When do you need to recalculate your salary?

In accordance with Article 22 of the Labor Code of the Russian Federation, the employer is obliged to pay full wages to its employees.

The amount of remuneration is established for the employee by the employment contract. The need for accounting to recalculate wages arises if the employee’s wages are not paid in full or in a larger amount. Such situations arise when:

- counting error;

- payment of bonuses for previous years;

- salary indexation;

- changes in the minimum wage;

- employee illness during vacation or recall from vacation;

- receiving a court decision on additional assessments.

If, as a result, the employee received less income, then the company is obliged to recalculate wages for the previous period. If a large amount is transferred, the company is not obliged to make corrections. But in case of a calculation error, she has the right to recalculate wages (Article 137 of the Labor Code of the Russian Federation).

Documents that can be used to make personal income tax accounting adjustments

Adjustments to personal income tax accounting can be made using the following documents:

- Recalculation of personal income tax (Taxes and contributions - Recalculation of personal income tax) - a document that allows you to register the recalculation of calculated personal income tax (including for previous tax periods);

- Personal income tax accounting transaction (Taxes and contributions - See also - Personal income tax accounting transactions) - a document that allows you to make manual adjustments in personal income tax accounting;

- Data transfer (Administration – See also – Data transfers) is a document that can be used to register adjustments to any registers, including personal income tax. Information is entered directly into the registers, so adjustments are more labor-intensive than adjustments using a specialized document. Therefore, we will not consider the adjustments in this document in detail.

Counting error

A counting error is an incorrect arithmetic calculation when calculating payroll. For example, an accountant, instead of adding the amount of profit to the salary, multiplied these two values. In case of underpayment, it is necessary to recalculate wages for previous months. In case of overpayment, the employer also has the right to this, but subject to proper registration.

How to recalculate wages in case of a counting error:

- Draw up a document confirming the discovery of an error (for example, a report).

- Make sure that the month has not expired since the overpayment (Part 3 of Article 137 of the Labor Code of the Russian Federation).

- Notify the employee about the error and obtain written confirmation from him that he does not object to the corrections (you can submit an application for wage recalculation).

- Issue a withholding order and withhold the overpaid amounts.

If you do not meet the allotted monthly deadline, you can recover the overpayment in court.

What are standard deductions called and why are they recalculated?

Standard deductions (SD) are:

- established by art. 218 of the Tax Code of the Russian Federation, amounts that reduce the income received by an individual when determining the tax base for personal income tax;

- one of the types of tax deductions (along with social, property, etc.) used in calculating personal income tax.

To receive SV, you must:

- receive income taxed with personal income tax at a rate of 13% (persons receiving only income exempt from personal income tax, or only income from dividends, or income taxed at other rates cannot apply for SV);

- be a resident for personal income tax purposes (stay in our country for more than 183 days for 12 consecutive months).

Indicated in Art. 218 of the Tax Code of the Russian Federation, deductions are fixed - established by tax legislation in fixed amounts depending on the category of taxpayer:

It should be noted that receiving SV is an employee’s right:

- which he may not use or apply for it not from the beginning of the calendar year;

- which cannot be used in the absence of supporting documents and an application from the potential recipient of the deduction.

A sample application for a standard deduction can be downloaded here.

These reasons may serve as a reason to recalculate the SV. In addition, the need for recalculation may arise in other cases - for example, if an employee acquired resident status during the year or an error was identified in the calculations.

We will tell you how to reflect the fact of recalculation of deductions in 6-NDFL in the next section.

How is salary indexation taken into account?

The employer is obliged to index wages annually. Indexation affects the calculation of average earnings, which is determined for vacation pay, sick leave, etc. Average earnings are calculated based on the previous 12 months. Salaries for the previous year are recalculated as follows:

- the salary and payments depending on it, accrued before the indexation, are increased by the indexation factor;

- other payments (in a fixed amount) do not change.

Example 1

Semenov S.S. upon hiring on October 1, 2017, the salary was set at RUB 30,000. and a bonus for qualifications of 20% of the salary (6,000 rubles). From 02/01/2019, wages were indexed throughout the enterprise. In Semenov S.S. from this moment the salary is 33,000 rubles. and bonus - 6600 rubles. In addition, in October 2018, the employee was paid a bonus in the amount of 10,000 rubles. As of August 1, 2019, the employee goes on vacation. It is necessary to calculate his average earnings (the entire period has been worked out in full).

Payments from February to July 2020 are taken into account in the accrual amount:

We calculate the indexation coefficient as follows:

Payments through January 2020 need to be indexed (from August 2020 to January 2020):

Average earnings will be:

Recalculation of personal income tax

There are quite a lot of cases of recalculation of personal income tax: a calculation error, recall of an employee from vacation, excessive withholding of personal income tax from an employee as a non-resident, if he is actually a resident, payment of interim dividends to foreigners, submission by an employee of documents confirming the deduction for a child... Each of the cases of recalculation has its own characteristics.

Before recalculating personal income tax, you need to understand whether your case falls under the recalculation of personal income tax. Let's consider the main cases.

An individual changed status from non-resident to resident

If an individual acquires the tax status of a resident of the Russian Federation, which will no longer change in the tax period, the tax agent must recalculate the amounts of personal income tax withheld from the individual’s income from sources in the Russian Federation, based on the tax rate of 13% (letter from the Ministry of Finance Russia dated 04/04/2014 No. 03-04-05/15215).

In some cases, there is no need to recalculate the tax.

Example 1.

If in 2020 a Russian organization withheld from the salary of an employee - a citizen of the Republic of Belarus, who is not a tax resident of the Russian Federation, personal income tax at a rate of 13% and the employee quit before the expiration of 183 days of stay in the Russian Federation, the organization does not recalculate personal income tax at a rate of 30% and pay additional tax must.

The employee is recalled from vacation

When an employee is recalled from vacation, the organization (tax agent) recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax. Previously accrued amounts of vacation pay and the corresponding amounts of tax are reversed, and for the days actually worked, wages are accrued and tax is calculated (letter of the Federal Tax Service of Russia dated October 24, 2013 No. BS-4-11/190790).

Payment of dividends to foreign citizens

In Art. 232 of the Tax Code of the Russian Federation in relation to personal income tax, a special procedure is established for the implementation of the provisions of international treaties (agreements) on the avoidance of double taxation, establishing, in particular, that the maximum period for the taxpayer to submit the corresponding confirmation cannot exceed one year after the end of the tax period in which the taxpayer has grounds for their application (letter of the Ministry of Finance of the Russian Federation dated August 31, 2010 No. 03-04-08/4-189).

ORIGINAL SOURCE

Before the return of the excessively withheld and transferred amount of tax from the budget system of the Russian Federation, the tax agent has the right to refund such amount of tax at his own expense.

— Paragraph nine of paragraph 1 of Art. 231 Tax Code of the Russian Federation.

A counting error has occurred

In accordance with paragraphs. 3 and 4 tbsp. 226 of the Tax Code of the Russian Federation, tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income in respect of which the tax rate established by clause 1 of Art. 224 of the Tax Code of the Russian Federation, accrued to the taxpayer for a given period, with the offset of the amount of tax withheld in previous months of the current tax period.

The amount of tax in relation to income for which other tax rates are applied is calculated by the tax agent separately for each amount of the specified income accrued to the taxpayer.

If an error is detected in the calculation of personal income tax, it is necessary to recalculate the amounts.

POSITION OF THE COURT

A taxpayer can return personal income tax from the budget through the tax authority only in the absence of a tax agent. If a tax agent exists, then you should first contact him with an application for a refund of overly withheld tax.

— Determination of the Constitutional Court of the Russian Federation dated February 17, 2015 No. 262-O.

When the right to a deduction for a child arises

If an employee lately submitted documents confirming the right to deduct personal income tax for a child, then personal income tax must be recalculated (letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118):

- if the right to deduction arose in the current year - from the moment of its occurrence. For example, if a child was born in March, and the employee brought the birth certificate in July, personal income tax must be recalculated for the period from March to June;

- if the right to deduction arose in past years - from January of the current year. For example, if a child was born in November last year, and the employee brought the birth certificate in February of the current year, the personal income tax must be recalculated only for January of the current year.

An employee's business trip lasting more than 183 days

If the duration of the business trip is more than six months, the employee will become a non-resident. After all, he will be outside the Russian Federation for more than 183 days (clause 2 of Article 207 of the Tax Code of the Russian Federation).

But the average earnings and daily allowance will still be his income from a source in the Russian Federation (letters from the Ministry of Finance of Russia dated August 22, 2013 No. 03-04-05/34436, dated March 19, 2013 No. 03-04-06/8402 and dated November 22, 2012 No. 03 -04-06/6-332).

IMPORTANT IN WORK

If the amount of tax to be transferred by the tax agent to the budget system of the Russian Federation is not enough to return the excessively withheld and transferred amount of personal income tax to the taxpayer within three months, the tax agent, within 10 days from the date the taxpayer submits an application to him, sends an application to the tax authority at the place of his registration. refund to the tax agent of the amount of tax withheld in excess.

Overpayment of personal income tax

If the company overpaid, then two situations are possible:

1. The company adjusts personal income tax amounts in its accounting and reverses them.

Example 2.

Bereg LLC provides leave to chief engineer A.K. Savelyev.

Vacation from March 29, 2020.

For a period of 14 calendar days.

However, due to the need to hand over the facility to the working commission, on April 6, 2020, the chief engineer was recalled from vacation.

The accountant, accordingly, recalculated.

| Debit | Credit | Sum | Operation |

| 96 | 70 | RUB 23,820.30 (RUB 1,701.45 x 14 calendar days) | Vacation pay accrued |

| 70 | 68 | 3097 | Personal income tax accrued |

| 68 | 51 | 3097 | Personal income tax from vacation pay transferred to the budget |

| 70 | 51 | 20 723,30 | Vacation pay is transferred to the employee’s bank card |

| 96 | 70 | 11 910,15 | Vacation pay reversed 7 calendar days |

| 44 | 70 | RUB 43,478.26 (RUB 50,000: 23 working days x 20 working days) | Wages accrued for April |

| 70 | 68 | 4104 rub. [(RUB 43,478.26 – RUB 11,910.15) x 13%] | Personal income tax accrued on income for July, taking into account the reversal of part of the amount of vacation pay for unused vacation days |

| 68 | 51 | 4104 rub. | Personal income tax transferred to the budget, taking into account reversed amounts |

2. The company recalculates personal income tax from the month when the employee received resident status, and the employee himself applies to the tax authority to return the overpayment.

Example 3.

A foreign worker, a qualified worker A.K. Belov, got a job at Bereg LLC.

The accountant withheld 30% of his income from November 1, 2020 to May 1, 2020. During this period, the employee was accrued 303,500 rubles. At this time he was not a tax resident of the Russian Federation. The amount of personal income tax withheld was RUB 91,050. (RUB 303,500 x 30%).

When calculating personal income tax on wages for May 2020, the accountant took into account the overpayment of tax. The amount of personal income tax accrued from wages for May amounted to 3,770 rubles. (RUB 29,000 x 13%). But there is no need to withhold it, since it is less than the overpayment of tax (RUB 51,595).

Consequently, from May the accountant calculates personal income tax at a rate of 13%.

In relation to the resulting overpayment for personal income tax in the amount of 51,595 rubles. the employee must contact the tax authority independently.

IMPORTANT IN WORK

The refund of the tax amount to the taxpayer in connection with the recalculation at the end of the tax period in accordance with his acquired status of tax resident of the Russian Federation is made by the tax authority in which he was registered at the place of residence (place of stay), when the taxpayer submits a tax return at the end of the specified tax period. period, as well as documents confirming the status of a tax resident of the Russian Federation in this tax period.

If a company refuses to recalculate personal income tax for an employee

As an example, consider a situation where an employee first brought documents confirming the right to a deduction, and then writes a statement that he does not want to receive a deduction.

In this case, the company may not recalculate.

Example 4.

During the tax period (calendar year), the taxpayer received income from two employers at once.

At the same time, he submitted an application to his first employer for a standard child tax deduction and the corresponding documents. Considering that the employee’s income for the period from January to April exceeded 280,000 rubles since the beginning of the year, the employer provided the employee with a deduction only for the period from January to March inclusive. Since April, the child deduction has not been provided.

This person also received income taxed at a rate of 13% from another employer in a given calendar year. But for the whole year they did not exceed 280,000 rubles.

And this taxpayer wanted to receive a deduction for a child for the entire tax period according to the declaration, replacing the first employer who provided a deduction for a child with another tax agent from whom he received income that did not exceed 280,000 rubles for the entire year.

Therefore, it was explained to him that recalculating the deduction for a child on the basis of the 3-NDFL declaration was impossible in his case (letter of the Ministry of Finance of Russia dated February 19, 2015 No. 03-04-05/7763).

IMPORTANT IN WORK

The return to the taxpayer of the excessively withheld amount of personal income tax is made by the tax agent at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other individuals from whose income the tax agent withholds this tax, within three months from the date the agent receives the taxpayer’s application.

Refund of over-accrued amounts by the tax agent

If a company has overpaid personal income tax, it is possible to return the overcharged amounts. Companies often agree to refund overpayments when large amounts are involved.

A tax agent can submit an application for a refund (offset) of personal income tax within three years from the date of payment of the tax (Clause 7, Article 78 of the Tax Code of the Russian Federation).

It is advisable to attach documents confirming the fact of overpayment to the application, for example, this could be a reconciliation report.

Together with the application for the return of the amount of tax that was excessively withheld and transferred to the budgetary system of the Russian Federation, the tax agent submits to the tax authority an extract from the tax accounting register for the corresponding tax period and documents confirming the excessive withholding and transfer of the amount of tax to the budgetary system of the Russian Federation.

When making a refund of personal income tax, the type of income paid to other persons, as well as the applicable tax rate, does not matter (letter of the Federal Tax Service of Russia dated September 20, 2013 No. BS-4-11/17025).

The decision to return (offset) the “surplus” or to refuse to return it must be made by tax authorities within 10 days from the date of receipt of the application and attached documents or from the date of signing the act of joint reconciliation of the amounts paid by the tax agent, if one was carried out. The inspectors are required to inform him about the decision made within 5 days from the date of the verdict. If the decision is positive, the refund will be made within a month from the date the controllers receive the application.

After this, the employer, in accordance with Art. 231 of the Tax Code of the Russian Federation returns personal income tax to the employee.

POSITION OF THE FTS

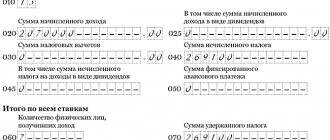

When filling out 2-NDFL certificates, the amounts of accrued income in the form of wages are reflected in the month of the tax period for which such income was accrued. The amounts of accrued personal income tax are also reflected in the tax period for which they were calculated. The amounts of withheld tax should be reflected in the certificate in the tax period for which the tax was calculated. If the amount of personal income tax is withheld after the end of the tax period and the submission of certificate 2-NDFL to the tax authority, then the certificates previously submitted to the tax authority are subject to adjustment by submitting a new certificate.

— Letter dated 03/02/2015 No. BS-4-11/3283.

What if the year is over?

As a general rule, recalculation is carried out:

- at the moment when the accountant discovered that it was necessary to make it (for example, an employee brought documents);

- at the end of the year (for example, if the employee changed his tax resident status).

Recalculation is carried out at the end of the year by the tax authority on the basis of a declaration and documents confirming the status of a resident of the Russian Federation, and not by a tax agent (clause 1.1 of Article 231 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-05/6-353) .

However, if an error is discovered or recalculation needs to be done for the previous year, then in this case it is necessary to submit updated reporting for the previous year. In accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents submit to the tax authority at the place of their registration information on the income of individuals for the expired tax period and the amounts accrued, withheld and transferred to the budget system of the Russian Federation for this tax period of taxes annually no later than April 1 of the year following the expired tax period . It follows from the above that when filling out certificates of income for individuals in Form 2-NDFL (hereinafter referred to as the Certificate), in the relevant sections of the Certificate, the amounts of accrued income in the form of wages are reflected in the month of the tax period for which such income was accrued. In this case, the amounts of accrued tax are reflected in the tax period for which they were calculated. The amounts of withheld tax should be reflected in the Certificate in the tax period for which the tax was calculated (letter of the Federal Tax Service of Russia dated March 2, 2015 No. BS-4-11/3283).

GOOD TO KNOW

Certificate 2-NDFL is filled out by the tax agent based on the data contained in the tax registers.

What if an employee quits?

If an employee quits, then it is still necessary to recalculate personal income tax. You need to understand whether the company should budget or not.

If the employment relationship with the employee is terminated and you do not pay him income, then, accordingly, you have nothing to withhold the missing tax amounts from. In this case, you need to inform the taxpayer and the tax authority at your place of registration in writing about the impossibility of withholding tax (letter of the Ministry of Finance of Russia dated March 19, 2007 No. 03-04-06-01/74).

If personal income tax was withheld excessively, it must be returned to the employee. According to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation, within 10 days from the day you discovered excessive withholding of personal income tax, you are obliged to inform the former employee about it. In a letter dated December 24, 2012 No. 03-04-05/6-1430, the Ministry of Finance specifically noted that the termination of the employment relationship between the taxpayer and the organization that is the source of payment of income from which the tax was excessively withheld, as well as the period in which the excessively withheld tax is refunded , do not affect the procedure for applying the provisions of Art. 231 Tax Code of the Russian Federation. Therefore, if a former employee is found to have over-withheld personal income tax, he must be notified (for example, by sending a registered letter with return receipt requested to the address specified during employment).

This can be done by sending a registered letter with notification to the registration address. In this case, the refund of overpaid amounts will be made based on the employee’s application. You will have to return the tax within 3 months from the date of receipt of the application. If an employee received a notice of personal income tax refund, but did not show up for some reason (moved, was absent from his place of registration), then in this case the employer will not be held responsible for non-refund of the amounts to the taxpayer.

GOOD TO KNOW

The return to the taxpayer of excessively withheld tax amounts is made by the tax agent in non-cash form by transferring funds to his account in the bank specified in the application.

What if the recalculation was caused by incorrect or illegal actions of the accounting department?

If the recalculation was caused by incorrect or illegal actions of the accountant, the employer can do the following:

1. Do not take any action, because the work of an accountant is already difficult.

2. Impose disciplinary action on the employee.

For committing a disciplinary offense, i.e. for culpable failure or improper performance by an employee of his labor duties, three types of penalties can be applied to him (Part 1 of Article 192 of the Labor Code of the Russian Federation):

- remark (less strict measure of liability);

- reprimand (a more severe measure of responsibility);

- dismissal.

But, for example, it is impossible to collect a fine from an accountant’s salary.

In addition, when imposing a disciplinary sanction, it is important to remember that the disciplinary sanction must correspond to the degree of guilt of the employee, for example, if the overpayment of personal income tax due to the employee’s actions amounted to 1000 rubles, which can later be returned from the budget or offset, then the dismissal of the accountant will be at least at least illogical.

But, for example, if a mistake is made, a penalty can be imposed in the form of a reprimand, and if the accountant’s actions led to serious additional tax charges and penalties, then in this case one can reprimand and even fire the employee.

The procedure for imposing a disciplinary sanction is enshrined in Art. 193 Labor Code of the Russian Federation. In particular, before applying a disciplinary sanction, the employer must request a written explanation from the employee. If after two working days the employee does not provide the specified explanation, then a corresponding act is drawn up.

In this case, disciplinary sanction is applied no later than a month from the date of discovery of the misconduct, not counting the time of illness of the employee, his stay on vacation, as well as the time required to take into account the opinion of the representative body of employees.

In addition, a disciplinary sanction cannot be applied later than six months from the date of commission of the offense, and based on the results of an audit, inspection of financial and economic activities or an audit - later than two years from the date of its commission.

The employer's order to apply a disciplinary sanction is announced to the employee against signature within three working days from the date of its issuance, not counting the time the employee is absent from work. If the employee refuses to familiarize himself with the specified order against signature, then a report about this is drawn up.

Calculation of bonuses for the last year: recalculating vacations and sick leave

When calculating average earnings, bonuses based on the results of work for the year are taken into account regardless of the date of their accrual. In this regard, if, after calculating average earnings (vacation, illness, business trip, other reasons), an annual bonus was accrued relating to the billing period, it is necessary to recalculate the accrued amounts.

When recalculation is made, premiums for the previous period are taken into account if:

- they are accrued at the end of the year;

- this year refers to the billing period.

Example 2

Let's add the conditions of the first example. In April 2020, Semenov S.S. paid annual bonuses: for 2020 - 5,000 rubles, for 2020 - 30,000 rubles. Since the bonus for 2020 does not relate to the holiday pay calculation period, it does not need to be taken into account when recalculating. But the bonus for 2020 should be included in the calculation of average earnings in full:

Average earnings have increased, which means Semenov needs to pay extra vacation pay.

Time limits have been established for the recalculation of wages in case of underpayment. Unpaid accruals must be paid to the employee no later than the next payday after the changes are made.

Should last year's personal income tax be withheld from the new year's income?

You must inform the Federal Tax Service about the impossibility of withholding personal income tax - submit a 2-NDFL certificate with sign “2” - no later than March 1 of the year following the one in which this personal income tax was calculated.

5 tbsp. 226 Tax Code of the Russian Federation. But in January - February, that is, from the beginning of the year before the message is submitted, an individual may have time to receive some kind of monetary income from you (for example, a salary). Is it necessary to withhold from them the balance of personal income tax calculated in 2016, but for some reason not withheld until the end of the year? Previously it was necessary, but now it’s not: don’t make the mistake of acting by inertia 11/15/2017 N.A. Martynyuk, tax expert

Like before

Of any money paid from the end of the reporting year until the submission of 2-NDFL certificates with sign “2” for it or before the deadline for their submission, last year’s tax should have been withheld and transferred to the budget. And in the 2-NDFL certificate for the reporting year, submitted with sign “1”, it was necessary to show such tax as withheld and paid. This followed from the explanations of the Ministry of Finance. But they were relevant only until 2020.

As it is now

Now it won't be possible to do that.

Firstly, the Tax Code norm, on which the Ministry of Finance relied in its explanations, has been formulated in a new way since 01/01/2016.

Now it says that the impossibility of withholding tax should be reported if the amount could not be withheld “during the tax period,” that is, a year.

It turns out that from the income paid to individuals in the new year, we no longer withhold personal income tax from last year’s income.

Secondly, if you do it as before, then the data on this tax in the calculation of tax amounts in Form 6-NDFL and in the income certificates of individuals in Form 2-NDFL for 2020 will not coincide.

In Form 2-NDFL, the tax will be shown as withheld. And in form 6-NDFL - as calculated, but not withheld, since this form includes deductions made before the end of the reporting period.

It will not be possible to enter such a tax into Form 6-NDFL for 2020, since only taxes calculated in 2017 should be included in it. And the moment the tax is calculated coincides with the moment the income is received, that is, in our case, it falls on 2016.

The Federal Tax Service specialist agrees that the personal income tax calculated in 2020 does not need to be withheld from other income of the beginning of 2020, paid before the submission of the 2-NDFL certificate with sign “2”.

FROM AUTHENTIC SOURCES

KUDYAROVA Elena Nikolaevna

Advisor to the State Civil Service of the Russian Federation, 3rd class

“The tax agent has no obligation to additionally withhold personal income tax calculated from non-cash income received in 2020 (from financial benefits, income in kind), from cash income paid to an individual in 2020 before the deadline for submitting a report on the impossibility of withholding tax for the previous year (or before the message is submitted, if it is submitted earlier).

If a tax agent, before the end of the 2016 tax period, did not withhold from an individual the personal income tax calculated from his income due to the lack of such an opportunity, he is obliged to send both to the tax authority and to the individual himself a message about the impossibility of withholding personal income tax for the 2020 tax period no later than March 1 2020.”

Obviously, this is true for personal income tax not only on non-cash income, but also on any other income paid to an individual in 2020, the tax on which you will not be able to withhold until 01/01/2017.

***

So, the Federal Tax Service must be notified of the amount of tax remaining unwithheld as of January 1 of the year following the year in which non-cash income was paid to the individual. That is, include the tax in the 2-NDFL certificate with attribute “2” and submit it no later than March 1 of the year following the one in which the personal income tax was not withheld.

An individual will have to pay this amount independently no later than December 1 on the basis of a tax notice sent to him by the inspectorate, that is, without filing a declaration.

Main book

Subscribe Post:

We make deductions when vacation is interrupted

If an employee is recalled from vacation, then he also needs to recalculate vacation payments. From the first day of work, the employee is paid a salary. But previously paid vacation pay for the days of recall from vacation must be reversed.

Another non-standard situation is incapacity for work during vacation. In this case, the employee has a choice:

- extend vacation for sick days;

- ask the employer to reschedule the vacation to another time.

In the first case, no corrections need to be made. And in the second, vacation pay will be recalculated. It is necessary to withhold payments for vacation during illness. And at the same time, accrue temporary disability benefits.