Entrepreneurial activity for the production of products and their sale is inevitably associated with a certain share of costs for the manufacture of goods and their promotion. Planned cost is an indicator of the estimated cost of a product that enterprises strive to achieve while maintaining a stable production process. Manufacturers inevitably face cost fluctuation problems. Entrepreneurs resort to improving the technical base, streamlining technological lines, selecting cheap raw materials or reducing the quality of the output product. Today, standard or planned cost is the goal of any production. This indicator is influenced by many factors, which our article talks about.

Branches of cost regulation

The planned cost of finished products is calculated at enterprises that are engaged in the production and further sale of goods. These industries include:

- Heavy industry enterprises: metallurgical, coal, mechanical engineering and others.

- Agricultural enterprises engaged in raising livestock, grain, etc.

- Light industry, which includes all sub-sectors dealing with consumer goods.

- Food industry: canneries, meat processing plants, bakeries and other enterprises.

Each of the presented areas of activity has its own specific features for calculating planned production costs.

The cost of production includes costs of various types. For the correct approach to calculating the indicator per unit of production, it is necessary to take into account all the nuances of production costs.

Methods

Methods for calculating product costs are represented by three main points:

Popoterenny

The final phase of processing and the final step in the resulting product is the limit. The calculation in this case is carried out according to its data or production items. The most relevant method is in the metallurgical, oil and food industries. It is simple and does not require any indirect cost allocation or statements.

Initially, the calculation is carried out in conventional units, and then the cost of one conventional unit is determined. Based on the data obtained, the cost of production is then calculated. This is the simplest example of how to create a cost estimate.

Process-by-process

When calculating the cost of products, this method takes into account individual limits, which in turn may include a number of processes. Process is understood as a technological stage of a production procedure.

The method is most often used in the mining and chemical industries. It is relevant for mass production of goods in cases where there is no completed process. The cost of one unit of production is calculated by dividing expenses for a specific time period by the volume of goods produced for it. If the cycle is long enough, then all costs are distributed between the goods produced and the unfinished balances of production.

Custom

The method is used in the construction, aviation industries, etc. In this case, the order includes not only goods, but also construction projects. This method of calculating costs is especially in demand in the field of medium and small businesses: in the production of clothing, repair work, furniture, etc. Cost accounting is carried out simply and quickly, but only after the work is completed.

Of course, these calculation methods have their advantages and disadvantages. Therefore, you need to choose one or another calculation method, taking into account the industry for which you want to make calculations.

Types of start-up costs

All costs associated with the production of raw materials are taken into account when determining the planned cost. This is an indicator that initially forms the future price of a product for the end consumer. Based on the obtained figure, the value added tax and other deductions are obtained.

There is a division of costs based on the following types of expenses:

- Basic. Are directly related to the acquisition of raw materials for the production of the product. These are also the costs of ensuring the production process and paying workers.

- Invoices. They are formed in direct dependence on the structure of the management units of the business entity.

Based on how costs are taken into account in the cost of production, they are divided into:

- Direct – are formed based on primary accounting data.

- Indirect - related to ensuring the production process.

Cost components can contain one cost element, such as materials, or several expense parts, such as shop items. Such costs are usually called complex.

Economic elements of costs: material, wages, social contributions, depreciation of funds, other costs.

Cost calculation methods

The formula for calculating the cost of products (works, services), as a rule, is formed in accordance with the volume of costs taken into account.

Today there are several methods of calculation - these are normative, process-by-process, incremental and custom-made.

However, they are all based on the classical method of calculating planned costs.

To make the calculations easier to understand, as an example, consider enterprise “N”, which produces product “A” in certain volumes.

Planned cost

The amount of all costs of an enterprise is determined by standard indicators or by directly transferring them to products.

According to the definition, planned cost is an indicator of the value of the volume of production during its production. The calculation is carried out both for total output and per unit of goods.

Planned cost indicators are typical for the manufacturing industry, but they also occur in the accounting of trading enterprises. The spent part of the money that supports production processes is also included in the price of the finished product.

Planned calculation of product costs is necessary to determine the feasibility of producing goods. Based on this indicator, the management of the enterprise makes a decision to change the course of activity and work with contractors.

Example of calculating the cost of goods

To make the information presented in the article more understandable and visual, we bring to your attention an example of calculating product costs. So, the workshop needs to produce 200 shelves with glass doors. The following shows how to calculate the costing:

- Consumption of materials. It is necessary to take into account all the materials that will be used in the production of one unit of goods and their cost. For example, glass will require 5 conventional units, the cost of each will be 95 rubles. The total is calculated by multiplying the price per unit by the total quantity of material required. For this expense item, expenses on chipboards, components and paints and varnishes are considered in this way.

- Energy consumption. All necessary volumes of electricity for work are also subject to accounting. They are multiplied by the price of 1 kW.

- Wage. The remuneration of employees for completing this order in monetary terms is divided by the number of racks.

- Repair work. The cost of servicing the equipment required to make the racks is divided by the number of racks.

- Target costs. For this item, all costs must also be divided by the number of racks.

- Business expenses. These include the costs of delivering goods to the point of sale and advertising. They must also be divided by the required number of racks.

This costing example is quite simple. All costs for each item are summed up, and a total is displayed, which is the calculation of the cost per unit of goods.

If you are asked to provide this document at customs, then many experts recommend writing an explanatory note addressed to the head of customs, in which, under the reason for refusing to provide the calculation, indicate a trade secret. Sometimes this helps, and the question disappears by itself.

Evidence of the real and not underestimated value of the goods can be an export declaration and a price list, duly certified at the customs point of the country sending the goods.

The presence of several types and methods of calculation is designed for various industries. After all, the costing calculations used in small businesses differ significantly from those used in large oil refineries or construction companies.

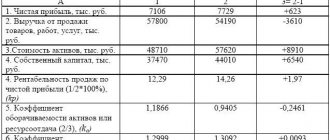

Actual cost

The indicator characterizing the actual funds spent on the production of a unit of goods is called its actual cost. Material, production, financial and other costs are recorded in accounting.

Planned and actual costs are different values. Planning occurs at the beginning of the annual or quarterly period, but during the production process, the amount of costs and the cost of materials may change.

The actual indicator is the amount of costs for the acquisition of inventories (MPI). Refundable taxes, such as value added tax (VAT), are not taken into account.

Results

To effectively use cost accounting methods and calculate product costs, an organization must analyze its processes in detail, identify current management tasks, identify KM objects, and ultimately select one or more methods. The labor-intensive methods of cost accounting and calculating product costs are compensated by obtaining detailed information that helps in solving pressing issues.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Methods for determining production cost values

The monetary expression of planned cost is the process of costing.

Internal planning at each enterprise has its own differences. There are three main methods of costing:

- Calculation according to established standards. Based on the experience of past periods, internal standardization is determined or generally accepted industry indicators are used.

- Planned. Based on cost planning, which is based on previous total production or sales costs.

- Reportable. It is the most accurate, since it is based on the funds actually spent over the past period.

Costing

The calculation of planned cost begins with the preparation of cost estimates and costing. The indicator characterizes the planned average value. The basis for identifying the amount is progressive cost standards for production, consumables, fuel, energy and others.

Planned costing begins with collecting information about previous expenses and the rates of consumption of materials and raw materials. The final result depends on many factors:

- Production waste.

- Technical characteristics of the equipment.

- Purchase cost of raw materials and additional components.

- Production time and labor costs.

Thanks to the calculation, the management of the enterprise receives a complete picture of the cost of each individual type of product.

An example of calculation for the total production volume and each type of product is presented below.

According to the example presented, the cost of 1 stool will be 1119.45 rubles, and the cost of a cabinet will be 2217 rubles.

At mass production enterprises, cost calculation occurs in stages. In each of the workshops, the products receive an additional markup and come out with a certain cost. This is how a gradual increase in the value of a product is formed during the production process.

This method of determining cost helps to make a reliable cost analysis. For example, in the production of fabrics, the spinning shop determines the costs of making cloth, and the dyeing department writes off its costs to the finished fabric. Based on the results of the formation of the cost of the canvas, the enterprise’s economists can identify at which point in production the costs can be optimized.

The method of incremental costing is relevant for the production of large volumes at large enterprises.

It is better to determine the planned cost of production using cost estimates for a new type of product. The basis for calculations are projects and standards for individual cost estimates. Planned unit costing is a short-term planning system. It is necessary so that the enterprise can determine the stages of further development.

Reported costs help determine the amount of the actual cost of production. It may consist of the following costs:

- Raw materials.

- Waste production.

- Energy and fuel for technical support.

- Workers' wages.

- Additional wages.

- Social deductions.

- Equipment depreciation.

- General running costs.

- Production and non-production costs.

- Other expenses.

In factories with a large area, transport costs may be included in the cost. Depending on the specifics of the industry, there may be other costs: purchase of semi-finished products, additional units, etc.

Calculation of actual cost = Product balance at the beginning of the cycle (work in progress) + Costs incurred during the month - Costs for setting up the production process - Remaining at the end of the cycle - Defects.

Methods for accounting for changes in norms and deviations from norms

All deviations of actual costs for any item from current standards are considered as deviations from the standards. This approach allows not only to organize reliable cost accounting and calculation of product costs, but also to systematically analyze deviations from the norms for prompt influence on the cost formation process.

Accounting for deviations from norms is the most difficult in organizing and maintaining standard accounting of production costs. To take into account deviations at all stages of production (from the moment of identification and registration to inclusion in the cost of a unit of production), it is necessary to resolve a number of methodological and organizational issues, which include:

- selection of accounting items (locations, types, reasons for deviation) and their classification;

- organization of primary accounting (documentation) of deviations; current accounting of deviations;

- summation of deviations by places of occurrence, centers of responsibility (groupings, regroupings, codes);

- calculation of the share of deviations in the cost of the costing unit.

Changes to standards are formalized by special notices, which are issued by departments that control the relevant standards. Notifications from design and technological services are received by the regulatory bureau, where they are registered in a special sheet for recording changes in standards and monitoring the implementation of the plan of organizational and technical measures. The summary data from this statement at the end of the month is used to adjust the standard costing for this product. As notifications are received, the regulatory bureau makes changes to the technical documentation, and by the beginning of the month, to the regulatory calculations. At the end of the month, information on the economic efficiency of implementing organizational and technical measures is calculated and analyzed here.

According to their content, deviations from norms are divided into two main groups: negative and positive.

1. Negative deviations represent overruns in product costs and indicate certain violations in technology, organization and production management.

2. Positive deviations are the result of measures aimed at reducing costs and achieving savings in product costs.

Analytical accounting of deviations from the norms should be carried out by places of occurrence, causes and culprits, and by types of products.

Accounting for deviations from the norms shows the state of production progress in terms of cost levels in comparison with the planned one. It must be carried out synchronously with production and supply information to the appropriate management levels in accordance with their functions and the frequency of cost control. Where costs arise, information about deviations of the most important ones should be received in shifts. In the workshops, this information should be presented at intervals per shift, five days, ten days, month in a generalized form, covering a wider range of cost items and causes of deviations. At the enterprise management level, information about deviations from norms is provided in an even more generalized form for analysis and adoption of control actions [2].

Calculation of the actual cost of products using the standard cost accounting method is carried out on the basis of consolidated cost accounting data, which is carried out item by item for accounting objects, workshops and the organization as a whole, with expenses subdivided according to the norm, changes in norms and deviations from norms.

The construction of consolidated cost accounting depends on the specific features of a particular enterprise and, above all, on the nature of the technology and organization of production, the number of business units, and their intra-production organizational structure.

Consolidated accounting of production costs in standard accounting is usually carried out in special statements opened for a certain type or group of similar products.

In production organizations that maintain standard accounting, it is planned to distribute deviations from norms and changes in norms between commodity output and work in progress balances. With stable balances of work in progress, deviations from the norms are recommended to be written off to the cost of commodity output. Periodically, reports on deviations in the consumption of materials, components, and wages should be compiled for workshops and sections. They indicate the reasons and culprits (initiators) of deviations.

There are two methods for recalculating work in progress taking into account changes in standards. The first method is to directly recalculate the cost of parts, taking into account the degree of their readiness according to operational dispatch data or according to the inventory of work in progress.

The second method consists of calculating the coefficients for changes in standard costs under the influence of changes in standards and recalculating the standard costing for items using such coefficients.

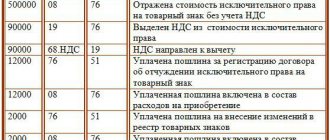

Accounting for the planned cost of finished products

The result of the enterprise's production activities is the finished product. It includes all stages of production, packaging and transfer of goods to the storage warehouse.

Finished products are accounted for using one of two methods: at actual cost and planned cost (at accounting prices).

The organization chooses the most convenient calculation option for itself and is subsequently guided by it when determining the costs of producing goods.

On the day the finished product is transferred to the warehouse, it is debited from account 43 “Finished products” to 20 “Inventory”.

Deviations of actual cost, positive or negative, are also posted to the specified accounts.

Products are accounted for at planned cost using account 40 “Output of products or services” or without it. Thus, the products are posted at the stated prices.

The normatively planned cost price without using account 40 occurs as follows: Dt 43 (“Finished products”) Kr 20. Finished products are written off from account 20 (“Main production”), sometimes 23 (“Auxiliary production”) or 29 (“Service production and farms").

At the end of the billing month, the deviation from the planned cost is written off over the actual cost.

Posting: Dt 90 (“Sales”) Kr 40.

If the actual cost exceeds the planned cost, then a loss is observed. A situation in which standard calculations exceed actual ones leads to savings.

The reversal entry Dt 90 Kt 40 writes off the credit balance (savings).

How to calculate cost by expenses

The algorithm for calculating the actual cost of production in production will be as follows:

- Sum up the costs of purchasing raw materials (main and additional) that are used at all stages of production, including intermediate ones. In addition to raw materials, finished components and semi-finished products purchased from contractors are also added.

- Calculate how much was spent on purchasing fuel and paying for electricity.

- Calculate labor costs, not forgetting 38% for insurance contributions to non-budgetary funds.

- Sum up the costs of maintaining and repairing equipment with depreciation charges.

- Add costs for selling finished products;

- Calculate all other investments made.

- Add up the learned positions and, if necessary, divide the resulting result by the number of units of production.

back to menu ↑

Calculation of standard cost per unit of production

The planned cost of production can be determined based on the product blanks at the beginning of the production process in monetary terms, according to their estimated value. Total production volume includes costs:

- Direct: raw materials and materials, semi-finished products, fuel and energy, wages of production workers, additional wages, social and insurance contributions.

- Shop cost includes: direct costs, production and preparation costs.

- Production costs are supplemented by general business expenses and taxes, which are included in the price of the product.

- Commercial (or full) cost includes non-production costs.

Raw materials and materials planned cost per unit of production is calculated based on purchasing data. Purchased materials are included in the price on a direct basis. Consumed fuel and energy are also added to the cost of products and are calculated based on the consumption of these resources.

The basic wages of workers in the production department are included in the unit cost of goods. In production, piecework wages are often used, which depend on the volume of work performed (how many products a person produces is how much money he receives). Planned and actual costs include the cost item for wages, with the difference that actual costs often take into account work time and piecework output.

Time-based wages are established in individual production departments and also contribute to the resulting cost of the output product.

Additional allowances for workers' wages are calculated as a percentage of the basic rates.

The costs of developing production and setting up equipment are calculated based on established standards.

The maintenance of the management apparatus is also one of the expense items. General business expenses are subject to inclusion in the planned cost of finished products. Manufacturing overhead costs are calculated by adjusting the base salary by the cost type percentage. So, you can determine the planned cost of production from the sum of shop costs, general business expenses and deductions from the cost of finished products to government services (taxes and fees).

Deductions included in the cost of goods:

- Land and transport tax.

- Property tax.

- Pollution tax.

The legislation of the Russian Federation establishes interest rates for each type of tax.

The planned cost is the sum of production costs and commercial support for the promotion of the enterprise's goods.

Non-production costs are associated with transportation, packaging and delivery of finished products to a wholesale buyer or end consumer. This expense item includes all the organization's measures to promote its products.

Based on the calculations, the economic department prepares a planned cost estimate. In this way, you can determine all costs at different stages of their occurrence and optimize costs, if necessary.

This document is the basis for analyzing the production activities of the enterprise and allows you to consider the strengths and weaknesses of the production line.

Planned costing is compiled in the form of a table listing each type of cost. Per unit costs are calculated simply by dividing the cost by the number of units produced.

Calculation is a comprehensive system of economic calculations of production costs and unit costs of individual types of products, works and services.

The purpose of calculating the cost of certain types of products is to generate information on the amount of costs at all stages of manufacturing these products to determine the profitability of production, control costs, find reserves for saving material, labor and financial resources, and identify the results of economic activity.

The following main tasks of cost calculation can be identified:

1. reliable calculation of the actual cost per unit of certain types of products (works, services);

2. control over the implementation of planned targets at cost, compliance with current expenditure standards and cost standards;

3. determination of product profitability and factors determining its level;

4. assessment of the efficiency of the structural divisions of the enterprise;

5. ensuring the receipt of information for the analysis of cost reduction reserves.

Costing work at an enterprise requires adherence to general principles that ensure methodological unity in calculating product costs and the ability to use reporting calculation data to monitor the implementation of the cost plan, analyze and evaluate the work of the enterprise and its internal production units.

These principles are:

scientifically based classification of production costs, grouping of costs in accounting by structural divisions, types of products, elements and expense items;

establishment of cost accounting and costing objects, costing units;

consistency of actual objects of cost accounting and calculation of product costs with pre-established ones;

consistency of cost accounting objects with calculation objects and calculation on this basis of the cost of production according to accounting data on expenses;

differentiation of costs by period and inclusion of all costs of production of products of the reporting period in its cost;

selection of methods for allocating indirect costs;

expansion of the composition of costs attributable to objects of their accounting on a direct basis;

choice of methods for calculating the cost of the calculated unit of production.

ensuring the maximum possible separation in cost accounting according to current standards, deviations from standards and changes in standards;

determining the impact of changes in standards and deviations from standards on costs.

These general principles are specified at individual enterprises, taking into account the specifics of the industry and the characteristics of production

There is a close relationship between cost accounting and calculating the actual cost of production. This is manifested on the one hand in the fact that the basis for calculating the cost of production is the accounting data for production costs, on the other hand, cost accounting is organized with such detail as is necessary for calculating, controlling and managing costs.

Cost accounting and costing are considered as a single process for studying production costs.

Organizational cost accounting is the documentation of all costs, their grouping by cost and responsibility centers, production facilities, prompt identification of deviations from current cost standards, and costing consists of a series of sequential calculations aimed at localizing the costs included in the costing items that relate to products enterprise, its structural divisions, calculating the cost per unit of production.

From an economic point of view, cost accounting and cost calculation as interrelated and interdependent stages of a single cost calculation process are aimed at solving cost management problems - determining production efficiency, monitoring the use of all types of resources, finding savings reserves.

The following main stages of calculation calculations can be distinguished:

grouping of costs by costing items and by cost accounting objects;

determining the cost and attributing the costs of auxiliary production to the costs of the main production;

distribution of indirect costs between individual cost accounting objects;

determining the cost of final marriage;

assessment of returnable waste and work in progress;

distribution of costs between marketable products and work in progress;

calculation of the cost of each costing object and costing unit.

1.3. Norms and standards: features of formation and application in calculation .

Progressive calculation is associated primarily with the use of scientifically based standards.

With the development of standards, essentially calculation begins, which is based on the calculation of economic profitability and the search for reserves for reducing the cost of manufactured products. By rationing, enterprises thereby provide for the optimal amount of material and labor costs. According to the norms, the actual release of raw materials into production is carried out, and wages are calculated.

When developing and applying standards, it is important to take into account industry specifics.

So, if the standardization of material consumption in mechanical engineering, metalworking, metallurgy and in some other industries is determined by the level of technology and technology, the ratio of raw materials used and purchased products, standard sizes and types of materials used, then in industries that consume agricultural raw materials, the cost is significantly influenced by its grade . The cost level is often determined by changes in the grade of raw materials. Prices for cotton used in one sort or another fluctuate sharply depending on the types of raw materials supplied to factories and mills. Between the first and sixth grades, the difference in the price of cotton is more than 50%. Therefore, it is more profitable for the enterprise to process raw materials of lower grades. The additional costs associated with processing contaminated cotton are offset by price savings. For the same reason, within a factory or plant, planned calculations are noticeably higher or lower than standard standards (gradings) planned based on the types of raw materials actually consumed. The same situation is typical for the meat and dairy, wool, shoe and some other industries. Cost standards and planned costs should reflect the raw materials that are actually supplied to enterprises. Accordingly, the standard cost will also change.

A reasonable determination of the size of waste raw materials and supplies is also of no small importance. First of all, when planning their value, one must proceed from the minimum acceptable for consumption of specific types or groups of raw materials. This waste is still very large, especially in mechanical engineering. For example, the coefficient of metal utilization varies at enterprises in different sub-sectors of mechanical engineering from 0.53 to 0.80. In machine tool industry, metal losses often reach 25-30%. This is due, first of all, to the supply of non-profile material of large thicknesses and diameters, and frequent replacement of one standard size with another. Hence the excess weight of the products.

It also requires proper grouping of waste by type of raw material and their evaluation. Thus, when collected, ferrous metal waste is depersonalized and valued at a lower price. Meanwhile, prices for tool steel waste are much higher than for structural waste.

The following relationship takes place: the lower the waste estimate in the calculations, the higher the planned, standard and actual cost of products and the entire production output.

Issues of collection, sorting and proper assessment of waste are also relevant to those industries where raw material balances are compiled during calculation (metallurgical, chemical, textile and some other industries).

Rationing the consumption of materials is interconnected with the costs of energy, labor, technical and economic indicators of capacity utilization, and progressive methods of organizing production. With an increase in the share of purchased products and semi-finished products, the supply of materials that are maximally adapted to the profile of the forgings being manufactured, labor costs for their processing and losses from defects are reduced. Flow organization of production in workshops or in individual areas reduces labor intensity and improves the use of equipment. This should be taken into account in a timely manner in the standards themselves.

Some difficulties arise in practice when determining labor costs. A significant part of the applied standards is determined experimentally and statistically. In single-unit and small-scale production, working conditions often change, so the norms for labor costs and wages fluctuate. O6based rationing should first of all be preceded by the identification of lost working time; analysis of data on compliance with production standards; identification of so-called “profitable” and “unprofitable” norms and prices, as well as work that is difficult to standardize; comparison of applied standards with standards for similar parts and work at other enterprises, checking timing data and photographs of workplaces; characteristics of equipment performance and prospects for the introduction of new, more progressive equipment, in particular when mechanizing labor-intensive work.

In the process of rationing labor costs for parts, assemblies, semi-finished products and products, reserves for reducing costs included in the cost of production are identified.

As for the standardization of costs for the management and maintenance of production, it did not go beyond the approval of general estimates, often compiled without an economic analysis of the dependence of these costs on the scale of production, volume of production, organizational structure of enterprises, the introduction of mechanization and scientific organization of labor.

Of particular importance is the rationing of material and labor costs as part of the costs associated with equipment operation and management. At the same time, it is important to economically justify their division into dependent and independent of production volume, into constant and variable. Within the latter, their own differentiation should be provided, determined by the degree of changes in one or another type of so-called dependent costs on the level of growth in production. Experimental tests show significant fluctuations in one direction or another of certain types of costs in comparison with changes in the volume of output.

Great importance is also attached to standardizing costs for new products. It is known that at the initial stage of production there is a slight increase in the cost of a physical unit of production. Relentless control over cost reduction is necessary as products are mastered and the final effect is achieved.

1.4. Types of product costing .

The type of calculation is determined by its purpose, the time for which it is designed, as well as the method of its preparation.

Based on the purpose and time of preparation, calculations are divided into preliminary and subsequent.

Preliminary calculations include planned, project and standard calculations. They are compiled before production begins.

Subsequent - reporting calculations, which are compiled after production of products and characterize the actual cost of products.

Based on the scope of costs, calculations are divided into full, production, individual types of work or processes, technological (according to the range of costs depending on the activities of teams and sections).

The frequency of calculations depends on the nature of production. In mass continuous production, cost estimates are compiled for a certain calendar period (month, quarter, year) and characterize the average cost of manufactured products for this period. In individual and small-scale production, cost estimates are compiled after all work on the order has been completed.

Based on the properties of the calculation object, they distinguish between general, self-supporting and parametric calculations.

Based on the initial data for calculating costs, planned, normative, technical and reporting calculations are distinguished.

Let us consider the content and features of some types of calculations.

Planned costing of individual types of products is a calculation of the costs of producing the corresponding type of products, works, services, semi-finished products of own production in the planning period.

The basis for drawing up planned calculations are the norms of consumption of raw materials, materials, fuel, energy, approved in the established manner, current wholesale prices and tariffs for their transportation and delivery, rates for remuneration of production workers, cost estimates for the maintenance and operation of equipment, for the management of workshops and the enterprise and etc.

Planned calculations are developed for the year, broken down by quarter, and in individual industries - by month for all types of products included in the plan.

For the most important types of products, detailed planned calculations are compiled with a breakdown of material cost items and wages of production workers. For other types of products, planned cost estimates are compiled only by expense items. The planned cost of products in various designs is determined for each design option.

Based on the data of planned calculations, the planned cost of all commercial products, comparable products and costs per ruble of commercial products are calculated.

For the economic justification of new construction, expansion and reconstruction of existing enterprises, production facilities and workshops, modernization of equipment, when designing new types of products, developing new technological processes, introducing inventions and rationalization proposals, so-called project (prospective) calculations are used. They are compiled on the basis of technical and economic standards for the use of resources, current prices, the estimated cost of fixed assets, the current level of wages and others according to the methodology adopted in the development of planned calculations. Depending on the goals, project estimates are compiled for the entire range of costs that form the cost, or for individual types of costs.

Standard costing is compiled on the basis of current norms and cost standards, reflecting the achieved level of equipment, technology, organization of production and labor.

The relationship between planned and standard costing is manifested in the fact that standard costing for certain types of products acts as the basis for developing planned costing and calculating tasks to reduce costs.

Standard costing is periodically updated in connection with changes in cost standards.

Standard costing is also distinguished by a greater degree of disclosure of material and labor costs, especially for the component parts of the product (parts, assemblies, assembly connections).

Standard calculations are compiled for the entire expanded range of products. They are used for ongoing monitoring of the implementation of the plan of organizational and technical measures, to identify deviations from consumption standards, assess work in progress, defects, and calculate the actual cost of production.

Norms form the basis of planned cost. However, if they are not systematized, the most economical option is not selected, and the standards in physical terms have not received the proper monetary value, then the planned costs, which include tasks to reduce costs, do not sufficiently reflect cost savings.

Standard calculation of product costs is compiled based on current reasonable standards in force on a certain date. The planned calculation of product costs is based on progressive standards, calculated according to current standards at the beginning of the planning period, taking into account organizational and technical measures, the implementation of which should ensure a gradual reduction in product costs. These calculations cannot be opposed, since each of them plays its own role and they are interconnected; this is primarily manifested in the fact that the cost rates used in the preparation of planned calculations are weighted averages of the current current standards.

Reporting costing is a calculation of the actual unit cost of certain types of products (works, services) of the main and auxiliary departments of an enterprise in the context of costing items. It is compiled by summing up the costs of production of the entire output of products according to the items of the calculation sheet for the reporting period and dividing the resulting amount by the number of products produced in the same period. Reporting calculations of the actual cost of products (works, services) must include all costs related to the production of products in a given calculation period.

Reporting calculations contain the necessary information to study the dynamics and structure of product costs, identify reserves for production growth, analyze the causes of deviations from standard or planned costs, and are used to control the reduction in the cost of industrial products. They clearly and concisely, but at the same time quite fully reflect the economic results of enterprises. Calculation of the actual cost of industrial products allows us to determine the costs of production of all commercial products and comparable products.

The frequency of compiling reporting calculations of the cost of production is established in industry instructions for planning, accounting and calculating the cost of industrial products. In mass and serial production, accounting calculations are prepared once a month. In this case, the average cost per unit of production of each item produced during the reporting period is calculated. In individual production that produces products for single orders, reporting cost estimates are compiled as the order is completed and closed. In this case, the actual cost of a product manufactured to order is determined by the summation of all production costs. In seasonal industries, accounting estimates are compiled quarterly (food industry), half-yearly or once a year (in other industries).

In production management, self-supporting costing is used, which is a type of reporting costing, adjusted to take into account the influence of factors that do not depend on a given self-supporting link (for example, price changes). It allows you to objectively evaluate the results of the work of the corresponding self-supporting unit in producing products. Self-supporting costing is compiled for all products of the corresponding division of the enterprise (workshop, production, site, etc.), while the costing items are filled out with a division into those dependent and independent of this division. The first of them are shown according to the actual level of costs, and the second - according to the prices of the planned task. Such a calculation is a report from the corresponding self-accounting unit to the management of the enterprise.

Reasons for deviation of the estimated cost

During the production and sale of products at an enterprise, unforeseen situations may arise. These circumstances force the use of additional measures to eliminate negative consequences, which entails a waste of money. These costs are covered by increasing the estimated cost of the product at the exit, that is, at the expense of the end consumer.

The main reasons for the deviation of the planned cost from the actual cost are:

- Increased consumption of raw materials as a result of defective or technically outdated equipment.

- Excessive consumption of consumable fuel and energy resources.

- The time-consuming process of producing a batch of goods.

- Labor related expenses.

- Other factors.

As mentioned above, planned and actual production costs have different meanings in practice. Usually, upon production, the amounts are higher than the normative ones. This leads to losses, but the company can take measures to adjust future profit levels. In this case, the company's management makes decisions to improve marketing programs and search for new markets. Often, enterprises resort to price reductions to quickly sell and reduce stock in warehouses. The released funds are used to optimize production.

Composition of cost by costs

In order to make a profit in the future, certain expenses will first be required. For ease of calculation, they are combined into groups according to certain characteristics.

The calculation of the cost of production includes various items determined by the specifics of the product being manufactured or the peculiarities of the organization of production.

But, as a rule, the list of costing items looks something like this:

- Materials, which includes raw materials, semi-finished products, finished components, etc.;

- Energy and fuel;

- Depreciation of general capital assets, that is, fixed assets (machines, equipment, machinery, etc.);

- Staff salaries (according to tariffs or salaries);

- Additional payments to staff (incentives, additional payments, allowances, etc.);

- Insurance contributions (PFR, Social Insurance Fund), amounting to a certain percentage of salary;

- Travel, daily allowance and other related expenses;

- General production expenses;

- Payment for the work of third parties, including outsourcing;

- Administrative expenses for the management apparatus.

As can be seen in the diagram above, most of the cost consists of the costs of raw materials and energy necessary for production, as well as wages for those whose efforts the product is created.

All other expenses will make up significantly smaller shares in the cost structure.

A similar picture is observed in all industries, with minor deviations.

Costs are usually divided into direct costs, the size of which depends on the volume of products produced.

These are, first of all, raw materials and energy, and the salaries of key workers.

And also to indirect ones, which are not directly determined by production volumes.

These include salaries of management and maintenance personnel, rent, etc.

back to menu ↑

Measures to reduce unplanned costs

In order to reduce costs, organizations carry out a number of activities:

- Modernization of obsolete equipment.

- Complete or partial replacement of production lines.

- Improvement of employee qualifications at the expense of the enterprise.

- Development of a labor motivation system for workers.

- Searches for new suppliers.

- Purchasing high-quality raw materials, which produce significantly less waste when working with them.

In practice, the main way to reduce costs is to replace raw materials. Unfortunately, organizations often purchase cheaper materials. As a result, product quality suffers.

The company's policy outlines the course of activity and further development. Management makes decisions for itself to improve quality or increase quantitative indicators. The export or import orientation of an enterprise and the demand for products play an important role in the direction of the company's activities.

Negative situations stimulate the enterprise to take serious measures for further development. Quick market orientation helps an enterprise stabilize its activities in a timely manner and improve profitability.