The implementation of Vladimir Putin's initiative began last spring. However, the procedure took much longer than expected. Special laws extended the review of arrears until the end of February 2020. Debts are written off for individual taxes and fixed insurance premiums. Enforcement proceedings of a hopeless nature are subject to termination.

The concept of tax amnesty

A set of measures represents procedures as a result of which citizens and legal entities are subject to exemption from the obligation to pay tax. The amount is formed due to late payment of fines and penalties. According to statistics, the amount of debts reached three million rubles. The reason for the accrual of fines is the lack of activity reports on the part of the entrepreneur. An individual entrepreneur does not stop reporting when the business is actually terminated, but not closed to the Federal Tax Service. Law No. 436 gave citizens the right to get rid of monetary obligations.

The first amnesty in Russian history was announced in 1993. The duration was one month and three days. To use the granted right, people and legal entities were required to declare.

The next write-off occurred in 2007 and made it possible to use it within one year. The right applied exclusively to individuals and individual entrepreneurs. Debts that had accrued in 2006 were cancelled.

The third wave of amnesty came into effect in 2020. A special feature was the provision of declarations where information about assets was open.

The government write-off, which came into force in 2020, is distinguished by the provision of a complete exemption. All previously carried out procedures allowed individuals to avoid only penalties.

The procedure for writing off debts

The 2020 tax amnesty for transport tax is extremely relevant. The motorist pays transport tax annually for the car. A situation often arises when a car is no longer in use, but the tax levy continues to accrue due to the fact that the former owner did not deregister it on time.

The 2020 transport amnesty is being implemented according to the most simplified debt write-off scheme, which is carried out by the authorized tax service at the place of registration of the conditional citizen. Individuals and individual entrepreneurs are not required to fill out declarations, prepare applications or provide certificates. The procedure is carried out automatically, without the participation of the debtor citizen, payment of duties or government fees.

The adopted law does not require notification of debt cancellation. Specific deadlines for the procedure have not been established, so each citizen can independently contact the tax service at the place of registration of the individual.

A response to the corresponding request can be obtained in one of the following ways:

- on the official website of the tax office - log into your personal account and clarify the status of the debt. To do this, you must first go through the registration procedure in the system;

- at the tax office at the place of registration - visit in person and request information about the debt. As a rule, this procedure does not require much time and depends on the availability of queues.

Transport tax debts are written off automatically - they are deleted from the electronic system of the tax authorities. According to the amendments made to the legislation, the write-off of all debts, fines and penalties is carried out unilaterally without the participation of the debtor. In fact, the transport amnesty does not cause difficulties for individuals, since the debt is removed immediately without any exceptions - citizens get rid of accumulated debts in the fastest possible way without visiting the tax authorities.

Who is eligible to receive amnesty

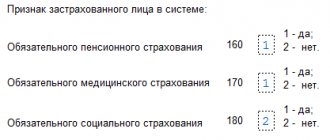

The Decree of the President of Russia and the Tax Code define the following categories of tax payers from whom debts are written off:

- IP. This also applies to people who have ceased to engage in economic activity. The write-off applies to taxes that were payable while doing business before January 1, 2015.

- Individuals. People have the opportunity to receive an amnesty regarding the payment of property taxes, namely: land tax, property tax, and transport tax.

- Self-employed persons. This applies to lawyers and notaries who are active or have stopped working. They are exempt from the obligation to pay off tax debts if they arose before January 1, 2020. The write-off amount does not exceed 8 minimum wages.

Law No. 436 provides a list of situations that do not give a person the right to apply for an amnesty.

We recommend you study! Follow the link:

Do individual entrepreneurs pay property tax under the simplified tax system in 2020?

Personal income tax is not written off if it is accrued and not paid from the following income:

- material benefit;

- prizes, winnings received from taking part in competitive programs and games;

- monetary rewards received by a person as a result of performing work or providing services specified in a contract;

- income in kind;

- interest, dividends;

- gifts from the company.

The debt is not canceled if it arose as a result of non-payment of tax from the extraction of mineral and organic formations of the earth's crust, transportation of products outside the state and excise taxes.

Large-scale amnesty announced by the President

At a press conference on December 14, 2020, V. Putin said: “Tax debt that arose over the previous many years due to circumstances that are sometimes not even connected with a person, due to the imperfections of our tax system - these debts concern somewhere 42 million people, and the total volume of this debt is 41 billion rubles.

After this statement, the Federal Law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” was prepared and quickly adopted. The rules on debt forgiveness are expected to come into force on January 1, 2020.

Types of individual entrepreneur tax debts that are written off

Individual entrepreneurs have the right to receive debt write-off for the following payments:

- Insurance premiums. If debts to pay them were incurred before the beginning of 2020, entrepreneurs, notaries and lawyers receive an amnesty.

- Taxes. Cancellation is allowed for such types of taxation as the established system, single tax, patent. Debts on fines from activities incurred before 2020 are also written off.

At the legislative level there is no limited write-off amount.

Due to the lack of reporting on insurance premiums for individual entrepreneurs, debts incurred after accrual of payments to the Russian Pension Fund will be forgiven.

For which taxes will the 2018 tax amnesty for individual entrepreneurs take place?

“Forgiveness” of debts of individual entrepreneurs is provided for almost all taxes, with the exception of (clause 2 of article 12 of law No. 436-FZ):

- mineral extraction tax,

- excise taxes,

- taxes associated with the movement of goods across the Russian border.

Thus, the amnesty applies to debtors who used OSNO or special regimes, who have unpaid debts for personal income tax, the single tax under the simplified tax system, imputation, patent and other taxes at the beginning of 2020. This tax amnesty applies to individual entrepreneurs, both active and those who, on the date of writing off their debts, have already lost the status of an individual entrepreneur. Entrepreneurs who did not operate but remained in the status of individual entrepreneurs are also subject to the amnesty.

The tax arrears “accumulated” as of 01/01/2015, penalties accrued on this arrears, and fines not paid by the entrepreneur on the date the tax authorities made the decision to write off the debt are considered hopeless for collection.

It does not matter the size of the amounts not paid by the entrepreneur - write-off is carried out in full for all debts incurred during the period from the creation of the individual entrepreneur to 01/01/2015.

How to take advantage of the amnesty for individuals

The bill provides for writing off debts to people if they incurred the following debts before 2020:

- land;

- tax established for vehicle owners;

- tax on the right to own property.

The amount of mandatory payment for the owner of a car with a volume of 200 liters or more. With. essential. If you stop using it without timely deregistration, a debt will arise. The amount is written off if accumulated as of January 1, 2015. Often, property owners do not have information about the required payments, which leads to debt. All unpaid receipts before 2020 will be canceled in accordance with legal regulations.

What types of individual entrepreneur debts are covered by the 2020 tax amnesty?

| Types of mandatory payments of individual entrepreneurs that can be written off as part of the 2020 tax amnesty | Education time | Write-off period |

| Taxes under special taxation regimes (UTII, simplified tax system, personal income tax, cost of patents, etc.) | As of 01/01/2015 | 2020 |

| Accrued penalties and fines for unpaid taxes | As of 01/01/2015 | 2020 |

| Debts to transfer contributions to insurance funds | As of 01/01/2017 | 2020 |

| Accrued penalties and fines on contributions to insurance funds | As of 01/01/2017 | 2020 |

- Transport tax, land and property payments are amnestied. The owners of the above property receive a notification by mail from the tax office about the amount of tax to be paid and must pay before the specified time. If payments are late, no penalty will be charged according to the decision made by the tax office.

- In relation to personal income tax, the period is provided from 01/01/2015. until January 1, 2017, the statute of limitations for which expires.

This period is provided for by the tax amnesty law. The amendments made to the Tax Code of the Russian Federation indicate that income is exempt from personal income tax in the case where the taxpayer has provided all the necessary information to the tax office. Here we consider a situation in which the taxpayer informs the regulatory authority that it is not possible to collect the tax and transfer it to the state budget (clause 5 of Article 226 of the Tax Code of the Russian Federation).

- Amnesty of capital of Russian citizens, including individual entrepreneurs

The effect of the tax amnesty for individual entrepreneurs in 2020 in relation to capital is to voluntarily indicate their property and income, which were not reflected in previously submitted declarations. The state is thus trying to bring the income of businessmen from the shadow sector into the open legal field.

Individual entrepreneurs have the right to indicate the following as part of the 2020 tax amnesty:

– funds in banking institutions (including foreign ones);

– land plots, vehicles, real estate and other property;

– unaccounted income that was received from other states.

The above categories of income must be indicated in a tax return, specially developed for this purpose, and submitted to the territorial office of the tax service once.

If an individual entrepreneur submits a special declaration to the tax office, then, according to the adopted tax amnesty of 2020, he will be exempt from all types of liability.

The right of pensioners and beneficiaries to amnesty

The state does not ignore the elderly and a property amnesty applies to them for one garage and real estate.

Land taxes are required to be paid. Exceptions may apply if additional legislation is passed at the local level.

Veterans and disabled people have land tax benefits of ten thousand rubles. This means that the tax is levied on the ownership of more than six hundred square meters of total area.

We recommend you study! Follow the link:

Procedure for closing an individual business

In 2020, a proposal was made to include pensioners in the list of persons entitled to a land amnesty. To substantiate the proposal, the size of the financial security of citizens of retirement age is given.

Is there justice in the amnesty for taxes and contributions?

According to the amnesty law, arrears of insurance premiums and arrears of penalties and fines in the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund for individual entrepreneurs and persons engaged in private practice are considered hopeless for collection. We are talking about debts incurred as of January 1, 2020 and attributed to individual entrepreneurs, lawyers, notaries and other persons engaged in private practice, including those who by this time had already ceased their activities.

Please note: tax authorities will write off arrears of contributions up to January 1, 2020 only for those individual entrepreneurs who did not conduct business and did not submit reports, as a result of which they were assessed contributions in the maximum amount. The basis for writing off debts will be the amount of debt to the tax office or funds. That is, to write off debt on insurance premiums, individual entrepreneurs do not need to collect any documents and contact the Federal Tax Service or extra-budgetary funds.

If an individual entrepreneur regularly paid his contributions until 2020, submitted reports to the funds and the tax office, but has, for example, one payment overdue, then such a payment will not fall under the amnesty. After all, the President said at a press conference that those who were registered as individual entrepreneurs but were never engaged in business were eligible for amnesty. “A man started a business, but something didn’t work out for him, such people should not be punished,” the President urged.

In our opinion, if an individual entrepreneur has arrears in insurance premiums, then it makes sense to ask your Federal Tax Service in January 2020 when the decision to write it off will be made.

Let us note that before the adoption of the commented law, it was impossible to write off the debt of individual entrepreneurs on insurance premiums “for themselves” without a court decision.

But is the amnesty on taxes and contributions fair to those people who constantly and regularly pay mandatory payments? To understand this, you need to evaluate the very purpose of the amnesty. The fact is that the overwhelming majority of written-off debts are hopeless, so we are not talking about any losses for the budget. On the contrary, writing off these debts will avoid wasting financial and labor resources.

Of course, it is possible that the amnesty will also include those tax debts that are not hopeless and can be collected. However, the number of such debts is insignificant, since the period of formation of such debts exceeds three years. Their percentage in the total tax debt will not cover the cost of collection.

In our opinion, the amendments are rather aimed at putting information on debts in the Federal Tax Service databases in order. After all, if something that is unrealistic to recover is written off, then there is no need to worry about billions - they are quite conditional.

Legislative confirmation of writing off tax debts

The Tax Code of the Russian Federation is the main legislative act that establishes issues of tax payment and exemption. In 2020, changes were made by bill 300200-7. The following amendments were provided:

- Detailed procedure for transferring losses incurred by a foreign company.

- Clarification of the conditions that give the right not to pay tax on profits.

- Changes in the tax deduction procedure.

- Defining rules for calculating income and expenses received by citizens.

Subsequently, adjustments took place.

They touched on the following:

- Customs rules are subject to new regulation.

- The procedure for determining the profitability and unprofitability of foreign companies.

- Grounds for establishing late payments for self-employed citizens.

In case of repayment of debts, penalties, fines before January 1, 2015 or they were collected before the law came into force, the money is not refundable.

Procedure and rules for writing off bad debts of individual entrepreneurs

| Income in the form of remuneration for the performance of labor or other duties, performance of work, provision of services. |

| Income in the form of dividends and interest. |

| Income in the form of material benefits, determined in accordance with Article 212 of the Tax Code of the Russian Federation. |

| Income in kind, determined in accordance with Article 211 of the Tax Code of the Russian Federation, including gifts received by taxpayers from organizations or individual entrepreneurs. |

| Income in the form of winnings and prizes received in competitions, games and other events. |

As you can see, the list of income not subject to the tax amnesty is quite wide. It includes, in particular, payments and remuneration under civil law and employment contracts. But then what kind of income received from 01/01/2015 to 12/01/2017 fell under the tax amnesty? For what income was a new paragraph 72 of Article 217 of the Tax Code of the Russian Federation introduced?

We are talking about writing off tax debts from “notional income”. These are incomes that in fact do not really exist. For example:

- Banks sometimes write off part of the debt as interest on a loan when they see that a person is unable to repay the loan. In accordance with current tax law, all these funds, once written off, become the person's income, and, therefore, having carried out such debt forgiveness, the bank or company must immediately notify the tax service that the person must pay income tax on these incomes (that is, send certificate 2-NDFL with sign “2”);

- Sometimes companies servicing the housing and communal services complex write off penalties on utility bills when people in difficult life situations simply cannot pay them. In such a situation, people also have income on which they need to pay personal income tax.

This kind of income fell under the tax amnesty. For such income received from January 1, 2020 to December 1, 2017, there is no need to submit a 3-NDFL declaration and remit taxes.

The tax amnesty for individual entrepreneurs announced for 2020 implies the writing off of bad debts. Arrears arise due to failure to fulfill obligations to pay mandatory taxes and contributions. It is formed due to the impossibility of collecting it for various objective reasons:

- the debtor does not have the financial and/or material (through the sale of property) capabilities to repay the arrears;

- declaring the debtor bankrupt;

- the bailiff issuing a resolution to terminate enforcement proceedings;

- exclusion of an individual from the Unified State Register of Individual Entrepreneurs (USRIP);

- the statute of limitations has passed;

- liquidation of the organization;

- the debtor lost his freedom or his death occurred, etc.

The amnesty carried out in 2020 has both its undeniable advantages and disadvantages. From the point of view of entrepreneurs, it is a painless way to write off the resulting financial burden. The administrative apparatus also supports such steps - paperwork is reduced, funds allocated for debt collection are saved, and there is a chance to establish cooperation with individual entrepreneurs in a new way.

The Law on Tax Amnesty for Individual Entrepreneurs 2020 will help resolve the issue of debt and avoid fines for former entrepreneurs who failed to manage their business, or who, having registered, never started developing their own business. If we talk about shortcomings, there is a risk of increasing debtors among law-abiding citizens who pay their obligations on time.

| Tax regime | Taxes |

| General taxation system (OSNO) |

|

| Simplified taxation system (USNO) | Single tax |

| Imputed system (UTII) | A single tax on imputed income, which does not depend on the revenue received |

| Patent system (PSN) | The cost of the patent is paid depending on the type of activity and conditions of application |

| Taxation system for producers, processors and distributors of agricultural products | Single tax is paid |

According to Article 12 of Law No. 436-FZ, all resulting arrears on the above taxes are subject to complete write-off. Additionally, penalties and fines accrued for obligations not repaid on time will be forgiven. There are also no additional conditions regarding the amount of debt. Tax authorities are required to cancel all debts incurred by individual entrepreneurs before January 1, 2020.

In addition to tax arrears, individual entrepreneurs could have incurred debts due to non-payment of insurance premiums, which are transferred to state extra-budgetary funds. The 2020 tax amnesty for individual entrepreneurs on insurance premiums provides for the possibility of canceling the accumulated debt and the resulting penalties and fines for the period before January 1, 2020.

In this case, the amnesty applies not only to individual entrepreneurs, but also to notaries, lawyers and other individuals engaged in private practice and required to make insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Mandatory Medical Insurance Fund. The campaign affects all individual entrepreneurs - those who continue to engage in business and those who have ceased their activities.

Upon careful study of the law, it becomes clear that not all debt on insurance premiums is offset. Debt cancellation will be made only to those individual entrepreneurs for whom compulsory insurance premiums were accrued in the maximum amount in accordance with Law No. 212-FZ, signed on July 24, 2009 and no longer in force on January 1, 2020. This explains the period established by the amnesty.

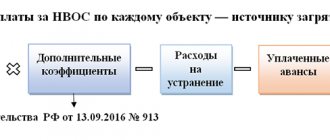

8 x minimum wage x 26% x K, where:

- 26% – the rate of insurance premiums;

- K – the number of months and/or days of the year during which business activities were carried out;

- Minimum wage value:

- 2014 – RUB 5,554;

- 2015 – RUB 5,965;

- 2016 – RUR 6,204

Using the calculation method, you can determine the amount due for payment of insurance premiums. So, for example, for the whole year 2020 it is equal to 154,851.84 rubles. (8 x 6204 x 0.26 x 12 = 154851.84). In addition to this, it is worth taking into account the accrued penalties and fines. The total amount, without any restrictions on the maximum amount, will be written off from the entrepreneur’s debt.

Debts incurred by former and current entrepreneurs will be canceled in 2020 by the Federal Tax Service, located at the individual’s place of residence. The amount of debt will be determined according to the information available to government agencies. The law does not provide for the exact form of the document regarding the amnesty of arrears.

Articles 11 and 12 of Law No. 436-FZ stipulate that the decision on amnesty is made by the Federal Tax Service without the personal participation of the entrepreneur, i.e., compliance with the law occurs automatically without sending a notification. The period during which the delay is canceled is also not fixed. According to experts, such uncertainty may cause the process to be delayed.

The task set by the president to debureaucratize the 2020 amnesty process assumes that the tax authorities themselves will do all the work without involving debtors in the process. The law does not prohibit an entrepreneur from independently contacting the Federal Tax Service with a request to clarify the procedure for making a decision to write off arrears and in what time frame the procedure will be carried out.

If an individual entrepreneur falling under the tax amnesty has submitted a corresponding application to the tax office, inspection specialists are required to consider the application no later than 30 days from the date of filing the paper. Such standards are established by Federal Law No. 59-FZ of May 2, 2006. After this, the debtor will be notified of the decision made regarding him, indicating the timing of debt write-off in 2020.

Residents of Russia will be forgiven not only the taxes themselves, but also the fines that were assessed during the specified period. The following categories of income will not fall under the new law:

- remuneration for the provision of any services;

- interest on deposits;

- material benefit;

- winnings and prizes.

You can find out about the status of your debt on the official website of the Federal Tax Service.

Individuals will be forgiven the lack of payments for transport tax, as well as all accumulated fines, provided that they were incurred before the beginning of 2020.

As an example, the situation is this: if the owner of a car did not pay tax on it in 2012 or 2013, the debt will be written off. All penalties that have accumulated from this moment will also be canceled.

This does not apply to fines from the State Traffic Inspectorate that were assessed during the relevant period. Initially, Putin’s law assumed that arrears incurred before 2017 would be forgiven, but in the final version they set a different deadline - 2015.

Additional changes will affect pensioners. Today they do not pay property taxes, paying only taxes on land plots to the budget.

In some regions the amount reaches 20 thousand rubles. annually. Not all pensioners have the opportunity to make such impressive payments.

In this regard, government officials made an additional proposal. Pensioners will not pay tax on a plot if its area is less than 600 square meters. m.

If it is larger, the contribution will be calculated according to the following scheme: plot area – 600 sq.m. x cadastral value.

Payments to the budget that are not subject to amnesty

According to the 2020 tax amnesty for individual entrepreneurs, not all debts can be written off. Law No. 436-FZ clearly defines them:

- Excise taxes. Every month, entrepreneurs who carry out transactions with excisable goods (alcohol, tobacco, etc.) are required to contribute a certain amount of tax to the federal budget, which is stipulated by law. Excise tax is an indirect tax that is initially paid by the entrepreneur and subsequently included in the cost of the product. The contribution amount is determined in different ways: at fixed rates, interest rates or a combined method. The choice depends on the units of measurement of the product (kilograms, liters, etc.) and is determined by law. The advance payment for excise taxes is transferred no later than the 15th, and the final payment – before the 25th.

- Mineral extraction tax (with the exception of common minerals, such as crushed stone, sand, etc.). Rates are calculated in two ways: as a percentage of the tax base, defined as the cost of the extracted mineral, or in rubles per ton. It is paid monthly to the budget at the location of the site where minerals are mined, no later than the 25th day of the month following the reporting month. If the subsoil is located outside the Russian Federation, contributions are made at the place of residence of the individual entrepreneur.

- VAT when transporting goods across the Russian border. Federal tax paid by individual entrepreneurs to customs authorities in the generally established manner. Even if an entrepreneur is not a tax payer and works on a simplified or imputed basis, according to the Tax Code of the Russian Federation he is obliged to pay import VAT.

- Insurance premiums for employees.

- Insurance premiums for yourself, which are paid in fixed amounts. These include contributions to the Pension Fund and compulsory health insurance. Their size is determined annually, and payment occurs before December 31.

- Tax amnesty for individual entrepreneurs and individuals on taxes and insurance premiums