Income tax payers

The subjects whose responsibilities include the calculation and payment of tax on generated profits are all legal entities. The exception is enterprises on preferential tax regimes, such as UTII, Unified Agricultural Tax, simplified tax system, as well as organizations exempt from tax on the basis of paragraphs. 2 and 4 tbsp. 246 and art. 246.1 Tax Code of the Russian Federation. The combination of taxation regimes, for example OSNO and UTII, involves the calculation of tax only within the framework of the profit received on OSNO.

The tax rate is set for commercial organizations at 20%. The exception is some educational and medical institutions, agricultural institutions, participants in regional investment projects, etc. in accordance with Art. 284 Tax Code of the Russian Federation.

For more information on tax rates, see this article .

Tax payments should be made monthly or quarterly. The frequency of accruals depends on the total revenue of the organization or its status (Article 286 of the Tax Code of the Russian Federation).

For more detailed information on tax calculation and frequency of payments, see the material “Advance payments for income tax: who pays and how to calculate?”.

The deadline for paying advance tax is the next month after the reporting period, no later than the 28th. The final annual income tax amount must be transferred to the budget no later than March 28.

On our forum you can discuss any question you have regarding the calculation and payment of certain taxes, as well as the generation of reporting on them, including income tax. In this thread, for example, we are discussing innovations in the calculation of income tax.

BCC for individual entrepreneur contributions for 2020

In Order No. 132n, the Ministry of Finance updated the BCC for entrepreneurs. We are talking about fixed contributions for yourself. In 2020, contributions to the Pension Fund were paid per one general BCC, regardless of the amount of income (within and over 300,000 rubles). In the new order, the Ministry of Finance changed the name for the code. From the name it follows that this BCC is used only for pension contributions from income within the limit of 300,000 rubles. There is no separate code for above-limit income.

| Payment Description | KBK contribution | KBK penalties | KBK fine |

| Contributions in a fixed amount to an insurance pension (from income within 300,000 rubles) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Contributions to the FFOMS in a fixed amount | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

Back to section

BCC of income tax in 2019-2020 for legal entities

The tax is transferred to the federal budget and the budgets of the constituent entities of the Russian Federation.

For the period 2017-2020, this distribution is set as follows:

- to the federal budget - 3% of the tax base;

- regional budgets - 17%.

When paying income tax in 2019-2020, the following BCCs are used (orders of the Ministry of Finance dated November 29, 2019 No. 207n, dated June 8, 2018 No. 132n):

- 182 1 0100 110 - for transfers to the federal budget;

- 182 1 0100 110 - when credited to the budgets of constituent entities of the Russian Federation.

These codes are used by organizations that are not consolidated groups of payers, foreign institutions and participants in production sharing agreements.

At KBK 182 1 0100 110 it is necessary to pay income tax on income received in the form of interest on bonds of Russian organizations (with the exception of bonds of foreign organizations recognized as tax residents of the Russian Federation) issued during the period from 01.01.2017 to 31.12.2021 inclusive, as well as for mortgage-backed bonds issued after 01/01/2007.

For line-by-line explanations on how to fill out a payment slip for the transfer of income tax for the year and advance payments, as well as samples of such payment slips, see the Ready-made solution from ConsultantPlus.

KBC for payment of fines on insurance premiums from January 2019

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

KBK for fines and penalties for income tax in 2019-2020

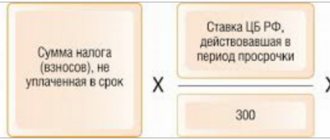

If an enterprise makes late payments, it will have to pay accrued tax penalties. It is recommended to accrue and calculate penalties independently before submitting updated calculations in the event of arrears.

Use our penalty calculator.

Payments for late payment of tax are also made according to various BCCs, depending on the budget of the recipient of the funds.

If the underpayment occurred under the federal budget, then the BCC for penalties will be as follows: 182 1 0100 110. BCC for fines is 182 1 0100 110.

If arrears are detected, penalties are transferred to the budgets of constituent entities of the Russian Federation using KBK 182 1 0100 110, and for fines KBK 182 1 0100 110 is provided.

But for other categories of taxpayers, the legislation also provides for other BCCs. For your convenience, we have collected the main BCCs for income tax, effective in 2019-2020, into a single table

For all the information on how to fill out a payment form for the transfer of interest on income tax, as well as a sample of such a payment form, see the Ready-made solution from ConsultantPlus.

KBC for payment of penalties on insurance premiums from January 1, 2019

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Results

KBK in terms of profit in 2019-2020 did not change. When transferring payments, you should pay attention to which budget the funds are credited to - each of them is characterized by the use of its own BCC. If the tax is not transferred on time, the payer will have to pay penalties and, possibly, fines, which also have their own BCC.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

KBC for payment of insurance premiums from January 1, 2020

The Ministry of Finance approved new budget classification codes for payment orders for insurance contributions by Order No. 132n dated June 8, 2018.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

KBK tax for types of payments in 2020

Income tax is charged:

- from profit from sales;

- from the amounts of dividends received;

- % of state municipal securities;

- from certain types of companies.

Profits of consolidated groups of taxpayers

A consolidated group of taxpayers (CGT) is a voluntarily created society of legal entities that remit income taxes on the basis of an agreement. A member of the KGN is a company that is a party to the agreement on the formation of an association in accordance with the fixed parameters.

A privilege for KGN partners is a reduction in the tax burden. The profit and loss indicators of the members of the consolidated group are subject to addition.

The tax base of the group members is added up (consolidated). Group member companies gather without forming a legal entity. BCC in table. in Appendix No. 1.

Dividends received from Russian companies

The tax withheld by the tax agent on dividends paid to residents of the Russian Federation is calculated at a 13% rate. It is calculated from the total amount of dividends minus the amounts withheld by the tax agent.

The amount to be distributed includes payments:

- non-residents;

- at a rate of 0%.

Dividends are excluded from the tax agent's amount at a rate of 0%. The amount is taken minus the tax deducted from it. Requirements for using a 0% rate on taxation of dividends from Russian companies: ownership of a share of at least 50% in the authorized capital of the company that is the source of payment, for at least 356 calendar days.

BCC are reflected in table. in adj. No. 1.

Dividends received from foreign companies

When purchasing dividends from a foreign company or through a diplomatic mission in Russia, tax is levied using a special method. The tax on foreign2 dividends of the company is calculated personally. The rate is 15% of the dividend amount.

The tax base includes dividends, regardless of tax withholding in the state of the non-resident company that paid the income.

A credit for tax paid outside Russia is provided to the beneficiary in the Russian Federation upon signing a protocol on double taxation with the state whose company paid the income.

Tax offsets are made in an amount not exceeding the amounts calculated to be paid in Russia. Amounts are deducted upon presentation of receipts confirming payment of tax outside Russia.

Interest on state and municipal securities

Interest income from securities is classified as non-sale income. Interest is recognized as payments accrued on bank deposits and promissory notes.

Tax on income from interest received on state (municipal) securities is paid by the owner of the security.

CFC income tax

When calculating income tax, the list of income includes profit from a controlled foreign company (CFC). The tax rate on CFC profit is 20%. Paid to the federal budget.

Dividends paid by a foreign company in the year following the year of preparation of the financial results statement are deducted from the CFC's profits.

When calculating profits, CFCs do not take into account dividends paid by organizations in the Russian Federation.

Payment order for income tax

Create 2 payment orders:

- to the federal budget - 3%;

- to the regional budget - 17%.

For two levels, the BCC has been approved, which is written in field 104 of the payment invoice. Payments are made according to previously existing rules, as well as the BCC for income tax to the federal budget in 2020, which has not been changed for the current year 2020. Payments are made until March 28, 2019.

KBC for payment of fines and penalties

The complex 20-digit structure of the KBK still gives a chance to avoid mistakes if you understand that the “set of numbers”:

- has a certain structure;

- It is more correct to call numbers digits.

In order to determine the correct BCC for the payment of fines and penalties, you can easily use Table 1, changing the group of budget income subtypes (14 - 17 digits of the code) in the years presented there. For your convenience, we have highlighted this group in bold.

Group "1000" means you pay tax. You will receive a new BCC if you bet instead of 1000:

- 2100 (for payment of penalties);

- 3000 (to pay fines).

Although we indicated these values in the context of income tax, for a number of other taxes the level for payment of tax, penalties and fines is the same.