Is it allowed or not to pay taxes for other people? Is it possible for third parties to pay insurance premiums for an organization or individual entrepreneur? Is it permissible to pay state fees for others? How can third parties fill out payment orders and who to write as the payer? Is the founder or director entitled to pay taxes for his company? Can a husband pay taxes on his wife? The answers to most of these questions were provided by Federal Law No. 401-FZ of November 30, 2016, which introduced rules into the Tax Code of the Russian Federation that taxes, fees and contributions can be paid by third parties. Let's look at the amendments in detail.

Long-awaited changes

Previously, tax legislation obligated taxpayers to pay taxes and fees independently (clause 1 of Article 45 of the Tax Code of the Russian Federation). However, due to the entry into force of Federal Law No. 401-FZ of November 30, 2016, the situation has changed. This law amended Article 45 of the Tax Code of the Russian Federation, thanks to which third parties will be able to pay taxes, fees and insurance premiums for organizations, individual entrepreneurs or individuals. However, the amendments will be introduced in stages, namely:

- from November 30, 2020, some persons have the right to pay taxes and fees for others;

- From January 1, 2020, third parties have the right to transfer insurance premiums for others.

An example of filling out a tax payment order for a third party

So, a certain Korablev (TIN 6702321470) pays advances under the simplified tax system for LLC “Success” (6701111870/ 670101001).

It is contained in Appendices 2 and 3 to the Bank of Russia Regulation “On the Rules for Transferring Funds” dated June 19, 2012 No. 383-P. You can download the payment order on our website. The form has long been familiar to everyone. It has been in effect for many years and has never changed fundamentally.

PS By the way, when I paid property tax for my daughter, in field (22) I also indicated the UIN, which was on the receipt sent in her name from the tax office. Typically, tax notices already include everything you need to know. It is enough to carefully transfer this information to the Internet banking payment system. The main thing is to pay not one sum for everyone, but separately for each.

When paying online, this procedure does not take much time.

But you can also go to the post office the old fashioned way and pay all taxes in one fell swoop - there they will calculate the total amount for you, but they will issue payments for each individual.

In principle, standing in line once a year is not difficult, but at Sberbank there are no lines at all (unless you stand at the ATM). Fulfillment of the obligation to pay taxes, fees, and insurance premiums. Therefore, it is now possible to submit an application to the tax authority at the place of registration, where the error will be indicated.

Payment of taxes and fees by third parties from November 30, 2020

Federal Law No. 401-FZ dated November 30, 2016 was officially published on the legal information portal on December 30, 2020. From this date, third parties were able to pay taxes and fees for others. This is provided for in paragraph 1 of Article 13 of this law.

From the provisions of the new edition of Article 45 of the Tax Code of the Russian Federation it follows that from December 30, 2020, third parties can pay any taxes and fees for others. From the specified date for an organization, individual entrepreneur or individual, you can transfer:

| Value added tax (VAT) |

| Excise taxes |

| Personal income tax (NDFL) |

| Income tax |

| Mineral extraction tax |

| Water tax |

| State duty |

| Unified Agricultural Tax (USAT) |

| Single tax under “simplified taxation” (USN) |

| "Patent" tax (PSN) |

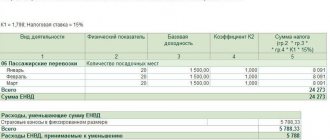

| Unified tax on imputed tax (UTII) |

| Organizational property tax |

| Gambling tax |

| Transport tax |

| Land tax |

| Property tax for individuals |

| Trade fee |

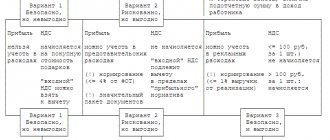

It is worth noting that the Tax Code does not contain any restrictions regarding the circle of persons who have the right to pay taxes and fees for taxpayers. Thus, various options are possible:

- an organization can pay taxes and fees for another organization, individual entrepreneur or individual;

- an individual entrepreneur can transfer taxes and fees for another individual entrepreneur, organization or individual;

- an individual has the right to pay taxes and fees for another individual, organization or individual entrepreneur.

Thanks to these amendments, for example, the founder or director of a company, starting from November 30, 2020, can easily pay taxes and organization fees from his own funds. This may be necessary if, for example, there is not enough money in the account of a legal entity to pay. Previously, third parties did not have the right to fulfill the obligation to pay taxes and fees for the organization (Letter of the Ministry of Finance of Russia dated February 14, 2013 No. 03-02-08/6).

What makes it possible for representatives to pay taxes?

Amendments to the Tax Code of the Russian Federation are beneficial to both the state and the taxpayer. Let's look at the main benefits:

- Prevention of violation of budget replenishment deadlines. Sometimes a company cannot fulfill its obligations on time. Subject to the amendments, she has the right to transfer the obligation to pay to other persons. Therefore, no debt is generated. The country's budget is replenished in a timely manner.

- The taxpayer does not incur any debt. Consequently, fines and penalties also do not appear.

- A third party no longer needs to collect a package of documents that confirm that the funds paid belong to the taxpayer.

The innovation is designed to improve the tax payment system. It also reduces the amount of debt. However, the amendment has some disadvantages. In particular, banks accepting funds face increased payment processing burden.

Payment of insurance premiums by third parties from January 1, 2020

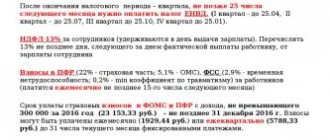

Organizations and individual entrepreneurs are required to transfer payments for insurance premiums independently (Part 4, Article 15, Part 2, Article 16 of the Federal Law of September 24, 2009 No. 212-FZ “On Insurance Premiums”). However, this federal law becomes invalid as of January 1, 2020. This is due to the fact that insurance premiums (except for contributions for injuries) are transferred from the Pension Fund to the control of the Federal Tax Service. From January 1, 2017, insurance premiums will be regulated by the provisions of the Tax Code of the Russian Federation. See "Insurance premiums from 2020: overview of changes." https://buhguru.com/strahovie-vznosy/strakh-vznosy-2017.html

From January 1, 2020, the provisions of the tax legislation of the Russian Federation will allow third parties to pay insurance premiums for others (except for contributions “for injuries”) - new paragraph 9 of Article 45 of the Tax Code of the Russian Federation. That is, you can transfer contributions from the moment their administration passes to the tax authorities. From 2020, third parties will be able to transfer the following types of insurance premiums:

| Insurance contributions for compulsory pension insurance |

| Insurance premiums for compulsory health insurance |

| Insurance premiums in case of temporary disability and in connection with maternity |

Filling out a payment order in 2020 - sample

> > > Tax-tax October 10, 2020 108182 All materials on the story Payment order in 2020 - you will see a sample of this document in this article. What is its form, what are the rules for filling it out, have there been any changes recently? Let's look at how to fill out a payment order in 2020. The payment order is a form according to OKUD 0401060.

When filling out a payment order, you should be guided by: Regulation No. 383-P; by order of the Ministry of Finance of Russia “On approval of the Rules for indicating information

How to transfer payments to third parties

If someone wants to pay taxes, fees or insurance premiums for others, then most likely the question will arise about how to fill out payment orders for such payment. Let me explain.

The tax, fee or insurance premiums will be considered paid on the day when the third party presents to the bank a payment order to transfer money from his current account to the account of the Treasury of Russia. In this case, there must be enough money in the current account for such a payment.

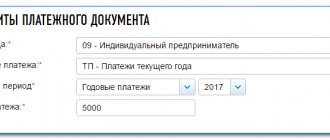

Of course, the payment order must be filled out correctly. Third parties must fill it out in accordance with the Rules approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. This follows from the first paragraph of paragraph 7 of Article 45 of the Tax Code of the Russian Federation. In our opinion, in the payment order the third party must indicate information about himself as the payer. Information about the payer is indicated in fields 8 “Payer”, 60 “TIN” and 102 “KPP”. However, in the purpose of the payment you will need to indicate which organization, individual entrepreneur or individual the payment is being made to. Here is a sample filling.

However, it is worth noting that, perhaps, the payment rules will be adjusted in 2017 and will provide for a special procedure for filling out payment orders by third parties. It is also possible that additional clarification will appear on the procedure for filling out payment orders when making payments to third parties.

Legal nuances

If we look at the information received from the Federal Tax Service of Russia on December 20, 2020, it becomes clear that the taxpayer in our case is not the person who actually makes the payment, but the tax agent himself, who is entrusted with such a duty. In order to correctly process a payment order, you must follow the following instructions:

- TIN of the payer, that is, the person whose obligation to pay taxes is fulfilled;

- payer checkpoint;

- "Payer". Here information is indicated about the person who contributes money to pay the tax (for legal entities - this is the name of the organization, for individuals - full name);

- "Purpose of payment". The INN and KPP (for individuals only the INN) of the person making the payment and the name (full name) of the payer whose duty is being fulfilled are indicated. To highlight information about the payer, the “//” sign is used;

- "Payer status". This indicates the status of the person whose obligation to pay taxes, insurance premiums and other payments to the budget is fulfilled. For a legal entity the status is “01”, for an individual entrepreneur – “09”, a notary engaged in private practice – “10”, a lawyer who has established a law office – “11”, the head of a peasant (farm) enterprise – “12”, an individual – “13” , individual entrepreneur making payments to individuals – “14”.

Compliance with the above requirements should guarantee that the payment will be taken into account by the Federal Tax Service and there will be no need to return or clarify the payment.

Users of the “1C cloud program” can familiarize themselves with the Tax Administration’s regulations on this issue in more detail on the website.

What are the restrictions?

It is worth noting that there are some restrictions associated with the transfer of taxes, fees and insurance premiums. They are as follows:

- after payment, a third party does not have the right to demand the return of the amount paid to an organization, individual entrepreneur or individual;

- It will be impossible to clarify the payment of insurance premiums for compulsory pension insurance if the Pension Fund of Russia division manages to record the received amounts in the personal accounts of the insured persons.

Third parties are not required to obtain any authorization to pay taxes, fees or insurance premiums for others.

Agreement between the taxpayer and a third party

The legislation does not establish strict requirements on exactly how the relationship between the taxpayer and the person paying the tax for him should be formalized. However, an agreement or other documentary evidence between the two persons in this situation must be drawn up.

The type of agreement can be one of the following: (click to expand)

- If the third party is a debtor of the taxpayer, then a contract of agency or an agreement to transfer tax for the taxpayer is concluded. One option may also be to write a letter to the debtor asking him to pay the tax to pay off the debt;

- If there are no contractual relations between two persons, then a loan agreement is concluded for the amount of the tax. The agreement can be either interest-free or interest-bearing;

- If the third party is the founder, then the following types of agreement can be concluded: loan, gift or interest-free targeted financing.

What is OKTMO in the payer’s or payer’s payment in 2020

Since 2020, OKTMO codes have been used instead of OKATO codes. But still not everyone knows where to get new codes and where to enter them.

What is OKTMO in a payment order in 2020? For 2020, indicating the OKTMO value in payment order forms when paying contributions to the budget is mandatory.

And if payers managed to figure out the definition of the term quite quickly, problems are still observed with indicating the correct code.

We recommend reading: How to return the agent's commission when refusing to rent an apartment

First of all, errors arise due to a lack of understanding of which classifier should be indicated in the payment, the recipient or the payer.

What OKTMO should be written on payment slips in 2020?

Starting from 2020, new rules for drawing up payment orders when paying insurance premiums and tax payments are in effect. The changes are due to the replacement of some payment details. In particular, the OKATO code was replaced. Now the OKTMO code is written in its place.