Starting next year, companies and individual entrepreneurs will use new maximum bases for calculating insurance premiums in 2018 in accordance with Government Decree No. 1378 dated November 15, 2017. In this consultation, we will tell you how their values will change, and also show with an example how to apply the new ones limits. But first, let’s find out what the basis for calculating insurance premiums is formed from.

What is the basis for calculating insurance premiums?

A citizen can be hired by a company or entrepreneur (clause 1 of Article 420 of the Tax Code of the Russian Federation):

- under an employment contract;

- under a civil law agreement (GPC) for the performance of work, provision of services;

- under the author's order agreement, etc.

Payments and rewards made in favor of individuals within the framework of these agreements form an object of taxation with insurance premiums (paragraph 1, paragraph 1, article 420 of the Tax Code of the Russian Federation) Not everything is of course! There is no need to pay insurance premiums for some types of payments (they are listed in Article 422 of the Tax Code of the Russian Federation).

Thus, in order to determine the basis for calculating insurance premiums, you need to add up all taxable payments. It is important to remember that it is considered (clause 1 of Article 421 of the Tax Code of the Russian Federation):

- each company (IP) independently, without taking into account payments for other places of work (if any);

- for each individual separately;

- monthly on an accrual basis from the beginning of the calendar year.

Reduced insurance premium rates

Changes to the procedure for applying preferential tariffs in 2020 were introduced by Federal Law dated December 2, 2013 N 333-FZ.

Who will lose the right to a reduced tariff

In 2020, some companies that previously paid insurance premiums at reduced rates (Articles 58 and 58.1 of Law No. 212-FZ) will lose benefits (clause 1 of Article 1 of Federal Law dated December 2, 2013 No. 333-FZ):

- agricultural producers;

- companies using UTII;

- companies making payments to disabled people of groups I, II or III (clauses 1 - 3, part 1, article 58 of Law No. 212-FZ);

- Mass media (clause 7, part 1, article 58 of Law No. 212-FZ);

- engineering companies (clause 13, part 1, article 58 of Law No. 212-FZ).

Federal Law No. 333-FZ dated December 2, 2013 did not extend the effect of reduced tariffs for these policyholders to 2015.

Therefore, starting from 2020, they must charge insurance premiums at the general rates established by Part 2 of Art. 58.2 of Law No. 212-FZ. All other companies that had the right to apply reduced tariffs in 2014 will continue to apply them in 2020 (Table 3 on p. 22).

Table 3

Reduced insurance premium rates in 2015

| Policyholders | Norm Art. 58 Law No. 212-FZ | Extrabudgetary fund | ||

| Pension Fund | FSS RF | FFOMS | ||

| Business societies | Points 4 - 6 part 1 and part 3 | 8% | 2% | 4% |

| Companies in the field of technology development activities | ||||

| IT companies | ||||

| Companies making payments to crew members of ships registered in the Russian International Register of Ships | Clause 9 part 1 and part 3.3 | 0% | 0% | 0% |

| Companies on the simplified tax system, the main activity of which is specified in clause 8, part 1, art. 58 Law No. 212-FZ | Clause 8 part 1 and part 3.4 | 20% | 0% | 0% |

| Companies paying UTII | Clause 10 part 1 and part 3.4 | |||

| Organizations engaged in the field of social services, scientific research, etc. | Clause 11 part 1 and part 3.4 | |||

| Charitable organizations on the simplified tax system | Clause 12 part 1 and part 3.4 | |||

| Individual entrepreneurs on a patent | Clause 14 part 1 and part 3.4 | |||

Such companies pay insurance premiums until the employee’s payments exceed the maximum base for calculating contributions. Excess amounts are not subject to contributions.

Changes in the calculation of contributions at reduced rates

These changes apply to pharmacies and individual entrepreneurs on a patent.

Pharmacies . From 2020, pharmacy organizations and individual entrepreneurs with a license for pharmaceutical activities can apply reduced tariffs only to payments to employees who have the right to engage in pharmaceutical activities or are allowed to carry out pharmaceutical activities (clause “a”, clause 29, article 5 of the Federal Law dated June 28, 2014 N 188-FZ).

Note. Persons who have the right to engage in pharmaceutical activities before January 1, 2020 are listed in paragraph 1 of Art. 100 of the Federal Law of November 21, 2011 N 323-FZ.

Thus, the question of whether preferential tariffs apply to all workers, including those who are not directly involved in pharmaceutical activities, is finally resolved.

Individual entrepreneurs on a patent . The majority of insurers will be able to apply a reduced tariff only for payments in favor of workers engaged in the type of economic activity specified in the patent (clause “b”, paragraph 29, article 5 of the Federal Law of June 28, 2014 N 188-FZ).

This restriction will not apply to individual entrepreneurs who carry out the types of activities listed in paragraphs. 19, 45 - 47 p. 2 art. 346.43 of the Tax Code:

- retail stationary trade in a sales area of no more than 50 sq. m;

- retail stationary trade without trading floors and through non-stationary retail chain facilities;

- catering services provided in a customer service hall with an area of no more than 50 square meters. m;

- leasing (hiring) of residential and non-residential premises, dachas, land plots owned by an individual entrepreneur by right of ownership.

Limit value of the base for calculating insurance premiums

From the taxable base of each “physicist”, the organization (IP) calculates and pays insurance premiums to the Federal Tax Service at the following basic tariffs (clause 1 of article 421 of the Tax Code of the Russian Federation, clause 1 and clause 4 of article 431 of the Tax Code of the Russian Federation, article 426 of the Tax Code of the Russian Federation ).

| Type of insurance premiums | Contribution rate (%) |

| Contributions to compulsory pension insurance (OPI) | 22% |

| Contributions for compulsory health insurance (CHI) | 5,1% |

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity (VniM) | 2,9% |

| TOTAL: | 30% |

Notice! For payments to foreigners and stateless persons temporarily staying in Russia (with the exception of highly qualified specialists), VNIM contributions are calculated at the rate of 1.8%.

Additionally, policyholders pay contributions to the Social Insurance Fund “for injuries” at a rate of 0.2% to 8.5%, depending on the main type of economic activity (Article 21, paragraph 1 and 3 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ (hereinafter referred to as Law No. 125-FZ), Federal Law dated December 19, 2016 No. 419-FZ, Federal Law dated December 22, 2005 No. 179-FZ).

Note! For some categories of employers, the Tax Code provides for reduced (or zero) insurance premium rates. For example, IT companies pay contributions for compulsory health insurance in the amount of 8%, for compulsory medical insurance - 4%, for VNIM - 2% (clause 3, clause 1, clause 1.1, clause 2, clause 5 of Article 427 of the Tax Code RF). And “simplers” who carry out preferential activities listed in clause 5, clause 1, Article 427 of the Tax Code of the Russian Federation, pay only one pension contribution at a rate of 20% (clause 3, clause 2, Article 427 of the Tax Code of the Russian Federation).

In this case, the payer calculates contributions for compulsory health insurance and the case of personal and personal care based on the tariffs indicated in the table until the taxable base of an individual person reaches the so-called maximum value.

The maximum value of the base for calculating insurance contributions for compulsory pension and social insurance is established by the Government of the Russian Federation at the end of each year for the next calendar year, taking into account the growth of average wages in the country (clauses 4-6 of Article 421 of the Tax Code of the Russian Federation). Thus, in 2020 the following values apply (clause 1 of the Decree of the Government of the Russian Federation of November 29, 2016 No. 1255):

- for contributions to compulsory health insurance – 876,000 rubles;

- for contributions to the case of VniM - 755,000 rubles.

And if the amount of taxable payments accrued in favor of an individual on an accrual basis from the beginning of the year (base) exceeds the established limits, then the rate of contributions for compulsory pension insurance is reduced from 22% to 10%, and contributions for the case of VNIM cease to be accrued altogether (paragraph 3 p. 1 Article 426 of the Tax Code of the Russian Federation, clause 3 of Article 421 of the Tax Code of the Russian Federation).

Keep in mind! For the purposes of calculating medical and pension contributions paid at an additional tariff, as well as contributions for “injuries,” maximum bases are not approved. In other words, these types of contributions are paid at the rates provided by the Law, regardless of the total income of the individual.

Let's see how the contribution limits will change in 2018.

Current tariffs

Organizations and individual entrepreneurs must pay insurance premiums at additional rates for pension insurance in 2020. However, not everyone needs to pay additional fees. Additional contributions are accrued only for payments to employees employed:

- in underground work, in work with hazardous working conditions and in hot shops (subclause 1, clause 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ, list No. 1, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10 );

- on special types of work listed in subparagraphs 2–18 of paragraph 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ.

Additional insurance premium rates depend on whether a special assessment of working conditions or workplace certification was carried out.

If there was no special assessment or certification

If neither a special assessment of working conditions nor certification of workplaces was carried out, then in 2020 organizations and individual entrepreneurs need to use additional insurance premium rates, which are determined by paragraphs 1 and 2 of Article 428 of the Tax Code of the Russian Federation. Apply them to payments to employees.

| General tariffs for additional “pension” contributions | ||

| Who applies | Additional tariff, % | Norm |

| Organizations and individual entrepreneurs making payments to employees engaged in work specified in paragraph 1 of part 1 of Article 30 of Federal Law No. 400-FZ dated December 28, 2013 (according to List 1, approved by Resolution of the USSR Cabinet of Ministers dated January 26, 1991 No. 10) | 9 | clause 1 art. 428 Tax Code of the Russian Federation |

| Organizations and individual entrepreneurs making payments to employees engaged in work specified in paragraphs 2–18 of part 1 of article 30 of the Law of December 28. 2013 No. 400-FZ (according to lists of professions, positions and organizations in which work gives the right to an early (insurance) old-age pension) | 6 | clause 2 art. 428 Tax Code of the Russian Federation |

Individual entrepreneurs are required to pay insurance premiums on payments and remunerations accrued in favor of individuals within the framework of labor relations and civil contracts for the performance of work and provision of services (Clause 1 of Article 419 of the Tax Code of the Russian Federation). But individual entrepreneurs must also transfer mandatory insurance premiums “for themselves” (Article 430 of the Tax Code of the Russian Federation):

- for pension insurance;

- for health insurance.

There are also insurance premiums in case of temporary disability and in connection with maternity. Individual entrepreneurs, as a general rule, do not pay this type of insurance premiums (clause 6 of Article 430 of the Tax Code of the Russian Federation). However, payment of these contributions can be made on a voluntary basis. This is provided for in Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ.

Individual entrepreneurs do not pay insurance premiums for injuries at all. Payment of this type of insurance premiums by individual entrepreneurs is not provided even on a voluntary basis.

From January 1, 2020, the minimum wage will be 9,489 rubles. See “Minimum wage from January 1, 2020.” If we adhere to the previous rules, then the amount of fixed insurance premiums for individual entrepreneurs should have increased from 2020. However, starting from 2020, a new procedure for calculating insurance premiums for individual entrepreneurs will be introduced. It is enshrined in the Federal Law of November 27.

From January 1, 2020, a new fixed amount of insurance contributions for compulsory pension and health insurance is established for individual entrepreneurs without employees (paying contributions “for themselves”). These payments will no longer depend on the minimum wage (minimum wage). Why are such amendments introduced? Let me explain.

The Russian government has decided to bring the minimum wage to the subsistence level - this should happen at the beginning of 2020. This means that insurance premiums for individual entrepreneurs, if they are not decoupled from the minimum wage, will grow very strongly in the next couple of years. And the proposed changes will make it possible to maintain an “economically justified level of fiscal burden” for the payment of insurance premiums for individual entrepreneurs who do not make payments to individuals. This is stated in the explanatory note to the bill.

The idea of the bill was discussed and approved during a meeting between Russian President Vladimir Putin and President of Opora Russia Alexander Kalinin.

Next, we will tell you what exactly has changed in the procedure for calculating insurance premiums for individual entrepreneurs “for themselves” since 2020 and indicate the new amounts with examples.

From 2020, insurance premiums for compulsory pension insurance will be calculated in the following order:

- if the payer’s income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period;

- if the payer’s income for the billing period exceeds 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period.

Let's decipher the new meanings and give examples of calculations of amounts payable in various circumstances.

Fixed amount for income of 300 thousand rubles or less

https://youtu.be/DY9qUEITa84

As we have already said, in 2020, fixed pension contributions of individual entrepreneurs “for themselves” with incomes of less than 300,000 rubles amounted to 23,400 rubles. This amount was determined using a special formula based on the minimum wage and insurance premium rates. However, from 2020 the fixed amount of pension contributions will not depend on these values. It will simply be enshrined in law as 26,545 rubles.

Thus, since 2020, fixed pension contributions have increased by 3,145 rubles. (RUR 26,545 – RUR 23,400). From 2020, all individual entrepreneurs, regardless of whether they conduct business or receive income from business, will need to pay 26,545 rubles as mandatory pension contributions.

Next, we will consider examples when individual entrepreneurs will need to pay fixed pension contributions in a new (increased) amount.

If income is more than 300,000 rubles

If at the end of 2020 the income of an individual entrepreneur exceeds 300,000 rubles, then the individual entrepreneur will need to pay an additional plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period. There have been no changes in this part since 2020. This approach has been used previously.

Maximum amount of pension insurance contributions

The maximum amount of pension contributions of individual entrepreneurs for 2020, calculated using this formula, was 187,200 rubles. (8 x RUB 7,500 x 26% x 12 months).

As you can see, in 2020 the eight-fold limit will also apply, but not to the minimum wage, but to a fixed amount of 26,545 rubles. Thus, more than 212,360 rubles. (RUR 26,545 x in 2018 cannot be paid as pension contributions.

Thus, more than 212,360 rubles. (RUR 26,545 x in 2018 cannot be paid as pension contributions.

It turns out that the maximum amount of pension contributions payable since 2018 has increased by 25,160 rubles. (RUR 212,360 – RUR 187,200).

The amount of medical insurance contributions to the FFOMS in 2020 did not depend on the income of the individual entrepreneur, but was also calculated based on the minimum wage. In 2017, the amount of medical contributions was 4,590 rubles. See “Insurance premiums for individual entrepreneurs in 2020.”

Since 2020, the amount of compulsory medical insurance contributions has been “untied” from the minimum wage and is fixed at 5,840 rubles for the billing period. How much have individual entrepreneur insurance premiums increased since 2020? The answer is 1250 rubles. (5840 rub. – 4590 rub.).

5840 rubles is a mandatory amount. Starting from 2020, all individual entrepreneurs must pay it for the billing period, regardless of the conduct of activities, movement of accounts and receipt of income.

The maximum value of the base for calculating insurance premiums for 2018 was approved in accordance with paragraphs 3 and 6 of Article 421 of the Tax Code of the Russian Federation. The new values were approved by Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378).

This Resolution was published on the official legal information portal on November 17, 2020. From January 1, 2020, the maximum values of the base for calculating insurance premiums are as follows:

- 815,000 rubles is the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- 1,021,000 rubles is the maximum value of the base for calculating insurance contributions for compulsory pension insurance.

Please note: the maximum amount of the base for calculating “medical” contributions is not approved. These contributions, regardless of the amount of income of an individual in 2020, must be paid at a rate of 5.1%. There is also no maximum base for contributions “for injuries”. Therefore, their size for 2020 is not given in the table.

In 2020, the maximum values of the base for insurance premiums increased compared to 2020. Let's compare the values in the table.

| Year | Maximum base for pension contributions | Maximum base for social contributions |

| 2017 | 876,000 rub. | RUB 755,000 |

| 2018 | RUR 1,021,000 | RUB 815,000 |

| Type of contributions | Tariff, % | |

| With payments within the limit | With payments over the limit | |

| Pension | 22% | 10% |

| Social benefits in case of illness and maternity | 2,9% | – |

| Medical | 5,1% | 5,1% |

| Conditions for applying the tariff | Insurance premium rates, % | ||

| Pension Fund | FSS | FFOMS | |

Business companies and partnerships that practically apply (implement) the results of intellectual activity, the exclusive rights to which belong to their founders (participants):

| 13,0 | 2,9 | 5,1 |

Organizations and entrepreneurs who have entered into agreements on the implementation of technology innovation activities and who make payments to employees working:

| |||

| Organizations and entrepreneurs who have entered into agreements on the implementation of tourism and recreational activities and who make payments to employees working in tourist and recreational special economic zones, united by a government decision into a cluster | |||

Russian organizations that work in the field of information technology and are engaged in:

| 8,0 | 2,0 | 4,0 |

| Organizations and entrepreneurs with payments and remunerations for the performance of labor duties to crew members of ships registered in the Russian International Register of Ships (except for ships for storage and transshipment of oil and petroleum products in Russian seaports) | 0 | 0 | 0 |

| Organizations and entrepreneurs on a simplified basis that are engaged in certain types of activities and if their cumulative income for the calendar year does not exceed 79 million rubles. | 20,0 | 0 | 0 |

| Payers of UTII: pharmacy organizations and entrepreneurs with a license for pharmaceutical activities, with payments to citizens who have the right or are admitted to pharmaceutical activities | |||

Non-profit organizations that use the simplified approach and operate in the field of:

Exception: state and municipal institutions | |||

| Charitable organizations simplified1 | |||

Entrepreneurs who apply the patent tax system, except for:

| |||

| Organizations participating in the Skolkovo project | 14,0 | 0 | 0 |

| Commercial organizations and entrepreneurs with the status of residents of the territory of rapid socio-economic development in accordance with Law dated December 29, 2014 No. 473-FZ1 | 6,0 | 1,5 | 0,1 |

| Commercial organizations and entrepreneurs with the status of residents of the free port of Vladivostok in accordance with the Law of July 13, 2015 No. 212-FZ1 | 6,0 | 1,5 | 0,1 |

| Organizations with resident status of a special economic zone in the Kaliningrad region in accordance with Law dated January 10, 2006 No. 16-FZ2 | 6,0 | 1,5 | 0,1 |

| Amount of additional contributions to the Pension Fund | = | Amount of income | — | 300 000 | X | 1% |

Tax liability

| No. | Territory of primary use of the vehicle | Coefficient for vehicles, with the exception of tractors, self-propelled road construction and other machines | Coefficient for tractors, self-propelled road-building and other machines, with the exception of vehicles that do not have wheel propulsors |

| 1 | 2 | 3 | 4 |

| 1 | Republic of Adygea | 1,3 | 1 |

| 2 | Altai Republic | ||

| 2.1 | Gorno-Altaisk | 1,3 | 0,8 |

| 2.2 | Other cities and towns | 0,7 | 0,5 |

| 3 | Republic of Bashkortostan | ||

| 3.1 | Blagoveshchensk, Oktyabrsky | 1,2 | 0,8 |

| 3.2 | Ishimbay, Kumertau, Salavat | 1,1 | 0,8 |

| 3.3 | Sterlitamak, Tuymazy | 1,3 | 0,8 |

| 3.4 | Ufa | 1,8 | 1 |

| 3.5 | Other cities and towns | 1 | 0,8 |

| 4 | The Republic of Buryatia | ||

| 4.1 | Ulan-Ude | 1,3 | 0,8 |

| 4.2 | Other cities and towns | 0,6 | 0,5 |

| 5 | The Republic of Dagestan | ||

| 5.1 | Buynaksk, Derbent, Kaspiysk, Makhachkala, Khasavyurt | 0,7 | 0,5 |

| 5.2 | Other cities and towns | 0,6 | 0,5 |

| 6 | The Republic of Ingushetia | ||

| 6.1 | Malgobek | 0,8 | 0,5 |

| 6.2 | Nazran | 0,6 | 0,5 |

| 6.3 | Other cities and towns | 0,6 | 0,5 |

| 7 | Kabardino-Balkarian Republic | ||

| 7.1 | Nalchik, Prokhladny | 1 | 0,8 |

| 7.2 | Other cities and towns | 0,7 | 0,5 |

| 8 | Republic of Kalmykia | ||

| 8.1 | Elista | 1,3 | 0,8 |

| 8.2 | Other cities and towns | 0,6 | 0,5 |

| 9 | Karachay-Cherkess Republic | 1 | 0,8 |

| 10 | Republic of Karelia | ||

| 10.1 | Petrozavodsk | 1,3 | 0,8 |

| 10.2 | Other cities and towns | 0,8 | 0,5 |

| 11 | Komi Republic | ||

| 11.1 | Syktyvkar | 1,6 | 1 |

| 11.2 | Ukhta | 1,3 | 0,8 |

| 11.3 | Other cities and towns | 1 | 0,8 |

| 12 | Republic of Crimea | ||

| 12.1 | Simferopol | 0,6 | 0,6 |

| 12.2 | Other cities and towns | 0,6 | 0,6 |

| 13 | Mari El Republic | ||

| 13.1 | Volzhsk | 1 | 0,8 |

| 13.2 | Yoshkar-Ola | 1,4 | 0,8 |

| 13.3 | Other cities and towns | 0,7 | 0,5 |

| 14 | The Republic of Mordovia | ||

| 14.1 | Ruzaevka | 1,2 | 1 |

| 14.2 | Saransk | 1,5 | 1 |

| 14.3 | Other cities and towns | 0,8 | 0,6 |

| 15 | The Republic of Sakha (Yakutia) | ||

| 15.1 | Neryungri | 0,8 | 0,5 |

| 15.2 | Yakutsk | 1,2 | 0,7 |

| 15.3 | Other cities and towns | 0,6 | 0,5 |

| 16 | Republic of North Ossetia-Alania | ||

| 16.1 | Vladikavkaz | 1 | 0,8 |

| 16.2 | Other cities and towns | 0,8 | 0,5 |

| 17 | Republic of Tatarstan | ||

| 17.1 | Almetyevsk, Zelenodolsk, Nizhnekamsk | 1,3 | 0,8 |

| 17.2 | Bugulma, Leninogorsk, Chistopol | 1 | 0,8 |

| 17.3 | Elabuga | 1,2 | 0,8 |

| 17.4 | Kazan | 2 | 1,2 |

| 17.5 | Naberezhnye Chelny | 1,7 | 1 |

| 17.6 | Other cities and towns | 1,1 | 0,8 |

| 18 | Tyva Republic | ||

| 18.1 | Kyzyl | 0,6 | 0,5 |

| 18.2 | Other cities and towns | 0,6 | 0,5 |

| 19 | Udmurt republic | ||

| 19.1 | Votkinsk | 1,1 | 0,8 |

| 19.2 | Glazov, Sarapul | 1 | 0,8 |

| 19.3 | Izhevsk | 1,6 | 1 |

| 19.4 | Other cities and towns | 0,8 | 0,5 |

| 20 | The Republic of Khakassia | ||

| 20.1 | Abakan, Sayanogorsk, Chernogorsk | 1 | 0,8 |

| 20.2 | Other cities and towns | 0,6 | 0,5 |

| 21 | Chechen Republic | 0,6 | 0,5 |

| 22 | Chuvash Republic | ||

| 22.1 | Kanash | 1,1 | 0,8 |

| 22.2 | Novocheboksarsk | 1,2 | 0,8 |

| 22.3 | Cheboksary | 1,7 | 1 |

| 22.4 | Other cities and towns | 0,8 | 0,5 |

| 23 | Altai region | ||

| 23.1 | Barnaul | 1,7 | 1 |

| 23.2 | Biysk | 1,2 | 0,8 |

| 23.3 | Zarinsk, Novoaltaisk, Rubtsovsk | 1,1 | 0,8 |

| 23.4 | Other cities and towns | 0,7 | 0,5 |

| 24 | Transbaikal region | ||

| 24.1 | Krasnokamensk | 0,6 | 0,5 |

| 24.2 | Chita | 0,7 | 0,5 |

| 24.3 | Other cities and towns | 0,6 | 0,5 |

| 25 | Kamchatka Krai | ||

| 25.1 | Petropavlovsk-Kamchatsky | 1,3 | 1 |

| 25.2 | Other cities and towns | 1 | 0,6 |

| 26 | Krasnodar region | ||

| 26.1 | Anapa, Gelendzhik | 1,3 | 0,8 |

| 26.2 | Armavir, Sochi, Tuapse | 1,2 | 0,8 |

| 26.3 | Belorechensk, Yeisk, Kropotkin, Krymsk, Kurganinsk, Labinsk, Slavyansk-on-Kuban, Timashevsk, Tikhoretsk | 1,1 | 0,8 |

| 26.4 | Krasnodar, Novorossiysk | 1,8 | 1 |

| 26.5 | Other cities and towns | 1 | 0,8 |

| 27 | Krasnoyarsk region | ||

| 27.1 | Achinsk, Zelenogorsk | 1,1 | 0,8 |

| 27.2 | Zheleznogorsk, Norilsk | 1,3 | 0,8 |

| 27.3 | Kansk, Lesosibirsk, Minusinsk, Nazarovo | 1 | 0,8 |

| 27.4 | Krasnoyarsk | 1,8 | 1 |

| 27.5 | Other cities and towns | 0,9 | 0,5 |

| 28 | Perm region | ||

| 28.1 | Berezniki, Krasnokamsk | 1,3 | 0,8 |

| 28.2 | Lysva, Tchaikovsky | 1 | 0,8 |

| 28.3 | Permian | 2 | 1,2 |

| 28.4 | Solikamsk | 1,2 | 0,8 |

| 28.5 | Other cities and towns | 1,1 | 0,8 |

| 29 | Primorsky Krai | ||

| 29.1 | Arsenyev, Artem, Nakhodka, Spassk-Dalniy, Ussuriysk | 1 | 0,8 |

| 29.2 | Vladivostok | 1,4 | 1 |

| 29.3 | Other cities and towns | 0,7 | 0,5 |

| 30 | Stavropol region | ||

| 30.1 | Budennovsk, Georgievsk, Essentuki, Mineralnye Vody, Nevinnomyssk, Pyatigorsk | 1 | 0,8 |

| 30.2 | Kislovodsk, Mikhailovsk, Stavropol | 1,2 | 0,8 |

| 30.3 | Other cities and towns | 0,7 | 0,5 |

| 31 | Khabarovsk region | ||

| 31.1 | Amursk | 1 | 0,8 |

| 31.2 | Komsomolsk-on-Amur | 1,3 | 0,8 |

| 31.3 | Khabarovsk | 1,7 | 1 |

| 31.4 | Other cities and towns | 0,8 | 0,5 |

| 32 | Amur region | ||

| 32.1 | Belogorsk, Svobodny | 1,1 | 0,9 |

| 32.2 | Blagoveshchensk | 1,6 | 0,9 |

| 32.3 | Other cities and towns | 1 | 0,6 |

| 33 | Arhangelsk region | ||

| 33.1 | Arkhangelsk | 1,8 | 1 |

| 33.2 | Kotlas | 1,6 | 1 |

| 33.3 | Severodvinsk | 1,7 | 1 |

| 33.4 | Other cities and towns | 0,85 | 0,5 |

| 34 | Astrakhan region | ||

| 34.1 | Astrakhan | 1,4 | 1 |

| 34.2 | Other cities and towns | 0,8 | 0,5 |

| 35 | Belgorod region | ||

| 35.1 | Belgorod | 1,3 | 0,8 |

| 35.2 | Gubkin, Stary Oskol | 1 | 0,8 |

| 35.3 | Other cities and towns | 0,8 | 0,5 |

| 36 | Bryansk region | ||

| 36.1 | Bryansk | 1,5 | 1 |

| 36.2 | Klintsy | 1 | 0,8 |

| 36.3 | Other cities and towns | 0,7 | 0,5 |

| 37 | Vladimir region | ||

| 37.1 | Vladimir | 1,6 | 1 |

| 37.2 | Gus-Khrustalny | 1,1 | 0,8 |

| 37.3 | Moore | 1,2 | 0,8 |

| 37.4 | Other cities and towns | 1 | 0,8 |

| 38 | Volgograd region | ||

| 38.1 | Volgograd | 1,3 | 0,8 |

| 38.2 | Volzhsky | 1,1 | 0,8 |

| 38.3 | Kamyshin, Mikhailovka | 1 | 0,8 |

| 38.4 | Other cities and towns | 0,7 | 0,5 |

| 39 | Vologda Region | ||

| 39.1 | Vologda | 1,7 | 1 |

| 39.2 | Cherepovets | 1,8 | 1 |

| 39.3 | Other cities and towns | 0,9 | 0,5 |

| 40 | Voronezh region | ||

| 40.1 | Borisoglebsk, Liski, Rossosh | 1,1 | 0,9 |

| 40.2 | Voronezh | 1,5 | 1,1 |

| 40.3 | Other cities and towns | 0,8 | 0,6 |

| 41 | Ivanovo region | ||

| 41.1 | Ivanovo | 1,8 | 1 |

| 41.2 | Kineshma | 1,1 | 0,8 |

| 41.3 | Shuya | 1 | 0,8 |

| 41.4 | Other cities and towns | 0,9 | 0,5 |

| 42 | Irkutsk region | ||

| 42.1 | Angarsk | 1,2 | 0,8 |

| 42.2 | Bratsk, Tulun, Ust-Ilimsk, Ust-Kut, Cheremkhovo | 1 | 0,8 |

| 42.3 | Irkutsk | 1,7 | 1 |

| 42.4 | Usolye-Sibirskoye | 1,1 | 0,8 |

| 42.5 | Shelekhov | 1,3 | 0,8 |

| 42.6 | Other cities and towns | 0,8 | 0,5 |

| 43 | Kaliningrad region | ||

| 43.1 | Kaliningrad | 1,1 | 0,8 |

| 43.2 | Other cities and towns | 0,8 | 0,5 |

| 44 | Kaluga region | ||

| 44.1 | Kaluga | 1,2 | 0,8 |

| 44.2 | Obninsk | 1,3 | 0,8 |

| 44.3 | Other cities and towns | 0,9 | 0,5 |

| 45 | Kemerovo region | ||

| 45.1 | Anzhero-Sudzhensk, Kiselevsk, Yurga | 1,2 | 0,8 |

| 45.2 | Belovo, Berezovsky, Mezhdurechensk, Osinniki, Prokopyevsk | 1,3 | 0,8 |

| 45.3 | Kemerovo | 1,9 | 1 |

| 45.4 | Novokuznetsk | 1,8 | 1 |

| 45.5 | Other cities and towns | 1,1 | 0,8 |

| 46 | Kirov region | ||

| 46.1 | Kirov | 1,4 | 1 |

| 46.2 | Kirovo-Chepetsk | 1,2 | 0,8 |

| 46.3 | Other cities and towns | 0,8 | 0,5 |

| 47 | Kostroma region | ||

| 47.1 | Kostroma | 1,3 | 0,8 |

| 47.2 | Other cities and towns | 0,7 | 0,5 |

| 48 | Kurgan region | ||

| 48.1 | Mound | 1,4 | 0,8 |

| 48.2 | Shadrinsk | 1,1 | 0,8 |

| 48.3 | Other cities and towns | 0,6 | 0,5 |

| 49 | Kursk region | ||

| 49.1 | Zheleznogorsk | 1 | 0,8 |

| 49.2 | Kursk | 1,2 | 0,8 |

| 49.3 | Other cities and towns | 0,7 | 0,5 |

| 50 | Leningrad region | 1,3 | 0,8 |

| 51 | Lipetsk region | ||

| 51.1 | Dace | 1 | 0,8 |

| 51.2 | Lipetsk | 1,5 | 1 |

| 51.3 | Other cities and towns | 0,8 | 0,5 |

| 52 | Magadan Region | ||

| 52.1 | Magadan | 0,7 | 0,5 |

| 52.2 | Other cities and towns | 0,6 | 0,5 |

| 53 | Moscow region | 1,7 | 1 |

| 54 | Murmansk region | ||

| 54.1 | Apatity, Monchegorsk | 1,3 | 1 |

| 54.2 | Murmansk | 2,1 | 1,2 |

| 54.3 | Severomorsk | 1,6 | 1 |

| 54.4 | Other cities and towns | 1,2 | 1 |

| 55 | Nizhny Novgorod Region | ||

| 55.1 | Arzamas, Vyksa, Sarov | 1,1 | 0,8 |

| 55.2 | Balakhna, Bor, Dzerzhinsk | 1,3 | 0,8 |

| 55.3 | Kstovo | 1,2 | 0,8 |

| 55.4 | Nizhny Novgorod | 1,8 | 1 |

| 55.5 | Other cities and towns | 1 | 0,8 |

| 56 | Novgorod region | ||

| 56.1 | Borovichi | 1 | 0,8 |

| 56.2 | Velikiy Novgorod | 1,3 | 0,8 |

| 56.3 | Other cities and towns | 0,9 | 0,5 |

| 57 | Novosibirsk region | ||

| 57.1 | Berdsk | 1,3 | 0,8 |

| 57.2 | Iskitim | 1,2 | 0,8 |

| 57.3 | Kuibyshev | 1 | 0,8 |

| 57.4 | Novosibirsk | 1,7 | 1 |

| 57.5 | Other cities and towns | 0,9 | 0,5 |

| 58 | Omsk region | ||

| 58.1 | Omsk | 1,6 | 1 |

| 58.2 | Other cities and towns | 0,9 | 0,5 |

| 59 | Orenburg region | ||

| 59.1 | Buguruslan, Buzuluk, Novotroitsk | 1 | 0,8 |

| 59.2 | Orenburg | 1,7 | 1 |

| 59.3 | Orsk | 1,1 | 0,8 |

| 59.4 | Other cities and towns | 0,8 | 0,5 |

| 60 | Oryol Region | ||

| 60.1 | Livny, Mtsensk | 1 | 0,8 |

| 60.2 | Eagle | 1,2 | 0,8 |

| 60.3 | Other cities and towns | 0,7 | 0,5 |

| 61 | Penza region | ||

| 61.1 | Zarechny | 1,2 | 0,8 |

| 61.2 | Kuznetsk | 1 | 0,8 |

| 61.3 | Penza | 1,4 | 1 |

| 61.4 | Other cities and towns | 0,7 | 0,5 |

| 62 | Pskov region | ||

| 62.1 | Velikie Luki | 1 | 0,8 |

| 62.2 | Pskov | 1,2 | 0,8 |

| 62.3 | Other cities and towns | 0,7 | 0,5 |

| 63 | Rostov region | ||

| 63.1 | Azov | 1,2 | 0,8 |

| 63.2 | Bataysk | 1,3 | 0,8 |

| 63.3 | Volgodonsk, Gukovo, Kamensk-Shakhtinsky, Novocherkassk, Novoshakhtinsk, Salsk, Taganrog | 1 | 0,8 |

| 63.4 | Rostov-on-Don | 1,8 | 1 |

| 63.5 | Mines | 1,1 | 0,8 |

| 63.6 | Other cities and towns | 0,8 | 0,5 |

| 64 | Ryazan Oblast | ||

| 64.1 | Ryazan | 1,4 | 1 |

| 64.2 | Other cities and towns | 0,9 | 0,5 |

| 65 | Samara Region | ||

| 65.1 | Novokuybyshevsk, Syzran | 1,1 | 0,8 |

| 65.2 | Samara | 1,6 | 1 |

| 65.3 | Tolyatti | 1,5 | 1 |

| 65.4 | Chapaevsk | 1,2 | 0,8 |

| 65.5 | Other cities and towns | 0,9 | 0,5 |

| 66 | Saratov region | ||

| 66.1 | Balakovo, Balashov, Volsk | 1 | 0,8 |

| 66.2 | Saratov | 1,6 | 1 |

| 66.3 | Engels | 1,2 | 0,8 |

| 66.4 | Other cities and towns | 0,7 | 0,5 |

| 67 | Sakhalin region | ||

| 67.1 | Yuzhno-Sakhalinsk | 1,5 | 1 |

| 67.2 | Other cities and towns | 0,9 | 0,5 |

| 68 | Sverdlovsk region | ||

| 68.1 | Asbest, Revda | 1,1 | 0,8 |

| 68.2 | Berezovsky, Verkhnyaya Pyshma, Novouralsk, Pervouralsk | 1,3 | 0,8 |

| 68.3 | Verkhnyaya Salda, Polevskoy | 1,2 | 0,8 |

| 68.4 | Ekaterinburg | 1,8 | 1 |

| 68.5 | Other cities and towns | 1 | 0,8 |

| 69 | Smolensk region | ||

| 69.1 | Vyazma, Roslavl, Safonovo, Yartsevo | 1 | 0,8 |

| 69.2 | Smolensk | 1,2 | 0,8 |

| 69.3 | Other cities and towns | 0,7 | 0,5 |

| 70 | Tambov Region | ||

| 70.1 | Michurinsk | 1 | 0,8 |

| 70.2 | Tambov | 1,2 | 0,8 |

| 70.3 | Other cities and towns | 0,8 | 0,5 |

| 71 | Tver region | ||

| 71.1 | Vyshny Volochek, Kimry, Rzhev | 1 | 0,8 |

| 71.2 | Tver | 1,5 | 1 |

| 71.3 | Other cities and towns | 0,8 | 0,5 |

| 72 | Tomsk region | ||

| 72.1 | Seversk | 1,2 | 0,8 |

| 72.2 | Tomsk | 1,6 | 1 |

| 72.3 | Other cities and towns | 0,9 | 0,5 |

| 73 | Tula region | ||

| 73.1 | Aleksin, Efremov, Novomoskovsk | 1 | 0,8 |

| 73.2 | Tula | 1,5 | 1 |

| 73.3 | Uzlovaya, Shchekino | 1,2 | 0,8 |

| 73.4 | Other cities and towns | 0,9 | 0,5 |

| 74 | Tyumen region | ||

| 74.1 | Tobolsk | 1,3 | 0,8 |

| 74.2 | Tyumen | 2 | 1,2 |

| 74.3 | Other cities and towns | 1,1 | 0,8 |

| 75 | Ulyanovsk region | ||

| 75.1 | Dimitrovgrad | 1,2 | 0,9 |

| 75.2 | Ulyanovsk | 1,5 | 1,1 |

| 75.3 | Other cities and towns | 0,9 | 0,6 |

| 76 | Chelyabinsk region | ||

| 76.1 | Zlatoust, Miass | 1,4 | 0,8 |

| 76.2 | Kopeisk | 1,6 | 1 |

| 76.3 | Magnitogorsk | 1,8 | 1 |

| 76.4 | Satka, Chebarkul | 1,2 | 0,8 |

| 76.5 | Chelyabinsk | 2,1 | 1,3 |

| 76.6 | Other cities and towns | 1 | 0,8 |

| 77 | Yaroslavl region | ||

| 77.1 | Yaroslavl | 1,5 | 1 |

| 77.2 | Other cities and towns | 0,9 | 0,5 |

| 78 | Moscow | 2 | 1,2 |

| 79 | Saint Petersburg | 1,8 | 1 |

| 80 | Sevastopol | 0,6 | 0,6 |

| 81 | Jewish Autonomous Region | ||

| 81.1 | Birobidzhan | 0,6 | 0,5 |

| 81.2 | Other cities and towns | 0,6 | 0,5 |

| 82 | Nenets Autonomous Okrug | 0,8 | 0,5 |

| 83 | Khanty-Mansiysk Autonomous Okrug - Ugra | ||

| 83.1 | Kogalym | 1 | 0,8 |

| 83.2 | Nefteyugansk, Nyagan | 1,3 | 0,8 |

| 83.3 | Surgut | 2 | 1,2 |

| 83.4 | Nizhnevartovsk | 1,8 | 1 |

| 83.5 | Khanty-Mansiysk | 1,5 | 1 |

| 83.6 | Other cities and towns | 1,1 | 0,8 |

| 84 | Chukotka Autonomous Okrug | 0,6 | 0,5 |

| 85 | Yamalo-Nenets Autonomous Okrug | ||

| 85.1 | New Urengoy | 1 | 0,8 |

| 85.2 | Noyabrsk | 1,7 | 1 |

| 85.3 | Other cities and towns | 1,1 | 0,8 |

| 86 | Baikonur | 0,6 | 0,5 |

| N p/p | Minimum KBM coefficient for compulsory insurance contracts valid as of January 1, 2020 or terminated in 2020 | KBM coefficient for 2020 depending on the amount of insurance compensation made by insurers in previous periods when carrying out compulsory insurance | ||||

| 0 insurance claims | 1 insurance compensation | 2 insurance compensation | 3 insurance claims | More than 3 insurance claims | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | 2,45 | 2,3 | 2,45 | 2,45 | 2,45 | 2,45 |

| 2 | 2,3 | 1,55 | 2,45 | 2,45 | 2,45 | 2,45 |

| 3 | 1,55 | 1,4 | 2,45 | 2,45 | 2,45 | 2,45 |

| 4 | 1,4 | 1 | 1,55 | 2,45 | 2,45 | 2,45 |

| 5 | 1 | 0,95 | 1,55 | 2,45 | 2,45 | 2,45 |

| 6 | 0,95 | 0,9 | 1,4 | 1,55 | 2,45 | 2,45 |

| 7 | 0,9 | 0,85 | 1 | 1,55 | 2,45 | 2,45 |

| 8 | 0,85 | 0,8 | 0,95 | 1,4 | 2,45 | 2,45 |

| 9 | 0,8 | 0,75 | 0,95 | 1,4 | 2,45 | 2,45 |

| 10 | 0,75 | 0,7 | 0,9 | 1,4 | 2,45 | 2,45 |

| 11 | 0,7 | 0,65 | 0,9 | 1,4 | 1,55 | 2,45 |

| 12 | 0,65 | 0,6 | 0,85 | 1 | 1,55 | 2,45 |

| 13 | 0,6 | 0,55 | 0,85 | 1 | 1,55 | 2,45 |

| 14 | 0,55 | 0,5 | 0,85 | 1 | 1,55 | 2,45 |

| 15 | 0,5 | 0,5 | 0,8 | 1 | 1,55 | 2,45 |

| Month of 2020 | Growing base of insurance contributions for pension insurance from the beginning of 2020 (in rubles) | The amount of insurance premiums that were accrued (in rubles) | ||

| Up to 1,021,000 rubles | Over 1,021,000 rubles | At a rate of 22% | At a rate of 10% | |

| January | 95 000 | 20 900 | ||

| February | 190 000 | 20 900 | ||

| March | 285 000 | 20 900 | ||

| April | 380 000 | 20 900 | ||

| May | 475 000 | 20 900 | ||

| June | 570 000 | 20 900 | ||

| July | 665 000 | 20 900 | ||

| August | 760 000 | 20 900 | ||

| September | 855 000 | 20 900 | ||

| October | 950 000 | 20 900 | ||

| November | 1 021 000 | 24 000 | 15 620 | 2 400 |

| December | 1 140 000 | 9 500 | ||

Insurance contributions for social insurance for temporary disability and in connection with maternity Sviridova A.P. in 2018

| Index | Rate |

| For compulsory pension insurance (MPI) (within the base of 1,021,000 rubles for each individual) | 22% |

| For compulsory pension insurance (in addition to payments of 1,021,000 rubles for each individual) | 10% |

| For compulsory social insurance in case of temporary disability and in connection with maternity (VNIM) (within the base of 815,000 rubles for each individual) | 2,9% |

| For compulsory social insurance in case of temporary disability and in connection with maternity in relation to foreigners and stateless persons temporarily staying in the Russian Federation (except for HQS) (within the base of 815,000 rubles for each individual) | 1,8% |

| For compulsory social insurance in case of temporary disability and in connection with maternity (in addition to payments of 815,000 rubles for each individual) | 0% |

| For compulsory health insurance (CHI) (except for foreigners and stateless persons, including HQS, who are temporarily staying in the Russian Federation) | 5,1% |

| Type of contributions | From payments not exceeding the maximum contribution base | From payments exceeding the maximum contribution base |

| Contributions to OPS | 22% | 10% |

| Contributions to compulsory medical insurance | 5,1% | 5,1% |

| Contributions to OSS | 2,9% | are not credited |

| Contributions to OSS for foreign citizens temporarily staying in the Russian Federation (except for refugees, highly paid specialists and citizens of EAEU countries) | 1,8% | are not credited |

| Payer of contributions | Contribution rate | ||

| OPS | Compulsory medical insurance | OSS | |

| Taxpayers of the simplified tax system for certain types of activities* and individual entrepreneurs on the special tax system | 20% | 0 | 0 |

| organizations carrying out IT activities | 8% | 4% | 2% |

| participants of the Skolkovo project | 14% | 0 | 0 |

| payers making payments to ship crew members | 0 | 0 | 0 |

- manages real estate (codes 68.2 and 68.32);

- uses IT and computer technology for his work (code 63);

- repairs personal and household items (code 95.2);

- provides personal services (code 96);

- works with transport or is engaged in communications (codes 49–53);

- collects wastewater and waste, carries out similar work (codes 37, 38.1 and 38.2);

- repairs the vehicle and carries out maintenance (code 45.2);

- construction (codes 41–43);

- processes secondary raw materials (code 38.3);

- processes wood and produces products from it (code 16).

- does not exceed 300 thousand rubles, the entrepreneur will have to pay a fixed payment no later than December 31, 2018 (paragraph 2, paragraph 2, article 432 of the Tax Code of the Russian Federation). The entrepreneur determines the specific amounts and terms of payment of the fixed payment during 2020 for himself. It can be paid either at the end of the year in full, or divided into several periodic payments. The main thing is to make the entire fixed payment amount by the end of 2020.

- exceeds 300 thousand rubles, you must pay additional contributions for compulsory pension insurance in the amount of 1% of the excess amount. The payment deadline is no later than April 1 of the year following the reporting year. For 2020 - no later than April 1, 2020.

| Type of tax | For what period is it paid? | Payment deadline |

| Income tax (if only quarterly advance payments are made) | For the first quarter of 2020 | No later than 04/28/2018 |

| For the first half of 2020 | No later than July 30, 2018 | |

| For 9 months of 2020 | No later than October 29, 2018 | |

| For 2020 | No later than 03/28/2019 | |

| Income tax (when paying monthly advance payments with additional payment at the end of the quarter) | ||

| For January 2020 | No later than 01/29/2018 | |

| For February 2020 | No later than 02/28/2018 | |

| For March 2020 | No later than March 28, 2018 | |

| Additional payment for the first quarter of 2020 | No later than 04/28/2018 | |

| For April 2020 | No later than 04/28/2018 | |

| For May 2020 | No later than 05/28/2018 | |

| For June 2020 | No later than June 28, 2018 | |

| Additional payment for the first half of 2020 | No later than July 30, 2018 | |

| For July 2020 | No later than July 30, 2018 | |

| For August 2020 | No later than 08/28/2018 | |

| For September 2020 | No later than September 28, 2018 | |

| Additional payment for 9 months of 2020 | No later than October 29, 2018 | |

| For October 2020 | No later than October 29, 2018 | |

| For November 2020 | No later than November 28, 2018 | |

| For December 2020 | No later than December 28, 2018 | |

| For 2020 | No later than 03/28/2019 | |

| Income tax declaration (for monthly payment of advances based on actual profit) | ||

| For January 2020 | No later than 02/28/2018 | |

| For February 2020 | No later than March 28, 2018 | |

| For March 2020 | No later than 04/28/2018 | |

| For April 2020 | No later than 05/28/2018 | |

| For May 2020 | No later than June 28, 2018 | |

| For June 2020 | No later than July 30, 2018 | |

| For July 2020 | No later than 08/28/2018 | |

| For August 2020 | No later than September 28, 2018 | |

| For September 2020 | No later than October 29, 2018 | |

| For October 2020 | No later than November 28, 2018 | |

| For November 2020 | No later than December 28, 2018 | |

| For 2020 | No later than 03/28/2019 | |

| VAT | ||

| 1st payment for the first quarter of 2020 | No later than 04/25/2018 | |

| 2nd payment for the first quarter of 2020 | No later than 05/25/2018 | |

| 3rd payment for the first quarter of 2020 | No later than June 25, 2018 | |

| 1st payment for the second quarter of 2020 | No later than July 25, 2018 | |

| 2nd payment for the second quarter of 2020 | No later than 08/27/2018 | |

| 3rd payment for the second quarter of 2020 | No later than September 25, 2018 | |

| 1st payment for the third quarter of 2020 | No later than October 25, 2018 | |

| 2nd payment for the third quarter of 2020 | No later than November 26, 2018 | |

| 3rd payment for the third quarter of 2020 | No later than December 25, 2018 | |

| 1st payment for the fourth quarter of 2020 | No later than 01/25/2019 | |

| 2nd payment for the fourth quarter of 2020 | No later than 02/25/2019 | |

| 3rd payment for the fourth quarter of 2020 | No later than March 25, 2019 | |

| Tax under the simplified tax system (including advance payments) | ||

| For the first quarter of 2020 | No later than 04/25/2018 | |

| For the first half of 2020 | No later than July 25, 2018 | |

| For 9 months of 2020 | No later than October 25, 2018 | |

| For 2020 (only organizations pay) | No later than 04/01/2019 | |

| For 2020 (only individual entrepreneurs pay) | No later than 04/30/2019 | |

| Personal income tax on vacation and sick leave benefits | ||

| For January 2020 | No later than 01/31/2018 | |

| For February 2020 | No later than 02/28/2018 | |

| For March 2020 | No later than 04/02/2018 | |

| For April 2020 | No later than 05/03/2018 | |

| For May 2020 | No later than 05/31/2018 | |

| For June 2020 | No later than 07/02/2018 | |

| For July 2020 | No later than July 31, 2018 | |

| For August 2020 | No later than 08/31/2018 | |

| For September 2020 | No later than 01.10.2018 | |

| For October 2020 | No later than 10/31/2018 | |

| For November 2020 | No later than November 30, 2018 | |

| For December 2020 | No later than December 31, 2018 | |

| UTII | ||

| For the first quarter of 2020 | No later than 04/25/2018 | |

| For the second quarter of 2020 | No later than July 25, 2018 | |

| For the third quarter of 2020 | No later than October 25, 2018 | |

| For the fourth quarter of 2020 | No later than 01/25/2019 | |

| Unified agricultural tax | ||

| For the first half of 2020 | No later than July 25, 2018 | |

| For 2020 | No later than 04/01/2019 | |

| Trade tax on the territory of Moscow | ||

| For the first quarter of 2020 | No later than 04/25/2018 | |

| For the second quarter of 2020 | No later than July 25, 2018 | |

| For the third quarter of 2020 | No later than October 25, 2018 | |

| For the fourth quarter of 2020 | No later than 01/25/2019 |

- Info

Take into account in the database only those employee incomes that are subject to insurance contributions.

- Insurance premium rates Insurance premiums in 2020: rates (Table 2) Insurance premiums are calculated based on accruals to “physicists”, established limits on the taxable base and rates. The interest rate of contributions directly depends on the amount of insurance premiums.

The maximum base for insurance premiums in 2020: how it was calculated

The maximum base for insurance premiums in case of temporary disability and in connection with maternity in 2020

The maximum base for contributions to the case of VNIM is an indexed value (clause 4 of Article 421 of the Tax Code of the Russian Federation). When calculating it, the growth of average wages in the Russian Federation is taken into account.

Thus, according to the forecasts of the Ministry of Finance for 2020, the nominal accrued average monthly salary per employee will be 42,522 rubles, which is 8% more than the previous year (2017) (39,360 rubles).

Thus, the limit for calculating insurance premiums for compulsory social insurance in 2020 will be indexed by a factor of 1.080 (= 42,522 rubles: 39,360 rubles). We get a value equal to 815,400 rubles. (= 755,000 x 1.080), which is rounded according to the rules of clause 6 of Article 421 of the Tax Code of the Russian Federation: amount less than 500 rubles. discarded.

Consequently, the maximum base for calculating insurance premiums for accidents in 2020 will be 815,000 rubles.

Maximum base for pension contributions in 2020

The maximum base for contributions to compulsory pension insurance is calculated in accordance with clause 5 of Article 421 of the Tax Code of the Russian Federation using the following formula:

The maximum base for contributions to mandatory pension insurance in 2020 = the average salary in the Russian Federation for 2020 x 12 x the increasing factor for 2020 = 42,522 rubles. x 12 x 2 = 1,020,528 rubles.

In this case, the size of the maximum base is rounded to the nearest thousand rubles: the amount is 500 rubles. and above is rounded up to RUB 1,000. (Clause 6 of Article 421 of the Tax Code of the Russian Federation). Consequently, the maximum base for calculating insurance premiums for compulsory health insurance in 2020 will be 1,021,000 rubles.

| Limit base for calculating insurance premiums for compulsory pension insurance (OPI) in 2020 | The maximum base for calculating insurance premiums in case of temporary disability and in connection with maternity (VNiM) in 2020 |

| RUB 1,021,000 | 815,000 rub. |

What it is

The maximum value of the insurance premium base is established by the state and represents a certain amount of payments by the employer to the employee, above which payments are made at reduced rates.

The employer's main contributions consist of insurance payments for pension (22%), medical (5.1%) and social (2.9%) insurance, which amounts to 30% of wages and other payments in his favor. If the annual contribution amount is paid in excess of the limit, the payment rate for employees is reduced and the employer pays a smaller amount of contributions. In 2020, the base for calculating insurance premiums changed after the approval of Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378. The limits for compulsory pension and social insurance have increased - you will have to pay more.

The concept of “ultimate base” has nothing to do with the activities of individual entrepreneurs. However, for entrepreneurs there is a maximum rate deducted to the Pension Fund, and it does not depend on the income of the owner’s business. Let us remind you that payment for insurance premiums is made according to the details of the Federal Tax Service.

How to apply the new premium bases in 2018

So, in 2020, when calculating insurance premiums, payers will be guided by new values of the maximum base:

- for contributions to compulsory pension insurance – 1,021,000 rubles. (from an individual’s income within the limit, contributions are paid at a rate of 22%, above the limit - at a rate of 10%);

- for contributions to the case of VniM - 815,000 rubles. (from an individual’s income within the limit, contributions are paid at a rate of 2.9%; above the limit, they are not paid at all).

Let's reflect all of the above in the table.

| Type of insurance premiums | Rates (%) | |

| from payments within the limit | from payments over the limit | |

| Insurance premiums for OPS | 22% | 10% |

| Insurance premiums in case of VNiM | 2,9% | — |

| Insurance premiums for compulsory medical insurance | 5,1% | 5,1% |

| TOTAL: | 30% | 15,1% |

The base for contributions “for injuries”, as well as for compulsory medical insurance, is not limited, therefore contributions are calculated from all taxable payments and remunerations in favor of individuals at the rate established by the Social Insurance Fund (clause 1 of Article 22 of Law No. 125-FZ).

Note! Payers of insurance premiums who apply reduced tariffs do not pay contributions from excess income of individuals either for pension insurance or for insurance in case of temporary disability and in connection with maternity.

Let us remind you that monthly payments for insurance premiums for compulsory medical insurance, compulsory medical insurance and the case of VNIM from the income of individuals are transferred until the 15th day of the month following the settlement month, taking into account the transfer rules established by clause 7 of article 6.1 of the Tax Code of the Russian Federation, according to the details of the Federal Tax Service (clause p. 3, 7 and 11 of Article 431 of the Tax Code of the Russian Federation):

- at the location of the organization (or its separate division);

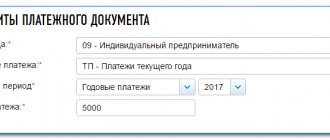

- at the place of registration (i.e. place of residence) of the individual entrepreneur.

In this case, for each type of insurance, a separate payment slip is issued, in which the amount of the contribution is indicated in rubles and kopecks (clauses 5 and 6 of Article 431 of the Tax Code of the Russian Federation).

The procedure for paying contributions “for injuries” is regulated by clause 4 of article 22 of Law No. 125-FZ. In accordance with this norm, the monthly obligatory payment must be sent to the account of the territorial branch of the Social Insurance Fund before the 15th day of the month following the month for which contributions were calculated.

General insurance premium rates

The current aggregate general tariff of insurance premiums of 30% has been retained (Part 1.1, Article 58.2 of Law No. 212-FZ). It consists of the following tariffs:

- 22% - tariff for calculating pension contributions;

- 2.9% - tariff for calculating contributions in case of temporary disability and in connection with maternity;

- 5.1% is the tariff for calculating contributions for compulsory health insurance.

General tariffs must be applied by all insurers, with the exception of those companies for which reduced tariffs are provided (Articles 58 and 58.1 of Law No. 212-FZ).

Note. The amounts of insurance premiums no longer need to be rounded. From January 1, 2020, insurance premiums must be transferred in rubles and kopecks (Part 7, Article 15 of Law No. 212-FZ). This will make it possible to achieve identical indicators of accrued and paid insurance premiums in Form-4 of the FSS and Form RSV-1 of the Pension Fund of the Russian Federation.

Limit bases for calculating insurance premiums in 2020: example of application

Example. Vesna LLC pays insurance premiums from payments and rewards to individuals at general rates. The general director of the company receives a monthly salary of 100,000 rubles. The procedure for calculating insurance premiums from payments to an employee (citizen of the Russian Federation) is presented in the table below.

Note. Let us assume that the Company pays contributions to the Social Insurance Fund “for injuries” at a rate of 0.2%.

| Month | Contributory payments accrued per month, rub. | Contributory payments accrued on an accrual basis from the beginning of the year, rub. | Insurance premiums calculated per month, rub. | Total contributions, rub. | |||||||

| on OPS | at VNiM | on compulsory medical insurance | for injuries | ||||||||

| Total | up to RUB 815,000, inclusive | up to RUB 1,021,000, inclusive | over 1,021,000 rub. | from payments up to RUB 1,021,000, inclusive | from payments over 1,021,000 rubles. | ||||||

| 22% | 10% | 2,9% | 5,1% | 0,2% | |||||||

| January | 100 000 | 100 000 | 100 000 | 100 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| February | 100 000 | 200 000 | 200 000 | 200 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| March | 100 000 | 300 000 | 300 000 | 300 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| April | 100 000 | 400 000 | 400 000 | 400 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| May | 100 000 | 500 000 | 500 000 | 500 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| June | 100 000 | 600 000 | 600 000 | 600 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| July | 100 000 | 700 000 | 700 000 | 700 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| August | 100 000 | 800 000 | 800 000 | 800 000 | 22 000 | 2 900 | 5 100 | 200 | 30 200 | ||

| September | 100 000 | 900 000 | 815 000 | 900 000 | 22 000 | 435 | 5 100 | 200 | 27 735 | ||

| October | 100 000 | 1 000 000 | 1 000 000 | 22 000 | 5 100 | 200 | 27 300 | ||||

| November | 100 000 | 1 100 000 | 1 021 000 | 79 000 | 4 620 | 7 900 | 5 100 | 200 | 17 820 | ||

| December | 100 000 | 1 200 000 | 179 000 | 10 000 | 5 100 | 200 | 15 300 | ||||

Additional insurance premium rates increased in 2015

Additional contributions to the Pension Fund are paid by companies that have jobs with harmful (dangerous) working conditions and the right to early retirement. Contributions are calculated regardless of the maximum value of the taxable base (Part 3, Article 58.3 of Law No. 212-FZ, Clause 3, Article 33.2 of Law No. 167-FZ).

The types of work that give the right to early retirement were listed in paragraphs. 1 - 18 p. 1 tbsp. 27 of the Federal Law of December 17, 2001 N 173-FZ (hereinafter referred to as Law N 173-FZ) (clauses 1 and 2 of Article 33.2 of Law N 167-FZ). However, as of January 1, 2020, many provisions of Law No. 173-FZ do not apply.

Note. Federal Law No. 173-FZ of December 17, 2001 was applied only to calculate the insurance part of the labor pension in the period before January 1, 2020.

Now you need to use two Federal laws:

- dated December 28, 2013 N 400-FZ “On Insurance Pensions” (hereinafter referred to as Law N 400-FZ);

- dated December 28, 2013 N 424-FZ “On funded pensions”.

The types of hazardous work that give the right to early retirement are now specified in Law No. 400-FZ.

The rates of additional contributions for such companies will depend on whether they have undergone a special assessment of working conditions or not.

Additional tariffs for companies that have not carried out a special assessment

If a special assessment has not been carried out, companies must pay additional contributions for employees engaged in hazardous work at the rates given in table. 1 below.

Table 1

Additional rates for contributions to the Pension Fund in 2020. No special assessment was carried out

| Tariff 6% | Tariff 9% | Tariff 4% | Tariff 6% |

| Until December 31, 2014 | From 01/01/2015 | Until December 31, 2014 | From 01/01/2015 |

| For the types of work listed in paragraphs. 1 clause 1 art. 27 Law No. 173-FZ | For the types of work listed in clause 1, part 1, art. 30 Law No. 400-FZ | For the types of work listed in paragraphs. 2 - 18 p. 1 tbsp. 27 Law No. 173-FZ | For the types of work listed in paragraphs. 2 - 18 p. 1 tbsp. 30 Law No. 400-FZ |

Additional tariffs based on the results of a special assessment

The size of additional tariffs may change if companies have carried out a special assessment of working conditions. Depending on the established subclass of working conditions in 2020, policyholders must pay premiums according to the additional tariffs given in table. 2 below (part 2.1 of article 58.3 of Law No. 212-FZ and paragraph 2.1 of article 33.2 of Law No. 167-FZ).

table 2

Additional rates for contributions to the Pension Fund in 2020. Special assessment completed

| Class of working conditions | Subclass of working conditions | Additional tariff, % |

| Dangerous | 4 | 8 |

| Harmful | 3.4 | 7 |

| 3.3 | 6 | |

| 3.2 | 4 | |

| 3.1 | 2 | |

| Acceptable | 2 | 0 |

| Optimal | 1 | 0 |

Insurance premiums paid by individual entrepreneurs “for themselves”, in 2020 - 2018

The maximum bases that we described above are used by organizations and entrepreneurs exclusively when calculating insurance premiums from payments and rewards to individuals - ordinary citizens.

Individual entrepreneurs also pay insurance premiums for compulsory medical insurance and compulsory medical insurance. But the basis for their calculation is the minimum wage established at the beginning of the year for which contributions are calculated (clause 1 of Article 430 of the Tax Code of the Russian Federation). The following formula is used:

Annual contribution = minimum wage x 12 x interest rate

The rates of insurance premiums paid by individual entrepreneurs “for themselves” are established by clause 2 of Article 425 of the Tax Code of the Russian Federation: for compulsory health insurance in the amount of 26% and for compulsory medical insurance in the amount of 2.9%. Thus, for 2020 an entrepreneur needs to pay:

- pension contributions - in the amount of 23,400 rubles. (= RUB 7,500 x 12 x 26%);

- medical contributions - in the amount of 4,590 rubles. (= RUB 7,500 x 12 x 2.9%).

(Since 01/01/2017, the minimum wage has been in force, approved by Article 1 of Federal Law No. 82-FZ dated 06/19/2000 (as amended on 06/02/2016).)

At the same time, if an individual entrepreneur earns more than 300 thousand rubles in a year, then he will have to pay additional contributions to compulsory pension insurance in the amount of 1% on income in excess of the specified amount. At the same time, maximum contributions to pension insurance in 2020 should not exceed 8 times the annual fixed contribution, i.e. 187,200 rubles. (= 8 x 7,500 rub. x 12 x 26%).

Please note that from 2020, insurance premiums for individual entrepreneurs will be determined on a new basis. Thus, “entrepreneurial” contributions will no longer depend on the minimum wage. For them, Federal Law No. 335-FZ dated November 27, 2017 established fixed sizes in rubles:

for compulsory pension insurance (OPI):

- for 2020 – 26,545 rubles;

- for 2020 – 29,354 rubles;

- for 2020 – 32,448 rubles;

for compulsory health insurance (CHI):

- for 2020 – 5,840 rubles;

- for 2020 – 6,884 rubles;

- for 2020 – 8,426 rubles.

At the same time, individual entrepreneurs whose annual income exceeds 300 thousand rubles still have the obligation to pay an additional “pension” contribution (1%).

Read more about this in the article “Fixed insurance premiums for individual entrepreneurs in 2020.”

Contribution rate in case of injury

Federal Law dated December 1, 2014 N 401-FZ preserves the current rates of contributions in case of injury for 2020 (from 0.2 to 8.5%) (Article 1 of Federal Law dated December 22, 2005 N 179-FZ). Therefore, as before:

- The amount of contributions depends on the main type of economic activity. To confirm it, you must, no later than April 15, 2015, submit an application and a confirmation certificate to your territorial branch of the Federal Social Insurance Fund of the Russian Federation in the forms approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55;

- There is no limit on the taxable base for them, so they are charged on all taxable payments.

If an individual entrepreneur employs disabled people of group I, II or III, payments in their favor, as before, are subject to contributions in case of injury at a reduced rate - based on 60% of the established insurance rate (Article 2 of the Federal Law of December 1, 2014 N 401-FZ).