Who is the tax agent for personal income tax?

The following persons are recognized as tax agents for personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation):

- Russian organizations;

- individual entrepreneurs;

- notaries and lawyers engaged in private practice or having law offices;

- separate divisions of foreign companies.

The tax base for personal income tax is payments to taxpayers at the expense of a tax agent (clause 9 of Article 226 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated 02/06/2017 No. GD-4-8/ [email protected] , Ministry of Finance dated 12/15/2017 No. 03-04 -06/84250).

If a company hires personnel under an employee supply agreement, then the functions of a tax agent for personal income tax remain with the executing organization, since it is the organization that makes direct payments to individuals under employment contracts (letter of the Ministry of Finance of Russia dated November 6, 2008 No. 03-03-06/8/618 ).

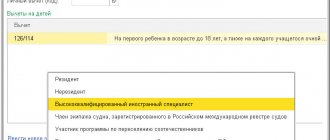

Individuals who are not registered as individual entrepreneurs who make payments in favor of individuals who are employees are not recognized as tax agents. In this case, recipients of funds must independently calculate and pay personal income tax (letter of the Ministry of Finance of Russia dated July 13, 2010 No. 03-04-05/3-390).

The list of income subject to personal income tax is presented in Art. 208 Tax Code of the Russian Federation.

Read more about the features of calculating and withholding income tax in the article “Calculation of personal income tax (personal income tax): procedure and formula.”

The taxpayer independently paid the tax payable by the tax agent

From the analysis of judicial practice, we can conclude that the tax authority does not have the right to hold the tax agent liable under Art. 123 of the Tax Code of the Russian Federation, if the taxpayer independently calculated and paid the tax on time . For example, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated January 26, 2010 N KA-A40/15099-09 in case N A40-83081/08-80-312, additional assessment of personal income tax, penalties and fines for an organization was recognized as unlawful, since taxpayers who received income paid the tax themselves . The Federal Arbitration Court of the Ural District, in its Resolution dated May 13, 2009 N F09-2909/09-S3 in case N A76-22171/2008-42-760, considered the following situation. The entrepreneur paid remuneration to the individual under the lease agreement, but did not withhold or transfer personal income tax on this amount. However, the tax was calculated and paid by the individual on time. Having assessed all the circumstances, the court came to the conclusion that holding the entrepreneur liable under Art. 123 of the Tax Code of the Russian Federation in such a situation is unlawful. It should be taken into account that there is another position. Thus, in the Resolution of the Federal Antimonopoly Service of the Ural District dated March 5, 2008 N F09-1106/08-S2, the court found that the organization did not transfer personal income tax on income paid to an individual under a lease agreement. In this case, the tax was paid by the taxpayer himself. By virtue of the direct instructions of the law, the responsibility for calculating, withholding and transferring personal income tax to the budget on amounts of income paid to individuals is assigned to the tax agent. Consequently, the inspection has the right to hold the agent accountable under Art. 123 of the Tax Code of the Russian Federation and charge penalties, even if the tax was paid by an individual independently.

Responsibilities of a tax agent – Article 230 of the Tax Code of the Russian Federation

Tax legislation establishes what a personal income tax agent must do. Article number 230 of the Tax Code of the Russian Federation contains a small but comprehensive list from which the responsibilities of a tax agent for personal income tax are visible:

- calculate tax on payments to individuals;

- withhold tax;

- transfer tax amounts to the budget;

- within the prescribed period, report on the calculated, withheld and transferred to the budget income tax in forms 2-NDFL and 6-NDFL.

It is important to perform all the above operations correctly and within the time limit established in the Tax Code of the Russian Federation. ConsultantPlus experts explained in detail how to do this. Full trial access to K+ is available for free. This ready-made solution will help you correctly calculate personal income tax, this material will tell you about the procedure for withholding personal income tax, and this instruction will introduce you to the nuances of transferring personal income tax to the budget.

To fulfill his duties, a tax agent must be able to withhold tax. Payment of tax amounts must be made exclusively on payments to individuals. A tax agent has no right to pay taxes from his own funds. It is also prohibited to include clauses on the payment of tax amounts at the expense of the tax agent for personal income tax in the terms of an employment or civil contract (clause 9 of Article 226 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated July 11, 2017 No. 03-04-06/43981, dated August 30 .2012 No. 03-04-06/9-263). It is also impossible to shift the payment of personal income tax from the agent to the taxpayer himself.

However, the Supreme Court believes that it is impossible to punish a taxpayer for early payment of income tax (see resolution No. 305-KG17-15396 dated December 21, 2017).

The Ministry of Finance allowed the overpayment of personal income tax to be counted against future payments for this tax, but with restrictions. Read more here.

Also, starting from 2020, a tax agent has the right to pay personal income tax from his own funds in the case where the tax was additionally assessed during the audit. See here for details.

Late payment of tax

The Letter of the Federal Tax Service of Russia dated February 26, 2007 N 04-1-02/ [email protected] states that the tax agent is subject to prosecution for committing a tax offense under Art. 123 of the Tax Code of the Russian Federation, regardless of the transfer of tax amounts at a later date, including during or after an on-site tax audit (in the absence of circumstances precluding holding a person liable for committing a tax offense or excluding the person’s guilt in committing a tax offense). The amount of tax payable to the withholding agent must be paid on time. For example, according to paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks . In other cases, tax agents transfer the amounts of calculated and withheld tax no later than the day following the day the taxpayer actually receives income, for income paid in cash, as well as the day following the day the calculated tax amount is actually withheld, for income received by the taxpayer in kind or in the form of material benefits. Accordingly, unlawful non-transfer (incomplete transfer) of tax amounts subject to withholding and transfer by the tax agent, i.e. tax offense under Art. 123 of the Tax Code of the Russian Federation, occurs when tax is withheld from the taxpayer, and not when it is transferred. According to the tax service, a tax agent, by withholding tax from a taxpayer but not remitting it within the prescribed period, is aware of the illegal nature of his actions (inaction), desires or consciously allows the harmful consequences of such actions (inaction), and also obviously must and can realize this. The transfer by a tax agent of amounts of tax withheld from the taxpayer, but not transferred within the established period, at a later date, including during or after an on-site tax audit, does not affect the guilt of the tax agent. Meanwhile, according to arbitration practice, if the tax is transferred after the established deadline, then the fine under Art. 123 of the Tax Code of the Russian Federation does not apply (Resolutions of the Federal Antimonopoly Service of the Ural District dated November 24, 2009 N F09-9311/09-S3, FAS West Siberian District dated January 22, 2009 N F04-7718/2008 (17480-A03-29)). A similar position exists in the case where the tax was transferred even before the start of the tax audit (Resolutions of the FAS Moscow District dated 02.27.2010 N KA-A40/1259-10, FAS North Caucasus District dated 07.28.2009 in case N A32-10745/ 2008-33/163). In the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated September 14, 2010 in case No. A32-14406/2010-58/215, the court, recognizing the position of the tax authority as unlawful, indicated that untimely fulfillment of an obligation means its fulfillment in violation of the established deadline. A tax agent’s untimely transfer of withheld taxes to the budget cannot be regarded as a failure to fulfill the obligation to transfer taxes. Responsibility under Art. 123 of the Tax Code of the Russian Federation is established only for failure to fulfill this obligation.

Responsibility of the tax agent – penalties and fines for non-payment

The duties of the tax agent for personal income tax regarding the transfer of tax amounts may not be fulfilled or partially fulfilled. Such situations often arise if the income is paid in kind or represents a material benefit received by an individual.

Read about the duties of a tax agent when paying an employee income in kind in the material “Did the individual receive income in kind? Perform the duties of a tax agent .

Here it is necessary to deduct money payments due to the person himself or to a third party on behalf of the recipient of the income. The amount of withholding corresponds to the amount of the payment arrears and the newly accrued tax, if any (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

If payments to the debtor under personal income tax will no longer be made or the amount of payments is not enough to cover the debt, the tax agent for personal income tax is obliged to notify the tax authorities and the taxpayer about this. This should be done before March 1 after the end of the tax period (subclause 2, clause 3, article 24, clause 5, article 226 of the Tax Code of the Russian Federation). Sending a message relieves the agent of the obligation to withhold personal income tax amounts from this person. The obligation to pay tax will arise on the taxpayer himself upon receipt of a tax notice from the Federal Tax Service.

It is also noted that if the tax agent did not report the impossibility of withholding personal income tax to either the tax service or the taxpayer or did not lose such an opportunity, then penalties may be assessed on the amount of arrears to the personal income tax agent based on the results of an on-site tax audit (letter from the Federal Tax Service of Russia dated November 22, 2013 No. BS-4-11/20951 and No. SA-4-7/16692 dated August 22, 2014). A message about the impossibility of withholding tax must be sent even if the deadline for its submission is missed (letter of the Federal Tax Service of Russia dated July 16, 2012 No. ED-4-3 / [email protected] ). To submit the message, form 2-NDFL with sign 2 is used.

For a life hack from the specialists of our website, see the material “[LIFE HACK] Checking whether you need to submit a 2-NDFL with sign 2.”

In addition to penalties, tax authorities have the right to impose a fine for non-payment of personal income tax by a tax agent.

For more information about the responsibility of this category of taxpayers and when a fine is imposed for non-payment of personal income tax by a tax agent, read the article “What liability is provided for non-payment of personal income tax”.

But a fine can be avoided if:

1. 6-NDFL was submitted to the Federal Tax Service without delay;

2. The amount of personal income tax is correctly indicated in the form (without underestimation);

3. The tax and penalties are paid before the tax authorities find out about the non-payment.

Such rules are in force from January 28, 2019 and apply to legal relations that arose before this date. We talked about the details here.

Find out also about the innovations when imposing fines on tax agents in 2020 - 2020.

Vacation pay in 6-NDFL

General rules for personal income tax on vacation pay:

- the date of actual receipt of income in the form of vacation pay is the day of their payment (subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation);

- Tax agents must transfer to the budget the amounts of calculated and withheld personal income tax from vacation pay no later than the last day of the month in which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

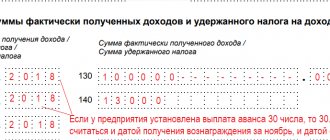

The employee goes on vacation on June 1, 2020. The amount of vacation pay was 10,000 rubles, which he received on May 28. The amount of personal income tax is 1300 rubles.

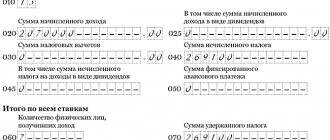

We fill out section 2 of form 6-NDFL for the six months:

- line 100 - 05/28/2017;

- line 110 - 05/28/2017;

- line 120 - 05/31/2017;

- line 130 - 10,000;

- line 140 - 1,300.

The employee decided to quit immediately after his vacation. On March 15 of this year, he received vacation pay and went on vacation, followed by dismissal.

Fill out section 2 for the first quarter:

- line 100 - 03/15/2017;

- line 110 - 03/15/2017;

- line 120 - 03/31/2017;

- line 130 - amount of vacation pay;

- line 140 - personal income tax amount.

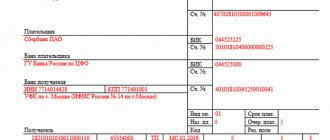

KBK for transferring tax amounts

In 2020, the following personal income tax codes are in effect (order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n):

- 182 1 0100 110 - code for transferring personal income tax on income paid by a tax agent to a taxpayer. The exception is income received in accordance with Art. 227, 227.1, 228 Tax Code of the Russian Federation.

- 182 1 0100 110 - code for transferring personal income tax received by an individual - an individual entrepreneur, a notary or lawyer or a person carrying out other business activities under Art. 227 Tax Code of the Russian Federation.

- 182 1 0100 110 - transfer of tax on personal income received under Art. 228 Tax Code of the Russian Federation.

- 182 1 0100 110 - code for transferring tax on the income of foreign citizens carrying out activities in accordance with the patent. The personal income tax payment in this case is a fixed advance payment and is made on the basis of Art. 227.1 Tax Code of the Russian Federation.

The nuances of paying personal income tax can be found in the section “Time limits and procedures for paying personal income tax in 2019-2020.”

How to make a refund of overpaid personal income tax by a tax agent?

If a tax agent overpaid personal income tax, then he, in fact, reduced the income of an individual by such action. The injured employee has the right to apply to the employer for a refund of the overpaid amount of tax. Tax legislation in paragraph 7 of Art. 78 of the Tax Code of the Russian Federation determines that the statute of limitations for such cases is 3 years, during which a statement can be written.

After receiving a written request from the employee, the tax agent writes a statement to his Federal Tax Service and attaches documents that can confirm the fact of the overpayment. The tax authorities will make a decision within 10 days and inform the employer about it. The tax agent is given the right to choose one of two ways to repay the debt:

- Offset the overpayment against future personal income tax payments.

- Transfer the identified amount of overpayment to the taxpayer's account.

If it is not possible to return the tax through the employer, the taxpayer has the right to apply for a tax refund directly to the Federal Tax Service. How to draw up an application for a personal income tax refund in this case, see our article.

Results

The employer has tax agent responsibilities in relation to income tax on payments to employees. The employer must timely calculate, withhold and transfer personal income tax to the budget, as well as report to the budget on income tax amounts. Failure of a tax agent to fulfill his duties is a reason for a fine from regulatory authorities.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Withheld personal income tax

Certificate 2 of the personal income tax should reflect the amount of tax withheld at the time of payment of earnings, which was calculated earlier under Article 226, paragraph 4. Thus, the individual. the person receives income in hand, reduced by the amount of income tax, which remains in the accounting accounts of the tax agent and is transferred to the treasury within the time limits established by law.

The amount of income tax withheld does not exceed half of earnings.

The income tax withholding rate applies to vacation pay, sick leave payments, and child benefits.