Currency transactions in accounting in 2019–2020

In accordance with the above PBU, in 2019–2020, as in previous periods, currency transactions in accounting are reflected exclusively in rubles. This accounting provision does not apply to accounting for currency transactions related to:

- with the recalculation of financial reporting indicators, which are submitted in rubles, into foreign currency according to the requirements of foreign creditors;

- when compiling consolidated accounting, when the parent company processes the accounting of dependent institutions located abroad.

You can get more detailed information about currency transactions in our material “Currency transactions: concept, types, classifications” .

For conversion, the exchange rate of the Central Bank of Russia is used on the date that corresponds to the nature of the transaction. We will tell you more about the procedure for converting into rubles when accounting for foreign exchange transactions.

Accounting for transactions in foreign currency in 2020

No fundamental changes are expected in the accounting of foreign exchange transactions. As before, they are taken into account using active accounts , , , and cash transactions are attributed to the subaccount 50/4.

The debit of these accounts records the receipt, and the credit records the debit of funds from the account. For the convenience of conducting separate analytics, sub-accounts are opened. Cash transactions in foreign currency are carried out in companies conducting foreign trade operations. They are reflected in the 50/4 subaccount, while all currency flows are accounted for in rubles, recorded in the company’s cash book.

Exchange rate differences associated with market fluctuations of the ruble on different days of the assessment of foreign exchange reserves are reflected in the account of other income and expenses.

How to convert currency to rubles

To account for transactions in foreign currency, the date on which you should take the Central Bank exchange rate and convert the currency into rubles is very important. As already mentioned, in Russia, accounting for foreign exchange transactions is carried out exclusively in rubles, and since exchange rates are constantly changing, it is important to know the “correct” moment of converting currency indicators into rubles.

Thus, in order to be reflected in accounting and reporting, the cost values of liabilities and assets of a legal entity expressed in foreign currency, as well as the amount of reserves in foreign currency, must be converted into rubles.

In accounting for foreign exchange transactions, only the official exchange rate of the Central Bank of a given currency to the ruble is used to convert cost indicators into Russian rubles. The exception is cases when, in order to convert the value of a monetary obligation or a tangible asset into rubles, a special law or agreement establishes a different rate at which the amount payable must be recalculated.

The date of conversion of currency indicators into rubles is different for each operation. Most often, the date of conversion at the official exchange rate is the moment when the business operation is carried out. In the case where over the course of a month (or a shorter time period) an enterprise carries out a large number of similar transactions in foreign currency, and the official exchange rate has not undergone significant changes, it is possible to keep records of transactions in foreign currency of this type at the rate averaged over a given period of time.

PBU 3/2006 clearly defines all the moments when currency amounts should be converted into rubles:

- On the date of the business operation (when cash flows), as well as on the reporting date (balances at the cash desk/account), it is necessary to convert into rubles all cash/non-cash currency at the cash desk/on the foreign exchange account. Also, in a number of situations, the value of funds may be recalculated as the exchange rate changes.

- Cash/non-cash currency is recalculated at the rate existing at the reporting date in order to reflect the data in the financial statements.

- As of the date of the business transaction, the value of fixed assets, intangible and other non-current assets accepted for accounting, as well as the value of inventories and other assets, with the exception of cash, is recalculated.

- On the date of recognition of foreign currency income or expenses, they are recalculated into rubles. As for the date of recognition of travel expenses, it coincides with the moment of approval of the traveler’s advance report.

- On the date of recognition of costs that form the cost of fixed assets, intangible and other non-current assets, the amount of investments in foreign currency in these non-current assets is recalculated into Russian rubles.

- If an enterprise has received an advance payment in the form of a deposit or an advance payment, then these funds are accounted for in accounting in Russian rubles at the exchange rate at the time of receipt of the specified amounts.

- If the prepayment was paid by the company (in the form of transfer of a deposit or payment of an advance against the delivery of assets or for expected expenses), then this payment will be reflected in the accounting records in rubles at the rate prevailing on the date of payment.

After non-current assets, transferred or received advances have been reflected in accounting, their value is not recalculated when the exchange rate changes.

Read about what points you need to pay special attention to when organizing accounting for foreign economic activity in the article “Features of accounting for foreign economic activity .

Settlements in foreign currency on the territory of the Russian Federation between legal entities

Let us immediately note that the Law “On Currency Regulation” contains a direct ban on settlements in foreign currency on the territory of the Russian Federation between residents. The legislation allows that in contracts and other transaction documents the cost of goods or services may be denominated in foreign currency. But in fact, the payment must be made in rubles; the amount to be paid is in this case determined at the official exchange rate on the day of settlement.

Legal entities can open foreign currency accounts in any quantity and in any currency. The latter can be limited only by the internal policy of the bank, for example, all credit institutions offer to open accounts in US dollars or euros, but opening an account in Mongolian tugriks is unlikely. These accounts can be used for settlements with foreign partners, or for transfers to your own accounts opened with foreign credit institutions

Also, the legislation does not restrict transfers from a foreign currency account to your ruble account, or vice versa - when performing such an operation, the currency is converted into rubles at the rate of the bank where the accounts are opened.

Read also: Currency account: exchange rate differences

Only in some cases can a Russian legal entity transfer foreign currency funds to another organization or citizen who is a resident of the Russian Federation - their list is given in Art. 9 of Law No. 173-FZ, where, in particular, it is allowed:

- transfer of currency from an account opened in the Russian Federation to a resident’s account opened in a foreign state;

- transfer of funds as wages to employees located outside the Russian Federation on official business;

- carrying out transactions on the securities market denominated in foreign currency in the manner prescribed by Law No. 39-FZ “On the Securities Market”.

All such operations are subject to currency control, which is carried out by credit institutions where the foreign currency accounts used are opened.

What is exchange rate difference

The difference in rubles that arises when recalculating the currency value of assets and liabilities on different dates is called exchange rate. The exchange rate difference at the end of the reporting period relates to the financial result of the company, with the exception of the difference that is calculated on constituent deposits. In the latter case, the difference in rubles arises during the time interval between the founders’ decision to make a contribution in foreign currency and the very moment the founder pays the contribution. Such exchange rate differences do not affect the company’s financial results, but change the amount of additional capital.

Also included in the company’s additional capital is the exchange rate difference that arises when converting into rubles the tangible assets and monetary liabilities of a legal entity used to carry out business activities abroad. Exchange differences in this case can be attributed to the financial result in the form of adding part of the additional capital in the event of termination of activities abroad.

In all other cases, the exchange rate difference is credited to the financial result, reducing or increasing its total value.

Exchange differences arise on the following transactions:

- In case of partial or full repayment of debts by debtors or creditors in foreign currency. In this case, recalculation is carried out at the time of payment, if the debt was previously reflected in accounting at a different rate (the cost in rubles was calculated on the day of the transaction or recalculated on the last reporting date).

- When converting assets in the form of non-cash or cash into rubles.

The article “What is the responsibility for illegal currency transactions?” will introduce you to the types of currency violations and penalties for committing them.

Payments in foreign currency and reporting

The statements indicate exclusively the ruble equivalent of the value of the company's assets, existing liabilities and reserves (including those used/located abroad).

If in the country where a Russian company operates, it is required to prepare reports in the currency of that state, then the reports are also prepared in foreign currency.

The financial statements reflect those cost values that are indicated in the accounting. In most cases, the conversion of the currency value into rubles is carried out at the time of the transaction, but there are situations when it is necessary to make a conversion at the reporting date.

The accounting records reveal the amounts of exchange rate differences:

- formed when converting into rubles the currency value of assets and liabilities for which it is required to pay in foreign currency;

- when recalculating the currency value of assets and liabilities for which payment will be made in rubles;

- credited to accounting accounts, which do not take into account financial results.

The official exchange rate in rubles established by the Central Bank on the reporting date is also reflected in the financial statements. If a rate other than the official rate of the Central Bank of the Russian Federation is established (by agreement or law), then this information is also reflected in the reporting.

Find out about the latest changes in currency legislation from this publication.

Making payments in foreign currency abroad

The procedure for settlements through accounts opened outside the Russian Federation is stipulated by the legislator in Art. 12 of Law No. 173-FZ.

According to the general rule, paragraph 6 of Art. 12, without any restrictions, settlements can be made between residents (legal entities and individuals) with funds credited to their accounts in banks outside the Russian Federation. But there are still a number of exceptions. Their complete list is given in paragraph 1 of Art. 9 of Law No. 173-FZ.

At the same time, the legislator provided for a number of exceptions to the established ban. As for currency transactions between residents outside the Russian Federation, these exceptions are listed in clause 6.1 of Art. 12 of Law No. 173-FZ.

The resident must notify the territorial tax authority (at the place of his/her own registration) about all actions with the investment account on a bank account outside the Russian Federation (opening, closing, changing details).

Currency transactions in case of conducting business abroad

If an enterprise operates abroad, then when preparing financial statements, all assets used and existing liabilities are recalculated into rubles. This also applies to funds held in accounts in foreign banks operating abroad.

Conversion into rubles to reflect foreign exchange transactions in accounting is carried out at the official rate established by the Central Bank for the currency in which assets, liabilities and inventories are recorded. The exception is when recalculation is made at the average rate.

Cash in foreign currency, including in settlements of borrowed obligations, which are used by the organization to conduct business abroad, are converted into rubles at the Central Bank exchange rate in effect on the reporting date. Foreign non-current assets of the company, as well as advances received and sent in connection with activities abroad are recalculated into rubles at the Central Bank exchange rate on the day of the transaction in foreign currency.

If a company has recalculated the value of its foreign assets and liabilities as required by foreign legislation, then this recalculated value is converted into rubles at the rate that was in effect on the date of recalculation.

The difference that arises when converting into rubles the value of assets and liabilities that are used to conduct the company’s foreign activities is reflected in account 83 as additional capital in the accounting of foreign exchange transactions.

The materials in this section will help you understand the intricacies of accounting.

Option one: payment received after shipment

In the buyer's accounting, costs arise in the form of the cost of the goods received, expressed in currency or conventional units. According to accounting standards, expenses must be recalculated at the exchange rate established on the date of shipment. This follows from paragraph 6 of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” In tax accounting, costs are also recalculated at the exchange rate on the date of shipment (Clause 10, Article 272 of the Tax Code of the Russian Federation). Let us immediately make a reservation that hereinafter it is assumed that the purchasing company is on the general taxation system and uses the accrual method.

Next, the supply payables must be adjusted up or down, depending on whether the exchange rate increases or decreases. Adjustments are made through exchange rate differences.

The moment and procedure for determining exchange rate differences in tax and accounting are the same. This follows from paragraph 8 of Article 271 of the Tax Code of the Russian Federation, paragraph 10 of Article 272 of the Tax Code of the Russian Federation and from the provisions of PBU 3/2006. Thus, the exchange rate difference is formed on the last day of each month until full payment is made. Plus, the exchange rate difference is formed at the time of payment, both full and partial.

The exchange rate difference on the last day of each month is the cost of the unpaid part of the delivery in foreign currency or monetary units, multiplied by the difference between the two rates. The first rate is on the date of the previous recalculation (if there have been no recalculations yet, then on the delivery date). The second course is for the current date, that is, the last day of the month.

The exchange rate difference at the time of payment consists of two parts. To find the first part, you need to take the cost of part of the delivery (in foreign currency or cu), which is paid by the buyer. To find the second part, you need to take the cost of the remaining unpaid part of the delivery in foreign currency or cu. Both the first and second values must be multiplied by the difference between the two rates: on the date of the previous recalculation (if there have been no recalculations yet, then on the delivery date) and on the date of payment.

If the exchange rate has decreased since the previous recalculation (or delivery), then the resulting difference is positive. Both in tax and accounting it should be classified as non-operating income (subclause 11 of article 250 of the Tax Code of the Russian Federation and clause 13 of PBU 3/2006).

If the exchange rate has increased since the previous recalculation (or delivery), then the resulting difference is negative. Both in tax and accounting it is supposed to be written off as non-operating expenses (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation and clause 13 of PBU 3/2006).

Particular attention should be paid to VAT deduction. Its value is formed once - at the time of shipment at the rate established on the date of shipment. When making subsequent payments, the deduction amount is not adjusted, even if the exchange rate changes. Exchange differences (both positive and negative) are included in income and expenses along with VAT (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Fill out and submit the balance sheet using the current form to the Federal Tax Service and Rosstat Submit for free

Example 1 In March, Alpha LLC shipped to Betta LLC a consignment of goods with a total value of 120,000 conventional units (including VAT 20% - 20,000 USD). The exchange rate on the date of shipment was 45 rubles/cu. The exchange rate as of March 31 was 42 rubles/cu. In April, Betta LLC partially paid for the goods, transferring 40,000 USD to Alfa. at the rate of 40 rubles/cu. The exchange rate as of April 30 was 38 rubles/cu. In May, Betta finally paid for the goods, transferring the remaining 80,000 USD. at the rate of 35 rubles/cu.

Betta's accountant reflected these transactions as follows. In March, on the date of shipment, he made the following entries: DEBIT 41 CREDIT 60 - 4,500,000 rubles. ((120,000 c.u. – 20,000 c.u.) x 45 rub./c.u.) - reflects the cost of the goods received; DEBIT 19 CREDIT 60 – 900,000 rub. (20,000 c.u. x 45 rub./c.u.) - input VAT is reflected. Tax accounting includes costs associated with production and sales in the amount of RUB 4,500,000. On March 31, the accountant made the following entry: DEBIT 60 CREDIT 91 – 360,000 rubles. (120,000 c.u. x (45 rub./c.u. – 42 rub./c.u.) - a positive exchange rate difference is reflected when recalculating accounts payable at the rate on the last day of the month. In tax accounting, non-operating income was formed in in the amount of 360,000 rubles.

In April, on the date of transfer of money to the Alpha account, the accountant made the following entries: DEBIT 60 CREDIT 51 - 1,600,000 rubles. (40,000 c.u. x 40 rub./c.u.) - partial payment was transferred to the account of Alpha LLC; DEBIT 60 CREDIT 91 – 80,000 rub. (40,000 c.u. x (42 rub./c.u. – 40 rub./c.u.) - reflects the positive exchange rate difference when recalculating the amount of payment according to the kur on the day of payment; DEBIT 60 CREDIT 91 – 160,000 rub. . ((120,000 c.u. – 40,000 c.u.) x (42 rub./cu. – 40 rub./c.u.) - reflects the positive exchange rate difference when recalculating the balance of accounts payable at the exchange rate day of payment. In tax accounting, non-operating income was generated in the amount of 240,000 rubles (80,000 + 160,000). On April 30, the accountant made the following entry: DEBIT 60 CREDIT 91 - 160,000 rubles ((120,000 cu - 40,000 cu .u.) x (40 rub./cu - 38 rub./cu) - a positive exchange rate difference is reflected when recalculating the balance of accounts payable at the rate on the last day of the month. Non-operating income in the amount of 160 is generated in tax accounting 000 rub.

In May, the accountant made the following entries: DEBIT 60 CREDIT 51 – 2,800,000 rubles. (80,000 c.u. x 35 rub./c.u.) - the final payment was transferred to the account of Alpha LLC; DEBIT 60 CREDIT 91 – 240,000 rub. (80,000 c.u. x (38 rub./c.u. – 35 rub./c.u.) - a positive exchange rate difference is reflected when recalculating the payment amount at the rate on the day of payment. Tax accounting shows non-operating income in the amount 240,000 rub.

Is an invoice drawn up in foreign currency in 2019-2020?

When issuing an invoice in foreign currency, the taxpayer should consider 2 factors:

- clause 7 art. 169 of the Tax Code of the Russian Federation allows that an organization has the right to indicate an amount in foreign currency in an invoice if it is the means of payment;

- clause 1 section Government Resolution II “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137 contains a provision according to which, if payments in ruble equivalent are indicated in the contract with the total contract price in foreign currency, the invoice must be issued in rubles.

The resulting inconsistency is a source of trouble for organizations that take the rules of the Tax Code too literally. During audits, tax authorities quite often file complaints on this basis. However, judicial practice shows that in such disputes the taxpayer wins. The judges believe that the Tax Code of the Russian Federation has an advantage over the decision of the Government of the Russian Federation.

Read more about the rules for issuing foreign currency invoices in the material “Invoice in foreign currency - how to issue?” .

In what currency can residents make payments?

Let's turn to Art. 140 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). According to the general rule established therein, all payments and settlements in Russia can be made in 2 ways:

- cash, in which the only acceptable means of payment are coins and banknotes of the Bank of Russia (Article 29 of the Law “On the Central Bank of the Russian Federation” dated July 10, 2002 No. 86-FZ, hereinafter referred to as Law No. 86-FZ);

- non-cash.

In both cases, the legislator designated the ruble as the main legal tender. All monetary obligations are expressed in rubles (Part 1, Article 317 of the Civil Code of the Russian Federation).

It is permissible to set the payment amount in foreign currency (FC), if in fact the settlement will be in rubles. Conversion into rubles by default occurs based on the official exchange rate valid on the day of payment (a different procedure can be agreed upon in the contract).

In addition, within a very narrow framework established by law, it is permissible to carry out settlements for obligations on the territory of the Russian Federation using IW, as well as payment documents in IW.

What is a currency clause and how to agree on it in a contract, read in the ready-made solution of ConsultantPlus. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

Entries in accounting registers

Accounting for currency transactions is carried out using special registers. Entries in such registers are made in rubles according to the accounting accounts of existing assets and liabilities in foreign currency. It does not matter where exactly the company operates - abroad or in Russia. Entries for accounting for settlements and funds are also made simultaneously in the currency in which settlements were made (accruals of liabilities) or payment was received.

In accounting for transactions with foreign currency, exchange rate differences are reflected separately from other income/expenses, including separately from the financial results obtained from conducting business operations in foreign currency.

Read about the role of currency payments in organizing accounting for export transactions in the material “How to take into account exports in accounting (nuances)?” .

General procedure for non-cash currency payments

The specified procedure is defined in Art. 14 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ (hereinafter referred to as Law No. 173-FZ). Residents have the right to make payments on their bank accounts in any foreign currency. It does not matter in what currency the bank account was opened - if the need arises, a conversion operation will be carried out at the rate of the corresponding bank.

For individuals, the procedure for making non-cash payments in the Internet is similar to the procedure for legal entities.

A number of by-laws establish features:

- purchases of foreign currency by legal entities and entrepreneurs (Instruction of the Bank of Russia dated August 16, 2017 No. 181-I);

- payment in currency of the authorized capital of a credit organization (clause 4.3 of the Bank of Russia instructions dated 04/02/2010 No. 135-I).

Currency account: how to keep track of transactions

To keep records of foreign exchange transactions for foreign exchange settlements, there is a separate synthetic account 52 in the chart of accounts. The main basis for entering information into accounting for this account is bank statements. The credit of the account reflects transactions involving the transfer and debit of foreign currency funds from the account.

The debit of this active account reflects:

- at the beginning of the month - the balance of non-cash foreign currency;

- during the month - all foreign exchange earnings.

In accounting, currency balances on accounts are reflected in ruble revaluation. Make sure that you recalculate correctly and reflect the revaluation in accounting and tax accounting according to established rules using a Ready-made solution from ConsultantPlus. You can access the system absolutely free.

If, when checking bank statements, the company discovers errors when posting or debiting money from a foreign currency account, then they are reflected in the “Claims” subaccount opened to account 76.

For account 52, for the convenience of maintaining analytical accounting, it is customary to open sub-accounts of the 1st and 2nd order. Sub-accounts of the 1st order: 52-1 “Accounts in foreign currency within the state” and 52-2 “Accounts in foreign currency abroad.” Subaccounts of the 2nd order help to maintain separate accounting for accounts opened in different currencies. But most often, 2nd order subaccounts are created to reflect transactions on current, transit and special transit accounts.

A transit account in foreign currency was previously used for the mandatory sale of foreign currency earnings that were transferred by non-residents as payment for services or products. After the sale of the required amount of foreign currency, the remaining amount in the transit account was transferred by the bank to the client’s current account opened in foreign currency. Now the transit account is used to record on it amounts for which information has not yet been submitted to the bank confirming that the foreign currency receipts belong to a specific agreement.

The company's regular (current) account, opened in foreign currency, is credited with its foreign currency earnings, bank interest for the use of available funds and other foreign currency earnings related to business activities. Foreign currency accounts abroad, in accordance with federal legislation, can be opened for transactions related to the movement of capital investments.

A transit special account in foreign currency is opened by an authorized bank independently without the participation of the client. Such an account is needed to record foreign exchange transactions related to the purchase/sale of currency.

Companies usually store all available funds in foreign currency in foreign currency accounts of those banks that have appropriate licenses for the right to conduct foreign exchange transactions issued by the Central Bank. To open a foreign currency account abroad, you will need to obtain appropriate permission from the Central Bank of Russia.

Each bank foreign currency account is usually maintained in the currency that the bank client indicated when opening it. If another currency is received into this account, the bank will independently convert it under the conditions specified in the account servicing agreement. The currency is converted according to the international foreign exchange market exchange rate valid on the day of transfer.

To record currency transactions, active account 55 can also be used. It summarizes information on the availability/movement of money in Russia and abroad, both in Russian rubles and in foreign currency: in check books, letters of credit, on deposits and in other payment forms (except for bills of exchange). For each of the payment forms, 1st order subaccounts are opened for account 55. Analytical accounting is maintained for each letter of credit, deposit, checkbook, etc.

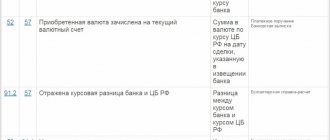

Also, to record foreign exchange transactions (when purchasing currency), organizations can use account 57, called “Transfers in transit.” For account 57, 1st order subaccounts can be opened:

- Currency listed for sale.

- Currency for sale deposited with a banking institution.

- Money in rubles transferred for the purchase of currency (funds before the day of purchase are taken into account here).

Subaccount 52-2 reflects monetary transactions in foreign currency carried out on the company's foreign accounts. The debit of this subaccount reflects:

- operations to receive funds transferred from the company’s current accounts opened with authorized Russian banks;

- unused currency;

- interest accrued by the bank for using the account balance;

- previously erroneously written off and then returned funds.

The account credit reflects:

- transactions for payment for the maintenance of a foreign representative office of the company;

- funds withdrawn for payment of salaries and compensation for travel expenses, as well as for payment of other expenses approved by the estimate;

- account servicing costs;

- transfers to the company's current account opened with a Russian authorized bank.

Bank clients can withdraw currency from their accounts to pay for travel expenses of their employees and with special permission from the Bank of Russia. Also, the enterprise can operate a cash register in foreign currency; transactions in it are reflected in subaccount 50-4 (in the case of foreign economic transactions and business trips abroad). All currency movements at the cash register are reflected in the enterprise's unified cash book. Naturally, all entries are made in rubles.

Exchange differences associated with changes in the ruble exchange rate on different days of valuation of foreign currency assets and liabilities that arise on accounts 52 and 57 are reflected using account 91. Positive exchange differences are visible in the subaccount “Other income” (on a loan), and negative ones - on subaccount “Other expenses” (by debit). The basis for reflecting exchange rate differences is an accounting certificate. Analytical accounting of exchange rate differences is carried out separately from other non-operating income/expenses of the enterprise. For this purpose, a separate accounting register is created.

Find out about codes for types of currency transactions from the material “Directory of codes for types of currency transactions (2019 - 2020)” .

Currency account: concept, purpose, types

Clause 8 of Article 1 of Chapter.

1 of Federal Law No. 173-FZ of December 10, 2003. “On Currency Regulation and Currency Control” defines the concept of authorized banks. Business entities (residents and non-residents) have the right to open foreign currency accounts in credit institutions (authorized banks) licensed by the Central Bank of the Russian Federation to carry out foreign currency transactions. There are no restrictions on the quantity and type of foreign currency when opening foreign currency accounts. Banks licensed for this type of activity do not have the right to refuse a client to open a foreign currency account if the client does not have an account in ruble equivalent with this bank. Conceptual help!

A foreign exchange account is an account opened by an individual or legal entity in foreign currency with a credit institution (bank).

Opening a foreign currency account involves drawing up a bank account agreement, which contains a list of banking services, conditions for placing funds in the account, rights, obligations of the parties, etc. After concluding the agreement, the credit institution simultaneously opens transit and current foreign currency accounts for the business entity.

A transit currency account is an auxiliary account intended for crediting proceeds when carrying out export activities. Opening this account does not require the conclusion of a separate agreement, but exporting companies cannot refuse it. When opening a foreign currency account, the application will need to indicate two accounts: foreign currency (current) and transit.

A current (settlement) foreign currency account is an account opened by an individual or legal entity at a credit institution, intended for storing funds in foreign currency and carrying out foreign exchange transactions in non-cash form.

A foreign currency deposit account is an account opened by a legal entity or individual (resident or non-resident) in a bank in foreign currency for the purpose of receiving income in the form of interest.

A special currency account is an account opened with a credit institution for the transfer of foreign currency for purposes according to the client’s instructions.

Currency account outside the territory of the Russian Federation - an account opened by residents outside the territory of the Russian Federation. The procedure for opening these accounts is regulated by Section 12 of Federal Law No. 173-FZ of December 10, 2003.

Opening of foreign currency accounts in authorized banks of the Russian Federation by organizations and individuals is carried out by residents and non-residents.

| № | Contents of business transactions | Source documents | Corresponding accounts |

| 1 | 2 | 3 | 4 |

| 1 | Individuals residing: | In the Russian Federation | Outside the Russian Federation |

| 2 | Legal entities located: | In the Russian Federation | In foreign countries, outside the Russian Federation |

| 3 | Organizations that are not legal entities, created in accordance with the law and located: | In the Russian Federation | In foreign countries, outside the Russian Federation |

| 4 | Official diplomatic and other missions located at: | Russian:

| Foreign countries:

|

| 5 | Branches and representative offices of legal entities in clause 2, clause 3, located: | Russian - outside the Russian Federation | Foreign - in the Russian Federation |

The concepts of subjects of foreign exchange transactions are discussed in more detail in the question: “Subjects of foreign exchange transactions” in the article: “Characteristics of foreign exchange transactions: concept, subjects, legal regulation.”

Currency accounts can be opened in the following freely convertible currencies:

Foreign exchange accounts can also be opened in closed (national) currencies within the established quotas for the export of goods (works, services) by mutual agreement or clearing currency.

Conceptual help!

Currency clearing is foreign exchange transactions within the framework of an intergovernmental agreement on the mutual offset of counterclaims and obligations, determined by the value equality of goods supplies and services provided.

It includes a set of mandatory elements provided for in the intergovernmental agreement:

- Clearing volume;

- Clearing account system;

- Clearing currency;

- The volume of technical credit is the maximum debt balance necessary to prevent failures in settlements;

- Method of debt repayment;

- Scheme for the final repayment of the balance upon expiration of the agreement.

Purchase, sale of foreign currency and other operations: transactions

When maintaining accounting records, transactions on currency transactions are reflected in accordance with the chart of accounts and provisions on accounting. According to this document, account 52 “Currency accounts” can correspond with accounts 50, 51, 55, 57, 58, 60, 62, 66–69, 71, 73, 75, 76, 79, 80 - by debit and with accounts 04, 50, 51, 52, 55, 57, 58, 60, 62, 66, 67–71, 73, 75, 76 - on loan.

The most common postings for foreign exchange transactions are:

- upon receipt of currency:

- Dt 52 Kt 62 - receipt of foreign currency earnings to a bank account;

- Dt 52 Kt 66, 67 - receipt of borrowed funds in foreign currency;

- Dt 52 Kt 75, 76, 79 - receipts in foreign currency from the founders, other counterparties, separate divisions;

- Dt 57 Kt 52 - currency transfer for sale;

- Dt 51 Kt 57 - crediting proceeds from the sale of foreign currency in ruble equivalent;

- Dt 91 Kt 57 or Dt 57 Kt 91 - reflection of the financial result from the sale of currency;

- buying currency:

- Dt 57 Kt 51 - transfer of ruble equivalent for the purchase of foreign currency;

- Dt 52 Kt 57 - reflection of the amount of acquired foreign currency;

- Dt 91 Kt 57 or Dt 57 Kt 91 - reflection of the financial result from the purchase of currency;

- payment in currency:

- Dt 60 Kt 52 - write-off of foreign currency funds to pay for supplies;

- Dt 66, 67 Kt 52 - return of borrowed funds, payment of interest in foreign currency;

- Dt 75, 76, 79 Kt 52 - transfer of foreign currency funds to the founders, other counterparties, separate divisions;

- actions with cash currency:

- Dt 50 Kt 52 - receiving currency from the bank to the cash desk;

- Dt 71 Kt 50 - issuance of currency to an accountable person traveling on a business trip abroad;

- Dt 50 Kt 71 - return of unused currency by the accountable person to the cash desk;

- Dt 52 Kt 50 - return of currency from the cash desk to the bank.

Exchange rate differences in accounting are reflected in the correspondence of account 91 “Other income and expenses” and accounts that reflect property or liabilities in foreign currency.

To reflect the positive exchange rate difference in accounting, the following entries are made in 2019-2020: Dt 50, 52, 55, 57, 60, 62, 66, 67, 76 Kt 91 (subaccount “Other income”).

To reflect the negative exchange rate difference, the postings will be as follows: Dt 91 (subaccount “Other expenses”) Kt 50, 52, 55, 57, 60, 62, 66, 67, 76.

When accounting for exchange rate differences, entries for securities denominated in foreign currency (except for shares) are recorded in accounts 58 and 91. Moreover, such entries are made only in accounting, and in tax accounting, securities denominated in foreign currency are not revalued.

Exchange differences in accounting and tax accounting in 2019–2020

In recent years (starting from 2020), the recalculation of assets and liabilities is carried out at the rate of the Central Bank, unless otherwise specified in another law or agreement between the parties. In another case - at a different rate. Recalculation of liabilities must be carried out on the last date of the month. Before this year, there were 2 types of exchange rate differences: exchange rate differences, which arise during the revaluation of assets and liabilities under contracts with payment in foreign currency, and amount differences, which arise when payment is made in rubles at the rate agreed upon by the parties to the transaction.

In practice, accounting for exchange rate differences is not an easy task, raising many questions among accountants. Resolve them with the help of ConsultantPlus experts. Get a free trial access and go to the Ready Solution.

How to determine the date?

Federal Law 402 (Article 12) states that all accounting and reporting objects must be expressed exclusively in rubles, and assets calculated in foreign currency must be recalculated into rubles. According to PBU, such recalculation is carried out at the rate of the Central Bank or by agreement of the parties to the transaction.

The exchange rate of any monetary unit constantly fluctuates, therefore, determining the correct date of conversion is one of the main tasks of an accountant.

PBU sets the date depending on the nature of the transaction:

- cash, banking volumes of currency - at the time of transactions and at the reporting date, as well as following changes in the exchange rate (if necessary);

- for reporting, all currencies: non-cash, cash, are recalculated on the reporting date;

- Intangible assets, fixed assets, inventories, other non-monetary assets - as of the date of the transaction and their registration;

- foreign currency income and expenses - as of the date of recognition (travel expenses in foreign currency are recalculated on the date of signing the advance report);

- costs for VNA - as of the date of recognition of costs that determine these assets, their value.

In addition, when receiving a foreign currency advance payment or deposit, the amount is taken into account at the exchange rate at the time of its receipt, and when paid - on the date when the payment was made.

According to PBU, paragraph 10, non-current and other assets, except cash, as well as advances and prepayments after being reflected in accounting, are not subject to recalculation due to exchange rate fluctuations.

Important! If the official exchange rate changes insignificantly and a large number of similar currency transactions take place, the average rate for a month or for a shorter period can be used for recalculation (clause 6 of PBU 3/2006).

Salary in foreign currency: nuances

According to Art. 131 of the Labor Code of the Russian Federation, wages at domestic enterprises must be paid in rubles.

Find out from this publication whether an improperly executed employment contract can lead to an unscheduled labor inspection.

The issuance of earned money in the form of foreign currency is regarded as a violation for the following reasons:

- A change in the exchange rate of the ruble to a given currency may lead to the fact that the real salary will be less than it is established in the staffing table. That is, there will be a deterioration in wage conditions, which is considered a punishable act. Sanctions for such violations are determined by Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- Salaries can be paid through a cash desk, and foreign currency can be issued in cash only for business travel purposes. Tax authorities may regard such an operation as a violation of currency laws.

Moreover, citing the fact that such payments are a violation of labor laws, tax authorities during audits may generally exclude such payments from expenses.

It is allowed to pay wages in the following currency:

- resident employees, if they actually perform their labor duties outside the territory of the Russian Federation (clause 26, part 1, article 9 and part 2, article 14 of law No. 173-FZ, letter of the Federal Tax Service dated 04.04.2018 No. OA-4-17 / [email protected] );

- non-resident employees (Part 2 of Article 14 of Law No. 173-FZ, letter of the Federal Tax Service dated January 12, 2018 No. OA-4-17 / [email protected] ).

Find out more about who can receive a salary in foreign currency from this article.

Will an employer be fined if he evades wage indexation, the publication “Fine for non-indexation of wages - under what article and by how much?” will tell you..

Settlements in foreign currency on the territory of the Russian Federation between individuals

The procedure for regulating payments in foreign currency between individuals in Russia is similar to the regulation of this issue in relation to legal entities. Citizens also cannot pay each other with banknotes other than rubles. However, the law allows for the possibility of donating currency from one person to another, provided that the donor and recipient are close relatives. Inheritance of funds in foreign currency is also allowed (Articles 9, 14 of Law 173-FZ).

Individuals have the right to purchase cash currency from authorized banks without opening a foreign currency account, as well as send a bank transfer in foreign currency to another individual in the territory of the Russian Federation. In the latter case, the bank may request confirmation from the sender that the transfer is not related to the obligation to settle within the framework of the contractual relationship.

Read also: How to open an account abroad

Results

To account for currency transactions, accounting accounts 52, 55, 57 and subaccount 50-4 are used. These accounts correspond with active-passive account 91 when taking into account emerging exchange rate differences from transactions.

The procedure for converting currency into rubles, calculating exchange rate differences, features of maintaining accounting registers and reporting are described in detail in PBU 3/2006. In addition, to organize the accounting of currency transactions, one must adhere to the norms of the currency and tax legislation of the Russian Federation, and in some cases, the legislation of those countries where foreign representative offices of Russian companies operate.

Sources:

- Order of the Ministry of Finance of Russia dated November 27, 2006 N 154n

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

- Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Basic provisions of civil legislation and their tax consequences

In accordance with paragraph 2 of Art. 317 of the Civil Code of the Russian Federation, a monetary obligation may provide that it is paid in rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units (ecus, “special drawing rights” (hereinafter referred to as SDR), etc.). In this case, the amount payable in rubles is calculated at the official exchange rate of the corresponding currency or conventional monetary units on the day of payment, unless a different rate or another date for its determination is established by law or by agreement of the parties (clause 2 of Article 317 of the Civil Code of the Russian Federation).