Issues discussed in the material:

- In what cases does an individual entrepreneur overpay taxes?

- What sources can you find information about overpayment of taxes by individual entrepreneurs?

- Is it possible to reconcile with the tax office and write an application for a refund of overpaid taxes for individual entrepreneurs online?

- Is it possible to return an overpayment of taxes to an individual entrepreneur if more than 3 years have already passed?

The main task of the Federal Tax Service (FTS) is to replenish the state budget and control tax contributions. This determines the primary focus of its actions - ensuring timely and full tax payments, which is achieved through various means of influence, including financial sanctions. In practice, the opposite phenomenon is often encountered, namely, excessive payments to the state treasury. What can an individual entrepreneur do in such a situation? How to return overpayment of taxes to individual entrepreneurs? Let's find out.

Why does an individual entrepreneur overpay taxes?

Of course, no one will deliberately deduct excess tax. As a rule, the cause of this phenomenon is trivial errors, for example, in calculating the tax itself or in filling out the payment order form.

In addition, overpayment is possible for other reasons:

- The entrepreneur was not aware of the special reduced rate under the simplified tax system “Income minus expenses”, which is valid in the corresponding region, and paid tax at a rate of 15%.

- A declaration was submitted with clarifications for the previous period, due to which the payment was due in a smaller amount.

- Preferential conditions that were available for use, for example, from the beginning of this year, and were introduced by regional authorities later.

- Under the simplified tax system “Income minus expenses,” the entrepreneur transferred more funds in quarterly advance payments throughout the year than is required for the final tax amount for the annual period.

- Lack of awareness that a specific type of activity is subject to preferential taxation.

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

How to find out about overpayment of taxes as an individual entrepreneur

There are two ways to clarify this issue: receive a notification from the Federal Tax Service or deal with it yourself (through the taxpayer’s personal account).

- Notification from the Federal Tax Service

May take the form of a telephone call. For example, at the Federal Tax Service they found an overpayment and call you on your mobile, introducing themselves something like this: “Hello, this is the tax office.” In this case, be sure to write down which branch you are calling from and what tax was paid in excess. Pay special attention to recording the phone number or address of the branch where your overpayment was detected.

If excess tax is detected, the Federal Tax Service may require documentation, such as acts, contracts, invoices and even a cash register for double-checking. There is no point in obstructing, because these measures serve your interests, and, moreover, refusal to implement them can result in a fine of about 10,000 rubles. And the sooner you provide the data and allow the tax inspectorate to clarify everything, the sooner you can return the erroneously transferred funds.

- Taxpayer personal account

You can use your personal account on the official website of the Federal Tax Service; Among other things, it helps to find out whether overpayments exist and monitor the progress of applications for their return. If you have an EDS (electronic digital signature), you will be able to transfer your reporting and contacts with the tax office into digital format, giving up paper documents and personal visits.

Just register on the Federal Tax Service website and you will be able to track the entire progress of your tax payments in your personal account.

There is another way. You can clarify the existence of an overpayment and return it through a personal visit to the tax office and the Russian Post. If it is more convenient for you to personally ask for information and have all relationships fixed on paper, you can choose this path. Just while reading the article, replace “electronic appeals” with “visiting the tax office at the place of registration” and “letter with a list of attachments” - in general, the algorithm is common.

How to return overpayment of taxes to individual entrepreneurs: step-by-step instructions

We provide step-by-step instructions to help you, which will tell you how an individual entrepreneur can return an overpayment for the simplified tax system, UTII and in other cases.

Step 1. Reconciliation with the Federal Tax Service

Determine the amount of overpaid funds. This is carried out through reconciliation of mutual settlements (and execution of the appropriate act).

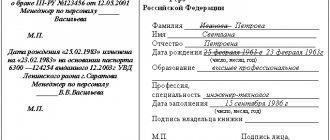

The act of reconciliation with the tax service has a regulated form. To obtain such a document, the taxpayer needs to write an application and submit it to his Federal Tax Service office.

The application can be drawn up in free form; make sure that it contains the main elements:

- full designation of the Federal Tax Service body, its address;

- information about the tax payer (last name, first name and patronymic, TIN, address, contact telephone number);

- reconciliation parameters (period subject to reconciliation; type of taxation – UTII, simplified tax system, etc.);

- method of receiving the reconciliation report (by mail or in person at the tax office);

- date of writing the application.

Having submitted such an application, the entrepreneur will receive a reconciliation report within five working days. The document will be provided in 2 copies and completed by the Federal Tax Service. Enter your part of the data into it (in accordance with how payments were actually accrued and made), sign. Provide one copy to the tax office, the second remains for you.

The amount of tax overpayment can be seen in the line called “Positive Balance”.

The calculations will be reconciled, the data on them will be agreed upon, and the amount to be returned will be confirmed when the positive balance indicators from both the tax service and the entrepreneur are the same.

How to reconcile tax payments with the Federal Tax Service?

In accordance with Art. 78 of the Tax Code of the Russian Federation, tax authorities must inform the payer about the fact of excessive tax payment within 10 days from the date of its discovery and offer to reconcile the calculations. The initiative for such a reconciliation can also come from the businessman himself, for which he must contact the tax office with an application for its implementation.

Such a statement is written in any form, indicating the taxpayer’s right to offset or return amounts of overpaid or overcharged taxes, penalties and fines under Art. 21 Tax Code of the Russian Federation.

According to the Federal Tax Service Regulations, the period for reconciliation should not exceed 10, and if disagreements are identified, 15 working days. The reconciliation report is issued on a special form provided by Order of the Federal Tax Service of Russia dated August 20, 2007 No. MM-3-25/ [email protected]

In general, reconciliation of tax calculations is not the responsibility of the taxpayer, but his right. Therefore, you don’t have to go through it, but immediately apply for a refund. But in this case, if there are disagreements with the inspectors, you will still have to answer their questions and present, upon their request, copies of payments and tax returns. Therefore, it is still better to go through the reconciliation.

How to return overpayment of taxes to an individual entrepreneur through a tax agent (in terms of personal income tax)

If a tax agent withholds excess personal income tax from your income, it is this agent who must return it himself (grounds: clause 14 of article 78, clause 1 of article 231 of the Tax Code of the Russian Federation; clause 34 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). This refers to the return of personal income tax collected incorrectly as a result of an error. For example, the accountant withheld the appropriate percentage of earnings from income that is not subject to taxation.

What should your actions be in this case? Here's an algorithm to help.

Stage 1. Submitting an application to the tax agent.

There is no regulated form, write freely. Be sure to indicate the bank account number where your funds should be transferred. The employer, by law, has the right to return overpaid taxes only by non-cash means (Clause 1, Article 231 of the Tax Code of the Russian Federation).

Application deadlines are limited: an application can be submitted within three years from the date of transfer of the excessively collected amount to the state budget.

Please note that your ability to get your money back will not be affected by whether you are still employed by the company or have already left.

Stage 2. Receipt of erroneously withheld personal income tax (to the designated account).

The employer is obliged to return the funds no later than three months from the receipt of the application by the employer. If after the specified period the money has not been received into the account, you are additionally entitled to a certain percentage for each overdue calendar day. The size of this percentage will be determined by the current refinancing rate of the Central Bank of the Russian Federation (basis: paragraph 3, 5, paragraph 1 of Article 231 of the Tax Code of the Russian Federation).

How to guarantee error-free settlements with tax authorities

No one is immune from mistakes, and even more so from changes in the financial situation during the year. Therefore, overpayment of taxes occurs quite often.

If an overpayment is detected, tax officials are obliged to inform the entrepreneur about this fact (Clause 3 of Article 78 of the Tax Code of the Russian Federation). But it is clear that in practice they are in no hurry to do this. And if the businessman did not pay attention to the state of the payments and missed the three-year period, then it will no longer be possible to return the money. The absence of a message from the tax authorities does not play a role in this case. The Supreme Court of the Russian Federation indicated this in No. 307-KG18-12491 dated August 30, 2018.

Therefore, there is no need to rely on the integrity of officials in this matter. After all, for them, a tax refund means a deterioration in reporting indicators. A businessman needs to regularly check with the Federal Tax Service on taxes. It is better to do this at least once a quarter, and also if there are any doubts about the reliability of the data.

Nuances of refunding overpayments on taxes for individual entrepreneurs

1. First of all, find out which Federal Tax Service you need to contact.

This will depend on your place of registration, the region where you operate, and the type of taxation you prefer.

For the most part, taxes are paid at the place of registration of the individual entrepreneur, which is based on his registration. For example, a person is registered in the Tver region, which means that his registration as an individual entrepreneur will be attached to this region. At the same time, he can carry out activities in the Nizhny Novgorod region, but he will still fulfill tax obligations in Tverskaya.

Registration of an individual entrepreneur at the place of his official residence does not at all limit the field of his activities - it can be freely carried out within the entire Russian Federation. You will not need to change your place of registration for this.

An entrepreneur's tax obligations correspond to the rate of the region where he is registered. For example, an individual entrepreneur chose the simplified tax system and registered in Crimea, where he is registered. He runs his business in Moscow. The tax rate in Crimea is 3%, and in Moscow 6%. Tax payments are subject to a rate of 3%. If they are carried out at the place of business (6%), the individual entrepreneur pays them in error and in excess.

However, some entrepreneurs are entitled to tax binding to another region. When are there exceptions?

- Patent applies. In this case, the individual entrepreneur is subordinated to the tax inspectorate at the place where the patent was acquired. In addition, there cannot be an overpayment here, because tax obligations in this option are fixed and are included in the initial cost. At the same time, all other taxes continue to be paid in accordance with the region of residence of the individual entrepreneur.

- UTII is applied. Here you will need to register only with the tax office whose jurisdiction is indicated first in your application to conduct business. However, you will need to submit reports to different inspectorates - according to the regions of the country or intra-city territories that have separate tax authorities where you conduct your business.

- The simplified tax system is applied, commercial real estate has been purchased where the activity is carried out. In this situation, registration is required at the place of purchase - there you will pay taxes on the real estate itself, and others - as before, at the place of your registration.

The taxation system that applies in your case can be clarified in the taxpayer’s personal account.

Important Note:

If there was an overpayment, and you registered with several inspectorates, to get the money back, contact exactly the one where the excess payment was sent.

2. Be sure to assist the Federal Tax Service in establishing the overpayment.

Reconciliation with the budget (as well as a certificate of the status of settlements) will help with this. These measures are not mandatory, but help confirm the excess tax payment and return it sooner.

Reconciliation of your calculations with the budget is information about how much money you were supposed to transfer over a certain period and how much was actually paid. For example, in 2020, tax obligations amounted to 25,000 rubles - and you (let’s say, by mistake) sent 250,000 rubles. All this will be reflected.

It is convenient to carry out such a verification procedure from your personal account. In the “Calculations with the budget” section, select “Submit an application to initiate the procedure...”, and then follow the algorithm that will be proposed.

3. Reconciliation will take 10-15 business days.

You can request a certificate about the status of your payments to the budget. It is not related to the reconciliation process and may well be issued in parallel. This document reflects overpayments and debts as of a specific calendar date. You can also request it from your personal account: in the “Get a certificate” section, click “Get a certificate on the status of tax payments...”, then follow the instructions.

4. Preparation of the certificate takes approximately 5 working days.

Don't agree to re-apply. It may happen that an individual entrepreneur submits an application for a refund of the overpayment, then an act of reconciliation of mutual settlements with the Federal Tax Service - and at this moment he is sent to write a new application. Refuse: according to the law, one is enough.

The timing of the decision on the refund of funds will depend on whether you submitted your application immediately with a reconciliation report or initially without it, that is, in two stages.

- If both documents are submitted at once (and also if the tax office does not find it necessary to check), the decision will be made within 10 days.

- If the tax office conducts an audit, the result will take 20–25 days.

When talking about the three-year allowable period within which an overpayment can be returned, the starting point does not mean the date of discovery of the tax surplus or submission of the application, but the date of submission of the declaration.

The result of your request, as well as the status of its consideration, can be tracked through your personal account.

Let us remind you once again: the refunded funds will arrive approximately a month after a positive decision.

If this period has expired and the money has not arrived in the current account, the Federal Tax Service will pay you interest for each overdue day. The percentage will depend on the current refinancing rate of the Central Bank (for example, 7.75% per annum).

Application deadlines

However, you cannot demand a refund of individual entrepreneur tax or transfer of funds paid after a long period of time. The application is sent within 3 years from the date of payment of the contribution for which the overpayment occurred.

The amount will be transferred to the taxpayer’s bank account on any day within a month from the date of submission of the application. If the Tax Inspectorate delayed payment and exceeded the refund period, then for each day of delay interest is charged, which is determined by the refinancing rate of the Bank of Russia.

Tax refunds to individual entrepreneurs take on average 3 months, and the amount is sent to the taxpayer to fulfill obligations regarding the payment of budget contributions.

If there is a shortfall in one of the budgets, then an offset occurs. After 3 months, the amount is returned to the payer’s account. However, this is preceded by the taxpayer writing a statement.

How to return overpayment of taxes to an individual entrepreneur if it is closed

If you sent an excess payment before the termination of your activity, again try to return the funds through an application to the Federal Tax Service. The tax surplus will be transferred according to the details that you provide in this application. In this case, a debit card will also work.

In this case, the reconciliation should be ordered through the tax service using a separate document flow system.

How to return overpayment of taxes to an individual entrepreneur after closure? You can also use your taxpayer account. However, in case of termination of activity, the entrepreneur will still need to personally visit the Federal Tax Service to reconcile mutual settlements. Do not forget that the application must be filled out and printed in duplicate.

One of them is handed over personally to the authorized inspector, and the other serves to confirm the acceptance of the first - it must be returned with a special mark with the date. It is mandatory to have your passport with you. The inspection will prepare a reconciliation report within five days.

The document will be sent to you by mail, or you will be notified that it is ready for personal receipt. It happens that the tax reconciliation result is given on the day of application. If he confirms the absence of both debt and overpayment, everything is in order. If a debt is discovered, you can calmly pay it off; it will be registered with you as an individual outside of entrepreneurial activity.

If you find out that you overpaid, the news is also good: most likely, with simple steps you will return the funds back. Send the received reconciliation report to the Federal Tax Service along with a separate application for a refund of overpaid tax. Overpayment will be refunded.

An application of this type can be submitted within three years from the date of transfer of the excess payment. For example, the overpayment occurred in 2020, and the termination of activity in 2019. You can request a refund until 2021.

So, how to return the overpayment of taxes to an individual entrepreneur when he closes his activities? The application is fully prepared, duplicated, both copies are submitted to the tax office at your place of residence, one is immediately returned to you (with a stamp of acceptance and date). Refusal is not allowed.

The Tax Office will review your application within 10 days and provide a decision. If the overpayment is confirmed, it must be returned to you within one month. In practice, however, things may be different.

How to return overpaid taxes from the budget?

If you come to an agreement with the tax inspectorate about the fact of overpayment, you should submit another application - for a refund of the overpaid tax . The application period is three years from the date of the erroneous payment. Previously, the application was submitted in any form; a copy of the reconciliation report and payment order could be attached to it. Tax authorities are given 10 working days to consider the application and make a decision on it, and another 5 days to notify the taxpayer about it in writing.

The application for tax refund is written according to the form given in Appendix No. 8 ().

Based on a positive decision, the Federal Tax Service issues an order to the Treasury to return the excess amount of tax to the entrepreneur’s current account. The money must be returned within one month from the date of receipt of the return application. It should also be taken into account that the tax office may refuse to refund the overpayment. Such a decision can be appealed to a higher tax authority or court.

Delays in returning overpaid taxes for individual entrepreneurs

The tax office may not provide you with a decision on time for various reasons: the application was lost, it was not possible to consider it within the required period, there was a glitch in the program, etc. Not 10, but 15 days have passed - no response has been received? Submit another application with a request to issue you a decision from the Federal Tax Service (this is done through the same taxpayer account).

Do they unmotivatedly refuse to return your funds or leave you without an answer even after the second application? File a complaint with the Federal Tax Service, which manages all territorial divisions. Your personal account on the website will again help with this: find the “Contact the tax authority” section, where you click “Write a request” and follow the instructions.

If this measure does not bring results, you should contact the Arbitration Court. This can be done no later than three years from the date the overpayment was established.

How much can I get back?

The entire tax surplus must be returned by law. However, if you have a parallel debt, the tax office can pay it off with overpayments and, accordingly, deduct this amount from the refund.

At the same time, keep in mind that both issues can be resolved with such a convenient offset only with taxes of the same type. For example, in 2019 you overpaid income tax, but for 2020 you still have a debt for it - the tax office will make an offset and send a notification about this within 5 days (track it in your personal account).

The situation is completely different if the overpayment occurred for income tax, and the debt was for property tax. Here you cannot cover one with the other. The overpayment can be returned, but the debt will remain and will be supplemented by penalties. It will have to be repaid separately.

Do you want to speed up the offset or cover the debt for one tax with the excess paid from another? Write this when you apply for a refund: just add in free form that you are asking to use the overpayment to pay off debts. If the latter exceeds the overpayment, specify what debts you are asking for it to be used to repay.

Thus, the entire excess payment may be used to cover the existing tax debt, and nothing will be transferred to you. But the size of the debt will decrease.

What is tax overpayment?

First of all, let's understand the terms: what is meant by tax overpayment in Russian legislation? To answer this question, we need to turn to the Tax Code of the Russian Federation: Art. 78 of the Tax Code of the Russian Federation indicates that the amount of overpaid tax is the amount that is paid by the taxpayer in the absence of his obligation to pay it.

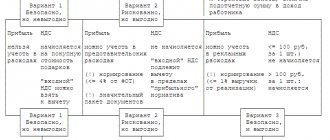

What to do if you have such an overpayment? Currently, amounts of overpaid tax can be used in the following ways:

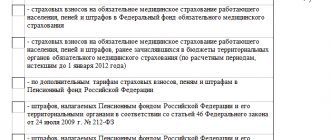

- Offset against tax debt, penalties, fines;

- Offset against future tax payments;

- Return to taxpayer's bank account.

How to return overpayment of taxes to individual entrepreneurs if more than 3 years have passed

Option 1. Go to court

If the excess payment is determined after the 3-year refund period has already expired, try the following to resolve the problem:

Step 1: Prepare evidence of when the overpayment was discovered (specific date).

Step 2. Submit a motivated application to the tax office to return or offset the overpaid funds.

Step 3. File a claim with the court within three months. This period is counted:

- or from the moment when they received a refusal from the Federal Tax Service to return or offset the funds;

- or from the moment when 10 days have elapsed from your submission of the application, and no official response has been received.

If you want to get back money you overpaid due to an incorrect withholding by the IRS rather than your own error, the process is the same.

Option 2. Write off the debt amount

If the court legally refused to return the overdue tax surplus due to the expiration of the statute of limitations (or the entrepreneur simply decided not to initiate legal proceedings), the existing overpayment can be used to pay off the current income tax. An individual entrepreneur’s application is not necessary for this.

The Federal Tax Service does not have the right to write off an outdated overpayment, at least for those taxpayers who did not request this, but continue to conduct their business and submit reports on it on time (grounds: Letter of the Federal Tax Service of Russia dated November 1, 2013 No. ND-4-8/ [ email protected] ).

The procedure for returning personal income tax, which is excessively withheld from the income of an individual and transferred to the budget.

A situation where a tax agent organization excessively withheld personal income tax from an individual’s income and transferred it to the budget may arise, for example, when providing an employee with a property or social deduction not from the beginning of the year. In this case, according to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation, the amount of tax excessively withheld by a tax agent from the taxpayer’s income is subject to refund by the tax agent on the basis of a written application from the taxpayer. In this case, the organization is obliged to inform the taxpayer about each fact of excessive tax withholding and the amount of excessive tax withheld within 10 days from the date of discovery of such a fact.

Note:

The return of the tax amount to the taxpayer in the absence of a tax agent (for example, in the event of liquidation of an organization) or in connection with recalculation at the end of the tax period in accordance with the status of a tax resident of the Russian Federation acquired by him is carried out by the tax authority with which he was registered at the place of residence (place stay), and not an organization - a tax agent (clauses 1 and 1.1 of Article 231 of the Tax Code of the Russian Federation). The refund to the employee-taxpayer of the excessively withheld amount of tax is made by the tax agent organization at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other taxpayers from whose income the tax agent withholds tax, within three months from the date the tax agent receives the relevant application from the taxpayer. Such a refund can only be made by transferring funds to the taxpayer’s bank account specified in his application (Article 231 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated July 18, 2016 No. BS-4-11 / [email protected] , Ministry of Finance of the Russian Federation dated May 16. 2011 No. 03 04 06/6-112 (clause 2)). Here are examples of the return of excessively withheld personal income tax and transferred to the budget.

Possible consequences for unrefunded overpayment of taxes for individual entrepreneurs

What happens if you do not file the excess tax refund? No penalties will be charged and no penalties will follow.

Most likely, your inspectorate will take this excess into account in a future period of the same tax. For example, in 2020 you overpaid your transport tax; You did not submit an application to return it. In this case, the Federal Tax Service will simply reduce your transport tax for 2020 by this amount.

If you stopped using corporate transport and, accordingly, paying tax on it, and did not return the overpayment, the tax office will not take any action against it in the new period. Here you have three years from the date of payment of the excess to return it or take it into account in another form of tax. If you don't do this, the money will simply disappear.

Is that exactly what happened? Then it is better to write off the outdated overpayment under the guise of a “bad debt.” This is the name of the amount that cannot be returned for objective reasons, such as the bankruptcy of the debtor company or the expiration of the permissible statute of limitations.

In accounting, a written-off debt is treated as an expense that is covered by income, resulting in the convergence of debits and credits. As a result, the amount of income subject to taxes decreases. The Federal Tax Service perceives debt write-off as a reduction in tax payments, so it carefully checks (sometimes more than once) cases of loss write-off.

The order of the Ministry of Finance on accounting allows you to write off a non-refundable overpayment as a bad debt, but in a real situation of this kind you may be refused. Here the actions will depend on the amount in question and whether it would be beneficial for you to have it written off. If the answer is yes, enlist the help of qualified lawyers and accountants who will bring this issue to a victorious conclusion.

Refund of overpaid tax

So, you've overpaid and want to get it back. What should you pay attention to?

First of all, on the date of its occurrence. The Tax Code allows 3 years for tax refunds. They are calculated from the date the overpayment occurred. And if for mandatory payments, which are transferred only at the end of tax periods, it is quite simple to determine this date, then for taxes with an advance payment mechanism, the question may arise: “Should we count the deadline for tax refunds from the date of making an advance or annual payment to the budget?”

Find the answer to this question in this publication . It examines income tax, but the conclusions apply to all taxes with which we advance the budget.

If the 3-year deadline is missed, you may not expect a tax refund.

If your time frame allows, you need to decide how you want to use the surplus you have. You can get it back not only in the form of a tax refund, but also in the form of offsetting the “extra” against arrears or future payments. In both cases, you will be required to submit a statement.

You can also view tax refund applications in this article .

The application has been submitted - all that remains is to wait for the tax authorities’ decision. They have 10 days to decide on a credit, and 1 month to decide on a tax refund after receiving the application. For violation of the terms of return, you can receive interest from the Federal Tax Service.

Find out about their amount in the article “How to calculate interest for late tax refunds .

And all controversial issues related to tax overpayment will help you to clarify the material “Art. 78 Tax Code of the Russian Federation (2017): questions and answers.”

How to return an overpayment of taxes to an individual entrepreneur if the tax office refuses to issue a refund

If the inspection delays its response, which is why you cannot return the funds, do not waste time - act.

First, check what payment details you provided on your application. You still have one copy, you can easily check this information for errors. If they simply did not accept your application during a personal visit, this is illegal action. Send it to the tax office anyway, for which you have two ways: a registered letter (with notification of delivery to the sender) and an online application (available only with a qualified digital signature).

If you are not given a decision, in a dialogue with a representative of the Federal Tax Service, mention the period indicated in the Tax Code of the Russian Federation within which the overpayment is supposed to be returned - 1 month from the date of receipt of the application. This period has expired and the situation has not changed? Write complaints to a higher authority. Please submit this only by letter (with acknowledgment of delivery).

The Federal Tax Service should answer you in the same way, in writing. It will not be possible to return the funds more quickly by calling by phone: these dialogues will not be recorded, you may be given false information, and you will not be able to attach the result of such an appeal to court proceedings.

All the deadlines have passed, but you don’t have a definite answer, and you also couldn’t get your money back? You will have to draw up a statement of claim and send it to the court. This document includes a requirement to pay the tax surplus with interest for late payments.

Note that such lawsuits are usually won by taxpayers. As a rule, the court takes the side of the Federal Tax Service only in cases of incorrectly completed documents that were submitted for the return of overpayments.

How to get your money back

So, according to the reconciliation report or certificate from the Federal Tax Service, it became clear that the company had a real overpayment of tax(s). You can manage this money by following a series of steps:

- Determine the reason for the overpayment: the fault of the taxpayer or the fault of the Federal Tax Service. In the future, when contacting the inspectorate, you will need to refer to Art. 78 or 79 of the Tax Code of the Russian Federation, respectively. In the first case, the amount of overpayment is called “overpaid”, and in the second - “overcharged”. For the use of the company’s funds, the inspection is obliged to pay interest (Articles 78-10, 79-5 of the Tax Code of the Russian Federation).

- Write an application for the return of the overpayment to the current account or for the offset of payments for another tax with this amount. Thus, the overpayment will indirectly “return” to the company’s budget. The application is submitted in person, can be sent by mail, registered mail with a list of attachments, or, if there is electronic document exchange with the Federal Tax Service, sent via the Internet. The application can be written in free form, however, the electronic format for exchanging documents, as a rule, assumes that the tax office provides a ready-made form for filling out.

- Wait for the decision of the Federal Tax Service. It must be accepted no later than 10 working days after receiving the application. If the decision is made in favor of the taxpayer, then within a month after filing the application the money is returned to the company. However, if the overpayment is revealed as a result of a desk audit, in connection with the submission of an updated declaration, then the period is increased to 4 months (letter of the Ministry of Finance No. 03-04-05/9949 dated 02/21/17, information letter of the Presidium of the Supreme Arbitration Court No. 98 dated 22-12-05).

On a note! When submitting an application in person, request the signature of the responsible persons on the second copy, indicating that the document has been accepted. Please note that there is a current acceptance date. When sending by mail, keep proof of mailing. In electronic document exchange, a file confirming transmission is usually stored in a database.

The Federal Tax Service returns the money faster if the debt is confirmed by a bilateral document - a reconciliation report. If a taxpayer wants to reconcile mutual settlements, the fiscal authority has no right to evade it (Regulations for working with taxpayers, payers of fees, contributions. Approved by Pr. No. SAE-3-01 / [ email protected] Federal Tax Service dated 09-09-05 .).

The right to timely offset or return of overpayment to the current account is guaranteed by Art. 21-1 (clause 5) of the Tax Code of the Russian Federation.