Cases of returning goods

In accordance with the norms of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the return of goods can be carried out:

- according to the law: if the goods were delivered of inadequate quality or not at all what was specified in the contract (i.e., there is a failure to fulfill the contract);

- an agreement (such a clause on the return of goods of proper quality may be specified in the contract, or may exist in the form of implementing the rules on the buyer’s responsibility if he does not pay the full amount for it on time).

Based on Art. 454 of the Civil Code of the Russian Federation, the seller transfers the goods to the buyer, who pays for it and takes ownership of it. At the same time, in accordance with Art. 223 of the Civil Code of the Russian Federation, the moment of transfer of goods is at the same time the moment of transfer of ownership of it from the seller to the buyer. In addition, the contract may establish another moment for the transfer of ownership.

The grounds for returning goods are given in the Civil Code of the Russian Federation. So, a refund can be made:

- in case of short delivery of goods (Articles 465 and 466 of the Civil Code of the Russian Federation);

- deliveries with a violation of the assortment (Articles 467 and 468 of the Civil Code of the Russian Federation);

- deliveries without proper packaging or in violation of the integrity of the packaging (Articles 481 and 482 of the Civil Code of the Russian Federation);

- the presence of a marriage (Article 475 of the Civil Code of the Russian Federation);

- detection of shortages (Articles 479 and 480 of the Civil Code of the Russian Federation);

- if the seller did not transfer accessories or documents related to the goods within the prescribed period (Article 464 of the Civil Code of the Russian Federation).

The contract may also provide for other grounds for returning goods.

In these cases, the buyer has the right to refuse to accept the goods and is not obliged to pay its cost, while the received advance payment must be returned by the seller upon the buyer’s first request.

Legal assistance

Analysis of law enforcement indicates the presence of certain gaps in the legislative regulation of liability for abuses in the field of public procurement by persons representing the interests of state or municipal customers, as well as persons executing state or municipal contracts. March 7, 2020 Draft Federal Law No. 408171-7 “On the peculiarities of the participation of socially oriented non-profit organizations in the privatization of leased state or municipal real estate and on amendments...” The purpose of this bill is to provide socially oriented non-profit organizations with preferences when alienating subjects from state property Russian Federation or from municipal property of real estate leased by these organizations.

We recommend reading: Date of Acceptance Certificate Ministry of Finance

Indication in the declaration of a negative difference between the amount of returned advances and the amount of income received leads to an unlawful declaration of tax for refund from the budget. However, the cassation court found the conclusions of lower colleagues unfounded. And that's why. In the case of an advance refund, the income of the tax (reporting) period in which the refund was made is reduced by this amount.

The position of the Ministry of Finance and the Federal Tax Service regarding the return of goods with VAT simplified

In all situations when it comes to returning goods, the Federal Tax Service and the Ministry of Finance of Russia use two concepts: return of goods and reverse sales. At the same time, according to both the financial and fiscal departments, the return of goods takes place if the goods and materials were not capitalized by the buyer. But if the goods were accepted for registration by the buyer and then returned to the seller, then reverse sales take place. And an agreement with the seller to return the goods if for some reason it was not sold is nothing more than a sale.

But such differences (return of goods or their resale) are important if the buyer is subject to the general taxation system.

For more information, see the material “What is the procedure for accounting for VAT when returning goods to a supplier?” .

However, the financial department has already explained more than once what to do if the goods are returned by a simplifier who does not apply the deduction because he is not a VAT payer.

The Ministry of Finance of Russia, in its letter No. 03-07-15/8473 dated March 19, 2013, clearly indicated that it does not matter what kind of goods the simplifier returns (posted or not), the procedure for issuing invoices for the seller will be the same.

The Federal Tax Service of Russia, in its letter dated May 14, 2013 No. ED-4-3/ [email protected], confirmed compliance with the standards specified by the Ministry of Finance. At the same time, the fiscal department reminded that the seller can apply a deduction for returned goods only for a year from the date of formalized refusal of the goods or its return by the buyer (clause 4 of Article 172 of the Tax Code of the Russian Federation).

“Simplified”: we return goods to the supplier

Unlike the refusal of a low-quality product, to which the buyer has the right by force of law, the return of a quality product is always a consequence of the agreement of the parties to the supply contract.

Example 1 . In March 2012, the supplier shipped a batch of 1,000 products to the buyer. in the amount of 200,000 rubles. excluding VAT (“accounting” cost per unit of production is 150 rubles). According to the terms of the contract, the buyer has the right to return quality goods that he has not sold within three months from the date of delivery. The buyer, who is a VAT payer, exercised this right and returned the goods in the amount of 300 pieces to the supplier, and also presented VAT in the amount of 10,800 rubles. and issued an invoice.

The following entries will be made in the buyer's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| At the time of purchase of the goods | |||

| Goods received | 41 | 60 | 200 000 |

| At the time of returning the goods | |||

| The goods were transferred to the supplier (RUB 200 x 300 pcs.) | 76 | 41 | 60 000 |

| VAT charged | 76 | 68 | 10 800 |

Now let's move on to the seller's tax obligations. Let us recall that we previously concluded that the tax consequences of returning a quality product are the same as when returning a low-quality product, that is, the income tax payer must reflect:

- as part of non-operating expenses - the amount of payment for the goods returned to the buyer as losses of previous tax periods identified in the current reporting (tax) period (clause 1, clause 2, article 265 of the Tax Code of the Russian Federation);

- as part of non-operating income - the cost of the goods returned by the buyer, by which the income from its sale was reduced, as income from previous years identified in the reporting (tax) period (clause 10 of Article 250 of the Tax Code of the Russian Federation).

By the way, the legitimacy of this approach was confirmed by Moscow tax authorities in Letter dated December 23, 2011 N 16-15/ [email protected] , which addressed the issue of returning high-quality non-food goods purchased at retail on the basis of Art. 502 of the Civil Code of the Russian Federation. Let's try to apply these conclusions to the tax obligations of the "simplified".

First of all, it is necessary to say about the special procedure for recognizing expenses for the production of finished products (this is relevant for taxpayers who have chosen as an object of taxation income reduced by the amount of expenses). Unlike ch. 25 of the Tax Code of the Russian Federation in its chapter. 26.2 does not contain rules governing the calculation of product costs, and the recognition of production costs is not made dependent on the fact of its sale. Expenses that are allowed to be recognized by Art. 346.16 of the Tax Code of the Russian Federation are included in the calculation of the tax base subject to their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). The recognition of expenses only in the form of the cost of purchased goods and the amount of “input” VAT on them depends on the moment of sale (clause 8, 23 clause 1 of article 346.16, clause 2 of clause 2 of article 346.17). Obviously, this rule does not apply to finished products. Thus, regardless of the fate of the products produced, expenses that meet the conditions of Chapter. 26.2 of the Tax Code of the Russian Federation are included in the calculation of the tax base. All these expenses, already at the time of implementation, must meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation), which means there is no reason to adjust them in the future.

Next, ch. 26.2 of the Tax Code of the Russian Federation requires non-operating income to be included in the calculation of the tax base (clause 1 of Article 346.15), including income from previous years (clause 10 of Article 250). However, even if you want to show non-operating income in the form of the cost of the returned goods, the “simplified” taxpayer cannot estimate this value, since Ch. 26.2 of the Tax Code of the Russian Federation does not contain the necessary rules, but be guided by accounting data or the requirements of Chapter. 25 of the Code there is no reason. In other words, one of the mandatory conditions for recognizing income is not met - the ability to assess economic benefits (Article 41 of the Tax Code of the Russian Federation). Thus, regardless of the chosen tax object, the supplier does not recognize income in the form of the cost of returned products.

Let's move on to the issue of recognizing expenses in the form of the amount paid to the buyer for returned goods. The decision depends on whether the buyer has paid for the product before returning it. If the payment is received, then the supplier recognizes the proceeds from the sale in tax accounting (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Chapter 26.2 of the Tax Code of the Russian Federation does not provide for the possibility of recognizing non-operating expenses in the form of losses of previous years, therefore it will not be possible to translate the recommendations of financiers addressed to income tax payers into the procedure for calculating the single tax. Meanwhile, the return of the goods means that the seller did not receive any economic benefit from its sale, and this may still serve as a basis for adjusting the income of the “simplified”. The only question is how to do it technically. We believe that here you can use the explanations presented in the Letter of the Federal Tax Service for Moscow dated October 1, 2007 N 18-11/3/ [email protected] , according to which in such a situation it is possible to recalculate tax liabilities in accordance with Art. Art. 54 and 81 of the Tax Code of the Russian Federation. When taxpayers applying the simplified tax system return the amount of money paid by buyers for goods, the tax base for the tax paid in connection with the application of the simplified tax system is clarified starting from the reporting (tax) period in which these funds were received. These transactions are reflected by taxpayers using the simplified tax system in the book of income and expenses of organizations and individual entrepreneurs using the simplified system (if the goods were returned in the current tax period), or in the tax return for the tax paid in connection with the use of the simplified system. system (in case the goods are returned in the next tax period). In this case, adjustments are made only to those indicators for which errors (distortions) were detected.

If payment for goods subsequently returned is not received and income is not recognized, then there is no need to adjust tax liabilities.

At the same time, we must not forget that the buyer who pays VAT will present the amount of this tax in addition to the price when returning the goods. What to do with it? We believe that when adjusting previously recognized income, we can only talk about an amount equal to the receipt from the buyer. The supplier has no right to reduce income by the cost of the returned goods, including VAT. The tax presented is an expense of the taxpayer, the question of recognition of which arises only if the object of taxation is income reduced by the amount of expenses. And, unfortunately, such expenses are not taken into account when calculating the single tax, since they are not included in the closed list of expenses (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Subclause 8, clause 1, art. 346.16, which is allowed to include in expenses the amount of VAT on goods paid by the taxpayer, cannot be applied, since the returned products are not goods purchased for further sale (the return of goods under the terms of the contract or on the basis of termination of the contract is not a sales transaction).

Accounting entries do not depend on the taxation system used by the company. Let's show the postings in the accounting of a “simplified” supplier using an example.

Example 2 . Let's use the conditions of example 1.

The following entries will be made in the supplier's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| At the time of product sale | |||

| Product sales reflected | 62 | 90-1 | 200 000 |

| Cost of goods sold written off | 90-2 | 43 | 150 000 |

| At the time of product return | |||

| Reversal Adjusted revenue from product sales (300 pcs. x 200 rub.) | 62 | 90-1 | (60 000) |

| Reversal Adjusted cost of goods sold (300 pcs. x 150 rub.) | 90-2 | 43 | (45 000) |

| The debt to the buyer is reflected in the amount of VAT claimed | 91-2 | 62 | 10 800 |

Example 3 . Let's change the conditions of example 2. The goods were shipped in December 2011, and returned (in accordance with the terms of the supply agreement) in May 2012 (that is, after the supplier's annual financial statements were signed).

The following entries will be made in the supplier's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| At the time of product sale | |||

| Product sales reflected | 62 | 90-1 | 200 000 |

| Cost of goods sold written off | 90-2 | 43 | 150 000 |

| At the time of product return | |||

| Recognized in other expenses is the amount payable to the buyer | 91-2 | 62 | 70 800 |

| An amount equal to the cost of returned quality products is recognized in other income. | 43 | 91-1 | 45 000 |

Returning goods from a simplifier

In Chapter 21 of the Tax Code of the Russian Federation there are no exceptions for the procedure for sellers to apply deductions when returning goods from a buyer who is on a simplified taxation system and therefore is not a VAT payer. To explain to taxpayers how to proceed in this situation, the Ministry of Finance has provided two options for the development of events, regardless of whether the goods accepted or not accepted for accounting by the buyer are returned (letter No. 03-07-15/8473):

- when the buyer returns the entire product;

- when the buyer returns the goods partially.

The seller has the right to a deduction in accordance with clause 5 of Art. 171 Tax Code of the Russian Federation. In the purchase book, he makes an entry either on the basis of a previously issued invoice or on the basis of an adjustment invoice. This will be discussed in more detail below.

Find out how to keep VAT records in a simplified manner here.

Full refund

In this case, the financial department (and after it the Federal Tax Service of Russia) recommends that the seller be guided by the standards specified in clause 5 of Art. 171 Tax Code of the Russian Federation. In this case, the invoice registered by the seller in the sales book when shipping goods is registered by him in the purchase book as the right to tax deductions arises, taking into account the provisions of clause 4 of Art. 172 of the Tax Code of the Russian Federation.

We will tell you more about the sales book and the purchase book here.

Return in parts

If the delivered goods are not returned in their entirety, but only in some part (and the reason for the return is unimportant), then there is a decrease in the quantity, and therefore in the cost, of previously shipped goods. This means, in accordance with paragraph 13 of Art. 171 and paragraph 10 of Art. 172 of the Tax Code of the Russian Federation, the seller must issue an adjustment invoice when returning goods from a buyer who is not a VAT payer.

Find out about the adjustment invoice from the article “What is an adjustment invoice and when is it needed”.

The value indicated on the adjustment invoices must correspond to the amount for which the goods were returned from the buyer.

It is important that the buyer registers the returned goods and prepares the necessary supporting documents.

USN: income upon repayment of advance payment

And if the seller returns in the current tax period advances received last year, and the taxpayer currently has no income. How can you adjust your tax obligations in this case?

In the case of an advance refund, the income of the tax (reporting) period in which the refund was made is reduced by this amount. As we said above, this rule is established by the Tax Code of the Russian Federation. This procedure for reducing income applies to both taxpayers using the simplified tax system with the object “income minus expenses” and to “simplified” taxpayers who have chosen the object “income”. This rule provides the taxpayer with the opportunity, when returning an advance payment, to exclude from the object of taxation the income that was actually not received in the tax period when the advance payment was returned to the counterparty. In this case, the return of the advance cannot be considered as expenses and is not a loss of previous periods.

Reflection in accounting

In the event of returning goods that have not been received by the buyer, the seller makes adjustments in accounting:

Dt 62 Kt 90 (reversal) - revenue from the sale of low-quality goods has been reduced;

Dt 90 Kt 41 (reversal) - the cost of low-quality goods has been reduced;

Dt 90 Kt 68.2 (reversal) - reduced VAT on shipped low-quality goods;

Dt 62 Kt 51(50) - the buyer’s money was returned.

If a quality product that has been accepted by the buyer for registration is returned, the following entries are used:

Dt 41 Kt 60 - the seller accepted the goods returned by the buyer for registration;

Dt 19 Kt 60 - VAT included;

Dt 62 Kt 51 - the seller returned the money to the buyer for the returned goods;

Dt 60 Kt 62 - debt adjustment.

The following materials will tell you about the nuances of using the simplified tax system:

- “Is a cash register needed under the simplified tax system in 2019?”;

- “The Ministry of Finance denies individual entrepreneurs using the simplified tax system the right to accept business travel expenses”;

- “They want to allow simplifiers not to submit reports.”

What documents are used to document the return of goods?

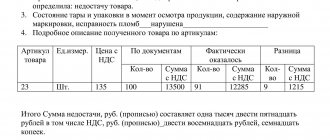

If a low-quality product is detected, a report on the identified defects is drawn up. This act is drawn up by the buyer, and it can also be signed by a representative of the seller. The form of the act can be presented in the supply agreement or developed by the buyer in accordance with its accounting policies. Based on this act, a claim is made to the seller, and the buyer will be able to recover from him losses associated with the supply of low-quality products (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated January 31, 2014 No. A53-27651/2012).

When returning a defective product that was previously accepted by the buyer for accounting, in addition to the acceptance certificate for the defective product, the TORG-12 form is also filled out, on which the note: “Return of goods” is made. This procedure is provided for in clause 2.1.9 of the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved by Roskomtorg letter No. 1-794/32-5 dated July 10, 1996.

This set of documents was also approved by existing judicial practice (resolution of the Federal Antimonopoly Service of the West Siberian District dated 08.08.2013 No. A45-22984/2012, which was confirmed by the ruling of the Supreme Arbitration Court of Russia dated 21.10.2013 No. VAS-14900/13).

Find out how to fill out a return shipping slip in this publication.

The invoice should indicate that a report on the identified deficiencies has been drawn up and a claim has been filed with the supplier. In this case, the act itself must be drawn up immediately after the discovery of deficiencies. If you have correctly executed documents, the buyer has a chance to confirm in court the fact and shelf life of the defective goods, and therefore compensate for their expenses for storing the defective goods until they are exported by the seller (Resolution of the Federal Antimonopoly Service of the Volga District dated November 20, 2013 No. A55-34907/2012 ).

When returning a quality product by mutual agreement, the parties must sign a return agreement. The transfer of goods itself is formalized by drawing up a consignment note (the TORG-12 form is most often used, on which the note: “Return” is made).

Find out about the updated formats of TORG-12 by following the link.

How to reflect the return of money to the buyer in the book of income and expenses

This is directly stated in clause 2.4 of the Procedure approved by Order No. 135n. How to keep a book of income and expenses in electronic format Most official portals with regulatory documents offer to download a file in MS Excel format for maintaining a register in electronic form.

We recommend reading: Young Family Program Izhevsk 2020

Let's look at examples of filling out a book of income and expenses depending on the moment of return of the prepayment. On February 28, the “simplified” contractor () entered into an agreement with the customer () for the provision of services on the terms of 100 percent prepayment.

Results

When returning goods from a buyer who is on the simplified tax system, the seller has the right to deduct VAT in any case. That is, for tax accounting it is completely unimportant for what reason the goods are returned.

In this case, the seller makes an entry in the purchase book when preparing documents for the return of goods by the buyer on the basis of:

- previously issued invoice (if the product is returned in its entirety),

- or an adjustment invoice (if part of the previously shipped goods is returned).

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Are refunds of advances from suppliers included in income under the simplified tax system?

As a general rule, it is not allowed to re-reflect the amount previously taken into account by the organization in income (clause 3 of Article 248 of the Tax Code of the Russian Federation). The organization will be able to recognize the advance payment transferred to the supplier using the simplified tax system as an expense only after goods (work, services) have been supplied to it (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Until then, the corresponding amount will be listed in the buyer’s tax records as his property.

An organization using the simplified tax system with the object “income minus expenses” transferred an advance to the supplier, which was later returned due to termination of the contract. Should this income be included in income?