Every entrepreneur, director, and chief accountant is familiar with the feeling of slight anxiety when receiving requests from tax authorities to provide documents (information). The requirement may concern the taxpayer himself, his counterparties, familiar and unfamiliar third parties. Along with the requirements, notifications are often received about the need to provide explanations, including written ones, which differ little from the content requirements. Requirements may come as part of an ongoing inspection or at the stage of pre-inspection analysis, indicating the inspector’s interest.

Let's try to figure out how to save time, nerves and paper in the printer if a requirement has arrived, and how not to run into fines for failure to comply.

In recent years, the Tax Code of the Russian Federation has been giving inspectors more and more opportunities to request documents, judicial practice is turning away from taxpayers, and tax inspectors are getting the hang of it, sending more and more demands and asking for clarifications. As a result, the number of demands drawn up by tax authorities has reached its peak.

First, let’s figure out what the inspector can ask and from whom:

| According to Art. 88, 93 of the Tax Code of the Russian Federation as part of a desk audit | According to Art. 89, 93 of the Tax Code of the Russian Federation as part of an on-site inspection | According to Art. 93.1 of the Tax Code of the Russian Federation as part of a “counter” inspection | Summons to give explanations, including written ones, on the basis of (subclause 4, clause 1, article 31 of the Tax Code of the Russian Federation) | |

| In relation to the taxpayer himself | — Documents that are submitted along with the tax return; — Documents confirming the loss (reduction of the tax amount) declared in the updated declaration filed 2 years after the submission of the initial declaration; — Other documents provided for in Art. 88 of the Tax Code of the Russian Federation related to inspections of the application of benefits, payment of VAT, investment partnerships, returns of excisable goods, services of foreign organizations registered in the Russian Federation, transactions exempt from insurance contributions, deductions for the sale of goods under tax free, investment deductions. | Any documents and information related to the calculation and payment of audited taxes in the audited period. | Documents and information regarding a specific transaction, in the absence of a desk or on-site audit, if the tax authority has a reasonable need to obtain them. | Explanations about any aspects of the taxpayer’s activities, including the obligation to attach supporting documents. Response deadlines are set arbitrarily by the inspector. |

| Regarding your counterparty | Not requested. | Not requested. | Any documents and information related to the calculation and payment of taxes. | Explanations about the specifics of the relationship with the counterparty. |

| In relation to a third party - that is, organizations/individual entrepreneurs with which you, as a taxpayer, do not directly have contractual relations | Not requested. | Not requested. | Any available documents and information, if the person being inspected is connected with you “along the chain” of supply of goods (performance of work, provision of services). | Not requested. |

| Sanctions for non-compliance | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Confiscation of documents is possible. Failure to provide information requested on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation - a fine of 5,000 rubles. | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Confiscation of documents is possible. | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Failure to provide information - a fine of 5,000 rubles. | Disobedience to a lawful order or requirement of an official - a fine of 500 to 1,000 rubles for individuals, and from 2,000 to 4,000 rubles for officials (19.4 Code of Administrative Offenses of the Russian Federation) |

And now in more detail.

What may be asked during inspections?

The harsh reality: everything that is in any way connected with the calculation and payment of taxes audited by the inspection can be demanded from anyone.

One gets the strong impression that soon no one will be surprised by the demand, for example, for the birth certificate of the chief accountant, since it is the chief accountant who is responsible for calculating and paying taxes in the company. The other side of the coin is the possibility of tax officials abusing their powers.

And it is precisely because of such abuses, and not at all because of the taxpayer’s desire to hide compromising information, that there is often a reluctance to respond to requests from tax authorities. And sometimes there are outright stupidities.

Thus, quite recently, in the Sverdlovsk region and Chelyabinsk regions, taxpayers received requests asking them to submit “documents confirming the performance of work directly in outer space.”

Most likely, this wording was translated from Art. 164 of the Tax Code of the Russian Federation, which provides for the application of a 0% rate, and was thoughtlessly copied from the requirements set by any of the Roscosmos structures. However, for accountants of other companies such formulations, which gave reason to think about the vast expanses of the universe, caused bewilderment and a grin.

Costs for making copies of documents

Situation: should the tax office reimburse the organization for the costs of making and delivering copies of documents? During the on-site inspection, the inspectorate issued a requirement to the organization to provide documents.

No, you shouldn't.

The tax inspectorate must reimburse only those expenses that the organization incurs in connection with the illegal actions of the inspectorate (clauses 2, 4 of Article 103 of the Tax Code of the Russian Federation). As part of an on-site inspection, the inspection has the right to require the organization to submit documents (Clause 12, Article 89 of the Tax Code of the Russian Federation). Since there is nothing illegal in requesting documents as part of an on-site inspection, the inspection is not obliged to reimburse the organization for the costs of production and delivery of these documents. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated May 10, 2012 No. 03-02-07/1-116.

At the same time, when calculating income tax, an organization has the right to take into account the costs associated with the preparation of documents and their delivery to the inspectorate. The condition for recognizing expenses is their documentary evidence. This follows from subparagraphs 24 and 49 of paragraph 1 of Article 264, paragraph 1 of Article 252 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated September 27, 2013 No. 03-02-07/1/40175.

As part of the on-site inspection, any documents may be requested.

Clause 12 of Article 89 of the Tax Code of the Russian Federation contains only one limitation: they must be related to the calculation and payment of taxes. In the Letter of the Federal Tax Service of Russia dated July 25, 2013 No. AS-4-2/13622 “On recommendations for conducting on-site tax audits,” the tax service describes what documents and information may be of interest to inspectors, but in little more detail:

«During a tax audit, officials of the tax authority check, analyze, compare and evaluate documents and information that are important for drawing conclusions about the correctness of calculation, withholding and payment (transfer) of taxes and fees, as well as for making an informed decision based on the results of the audit

».

There is no exhaustive list of such documents; accordingly, the volume and composition of the requested documents and information is virtually unlimited.

Responsibility for desk and field inspections

A desk audit is carried out without the participation of the taxpayer in accordance with Art. 88 Tax Code of the Russian Federation. Federal Tax Service employees check the documentation provided to them. Penalties are applied to violators under Art. 126 and art. 129.1 Tax Code of the Russian Federation:

- Violation of deadlines or refusal to provide documentation requested from an organization or individual entrepreneur entails a fine of 200 rubles. for one document;

- if the company’s management refuses to provide information about activities related to other entities (counterparties, etc.), it will have to pay a fine of 10 thousand rubles;

- Providing the required documents with false information is punishable by a fine of 10 thousand rubles.

Officials (managers, chief accountants, bookkeepers, and other employees charged with providing information to the tax service) will also not be able to avoid punishment. For refusal to provide Federal Tax Service employees with the required papers and information, as well as for submitting them incompletely or in a distorted form, violators will have to pay an administrative fine, the amount of which will be 300-500 rubles. Basis – Art. 15.6 Code of Administrative Offenses of the Russian Federation.

Requirements under “counter checks”.

The list of documents that can be requested directly from the taxpayer is limited within the framework of desk audits (Article 88 of the Tax Code of the Russian Federation). Basically, these are documents confirming the right to apply benefits or the legality of a refund or VAT refund.

However, these restrictions can be easily overcome by the inspector.

If documents related to the taxpayer’s activities cannot be requested during a desk audit from the taxpayer himself, then why not request the documents the inspector is interested in as part of a “counter” audit of each of the taxpayer’s counterparties. It turns out that the inspector is asking for documents not regarding the taxpayer himself, but the documents he has regarding all his counterparties. In fact, it is the taxpayer himself who is being audited. Formally, such demands are legal and in the vast majority of cases it is not possible to challenge them in court.

An important nuance of counter verifications is that the documents and information requested during them must be related to the taxpayer being audited, that is, to your counterparty, in respect of whom the audit is being carried out.

This connection does not have to be direct.

In a situation where you are asked for documents regarding your relationship with your counterparty, but are being checked by a third party (whom you may not know), such a requirement will be legal if your counterparty is a link in the chain of suppliers (buyers) leading to the third party being checked face.

Or, for example, you may be asked to provide information on how you recorded a transaction with a counterparty in your accounting records. The connection of this information with the taxpayer being audited (your counterparty) is not obvious, but the courts recognize the request for such information as lawful.

Fine for failure to provide documents during a counter-inspection 2018

If the audit is suspended, then the period for preparing documents is interrupted, since during the period of validity of the suspension of the audit, both the actions of the tax authority to request documents from the taxpayer and the period during which the organization must submit documents are suspended. It is extended for this period (resolution of the Eighth Arbitration Court of Appeal dated May 24, 2010 No. 08AP-2682/2010).

If it is impossible to submit documents If the period specified in the request seems too short, then within 24 hours you should notify about the impossibility of fulfilling the request in writing, indicating the reasons why the requested documents cannot be submitted within the established time frame, and indicating the deadlines within which the requested documents can be presented (clause 3 of Article 93 of the Tax Code of the Russian Federation).

Requirements set as part of the pre-verification analysis.

If you receive a request that contains the phrase “Outside the scope of tax audits” and you are asked to submit documents relating to one or more tax periods, then “congratulations” - you are most likely a candidate for an on-site tax audit.

Let's give an example of a real claim received by a counterparty of one group of companies suspected by tax authorities of artificially splitting up their business:

Such requirements are used very widely by inspectors, and information about you with a similar requirement may be requested from all your counterparties.

The Tax Code of the Russian Federation does not provide for pre-audit analysis among tax control measures, but such requirements will have to be answered.

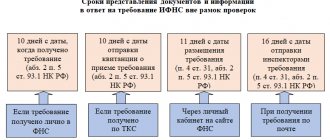

Deadline for transmitting data to the inspectorate

If inspectors have requested documents from the company itself as part of a tax audit, the information must be prepared and sent within 10 days. A slightly longer period is provided to KGN - 20 days, and to foreign enterprises - 30 days. (clause 3 of article 93 of the Tax Code of the Russian Federation).

If tax authorities are interested in a specific transaction, the deadline for sending a response is 10 days. But you will have to provide information about your counterparty during the counter check more quickly; only 5 days are given to prepare and send documents (information). (clause 5 of article 93.1 of the Tax Code of the Russian Federation).

It is very important to correctly determine the starting point of the deadline. Thus, a request from the Federal Tax Service, transmitted via TKS, is considered received from the date indicated in the receipt of its receipt; by mail - on the 6th day from the date of its dispatch; and posted in the Personal Account on the Federal Tax Service portal - the very next day from the date of its placement.

What to consider when preparing a response to a demand made outside the scope of tax audits?

The Tax Code of the Russian Federation contains a rule according to which, outside the framework of tax audits, an inspector may request documents and information about a specific transaction from the participants in this transaction or from other persons who have documents (information) about this transaction, if the tax authorities have a justified need to obtain them.

It follows from this rule that the tax authority must indicate information that makes it possible to determine the very specific transaction for which documents are requested, and the tax authority must justify the need to obtain them.

Information that allows you to specify a transaction (let us immediately note that this can be several transactions at once) can be details of a contract, invoices, and so on. And for such a specific transaction, you can request any volume of documents, any information.

That is, outside the framework of tax audits, the tax authority cannot request “all contracts for the last 3 years,” but can request “invoices from 01/01/2016 to 12/31/2018 related to the contract, for example, No. 1 dated 01/01/2015” .

In fact, the tax authority can request the same volume of documents as during an on-site tax audit, without going to it. The main purpose of such a pre-audit analysis is to determine whether it is worth going to an audit with a given taxpayer at all.

As for the justification for the need to request documents, the Tax Code of the Russian Federation does not explain what this “justified necessity” is, and whether the inspector is obliged to give the taxpayer any explanations about the reasons for requesting documents (information) from him outside the framework of tax audits.

Previously, courts more often agreed with taxpayers that the tax authority must clearly and clearly state what such a need is, otherwise “the requirement violates the rights and legitimate interests of a person in the field of entrepreneurial and other economic activities, imposing on him the obligation to submit documents not provided for in paragraph 2 of Art. 93.1 Tax Code of the Russian Federation.” Recently, there have been more decisions in which the court believes that “the justified need to obtain documents (information) only implies that they cannot be requested for non-official or other purposes not related to monitoring compliance with legislation on taxes and fees,” or the court agrees with the inspection that the need can be justified with the phrase “in connection with the emergence of a justified need,” or in other words, it is necessary because it is necessary...

Or it is even clarified that “the tax authority is not obliged to inform the counterparty of the relevant person whose documents (information) about transactions are requested, the reasons why he considered it necessary to send a request.” We believe that this judicial interpretation of Article 93.1 of the Tax Code of the Russian Federation is expansive, leading to the fact that the inspector is given the right to request documents arbitrarily from anyone, in any quantity, without carrying out any tax control measures, without any need, ignoring the norms of the Tax Code of the Russian Federation about the timing of the tax audit.

About on-site tax audit

- What is the purpose of an on-site tax audit?

- An on-site tax audit is designed to identify violations caused by the taxpayer’s abuses in the tax sphere and his desire to evade taxes. Moreover, the Constitutional Court is directing the tax authorities towards solving this problem (decision dated 04/08/2010 No. 441-o-o).

- Is the tax authority obliged to conduct on-site audits of taxpayers at certain intervals?

- No. The total number of taxpayers (organizations and entrepreneurs) registered with the tax authorities exceeds 8 million. It is physically impossible to cover all of them with on-site control (even once every three years). Currently, inspections affect 0.18%: two organizations or individual entrepreneurs out of a thousand are inspected.

- Are the number of on-site inspections decreasing?

- The downward trend has continued throughout recent years. In 2020, just over 20 thousand inspections were carried out. In 2020, the number of on-site inspections decreased by 30%: to just over 14 thousand.

- What rules are provided by the Tax Code of the Russian Federation for on-site inspection?

- The audit is carried out on the basis of a decision of the tax authority (clause 2 of Article 89 of the Tax Code of the Russian Federation). In relation to the largest taxpayer, this is a decision of the tax authority in which the first one is registered as the largest. In relation to a branch or representative office of an organization, this is a decision of the tax authority at the location of the branch or representative office.

- The basis for the inspection is the decision to conduct it. What should it contain?

- The form of the decision is given in Appendix No. 5 to the order of the Federal Tax Service dated November 7, 2018 No. ММВ-7-2/ [email protected] The decision must contain:

- number of the decision and the date of its adoption,

- name of the taxpayer in respect of whom the audit is being carried out.

- What period can be covered by the audit?

- The “depth” of the audit is the period of financial and economic activity for which the audit is carried out. As a general rule, an inspection may cover a period not exceeding three calendar years preceding the year in which the decision to conduct the inspection was made. Law enforcement practice proceeds from the fact that in this case a deadline is indicated for expired calendar years, and there is no prohibition on including periods of the current calendar year in the inspection period (Decision of the Supreme Court dated 09.09.2014 No. 304-KG14-737).

- Can a review decision cover months of the year in which the review decision is made?

- The inspection period may include months of the year in which the decision on the inspection was made, if we are talking, for example, about the inspection of a tax agent for personal income tax, whose responsibility in terms of withholding and remitting tax is not related to the end of the tax period (resolution of the Presidium of the Supreme Arbitration Court dated 07/05/2011 No. 1051/11). Thus, it is possible to hold the tax agent accountable based on the results of an audit of the month of the tax period that has not yet expired.

- What is the significance of enumeration in deciding the types of taxes to be audited?

- The types of taxes for which the audit is carried out constitute the subject of the audit. The audit may concern one, several or all taxes (“for all taxes, fees, insurance premiums”).

- Can employees not specified in the decision carry out inspection activities?

- The decision contains the full names and positions of the inspectors. These persons have the right of access to the territory of the person being inspected and carry out all necessary control measures.

- Where does the check begin?

- The actual verification begins with making a decision. The Tax Code of the Russian Federation does not establish a deadline for delivering to the taxpayer the decision to conduct an on-site tax audit (letter of the Federal Tax Service dated March 10, 2016 No. ED-4-2 / [email protected] ).

- How long does the verification last?

- During two months. For the purposes of calculating the inspection period, it does not matter whether the inspectors are located on the taxpayer’s territory or not.

- What are the grounds for extending the inspection period?

- Extension of the period is allowed up to six months, that is, taking into account the extension, the inspection cannot last more than six months (letter of the Ministry of Finance dated July 11, 2011 No. 03-02-07/1-234).

- Can the check be suspended?

- The Tax Code of the Russian Federation provides for a procedure for suspending an inspection.

Conducting an on-site inspection means that with a 98% probability, additional taxes, penalties, and fines will be assessed based on its results.

The amount of tax debt revealed by the results of a tax audit may entail the risk of criminal liability, as well as subsidiary liability of authorized persons of the taxpayer, both in bankruptcy proceedings and when filing claims for compensation for damage caused to the budget by non-payment of taxes.

When assigning tax audits, a risk-based approach is used.

The audit is preceded by a pre-audit analysis, carried out in accordance with the Concept of the planning system for on-site tax audits, approved by Order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/ [email protected]

One of the criteria for assessing risks when selecting for inspection is the level of tax burden below the average level in a particular industry. In the absence of an industry-specific load value, the load value for Russia as a whole is used (letter of the Federal Tax Service dated August 22, 2018 No. ГД-3-1/ [email protected] ).

The Federal Tax Service has developed the concept of a Taxpayer Behavior Management System. The point of this system is to move from checking an individual taxpayer to creating a transparent control environment in industries and markets.

It is expected that by 2020, 90% of scheduled on-site tax audits will be carried out using the automated risk management information system of the Federal Tax Service.

But at the same time, there is no prohibition on ordering unscheduled inspections. The generated annual (broken down by quarter) plan for conducting on-site tax audits can be adjusted depending on newly discovered circumstances (letter of the Ministry of Finance dated July 19, 2012 No. 03-02-08/62).

The provisions of Federal Law No. 294-FZ of December 26, 2008 “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” do not apply to relations arising in the process of tax control.

But this figure is influenced to a greater extent by the possibilities of desk control that the tax authority has, “working out” the application of Article 54.1 of the Tax Code of the Russian Federation on individual taxpayers.

In addition, in practice, taxpayers are subject to inspections by internal affairs bodies, which are not formally vested with tax control functions. But their verification of information about a crime is, in essence, indistinguishable from monitoring financial and economic activities in relation to taxpayers.

The Constitutional Court believes that the protection of violated rights during inspections by internal affairs bodies and tax authorities is possible in court, and changing the current regulatory procedure falls within the competence of the legislator (determination dated September 27, 2016 No. 2153-O).

Most often, the decision on an on-site tax audit of an organization is made by the tax authority at its location.

For some categories of taxpayers (residents of SEZs, participants in production sharing agreements, a consolidated group of taxpayers, participants in a regional investment project), the Tax Code of the Russian Federation provides for the specifics of conducting on-site tax audits.

When ordering an inspection of a branch or representative office separately from conducting an inspection of the organization, the name of the branch or representative office is indicated in the decision. In relation to separate divisions that are not registered as a branch and representative office, an inspection cannot be scheduled.

Inspection of branches and representative offices is possible only for regional, local taxes and trade fees. Independent on-site tax audits of branches and representative offices regarding the correctness of calculation and payment of federal taxes and fees, including those provided for by special tax regimes, are not carried out (letter of the Ministry of Finance dated March 28, 2011 No. 03-02-08/32).

When making a decision in 2020, the review may cover the periods 2020, 2020, 2020 and 2020 periods that expired before the month the decision was made.

It should be borne in mind that the tax authority, in order to verify the correctness of calculation and payment of income tax within the period covered by the on-site audit, has the right to verify the correctness of the formation of the loss.

The taxpayer must document the validity of the loss for the entire period when he reduces the tax base by the amount of the previously received loss (Resolution of the Presidium of the Supreme Arbitration Court of July 24, 2012 No. 3546/12).

Therefore, the actions of the inspectorate to verify the losses of previous years declared in the audited period, including the periods of its formation not covered by the decision on the audit, are based on the norms of tax legislation and are legal (Resolution of the Autonomous District of the Ural District dated September 7, 2015 No. F09-5869/15).

Separately, we would like to draw your attention to the fact that the three-year statute of limitations for bringing to justice for non-payment of tax is calculated from the next day after the end of the tax period in which the offense of non-payment of tax was committed (clause 15 of the Supreme Arbitration Court Resolution No. 57 of July 30, 2013). This will mean that since the amount of income tax, say, for 2020 must be paid in 2019, the statute of limitations for bringing to responsibility for failure to pay income tax for 2020 under Article 122 of the Tax Code of the Russian Federation will begin to be calculated from January 1, 2020 and will end on 1 January 2023.

The Tax Code of the Russian Federation limits the possibility of conducting audits on the same taxes for the audited period.

The decision to conduct an audit may indicate, for example, only corporate income tax. If an error is discovered regarding VAT, then based on the results of the audit, it is impossible to be held liable in terms of VAT, since VAT was not indicated in the decision on the audit. Similar consequences occur if the tax authority discovers an offense for a period that was not included in the decision on the audit.

In such circumstances, the tax authority must make a new decision to conduct an audit.

But this situation, according to the judicial authorities, should be distinguished from a situation where errors or typos were made in the decision. These include the absence in the decision to conduct an audit of a list of taxes being audited or the wording “for all taxes.” In itself, this does not mean that the decision does not comply with the norms of tax legislation if the inspectorate promptly and independently eliminated the technical error that did not in any way negatively affect the rights and obligations of the taxpayer and did not entail any negative consequences for him (resolution of the Moscow District Administrative Board dated January 18, 2019 No. Ф05-22585/2018).

If, from the moment the decision to conduct an inspection is made until the certificate is drawn up upon its completion, a change in the composition of the inspection team is required, then a decision must be made to amend the decision to conduct the inspection (Appendix No. 5 to the letter of the Federal Tax Service dated January 15, 2019 No. ED-4-2 / [email protected] ).

However, according to Resolution of the Presidium of the Supreme Arbitration Court dated January 24, 2012 No. 12181/11, the mere fact of signing a tax audit report by a person who did not conduct the audit cannot indicate a significant violation of the rights of the taxpayer being audited. The taxpayer must indicate what the violation of his rights was (this may include obstacles to the exercise of the right to file objections or provide explanations).

Upon delivery of the decision, the taxpayer familiarizes himself with it against signature. The copy of the decision, which remains with the tax authority, is marked with a note indicating receipt of the decision by the taxpayer’s representative. In certain cases, the decision is sent by registered mail or transmitted electronically via TKS through an electronic document management operator.

If the taxpayer provides a place on his premises for inspectors to work, then the inspection is carried out at the taxpayer’s location. A separate notification will be received regarding the inspection at the location of the tax authority (the form is given in Appendix No. 1 to the Federal Tax Service letter No. ED-4-2/ [email protected] ).

The period is calculated from the date of the decision until the last month of the term.

The period is calculated as follows. First, the total number of calendar days that are included in the verification period is determined. If there is no corresponding last day in the month, then the period ends on the previous day. If the last day falls on a weekend, the period ends on the next working day. But the inspection may be extended and suspended.

The list of grounds for extending the inspection period is established by Appendix No. 6 to the Federal Tax Service order dated November 7, 2018 No. ММВ-7-2/ [email protected]

The new edition of this list is closed in nature and includes eight grounds, in particular, an inspection of the largest taxpayer, an inspection of a taxpayer that has separate divisions, the presence of obstacles in conducting an inspection both on the part of the person being inspected and other persons (for example, failure to provide documents, obstruction of access, failure to appear of a witness, etc.).

The same reason can be used twice to extend a review.

The taxpayer must be presented with a decision to extend the inspection period (the form is given in Appendix No. 6 to the Federal Tax Service letter dated January 15, 2019 No. ED-4-2 / [email protected] ).

Examples of suspension of inspection for up to six months are as follows:

When can the submission of documents (information) be refused?

The most common formal violations that lead to invalidity of a claim:

- There is no instruction attached to the request;

- The requirement was drawn up by an unauthorized person, for example, an official of an inspectorate with which you are not registered;

- The requirement (instruction) was not drawn up in the form prescribed by Order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] “On approval of document forms provided for by tax authorities when exercising their powers...”. We are talking about a situation where, instead of a demand, the taxpayer is sent an “information letter” or another request not provided for by the Tax Code of the Russian Federation. Through such requests, tax authorities try to obtain information outside the audit deadlines or information that they cannot formally request. Whether to meet the inspector halfway or not in such a situation is purely the right of the taxpayer.

- The requirement was issued after the end of the tax audit. Important!

If a demand is made during an audit, but is received by the taxpayer after its completion, such a demand is recognized as legal.

- Documents and information were submitted to the inspection earlier.

- The requested documents and information do not relate to the period being audited or the subject of the audit.

This basis for refusal is fraught with several pitfalls.

Firstly, the connection between the requested documents and the verification period may exist, but may not be very obvious.

For example, an agreement may be dated to a previous period, but extend its validity to subsequent periods. Or the transaction may be completed in an earlier period, but affect the taxation of the next period for which the audit is carried out. In such cases, the demand will be legal.

Secondly, the connection between the requested documents (information) and the subject of the inspection may be indirect, but sufficient for the court to recognize such a request as lawful. In such cases, courts often comment in their decisions that the taxpayer is not given the opportunity to control and resolve the issue of the relevance of the evidence collected by the tax authority to the subject of the audit, since the decision on the need to require certain information for conducting a tax audit is the exclusive prerogative of the tax authorities.

Here you need to be careful and understand that the documents (information) must be clearly and definitely not related to the subject or the inspection period.

In what cases can fines be avoided?

Officials are people too, therefore, taking into account the human factor, you need to carefully study the received requirement for errors and inaccuracies.

- Your Federal Tax Service forwards the order from another tax office without issuing a demand on its own behalf.

- The instruction does not indicate on the basis of which control measure the need to provide information or documents arose.

- When requesting information about a specific transaction, information that allows one to uniquely identify this transaction, etc., is not provided.

At the same time, it is important not to ignore an erroneous request, but to send a polite, reasoned refusal with references to the provisions of the Tax Code of the Russian Federation.

If the volume of requested documents is very large or due to some other objective circumstances the organization is not able to fulfill the instructions of the tax authorities on time, you can apply for an extension of the deadline (clause 3 of Article 93 of the Tax Code of the Russian Federation). However, a request for a deferment must be sent no later than the day following the day the request is received from the Federal Tax Service.

What to do if asked for clarification?

Let us immediately pay attention to the basis on which norm they are asking for clarification.

If based on Article 93.1 of the Tax Code of the Russian Federation, then everything that is written above is relevant.

If, on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation, then the tax authority must indicate in the request what errors in the tax return (calculation) and (or) contradictions between the information contained in the submitted documents were revealed by the check, or inconsistencies were identified between the information provided by the taxpayer and the information contained in the documents available from the tax authority, received during tax control.

If the tax authority does not indicate what errors or contradictions have been identified, then responding to it is your right, but not your obligation.

IMPORTANT!

Even then, the requirement should not be ignored. It is advisable to indicate in the answer that when the taxpayer independently checked the declaration submitted by him, no errors or contradictions were identified, and accordingly, the obligation to give any explanations does not arise.

Keep in mind that explanations will have to be given in any case if:

- the amount of loss is declared in the income tax return;

- the taxpayer declared in the declaration transactions (property) for which tax benefits were applied;

- in other cases specified in clauses 8.1, 8.2, 8.5, 8.6, 8.8, 12 art. 88 Tax Code of the Russian Federation.

If subsection is indicated as the basis for requesting documents or information. 3 p. 1 art. 31 of the Tax Code of the Russian Federation, then the taxpayer is not obliged to provide written explanations and documents, however, he will still have to appear at the tax authority and give explanations. Therefore, when receiving a request for information and/or documents based on a notice of summons to the taxpayer’s tax authority, the issue of providing documents and written explanations to the taxpayer should be decided based on how convenient it is for him. In most cases, written explanations drawn up in a calm environment will be more balanced, reasoned and controlled than explanations during a conversation with a tax inspector.

What is the responsibility for this?

The Tax Code of the Russian Federation contains the following grounds on which a person can be fined for not responding (or not responding properly) to a request to submit documents:

- Art. 126 “Failure to provide the tax authority with information necessary for tax control.”

- Art. 129.1 “Illegal failure to report information to the tax authority.”

Responsibility under paragraph 1 of Art. 126 is applicable if the violation does not relate to those provided for in the Tax Code of the Russian Federation:

- Art. 119 (failure to send a tax return to the Federal Tax Service);

- Art. 129.4 (illegal failure to provide notification of controlled transactions or provision of false information about them);

- Art. 129.6 (failure to provide information on participation in foreign organizations);

- clause 1.1 art. 126 (failure to submit reports of a controlled foreign company);

- clause 1.2 art. 126 (failure to submit quarterly personal income tax calculations).

Failure to send documentation and (or) other data provided for by law under clause 1 of Art. to the Federal Tax Service within the period established by law. 126 of the Tax Code of the Russian Federation is punishable by a fine of 200 rubles. for each document not transferred.

According to paragraph 2 of Art. 126 of the Tax Code of the Russian Federation, a person who refuses to send inspectors the necessary documents about the taxpayer or otherwise evades this obligation (or who sent papers with deliberately incorrect data) will be fined 10,000 (firms, individual entrepreneurs) or 1,000 rubles. (individual, except individual entrepreneur). In this case, the violation must not comply with Art. 126.1 (submission of documents with false information) and 135.1 of the Tax Code of the Russian Federation (failure to send bank statements of account statements).

Art. 129.1 of the Tax Code of the Russian Federation also contains 4 points:

- pp. 1 and 2 relate to illegal failure to report (as well as communication after the established period) by the guilty person the data provided for by law, which is punishable by a fine of 5,000 rubles. (if the violation is single) or 20,000 rubles. (if the violation is repeated during the calendar year). In this case, violations should not fall under Art. 126 of the Tax Code of the Russian Federation.

- Clause 2.1 applies to foreign organizations that have real estate on the territory of the Russian Federation and are obliged to report information about their participants to the Federal Tax Service.

- Clause 3 provides for liability for individuals who have not reported to the tax authority information about their taxable assets (real estate and transport) if they have not received a tax payment notice.

Thus, there are two applicable articles, and their wording is somewhat similar, but the responsibility for them is completely different.

What circumstances are considered mitigating a fine for failure to provide documents on an oncoming ticket was explained by S.V. Razgulin, Actual State Councilor of the Russian Federation, 3rd class. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Ngs.business - business online magazine

- Documents for a tax audit are requested only on the basis of a written request, although there must be a copy of the request sent to your counterparty in case you are in different inspectorates

- Discrepancy between the lists of documents in the order and the request. This may happen if the tax officers of your inspection want to see more documents than they requested from another, thereby you can justify in writing why you will not provide those documents that were not initially required from you.

- Unreasonable demand for documents.

Tax Code, since there is a possibility that the tax authority will consider such a document as not submitted. But:

- responsibility for submitting a tax return in an unspecified form is not provided for by tax legislation (Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 11, 2006 No. A19-37884/05-32-F02-2150/06-S1);

- submission to the tax authority of calculations on old forms within the prescribed period does not indicate the commission of a tax offense, liability for which is provided for in Article 126 of the Tax Code of the Russian Federation (Resolution of the Tenth Arbitration Court of Appeal dated 03/28/2006, 04/04/2006 in case No. A41-K2-21907/05 );

- Responsibility for submitting documents with deficiencies in form is not provided for by tax legislation (Resolution of the Federal Antimonopoly Service of the Central District dated August 17, 2004 No. A09-548/04-10).

Answers to frequently asked questions

Question No. 1. We received a request for a counter-check with our supplier, it contains inaccurate wording in the dates, but the invoice numbers are indicated, can we not provide the data and what does this threaten us with?

Answer: If you can independently identify the requested period and select the invoice data, it is better to do this, although according to the rules the numbers are optional, but the dates must be, but in order not to incur unnecessary suspicions from the tax office and not to quarrel with the counterparty, answer to the requirement.

Question No. 2. What will be the fine for fifty late documents?

Answer: If you provided an answer on time, but fifty documents are not on time, then for each you will pay a fine of two hundred rubles, that is, ten thousand rubles

Useful links on the topic: “Tax liability for failure to submit documents”

- Tax on interest on deposits

- Tax control of accounts

- Why are benefits declarative in nature?

- Personal income tax on inheritance

- Tax liability for failure to submit documents

- Errors when filling out tax return 3-NDFL

- Confirmation of Russian tax resident status

- What is a tax offense, the procedure for attracting, mitigating and aggravating circumstances

- How to get a deferment (installment plan) for paying taxes

- Find out the address of your tax office:

- in St. Petersburg (addresses, telephone numbers, websites, operating hours of the regional Federal Tax Service);

- in Moscow (addresses, telephone numbers, websites, operating hours of regional Federal Tax Service);

- other cities of Russia

- Tax liability for unpaid taxes

- Tax liability for failure to appear when called to the tax authorities

- Directory of new fines of the Tax Code of the Russian Federation

- How to pay taxes and submit reports?