The company provides the employee with a social deduction

The employee received a notice of social deduction from the inspectorate. The employee brought the application for deduction and notification to the company in the second quarter.

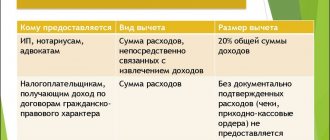

Starting from 2020, employees have the right to receive a deduction for medical treatment from their employer. To do this, the “physicist” applies to the inspectorate with an application according to the form from the letter of the Federal Tax Service of Russia dated December 7, 2015 No. ZN-4-11 / [email protected] The employee attaches to it a contract for treatment, receipts and other documents confirming expenses.

The inspectorate issues a notification within 30 calendar days from the moment the “physicist” submitted the application (approved by order of the Federal Tax Service of Russia dated October 27, 2015 No. ММВ-7/11/ [email protected] ). The employee brings the notice to the company and attaches it to the application in free form. The employer provides a deduction from the month in which the employee brought these documents (paragraph 3, paragraph 2, article 219 of the Tax Code of the Russian Federation).

The company takes into account deductions when calculating the tax base. In line 030 of the 6-NDFL calculation, reflect only those deductions that have already been provided to the employee during the reporting period. On line 130, report income without deductions. And in lines 070 and 140 the company will reflect the actual personal income tax withheld, that is, calculated from income minus deductions.

She filled out Section 1 of the half-year calculation as in sample 68.

https://youtu.be/aC2tKzbc2mQ

We fill out 6-NDFL when returning tax to an employee

There is no need to submit an update for previous periods.

If in the second quarter of 2020, for example in May, an employee brought you an application for a property deduction and a notice issued by the Federal Tax Service confirming the right to a deduction, this deduction must be provided to him from the beginning of the year (and not from the month of filing the documents, as was previously the case) ). Now the tax authorities and the Ministry of Finance are finally unanimous in this Letter from the Ministry of Finance dated 03/16/2017 No. 03-04-06/15201, dated 01/20/2017 No. 03-04-06/2416; Federal Tax Service dated November 3, 2015 No. SA-4-7/ [email protected] . That is, you need to recalculate personal income tax from January to April, taking into account the deduction, and return the excess withheld amount to the employee. And as of May, there is no longer any need to withhold tax from income.

But despite the fact that the tax must be recalculated from the beginning of the year, the updated calculation of 6-NDFL for the first quarter of 2020, as explained by the Federal Tax Service, does not need to be submitted to the inspectorate. All operations should be reflected in the half-year calculation. Letter of the Federal Tax Service dated April 12, 2017 No. BS-4-11/6925.

Nuances of filling out the calculation when deductions are greater than income

Previously, the tax service explained how to fill out section 2 of the 6-NDFL calculation if an employee has the amount of deductions provided for the month (for the purchase of housing, for treatment/education, for children, sub-clause 4, clause 1, article 218, sub-clause 2, 3, paragraph 1, paragraph 2, Article 219, paragraphs 3, 8, Article 220 of the Tax Code of the Russian Federation) turned out to be more income. The employer must fill out the data for this particular employee in section 2 of the calculation as follows Letters from the Federal Tax Service dated 08/05/2016 No. GD-4-11/ [email protected] , dated 06/20/2016 No. BS-4-11/ [email protected] :

• on line 100 - indicate the date of receipt of income, for example, for a salary it is always the last day of the month for which it was accrued and clause 2 of Art. 223 Tax Code of the Russian Federation; Letter of the Federal Tax Service dated May 16, 2016 No. BS-3-11/ [email protected] ;

• on lines 110 (date of withholding) and 120 (deadline for transferring personal income tax) - enter zeros (00.00.0000), since on the date of payment of income to the employee, personal income tax was not withheld from his salary due to the fact that the tax base is zero, paragraph 3 Art. 210 Tax Code of the Russian Federation. And therefore there is no deadline for transferring taxes to the budget;

• on line 130 - indicate the entire amount of income received; it does not need to be reduced by the deductions provided;

• on line 140 - put 0, since personal income tax was not withheld, and income was paid in full.

But if there are several employees, then it is clear that in section 2 in the block of lines 100-140 for salaries there will be no zero dates on lines 110 and 120, as well as a zero tax amount on line 140. After all, personal income tax is withheld from the income of other employees. So these lines will contain data for other employees.

Filling out the 6-NDFL calculation in accordance with the control ratios and clarifications of the Federal Tax Service will allow you to avoid fines for inaccurate information in the calculation. 3 p. 1 art. 111, paragraph 1, art. 126.1 Tax Code of the Russian Federation; Resolution of the Presidium of the Supreme Arbitration Court of November 30, 2010 No. VAS-4350/10.

And now the Federal Tax Service has given in its Letter the procedure for filling out Section 1 of the calculation when returning a tax to an employee in connection with the provision of a property deduction to him and Letter of the Federal Tax Service dated April 12, 2017 No. BS-4-11/6925:

• the amount of the deduction must be shown on line 030. The deduction will appear in this line in the period in which the employee brought the documents for the deduction (application and notification);

The amount of deductions on line 030 cannot be greater than the amount of income on line 020. It is always either less than or equal to line 020. This is laid down in the Control ratios for checking the calculation of 6-NDFL Letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11/ [ email protected] (clause 1.2) .

• the amount of personal income tax returned to the employee, including at the expense of personal income tax calculated from the income of other employees, must be reflected on line 090. To refund the tax to the employee, you have 3 months from the date of receipt of the application from him, paragraph 1 of Art. 231 Tax Code of the Russian Federation. In this regard, keep in mind that line 090 must be filled out exactly in the period in which you returned the money to the employee’s account. Letter of the Federal Tax Service dated October 13, 2016 No. BS-4-11/ [email protected] . If this happens, for example, in June, then fill out line 090 in the calculation of 6-NDFL for the six months. But if you return the tax in July, then line 090 will need to be filled out in the calculation of 6-personal income tax for 9 months;

• the amount of tax reflected on line 070, withheld from the beginning of the year from the income of all employees, does not need to be reduced by the amount of personal income tax that you returned to the employee. That is, you will transfer less personal income tax to the budget for the current month, but you will not show this in line 070. Such completion of the calculation is dictated by the Control ratios for checking the calculation of 6-NDFL Letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11 / [email protected] (clause 2.1):

It turns out that when returning personal income tax to some employee during the year, the amount of tax withheld on line 070 of section 1 will be greater than what you actually transferred to the budget. And tax officials don’t see anything strange in this. The main thing is that you pay no less than what was withheld (minus the amount returned).

But in this case, the Federal Tax Service remained silent about filling out line 140 of section 2. However, the indicator for it should also not be reduced by the amount of personal income tax returned to the employee. That is, the procedure for filling it out should be the same as line 070 of section 1.

Let us explain this with an example.

Condition. To make the example clearer, let’s say that the organization employs 20 people and everyone has the same salary - 40,000 rubles. per month. None of them receive deductions for children. The amount of personal income tax was calculated monthly and withheld when paying salaries to employees on the 6th of each month, and in May - on the 5th. The tax was transferred to the budget on the same day when salaries were paid.

In May, one of the employees brought to the accounting department a notice from the Federal Tax Service about the right to a property deduction in the amount of 2,000,000 rubles. and an application for a deduction.

Solution. The accountant's algorithm of actions will be as follows.

Step 1. We determine the amount of the deduction and the amount of personal income tax to be returned to the employee who brought the documents for the property deduction. The accountant provided a deduction from the beginning of the year and recalculated personal income tax from January to April inclusive. The over-withheld tax was returned to the employee’s salary card in May. And since May, they began to pay the employee’s salary in full - without deducting personal income tax. All employee data is shown in the table.

| Month | Cumulative total since the beginning of the year | ||||

| Employee income, rub. | Amount of deduction, rub. | Tax base, rub. | Personal income tax calculated and withheld, rub. | Personal income tax returned, rub. | |

| January | 40 000 | 0 | 40 000 | 5 200 | 0 |

| February | 80 000 | 0 | 80 000 | 10 400 | 0 |

| March | 120 000 | 0 | 120 000 | 15 600 | 0 |

| April | 160 000 | 0 | 160 000 | 20 800 | 0 |

| May | 200 000 | 200 000 | 0 | 20 800 | 20 800 |

| June | 240 000 | 240 000 | 0 | 20 800 | 20 800 |

Step 2. Determine the amount of personal income tax payable to the budget for May and June for all employees.

From January to April inclusive, the monthly amount of income for all employees was 800,000 rubles. (RUB 40,000 x 20 people). And the personal income tax calculated and withheld from her is 104,000 rubles. (RUB 800,000 x 13%).

Since, starting in May, personal income tax was no longer withheld from the income of the employee receiving the deduction and the excess withheld tax for January - April in the amount of 20,800 rubles was returned to him, then for all employees the data for May will be as follows:

• tax base—RUB 760,000. (RUB 800,000 – RUB 40,000);

• calculated personal income tax - 98,800 rubles. (760,000 x 13%);

• Personal income tax to be transferred to the budget - 78,000 rubles. (98,800 rub. – 20,800 rub.).

For June, the tax base for all employees and the amount of calculated tax will be the same as in May. Moreover, in July, the entire amount of the calculated tax for June must be transferred to the budget - 98,800 rubles.

Step 3. Fill out the 6-NDFL calculation for the six months.

An employee wrote an application for child support in the middle of the year.

The employee submitted an application for a child deduction in the second quarter. But he had the right to deduct since the beginning of the year. The company provided deductions for previous months in the current one.

This is important to know: How to correctly fill out a zero UTII declaration for 2020 for individual entrepreneurs: sample

An employee who has children is entitled to receive a standard deduction. To do this, the “physicist” writes an application and presents the child’s birth certificate, a copy of the passport and other documents confirming the right to the deduction (Article 218 of the Tax Code of the Russian Federation). The deduction is due to the employee from the month of birth of the child.

Deductions must be provided from the beginning of the year if the employee could receive a deduction all year, but submitted the application only in the second quarter. The company provides deductions up to the month in which the employee’s income exceeded 350 thousand rubles.

The company considers personal income tax as a cumulative total. Therefore, deductions for all previous months can be applied when calculating the tax base for the current period. In line 030 of the 6-NDFL calculation, reflect the deductions that were provided during the reporting period. Line 040 shows the calculated tax, and line 070 shows the tax actually withheld. In line 130 of section 2, fill in accrued income, not minus deductions.

Sample 69. How to fill in children's deductions in the calculation

Property deduction in 6-NDFL

Providing an employee with a property deduction is formalized in a similar way. This type of benefit is received by an employee on the basis of his application and a notification paper from the tax office, proving the right to the deduction. If the employee does not provide such documents, then the deduction is not taken into account.

If all the necessary documents are available, then every month the employer provides a part of the deduction in the amount of the accrued salary until it is fully repaid. In this case, personal income tax payable will be zero until the entire deduction amount is taken.

The company provided the employee with a property deduction from the beginning of the year

In the second quarter, an employee brought a notice confirming the right to a property deduction in 2020. The company recalculated income from the beginning of the year and returned the excessively withheld personal income tax to the employee.

An employee has the right to receive a property deduction from the employer. To do this, he receives a notification from the Federal Tax Service (approved by order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/ [email protected] ). The employee submits this document, together with a free-form application, to the employer (clause 8 of Article 220 of the Tax Code of the Russian Federation).

Return the excessively withheld personal income tax to the employee upon application to his account (Article 230 of the Tax Code of the Russian Federation). If income for the year is less than deductions, the employee has the right to declare the balance in subsequent periods. When calculating 6-NDFL, reflect the deduction in the amount that you managed to provide during the reporting period. Write it down on line 030. On line 070, write down the actual tax withheld. And the amount that was returned to the employee is in line 090.

Sample 70. How to reflect property deduction in section 1:

Financial assistance in 6-NDFL

Financial support provided by an employer to an employee is subject to personal income tax only to the extent that it exceeds 4,000 rubles. That is, when providing financial assistance within four thousand, personal income tax does not need to be calculated and withheld. If the amount of assistance is greater, then tax is withheld from the excess amount.

The above rule is general, but in some cases the taxation of financial assistance is different.

Financial assistance is not subject to personal income tax:

- if the employee was injured during natural disasters or an emergency event;

- if an employee suffered from terrorist attacks (or died, then assistance is provided to relatives);

- if an employee pays for treatment (or a former employee who has retired);

- if paid to the relatives of a deceased employee (one-time payment);

- if paid to an employee in the event of the death of a close relative (one-time payment);

- if a child is born or adopted into an employee’s family (one-time payment), assistance up to 50,000 rubles is not taxed. for both parents.

For the employee, the assistance received is income, and therefore must be entered into 6-NDFL in both sections. In section I, the amount of assistance in the total amount paid is shown in line 020, the non-taxable part (in the standard situation this is 4,000 rubles) is paid in line 030. Personal income tax, calculated from the difference between general assistance from line 020 and non-taxable tax from line 030, is recorded in line 040.

Section II on page 100 shows the day the income was received; for financial assistance this is the moment of payment. On page 110, the day of personal income tax withholding (the moment of payment), on page 120 – the date of transfer (the day of payment or the next one). On page 130 the total amount of assistance paid is written, on page 140 - the tax withheld.

An example of reflecting financial aid in 6-NDFL

The employee received financial assistance in the amount of 7,500 rubles on September 24. This amount will be shown in the report for nine months. Filling out fields 6-NDFL:

| Line number | Explanations for filling | Sum |

| Formatting of Section I | ||

| 010 | The rate at which financial assistance is taxed | 13% |

| 020 | Total amount of assistance | 7500 |

| 030 | Tax-free portion of assistance | 4000 |

| 040 | Tax on the amount of excess over the non-taxable part | 455 (7500 – 4000) * 13% |

| Formatting of Section II | ||

| 100 | For financial assistance, the date of actual receipt of income is the date the money is issued to the employee | 24 Sep. |

| 110 | The day of retention corresponds to the day of payment | 24 Sep. |

| 120 | The tax must be paid upon the issuance of financial assistance to the employee (on the same or next day) | 24 Sep. or 25 Sep. |

| 130 | Total amount of aid provided | 6000 |

| 140 | Amount of tax withheld | 455 |

If we neglect other employees and income, then in 6-NDFL the financial assistance issued to an employee is shown as follows:

Main details

First of all, in order to understand the key features of reporting under 6-NDFL, it is worth considering the basic requirements that are imposed on such documentation by current legislation.

Features and mechanism if the amount exceeds the salary

It is necessary to reflect a property deduction in such reporting only if the recipient of this deduction has an officially registered employment relationship with a legal entity, receives income as an individual, and has also given the employer a notification about the possibility of using this deduction. It is worth noting that in order to obtain the appropriate tax deduction, the employee must submit an application to his manager with a request to use it.

It is impossible to obtain a property deduction for yourself if the purchase of property was carried out from an interdependent person or at the expense of budget funds, an employer or maternity capital.

The property deduction itself should be provided in the form of a reduction in the tax base to which personal income tax applies. In this case, the calculation of personal income tax must be calculated every month with an accrual total for those types of income that are taxed at the standard rate of 13%, taking into account those amounts of tax that were previously withheld during previous months.

In 6-NDFL, the property deduction is reflected on line 030, which is located in the first section of the reporting, and it must be filled out, taking into account the following rules:

- the calculation of the generalized amount is carried out for all available types of tax deductions, including standard, professional, property and others;

- all available deductions are summed up for all individuals who have the right to receive them in accordance with the documentation they provide;

- tax deductions are summed up on an accrual basis;

- if the amount of available deductions is greater than accrued taxes, personal income tax is zero.

Legal requirements

In accordance with paragraph 2 of Article 230 of the Tax Code, any authorized tax agent must submit to the office located at the place of its registration a calculation of the amounts of personal income tax that were calculated and withheld from the salaries of company employees for the first quarter, half a year and nine months. These reports are submitted before the last day of the month following the reporting period.

The first section of the 6-NDFL form must be filled out, indicating all the necessary indicators with a cumulative total. The second section reflects only those financial transactions of the company that were carried out during three months of this reporting period.

Article 230. Enforcement of the provisions of this chapter

In accordance with paragraph 3.3 of the first section of the established procedure for filling out 6-NDFL, the total amount of taxes that were returned to taxpayers in accordance with Article 231 of the Tax Code must be indicated on an accrual basis, starting from the first month of the tax period, and this indicator is written in line 090.

Article 231. Procedure for collection and refund of tax

If a company recalculates the amount of vacation pay and the amount of personal income tax, then in the first case it is necessary to indicate the final amounts, taking into account the recalculation.

In accordance with the situation, which is given in the official letter published by the Tax Service, the employee’s profit is 200,000 rubles, while the personal income tax withheld from it is 26,000. At the same time, the employee was returned the excess tax withheld in the amount of 1,000 rubles, and therefore From this payment, the state budget received the amount of 25,000 rubles.

Accordingly, in reporting under 6-NDFL, this operation should be reflected as follows:

| Lines 100, 110 and 120 | The corresponding dates for the transactions performed are entered. |

| 130 | The amount indicated is 200,000 rubles. |

| 140 | The amount indicated is 26,000 rubles. |

| 090 | The amount indicated is 1000 rubles. |

If the tax agent returned the personal income tax amount to the employee during April, then it will need to be reflected in line 090 of the reporting that will be submitted based on the results of the past six months.

Sample reflection of a standard deduction in 6-NDFL

Important clarifications

In the first section, the amount of deductions provided, which were calculated from the first day of the year, should be reflected in line 030, while the total amount of the employee’s profit without taking into account deductions will be recorded in line 020.

The total amount of the deduction will not be subject to personal income tax, and therefore the tax calculation is carried out depending on the difference between the profit and the deduction, while the tax amount will ultimately be entered on line 040.

The second section reflects the totals indicated for the last quarter, while line 130 reflects the total amount of profit, excluding deductions, for the last three months, while line 140 includes the amount of tax that was withheld without taking into account the difference income reflected in line 130, as well as those deductions that were provided during this quarter.

All these explanations are reflected in the official letter of the Tax Service No. BS-4-11 / [email protected] , which was published on June 20, 2020.

Legal regulation and responsibility

If the enterprise had no income or made no payments to individuals, the income tax indicators will be zero. In this case, there is no need to submit the statement to the federal service. For late transfer of data, a fine of 1,000 rubles is assessed, and banking structures have the right to block the current account after 10 days of delay.

If an individual (IP) receives a property refund through the tax service, Form 6-NDFL must be filled out and submitted independently. When the payment is made by the employer, the accounting department is responsible for filling out the form.

What is needed to apply for a property deduction with subsequent display in form 6-NDFL:

- Declaration of income for the last reporting year;

- Certificate 2-NDFL (issued by the accounting department at the place of work) - accruals and deductions;

- Documents confirming ownership of the object in question;

- Agreement on mortgage or other loans, confirmation of loan payment (payment receipts, statements);

- Passport, identification code;

- Statement.

After the end of the calendar month, the taxpayer must receive a notification from the federal tax service of the right to receive a property refund. If a citizen applies through an employer, the payment occurs together with the salary in equal parts. It is mandatory that the employee and the employer enter into an employment contract or an agreement for part-time work.

An organization does not have the right to refuse payment to a hired worker who has provided the entire package of documents for the calculation and has received permission from the tax service. Statement 6-NDFL records wages, income tax and property returns.

Line 130 6 personal income tax, what is included there

The second section contains block graphs 100-140. Line 130, which is problematic for accounting, is called “Amount of income actually received,” which resonates with column 100 “Date of income actually received.”

In the classical understanding of an accountant, line 130 6 of personal income tax includes the amount transferred to the employee or issued in cash from the cash register, but according to the instructions for filling out the report, a different value is recorded there. According to instruction No. ММВ-7-11/ [email protected] , approved on October 14, 2015, the column reflects all personnel income without deduction of personal income tax, i.e. (tax base) received on the day indicated on line 100.

Important! Correctly determine the date of income received and fill out line 130 in accordance with the amounts accrued on that day.

Therefore, if you are in doubt whether to reflect your salary on an actual or accrual basis, choose the second option.