Accounting for import transactions

In accordance with the Federal Law of December 8, 2003 No. 164-FZ “On the Fundamentals of State Regulation of Foreign Trade Activities” (as amended and supplemented) (clause 10 of Article 2), import of goods is the import of goods into the Russian Federation without the obligation to re-export .

To avoid problems with legislation, it is necessary to very scrupulously maintain both accounting and tax records of import transactions.

Accounting for import transactions is in many ways similar to tax accounting, but there are a number of distinctive features:

| Similarities | Differences |

| When determining the cost of goods, the costs incurred by the taxpayer when importing goods into the territory of the Russian Federation are taken into account. Actual costs can be classified as expenses when calculating the organization's income tax. | When calculating income tax, an organization has the right to write off expenses in any manner convenient for it. |

Specifics of tax and accounting of imports

When accounting for the import of goods, as well as when paying duties, the primary cost is taken as a basis. When the cargo is registered, then, by analogy with accounting, it is also included in the price. When purchasing goods for the purpose of subsequent resale, the taxpayer has the right to independently determine the accounting procedure. You can choose from the following forms:

- In the cost of purchased goods. In this case, it will be possible to avoid tax differences when accounting for imports. However, they can only be written off after the sale of the batch.

- As part of indirect costs. If you accept this option, then the right to write off to reduce taxable profit arises immediately; implementation in this case is not mandatory. At the same time, the tax difference increases, and the complexity of accounting and tax accounting increases.

These procedures are regulated by articles of the Tax Code of Russia.

To avoid misunderstandings with the tax authorities, the procedure for accounting for imported goods should be prescribed in advance in the company’s accounting policy.

Accounting entries for accounting for import transactions

A detailed explanation of accounting and tax accounting for import transactions will be given below:

| Accounting entry | Explanation | Document confirming the operation | |

| D 60 | K 52 | Transfer of advance payment to the supplier for imported goods | Bank statement, payment order |

| D 76 | K 51 | Payment of customs duties | DT, bank statement, payment order |

| D 07 D 08-4 D 10 D 41 | K 60 K 76 | Ownership rights to goods as:

The owner makes an independent decision, guided by regulations. | Form No. OS-14 “Act of acceptance (receipt) of equipment” Form No. MX-1 “Act of acceptance and transfer of inventory items for storage” Form TORG-1 “Act of acceptance of goods” |

| D 19 | K 76 | Import VAT reflected | DT, bank statement, accounting certificate |

| D 07 D 08-4 D 10 | K 60 | Costs of delivering property to the territory of the Russian Federation | Accounting information |

| D 19 | K 60 | VAT on property transportation | Invoices, accounting certificates |

| D 01 | K 08-4 | Capitalization of received property | Form No. OS-1 “Act of acceptance and transfer of fixed assets (except for buildings, structures)” |

| D 68 | K 19 | Submitting import VAT for deduction | Invoice, accounting certificate |

| D 60 | K 91-1 | Accrual of positive exchange rate differences on settlements with suppliers in foreign currency | Accounting information |

| D 91-2 | K 60 | Accrual of negative exchange rate differences on settlements with suppliers in foreign currency | Accounting information |

| D 60 | K 52 | Final payment to the supplier for the imported goods | Bank statement |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Tax accounting of import transactions

According to paragraph 3 of paragraph 1 of Article 268 of the Tax Code of the Russian Federation, when selling property or property rights, the taxpayer has the right to reduce income from such transactions by the amount of expenses directly related to such sale.

The following expenses are accepted for accounting: (click to expand)

- at the rate;

- storage;

- service;

- transportation.

In accordance with Article 320 of the Tax Code of the Russian Federation, the procedure for determining expenses for trade operations is determined. According to this normative act, the amount of distribution costs includes expenses for:

- delivery of goods;

- warehousing costs;

- other expenses associated with the purchase of goods.

The taxpayer has the right to determine the cost of goods taking into account distribution costs. The formation of the cost of goods is explained in detail in the section “How is the cost of imported goods formed?”.

Example of accounting for import transactions

ABC LLC purchased goods in Spain for the amount of €8,000 on July 11, 2017. ABC LLC received property rights to the goods on July 11, 2017.

- Customs duty – 12,000 rubles.

- Customs duty – 15%.

- Calculated VAT: 8000*68.77*1.15*0.18=113883.12 rubles.

- Costs for delivery of property to the territory of the Russian Federation 34650.00 (including VAT 6237.00)

On July 16, 2017, the final payment for the goods was made. € exchange rate: 07/11/2017 – 68.77 rubles, 07/16/2017 – 68.36 rubles.

| Accounting entry | Explanation | Amount (rub.) | |

| D 76 | K 51 | Payment of customs duties | 12 000,00 |

| D 76 | K 51 | Payment of customs duties | 82 524,00 (8000*68,77*0,15) |

| D 07 D 08-4 D 10 D 41 | K 60 K 76 | Ownership rights to goods as:

The owner makes an independent decision, guided by regulations. | 550 160,00 (8000*68,77) |

| D 19 | K 76 | Import VAT reflected | 113 883,12 |

| D 07 D 08-4 D 10 | K 60 | Costs of delivering property to the territory of the Russian Federation | 34 650,00 |

| D 19 | K 60 | VAT on property transportation | 6 237,00 |

| D 01 | K 08-4 | Capitalization of received property | 550 160,00 |

| D 68 | K 19 | Submission for VAT deduction | 120 120,12 (113 883,12+6237) |

| D 60 | K 91-1 | Accrual of positive exchange rate differences on settlements with suppliers in foreign currency | 3 280,00 (8000*(68,77-68,36)) |

| D 60 | K 52 | Final payment to the supplier for the imported goods | 546 880,00 (8 000*68,36) |

Example

- Customs duty – 20,000 rubles.

- Duty 15% (20,000*70*0.15 = 210,000 rubles).

- VAT (20000*70*1.15*0.18 = 289800 rubles).

- Transport costs (35,000 rubles including VAT).

On April 10, 2018, payment was transferred to the supplier at the euro exchange rate of 69.80 rubles.

The exchange rate on the day the goods arrived at customs was 70 rubles.

In the postings, the buyer’s accounting department must reflect all the above amounts and transactions plus the inclusion of customs duty in the price of the goods (20,000 rubles), accrued VAT (289,800 rubles, debit 19, credit 68), deduction of VAT (including the amount of tax on transport costs), payment to the supplier in rubles at the exchange rate on the day of receipt of ownership of the goods (20,000 * 69.80 = 1,396,000 rubles).

Errors in accounting for import transactions

When accounting for import transactions, you must be very careful to avoid errors that are often identified during an audit:

- incorrect conversion of foreign currency into rubles when conducting a foreign exchange transaction;

- there is no translation into Russian of the text of the document on the basis of which payment is made from a foreign currency account;

- failure to meet deadlines for fulfilling obligations under contracts that provide for advance payments;

- incorrect correspondence of invoices for accounting of import transactions.

Documents required for registration of imported goods

According to the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (Article 9), each fact of economic activity must be subject to registration with a primary accounting document. To account for import transactions, the primary accounting documents, the presence of which is necessary for accounting and tax accounting of imported goods, are:

- foreign trade contract with the importer of goods;

- invoice issued by the seller;

- transport, forwarding documents;

- insurance documents;

- declaration of goods (DT);

- bank certificates confirming payment of customs duties and taxes;

- invoices, acts of acceptance of inventory items;

- technical documentation.

Import of goods to the Republic of Kazakhstan. Reflection in 1C.

May 5, 2014 This article discusses the topic of reflecting the import of goods in the accounting records of the Republic of Kazakhstan. Goods entering the market of the Republic of Kazakhstan “from abroad” can be divided into 2 large groups: imports from the countries of the Customs Union (which includes Kazakhstan since 2010) and, accordingly, imports from countries outside the Customs Union. All goods imported into the territory of the Republic of Kazakhstan are subject to customs clearance, except for imports from Belarus and the Russian Federation.

Albina Sartova, Accountant Intercomp Kazakhstan

Kazakhstan is a country with a high percentage of imported goods on the market, so we see similar products everywhere.

Delivery of imported goods, as any ordinary person knows, involves crossing the state border and is associated with the implementation of certain border and customs formalities.

Goods imported by persons under the temporary import regime are subject to declaration (indicating distinctive features) to the customs authority of the Republic of Kazakhstan in accordance with the Instructions for filling out a cargo customs declaration. At the same time, the customs declaration simultaneously becomes an obligation to re-export goods temporarily imported into the Republic of Kazakhstan.

The terms of temporary import and temporary export of goods are established by local customs authorities, but not more than two years.

With the entry into force of the Decision of the Board of the Eurasian Economic Commission, Kazakh importers, along with the customs declaration, are required to submit to the customs authorities documents certifying the compliance of the imported goods with the mandatory requirements of the Customs Union.

When declaring goods subject to mandatory conformity assessment, a declaration application is not accepted; this is a requirement of the legislation of the Customs Union in the field of technical regulation. Namely, the Regulations on the procedure for importing products (goods) into the customs territory of the Customs Union, in respect of which mandatory requirements are established within the Customs Union.

This norm is regulated by the Decision of the Board of the Eurasian Economic Commission dated December 25, 2012 No. 294.

Along with the customs declaration, the customs authorities are provided with documents certifying the compliance of such products with mandatory requirements, or information about such documents. These include: a certificate of conformity or a declaration of compliance of goods with the technical requirements of the Customs Union or the legislation of the member state in whose territory the products (goods) are placed under customs procedures.

The use of other documents is not regulated by Union and national legislation.

Storing goods in a temporary storage warehouse is quite expensive, and many entrepreneurs simply cannot afford to store goods in a temporary storage warehouse for a month or even two. However, the customs legislation of the Republic of Kazakhstan provides for alternatives. Those. Participants in foreign trade activities do not necessarily have to store their goods in a temporary storage warehouse while waiting for the issuance of a document confirming compliance with mandatory requirements.

Firstly, in accordance with Article 265 of the Customs Code of the Republic of Kazakhstan, upon a written application from a person with authority in relation to the goods, temporary storage of goods can be carried out in the recipient’s warehouse. To do this, it is not necessary to be included in the register of owners of places or temporary storage warehouses.

Secondly, in accordance with subparagraph 2) of paragraph 1 of Article 301 of the Customs Code of the Republic of Kazakhstan, imported goods can be conditionally released.

Conditionally released goods are considered to be goods placed under the customs procedure of release for domestic consumption, in respect of which restrictions on use and (or) disposal are associated with the submission of licenses, certificates, permits and (or) other documents necessary for the release of goods for free circulation.

Thus, a foreign trade participant can submit a customs declaration, pay all due payments and taxes, the customs authorities will carry out all the necessary procedures and conditionally release the goods.

It should be taken into account that conditionally released goods will acquire the status of goods of the Customs Union only after the provision of documents confirming the conformity of the goods and adjustment of the customs declaration, which means that until the provision of a document confirming compliance, the goods are prohibited from being transferred to third parties, including through their sale or alienation in any other way, and their use (exploitation, consumption) in any form is prohibited.

So, importing goods into Kazakhstan is a rather complicated procedure, requiring special knowledge not only in the field of accounting, but also in the field of tax and customs legislation.

The main part of customs clearance at the customs post includes:

— registration of a declaration (a statement in the established form of exact information about the goods and the customs regime);

— verification of all documents and information in them submitted for customs clearance (declarations of customs value, correctness of determining the country of origin of goods and their codes, etc.);

— verification of all financial documents and the correctness of determination of customs duties;

— the correctness of calculation of customs payments: customs duties (import, export, special, anti-dumping and countervailing duties), value added tax and excise taxes (levied when goods are imported into the customs territory), customs duties;

— final verification of the correctness of customs clearance of cargo in the declared customs regime and payment of customs duties.

If a company pays for the goods after shipment, then in tax and accounting the value of the goods is determined at the exchange rate on the date of transfer of ownership to the “receiving” company. When paying in advance, the cost of the goods in tax and accounting is determined at the exchange rate on the date of prepayment (in this case, the exchange rate difference does not arise when calculating income tax, as well as in accounting).

To register imported goods in accounting, you first need to collect a set of documents:

Contract

Invoice

Invoice

Additional costs (if any)

Currency exchange rate (at the rate of the National Bank of the Republic of Kazakhstan at the time of prepayment, if the company pays in advance; at the time of transfer of ownership, if the company pays after shipment of the goods))

Customs declaration (if the Supplier is located in a member country of the Customs Union, then customs declaration is not required)

The date of receipt of the goods is considered to be the date indicated in the “release permitted” stamp (lower right corner); if there is no customs declaration, then we set the date of actual receipt of the goods at the warehouse.

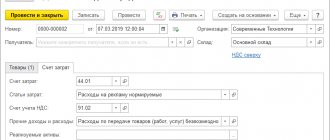

You can display information about customs duties and customs duties upon receipt of goods and fixed assets for import using the import customs declaration document (menu Purchase → import customs declaration). It is advisable to draw up this document on the basis of the document Receipt of Inventory and Services generated with the type of operation “Import”.

We proceed directly to entering the gas turbine engine. To do this, you need to enter, based on the Import receipt we just created, {Customer Customs declaration for import}

The “Basic” tab indicates the number of the customs declaration, the currency of mutual settlements for accounting for customs duties and fees, as well as the account for mutual settlements with the counterparty (3397).

The currency of the import customs declaration document is set using the “Prices and currency” button.

In the tabular part of the document, on the “Sections of Customs Declaration” tab, information on received imported goods (the “Inventory and Materials” tab) or fixed assets purchased through import (the “Fixed Assets” tab) is filled in. The invoice value of goods is entered in the currency of the “Customs Customs Document for Import” document. The list of goods can be taken from the document Receipt of goods and materials and). In this case, the entire list of inventory items goes from the document Receipt of inventory items and services to the tabular part of the corresponding section. Products that do not belong to this section can be deleted, and then repeat the procedure for the next section of the customs declaration.

We transfer information from the Customs Declaration about Customs Duty (in the Declaration it goes under “type of calculation of payment” 1010), Import Duty (2010), VAT Amount (5060), Customs Duty (2040).

Customs value (KZT) - the customs value is indicated in Kazakhstan tenge;

Customs duty - the amount of customs duty, currency, must correspond to the currency of mutual settlements;

Customs duty (KZT) - the amount of customs duty in the currency of mutual settlements. If it is necessary to indicate the amount of the duty in a currency, the “Duty in currency” flag is set. The import duty rate is indicated (reflected in the Declaration), the amount of the duty is calculated automatically;

The amount of VAT charged is indicated in tenge.

To check the amount of VAT, you can use the following formula: (customs value of goods + amount of import duty + amount of customs duty) * VAT rate (12%).

By clicking the “Distribute” button, the entered information on customs duties, fees and VAT is automatically distributed in proportion to the invoice value of the goods. Adding and removing sections of the customs declaration is done using the “Sections of the customs declaration” button and selecting the “Add” or “Delete” value.

If necessary, information about customs duties and VAT charged on each product can be adjusted manually.

The document can be carried out according to accounting and tax accounting. Information about accounting and tax accounts, the debit of which will include customs payments, with the exception of customs sanctions, is filled out in the tabular part “TMZ” (for the corresponding section of the customs declaration), in the columns “Accounting account (BU)”, “VAT account” , “Accounting account (NU)”.

When posting a document, in addition to entries (entries) for accounting and tax accounting, entries are made in the accumulation registers “VAT for reimbursement” in terms of VAT paid to the customs authorities.

Please note that if we indicated the amount in a currency in the Import Receipt, then it is automatically converted into the customs declaration, according to the specified exchange rate - in tenge.

So, we registered the customs declaration, which is displayed in the 1C Enterprise 8.2 program as follows:

Everyday practice shows that the matter is not limited to the receipt of gas turbine engines. As a rule, after receiving the main customs documents for the goods, the accounting department receives documents (invoices) reflecting the accrual of additional costs, which ultimately increases the cost of the incoming cargo (goods).

All this must be reflected in accounting. As a rule, invoices reflecting the receipt of additional expenses from brokers contain a reference to the customs declaration number. Using this number, we search the database for Import Receipt (which was registered at the first stage). And based on it (and NOT the customs declaration) we enter {Receipt of additional expenses}

We enter the total amount from the invoice from brokers into the “Amount of expense” (above the sign), select the VAT rate. We distribute the amount (the distribution method is by amount) by clicking the “Distribute” button on the top panel. I note that we do not transfer information about the services specified in the invoice (temporary storage, transportation, etc.), we are interested in the amount by which the cost of each received product will increase. Please pay attention to the Counterparty - you must replace it with the counterparty specified in the broker's invoice.

The wiring that will then need to be generated for you

DT 1330 KT 3310 for the invoice cost of the goods (at the exchange rate in tenge)

DT 1330 CT 3397 for customs procedures and duties (according to the customs declaration)

DT 1330 KT 3310 for additional expenses (according to documents)

DT 1420 CT 3130 for the amount of VAT (according to the customs declaration)

So, the customs value of goods represents the transaction price, that is, the amount actually paid for the goods. It consists of all payments directly to the supplier or other persons in favor of him. Let's list the main positions. The remuneration of intermediaries, the cost of containers and packaging, the cost of raw materials, materials, parts, semi-finished products that make up the imported goods, as well as tools, stamps, molds and other items used in the production of imported goods are taken into account. Expenses for transportation, loading, unloading or reloading of goods are also accepted. Also, the value may be increased by part of the income received as a result of the subsequent sale of imported goods, if it is due to the seller. And for royalties that relate to imported goods. The calculation of import payments depends on the value of the customs value of the goods, the determination of which must be documented.

And in conclusion, a few general points that an accountant needs to remember when registering imported goods:

Companies that apply the general regime can deduct the VAT paid when importing goods. To do this, you need to register a customs declaration and documents confirming tax payment in the purchase book.

The cost of goods for the purpose of calculating income tax is determined at the exchange rate on the date of their registration.

If a company pays for goods after they are delivered, in tax and accounting it is necessary to calculate exchange rate differences at the end of the reporting period, as well as on the date of payment for the goods.

Source: Accountant plus computer No. 5, May 2014

Additional links to our services: Accounting services Payroll in Kazakhstan Personnel leasing Accounting support Accounting outsourcing Back

Category “Questions and Answers”

Question No. 1. Are we required to make advance payments to a foreign seller when purchasing imported goods?

The obligation to pay an advance payment arises provided that this obligation appears in the contract that you have concluded with the foreign supplier. If the contract does not provide for an advance payment when purchasing imported goods, you are not obliged to pay it.

Question No. 2. Do I understand correctly that accounting for goods begins on the day the property rights to them are transferred, even if the goods have not yet been received and paid for?

Yes, in accordance with the legislation of the Russian Federation, the buyer of imported goods accepts the goods for fixed assets or inventories at the time of transfer of property rights from the seller.

Accounting for customs duties when purchasing intangible assets

First of all, let us remind readers what objects are included in intangible assets.

According to paragraph 4 of PBU 14/2000, intangible assets include the following objects of intellectual property (exclusive right to the results of intellectual activity):

- the exclusive right of the patent holder to an invention, industrial design, utility model;

- exclusive copyright for computer programs, databases;

- property right of the author or other copyright holder to the topology of integrated circuits;

- the exclusive right of the owner to a trademark and service mark, the name of the place of origin of goods;

- the exclusive right of the patent holder to selection achievements.

In accordance with paragraph 6 of PBU 14/2000, the initial cost of intangible assets acquired for a fee is determined as the amount of actual acquisition costs, excluding value added tax and other refundable taxes, except in cases provided for by the legislation of the Russian Federation. Actual expenses for the acquisition of intangible assets include, in particular, customs duties, patent duties and other similar payments made in connection with the assignment (acquisition) of the exclusive rights of the copyright holder, and other expenses directly related to the acquisition of intangible assets. Consequently, in accounting, customs duties and fees paid when acquiring intangible assets are included in the initial cost of these objects.

For profit tax purposes, in accordance with paragraph 3 of Article 257 of the Tax Code of the Russian Federation, intangible assets are recognized as the results of intellectual activity acquired by the taxpayer and other objects of intellectual property (exclusive rights to them) used in the production of products (performance of work, provision of services) or for the management needs of the organization for a long time time (lasting over 12 months).

Intangible assets for tax purposes include, in particular:

- the exclusive right of the patent holder to an invention, industrial design, utility model;

- the exclusive right of the author and other copyright holder to use a computer program, database;

- the exclusive right of the author or other copyright holder to use the topology of integrated circuits;

- exclusive right to a trademark, service mark, appellation of origin of goods and company name;

- the exclusive right of the patent holder to selection achievements;

- possession of know-how, a secret formula or process, information regarding industrial, commercial or scientific experience.

Research, development and technological work that did not produce a positive result, as well as the intellectual and business qualities of the organization’s employees, their qualifications and ability to work, are not considered intangible assets.

The assessment of the initial cost of intangible assets for the purpose of calculating income tax is regulated by Article 257 of the Tax Code of the Russian Federation.

The initial cost of amortizable intangible assets in accordance with paragraph 3 of Article 257 of the Tax Code of the Russian Federation is determined as the sum of expenses for their acquisition (creation) and bringing them to the state in which they are suitable for use, with the exception of value added tax and excise taxes, except for cases provided for by the Tax Code of the Russian Federation . Since payment of customs duties and fees may be a necessary condition for the acquisition of an intangible asset, the costs of paying them are included in the initial cost of intangible assets.