Which shifts are considered night shifts?

The law declares night work hours to be from 10 p.m. (10 p.m.) to 6 a.m.

A shift will be considered a night shift if at least half of it consists of work within the specified time period. Payment at the night rate will be only for the hours that make up this period; the rest will be rewarded, as is customary in day shifts. The definition of “night shift” in this case is significant for deciding the issue of attracting or not attracting a certain category of employees.

ATTENTION! According to Art. 96 of the Labor Code of the Russian Federation, the night shift should be 1 hour shorter than the corresponding day shift.

The night shift is not reduced by an hour in certain special cases, namely:

- the employee was specifically hired for night work, and this is reflected in the employment contract;

- the employee has a reduced schedule;

- The shift schedule is based on a 6:1 scheme;

- when the shift cannot be shortened due to the nature of production.

Night hours on a holiday: payment

Since both night work and work on holidays provide increased pay, night work on holidays involves the summation of the following additional payments:

- additional pay for working on holidays;

- surcharge for night work.

Let us remind you that increased payment is made for hours actually worked on a non-working holiday (Part 3 of Article 153 of the Labor Code of the Russian Federation). Specific amounts of payment for work on a holiday are established by an employment or collective agreement, but not less than double the amount (Part 1.2 of Article 153 of the Labor Code of the Russian Federation).

Documents on payment for night work

An enterprise must necessarily regulate the conditions for organizing and calculating remuneration for work outside normal hours. This should be implemented in the following local acts:

- in the regulations on wages (general or issued specifically for night hours);

- in the collective agreement (the opinion of the trade union body must be taken into account)

- in an employment contract with an individual employee;

- in the order to attract an employee to work at specified hours (if this is done one-time or an employee is attracted from a special contingent).

IMPORTANT! An order is necessary only in special cases; with a permanent schedule with night shifts, it is enough to fix the payment procedure in the Regulations.

Payment for night work

According to legislative acts, payment for this time must be increased and cannot be less than established by law.

The level of additional payment may be influenced by the indication in the employment or collective agreement, but it must comply with the minimum legislative acts.

Important: the Tripartite Commission for the Regulation of Social and Labor Relations takes part in the adoption of the minimum level.

Notice of employment at night.

The Government Decree recognizes that the minimum is an additional payment for each hour of work of 20% of the daily hourly payment, while there is no maximum, so organizations have the right to set it independently.

If an increase in additional payment is envisaged, this must be indicated in the local acts of the enterprise signed by the manager.

Categories of employees and amounts of additional payments

For a certain category of workers there is a special amount of additional payments:

- 35% is intended for employees:

- Railway, metro, river shipping;

- housing and communal services;

- Trade and catering;

- Motor transport without shift work;

- Fire, paramilitary and security guards.

- 50% is provided for workers at pasta production enterprises.

- 75% pay extra to employees:

- Textile workshops;

- Plywood production;

- Yeast factories, if production is shift-based or continuous.

- Specialists receive 100% additional payments:

- Bakery;

- Cereal factories;

- Flour industry.

Pay per hour

If the night period is paid using this payment option, the following calculation is used:

- An employee receives 100 rubles for an hour of daytime work, then with a minimum additional payment for a night hour he receives 120 rubles;

- For just 8 hours of night time, he will receive 160 rubles in additional payment plus 800 rubles for each hour, totaling 960 per night;

- If at the same time he started his shift at 20.00 and handed over the shift at 8.00, then he will receive an additional 400 rubles, which means a total of 1,360 rubles per shift.

Salary calculation scheme

The employee receives 30,000 rubles per month; he worked 22 shifts per month, 10 of them night shifts.

- Initially, the average daily earnings are calculated:

- 30,000 / 22 = 1,363.64 rubles.

- It is now possible to calculate the minimum surcharge for one night shift:

- 1,363.64 * 20% = 272.73 rubles.

- It follows from this that the amount of additional payment per month due to the night period:

- 272.73 * 10 = 2,727.30 rubles.

In this case, the additional payment per month may be different, since the number of shifts may vary monthly. If work at night falls on a holiday, then additional payment occurs for both night time and the holiday.

Important: if the employer refuses to act in accordance with the requirements of the law, the employee has the right to appeal to the labor inspectorate or the courts.

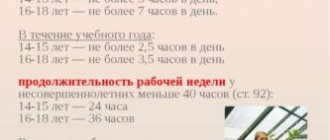

Reduced working hours for night workers.

Special contingent of personnel

Certain categories of employees do not have the right to work night shifts, without taking into account their opinion on this matter. Another list defines the circle of workers who can be involved in night work if they express their consent.

It is prohibited to work at night:

- women expecting a baby;

- minor workers, except for special categories provided for by the Labor Code of the Russian Federation and certain federal laws, for example, those involved in performances or other events.

You can work at night with written consent:

- mothers of young children (under 3 years old);

- disabled people of any group;

- employees who care for disabled people;

- workers caring for unhealthy family members (according to medical opinions);

- single parents with children under 5 years of age;

- guardians of children under 5 years of age.

FOR YOUR INFORMATION! An employee belonging to this category must be warned in writing that he has the right to refuse to work at night, and in turn, have his consent endorsed.

Factors determining the amount of pay for night shifts

The law establishes increased pay compared to daytime hours for each hour worked at night. The size of this increase depends on several important nuances:

- the minimum wage for night work established by the state;

- numbers set out in the relevant local act (usually the additional payment is a percentage of the daily salary or tariff);

- the number of night hours during which the employee was busy.

The amount of additional payment for each night hour of work cannot be less than a fifth of the regular daily salary (Article 154 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of July 22, 2008 No. 554).

Read more: Is it possible for people with many children to get money instead of land?

NOTE! A shift schedule or a regular schedule is accepted in the organization; night hours are paid according to the same principle - with an additional payment.

Legislation on night allowances

According to Art. 154 of the Labor Code of the Russian Federation, a person who works at night must receive additional money for each hour he works. This norm specifies Government Resolution No. 554 of July 22, 2008, which prescribes a minimum additional payment to the hourly rate or to the hourly rate of salary - 20%.

This limit represents a lower threshold, while an upper one is not established. If the employer intends to make the amount of the surcharge exceeding 20%, then he is obliged to reflect it in one of the following documents:

- Collective agreement.

- Fixed-term (indefinite) employment contract.

- Regulatory document of a specific enterprise.

There is a contingent of workers for whom the law specifies a percentage of “night” surcharges that exceeds 20%.

Night on a business trip

If an employee must work at night while on a business trip, this does not change the mandatory additional payment. The only difference is that the employer is not obliged to pay extra for night hours spent on the way to the business trip, although he can do this on his own initiative and desire.

What if it's overtime?

It’s one thing when night hours are included in the work schedule, and a slightly different situation when they end up being worked beyond the norm, even with a shift schedule. How to make payment in such cases?

It is necessary to apply both the extra pay per night and the overtime factor, which is 1.5 for the first two hours of overtime and 2 for the subsequent time.

Examples of night wage calculations

Example 1. Payment for night hours with a fixed salary

Employee Polivanov K.I. with a salary of 25 thousand rubles. per month Works on a shift schedule 5 days a week (Monday to Friday). His evening shift is from 20:00 to 04:00. According to his schedule, he has 10 such shifts per month. The local act of the enterprise establishes a 20% share of additional payment for work outside normal hours. We will calculate the amount of the surcharge.

For the accounting month Polivanov K.I. fully worked the hourly quota corresponding to the production calendar (170 hours). Night hours each shift account for 6 hours (from 22:00 to 04:00), for a month this will be 6 x 10 = 60 hours. We need to find the average hourly tariff rate: 25,000 / 170 = 147 rubles. Let's calculate the amount of the night supplement for each hour: 147 x 0.2 = 29.4 rubles. For 60 odd hours you will need to pay an additional salary of 60 x 29.4 = 1,764 rubles.

Example 2. Payment of night hours to hourly workers for overtime work

The production calendar for the accounting month provides for 172 hours worked, and employee Belchenko L.A. worked 176. At the same time, Belchenko has a shift work schedule with an hourly salary of 100 rubles. per hour, which leaves 3 hours of night time per shift. In the accounting month, Belchenko had 12 shifts. The “night” coefficient adopted by the company is standard - 20%. We will calculate the additional payment.

Let's find the number of night hours for a given month: multiply the number of shifts by the number of off-hours - 12 x 3 = 36 hours.

Let's find how much time was processed beyond the norm: 176 – 172 = 4 hours.

For night work, an allowance of 36 x 100 x 0.2 = 720 rubles is given.

For overtime: for the first two hours at time and a half 100 x 1.5 x 2 = 300 rubles; for the remaining two hours 100 x 2 x 2 = 400 rubles. Total 300 + 400 = 700 rub.

In addition to Belchenko L.A.’s usual daily earnings. should receive 720 + 700 = 1420 rubles. surcharges.

From a consumer's point of view, the opportunity to purchase a certain product or receive a service at night is attractive. But for workers this is discomfort. At the legislative level, special incentives are provided for employees who perform their duties after ten o’clock in the evening. How this is implemented is described below.

Payment for night hours on a holiday: example

Here is an example of calculating payment for night work on a holiday.

Let’s assume that an employee’s hourly wage rate is 250 rubles. Payment for work on holidays is double, and additional payment for night work is 20% of the hourly rate.

In accordance with the schedule, the employee worked from 16:00 on 02/23/2018 to 09:00 on 02/24/2018.

Payment for time worked consists of the following amounts:

| Payment period | Calculation | Amount, rub. | Explanations |

| from 16:00 02/23/2018 to 22:00 02/23/2018 | 6 hours * 250 rubles * 2 | 3 000 | 6 hours of daily work on a holiday are paid double |

| from 22:00 02/23/218 to 00:00 02/24/2018 | 2 hours * 250 rubles * 2 + 2 hours * 250 rubles * 20% | 1 100 | 2 hours of night work on a holiday are paid double and include a 20% surcharge |

| from 00:00 02/24/2018 to 06:00 02/24/2018 | 6 hours * 250 rubles + 6 hours * 250 rubles * 20% | 1 800 | 6 hours of night work on Saturday (according to the schedule this is a working day) are paid at a single rate, taking into account a surcharge of 20% |

| from 06:00 02/24/2018 to 09:00 02/24/2018 | 3 hours * 250 rubles | 750 | 3 hours of daytime work on Saturday are paid at a single rate |

In total, payment for work at the specified time amounted to 6,650 rubles (3,000 + 1,100 + 1,800 + 750).

Shift work schedules often include night work. For the employee, such work carries an increased burden, therefore, the payment for it should be higher. Employees are often concerned about the issue of pay during shift work, in particular when they are busy at night.

Let's consider how the laws of the Russian Federation relate to this issue, how accounting occurs when working outside of normal hours, how to calculate payment, and we will show this with a specific example.

Legislative regulation

The basic regulatory act regulating night work is Article 96 of the Labor Code of the Russian Federation. It indicates the hours that apply to the late period, as well as the rules for calculating the rate.

Note that an important feature of employment at night is that the work shift is shortened by one hour. If an employee works according to a standard eight-hour workday, then during a night shift he only needs to stay on site for seven hours; an additional hour is not subject to work.

The law states that when working at night, the hourly rate increases, that is, this category of employees will receive a higher salary than their daytime colleagues.

Who is not allowed to work at night

In accordance with Part 5 of Article 96 of the Labor Code, there are special categories of citizens for whom exceptional rules apply. Some employed people are not allowed to work at night, and some can carry out activities after ten in the evening, but only with their written consent.

Let's take a closer look at these categories.

| Not allowed to work | Allowed with their written consent |

| pregnant women | women with children under three years of age |

| employees under 18 years of age | disabled people |

| workers with disabled children | |

| workers caring for sick family members in accordance with a medical report | |

| mothers and fathers raising children under the age of five without a spouse | |

| guardians of children under 5 years of age |

Please note that persons who work at night with written consent have the right to refuse night shifts at any time. This right is prescribed by law.

Reducing night shifts

According to the general rule prescribed in the Labor Code, the night shift is reduced by an hour. For example, if an eight-hour workday is specified in an employment contract, then during a night shift it will be equal to seven hours. However, this principle has an exception; the rule does not apply to the following categories of employees:

- those hired to carry out activities at night, for example, subway repairmen;

- persons working reduced hours due to hazardous conditions or by agreement with the employer.

Read more: When to tell your employer about your pregnancy

The employer has the right not to reduce working hours, but this must be agreed upon with the workforce. For example, if working conditions allow for a long night shift and there is a need for a person to be present at work for eight hours.

Supplement for night work

Government Decree No. 554 states that the minimum additional payment for night work is twenty percent of the employee’s hourly rate. If his income is not formed at the rate of sixty minutes, then the monthly salary should be divided by the number of hours worked.

The company has the right to set its own bonuses, but not less than twenty percent, in order to make night work more attractive for employees. Thus, in some industries the rate for a night shift is one and a half times higher than for a day shift.

Employee consent to work at night

Carrying out work at night for some workers requires drawing up a document of consent to such workdays. The general list of employees who must sign and submit the relevant document is stated above.

Consent to work on night shifts must be formalized by a person if he is ready, at the request of the employer, to work in the period from 10 pm to 6 am. In addition to consent, it is necessary to provide a medical report on the real possibility of working in such conditions.

The consent usually includes the following information:

- information about the recipient of the application, i.e. employer;

- information about the employee;

- general part, which indicates consent;

- date and signature of the employee.

After submitting the application, the manager forms an order assigning the employee to night shifts in general mode; the employee’s consent and his medical report are attached to the order. There are no specific requirements for drawing up consent. The document is transferred to the HR department or the manager personally, and then reviewed. As a result, an order is issued to assign the employee to night shifts.

Calculation of wages at night

The principle of calculating wages at night is regulated by two regulations:

- Article 154 of the Labor Code of the Russian Federation;

- Government Decree No. 554 of 2008.

In accordance with the above laws, overtime at night is compensated by a financial surcharge. The amount of the premium is determined by the company’s internal documents, but cannot be lower than twenty percent of the hourly rate.

Example

Citizen Kireev has a salary of 75,000 rubles and, at the request of his employer, stayed at his place of duty for two hours after ten in the evening once a month.

First of all, you need to calculate how much an employee receives per hour. To do this, wages are divided by the total number of hours per month spent at work. With a standard forty-hour week, this figure will be equal to 426 rubles. This amount is then multiplied by two over the hour and by an increasing factor equal to twenty percent.

The total additional payment for the month will be 1,022 rubles for two additional hours spent at work after ten in the evening.

Night overtime

According to the provisions of the Labor Code of the Russian Federation, the employer has the right to involve employees in overtime work. This situation arises if there is a need to urgently complete a certain type of work, but it is not possible to do this during one shift.

Processing, as a rule, is taken into account within a certain accounting period - shift, week, month. The need for an employee to be present at production may also arise at night. Involvement of a subordinate during this period is allowed only with his written consent, and the time spent at work is recorded as additional and paid in the established manner. If he works in accordance with an irregular day schedule, then the excess period is not considered overtime.

Situations when an employee goes to work of his own free will:

- unfinished work that could cause damage to the property of the enterprise or personnel;

- forced production downtime and subsequent financial losses due to equipment breakdown;

- absence of a replacement due to illness or other reasons.

It is important to know! At the same time, the employer has the right to involve subordinates in night work without their consent, if there is a need to prevent an emergency, eliminate the consequences of a raging natural disaster, a man-made disaster, or urgent repair of equipment.

Shift work schedule

This work schedule assumes the introduction of two or more shifts at the enterprise. As a rule, this is due to the need for long-term operation of the enterprise, for example, around the clock. In this option, employees will have some of their shifts at night.

The procedure for paying compensation for work after ten in the evening is standard: the total number of hours that the employee spent at the place of duty after twenty-two hours is considered. The indicator is multiplied by the premium coefficient.

With a fixed salary

It is often easier to calculate additional pay for employees who are paid hourly. It is enough to multiply the indicator by the surcharge coefficient. When it comes to employees with a fixed salary, you first need to calculate the average hourly income in a particular month. To do this, wages are divided by the number of hours spent at work.

After calculating this indicator, the procedure for calculating the premium is standard.

During a business trip

The fact that a person works outside the office does not affect the remuneration procedure. If his work occurs at night, the employee has the right to count on additional payment.

As for travel time, the employer is not obliged to increase the rate per hour, but this is often included in travel allowances.

Overtime at night

If an employee has a shift schedule and part of the work time falls at night, then he is additionally paid only compensation. In cases where, at the request of the employer, a person is delayed at the place of work after ten in the evening, he must also be given an overtime bonus. Its calculation is as follows:

- for the first two hours of delay, the hourly rate is multiplied by fifty percent;

- over the subsequent time - doubles.

On holidays

At the legislative level, incentives are provided for work on holidays.

The tariff increase factor is two. That is, a person receives 1,000 rubles for a shift, and 2,000 rubles for work on May 9th. If part of the shift occurred at night, the premium will be calculated from the increased tariff.

Examples of calculations

Several rules for calculating allowances for night work have already been discussed above. Let's look at some difficult but common situations.

Payment for night hours at a fixed salary

Let us assume that an employment contract has been concluded with citizen Gavrilenko, under which a shift work schedule is established, with some shifts at night. The employee's salary is 25,000 rubles.

To calculate the night shift bonus, you need to know three indicators:

- Rate per hour. Determined by dividing income by the total number of hours worked in a month: 25,000/170 hours. The hourly rate is 147 rubles;

- The number of hours worked by the employee per month at night. Let's say that in our example there are sixty of them;

- The amount of the bonus for night work established by the company is twenty percent.

Read more: Free accounting consultation by phone

By multiplying the three indicators, it turns out that the additional payment for night work will be 1,764 rubles.

Payment for night hours to hourly workers for overtime work

Let’s say citizen Nikonenko works in a company with an hourly rate of one hundred rubles. In a month, she worked 176 hours, although the staffing table indicated 172, that is, she overworked 4 hours. For them, she will be paid an additional payment of 700 rubles, since the first two hours are multiplied by one and a half, and the subsequent ones by two.

As for the extra pay for night time, in the month after ten in the evening the woman worked 36 hours, the company’s standard bonus is 20%. The additional payment will be 720 rubles.

Taxation

All income received by citizens is taxed. Extra pay for night work is no exception. The accountant makes contributions to the Pension Fund and the Tax Service from his entire salary . Consequently, the employee does not need to independently report to the authorities about the additional profit received.

Working at night is a common practice. It is stated at the legislative level that a bonus is provided for work after ten in the evening. The minimum additional payment is twenty percent for each hour in accordance with the employee’s average hourly salary.

For a number of reasons, work can be carried out not only during the day, but also at night. How, in this case, is the employee paid? We'll talk about this in our consultation.

What is night time

Labor legislation defines that night time is the time from 22 o'clock to 6 o'clock (part 1 of article 96 of the Labor Code of the Russian Federation). In this case, the duration of work (shift) at night is reduced by one hour without further work. This means that if, with an established working time of 40 hours a week (8 hours a day), the work occurred at night, then instead of 8 hours a day the employee must work 7 (for example, from 22 to 5), and the working hours will be be considered fully worked and this lost 1 hour cannot be worked off (Part 2 of Article 96 of the Labor Code of the Russian Federation).

This procedure does not apply to employees who have been assigned reduced working hours or employees who were specifically hired to work at night.

Night work

In official language, night work in the current labor code of the Russian Federation means labor activity carried out at night . It is considered that a person is involved in night work if his work activity falls on the time period from 22:00 to 06:00.

The Labor Code of the Russian Federation (Article 96) stipulates: a person can work under such conditions only with his own consent , confirmed by documents.

Attention! The duration of work should be exactly one hour less than the usual day shift.

Night work must be shorter in duration than the day shift. Typically, an employee's work is about seven hours, but any work whose time period falls more than half of the specified time is also considered night work. may not be reduced in duration , this is possible:

- if an employee has one day off and works at night, no longer than during the day with a six-day week shift schedule;

- if the shift duration has already been reduced;

- when an employee is hired exclusively for night work.

The legislative framework does not provide detailed explanations of what type of activity is included here. Jobs are created at the local level, stipulated by collective agreements of enterprises and other regulatory documents.

Employees involved in a six-day work week and having a shift schedule should not overwork more than 5 hours. But for a certain type of profession, agreements provide for the duration of the schedule. For example, for correspondents, circus and theater performers, the duration of night work is stipulated by employment contracts and local documents - this is completely legal.

Who shouldn't work at night

Certain categories of workers are not allowed to work at night.

There is another category of workers who can work at night, but only with their written consent and provided that such work is not prohibited for them for health reasons in accordance with a medical certificate. At the same time, these employees must be informed in writing of their right to refuse to work at night (Part 5 of Article 96 of the Labor Code of the Russian Federation):

| Night work is not allowed | Allowed only with their written consent |

| pregnant women | women with children under three years of age |

| employees under the age of 18 (except, for example, child actors and other categories provided for by the Labor Code of the Russian Federation and other federal laws) | disabled people |

| workers with disabled children | |

| workers caring for sick family members in accordance with a medical report | |

| mothers and fathers raising children under the age of five without a spouse | |

| guardians of children under 5 years of age |

Who can't work the night shift

This work is specific, so not all able-bodied persons are allowed to do it.

There is a legally established list of workers who are not allowed to go out at night, namely:

- Pregnant women;

- Minors.

Also, certain persons are admitted only with a health certificate or with their written consent.

In this case, the employer is obliged to notify the following list of employees in writing about the possibility of refusing to go out at night:

- Mothers raising minor children under 3 years of age;

- Disabled people, parents of children with special needs, relatives of seriously ill people, if they have the appropriate document from a medical institution;

- Parents or guardians raising children under 5 years of age alone.