Business entities engage third-party individuals to perform certain work. To do this, there is no need to hire them; it is enough to draw up a GPC or GPA agreement. The Civil Code, in chapters 37 and 39, regulates relations within the framework of a contract or reimbursed provision of services. Let's consider how to correctly reflect both the advance and the GPC agreement in 6 personal income taxes.

Introduction

The relationship between the customer (organization) and the contractor (performer) is formalized by a civil contract. The contract reflects the responsibilities of the contractor - to complete the scope of work, and the customer - to accept and pay for the work in accordance with the acceptance certificate. In addition, the customer is required to reflect the accrued and withheld tax in the calculation.

Each type of profit that individuals receive. persons are subject to taxation. Personal income tax is calculated from each income. The difference between the GPC and the employment contract is only in the date of reflection of the receipt of profit. According to the employment contract, this is the last day of the accrual month.

General rules of reflection

According to the norms of the Tax Code of Article 223, paragraph 1, subparagraph 1, the day of reflection of profit under the GPC is the date of receipt. In part 1 of the declaration, line 020, information about earnings is reflected in the period on the day of payment.

Income is calculated on the day of receipt of profit under a legal contract (TK Article 226, paragraph 3). The day of payment is considered the day when income is paid through the organization's cash desk or transferred to the current account of an individual (Tax Code Article 223, paragraph 1).

In column 100 of the second part of the report indicate the number of actual receipts of income.

Withholding of personal income tax from profits received under GPC agreements is calculated on the day when the income is paid. Accordingly, the dates indicated in cells 100 and 110 of the second part of the calculation will be the same.

To transfer tax, you must be guided by the general requirements of the Tax Code:

- Article 226 clause 6 paragraph 1;

- Article 6.1 clause 7.

The transfer of tax must be made no later than the day following the date of payment under the GPC agreement.

Filling out the declaration 6

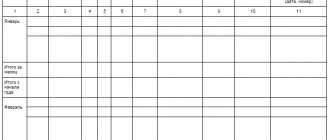

Part 1 of the report is completed on a cumulative basis from the beginning of the year; the second part includes information only from the reporting period.

In 6 personal income taxes, remuneration under a civil contract is formed during the period of completion of the operation.

- In field 020 – the total expression for GPC;

- in field 040 and 070 - personal income tax, which is accrued and withheld from profit in column 020;

- block of fields 100 -140 – filled in for each payment date under contracts.

When filling out the declaration, we are guided by the following legislative acts:

- letter of the Ministry of Finance 03-04-06-24982 dated May 26, 2014;

- letters from the Federal Tax Service BS 4-11-14329 dated July 21, 2017, BS 3-11-4816 dated October 17, 2020;

- NK article 223 clause 1.

Contract agreement and 6-NDFL: basic provisions

A work contract is one of the types of civil law agreements (GPC), in which:

- the contractor (performer) has the obligation to perform the work stipulated by the contract according to the customer’s instructions;

- The customer assumes the obligation to accept the results of the work performed and pay for it.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Find out what to pay attention to when concluding a contract in this article.

To reflect “contract” income in 6-NDFL, the following data will be required:

- the cost of “contract” work - it falls on page 020 of section 1 of the report;

- calculated and withheld personal income tax - it is reflected on lines 040 and 070;

- in section 2 of the report, blocks pp. 100–140 are filled in for each date of “contract” payments (they will be discussed in more detail later).

In order for “contract” payments to be reflected without errors in 6-NDFL, you should remember the following tax requirements:

- all payments under the contract (including advances) are subject to reflection in 6-NDFL (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982);

- the data in section 1 of the report is presented on an accrual basis, in section 2 - for the last 3 months of the reporting period;

- the date an individual receives “contract” income is the day it is transferred to the card or money is issued from the cash register, including the date the advance is issued to the contractor. But the date of signing the work acceptance certificate does not matter, which is confirmed by tax authorities (see, for example, letter from the Federal Tax Service for Moscow dated January 16, 2019 No. 20-15 / [email protected] );

- The deadline for transferring personal income tax is no later than the day following each “contract” payment.

Find out the nuances of a contract from the perspective of international standards from the article “IFRS No. 11 Contracts - application features” .

Nuances of generating a report when transferring advances

When transferring advance payments for work that are formalized by civil and process agreements, they are included in cell 020. The line is filled in with a cumulative total from the beginning of the year. Otherwise, filling out the section occurs as usual.

If no payments under the contract were made during the reporting period and only accrual is reflected, you need to fill in the corresponding total indicators in cells 020 and 040. Personal income tax should be withheld only when the profit is paid. Therefore, column 070 is filled out during the period of income transfer.

In the second part of the declaration, information is indicated in relation to transactions of this reporting period. If summary expressions are listed on the same day according to the GPA with several contractors, they are combined into one block of fields 100-140.

Example of filling out calculation 6

Let's look at an example of filling out a declaration.

The organization entered into a deal to carry out contract repair work with individuals. face:

- Implementation period – 3rd quarter;

- On August 15, an advance payment in the amount of 5,000 rubles was paid;

- the final payment was made on August 29 in the amount of 22,000 rubles.

Sample of filling out part 1 of calculation 6 of personal income tax under a contract:

In the second part, both the advance payment and the final transfer of profit are reflected in different blocks.

Reflection of the final calculation:

- 100 – 29.08 – date of receipt of income under the GPC agreement;

- 110 – 29.08;

- 120 – 30.08;

- 130 – 22 000;

- 140 – 2,860 – amount of accrued income tax.

Possible subjects of the contract

The subjects of the contract are the contractor (that is, the one who performs the task for a fee) and the customer (who needs to obtain the result of a certain activity after a specified period of time). The parties to the agreement can be both individuals and legal entities.

Thus, the following entities have the right to enter into a contract between themselves:

- legal companies (individual entrepreneurs - hereinafter referred to as individual entrepreneurs);

- individuals who are not individual entrepreneurs;

- citizen (customer) and organization (contractor);

- a legal entity (customer) and an individual who is not an individual entrepreneur (contractor).

Payment for services and compensation expenses

Under the terms of the contract, in a number of cases, the customer undertakes, in addition to the remuneration indicated therein, to pay the contractor’s expenses incurred when completing the task. For example, expenses for travel or accommodation of contractor employees, for the rental of special equipment or unique devices, and other compensation for actual and justified expenses. These amounts, even if they are provided for within the framework of the concluded agreement, must be taken into account separately. In most cases, they should not be included in the base for calculating the duty on personal income (hereinafter referred to as personal income tax) and insurance premiums and are not accepted for deduction for value added tax (VAT).

https://youtu.be/St6TZ0R0P04

Tax withholding

When concluding an agreement, it is important to understand who pays the personal income tax under the contract. For a contractor - a citizen who is not an individual entrepreneur (and only for him) - payment from the customer (company) for completing the task is income, and it must be subject to personal income tax.

Advice! If the customer is a legal entity, then he acts as a tax agent who is obliged to calculate, withhold and pay this tax to the budget, and then reflect these accruals and payments in the appropriate reporting forms: quarterly (in 6-NDFL) and annually (in certificates 2-NDFL).

6 personal income tax under the GPC agreement

Preparing, forming and submitting 6-NDFL for an accountant is a very difficult and responsible task. The report is compiled on an accrual basis from the beginning of the calendar year and is submitted to the Federal Tax Service quarterly via electronic communication channels or on paper (if there are 24 or fewer total recipients of taxable income), within the established time frame:

- for the first quarter - no later than the last day of the month after the expired quarter;

- for the 1st half of the year - no later than the last day of the month following the expired quarter;

- for 9 months - no later than the last day of the month following the expired quarter;

- a year - until April 1, inclusive.

Filling out 6 personal income taxes under a contract with an individual has features, information about which will be discussed below.

Features of reflecting income in 6 personal income taxes

Contractual relations are concluded with individuals. persons, individual entrepreneurs or non-residents. When generating a report, the filling details differ for each case.

- Individual entrepreneurs independently calculate taxes and generate reports on them. When drawing up a GPC agreement with an individual entrepreneur and 6 personal income tax on this profit is not filled in, and the organization does not calculate income tax;

- if the contract is concluded with a non-resident, the personal income tax rate is 30%.

In section 1, indicate the corresponding rate in field 010.

The second part of the declaration for this example will be completed as usual. Column 140 reflects taxes at a rate of 30%.

To reflect the advance:

- Fields 100 and 110 – 15.08;

- 120 – 16.08;

- 130 – 5 000;

- 140 – 1 500.

Filling out the graph block for the final calculation:

- 100 and 110 – 29.08;

- 120 – 30.08;

- 130 – 22 000;

- 140 – 6 600.

The nuances of “contract” payments

A contract may be concluded with an individual:

- having the status of individual entrepreneur;

- being a non-resident (a subject staying on the territory of Russia for less than 183 calendar days within 12 months).

For 6-NDFL this means:

- The money paid by an individual entrepreneur under a contract is not reflected in 6-NDFL by the tax agent - the entrepreneur himself pays taxes on the income received and reports on them;

- “contract” income of a non-resident is taxed at a rate of 30% (instead of the usual 13%).

Payment of income to a non-resident will not in any way affect the completion of the dates in the 2nd section of 6-NDFL, and pages 130 and 140 of this section and the lines of section 1, reflecting the personal income tax calculated from “contract” income, will change and will be reflected as follows:

Thus, the status of an individual affects the fact of reflecting “contract” income, as well as the amount of personal income tax.

The article “Tax resident of the Russian Federation is…” will tell you more about the status of a tax resident.

Example of filling out a declaration

- The advance is 70,000 rubles;

- On November 30, a transfer was made minus income tax - 9100. The tax was transferred to the treasury simultaneously on November 30:

- the act for contract work was signed on December 29;

- professional deduction amounted to 95,000 rubles;

- the transfer of profit to the contractor in the amount of 100,000 rubles was made on December 30;

- personal income tax withholding, taking into account the deduction, was made on December 30 in the amount of 650 rubles;

- The accountant completed the transfer of income tax on the first working day after the holidays - January 9.

The GPC agreement in declaration 6 of personal income tax in the annual report will be as follows:

The final payment is not included in the annual report. You show it in the second part of the report for January – March.

What is a civil contract?

A GPC agreement is a separate specific type of agreement. It can be as close as possible in its essence to labor, or it can be strikingly different from it.

A civil contract is concluded for the performance of certain work, which must be completed once and within a specified time frame.

Remuneration under such an agreement is usually paid based on the results of work, after signing a certificate of completion. However, by agreement with the customer, an advance payment may be provided.

Just as in the case of an employment contract, personal income tax is withheld from remuneration and transferred to the budget. The transfer of insurance premiums is usually not provided for in the contract, but by agreement with the customer such a clause can be included in the contract.

Personal income tax on payments under a civil contract

If an individual entrepreneur or an organization does not have the necessary specialists on staff or it is difficult to complete the work on their own, they enter into civil law contracts with third parties. For example, a contract or service agreement.

If the person involved is an individual entrepreneur, then formalizing relations with them is no different from relations with counterparties – organizations. Those. The individual entrepreneur issues an invoice for his services or a contract is concluded, the work and services are performed, and a certificate of completion is signed. Payment is transferred to the individual entrepreneur's bank account. Individual entrepreneurs pay taxes on their income themselves.

But if you simply involve an individual who is not registered as an individual entrepreneur, then the situation will be a little more complicated. And in this case, the customer organization will be obliged to withhold personal income tax from the income paid, because she will act as a tax agent. In this article we will discuss how to calculate and withhold personal income tax from payments under a civil contract for the performance of work or provision of services.

articles:

1. Features of a civil contract

2. Signing the acceptance certificate for completed work

3. Obligation to withhold personal income tax from payments under a civil contract

4. Personal income tax on cost compensation

5. Two points of view on withholding personal income tax from compensation of costs to the contractor

6. Standard tax deductions

7. Professional tax deduction

8. Accounting for payments and personal income tax deductions

9. Calculation of personal income tax under a contract in 1C

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

Features of a civil contract

Civil contracts for the performance of work (this is a contract) and the provision of services are regulated by the Civil Code (Civil Code) of the Russian Federation.

Individuals can provide you with services (regulated by Chapter 39 of the Civil Code) or perform work (regulated by Chapter 37 of the Civil Code). An important difference between a civil law contract and an employment contract is the presence of an individual specific task. The subject of such an agreement is always the final result of the work. And it is this result that the customer pays for.

Regardless of what you have - work or services, a contract or a contract for paid services, the general rules of the relationship between the customer and the contractor will be the same, since the contract provisions apply to the service contract (Article 783 of the Civil Code).

The parties to the contract are the customer and the contractor. The one who gives the task is called the customer (this is an organization or individual entrepreneur), and the one who carries it out is called the contractor. For a service agreement, the same applies to the customer and the contractor.

Under the terms of the contract, the contractor (performer) is obliged to perform specific work (provide a service), clause 1 of Article 702 of the Civil Code.

What exactly it consists of must be described in detail in the contract, which is concluded in writing.

In addition to the type of work or services performed, the contract specifies the start and completion dates of the work, the procedure for delivery and acceptance, the cost and payment procedure, and the parties’ responsibility for violating the terms of the contract.

The final price under the contract may include two parts:

- direct remuneration for the work (service) of the contractor (performer) (clause 1, 2 of Article 709 of the Civil Code);

- the cost of compensation for the contractor's (performer's) costs.

The payment procedure under the contract may provide for the payment of an advance. This can be either a fixed amount or a percentage of the total remuneration amount. Do not forget to state that in case of failure to fulfill obligations under the contract, the contractor is obliged to return the advance received to you!

Signing the acceptance certificate for completed work

Having completed the work, the contractor is obliged to hand over the result to the customer, and the customer is obliged to accept it.

The delivery and acceptance of the work result is documented in a delivery and acceptance certificate, which must be signed by the contractor and the customer (or their authorized representatives). Based on this act, the customer makes settlements with the contractor.

When drawing up an act, do not forget to include in it all the mandatory details provided for in Article 9 of Law No. 402-FZ “On Accounting”.

If the contractor incurs any costs associated with the work, the company or entrepreneur can pay them. The procedure for paying such expenses is determined in the contract. More on this a little later. For now, let's look at what such an act might look like.

The act is drawn up in two copies - one for each of the parties. Based on the signed act, payment for the work is made and expenses are recognized in accounting and tax accounting.

Obligation to withhold personal income tax from payments under a civil contract

An individual who performs work or provides services for an organization receives income. And this income is subject to personal income tax (clause 6, clause 1, article 208 of the Tax Code). The organization is the source of payment of this income, and therefore is a tax agent (clause 1 of Article 226 of the Tax Code). Therefore, the organization must withhold personal income tax from payments under a civil contract and pay it to the budget.

When discussing the price of the work performed with the contractor, in order to avoid conflict situations, please note that he will receive his remuneration minus the withheld tax.

You do not have the right to shift the responsibility of paying tax to an individual and thereby be released from fulfilling the duty of a tax agent. This is not provided for by law. Regardless of what you wrote in the contract.

Also, you cannot pay personal income tax at your own expense (clause 9 of Article 226 of the Tax Code), therefore the amount including personal income tax must appear in the contract.

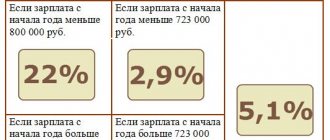

Personal income tax rates:

- for residents of the Russian Federation - 13%;

- for non-residents of the Russian Federation - 30%.

Please see the table below for information on the date of receipt of income, withholding and payment of tax.

| Name of payment (income) | Date of receipt of income | Tax withholding date | Tax payment (transfer) date |

| Payments under a civil law agreement (contract, lease, etc.) to a contractor who is not an individual entrepreneur | Day of payment of income (clause 1, clause 1.1, Article 223 of the Tax Code) | On the day of payment of income (clause 4 of Article 226 of the Tax Code) | No later than the day following the day of payment of income from which tax was withheld (clause 6 of Article 226 of the Tax Code) |

Tax is withheld directly from the amount of remuneration upon its actual payment (clause 1 of article 223 and clause 4 of article 226 of the Tax Code).

Do not forget that the performance of the duties of a tax agent by withholding and transferring personal income tax is not limited to:

- at the end of the year, no later than April 1 of the following year, a certificate in form 2-NDFL is submitted to the tax office;

- based on the results of the quarter in which the individual (your contractor or performer) received income, and based on the results of each of the subsequent quarters until the end of the year, you will show income and personal income tax in form 6-NDFL.

If the organization cannot withhold tax (for example, if the remuneration is paid in kind), then it must inform the tax office and the contractor himself (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Personal income tax on compensation of expenses

In connection with the execution by an individual of a civil contract, he may incur costs, for example, travel and accommodation costs, the acquisition of inventory items necessary to perform work or provide services. And the contract may provide for compensation of these actual costs by the customer (Articles 709, 783 of the Civil Code).

Compensation is paid when an individual provides primary documents on expenses incurred.

To pay expenses, you can draw up an act in any form, in which you indicate exactly what expenses were incurred, in what amount, and list the attached documents.

The act must also refer to the contract, which states the customer’s obligation to compensate for expenses incurred in connection with the execution of the contract.

The question arises: is it necessary to charge personal income tax on the amounts of such compensation? Unfortunately, there is currently no clear answer to this question.

According to Article 209 of the Tax Code, the object of personal income tax taxation is income received by the taxpayer. According to Article 41 of the Tax Code, income is recognized as economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed. Economic benefit is determined in accordance with Chapter 23 of the Tax Code.

But even there we will not find a clear definition of income. Clause 1 of Article 210 says that when determining the tax base, income in cash and in kind is taken into account. All! No specifics, the circle is closed.

https://youtu.be/wQhRwFggULg

As a general rule, even compensation received to reimburse previous expenses is recognized as income. And only in situations specifically stipulated by the legislator are these incomes not subject to personal income tax. Unfortunately, compensation for actual expenses incurred by an individual under a civil contract is not included in these cases.

Two points of view on withholding personal income tax from compensation of costs to the contractor

So, two points of view:

- Opinion of the Ministry of Finance

Source: https://azbuha.ru/ndfl/ndfl-s-vyplat-po-grazhdansko-pravovomu-dogovoru/

General requirements for filling out the report form

The general requirements for filling out 6NDFL in the presence of a GPC agreement are regulated by orders of the tax service.

It is stipulated that the report form is filled out for each OKTMO. That is, no matter how many OKTMO codes a company has, so many reports need to be submitted.

Despite the fact that a civil contract is a specific type of contract, data on it is reflected in the report on the same basis as regular wages and payments under an employment contract. Thus, the report is compiled on an accrual basis within the first section, for each tax rate applied in the company, and the second section reflects information for a single quarter. If different personal income tax rates were applied during the reporting period, then each of them is reflected in the report separately.

The report must be submitted to the tax office before the last day of the month following the reporting quarter.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Moment of reflection of remuneration for work and personal income tax in the reporting form

According to the legislation, namely Article 223, paragraph 1 of the Tax Code of the Russian Federation, the moment of reflection of income under a GPC agreement is the moment of their receipt. Since the date of receipt of remuneration is the date of its payment directly to the employee, personal income tax must also be withheld on the day the income is paid. The tax is transferred to the budget no later than the next day after the date of payment of income.

As you can see, issues that relate to the accrual and payment of income, as well as the withholding and payment of personal income tax, are no different from the same operations within the framework of an employment contract.

Filling out the title page and first section of the form

Let's start looking at filling out the reporting form from the title page.

At the top of the form you must indicate the company's Taxpayer Identification Number (TIN) and KPP.

Next, we indicate which report is being submitted - primary or corrective. If a corrective report is submitted, the adjustment number is entered in order, starting with one. In addition, the code must indicate the period for which the report was generated, as well as the tax period for which the report was compiled.

The line below is filled in with the tax authority code and the company location code.

Next you should write down the full or short name of the organization

If a reorganization has been carried out in relation to the company, then fill in the information about it.

Below we indicate the OKTMO code and the phone number where you can call a company representative

It is important to remember that if there are several OKTMO codes, then the report is filled out for each of them.

Section 1 contains generalized information and is filled in with a cumulative total. The following information must be filled in:

- We indicate the tax rate that is levied on the amount of remuneration under the contract, as a percentage. For Russian citizens the rate in most cases is 13%, for non-residents – 30%

- We reflect the amount of the contractor's remuneration under the contract. If the contract stipulates an advance, then its amount is also reflected here

- We write down the amounts of deductions that reduce the taxable income of the performer. Along with an employment contract, various types of deductions can be quite legally applied to GPC contracts. This issue is discussed with the customer in advance

- We show the amount of personal income tax calculated from the amount of remuneration minus deductions due to the employee

- We reflect the number of individuals who received income during the year. That is, here you need to indicate all those who work or worked in the company and received income throughout the year

- In the next line we indicate the amount of tax withheld. This is the amount of tax that is transferred to the budget on time

The section is filled out in the same way as when working under an employment contract.

Contract agreements in 6 personal income taxes clarifications of the tax inspectorate

Advance payment under the contract for the performance of work is 70,000 rubles. paid on November 30, 2016 minus personal income tax - 9,100 rubles. (RUB 70,000 x 13%). The tax is transferred to the budget on the same day.

That is, the act of completed work dated January 31, for example. This means that using the accrual method, we must accrue these costs into January accounting. And not when we decide to pay off this act.

How to reflect GPC in 6-NDFL (reflection of advance on GPC)

Typically, contract agreements are concluded for one-time work, for example, construction or finishing work, or other types of labor.

Employers act as tax agents in relation to individuals. the persons to whom they pay income withhold and remit income tax for them. Every quarter they report to the tax office, submitting reports. The report includes not only the employees of the enterprise, but also the performers under GPC agreements. How to reflect payments under contract agreements in 6 personal income taxes?

Advance payment under the contract for the performance of work is 70,000 rubles. paid on November 30, 2016 minus personal income tax - 9,100 rubles. (70,000 rub.

This is due to the fact that payments under the GPA have a date of receipt of income and a tax withholding date different from wages. Payments under the GPA have a date of receipt of income and a tax withholding date equal to the day of actual payment of money to individuals. In principle, everything is quite simple and transparent.

In practice, situations arise that seem simply impossible to solve.

If you have such misunderstandings, you should initially consult with a tax inspector, as well as get professional advice from an experienced lawyer who has been working in this particular field of activity for many years.

A work contract in 6-NDFL is reflected taking into account some nuances, because the payment of labor to persons hired under such documents is carried out according to different rules, and therefore requires a different approach when entering data.

Some people don’t wait even one day, while others can wait 2 months. Who will be able to come to an agreement with? There is not always enough money in the current account. In this regard, the idea immediately arose that the annual forms of 2-NDFL and section 1 of 6-NDFL would not coincide.

At the same time, the rules established by Art. 78 of the Tax Code of the Russian Federation, also apply to the offset or return of amounts of overpaid advance payments, fees, penalties and fines and apply to tax agents and payers of fees (clause 14 of Article 78 of the Tax Code of the Russian Federation).

The company entered into a contract with the employee. Along with the salary for April, on May 10, she issued remuneration under the contract. Salary - 38,000 rubles, personal income tax - 4940 rubles. (RUB 38,000 × 13%). Remuneration - 23,000 rubles, personal income tax - 2990 rubles. (RUB 23,000 × 13%).

This form of interaction does not imply the emergence of labor relations between the participants. The parties to the transaction are the customer and the contractor. The first one orders a certain service, for example, equipment repair, the second one performs the work within the time period established by the contract. The customer accepts the contract work, this fact is recorded in the act of completion, after which payment for services is made.

Taking into account the above provisions of the Tax Code, as well as the fact that payment for travel and accommodation is carried out in the interests of the organization, these amounts are not subject to taxation as income received in kind.

The question is: in section 1, line 020 “Amount of accrued income,” what amount should I have?

Consequently, the tax withheld from income paid for the performance of work at a stationary workplace under a contract to an individual is subject to transfer to the location of the specified workplace.

Remember that paying taxes is mandatory, because in any other case, you may suffer. So, if questions arise, you don’t need to leave everything to chance. It is imperative to find out who is obliged to make payments by law in order to prevent yourself from negative consequences in the first place.

Filling out section 1 and the title page of 6-NDFL when concluding GPC agreements (contract, provision of services) does not generally have any special features. The tax rate for GPC is the same as for wages.

The 6-NDFL report reflects only the income received and only in the period in which it was received. For example, if the contractor’s work was completed in March 2020, and the remuneration was paid to him in April 2020, then the tax agent will reflect his income in the report for the 2nd quarter of 2020.

As a general rule, this is 13%. Therefore, section 1 will be filled out in total for salary amounts and amounts under the GPA. Take all data from existing (consolidated) tax registers.

The 6-NDFL report reflects only the income received and only in the period in which it was received. For example, if the contractor’s work was completed in March 2020, and the remuneration was paid to him in April 2020, then the tax agent will reflect his income in the report for the 2nd quarter of 2020.

For contract agreements, lines in 6 personal income tax are filled out as follows:

- 100 – date of receipt of income by the contractor. Here you indicate either the day of transfer of funds or the day of cash issuance;

- 110 – date of personal income tax withholding (coincides with the day of payment of income);

- 120 – date of transfer of the fee according to the law. It is legally established that the transfer of fees to the budget must be made no later than the day following the withholding of personal income tax. Thus, even if the tax was paid on the day the reward was issued, the report reflects the next business day;

- 130 – the cost specified in the contract. If an advance payment is implied, then the amount of the advance and the settlement amount;

- 140 – amount of tax withheld.

Are GPC agreements included in 6 personal income taxes 2018

Income received in kind includes, in particular, payment (in whole or in part) for an individual by organizations for goods (work, services) or property rights, including utilities, food, recreation, training in the interests of the taxpayer (clause 1 clause 2 article 211 of the Tax Code of the Russian Federation).

If the contractor under the contract has the right to tax deductions (for example, professional), they are reflected in field 030 and reduce the amount subject to taxation. Such a right must be documented.

In the 6-NDFL report, payments are reflected in the first section in full, along with accrued wages at the enterprise. In the second section, each payment should be highlighted in a separate line.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Completing the second section of the report

The second section is filled in with data for each individual quarter.

| Line | How to fill |

| 100 | Unlike an employment contract, remuneration under a GPC agreement can be accrued and paid on any day of the month, in accordance with when the work was completed and the act was signed. Therefore, we indicate the date of accrual of income |

| 110 | In this line, you must indicate when the income was actually paid and personal income tax was withheld from the remuneration paid. This date is the same as the date in line 100 |

| 120 | This is the date the tax is transferred to the budget. That is, the next day after payment of income. If the tax payment date falls on a weekend, the payment date is postponed to the next business day |

| 130 | Here is the amount of remuneration accrued to the employee. If the contract provides for an advance, then the amount of the advance may be indicated in the line |

| 140 | The amount of personal income tax calculated from the employee’s income is indicated. |

Payments under the GPC agreement in 1C ZUP 3.0 (8.3)

In the information base 1C ZUP 3.0 (8.3) there are two options for payments under civil contracts:

- Payment is made once at the end of the GPC agreement. The expiration date of the contract will be the payment date for 6-NDFL:

- Payment under the GPC agreement is made on the date of the “Acceptance Certificate for Work Completed”. The document “Acceptance Certificate of Completed Work” is entered into 1C ZUP 3.0. In this act it is necessary to indicate the actual date of payment, that is, when the amount under the GPC agreement is paid. In fact, the payment may not even be activated, but the document must be entered into the 1C ZUP 3.0 program and the date of payment must be indicated:

In the information base 1C ZUP 3.0, payments under GPC agreements can be accrued in a separate document “Calculation of salaries and contributions”. Clicking the “Selection” button will fill in the “Agreements” tab, which reflects the date of payment under the GPC agreement. This date can be generated from the “Certificate of Work Completed” document, or when calculating wages, you can enter the required payment date yourself. This payment date will be reflected in line 100 of form 6-NDFL:

Accordingly, personal income tax on this income will also be on the date of receipt of income:

Reflection of advances under the GPC agreement in 6NDFL

Payment under a civil contract can be made upon completion of all work, after signing the act. Or an advance may be provided and this amount should also be reflected in the 6NDFL report.

The amount of the advance, as a general rule, is reflected in line 020 of section 1, since it is part of the total income of the individual. Since the final payment is made at a later date, in section 2 the amount of the advance payment and the final payment are indicated in different blocks. Moreover, the advance payment is also withheld and transferred to the personal income tax budget.

In addition, do not forget that if the transfer of income or an advance portion of income occurs on the last day of the quarter, then it must be reflected in Section 2 in the report of the next period.

Some features when compiling 6NDFL

In addition to the above points, when filling out the report, one should not forget that in the case when the work (service) is performed by a non-Russian citizen, his income is taxed at a rate of 30%.

There is also a nuance if an individual entrepreneur works under a civil law agreement. Remuneration under a civil contract is the income of the entrepreneur, who, in turn, independently submits all reports and transfers the tax for the income received to the budget. The organization that paid the income is not a tax agent in this case and does not report to the tax office for these amounts.

As you can see, filling out the 6NDFL report on civil law contracts is not much different from filling out the reporting form on employment contracts. To reflect payments under GPC agreements, it is not necessary to fill out any special sections or allocate such amounts separately. When filling out the report, special attention should be paid to the dates of payment of income and tax withholding, since remuneration is paid not at the end of the month, but upon completion of work. The amounts of advances under the contract are reflected both in the first section of the report and in the second. Moreover, the amount of the advance and the final payment should be shown in different blocks.

How to reflect a GPC agreement in 6-NDFL

As a general rule, payments under a GPC agreement are subject to personal income tax (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation, clause 1, article 210 of the Tax Code of the Russian Federation). The tax agent who is the source of income for the individual must withhold and transfer the tax to the budget (clause 1 of Article 226 of the Tax Code of the Russian Federation, clause 1 of Article 24 of the Tax Code of the Russian Federation). But if a civil contract is concluded:

- with an individual entrepreneur, then personal income tax is paid by the entrepreneur himself by virtue of paragraph 1, paragraph 1 and paragraph 2 of Article 227 of the Tax Code of the Russian Federation. In this case, the customer should request from the contractor a copy of the certificate of state registration as an individual entrepreneur (a copy of an extract from the Unified State Register of Individual Entrepreneurs - if the entrepreneur was registered after 01/01/2017); - with a citizen who performed work (provided a service), received remuneration abroad and based on the results of the years is not recognized as a tax resident of the Russian Federation, then his income is not subject to personal income tax (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation, clause 2, art. .209 Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 11, 2009 No. 03-04-06-01/206).

The tax agent withholds personal income tax from the remuneration under the GPC agreement:

at a rate of 13% if it is paid:

- to the performer - a tax resident of the Russian Federation (clause 1 of Article 224 of the Tax Code of the Russian Federation);

- a citizen of a country participating in the EAEU (for example, Belarus, Armenia, Kazakhstan) regardless of his residence status (Article 73 of the Treaty on the EAEU);

- a foreigner working in Russia on the basis of a patent, regardless of his residency status (paragraph 3, clause 3, article 224 of the Tax Code of the Russian Federation, article 227.1 of the Tax Code of the Russian Federation);

- a highly qualified foreign specialist, regardless of his residency status (paragraph 4, paragraph 3, article 224 of the Tax Code of the Russian Federation);

- a participant in the program for the resettlement of compatriots living abroad to the Russian Federation, regardless of his residency status (paragraph 5, clause 3, article 224 of the Tax Code of the Russian Federation);

- a refugee or a person who has received temporary asylum in Russia, regardless of his residency status (paragraph 7, paragraph 3, article 224 of the Tax Code of the Russian Federation);

at a rate of 30% if it is paid:

- to the performer - a non-resident of the Russian Federation (paragraph 1, clause 3, article 224 of the Tax Code of the Russian Federation).

In this case, the “physicist” has the right to claim the following personal income tax deductions:

- standard tax deduction (for yourself and/or children);

- professional tax deduction.

Notice! The customer cannot provide a property deduction to the contractor under a civil contract, since he is not the employer in relation to him (clause 3 of Article 220 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 14, 2011 No. 03-04-06/7-271 ).

The concept of professional tax deduction is explained by Article 221 of the Tax Code of the Russian Federation. In accordance with clause 2 of this norm, individuals who receive taxable income from the performance of work (provision of services) under GPC agreements have the right to reduce it by the amount of actually incurred and documented expenses associated with the fulfillment of obligations under the agreement. To do this, you need to submit a corresponding application to the tax agent.

Note! The contractor can receive personal income tax deductions only if he is a tax resident of the Russian Federation. This follows from clause 1 of Article 218 of the Tax Code of the Russian Federation, clause 3 of Article 210 of the Tax Code of the Russian Federation and clause 1 of Article 224 of the Tax Code of the Russian Federation.

6-NDFL and GPC agreement

Civil law contracts include contracts for the provision of services on a reimbursable basis (for example, renting property from an individual), etc. They are agreements in which a private person - contractor/contractor/lessor, undertakes to perform a set of works specified in the contract or provide certain services , and the customer must accept and pay for them.

Payment under a GPC agreement is income subject to personal income tax, so the customer has the obligation of a tax agent. He must accrue the payment amount to the contractor, withhold and transfer personal income tax from it, and also notify the Federal Tax Service about the conduct of these operations, i.e. fill out form 6-NDFL.

Calculation of 6-NDFL

This calculation is required to be completed by all tax agents for personal income tax and submitted quarterly to the tax authority no later than the last day of the month following the reporting period. Read more in the article “Who must submit a report on Form 6-NDFL”. The annual calculation is due no later than March 31 of the following year. The rules for filling out the calculation and its form were approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] Here you can download the current calculation form.

Now let's talk about the rules for filling out the 6-NDFL calculation when taking into account the amounts paid under the GPC agreement. To study the procedure for reflecting information on GPD in the calculation of 6-NDFL, let’s take a contract. Data for other civil contracts, for example, lease of property, provision of services, are entered in a similar way.