Work experience is a mandatory factor for calculating an insurance pension. Therefore, you need to think about its accumulation in advance, without waiting for the moment when you have to submit documents to the Pension Fund. Many citizens are concerned about the question of how sick leave is taken into account in SZV. We will talk about the registration procedure and enrollment of such days in this article.

Reporting

Before moving on to the procedure for accruing and registering sick leave, it is necessary to understand two concepts such as work experience and insurance experience. Many citizens confuse these two terms, which causes a misunderstanding of the calculation of social benefits.

These two periods are reflected in the work book and signify the official labor relationship between the employee and the employer. The difference lies in tax deductions.

Work experience, in turn, can be divided into:

- preferential;

- social;

- special (hot).

During the length of service, the employer makes mandatory payments to the Pension Fund. The amount depends on the specialty category, working conditions, employee qualifications, etc. In this case, the amount of deductions cannot be less than the insurance premium, which is also calculated based on individual parameters.

Special length of service presupposes that the employee performs a special category of work, or his workplace belongs to the category of “increased harmfulness.” The certification of such jobs is carried out by a commission, after which it assigns a category. When assigning STS, physical and social working conditions are taken into account. The category of such workers includes citizens working in the field of education, healthcare, etc.

Such workers can retire early

Such an employee has the right to early retirement. He has the right to express a desire to continue working, while receiving both a salary and a pension. The only difference in the amount of benefits compared to peers will be that the working pensioner will not be given an increase.

A preferential pension is awarded if a citizen performed particularly dangerous work and worked in particularly dangerous, harmful conditions. This formulation includes citizens who work in the north, in mines, in the radiation zone, etc. To assign such status, a workplace must have the appropriate certification.

The issue of determining and calculating length of service is extremely important when assigning pensions, bonuses, benefits and sick leave.

According to the current wording of the legislation, the insurance period should be understood as the entire work activity of a citizen, during which contributions were made to the Pension Fund. That is, SS is a much broader concept, unlike TS. After all, a citizen could make insurance contributions regardless of whether he had official employment at that time. Periods such as maternity leave, military service, and sick leave also fall under the SS formulation.

The beginning of such service is considered from the day of making a contribution to the fund.

What is included in the insurance period

In what life circumstances is such experience taken into account? When calculating pensions, disability benefits, unemployment, loss of a breadwinner, etc.

What does the insurance period include?

To correctly understand the accrual of sick days, you should understand what such length of service includes.

- A mandatory condition for accrual is the deduction of payments to the social fund. It does not matter who made such deductions. A citizen can make voluntary payments.

- If the subject was outside the country, working for a foreign company, but at the same time voluntarily made contributions to the state fund, he will also count this entire period as his length of service.

- The definition of such a period includes the time of military service, caring for a child, or caring for a disabled person. Moreover, if the wife was forced to be at the place of military service with her husband while he was performing his duties, she will also be credited for the entire period of the insurance period.

Even if the subject worked abroad for some time, but did not forget to make deductions, then this period will be counted towards the length of service

- When receiving unemployment benefits, the period of accrual of work experience is also counted. Since the state throughout this period made contributions to the insurance fund.

- If the subject was taken into custody, and later his innocence was proven, then this entire period is also counted towards the length of service. This also applies to those employees who were temporarily suspended from their positions as a result of the initiation of a criminal case. If their non-involvement is proven, the entire period of suspension from work will be counted as length of service.

The procedure for calculating length of service is carried out in accordance with the law. The determining document for the calculation is the work book. When calculating, all marks in this document are taken into account. If, for some reason, no entry was made, but the subject made contributions to the fund, a certificate must be provided.

It is also possible that during a certain period of time a citizen worked in several jobs at once, but the mark in the book was made only for one place. It is enough for the subject to submit a certificate confirming deductions from the SF contributions so that the length of service is doubled for this period.

How does absenteeism affect the insurance period for pensions and benefits?

Source: Glavbukh magazine

The definition of absenteeism is given in subparagraph “a” of paragraph 6 of part 1 of article 81 of the Labor Code of the Russian Federation. This is the absence of an employee from the workplace without good reason:

– throughout the entire working day (shift), regardless of its duration;

– more than four hours in a row during a working day (shift).

Let's figure out what to do with the insurance period for assigning a pension and separately with the insurance period for calculating benefits.

Insurance experience and labor pension

The insurance period for a pension is the total duration of periods of work or other activity of an employee, taken into account when determining the right to a labor pension, during which the employer paid insurance contributions for him to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period (Clause 1, Article 10 Law No. 173-FZ).

The rules for calculating and confirming the insurance period for establishing labor pensions were approved by Decree of the Government of the Russian Federation of July 24, 2002 No. 555.

Other periods included in the insurance period for a pension

Other periods counted towards the insurance period for the purpose of granting a pension are listed in Article 11 of Law No. 173-FZ. These include, in particular, the periods:

– military service (subclause 1, clause 1, article 11 of Law No. 173FZ);

– receiving compulsory social insurance benefits during a period of temporary disability (subclause 2, clause 1, article 11 of Law No. 173-FZ);

– care of one of the parents for each child until he reaches the age of one and a half years, but not more than 4.5 years in total (subparagraph 3, paragraph 1, article 11 of Law No. 173-FZ);

– receiving unemployment benefits (subclause 4, clause 1, article 11 of Law No. 173-FZ), etc.

Absenteeism time does not apply to periods of work and other periods counted towards the insurance period for the purpose of a pension.

There is no basis for calculating insurance premiums

One of the conditions for including a period in the insurance period is the calculation of insurance premiums for payments in favor of the employee accrued to him for this period (clause 1 of Article 10 of Law No. 173-FZ).

The object of taxation of insurance contributions to the Pension Fund of the Russian Federation, in particular, is recognized as payments accrued by the employer in favor of employees within the framework of labor relations (Part 1, Article 7 of Federal Law No. 212-FZ of July 24, 2009, hereinafter referred to as Law No. 212-FZ).

Minimum insurance period for pension

In 2014, an old-age insurance pension is assigned to an employee if he has five years of insurance experience (Clause 2, Article 7 of Law No. 173-FZ). From 2020, the length of the insurance period for the assignment of an old-age insurance pension will depend on the year the employee was assigned a pension (Appendix 3 to the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”).

Length of insurance period required to assign an old-age insurance pension

| Year of assignment of old-age insurance pension | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Required experience, in years | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

Since the employer does not pay wages to the employee for days of absenteeism, insurance contributions to the Pension Fund for these days are not charged.

Confirmation of insurance pension experience

To include a specific period of an employee’s activity in his insurance period for a pension, this period must be confirmed. Confirmation is made on the basis of individual (personalized) accounting information (clause 2 of Article 13 of Law No. 173-FZ).

Periods worked are automatically included in the length of service. Unworked periods are indicated by special codes.

They are established by the Classifier of parameters used in the forms of documents for individual (personalized) accounting in the compulsory pension insurance system, which is given in Appendix No. 1 to the Resolution of the Pension Fund Board of July 31, 2006 No. 192p (hereinafter referred to as the Classifier of Parameters).

Depending on the assigned code, the unworked period is either included in the insurance period, such as, for example, a period of temporary disability (code “VRNETRUD”), or is not included.

Absenteeism time is indicated by the code “NEOPL”. In accordance with the table “Calculable length of service: calculation of length of service: additional information (periods not included in the insurance period)” of the Parameter Classifier, this code is intended for periods that are not taken into account when forming the insurance period for a pension.

If absenteeism was forced

During forced absence, when an employee is reinstated at work by a court decision, he is paid the average salary (Part 2 of Article 394 of the Labor Code of the Russian Federation).

This payment, made within the framework of labor relations as compensation for lost earnings, is subject to insurance contributions on the basis of Part 1 of Article 7 of Law No. 212-FZ.

Article 9 of Law No. 212-FZ does not exempt average earnings during forced absence from insurance premiums.

Since insurance contributions to the Pension Fund are calculated on average earnings during forced absence, this time is included in the insurance period for assigning a pension.

Insurance experience for calculating benefits

The insurance period is taken into account when calculating benefits:

– due to temporary disability;

– pregnancy and childbirth.

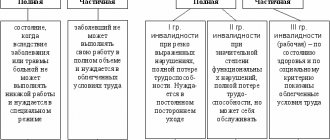

How the amount of benefits depends on the length of insurance coverage

The amount of temporary disability benefits depends on the length of the employee’s insurance period (Part 1, Article 7 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ). This dependence is reflected in the table below.

| Insurance experience of the insured person, years | Up to 5 | From 5 to 8 | From 8 or more |

| Average earnings, % | 60 | 80 | 100 |

If the insurance period is less than six months, temporary disability and maternity benefits are paid in an amount not exceeding the minimum wage for a full calendar month (Part 6, Article 7, Part 3, Article 11 of Law No. 255-FZ).

If the employee’s insurance period is more than six months, maternity benefits are assigned in the amount of 100% of average earnings (Part 1, Article 11 of Law No. 255-FZ).

The procedure for determining the insurance period for the assignment of benefits

Regulatory acts. The procedure for calculating the insurance period to determine the amount of benefits for temporary disability and pregnancy and childbirth is established:

– in Article 16 of Law No. 255-FZ;

– Rules approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91 (hereinafter referred to as the Rules for calculating the insurance period).

On what date. The insurance period is determined on the day of the onset of temporary disability (clause 7 of the Rules for calculating the insurance period).

The insurance period includes periods of work of the insured person (Part 1, Article 16 of Law No. 255-FZ and Clause 2 of the Rules for calculating the insurance period):

– under an employment contract;

– in the state civil or municipal service;

– other activities during which the citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

How to confirm. The main document confirming the periods of work under an employment contract and state civil or municipal service is a work book of the established form (paragraph 1, clause 8 of the Rules for calculating the insurance period).

Entries in the work book taken into account when calculating the insurance period must be drawn up in accordance with the labor legislation in force on the day they were entered into the work book (clause 24 of the Rules for calculating the insurance period).

Time of absenteeism when calculating the insurance period

Absenteeism does not reduce the period of insurance coverage for calculating benefits. This is explained as follows.

Work records do not reflect absenteeism (neither the fact of absenteeism itself, nor its duration). This is not provided:

– nor the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225;

Source: https://otchetonline.ru/art/buh/45857-kak-vliyaet-progul-na-strahovoy-stazh-dlya-pensii-i-posobiy.html

How to fill out the SZV form correctly

The SZV-experience form is a mandatory document for calculating the SS.

SZV-experience form

Therefore, it is important to correctly reflect the number of sick days in this document so that they are counted when determining the entire period.

This report was introduced by law in 2020, replacing the RSV-1 form.

Form RSV-1

The new form is mandatory for all persons who are registered with the company and for whom the policyholder makes contributions.

Documents regulating the procedure for filling out and calculating:

- Federal Law No. 27 dated April 1, 1996.

Federal Law on individual personalized accounting in the compulsory pension insurance system

- And PF Resolution No. 3 of 01/11/2017

Resolution of January 11, 2020

Filling out SZV-STAZH: dealing with complex issues

Alexey Krainev, March 5 March 5, 2020 Until March 1, accountants report to the Pension Fund of the Russian Federation using the SZV-STAZH form, presenting information for each employee.

Each of the ballots presented by the employee must be filled out. Many of the indicators in it will be identical. Only the dates for “Benefits due for the period” and the values of the lines “” and “” will differ. After all, you must calculate the benefit specifically for those days of illness that are indicated on the sick leave.

Although the form itself is not complicated at first glance, many questions arise when filling it out. The situation is further aggravated by the extremely unfortunate wording that is given in the officially approved instructions for filling out the SZV-STAZH.

When should the form include information about the director - the sole founder? What about retired workers?

How to fill out section 3 SZV-STAZH and column 11 of this section?

Let's figure it out. Difficulties in filling out a report arise already at the stage of deciding who should submit it and where.

Deadlines and form for submitting reports

According to the Pension Fund resolution of January 11, 2020, reporting must be submitted before March 1 for the previous calendar year.

This sheet reflects the number of days of incapacity for work for which the employer paid contributions to the fund.

Field 6 displays information about the start date of sick leave.

In field 7 – the end date of the sick leave.

In column 11 you must put Fr.

The document must contain information about all employees for whom the company makes insurance premiums and who took sick leave during the reporting period

Such persons include all citizens who work part-time, have legal and employment contracts, service contracts, contracts, etc. For all these categories of persons, the employer makes contributions to the Pension Fund.

The reporting form depends on the number of employees in the enterprise.

If the company has less than 25 registered employees, the accountant can submit the form in paper or electronic form.

If the company’s staff exceeds 25 units, then the submission form is electronic.

Frequently asked questions about SZV-STAZH

Question. Is it necessary to take SZV-M if the organization has no employees and no accruals?

Answer. According to the law, the SZV-STAZH report must be submitted if the organization or individual entrepreneur has employees who work under contract terms. This is stated in paragraph 2.2 of Article 11 of Federal Law No. 27-FZ of 04/01/1996. However, there are situations when there are no employees and no accruals; what to do in each case is clear from the table.

| Situation | To pass or not to pass |

| Employees on vacation | If the contract with employees was valid for at least 1 day, then you need to submit a report |

| No employees, no director | In this case, you do not need to take SZV-STAZH |

| No employees, but there is a director | In this case, you will have to submit the SZV-STAZH report to the Pension Fund of the Russian Federation, since the director works on the basis of an employment contract |

| There are employees, no accruals | The report includes all employees with whom there are valid contracts, so in this case it is necessary to submit a report. This is particularly stated in the PFR letter No. LCH-08-19/10581 dated July 27, 2016 |

Form type

Table 1. Four types of SZV-experience form

| Form type | Submission rules |

| Original | The document is submitted to the Pension Fund before the end of the reporting year. The certificate reflects all persons insured at the enterprise. |

| Complementary or complementary | If there were errors in the previously submitted certificate regarding any person. |

| Assignment of pension | This document reflects information about those persons who are retiring. The certificate must reflect information about the periods that must be taken into account when calculating the length of service. |

Depending on the type of document, you must check the appropriate box.

In the document put about

All documents are submitted to the Pension Fund in a single batch, without division into categories. If reporting is submitted electronically, a single file is created in which all persons are reflected.

If reporting is submitted in paper form, the package of documents must contain:

- form EDV-1;

- all other sheets of the form sv.

When submitting electronically, one file must contain information about the insured persons and the EFA-1 block.

Form EDV-1

The file must be certified with an enhanced electronic seal.

The EFA form is not a stand-alone report, but a supplementary appendix that reflects information about the enterprise.

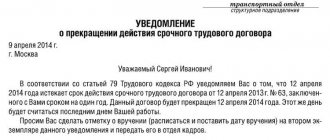

If an employee resigns during the current period, but his dismissal is not related to retirement, then the SZV form must be submitted along with all documents before March 1 of the following year.

If an accountant has submitted incorrect data, he can submit another report with the supplementary type.

How to correct errors in sv-stazh

About business

From January 1, 2020, organizations and individual employers submit two types of reporting to the Pension Fund: information about the insured persons and information about the insurance experience of the insured person. And if the “length of service” report is submitted once a year, that is, for the first time it will be necessary to report on the length of service of employees only in 2020 (no later than March 1), then information about the insured persons, as before, must be submitted to the Pension Fund on a monthly basis.

Deadline - no later than the 15th day of the month following the reporting period (month). Moreover, if the last day of the period falls on a weekend or a non-working holiday, then the end of the period is considered to be the next working day following it.

This was confirmed by the Pension Fund of Russia in a letter dated December 28, 2020 No. 08-19/19045 (see also Information from the Pension Fund of the Russian Federation dated January 26, 2020).

Thus, the last dates for submitting information on the SZV-M form in 2020 are February 15, March 15, April 17,

How to correctly reflect sick leave

The SZV-experience form reflects data on all insured persons for whom the organization paid contributions in the reporting period.

In column 5 the SNILS number must be entered.

In columns 6 and 7, periods of employment are written out. In this case, each period category is designated separately.

When registering sick leave, in column 11 you must indicate the code “VRNETRUD”. The period of temporary incapacity for work is entered exactly from the sick leave.

If this employee is registered as a part-time employee and the calculation of benefits will be made by another employer, then the period of incapacity for work must also be reflected in the form, but in column 11 it is necessary to enter a different code “NEOPL”.

NEOPL SZV-STAZH

Sick leave in SZV-STAZH

From January 1, 2020, employers submit information about employees’ insurance experience using a new form. Read how to now indicate sick leave in SZV-STAZH for an ordinary employee, part-time worker and maternity leave. In the SZV-STAZH report, employers show the periods of work of employees that are included in the insurance period. The time when the employee was sick and received disability benefits is also included in the insurance period.

This is stated in paragraph 2, part 1, article 12 of the law dated December 28, 2013 No. 400-FZ. download download The periods when the employee received sickness benefits are reflected in section 3 “Information on the periods of work of insured persons.” Fill out the report in the same way as for other employees.

To reflect a paid ballot, fill out three columns: Column What to indicate 6 Date of onset of illness 7 Date of end of illness 11 “VRNETRUD” The special code “VRNETRUD” indicates the days of temporary disability for which the employee received benefits. This procedure was established by Resolution of the Board of the Pension Fund of December 6, 2018 N 507p.

For internal part-time workers, sick leave is reflected in the report in the same way as for ordinary employees. Internal part-time work does not entail any special features of using the “VRNETRUD” cipher. The situation is different with external part-time workers.

On days of illness, the part-time worker was absent from work and did not perform work duties. This period cannot be designated as a working period. The procedure for filling out the report depends on who pays for the external part-time ballot.

The legislation lists cases when an external part-time worker receives benefits from only one employer.

And the circumstances in which both employers pay for the ballot. Hence there are two options for presenting the disease in the report:

- The code “NEOPL” indicates unpaid periods and is reflected in column 11.

- If the employer paid temporary disability benefits, the accountant indicates the code “VRNETRUD”,

- If the employer did not pay benefits to an external part-time worker, then the sick time is reflected in the information with the code “NEOPL”.

In some circumstances, an employer is not required to pay temporary disability benefits. Periods of absence from work are highlighted separately in the information.

The code "VRNETRUD" will not work here. Indicate an unpaid ballot with the code “NEOPL”, this indicates an unpaid period of work. In section 3, columns 6,7 and 11, fill out as follows: Column What to indicate 6 Start date of incapacity for work 7 End date of incapacity for work 11 “NEOPL” To indicate maternity leave, a special code “CHILDREN” is used.

It is indicated if disease code 05 “Maternity leave” is indicated on the certificate of incapacity for work. Maternity leave in information about the length of service is reflected in three columns: Column What to indicate 6 Start date of maternity leave 7 End date of maternity leave 11 “CHILDREN” The maternity bulletin is sometimes extended. Check what cause of illness is indicated in the continuation of the certificate of incapacity for work.

How to correctly fill out the period of work at SZV-STAZH if there was a holiday during the vacation?

Answered by Liliya Gabsalamova, expert on labor and employment. There are no official explanations from the fund regarding your situation. Non-working holidays falling during the vacation period are not included in the number of its calendar days (Part.

1 tbsp. 120 Labor Code of the Russian Federation). Accordingly, in the SZV-STAZH form, the vacation period must be indicated in three lines: from 06/01/2017 to 06/11/2017 DLOTPUSK from 06/12/2017 to 06/12/2017 from 06/13/2017 to 06/29/2017 DLOTPUSK For additional clarification, the accountant has the right to contact the territorial office of the Pension Fund of the Russian Federation. Justification From the recommendation of Olga Prygova, deputy manager of the Pension Fund branch for the city.

Moscow and the Moscow region How to draw up and submit SZV-STAZH Section 3 Section 3 reflects information about the periods of work of the insured person. In column 1, indicate the serial number of the entry in ascending order without omissions or repetitions.

Assign a number for each employee. If data on periods of work is reflected in several lines, assign a serial number only to the first record. In columns 2–4, indicate the employee’s last name, first name and patronymic in the nominative case.

The columns “Last name” and “First name” are required.

Do not fill out the “Middle name” column if there is no middle name on your passport (for example, for foreign employees). In column 5, enter the insurance number of the individual personal account of the insured person (SNILS).

If the employee does not have SNILS, issue it - either, or send the employee to receive documents. In columns 6 and 7 “Work period”, indicate the dates when the employee started and finished working, in the format: DD.MM.YYYY. Indicate the dates within the period for which you are submitting the report. For example, if an employee has been working in an organization since November 2020, in the report for 2020, in the “Work period” column, indicate “from January 1, 2017 to December 31, 2017.”

Also include full-time and part-time employees in the report. Take data on periods of work from time sheets and GPA agreements.

For forms with the “Pension assignment” type, fill out the “Period of work” column up to the date of expected retirement. If you need to reflect several periods of work for an employee, then indicate each period on a separate line*.

In this case, there is no need to fill out the columns “Last name”, “First name”, “Patronymic name”, “SNILS” again.

If the employee works part-time

If a person works part-time at an enterprise, he is still required to provide sick leave, but the insurance period will only be accrued once.

The insurance period is calculated 1 time

How to figure out which employer should submit such reports and make accruals?

This question gives rise to many interpretations and misconceptions among accountants. At the same time, there is a fairly simple calculation scheme and reporting procedure.

It is important to simply understand which of the three scenarios the case should be classified into.

- The employee held a full-time position with this company for the past 24 months and then moved to another position while remaining part-time. In this case, the responsibility for payment falls on that employer. It is important to understand that in case of part-time work and in case of temporary disability, it is necessary to issue exactly as many original sick leave forms as the employer. Here we are talking only about official employment. Each form must be issued to each employer separately, indicating the name, code, etc.

Registration of sick leave

- The employee worked for 2 years before the sick leave in another company. Here the employee can choose which company he wants to apply for the benefits. The company's accountant must take into account the average salary deductions when calculating. In this case, only one sheet is drawn up and submitted to the current employer, who will also pay the benefit. In addition to this, it is necessary to obtain from the accounting department of another enterprise a certificate of income for the last 2 years, on the basis of which the benefit will be calculated. It is also necessary to obtain a certificate from the external employer stating that the accounting department did not pay sick leave, so that double accrual of benefits does not occur.

- The employee combined work for two (or more) employers for 2 years. He can apply for sick leave at any enterprise, choosing the most favorable conditions for himself. In this case, the sheet can be provided only to the company where the payment will be made.

All these nuances entail different design of sheets, and accordingly, the submission of documentation will be different.

Sick leave in SZV: how to register correctly?

Work experience is a mandatory factor for calculating an insurance pension.

Therefore, you need to think about its accumulation in advance, without waiting for the moment when you have to submit documents to the Pension Fund.

Many citizens are concerned about the question of how sick leave is taken into account in SZV. We will talk about the registration procedure and enrollment of such days in this article.

Reporting Before moving on to the procedure for accruing and processing sick leave, it is necessary to understand two concepts such as work and insurance experience. Many citizens confuse these two terms, which causes a misunderstanding of the calculation of social benefits. These two periods are reflected in the work book and signify the official labor relationship between the employee and the employer.

The difference lies in tax deductions.

Work experience, in turn, can be divided into:

- special (hot).

- preferential;

- social;

During the length of service, the employer makes mandatory payments to the Pension Fund.

The amount depends on the specialty category, working conditions, employee qualifications, etc. In this case, the amount of deductions cannot be less than the insurance premium, which is also calculated based on individual parameters. Special length of service presupposes that the employee performs a special category of work, or his workplace belongs to the category of “increased harmfulness.”

The certification of such jobs is carried out by a commission, after which it assigns a category. When assigning STS, physical and social working conditions are taken into account.

The category of such workers includes citizens working in the field of education, healthcare, etc.

Such employees can retire early. Such employees have the right to early retirement.

He has the right to express a desire to continue working, while receiving both a salary and a pension. The only difference in the amount of benefits compared to peers will be that the working pensioner will not be given an increase. A preferential pension is awarded if a citizen performed particularly dangerous work and worked in particularly dangerous, harmful conditions.

This formulation includes citizens who work in the north, in mines, in the radiation zone, etc. To assign such status, a workplace must have the appropriate certification.

The issue of determining and calculating length of service is extremely important when assigning pensions, bonuses, benefits and sick leave. According to the current wording of the legislation, the insurance period should be understood as the entire work activity of a citizen, during which contributions were made to the Pension Fund. That is, SS is a much broader concept, unlike TS.

After all, a citizen could make insurance contributions regardless of whether he had official employment at that time. Periods such as maternity leave, military service, and sick leave also fall under the SS formulation.

What are the consequences of filling out the form incorrectly?

For late completion of the document or its delivery, a fine is imposed on the employer. However, a third party cannot pay this amount.

The fine is 500 rubles. Assigned for each person who was not reflected in the general reporting, or the certificate was not submitted within the specified period.

Accountants often mistakenly believe that in case of late submission of documents, a fine can be paid. However, the amount must be paid exclusively by the policyholder, that is, a legal entity that has entered into an employment contract with the subject and makes monthly contributions to the social fund.

Also find out how to indicate sick leave on your report card?

The fact is that tax legislation does not regulate the procedure for paying such fines.

The employer is obliged to correctly reflect the employee’s time on sick leave in a special statement and timely submit the document for insurance contributions.