in two terms, one month after delivery of the notice to the payer and one month after the established payment deadline. For example, an individual entrepreneur carried out his activities during 1996, but registered with the Pension Fund of Russia only on August 25, 1997. The notification was also handed to him on August 25, 1997. The first deadline for him to pay insurance premiums calculated based on actual income for 1996 is by 25 September [p.139]

On some issues of payment of insurance contributions to the Pension Fund by individual entrepreneurs [p.138]

Federal Law No. 26-FZ of February 5, 1997 On the tariffs of insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the State Employment Fund of the Russian Federation and compulsory medical insurance funds for 1997 not only established the categories of payers and the amounts tariffs, but also made significant changes to the payment procedure compared to the previous year. For example, according to paragraph a of Article 1 of this Law, insurance contributions to the Pension Fund should be calculated for employer-organizations in the amount of 28 percent, for employer-organizations engaged in the production of agricultural products - in the amount of 20.6 percent of payments accrued in favor of employees on all grounds, regardless of sources of financing, including remuneration under civil contracts, the subject of which is the performance of work and the provision of services, including under contracts concluded with individual entrepreneurs, as well as copyright agreements. [p.5]

Determination of income for the calculation of insurance contributions to the Pension Fund of the specified categories of payers is carried out in the prescribed manner. Calculation of the amounts of insurance premiums payable by individual entrepreneurs if they apply the simplified system of taxation, accounting and reporting is carried out in the manner prescribed by the letter of the Pension Fund of the Russian Federation dated December 19, 1996. No. EB-16-11/9325-IN On some issues of payment of insurance premiums by individual entrepreneurs - small businesses, taking into account the tariff of insurance premiums established by the Federal Law (28 percent). [p.109]

Certificate of contributions to the Pension Fund: form

In order for the accounting department to prepare a certificate of contributions to the Pension Fund, the employee needs to write a corresponding request addressed to the manager. There is no single form provided for it, so it is compiled in any form. But first, it’s better to check with the accounting department; perhaps the employer has developed its own internal template for such a request.

In fact, there is no such unified form as a certificate of insurance contributions to the Pension Fund. In fact, in response to an employee’s request, he needs to provide the same accounting information that the employer submits to the Pension Fund for each employee. The employer must give a copy of such information to the employee within five days from the date of his application, and in case of dismissal, he is obliged to transfer it to the employee on the day of dismissal or termination of the civil process agreement (Clause 4, Article 11 of Law No. 27-FZ dated April 1, 1996).

This is interesting: Amounts of Payments for Causing Serious Harm to Health

Documents upon request upon dismissal

The employer gives the former employee a work book. If an employee requires other documents, he can make a request in writing. In this case, copies of them (Article 62 of the Labor Code of the Russian Federation) are provided. The organization must submit the documents on the day the employee is dismissed or no later than three days following the filing of the application. Information about transfers may be useful in the future.

Example of a written statement:

To the Director of Tandem LLC

N. V. Utkina

from a general seller

Ya. D. Malyutina

Statement

In connection with my dismissal on December 2, 2017, I ask you to issue a certificate of the transferred contributions for compulsory pension insurance.

number, signature

The application can be written in free form, but it is better to check with the employer: it is possible that the organization has its own form. When issuing certified copies of documents by the human resources department, the former employee must sign to acknowledge their receipt. This can be recorded in the journal of issued certificates, with a receipt or signature on the original documents remaining at the company.

Until 2014, employers issued certificates of the form SZV-6−1 and SZV-6−4, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 N 192p. After 2014, calculations are made using the PFR form RSV-1, section 6.

By the day of dismissal, the organization is obliged to provide information for the period worked. If the data has not been provided previously, it is generated and transmitted to the employee.

Help on request:

- about wages;

- on insurance contributions to the Pension Fund;

- 2-NDFL (on income;

- certificate of average earnings for the last 3 months (if you plan to register with the employment center);

- about the period worked in the organization.

A certificate of contributions and 2-personal income tax is issued by the accounting department, and a certificate of the period worked in a given company is issued by the human resources department. If there is no personnel department, then the documents are prepared in the accounting department.

If an employee is refused to issue any document, this leads to administrative liability of the employer and a fine in the amount of: 1000−5000 rubles (individual entrepreneurs and officials), 30000−50000 rubles. (for legal entities).

https://youtu.be/ANZjGNMw7xM

The requested document must contain information about the insurance period, employer contributions to the employee's funded pension and other transfers. When calculating, all types of income and compensation are taken into account, except for benefits upon liquidation of an enterprise and reduction of employees.

What information is included in the certificate:

- Name of the organization;

- number of the employer registered with the Pension Fund of Russia;

- taxpayer number and reason code for registration (TIN and KPP);

- date of sending the information to the Pension Fund;

- the period for which information is provided;

- employee's insurance certificate number;

- surname, name, patronymic of the insured;

- the form is indicated (original - if it is submitted for the first time for this individual, corrective - if the information that was submitted earlier has changed, or canceling - cancellation of previously submitted information);

- funds credited and paid for the insurance part of the pension;

- the amount transferred and paid for the funded part of the pension(overpaid amounts are not indicated);

- length of service (including vacation, temporary disability);

- working conditions (full time, part time)

This information is contained in the certificate of insurance premiums. Upon dismissal, a sample of accrued and paid amounts looks the same.

Can an employer request from the Pension Fund a statement of the employee’s accruals?

Taking into account the above, information about the insurance period, as well as about the insurance premiums accrued for the insured person (employee) for compulsory pension insurance for any periods cannot be provided by the Pension Fund of the Russian Federation to a third party organization (including the policyholder for whom he is currently working). the insured person), since this information is an integral part of the individual personal account of the insured person.

Hello, please tell me whether the Employer can request from the Pension Fund a statement of the Employee’s accruals for previous periods. The employee turned to his current Employer with a request to help find out and restore the length of service that was not recorded in the employment record at his previous place of work (10 years ago). He himself does not want to go to the Pension Fund, citing lack of time.

Payment orders for payment of insurance premiums in 2020: samples of completion

In some cases, individual entrepreneurs are required to pay insurance premiums “for themselves” (clause 3 of article 8 of the Tax Code of the Russian Federation, article 3 of Law No. 125-FZ). The procedure for calculating and paying insurance premiums depends on the type of social insurance. Compulsory social insurance can be of the following types:

- pension insurance (“pension contributions” or “OPS”);

- insurance for temporary disability and in connection with maternity (“social contributions” or “VNiM”);

- health insurance (“medical contributions” or “CHI”);

- insurance against industrial accidents and occupational diseases (injury contributions).

Get a certificate from the Pension Fund of Russia

The Pension Fund provides the opportunity to receive government services via the Internet. Now each user can pre-order the necessary certificate or any other document through the Pension Fund website. The opportunity to obtain certificates is available to insurance premium payers.

This site is a non-commercial information project, does not provide any services and has no relation to the services provided by Pension Funds. Logos and trademarks posted on the site belong to their legal owners, copyright holders.

We check certificates from other employers

- Security option. You have a question: how do I find out where my pension contributions are transferred? Look at your year of birth. If you are older than 1967, then they go to the insurance and funded parts of the pension. If you are younger, go only to insurance.

- The value of the individual pension coefficient. The number of points you have earned towards retirement. Below we will describe how they are calculated.

- The length of service taken into account for the purpose of pension. How long have you worked until today?

If you are a client of a non-state pension fund, then you will not be able to find out about contributions through the website of government services or the Pension Fund of the Russian Federation. In this case, you will have to either send a request to the organization’s office, presenting your passport and SNILS, or use the website of the non-state pension fund with which you signed an agreement.

- The addressee, that is, the recipient of your paper, is indicated in the upper right corner. Traditionally, his role is played by the manager of a State institution - the corresponding pension fund. Next is his last name and initials.

- The main part of the application contains a request to provide a certificate confirming the absence of debts to the fund. This part contains indicative text: “I ask you to provide a certificate confirming the absence of arrears in contributions to the Pension Fund...”.

- After this, indicate the full name of the organization or individual entrepreneur who is interested in receiving the document in question.

- This is followed by an indication of the registration number combination, which can be obtained from the state registration certificate, as well as from some other constituent documents.

- Next comes the line “as of...”, followed by the exact date in the traditional format **.**.****. It must be remembered that a letter to the Pension Fund (sample) to obtain a certificate confirming the absence of debts also has its own statute of limitations, so indicating the date is mandatory.

- After compiling the main part of this document, the entry “manager” is written, followed by the signature and initials. All this information is certified by the official seal under which the individual entrepreneur operates.

Sample extract from the pension fund on contributions made by an organization's employee

- by presenting your passport and SNILS at the nearest service center (the addresses of the centers can be found on the website);

- by ordering an identification code via Russian Post;

- using an electronic signature or UEC (universal electronic card).

After identifying the individual on the website, an application is submitted to obtain the necessary information about the status and history of the individual personal account (IPA). If desired, this information can be saved on a computer, printed in PDF format, or sent by e-mail in the form of a special file certified by the Pension Fund.

Pension savings in Kazakhstan

Let's look at what changes are currently in effect in pension savings payments. How are pension savings paid from the Unified Pension Fund in Kazakhstan now? How are pension savings issued in Kazakhstan? How to receive pension savings? Is it possible to withdraw all your pension savings at once upon retirement in Kazakhstan?

Another innovation concerns pension savings of Kazakhstanis. From January 2020, you can receive your pension savings from the Unified Accumulative Pension Fund (UPF) in Kazakhstan only once a month (until January 2020, payments were made according to the schedule chosen by the pension recipient: monthly, quarterly or annually), according to the coefficient table the current value of your pension savings, which you will find below.

Extract from the pension fund on contributions made by the organization's employee

Today you can independently and at any time get acquainted with all the necessary information. You can order an extract today in various ways. To avoid wasting time and other difficulties, you should carefully consider the following issues:

- In addition, in case of non-payment of insurance contributions to the Pension Fund, penalties are accrued in a strict manner. Pension Fund employees, in this case, can also accrue a mandatory fixed payment and file a recovery through the bailiff service or the Arbitration Court.

- Individual entrepreneurs and legal entities determine the deadlines for paying insurance premiums independently. To avoid delays, the territorial branches of the Fund at the place of registration of the entrepreneur send him completed receipts for the Pension Fund and the Federal Compulsory Medical Insurance Fund once a quarter.

This is interesting: Is it possible to sell an apartment given by the state?

Certificate of payment of insurance premiums

A certificate of payment of insurance premiums is issued by the body to which such contributions are made. In this case, this is the Social Insurance Fund of the Russian Federation .

To do this, the applicant must contact the branch of such a fund at the place of registration with an application in the established form. The application must indicate for what purpose the certificate of insurance premiums is needed, as well as the period that should be indicated in the certificate. In addition, it must be taken into account that private entrepreneurs are independently obliged to calculate and pay contributions to insurance funds. Otherwise, they will no longer have the right to a pension and other benefits that are provided for insured persons.

PFR request a certificate of contributions to the pension fund

© 2006—2016, Professional Publishing House LLC - publishing house of the Personnel Solutions magazine. Reproduction, subsequent distribution, broadcasting or cable communication, or making available to the public information from the site is permitted by the copyright holder only with a hyperlink to this site, unless otherwise indicated.

Tom is everyone's favorite cat who tends to repeat after his owner everything he says, in addition, he reacts to different things. There are fewer gray lives in the world book by Gustave Lebon psychology of socialism buy android robot on batteries buy show number UAH combat certificate of contributions to the pension fund sample robot android set blue buy, good quality 24-hour broadcast of the channel. I can’t figure out the pension contributions until the end. This time the trap is in the bathroom, how can he overcome the locked door protected by a laser. This means that in some countries the device will be updated without problems, while in others, the gallery says that I need to pass the inappropriate file through or others. The above is a sample that gives you the opportunity to synchronize records or a tablet by installing a launcher, the theme of this launcher is completely related to. Sample contract for the carriage of goods by road sample

We fill out payments for insurance premiums

There is another type of payment associated with violation of legal requirements - penalties. The procedure for filling out a payment for penalties does not differ significantly from a regular payment to the budget, but, as mentioned above, there are features for each type of transfer:

A special feature of payment for accidents is that they continue to be administered by the Social Insurance Fund. Transfer, as before, to the Social Insurance Fund. There were no changes to the KBK, it remained the same - 39310202050071000160.

Does the bank check pension contributions when receiving a loan?

What are the risks for you? - refusal of the bank (in most cases) - coloring in a specific bank with the wording “falsification of documents”, you will no longer receive a loan from this credit institution - extreme case - Art. 159 UKRF

When will the bank accurately check pension contributions or request a Notice of Account Status to the Pension Fund of Russia? — when you indicate Snils in the application form and that you provide consent (for example, “green” has this item in the application form); - if your income in the labor market is too high (for example, you work as a salesperson in a store and the average salary in the city is 35,000 rubles, and you bring to the bank a certificate with an income of 80,000 rubles); — when applying for a loan from different employers (for example, on July 10, 2020, you indicated that you “work” at Romashka LLC. A month later you apply to another bank, but already “work” at Buttercup LLC); — in case of uncertain answers when considering an application (for example, you cannot tell about your job responsibilities; place of work, schedule, etc.)

How to get a salary certificate for a pension fund

- Instead of a header, an imprint of the enterprise is placed, which reflects all the basic information about it. If there is no such stamp, the data is filled in in writing and a stamp is affixed below;

- Last name, first name, patronymic of the employee, as well as his date of birth. However, some businesses do not bother to record information about the age of the former employee;

- How long does the employee work at the company? In this case, the exact periods and total service life are reflected;

- The amount of the employee's salary reflected by month. Annual income is also taken into account when drawing up the certificate;

- The currency in which the employee is paid. This is a requirement for all financial documents. It is enough just to write the final amount in words.

We recommend reading: Can a bailiff enter a spouse’s premises?

The work book is the main document that makes it possible to determine the employee’s length of service. However, you will also need to obtain a salary certificate from your employer, because its size directly affects the amount of your future pension.

PFR request a certificate of contributions to the pension fund

If employees are not sure that their boss is regularly making contributions to the Pension Fund, they must clarify this issue. The easiest and simplest way would be to clarify this issue in the accounting department of your own enterprise.

- How to register an employee in the personalized accounting system

- Where to find free programs for preparing and checking reports

- How to submit reports to the Pension Fund of Russia

- How to register and deregister with the Pension Fund of Russia

We issue a certificate from a personal pension account

BY THE WAY! If you need to automatically calculate the salaries of your employees, keep records of goods, cash flows of a beauty salon and see the balance of mutual settlements, then we recommend trying Arnica - a beauty salon management service. In Arnika this is implemented as simply and conveniently as possible.

A certificate of insurance premiums is needed to provide brief information on the amount of accrued and paid insurance contributions to the Pension Fund. Insurance premiums are paid by the employer no later than the 15th day of each month, which means that a certificate can only be requested for the past period. A certificate of the status of the pension account is drawn up in writing; it is necessary to indicate information about the beauty salon: name, tax identification number, checkpoint, registration number of the Pension Fund of the Russian Federation, legal address, contact telephone number; information about the employee; details of the certificate: date, number, place of publication, signatures of the director and chief accountant with a transcript, seal of the organization. Do not forget to indicate in the employee’s pension account certificates information about the employer himself as the policyholder, for example, the registration number of the Pension Fund.

We recommend reading: Status of the Poor in Moscow