How pension payments are recalculated

Pension benefits are indexed twice during a calendar year.

The first is provided for the recalculation of insurance payments and was previously carried out in February. But back in 2020, the President of the Russian Federation decided to postpone the indexation of old-age insurance accruals to January.

for the second time, that is, payments for the loss of a breadwinner, for disability, and others. The second recalculation takes place in April of the current financial period.

The regulatory conditions apply exclusively to unemployed pensioners, that is, for those citizens who have reached retirement age, received insurance payments and at the same time completed their working career.

If a citizen receiving old-age payments continues to work, then he is not entitled to indexation. Such instructions are enshrined in Law No. 358-FZ of December 29, 2015. Therefore, pension recalculation for working pensioners in 2020 is not allowed.

Interesting on the topic: Is a pensioner required to work 2 weeks upon dismissal?

Will pensions for employed people be increased or not?

Social pension supplements are paid to persons whose income is below the subsistence level for a given region. Such additional payments from the state are due only to unemployed pensioners, and are made monthly until the amount of his income becomes higher than the official subsistence level. Accordingly, working pensioners are not entitled to a pension supplement.

Currently, the only possible indexation of pensions for employed pensioners is carried out only after their dismissal from work. The annual increase in pensions for working pensioners occurs on August 1 in the form of a recalculation of the value of the pension points they previously accumulated. The cost of the IPC point is reviewed annually based on the inflation rate. There are no other options for increasing payments for this group of people.

Recalculation of pension upon dismissal of a working pensioner

Indexation of old-age benefits for a working citizen is suspended until he is fired. And upon termination of employment, the state is obliged to recalculate the insurance payments of the retired pensioner.

But there is a subtlety here: the recalculation will be done for the entire period of the person’s work (taking into account all indexations), but the new pension will be paid only from the date of dismissal. There is no point in waiting for the indexation payment for all past years to be paid retroactively - it will not happen.

Moreover, in 2020, there was a special procedure for recalculating pensions after the dismissal of a working pensioner: if a citizen quit on December 29, 2016, then he will be assigned an indexed pension only three months later, from March 29, 2017. Such instructions are contained in paragraphs 6 and 7 of Art. 3 of Law No. 358-FZ of December 29, 2015 (as amended on November 22, 2016).

But since January 2020, changes have been in effect: a new, more profitable recalculation algorithm. Question: if a working pensioner quits, when will the pension be recalculated in 2020? The bonus, in accordance with Law No. 134-FZ dated July 1, 2017, will be accrued from the day following the date of dismissal. Please note that increased insurance benefits should not be expected in the month of termination of employment. The additional payment will be paid later, but in full.

IMPORTANT! In August last year, representatives of the Pension Fund of the Russian Federation carried out an undeclared adjustment of payments to retired elderly people. The reform standard is determined by clause 3, part 2, part 4 of art. 18 of Law No. 400-FZ; clause 56 of the Rules, approved. By Order of the Ministry of Labor of Russia dated November 17, 2014 No. 884n. This means that a similar recalculation of pensions will be carried out in August 2020. Moreover, there is no need to submit any applications for increased payments to the Pension Fund.

Please note: if lawyers offer to help you recalculate your pension for a fee, they are most likely scammers! More details

Regardless of the date of retirement, a citizen does not need to contact the territorial fund with an application. As of April 2020, personal application is no longer required. The employer independently reports to the Pension Fund about the insured persons using the unified form SZV-M.

By

Who is responsible for late recalculation of payments?

The changed amounts are applied to pensions in practice no earlier than three months after dismissal.

But sometimes it happens that the specified period has passed, and the amount of payments has remained virtually unchanged. The problem has several causes and nuances. Several types of errors lead to this state of affairs:

- The employer continues to send lists to the Pension Fund without updates, although the dismissal has occurred and is recorded.

- The Pension Fund itself did not carry out indexation within the specified three-month period.

The time for termination of employment agreements is at the beginning of the month. Then you just need to wait - with a high probability the citizen’s name will appear on the lists, but a little later.

It is recommended to personally monitor the processes related to pension indexation. If, after three months, payments arrive without updates, you need to contact the Pension Fund employees to get clarification.

One of the acceptable options is to issue a certificate or extract in your Personal Account, on the official website of the Pension Fund. To do this, you will need to register on the State Services website and log in there.

Obtaining certificates involves completing the following steps:

- Visit your Personal Account on the Pension Fund website.

- Go to the Pensions section. Next, select the item “Order a certificate of pension amount.”

- A window will open where all you have to do is click on the “Request” button.

- In the “request history” section, citizens are shown the result of the request.

The result is information regarding the standard amount of pension payments and compensation for the period while the job is maintained. From the same certificates they will learn what compensation will be after dismissal. Contacting the Pension Fund client service also opens access to the document and the information contained in it.

Let us determine how the pension is indexed after the dismissal of a pensioner in 2020. Thus, during work, both the fixed part of the pension and the insurance part stop changing.

Thus, the first of them no longer increases by the amount of recorded inflation in the country, and when calculating the second, changes that have occurred with the value of the pension point are not taken into account. The freeze on pension indexation does not affect anything else.

According to statistics, as of mid-2020, there were 43 million pensioners in Russia, of which almost 10 million continued to work, despite their advanced age. A special feature of a working pensioner’s pension is the lack of annual indexation. This provision was introduced in 2020 as one of the emergency savings measures in the area of the outbreak of the economic crisis.

In 2020, the government even considered the issue of completely canceling pension payments to those pensioners who did not retire upon reaching the age threshold. However, this bill was ultimately rejected for two reasons:

- The number of working citizens would sharply decrease, since many of the 10 million working pensioners would simply stop working. Considering the labor shortage observed in the Russian Federation, an increase in the number of disabled citizens would have adverse economic consequences.

- Such a decision would violate the basic provisions of the Constitution. According to its articles, every Russian who has reached a certain age has the right to receive a pension, regardless of whether he continues to work or has retired.

What determines the size of indexing?

Let us define a list of indicators on which the size of the increase in insurance premiums depends:

- the amount of calculated and transferred insurance premiums on the citizen’s individual personal account;

- the sum of all periods of labor activity for which contributions were made (work experience);

- number of accrued (earned) pension points;

- personal (individual) pension coefficient;

- the total indexation coefficient established by current legislation.

There is no need to visit the branch of the territorial fund to write an application for indexation. But employees of the Pension Fund of the Russian Federation may require additional certificates and information, then the person will have to provide the missing documents.

Interesting on the topic: How to check contributions to the Pension Fund.

How are pensions recalculated for working pensioners after retirement if the employer has not provided the relevant information to the Pension Fund of the Russian Federation?

The employer is obliged to provide monthly information about the insured persons in the SZV-M form. If the employer provides incorrect information about the retired elderly employee in the report, the indexation will not be paid. Pension Fund representatives will recalculate only after providing correct information. The state will not pay compensation for the employer’s mistake. It will be possible to claim the lost amount from the employer through the court.

Let us remind you that if you find a job after the indexation of insurance payments, the pension will not decrease.

Benefits not subject to indexation

According to the law, after dismissal, two parts of the labor pension are indexed - directly fixed and labor, which is determined based on accumulated points. Both parts are reduced to the current values valid for that period of time.

In addition to the labor pension, a citizen can also receive additional bonuses, which are awarded for labor achievements or health status. Usually they are paid from the regional budget. Since they are not part of the labor pension, they are not indexed after dismissal.

Starting from 2020, a government decision established a one-time payment to pensioners, made once a year. In 2019, the amount of this payment is 5 thousand rubles. This amount is due to every pensioner, regardless of his status: in the current year 2020, 221 billion rubles were allocated from the state budget for these purposes. This is the only official pension supplement for working pensioners provided for by current legislation.

Formula for recalculating pension after dismissal: how much will be added

Representatives of the Pension Fund of the Russian Federation use a special formula for recalculating state pensions after the dismissal of working pensioners:

Pension after recalculation = (IPK1 + IPK2) × costIPK + FD,

Where:

- IPK1 is the number of pension points that were accumulated by a person at the time of assignment of a state insurance pension;

- IPK2 - part of the pension points accumulated by the pensioner during the period of work in retirement;

- CostIPK - the cost of one pension point, established on the date of dismissal from the last place of work of a senior citizen;

- PV is a fixed additional payment to the state pension, established at the time of the recalculation of payments.

According to the regulatory regulations establishing the rules for recalculating state pensions, the maximum increase factor is determined:

- coefficient 3 applies to citizens whose pension savings have been stopped;

- a coefficient of 1.875 is applied to people whose pension savings continued to be formed.

Until 2022, when recalculating the state insurance pension, the maximum IPC value of 3.0 is applied in connection with the suspension of the formation of a funded pension at the expense of insurance contributions for compulsory pension insurance (clause 4, article 33.3 of the law of December 15, 2001 No. 167-FZ; Article 6.1 of the Law of December 4, 2013 No. 351-FZ).

Calculation example.

Bukashka Anna Ivanovna received her pension in May 2020. IPC - 100 points. The state pension is 12,663.11 rubles. (RUB 78.58 × 100 points + RUB 4,805.11 (fixed payment)).

In August 2020, widespread indexation of pension income was carried out, the payment amounted to 13,131.65 rubles. (by 3.7%).

In the period 2017-2019, Bukashka continued to work and quit only in February 2020. During this time, another 15 points were accumulated.

The cost of the IPC 2020 is 87.24 rubles.

Fixed additional payment for 2020 - 5334.19 rubles.

In March 2020, the state pension after dismissal will be:

(100 + 15) × 87.24 + 5334.19 = 10,032.60 + 5334.19 = 15,366.79 rubles.

Is it profitable to work for retirees in 2020?

If you decide to quit your job and become an unemployed elderly person, then the indexation procedure will also apply to you. However, it should be noted that the pension will not be increased immediately after dismissal.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The procedure will take 3 months, and only after the expiration of this period of time, it will also be increased.

As of 2020, every fourth Russian continues to work after retirement. There are several reasons for this: the desire to remain in the work team, the fear of loneliness, the desire to bring some benefit to society. But the main reason for the phenomenon of working pensioners, of course, lies in the desire to ensure their financial situation.

To understand whether it is profitable to work after retirement, you can make small calculations. The lack of pension indexation deprives such people of approximately 950 rubles a month, if we take the average pension amount. The minimum wage officially established in the Russian Federation is 11 thousand rubles. The benefits of continuing to work are obvious.

However, constant attempts by the government to somehow “infringe” on the financial independence of employed pensioners, and the circulation of various rumors in the media about the possible complete deprivation of their pensions, create a nervous environment. As a result, the number of working pensioners is decreasing every year. As many experts note, many of them do not retire completely, but continue to work without official employment.

All plans for indexation of pensions for 2020 have already been announced by the authorities - it is known that insurance pensions will increase by 6.6%. But, as always, there are a lot of features that need to be sorted out.

From January 1, 2020, insurance pensions of Russians will be indexed by 6.6%. This is not the largest figure (in 2019 they increased by 7.05%), but it is higher than inflation, which is expected to be below 4%.

As always, indexation of pensions will be carried out by increasing the value of pension points and a fixed payment:

- the cost of 1 individual pension coefficient (that is, point) increases from 87.24 to 93 rubles;

- the amount of the fixed payment increases from 5,334.19 to 5,686.25 rubles.

It is clear that everyone’s pension amount is calculated individually, but the average pension in Russia is now 15.4 thousand rubles, therefore, indexation by 6.6% will add about 1,000 rubles to it.

More on the topic All about retirement in 2020 indexation retirement age increase

Pensions were indexed in approximately the same way from January 1, 2019 - the average pension increased by approximately 1,000 rubles.

That is, calculating what the pension will be in 2020 is simple: you need to multiply its current amount by 1.066.

However, pensions will not be increased by 6.6% for everyone, but only for those pensioners who:

- they receive an insurance pension (that is, not state or social);

- does not work;

- earn more than the living wage.

Social pensions will be increased later, usually increasing from April. Monthly cash payments to federal beneficiaries have been increasing since February, and working pensioners have been receiving more since August (when they get added pension points).

But for those who receive a living wage, everything is more complicated.

Terms of payment of increased pension after dismissal

When fired in 2020, a working elderly Russian can be sure that a recalculated pension will be assigned to him as early as the 1st day of the month following the month in which work was stopped.

For example, Bukashka Anna Ivanovna quit her job on February 27, 2020, therefore, starting March 1, pension income will be indexed.

The increased amount will not be paid immediately in March, but with some delay. Usually the delay is three months. Time is necessary to obtain information from the employer that the person has stopped working. In the third month, representatives of the Pension Fund of the Russian Federation are obliged to compensate for the delayed amounts of the increase and accrue payments in an increased amount. If the expected payments have not been received, you must contact the Pension Fund. There is no point in hiding the situation: if there is no announcement about the problem, then the recount may be missed.

Do I need to resign to index my pension?

There are several tips to make finding the right solutions easier:

- You should make your own decisions about the possibility of dismissal and the correctness of this approach.

- The main thing is to make at least approximate mathematical calculations.

- It must be remembered that there are benefits for working pensioners.

The increase will be more noticeable if the pension itself is significant and indexation has been missed many times. Experts recommend writing applications if you are confident in your ability to live on one allowance without increases. If your health and strength allow it, then you can think about staying.

The answer to this question can be unequivocally that yes – this option is possible. It is important to know here that after a working pensioner quits his job within three or four months from the date of dismissal, the Russian Pension Fund will launch the process of recalculation and indexation of mandatory pension payments. After re-indexation taking into account annual inflation, the pension amount increases.

And if, after indexation, the pensioner is officially employed again, all indexed payments remain with him. That is, this mechanism really works. After quitting your job, you can wait for the pension to be re-indexed and payments to increase and then get a job again, since the recalculation will remain yours.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

It is important to understand that if another re-indexation occurs, then the newly employed pensioner will not fall under it.

Also important information is what we discussed above in the article in a specific example. From the moment the pensioner quits and waits for these 4 months of indexation, the Pension Fund is not responsible and will not compensate for the 3-4 months during which the pensioner was no longer listed as working.

If the pensioner gets a job again

The size of pension income does not always meet expectations. The assigned amounts rarely cover all the necessary expenses of pensioners. As a result, the majority of elderly citizens continue to work after receiving a well-deserved retirement.

Disputes about reducing payments when a pensioner is re-employed do not subside. Let's get to the bottom of this issue.

Let’s say Bukashka Anna Ivanovna applied for a pension in 2020.

But she continued to work, since her pension was not enough to live on. Upon dismissal in 2020, her insurance savings were indexed, and payments were already received in an increased amount. But in 2020, Bukashka got a job again. Consequently, further indexation of Bukashka’s pension will be suspended. You have no right to reduce your payment - it is illegal. In addition, another indexation of payments for working pensioners is planned for August 2020 - thanks to the officials. comments powered by HyperComments

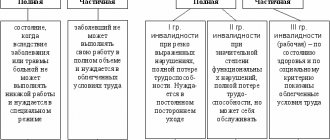

For what types of pensions is indexation prohibited?

The new rules do not apply to the following types of payments:

- Insurance pension.

- Fixed part.

When continuing to work, indexation is not applied to pensioners. They are not affected by the increase in security that occurs annually. The indexation coefficient itself was no exception. All payments of fixed types are subject to increase. Any citizen has the right to compensation with a larger amount as soon as his work activity ceases.

How indexation will be calculated for pensioners who retired in 2019

Senior citizens who continue to work and are wondering whether they will be recalculated should know that if they left work this year, their pensions will definitely be increased. At the same time, among other things, they will be spared the need to personally bother and collect all the necessary certificates.

The thing is that the Pension Fund of Russia introduced a new reporting form in 2020, which has become noticeably simpler. Thus, in accordance with the new requirements, organizations are required to notify the Pension Fund about the dismissal of employees. This, in turn, means that the above-mentioned department will automatically recalculate pensioners; after dismissal from work, the indexation will be calculated in accordance with the regulatory framework of the Russian Federation. The first elderly Russians who refused to work received increased payments at the end of the summer of 2019.

General procedure for indexing insurance pensions

Those with at least 5 years of work experience are paid an insurance or labor pension. The main thing is to take into account the time when the contributions were transferred. The social pension is assigned a minimum amount for those who have no work experience. Therefore, this collateral option is less profitable.

If you have work experience, at least in a minimal amount, it is always recommended to switch from a social pension to a labor pension. You can complete the required time even after reaching the appropriate age limits.

Delivery methods

Payments of social pensions are made monthly, in accordance with the schedule established by the Pension Fund. When filling out pension documents at the Pension Fund office, the citizen indicates which payment delivery method is preferable for him.

https://youtu.be/Vl4XxfmbFrw

It could be:

- Transfer of the required amount to a personal bank account or plastic card.

- Sending by money transfer through the post office. In this case, a person can receive a pension in person at the post office, or it will be brought to his home.

- With the help of a specialized delivery organization.

- Through your official representative. To do this, he must have a notarized power of attorney from the pensioner.

What documents are needed

Basic documents to be provided: passport of a citizen of the Russian Federation, SNILS.

After termination of employment, you must write an application for recalculation to the Pension Fund in person (through a legal representative who has a notarized power of attorney).

Documents are sent to the pension fund branch, the local MFC (multifunctional center), by letter via mail.

Registered users on the official PF website can send through their personal account.

https://youtu.be/zj510nYhSu4

The application shall indicate:

- passport data;

- the reason for the recalculation (in this case, dismissal);

- list of documents.

In addition to the originals, copies of documents will be required; they must be prepared in advance.

In some organizations, the HR department itself collects all documents for indexing pensions so that their employees do not waste their time and send them to the Pension Fund.

The pensioner must personally contact the Pension Fund to switch to another pension scheme. The legislation also allows you to send documents via the Internet, by mail or through a legal representative. The application is accompanied by the transfer of a certain package of documents:

- application for transfer;

- passport;

- power of attorney (if his representative acts on behalf of the pensioner);

- representative's identity card;

- documents justifying the right to receive an old-age insurance pension and confirming length of service;

- other documents that the Pension Fund cannot request on its own.

Documents for transferring to an old-age pension from preferential pensions are accepted subject to notification of acceptance and registration of applications and documents. The period for consideration of the application is only 10 days, during which the Fund makes a decision. At the end of this period (or earlier), the Pension Fund will send the applicant a written decision - to satisfy the request of the applicant, or to refuse to transfer to another pension.

When making a decision, specialists are guided not only by considerations of the law of transition, but also by the economic component of the transition. If the transition from a preferential pension to an old-age insurance pension for any reason turns out to be unprofitable and the amount of maintenance received in hand becomes less, the application will not be satisfied.