Accounting for goods in accounting is carried out on account 41 “Goods”. Is there a difference in accounting for goods in wholesale and retail trade? What accounting nuances arise when selling inventory through an agent or when storing goods in the warehouses of a third party? Read the answers to these and other questions in the article.

Accounting for goods receipt

Accounting for sales of goods in an organization

How are goods transferred for storage accounted for?

Accounting for goods sold through an intermediary

Results

Accounting for goods receipt

Goods are inventories purchased for the purpose of subsequent sale without additional processing. Receipt of inventory items is reflected in the debit of account 41 in correspondence with mutual settlement accounts: 60, 71, 75, 86, etc. (chart of accounts approved by order of the Ministry of Finance dated October 31, 2000 No. 94n).

Goods are accepted for accounting at actual cost (clause 5 of PBU 5/01), which includes all costs incurred when purchasing inventory items:

- payment for goods to the supplier;

- transport costs;

- information and consulting services;

- customs duties;

- non-refundable taxes, etc.

At the same time, companies that use simplified accounting methods can take into account the above-mentioned direct costs as part of the costs of ordinary activities, provided that there are no significant inventory balances (clause 13.2 of PBU 5/01).

Find out about the nuances of simplified accounting in the article “Features of accounting in small enterprises.”

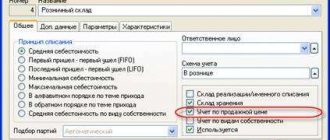

Accounting for goods in wholesale and retail trade has some differences. Companies that sell goods wholesale record them at cost of acquisition. Retail companies are given the right to choose to account for the cost of inventory items: either at the purchase price or at the sales price, with separate consideration of markups and discounts (clause 13 of PBU 5/01). The selected accounting option must be secured as an element of the enterprise's accounting policy.

Let's look at the main transactions when goods arrive.

| Wholesale | Retail | Content | ||

| Dt | CT | Dt | CT | |

| 41 | 60 | 41 | 60 | Goods received from supplier |

| 19 | 60 | 19 | 60 | VAT allocated |

| 41 | 60 | 41 | 60 | Related expenses reflected |

| 19 | 60 | 19 | 60 | VAT allocated on related expenses |

| 41 | 42 | Markup reflected | ||

Analytical accounting of account 41 is organized in the context of warehouses, financially responsible persons, names of inventory items, etc.

https://youtu.be/0NgIckcepbM

Accounting: goods in transit - account 45

Account 45 “Goods shipped” is used in supplier accounting. It is used to combine information about the availability and movement of goods released to the buyer during their transportation. The debit reflects the cost of goods transported to the buyer's warehouse; the credit records it off upon arrival at the place of receipt of the goods and materials.

Goods in transit: accounting entries from the seller

If the contract records the transfer of ownership of the goods at the time of receipt at the buyer’s warehouse, the supplier formalizes this operation as follows:

On the date of shipment, prepares a delivery note and an invoice. VAT on inventory items is accrued on the date of shipment, regardless of the terms of the contract;

The carrier company accepts the goods at the seller's warehouse, confirming their receipt in the invoice with a signature, and carries out transportation (for example, by rail);

After shipment, the supplier records the transferred inventory items in the account. 45, and after their receipt by the purchaser, recognizes income from sales, costs of transporting goods, accepting and paying the carrier’s invoice.

Accounting for sales of goods in an organization

When selling inventory items, they are assessed according to:

- Average cost.

- The cost of each unit.

- FIFO method (the first purchased goods are written off first).

Read more about the listed valuation methods in the material “Methods for valuing inventories.”

During retail sales, the selling price is written off to the debit of account 90.2 “Cost of sales”, and the markup is reversed. In accounting, these transactions look like this:

| Wholesale | Retail | Content | ||

| Dt | CT | Dt | CT | |

| 62 | 90.1 | 62 | 90.1 | Sale of goods and materials to the buyer |

| 90.3 | 68 | 90.3 | 68 | VAT charged |

| 90.2 | 41 | 90.2 | 41 | The cost of goods has been written off |

| 90.2 | 42 | Reversal surcharge | ||

The sale of goods must be accompanied by the following documents:

- For wholesale trade:

- Consignment note in the form TORG-12.

- Invoice.

- Transport documents: waybill in form T-1 and/or waybill.

- For retail:

- KKM check.

- Sales receipt (issued upon buyer's request).

The article “What are the features of warehouse accounting of goods?” will help you understand the issues of effective organization of warehouse accounting of goods.

Accounting for materials in transit

Inventories owned by the organization, but in transit or transferred to the buyer as collateral, are taken into account in accounting at the valuation provided for in the contract, with subsequent clarification of the actual cost.

The cost of materials remaining in transit at the end of the month or not removed from suppliers’ warehouses is reflected at the end of the month in the debit of account 10 “Materials” and the credit of account 60 “Settlements with suppliers and contractors” (without posting these values to the warehouse).

In a situation where ownership of materials transfers earlier than the actual receipt of materials at the warehouse, it is necessary to capitalize the specified materials to account 10 (without posting to the warehouse, and better without quantitative accounting, so that it is impossible to inadvertently write them off to production).

Transport delivery of goods can be organized by the seller or buyer using their own vehicle or through a transport company. The delivery method is provided for in the contract. This is a very important point in the contract, since it determines not only the moment of transfer of ownership, but also who will bear the risk of loss (damage) of the goods during transportation, as well as the method of accounting for transportation costs in expenses for accounting and tax purposes.

Ownership of the goods will pass to the buyer at the time of delivery of the goods to his warehouse (the consignment note is signed in the TORG-12 form). The seller can include the cost of delivery in the price of the product or indicate delivery in the documents as a separate service. The seller's accounting is carried out using account 41, and from an accounting point of view, the concept of “Goods in transit” does not arise. Delivery of goods is organized by the buyer with his own vehicle (pickup)

In this case, the delivery note is signed by an authorized representative of the buyer, which means that the transfer of ownership takes place at the seller’s warehouse. Further, the buyer himself is responsible for the goods.

In the above cases, the buyer’s obligation to pay for the goods arose at the time of receipt of the goods from the seller under the conditions specified in the contract. The seller records revenue in accounting, and the buyer registers the goods using goods accounting accounts

How are goods transferred for storage accounted for?

Companies can provide goods storage services. Such relationships are regulated by Ch. 47 Civil Code of the Russian Federation. The main actors in the storage agreement are the custodian (the person who accepted the goods for safekeeping) and the bailor (the company that gave the goods and materials for storage). In this case, the right of ownership of goods and materials does not pass to the custodian, and the goods must be returned within the terms specified in the contract.

The transfer of goods and materials is formalized by a transfer and acceptance certificate in form MX-1, and the return is accompanied by an act in form MX-3.

Forms and examples of filling out the above forms can be found in the publications:

- ;

- “Unified form No. MX-3 - form and sample.”

IMPORTANT! Organizations have the right to independently develop accounting forms taking into account their needs.

Accounting with the bailor

Since the transfer of goods and materials for storage does not imply a transfer of ownership, the goods continue to be accounted for on the balance sheet of the enterprise even after its transfer to secondary storage (physically the goods lot is in the warehouse of the custodian company). The wiring in this case will look like this:

- Dt 41 (warehouse of the custodian company) Kt 41 (sender's warehouse).

Accounting with the custodian

The custodian company records inventory items transferred for safekeeping in off-balance sheet account 002. In this case, analytical accounting is organized by owners, types, grades of goods, storage warehouses and financially responsible persons.

Receipt of goods is recorded on the debit of account 002, disposal - on its credit. Remuneration and expenses incurred in providing storage services for the custodian company are income and expenses for ordinary activities.

Storage and disposal of goods

After goods are accepted for accounting, they can be stored in a warehouse for some time until they are sent to the buyer. The storage of goods in a warehouse must be properly organized so that there is no confusion either in accounting or in the warehouse itself. Proper organized storage will allow you to find the right item at any time in the shortest possible time.

There are two ways to store goods:

- Party

- Varietal

Batch method of storing goods

This method is characterized by grouping incoming goods into batches as they arrive at the warehouse. Each batch is stored separately.

When accepting goods into the warehouse, the storekeeper or other financially responsible person draws up a batch card in the MX-10 form for each individual batch. The card is drawn up in two copies, one copy is transferred to the accounting department, the other remains in the warehouse.

When goods are removed from a batch for sale, the storekeeper makes a note in the batch card about the number of disposed goods, the date of shipment and the document on the basis of which it was released from the warehouse.

After all the goods from the batch have been shipped, there is no need for a batch card for this batch and the document is transferred to the accounting department.

Thus, the batch card allows you to control the balance of goods in the warehouse for each batch and shows the number of valuables shipped.

This storage method is convenient if each subsequent batch is noticeably different from the previous one (in quality, price or other characteristics).

Variety method of storing goods

With this method, all goods are grouped not by batches, but by varieties, brands, and names. Grouping occurs regardless of the date of receipt of goods.

When the next batch arrives, the goods are divided by item and added to those already in stock.

To control the movement of goods using the varietal storage method, an accounting log form TORG-18 is used. When goods arrive at the warehouse, a receipt order is issued, on the basis of which a record of receipt is already made in the TORG-18 journal. Similarly, when goods are removed from the warehouse, an expense document is drawn up, on the basis of which an entry is made about the disposal in the TORG-18 journal.

A product label is attached to each variety, brand, or product name, which is issued using the unified TORG-11 form. The label is always located next to the product, which allows you to find out at any time what kind of commodity values are stored in a given place and in what quantities. This data is usually used in the inventory process.

Storing goods in a warehouse may also be accompanied by the execution of documents such as:

- Card of quantitative and cost accounting form TORG-28, which is used for more detailed accounting of goods (analytical) taken into account in quantitative and cost terms

- Invoice for internal movement, form TORG-13, is used when it is necessary to transfer goods from one division of an enterprise to another, that is, when moving goods within the organization

- Report on damage, damage, scrap goods and materials, form TORG-15, is filled out if damaged goods are identified that are subject to write-off

Disposal of goods

As a rule, goods are purchased for the purpose of their further sale. Therefore, they are removed from the warehouse when they are sold to customers.

The sale of goods belongs to the usual activities of the enterprise and is registered using account 90 “Sales”, this is a complex account with several sub-accounts:

- the credit of the first subaccount reflects the proceeds from the sale

- on the debit of the second - the cost of commodity assets

- on the debit of the third – accrued VAT payable

- on the debit or credit of the ninth subaccount - profit or loss from sales

Note that the posting reflecting the shipment of goods to customers has the form D62 K90/1.

Valuation of goods when written off for sale can be carried out in one of the following ways:

- Based on the average cost of each unit

- At average cost

- FIFO method

The organization chooses one of the methods for itself and reflects it in its accounting policies.

Write-off of the cost of goods for sale is recorded using posting D90/2 K41.

This also includes sales expenses, which are written off at the end of the month from account 44 in proportion to the shipped commodity values using posting D90/2 K44.

Selling expenses may include:

- Transport and procurement costs (if they are accounted for separately on the 44th account

- Staff salaries

- Expenses for renting premises and equipment

- Depreciation of fixed assets and intangible assets

- Advertising expenses

- Entertainment expenses

- Expenses for business travel, etc.

If an organization is a value added tax payer, then VAT must be charged on the cost of goods for payment to the budget; the corresponding entry has the form D90/3 K68/VAT.

Shipment is made on the basis of a delivery note.

These entries are made if the transfer of ownership of the goods occurs at the time of shipment. If the contract provides for the transfer of ownership at the time payment is received from the buyer, then slightly different entries are made in the seller’s accounting, and an additional account 45 Goods shipped is used.

Accounting for goods sold through an intermediary

When selling inventory through an intermediary, the accounting of goods is organized in a special way. In this case, the goods do not become his property, and the accounting of inventory items with the intermediary is organized using off-balance sheet account 004 “Goods accepted on commission.”

Find out about the nuances of accounting for goods when selling or purchasing through an intermediary in the article “Features of an agency agreement in accounting.”

VAT upon shipment of goods

If goods are shipped in one tax period, and the ownership of the goods is transferred to the buyer in another period, then regardless of this, the supplier will have to charge VAT on shipment. The moment at which the tax base for calculating VAT is determined is the very first date: the date of shipment or the date of payment (partial payment). The date of shipment is the first date of drawing up the document, which is issued to the buyer or carrier. In case of sale of goods, an invoice is issued no later than 5 days from the date of shipment of the goods.

Results

Since goods are the main current asset of trading companies, clear and organized inventory accounting is very important for them.

At the same time, the accounting procedure depends on the type of activity, the size of the business, the tax system and the type of legal relationship on the basis of which goods and materials are transferred (accepted) for possession, for safekeeping or sale. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

A bad soldier is one who does not dream of becoming a general or Accounting for the Future

When growing a small tree at home, we root the seedling first in a small pot, knowing for sure that after a certain period of time it will be necessary to transplant it into a new, larger one. With business, everything is exactly the same - when opening a small store, somewhere in the depths of their souls, every entrepreneur has a secret dream of eventually turning it into a big one, or even developing an entire chain.

When asking the question of how to keep track of goods in your new business, you must keep in mind that today’s hundred or two items will turn into a thousand tomorrow, and that in addition to the warehouse and retail, literally in the very first months you will need to record suppliers somewhere, both buyers and staff work, and it would be advisable to analyze the movement of goods and funds in various sections, promptly, at the current moment...

But cumbersome, complex desktop programs with extensive functionality, such as 1C, designed at best for a medium-sized business that stands firmly on its feet, are not a way out. To survive, a small, recently opened trade enterprise needs a simple and accessible system for keeping records of goods, which can be opened from any computer connected to the Internet, allowing you to perform all trade operations, create, store and print documents, and most importantly - provide all the necessary reports to the manager, as they say , at any time of the day or night.

Today, the Internet services market offers a fairly large number of different accounting programs created specifically for the needs of small businesses, access to which is provided through websites for an easy subscription fee. This is, for example, the online accounting system “Big Bird”.

Having an intuitive interface familiar to users of desktop programs, it allows you to effortlessly keep track of retail goods, create the necessary documentation, print price tags and labels, and use a barcode scanner. In addition, the program supports a multi-user mode with differentiation of roles and is equipped with a special seller interface that allows you to optimize the sales process and control the work of staff. The system implements flexible pricing settings, creation and updating of price lists, and most importantly, numerous and varied analytical reports, prompt and visual, allowing the manager not only to monitor the current state of affairs, but also to predict further development.

The developers of “Big Bird” initially built the system based on the needs of small businesses. Especially for those who are at the beginning of their entrepreneurial journey, the system has a free tariff “Hummingbird”, which allows you to develop a small business within one warehouse and thousands of items of goods, so that someday, in the foreseeable future, move to a new level within the framework of the tariff “ Albatross” - manage an unlimited number of warehouses, partners, product names, and maybe even several companies, or even an entire retail chain! With “Big Bird” you will no longer have the question: “How to keep track of goods in retail?” — you will think about how to most effectively develop your business!

Margarita Pavlyuchenko is a content editor for the Big Bird project - an online accounting system for business, an expert at the Software Product Development Center of Etheron LLC.

0

Author of the publication

offline 18 hours

adminkos

0

Comments: 2Publications: 269Registration: 12/25/2012

Features of accounting in retail trade

A grocery store refers to a retail trade in which food products are sold directly to the consumer to satisfy personal needs. Sales in a store that is a stationary outlet are processed by issuing a cash receipt for the purchase, which reflects the amount of the purchase. After removing the cash register and readings from the cash register, the cashier enters the amount of daily revenue in the cashier-operator’s book. Every day, information from this journal must be entered into accounting entries that reflect the daily amount of revenue received from the sale of food products.

Modern accounting in a grocery store should be conducted on the basis of the correct combination of synthetic and analytical accounting. Synthetic accounting should be carried out on account 90 “Sales”. The “Credit” column of this account should reflect the selling price of goods sold, including VAT. The “Debit” column reflects:

- expenses for the purchase of goods;

- expenses for organizing trading activities;

- VAT amount;

- excise taxes

At the end of each month, the store accountant must enter all this information into the accounting documents and write off expenses from the total amount of revenue received in order to determine the amount of monthly gross income from food retail sales. The specifics of determining the amount of write-off and gross income will depend on the methods for valuing inventory, which can be carried out at purchase or sales prices.

Standard methods of accounting for goods

Any typical accountant uses invoices and invoices, as well as checks and receipts when accounting for transactions with goods. But recently the following types of accounting have become most popular:

- Sum - maintained by the amount of documents. Revenue is deducted from the receipt of goods, after which the resulting estimated balance is compared with the actual balance and the shortage is added up.

- Analytical - conducted by month and includes the name and quantity of the product, as well as its price.

In the first case, you can keep records even without a computer, just by acquiring a notebook and pen. But this method has a lot of disadvantages and is terribly inconvenient in the case of a large product range. With a large volume of products, it is simply impossible to monitor the prices of goods, and this is unacceptable.

The second method is more reliable because it is more visual. To use it, you need knowledge of two commonplace computer programs - Word and Excel. In addition, there are now many special computer programs designed for accounting.