For working citizens, the law provides for the receipt of sick leave in the event of their temporary incapacity for work. It is documentary evidence of the employee’s absence from the workplace for a valid reason. And besides this, these days must be paid to him in a certain amount in accordance with the Labor Code.

Regulation by law, definition of issuance and sick leave codes are described in detail in this article.

Russian legislation

A sick leave certificate is a very important document, because if it is available, the employer is obliged to pay part of the employee’s wages, despite the fact that the latter was absent from the workplace. Some dishonest citizens used to try to falsify this document so that they could avoid going to work and still get money for it.

The procedure for issuing sick leave in accordance with the Labor Code of the Russian Federation

In this regard, the procedure for issuing and extending sick leave is strictly regulated by Russian legislation. This procedure applies to the following categories of citizens:

- the employee who requires the issuance of the sheet;

- his employer;

- medical officer;

- tax authorities.

Thus, the employee must follow the established procedure for contacting medical institutions in the event of his incapacity for work or the occurrence of circumstances when he is forced to help a sick person.

The employer is obliged to pay wages to such an employee in accordance with the Labor Code, to reserve his position and place after the employee returns to work. And also, together with the tax authorities, the correct taxation of the employee’s income must be carried out.

The main legal acts governing the procedure for issuing and extending sheets are the following documents:

- order of the Ministry of Health “On approval of the procedure for issuing certificates of incapacity for work”;

- Law “On the fundamentals of protecting the health of citizens in the Russian Federation”;

- Labor Code;

- resolution “On approval of the Regulations on the specifics of the procedure for calculating benefits for temporary disability during pregnancy and childbirth”;

- Tax code.

These regulations establish a general procedure that all participants in these legal relations must adhere to.

What is sick leave

A sick leave certificate is the main document confirming a valid reason for missing work due to one’s inability to work or providing assistance to a disabled person.

Sick leave is issued by medical institutions. To receive it, a disabled citizen must contact them on the first day of missing work or feeling unwell.

On the first day of application, a sick leave certificate is issued. It can then be extended depending on the patient’s health condition. After the doctor determines that the person is healthy and can continue to perform his work duties, his sick leave will be closed. It will also indicate the possible date of return to work.

In order to avoid forgery of this document, it is filled out on a special form according to the established template. The form has several security elements:

- barcode;

- unique number;

- water marks.

All this excludes counterfeiting. Such a document can be easily checked against a common database.

Strict reporting for each sick leave has also been introduced for doctors. This makes it much more difficult to issue false sick leave. Distributes the required number of FSS forms. Distribution occurs only between medical institutions that have the appropriate license, as well as certified specialists.

Decor

Sick leave is issued according to the Labor Code of the Russian Federation in the manner specified by the relevant instructions.

The document is issued:

- attending physicians of the LPF;

- healthcare workers in private practice;

- health workers with secondary education (at the initiative of local health authorities);

- attending physicians at anti-tuberculosis sanatoriums, prosthetics research institutes.

To register a document, the Ministry of Health and Social Development of the Russian Federation has approved a specially designed form.

According to the Labor Code of the Russian Federation, sick leave can be issued only in licensed medical institutions, public or private . A certificate of incapacity for work issued abroad is replaced upon return to the health care facility with approval by the local administration.

To whom is it issued?

The main direction for issuing sick leave is for an ill employee. He may lose his ability to work due to illness or injury. However, in addition to this, the legislation provides for other circumstances in which an employee must also be issued a sick leave certificate:

- when forced to care for your child or relative;

- forced completion of a treatment course in a sanatorium or resort after a course of inpatient treatment;

- during pregnancy and childbirth;

- for dental prosthetics;

- during the examination and testing.

All these situations are grounds for opening a sick leave certificate for an employee. And every citizen should know in what situations he has the right to receive sick leave and go to medical institutions if necessary.

Dismissal during incapacity

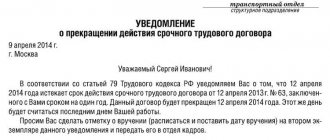

According to the Labor Code of the Russian Federation, a manager does not have the right to dismiss an employee working on an indefinite basis during sick leave on his own initiative, with the exception of the fact of liquidation of the enterprise. If the contract is for a limited period, expiring at the stage of illness, the citizen’s dismissal is possible. The procedures necessary for this can be carried out in his absence, the due payments are transferred to the card, the documentation is sent by mail.

Dismissal at the stage of sick leave at the request of the employee or by agreement of both parties is possible.

https://youtu.be/-hw7nfQGeeE

Validity period of the certificate of incapacity for work

The length of the time period for which sick leave is issued depends on several factors:

- on the health status of a temporarily disabled citizen, if he opens a sick leave sheet for himself;

- from the period established by law for which sick leave can be opened for a sick child or relative;

- on the duration of the examination and testing;

- from the requirements established by the legislation of the Russian Federation when issuing sick leave to a pregnant woman in connection with the upcoming birth;

- from the periods established by law for which a certain doctor can issue sick leave.

Sick leave codes

If the sick leave is extended several times, and the deadlines that are within the powers of the medical employee to extend this document expire, then a medical commission is appointed.

It consists of several doctors. They examine the patient and analyze his examinations. Based on this, the commission can extend sick leave several times.

The maximum possible period of sick leave is within a year. If during this time the employee has not recovered and there is no favorable prognosis for restoring his ability to work, then a sociological medical examination is convened to assign the employee a disability.

Taking sick leave due to illness

In this case, sick leave can be opened on the first day of the employee’s call and extended if necessary. On the last day of incapacity for work, the employee must present this sheet to close it. The maximum terms for self-extension of sick leave are established by the legislation of the Russian Federation. And they depend on the doctor’s specialization.

This article will tell you what is included in free medical care under the compulsory medical insurance policy.

The following main deadlines have been established:

- The therapist has the right to extend the sheet for up to 30 days.

- Various specialists from medical organizations, employees of specialized scientific institutes, including those who work in the field of prosthetics, can extend sick leave up to 15 days.

- A paramedic and a dentist can open sick leave for a maximum of 10 days.

Assignment of disability. IPR – individual rehabilitation program

Read about what dental services are included in the free compulsory medical insurance policy.

After completion of these periods, the employee who opened the sick leave has the right to convene a medical commission to extend the sick leave. Extension of sick leave beyond the listed periods by a physician alone is considered unlawful.

There is no minimum threshold for sick leave. That is, this document can be opened for 1 business day.

Failure to attend the doctor on time on the specified day is regarded as a violation of the hospital regime. A corresponding note about this is made on the sick leave certificate. This will be the basis for reduced sick pay.

In addition to the deadlines established for the doctors themselves, there are established deadlines for the commission, on the basis of which doctors must make a decision on the possibility of extending sick leave. There are 3 main periods:

- Up to 4 months, if there is an unfavorable prognosis for the restoration of a person’s working capacity, regardless of his injury or illness. After this period has expired, a medical examination must be ordered to determine disability.

- Up to 10 months, if there is a favorable prognosis for the person’s return to work.

- Up to 12 months, if there is a favorable prognosis, for a person to fully return to work. This period is used for the most serious injuries, during reconstructive operations, as well as tuberculosis.

Within these deadlines, an employee can receive sick leave and be absent from his workplace.

For child care

In cases where an employee’s child falls ill, he also has the right to take sick leave in order to assist in his treatment. The period for which sick leave will be open depends on the age of the child:

- Up to 7 years of age, the document is issued for the full duration of the child’s illness.

- If the child is under 15 years of age, the sick leave period will be up to 15 days.

- If the child is disabled and his age is under 15 years, then sick leave will be issued for the full duration of the illness.

- For parents of teenagers over 15 years of age, sick leave can be issued for up to 3 days. After this, if necessary, the period of sick leave can be extended by the medical commission.

- If a child over 15 years of age is hospitalized for serious treatment, a sick leave certificate can be issued to the parent for the entire duration of the illness.

- For parents of children of any age until adulthood, whose illness is caused by radiation exposure, sick leave is issued for the full duration of the illness.

Any close relative of the child, not just the parents, can apply for this certificate of incapacity for work.

Caring for an incapacitated adult

In the event of a serious illness or injury of an adult relative and the need to care for him, the employee has the right to take leave in accordance with the Labor Code for 3 working days.

After this, it can be extended with the help of a medical commission for up to 7 working days.

The main requirement for such a case is that the temporary disability should not be caused by an exacerbation of a chronic illness.

For pregnancy and childbirth

In this case, the legislation strictly establishes the time limits within which the sick leave is valid. It opens in normal situations at 30 weeks of pregnancy. The total period of sick leave is 70 days before childbirth and 70 days after, respectively, 140 days in total.

Sick leave may be opened earlier in the following cases:

- multiple pregnancy (at 27 weeks);

- under unfavorable working conditions and place of residence (at 25 weeks).

The period of sick leave may be increased in the following cases:

- during complicated childbirth (up to 156 days);

- when several children are born at the same time (up to 196 days).

Also, a sick leave certificate can be issued in case of early pregnancy termination and late pregnancy termination.

Calculation and payment of leave for temporary disability - provisions on remuneration under the Federal Law

The period of temporary disability must be paid to the employee based on his average monthly earnings. Payment must be made for each day of sick leave.

How to correctly fill out a sick leave certificate for an employer in 2017?

If the duration of sick leave is no more than 3 working days, then payment for days of temporary incapacity for work is at the expense of the employer. The rest of the sick leave, over 3 days, is compensated to the employee from funds from the Social Insurance Fund budget.

When a sick leave note states that during a period of temporary incapacity an employee violated sick leave, payment for sick leave is based not on the employee’s salary, but on the minimum wage. This amount is established annually by Russian legislation.

How is paid by law depending on length of service?

Also, when calculating sick leave pay, the employee’s length of service is taken into account, depending on which he is awarded a certain percentage of his earnings. How they are paid depending on length of service according to the Federal Law:

- up to 6 months - paid from the minimum wage;

- from 6 months to 5 years – 60% of the employee’s average monthly salary;

- from 5 to 8 years – 80%;

- over 8 years – 100%.

If the length of service is only 6 months, then the calculation will be based on the minimum wage in the region. Having a maximum required length of service of more than 8 years, an employee must receive sick leave pay in the amount of 100 percent of his salary. But the law sets a limit for the current year of 72,290.4 rubles. Payments above this limit will not be made.

Benefit calculation

Sick leave benefits are calculated as a percentage of earnings.

- 100% of earnings - in case of occupational disease, occupational injury, its aggravation, with at least 8 years of experience;

- 80% - with 5-8 years of experience;

- 60% - with less than 5 years of experience.

The insurance period is calculated according to the order of the Ministry of Health and Social Development No. 91. It is confirmed by a work book.

Higher sick leave benefits under the Labor Code of the Russian Federation are established for:

- disabled war veterans;

- participants in the liquidation work after the accident at the site of the Chernobyl nuclear power plant, located in the zones of resettlement of minor citizens from this zone and supervising them;

- persons who received a certain dose of radiation in the conditions of the Semipalatinsk test site;

- donors who donated two norms, the maximum permissible, of blood per year;

- persons interacting with chemical weapons;

- workers in areas located in the Far North.

If the length of service does not exceed 6 months, the amount of payments is not higher than the minimum wage, taking into account the coefficients.

The following persons are not provided with sick leave benefits:

- suspended from work for this period (in the absence of salary);

- persons released from work (with or without pay);

- those who caused intentional damage to their own health (by court decision);

- persons under arrest.

According to the Labor Code of the Russian Federation, payment is made through the accounting department.

Taxation according to the Labor Code of the Russian Federation

All income of citizens is subject to taxation at the rate of 13 percent. Sick leave payments are no exception and are taxed in the same way.

But if the amount due for sick leave exceeds the established limit, it can be paid to the employee in full, and the remaining amount of 13 percent must be transferred to the tax authorities.

The only sick leave document that is not subject to income tax is a document for pregnancy and childbirth.

An example of calculating sick leave according to the minimum wage

The minimum wage is approved by the legislation of the Russian Federation, taking into account territorial coefficients and is taken into account when regulating wages, determining the amount of benefits and other social purposes (tax calculations, for example).

The minimum wage value is used when calculating benefits:

- if the employee has not yet received a salary;

- if the average earnings are below the minimum wage.

Sick leave is calculated using the formula: Minimum wage ×24:730.

This is how the average daily earnings for 1 day are determined. 24 is the number of months in 2 years, 730 is the number of days, respectively.

From July 2020, the minimum wage is 7,800 rubles.

7800×24:730 =256.44 rubles – average earnings.

When working on a part-time basis, payment is determined based on the time worked. Example: during the previous two years, a citizen worked part-time. The average salary was less than the minimum wage. The benefit calculation will look like this:

7800×24:730×0.5=128.22 rub.

conclusions

Based on the cases provided for by law, an employee has the right to issue a sick leave and not come to work not only because of his own disability, but also because of his child or close relative.

This document also has certain time limits. The maximum period for which this sheet will be open is 12 months. There is no minimum threshold set, so it can be as low as 1 day.

Sick leave is paid in a certain ratio to the employee’s average monthly salary, and the amount of payment depends directly on the employee’s total length of service.

All income received on sick leave is subject to taxation, except for those related to the woman’s pregnancy and childbirth.

Read about compulsory health insurance, as well as compulsory medical insurance contribution obligations.

Example of calculating sick leave based on salary

It is important to correctly determine the calculated period of sick leave. Salary for the previous 24 months is taken into account. This is 730 days for calculations in 2017. First, one-day earnings are calculated. Why should the total amount earned be divided by 730?

The structure of earnings considers all types and categories of payments. The maximum monetary amount for calculating benefits was adopted in 2017 in the amount of 755,000 rubles. (in 2020 – 670,000, in 2020 – 718,000). The total amount of money earned over the past two years for calculating benefits cannot be higher than the sum of the two corresponding figures.

Example. Citizen Antonov was temporarily disabled due to ARVI from January 14 to January 23, 2020. Before that, he worked in the organization for 6 years. To calculate average earnings, we take into account the periods of the two previous years: 2020, 2020. In 2020, he earned 360,000 rubles, and in 2016 – 480,000 rubles. The total income for two years is 840,000 rubles.

The maximum base value for the two previous years in rubles: 670,000 + 718,000 = 1,388,000 . Antonov’s total income does not exceed this amount. Therefore, it is used in calculations. This includes all payments for which insurance premiums were transferred. His experience is 6 years, included in the period from 5 to 8 years. Therefore, the benefit must be calculated with a coefficient of 0.8 (or 80%).

So, the benefit must be paid in 10 days.

Average daily earnings: 840,000:730=1150.68 rubles.

The amount of the benefit due for a period of 10 days, taking into account the coefficient of 0.8, is as follows:

1150,68×0,8×10=9205.48 RUR.