How to prove that you paid the bill if the receipt is lost

Share on social networks: Every month we make at least one or two payments: for an apartment, for electricity, for major home repairs, for a telephone, for the Internet, kindergarten, school... And there are also receipts for payment of state duties, fines, loans, etc. .d. Let's be honest: storing them in one place for 2-3 years, as the rules dictate, is absolutely unrealistic. But losing a payment receipt is as easy as shelling pears. In some cases - if the payment was correctly processed and credited to the recipient's account - a receipt is not required. But in everyone’s life there have been unpleasant moments when money has been paid, but the receipt has been lost. So, how to restore a receipt for payment of services? Method number 1. In the archive of card transactions This method is the simplest, fastest and most accessible, but is only suitable for those transactions that you made non-cash through self-service devices - payment terminals and ATMs.

How to recover a purchase receipt

This article describes in detail how to recover a purchase receipt, and everything you need to know about it. There are situations in life when you need to return an item to a store, but the receipt for it has been lost. What should the buyer do in this case, what to do and where to turn. This issue is relevant and requires detailed study. According to Russian legislation, the consumer is always right and his claims should not be ignored.

In what cases may it be necessary to restore a purchase receipt?

Nowadays, after making a purchase, a person immediately throws away the receipt for it. It is not right. In the future, it may be required to perform the following actions:

- Returning low-quality, defective goods to the store;

- Returning to the store a product that does not suit any of its properties;

- Return of funds paid for it by social protection authorities, in accordance with various government programs to support it;

- In other cases, for reasons beyond the buyer's control.

What goods can the buyer return to the store without a receipt?

Currently, regardless of whether the buyer has a receipt for the goods or not, he has the right to return it. Returnable items include:

- Any purchase not intended for food purposes, if it has defects, defects, or does not correspond to the declared quality;

- Any item that has been tampered with by the seller;

- A purchase that is not a food item that is not suitable for a person based on its individual qualities. For example, by size, color, composition, and so on.

Products that cannot be returned to the store include:

- Products, some of which have been consumed;

- Household items intended for the kitchen, made of polymer materials;

- Underwear, socks, swimsuits, bed linen that have been used;

- Item that was broken due to the buyer's fault.

Is it possible to restore a purchase receipt?

Restoring the cash receipt itself is impossible, since the legislation does not provide for such regulatory legal acts. But there are alternative options for confirming your purchase. For example, receiving a copy of a cash receipt. Every store now must be equipped with cash registers that record every purchase. Cash register data is reset every six months. This may happen less frequently, but not more often. Therefore, any buyer can require the seller to provide him with a copy of the receipt. If the first refuses to provide the check, then the buyer has the right to go to court.

It is possible to exchange low-quality goods using a sales receipt, which is not issued in all cases. But if one was received by the buyer, then he can present it as proof of purchase. But if it was lost, then you can ask the seller for a second copy. Unfortunately, the law does not provide for the mandatory completion of two copies of a sales receipt, so the store may not have it. In this case, the buyer must resort to the first option or use the third.

The third option for returning a purchase without a receipt is to search for witnesses to the purchase. It’s good when a person was in a store with his friend or relative. In this case, the second one can confirm the purchase. The seller will be obliged to accept low-quality goods with written confirmation. But this option is not suitable if a person wants to return money for payment for goods, which is made by government authorities for social support of the population. For example, for purchasing a school uniform.

Procedure for returning goods to a store without a receipt

If a person bought a low-quality product or a product that does not suit him, he has the right to return it to the store. If the buyer has lost the sales receipt, he can take the following actions:

- Ask the seller for a copy of the sales receipt, which is kept in the store for six months from the date of purchase;

- Request the return of the goods using a sales receipt of the appropriate sample issued in this particular store;

- Demand that the product be replaced or the money paid for it be returned based on written and personal confirmation from a witness of the purchase.

If the seller refuses to accept a product that meets the return requirements established by law, and in particular government decree number 55 and the consumer protection law, the buyer has the right to contact the following authorities:

- Russian consumer supervision. Here you must submit an application indicating all justified reasons for returning the goods and a confirmed refusal of the seller;

- To court. To submit an application to the court, you need to thoroughly prepare. First, you need to obtain witnesses to the purchase. Secondly, you need to provide a written refusal from the seller to accept the returned goods. Then provide appropriate evidence that the product must be returned to the store.

The advantage of going to court is that the buyer will be able to return not only the money paid for the goods, but also recover the amount of moral damages from the seller.

In this article you learned how to recover a purchase receipt. If you have any questions or problems that require the participation of lawyers, then you can seek help from the specialists of the Sherlock information and legal portal. Just leave a request on our website and our lawyers will call you back.

Editor: Igor Reshetov

How to restore a payment receipt?

A protocol on an administrative offense provided for in Part 1 of Article 20.25 of this Code in relation to a person who has not paid an administrative fine in an administrative offense case considered by a judge is drawn up by a bailiff. And by and large, they don’t care that clause 4 was removed from this article (Administrative Code of the Russian Federation, Article 32.2), and now you don’t need to save payment documents. They agree that the failure occurred somewhere in the bank or in the organization through which the payment was made. But they won’t do anything (in this case they have no connection with the bank), you will have to find out and prove it, otherwise say goodbye to your money.

Attention

I hope that I was able to explain how this situation arises when you paid, and they take money from you again. This is not a racket or a gang that has withdrawn money from your account.

Everything is according to the law, so only you will have to prove your innocence.

What to do if loan payment receipts are lost?

Tell the employee the date the protocol was drawn up, the personal information of the person who wrote the document, the place and time of the incident. Based on this information, you will be issued a new receipt, according to which you can pay the fine. Instead of a payment document, you have the right to submit a receipt if you made a payment through the terminal, or a notification if you paid the fine via online transfer. Sources:

- Unpaid fines: how to recover lost receipts in 2018

The only way to prove the fact of payment of the state duty, fine or interest on the loan is to provide a receipt (check, invoice) for payment. A receipt is automatically issued when making payments through electronic account replenishment systems - ATMs, terminals, etc.

OFD-Y

We go to the operator’s website and enter the data:

- RN KKT (1).

- FPD (2).

Figure 11. Receipt for verification on the OFD-Ya website. Source: website ofd-ya.ru

After the data has been entered into the form, click “Check receipt”:

Figure 12. OFD-Ya service. Source: ofd-ya.ru

If the information is entered correctly, the service will provide a cash document in electronic form:

Figure 13. Test result. Source: ofd-ya.ru

Restore payment receipt

I don’t know where the check went, 2.5 years have passed, collectors are calling, like my loan has not been repaid. Is it possible to somehow challenge the issue of repayment if the receipt has not been saved?

InfoBank does not issue a printout indicating that the loan has been repaid. Collapse Victoria Dymova Support employee Pravoved.ru Try looking here:

- How to prove repayment of a loan from Russian Standard Bank?

- How to prove the fact of repayment of the loan if the bank requires repayment of the debt after 5 years?

You can get an answer faster if you call the free hotline for Moscow and the Moscow region. Available lawyers on the line: 7 Lawyers' answers (2)

- All legal services in Moscow Reduction of cash payments on a Moscow loan from 20,000 rubles.

Help with illegal actions of collectors Moscow from 5,000 rubles.

An accountable person has lost a cash receipt - what to do?

However, when filling out the expense report, I discovered that the terminal receipt was lost. The employee wrote an explanatory note indicating the date, place and amount spent, as well as the circumstances of the loss of the check.

The accountant requested a work completion certificate and a reconciliation report from the provider. The documents included an amount of 4,980 rubles. In order not to argue with the tax authorities, the head of the enterprise decided to take into account the expenses at the expense of the organization’s net profit, and include the amount of commissions in the employee’s income.

The accountant withheld personal income tax in the amount of 52 rubles. (400 × 13%) and calculated insurance premiums in the amount of 136 rubles. (26% - insurance part, 5.1% - FFOMS and 2.9% - insurance premiums in case of temporary disability and in connection with maternity). How can I restore my receipt and payment information? You need to restore your payment information because you need proof of payment of the fine. To do this, you need to: 1. remember which bank you paid the fine at (if it’s a terminal, which bank services it). 2. Remember the date of payment, at least approximately, in what month you paid (when the violation occurred + when you pay the fines). 3. Come to the bank and contact the operator, find your payment in the archive (by law, all banking organizations are required to store information about transfers for three years).

All transactions - non-cash, cash, in terminals or through a cash desk - are processed by the bank's processing. Any operator has access to the transaction archive.

You are required to indicate as accurately as possible the date, time, amount, recipient of the payment, as well as your data: full name, series and passport number.

How to prove that you paid the bill if the receipt is lost

The employee handed over the office, but lost the primary office, and therefore wrote an explanatory note. The accountant requested from the seller a duplicate of the delivery note, a copy of the cashier-operator's z-report and a reconciliation report.

The accountable amount appeared in all documents, and the advance report was accepted.

- In order to minimize tax risks, you can accept indirectly confirmed expenses for accounting at the expense of the company’s net profit, without taking them into account when calculating taxable profit.

IMPORTANT! If it is not possible to document the expenses, then the amount issued for reporting will be considered the employee’s income. Personal income tax must be withheld from her, as well as insurance premiums.

Example 3 The programmer was given 5,380 rubles. to pay for Internet for the company. He paid for the service in the amount of 4,980 rubles. and a commission in the amount of 400 rubles. via terminal. What to do if loan payment receipts are lost? When paying the next monthly loan installment, the borrower always receives a receipt in response confirming that the money has been deposited. As a rule, all responsible debtors are careful about preserving receipts. However, unfortunately, these small pieces of paper get lost quite easily, and sometimes the borrower cannot find the right copy. It is much worse if the bank claims that there was no payment, or the loan was not fully repaid. Then the borrower is faced with the problem of either proving to the lender that he is right, or repaying the required amount. How and for how long should loan payment receipts be kept? First of all, it must be emphasized that loan payment receipts should not be thrown away at least until the entire loan has been paid off. Today you will learn how to restore a receipt when you have already paid the fine, but have lost the receipt. What happens if there is no document confirming payment of the fine? You can print out the application for a refund.

Hello, dear blog readers. I have already told you what happens when you lose a receipt for a paid fine. Now you will learn how to restore your receipt. I settled on the fact that bailiffs write off money from your account without your knowledge.

Why bother washing your car? Me too! So I did like this guy with DRIVE2. And there are fewer hemorrhoids in my life. I recommend reading it.

Restore the receipt So, when you see that money has been withdrawn from your account, call or go to the bailiff service at your place of residence. There they tell you that yes, everything is correct: you owe it, so we withdrew the money. You say that I have already paid the fine.

Is it possible to get a duplicate of a cash receipt? What document will replace a cash receipt if the information on it has faded? Is it worth contacting an expert to confirm the faded information on the receipt?

Over time, the paint on cash register receipts fades, and the text fades almost completely. This is partly due to the storage conditions of the document, and the quality of the thermal paper plays an important role. If you have not made a photocopy of the receipt in advance, the expenses will remain without supporting documents, and this may threaten additional taxes. So, you need to restore a receipt or text. First of all, you should contact the seller. Some cash register models print duplicate receipts. The check will have the same date and details as on the faded check.

Our help You should not contact craftsmen who, using special programs, will make a copy of the check according to the specified parameters. After all, this will be nothing more than forgery of documents, which threatens with criminal sanctions (Article 327 of the Criminal Code of the Russian Federation). Despite the fact that you have faded sources, you will present the controllers with a deliberately forged document. Not even a copy, but a fake.

If you cannot obtain a duplicate, you will need to check with the seller. The act will become additional evidence; it will confirm the transaction that took place and the amount. But all this can be done with wholesalers; a regular retail store will not provide you with such documents. In addition, do not forget that wholesalers, in addition to the check, often also issue a receipt for the cash receipt order (PKO). Inspectors will almost certainly not like the absence of a cash receipt (letter from the Russian Ministry of Finance dated February 21, 2008 ˜ 03-11-05/40). But the judges believe that a cash receipt. is not the only document that can confirm a businessman’s expenses. A receipt from a parishioner may well replace a cash receipt (resolution of the Federal Antimonopoly Service of the Volga Region dated August 9, 2010 ˜ A55-30723/2009). Retail purchases, as a rule, are accompanied not only by the issuance of a cash register receipt, but also by the execution of a sales receipt (written out by hand, printed on a printer, or all on the same cash register). If the sales receipt is available, compiled in accordance with all the rules, the information on it has not faded, then consider that the expenses have been confirmed. Inspectors, of course, can find fault, but in a legal dispute, the sales receipt will become a powerful argument. Sometimes sellers print a sales receipt on thermal paper, like a cash receipt, which means it can also fade. And when buying gasoline, a sales receipt is not issued at all. Unfortunately, in such cases, it will not be possible to obtain any additional evidence confirming the expenses of the faded cash receipt. Here the hope remains that the faded text will be enough for the inspectors, and the necessary numbers on the check can still be seen. But in the event of a possible dispute, the merchant still has the opportunity to try to restore the lost text with the help of an examination.

Did you receive a strange SMS with a receipt? Let's talk.

January 31

We have long been accustomed to the fact that when carrying out any operation on a bank account, an SMS message is sent to the phone with detailed information about the completed / ongoing transaction. But what to do if the SMS did not come from the bank, but from some official department? Should I worry and take any urgent action?

For those who are too lazy to read a lot, we will answer right away: no - it’s not worth it. This is just a cashier's check, equal in strength to a paper check printed by the cash register. Those. something similar happened to simply taking a paper check from the cashier's basket, only in a digital environment. You do not have any demands for payment, obligations to pay taxes or the right to demand a refund. Almost always does not occur, provided that you received the check in error.

Well, now a little more detail.

We are not the largest operator of fiscal data, but at the same time, our support service receives questions every day from people who have never used and most likely do not even plan to use online cash registers, or even conduct business in general. Someone is worried that money has been debited from their card. Someone does not understand what and why he bought. Others simply request that they be removed from the mailing list. And then there are those who want to become a little richer and get money from the check (especially if they received a refund check).

Here's the thing. In 2020, on the crest of a wave of digitalization, cash register receipts ceased to be exclusively paper and such forms of document presentation as checks via SMS and email were added to the law. In 2020, they added a QR code displayed on the screen of the seller’s device (applicable only for couriers and vending machines). Also in 2020, the state allowed the use of cloud cash registers for courier delivery. Naturally, the number of receipts via SMS has increased significantly.

Since the number of electronic receipts has increased, the number of errors when entering a number has also increased. How many times have we made mistakes when entering contact information, or how often a delivery courier comes to us, whose only desire is to quickly fulfill the next order, and when accepting payment, he also needs to issue a check with the necessary information entered. There is also a category of buyers who specifically give someone else’s number in the hope of hiding from “big brother.” Usually, as a result of the listed errors, unknowing subscribers of the cellular operator receive unnecessary, and even extremely suspicious SMS messages with receipts. We even had a funny story when one owner of an extremely beautiful number like 999 99 99 simply drove the entire support team into hysterics, demanding to influence one of the clients so that he would not send him all his checks (as it later turned out, the courier, when drawing up a fiscal document, simply I typed in the simplest number that came to mind). It is worth noting that emails with erroneous receipts are received much less frequently.

So how scary, dangerous or risky is it to receive such an SMS? If you did not make a purchase, then the SMS you received is nothing more than ordinary digital garbage (not even spam). It does not give rise to any rights or obligations. NO debits from the account are made based on it. Write-offs can only be made by the bank, and not by the fiscal data operator. We will also upset those who have decided to make money and get the amount back: it will not work, if you do not have a contractual relationship with the seller, then you are not owed any amount. The seller made a mistake with the number on the check and not with the bank details for the transfer.

And also, there are quite a few cases when people contact us who actually made a purchase, but have no idea about SMS receipts, and that this is a complete replacement for a paper document. Remember, perhaps you recently made a purchase in an online store, or subscribed to some paid content.

How to behave when receiving an electronic check? If you have not made a purchase, then simply ignore the information received. If you made a purchase and are waiting for a receipt, then check that the link leads to the fiscal data operator’s website, which operates using a secure https protocol (for example). You can first google the domain name to avoid clicking on a phishing link, and after making sure that the check link leads to a resource authorized by the Federal Tax Service of Russia to process fiscal data, follow the link. The list of OFDs indicating the website address is always posted on the tax website.

But what to do if you receive an endless stream of SMS messages, as in the case with the owner of a beautiful number described above? Of course, no one will simply remove you from the list of recipients, since failure to send a cash receipt via SMS carries an administrative fine of up to 10,000 rubles. What if you are an inspector who is preparing mail for an upcoming inspection or just an ill-wisher who wants to frame his competitor? To unsubscribe from the mailing list, you will, at a minimum, be required to provide a duly certified unsubscribe, accompanied by documents confirming your right to act with your phone number/email address. But if some cashier regularly uses your number, then simply contact the fiscal data operator or directly the company that generates checks (its name or TIN is always indicated in the full version of the check) with a request to stop sending checks. Be sure to attach a screenshot from your phone screen to the letter; the company will easily recognize both itself and its lazy cashier.

Share this article:

Duplicate cash receipt

This pleasure is expensive, so businessmen prefer not to contact specialists until the inspectors’ verdict. And if the case comes to court, then petition for the appointment of an examination. The amount required for the examination is deposited into the deposit account by the party who insists on it (in this case it will be the merchant). If the initiative comes from both parties, the costs are divided equally. An examination ordered at the initiative of an arbitration court is carried out at the expense of the federal budget, so in practice judges rarely take the initiative. As a result, the cost of the examination will be reimbursed by the party who will not benefit from the results. If the claim is partially satisfied, then the legal costs are divided between the parties to the dispute in proportion to the size of the satisfied claims. And since the check is real, an examination will confirm the authenticity of the document, and the court will oblige the inspectorate to reimburse the costs. But to avoid such situations, make photocopies of cash receipts, especially for expensive purchases. Documents containing significant amounts have always attracted the attention of inspectors. And photocopies of cash register receipts and sales receipts, made to preserve the information reflected on them, certified by the signature of the entrepreneur, are sufficient primary documents confirming the actual costs of purchasing goods in cash (letter from the Federal Tax Service of Russia for Moscow dated April 12, 2006 ˜ 20-12/29007).

Organizations and individual entrepreneurs are required to issue customers (clients) when making cash payments and (or) payments using payment cards at the time of payment, printed cash register receipts. A cash receipt issued when using a cash register is a document confirming the fulfillment of obligations under a purchase and sale (service) agreement between the buyer (client) and the relevant legal entity or individual entrepreneur, and is drawn up at the time of the transaction.

About this Letter of the Federal Tax Service of Russia for Moscow dated July 20, 2012 N 17-15/064957.

According to the Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making cash payments and (or) settlements using payment cards” (hereinafter referred to as Law N 54-FZ) the scope of application of cash register equipment included in the state register are cash payments made by organizations and individual entrepreneurs in cases where they sell goods, perform work or provide services.

Law N 54-FZ stipulates that organizations and individual entrepreneurs are obliged to issue cash register receipts printed by cash register machines to buyers (clients) when making cash payments and (or) payments using payment cards at the time of payment.

In accordance with the current Regulations on the use of cash registers when making cash settlements with the population, approved by Decree of the Government of the Russian Federation of July 30, 1993 N 745, a cash receipt must contain the following details:

- name of company;

- taxpayer organization identification number;

- serial number of the cash register;

- serial number of the check;

- date and time of purchase or service provision;

- cost of purchase or service;

- a sign of a fiscal regime.

The receipt issued to buyers (clients) may contain other data provided for by the technical requirements for cash register equipment.

A cash receipt issued when using a cash register is a document confirming the fulfillment of obligations under a purchase and sale (service) agreement between the buyer (client) and the relevant legal entity or individual entrepreneur, and is drawn up at the time of the transaction.

Also, to confirm the fact of purchase, a control tape can be used (an accounting document executed by a cash register on paper or electronic media). In accordance with clause 14 of the Regulations on the registration and use of cash registers used by organizations and individual entrepreneurs, approved by Decree of the Government of the Russian Federation of July 23, 2007 N 470, all cash registers must have a control tape and must be stored for at least five years from the end date of its use.

According to clause

About manually entering check details:

In order to ensure the integrity of the organization, i.e. To check, you will need to find at least two combinations of numbers on the cash register receipt: FP and FN.

- 1) The Fiscal Sign of the Document is abbreviated in the new online check as “FP” or “FPD” - usually consisting of a sequence of 10 digits.

- 2) The Fiscal Storage Number is abbreviated in the new online check as “FN No.:” or simply “FN:” (or as “CCT Code FTS”), usually consisting of 11 digits

- 3) TOTAL - the total amount of the check.

More information about abbreviations on a check:

FPD on the check - what is this - a fiscal sign of the document

— a fiscal attribute generated using a fiscal drive to verify the accuracy of fiscal data protected by a fiscal attribute, using fiscal attribute verification tools used by the authorized body.

FP is a fiscal attribute - reliable information generated using a fiscal drive and a fiscal attribute key or using means of generating a fiscal attribute and a master key as a result of cryptographic transformation of fiscal data, the presence of which makes it possible to detect adjustments or falsification of these fiscal data when they verification using a fiscal drive and (or) a fiscal attribute verification tool.

FD

- this is a fiscal document - fiscal data presented in established formats in the form of a cash receipt, strict reporting form and (or) other document

FN

- this is a fiscal drive - a hardware-software encryption (cryptographic) means of protecting fiscal data in a sealed case, containing keys of a fiscal sign, providing the possibility of generating fiscal signs, recording fiscal data in an uncorrected form (with fiscal signs), their non-volatile long-term storage, checking fiscal data signs, decryption and authentication of fiscal documents confirming the receipt by the operator of fiscal data of fiscal documents.

All terms and their application in list order are set out in more detail in the new Federal Law - 54 here...

_____________________________

Unfortunately, the service for ordinary PCs on the website of the developer of this application does not currently work (more on this below in Part IV). All that remains is the websites of the OFD operators themselves (see just below).

13% refund if receipt is lost

1 tbsp. 7 of Law No. 54-FZ tax authorities:

- exercise control over compliance by organizations and individual entrepreneurs with the requirements of Law N 54-FZ;

- exercise control over the completeness of revenue accounting in organizations and individual entrepreneurs;

- check documents related to the use of cash register equipment by organizations and individual entrepreneurs, receive the necessary explanations, certificates and information on issues arising during inspections;

- conduct checks on the issuance of cash receipts by organizations and individual entrepreneurs;

- impose fines in the cases and manner established by the Code of Administrative Offenses of the Russian Federation on organizations and individual entrepreneurs that violate the requirements of Law No. 54-FZ.

- © We draw special attention of colleagues to the need to link to “Subschet.ru: Theory and Practice of Accounting and Taxation” when quoting (an active hyperlink is required for on-line projects)

OFD Peter-service

Open the service for checking cash receipts and enter the following data:

- Fiscal storage number (1).

- CCP registration number (2).

- Taxpayer Identification Number (3).

- FD (4).

- FP (5).

Figure 14. Cash document for searching on the OFD Peter-service website. Source: Ofd.ru

After entering the data, click “Find receipt”.

Figure 15. OFD service Peter-service. Source: Ofd.ru

After the information is entered, the service will generate an electronic receipt:

Figure 16. Search result through the OFD Peter-service service. Source: Ofd.ru

Need cash receipts? Order NIM from us, or print any cash receipts yourself

Cashier's checks are an agreement between the buyer and seller. A financial document confirming the sale (purchase) of goods.

Order a receipt printing machine to print cash receipts.

Buy a receipt printing machine on which you can punch any cash receipts. You can view samples of cash receipts below. I must warn you that falsifying cash receipts is punishable by law.

Order check printing machines in the payment and delivery methods section.

Types of cash registers and samples of cash receipts:

Samples of receipts for some cash registers that are most often used in stores:

New receipts from ON-Line cash desks:

Old cash desks with EKLZ:

How cash receipts are forged

Samples of receipts from some popular stores and other organizations:

- Sberbank

- Castorama

- Auchan

- McDonald's

- OK

- Pyaterochka

Required details on the check

Each cash receipt must contain the following details. If at least one item from this list is missing on the check, the cash receipt is fake and cannot be considered valid.

- name of organization or individual entrepreneur

- TIN of an organization or individual entrepreneur

- the amount for which the check is punched

- date

- time

- document (check) number

- cash register number

- ECLZ number

- PDA number in order

- PDA value - control verification code

Let's consider, for example, a KKM Mercury 180K cash register receipt:

Optional details that manufacturers usually use to protect receipts from their cash registers from counterfeiting:

sign of fiscal regime

Cash receipt SPARK-115-f (new online cash register)

Used at McDonald's.

Cash receipt ATOL 77F (new online cash register)

Used in Crossroads

Cash receipt Mercury 180

A miniature, very popular lately Mercury 180K cash register, it is possible to print the company logo on the receipt (optional), you can print any cash receipts on it.

The width of the receipt tape is 44 and 57 mm.

Programming the ChPM Mercury 180 check printing machine for the desired organization is done via a computer, and is not difficult even for a novice lamer. You can also enter all data through the cash register keyboard, or order programming from us.

Price Mercury 180: 3550 rubles.

Data programming: 600 rubles.

Printing receipts costs from 1 rub/piece due to the low cost of thermal printing.

Cash receipt Mercury 130K

One of the most common cash registers, Mercury 130K, prints cash receipts on thermochemical paper 57 millimeters wide. You can print in several fonts at the checkout; the fonts can be changed in programming mode.

Minik cash receipt 1102 F (without EKLZ)

The width of the receipt tape is 44 mm. This cash register is already outdated and does not include an ECLZ.

Cash receipt EKR 2102K with EKLZ

Almost similar to the Minik 1102K cash receipt, it can print in two types of font: narrow and wide.

Cash receipt AMC 100K

Cash receipt AMC 100 K can be of two types, the printing font can be small and large. Also on the right check you can see that the ECLZ is close to filling and should be changed soon.

| Small font | Large font |

Cash receipt Kasby 02K

Here is a receipt from a Kasbi 02K cash register connected to a network with a computer. In this combination, the cash register can print the names of goods - inexpensive trade automation is obtained.

| Cash register with automation | Regular print Kasbi 02 K | Compressed print Kasbi 02K |

Cash receipt Samsung ER4615RK

Nowadays it’s rare to find a Samsung cash register anywhere. It is the last of the stand-alone cash registers to have dot matrix printing. Now it has been replaced by Alpha 400K with thermal printing.

Cash receipt Ladoga K

Cash receipt Shtrikh M FR K (fiscal registrar)

Cash receipts from this device differ depending on where it is located: in a cafe, restaurant, store or gas station. The width of the receipt tape is 80 mm.

| gas station | Cafe or restaurant | Retail store. |

Cash receipt Shtrikh FR K (fiscal registrar)

The width of the receipt tape is 57 mm.

Cash receipt Elwes-Micro K

Elwes-Micro-K uses thermal tape 57 mm wide

Cash receipt Orion 100 K

Cash receipt OKA-102K

The miracle of Russian cash register OKA-102K, which has a MEGA mesmerizing design, issues the following documents on a 44 mm wide receipt tape.

| Normal font | Compressed font |

Cash receipt Shtrikh-Mini-K

The Shtrikh-Mini-K cash register prints on thermal paper 57 mm wide, up to 24 characters per line.

Agate 1K

Receipt tape width: 57 mm.

Printing type: thermochemical printing

See also: crazy cash receipts.

WAB-08RK

Receipt strip width: 57 mm

Printing type: thermal printing.

Cash receipt in the EGAIS system

These are the types of receipts that must be printed when selling alcoholic beverages. It should have a QR code, a link to the EGAIS database and a code by which the buyer can check the license and quality of the product.

An interesting way to forge cash receipts

Recently, friends suggested an interesting way to forge cash receipts, but before I tell you, I must warn you that this is not a manual for use, since document forgery is prosecuted by our valiant police officers and Vladimir Vladimirovich personally.

To emulate a cash receipt, you will need a fax. And the check forgery program Kassy.

- receipt and change it in Photoshop, or generate it through the Kassy program.

- Print the cash receipt on the printer.

- Copy the printed cash receipt via fax.

- Cut out the check from the sheet.

These cash receipts are very similar to real ones, as they are printed on thermal paper. Unfortunately, such a fake is easily detected. And in general, now, after the introduction of EKLZ, any emulation of cash receipts can be easily identified by checking the PDA code at the end of the receipt.

Discussion

II. Services for checking checks for authenticity online on OFD websites

The receipt can also be checked on the websites of OFD - fiscal data operators. Provided that you know or can see in the new online check the name of the OFD - the operator of the fiscal data of this cash desk (i.e. this check). Those. OFD's check services are usually functional, but less convenient, you will have to type in a bunch of details by hand, and besides, I repeat, the sites are not universal - they store receipts only for their specific clients - each only their own. Typically, you will need to find 3 or 4 details on a cash receipt:

- Reg. No. CCP - Registration Number of Cash Control Equipment

- Head No. FN - Serial Number of the Fiscal Storage Unit

- FD No. – Fiscal Document Number

- FPD - Fiscal Sign of the Document

Below are the services for checking online receipts of all operators that have received a license (the first five were included by the Federal Tax Service of Russia in the OFD register among the first - 08/31/2016):

1) OFD - Energy Systems and Communications LLC - First OFD - Search, verification and storage of checks - https://consumer.1-ofd.ru/#/landing (operability of the check authentication service was checked on 03/11/2017)

Results of checking a correct receipt:

2) OFD - Yarus LLC - fiscal data operator - Checking OFD-Ya checks - Check search service - https://ofd-ya.ru/check (operability of the check authentication service was checked on 01/17/2017)

I used my personal account, everything is just logical, convenient, a kind of traffic light depending on the status of the online cash register, although I couldn’t wait for the tab with detailed statistics, no matter how much I tried, apparently either the Java version is not the same, or I need a specific browser, I I used Opera.

OFD - limited liability company "PETER-SERVICE Special Technologies" - CHECK THE CHECK - https://ofd.ru/checkinfo

4. OFD - limited liability company "Evotor OFD" - Checking the check - check details - https://lk.platformaofd.ru/

OFD - limited liability company "Taxcom" (https://taxcom.ru/ofd/, Receipt details - https://receipt.taxcom.ru)

The Federal Tax Service of Russia was included in the OFD register a little later from April 10-14, 2017:

OFD - limited liability company "Yandex.OFD" (https://ofd.yandex.ru/, have not yet found a check verification service)

OFD - limited liability company " - Checking receipts - https://ofd.sbis.ru (have not checked the performance of the service yet)

OFD - closed joint-stock company "KALUGA ASTRAL" - Checking receipts - https://ofd.astralnalog.ru (have not yet checked the performance of the service)

OFD - limited liability company "Electronic Express" (on the website there is a link to the verification service - https://consumer.ofd-gnivc.ru/ - see section V of this article)

OFD - limited liability company "KORUS Consulting CIS" - (https://www.esphere.ru/products/ofd, I have not found a check verification service yet)

The entire list of fiscal data operators, officially published on the Federal Tax Service website, is duplicated here at the link.

______________________________

How to print a receipt on a printer. Printing sales and cash receipts

Before printing a check yourself, you need to decide what exactly needs to be printed. As you probably know, there are cash and sales receipts. There shouldn’t be any problems with printing product labels: we create the document in Word and print it on a regular printer. You can also use special programs designed for printing sales receipts.

If there is a need to print cash register receipts, then first keep in mind that receipts are usually printed with a special thermal printer (it is used in cash registers) on thermal paper. If you use a laser printer model for this purpose, the entire receipt tape may darken due to heating. As for a regular inkjet device, a cash receipt printed with it is quite easy to calculate, because it can be smeared with a wet finger.

It turns out that you either need to buy a special thermal printer, or try to select thin paper and use a laser printer. Let's take a closer look at the possible options.

Printing with Word

If you plan to print receipt tapes at home and use a laser printer (a more suitable option than an inkjet printer), then for this you can download special templates designed for Microsoft Word. To use this option, look in the software folder for a folder called “Templates”, which is used to store templates from Microsoft Office. Then copy the check template you downloaded there and restart the program - if it was open at the moment.

Click on "File" and go to the "Project Gallery". Find the template you need in the "Templates" list, after which a new document will open that will match the template you selected. If necessary, make changes that interest you to the open document (they will not affect the template itself), and then print several test receipts. Please note that the check must contain the name of your company, various organizational data (for example, TIN, ORGN), printing date, price, as well as product designation and some other equally important information.

You can also use special services that allow you to print a receipt online. For this purpose, you do not need to download a special receipt template for Microsoft Word. All you need is to open one of these web services, fill out all the necessary fields for the future cash receipt and click on “Print”.

Special programs

As for applications specifically designed for printing receipts on a printer, there are a lot of them today.

- For example, a utility called Kassy, which is absolutely free to use, is quite popular. The developers of this software constantly update their product, so the development of the program does not stop there. Another important advantage of this utility is its support for the Russian language, which allows you to easily understand its interface.

- Another good software application for creating layouts and printing cash receipts without using special cash registers is SNEgCheck. The program supports an unlimited number of profiles, which can be added, deleted and edited. With its help, you can set the font size, color and appearance of the text on the receipt. In addition, it allows you to add fonts that imitate dot matrix printers. When creating a cash receipt using SNEgCheck, you can use the result preview feature to make sure that the printed receipts are to your satisfaction.

- To prepare sales receipts, you can also use a program such as “VisualData Sales receipt”. It is a very simple and intuitive software that can store the entire sales history. In addition to filling out and printing checks, this program has a number of other features. For example, it has a database of goods, with its help you can analyze sales, draw up summary reports, control product balances, etc.

Thus, it is still possible to prepare and print receipts for the cash register on a regular laser printer without using a special device.

Before you start printing cash receipts yourself, we advise you to familiarize yourself with the laws and possible liability for violating them.

How to print a receipt on a printer Link to main publication

How to duplicate a check using the Refund function

This method of generating a duplicate check can be called quite complicated, which is why it is not popular. In order to print a duplicate using the “Return” function, the cashier performs the following steps:

- issue a return;

- by printing out the correction receipt, re-enter previously sold goods (services);

- print the receipt (original document), and then issue the receipt to the buyer.

Important! If the buyer requires two copies of the receipt, then he will need to install the “Copy of Receipt” application, and this will need to be done in advance.

How to print a receipt in a special program for printing cash receipts on a printer?

It happens that you need to print a receipt, but there is no cash register. It's okay - you can print a check by installing a special program on your computer. So, how to print a receipt on a printer?

First you need to install the Kassy program. This is a special program for printing cash receipts. The program is used to print receipts from various cash registers. The program has an information base that contains all the data relating to various cash registers. There is general and technical information, price and type of receipt. Receipt printing software is easy to use. Any PC user can print a cash receipt on a printer.

To print cash receipts on a printer, you need to buy special paper. A receipt printed in the Kassy program is practically no different from one printed on a cash register. This program can help you choose a cash register suitable for your business and see what a cash register receipt will look like.

How to make a duplicate of a check electronically through the OFD

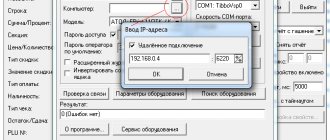

You can also configure the sending of an electronic check using OFD in 1C. To do this, select the following actions in the program: in 1C you need to select the reference data and administration - then setup, select Federal Law-54 and check the boxes next to “Send electronic checks by SMS through the fiscal data operator”, and then “Send electronic checks by E-mail via fiscal data operator."

A duplicate of the online cash register receipt should be sent through the “Cashier Workplace” – “Form of Payment” field.

Important! Even before the cashier accepts payment from the buyer, he should choose the method by which the repeat check will be sent, and also enter the buyer’s email or phone number.

Cash receipt

Confirmation of payment for the purchased goods is a cash receipt. Using a special direct link you can fill it out online and print it for free.

(Uploaded by: 4442) Every day, several times a day, people buy and sell objects of the material world, services. Needs and offers will exist forever as long as society exists. Confirmation of payment for the purchased item or service is a cash receipt, invoice, receipt, cash receipt order and other written documents. The cash register receipt is most common in the retail chain of goods. Let's take a closer look at the essential features of this paper. You can use a special direct link for free.

Despite the abolition of cash registers and simplification of the procedure for providing cash papers, the population is accustomed to receiving this sheet. Enterprise accountants are also accustomed to using this written act in tax reports to the state. A cash receipt is excellent evidence in case of litigation. The payment slip has unique properties and carries only positive qualities for all subjects of legal relations. That is why it is still in demand by society and the state.

:

- The name of the company that issued the check is at the top, in the middle;

- TIN, ORGN, address and other organizational data of the institution;

- Date of printing of the information paper, price, designation of the item or service;

- Brief explanations about discounts;

- Data of the operator who carried out the sale;

- Delivery information and more.

The structure of the check has exceptional characteristics. A cash receipt is an information document that does not contain signatures and seals of the organization. Symbolizing the amount, product name, date of purchase, name of the institution that carried out the sale, and the TIN of the company are quite sufficient for the client to confirm the fact of the legal relationship with the specified seller at a certain time. The institutions' recommendations for preserving these important sheets are quite reasonable.

Date: 2016-03-21

Sending an electronic copy

If such an application has not been installed, you will not be able to print a copy from your personal account. However, you can send a copy of the check electronically from the fiscal drive to the client’s specified email account, from which he can print it himself.

Sending to client email in 1C

To send duplicates in 1C, the services for sending via SMS and to the client’s email must be installed.

In the 1C system, it is possible to install the sending function immediately after the purchase has been completed. To do this you need to perform the following combination:

- Master data and administration, then – configuration;

- sales of Federal Law-54;

- check the box “Send electronic checks after entering the cash register.”

Fig 2. Setting the sending option after the operation has been completed

Important! In the same menu, you can set a schedule for sending electronic copies to clients, which will occur once a day simultaneously to all clients for each transaction.

Sending a check via OFD

If you need to send duplicates through a fiscal data operator (FDO), then you will need to set the appropriate options in the 1C system in advance:

- Reference data and administration, then setup.

- Sales of FZ-54.

- Check the boxes “Send electronic checks via SMS via the fiscal data operator” and “Send electronic checks via E-mail via the fiscal data operator”.

Fig 3. Setting options for sending duplicates via OFD

A copy is sent in the “Cashier Workplace” field from the “Form of Payment” menu (cash, non-cash or mixed payment).

In the payment acceptance field, before making a purchase, select the method of sending the duplicate and indicate the client’s email address.

Important! If the client refuses to print a duplicate himself, you can send it to your email for printing in the store, and then give the client a paper version.

Return of purchase

There is another, more complex option for printing a copy - to issue a return.

Part 1. Basics of returns at online checkouts.

Part 2. Types of returns technically possible at online cash registers.

Part 3. Return instructions for common models of online cash registers: Mercury, Atol, Shtrikh-M, fiscal registrars.

After printing the correction receipt, you will have to enter all goods (services) again. Upon completion, the cashier will print a new original. If you need to withdraw 2 copies at the same time, you must install the “Copy of Receipt” application in advance.

Issue a copy of the KKM check???

| Key words = how to easily and quickly start your own business, buy, choose a cash register, replacing EKLZ, registering cash registers, cash registers, receipt printer, cash register receipt. UTII exempts you from the cash register (except in Moscow, but people still want to receive them), but then you must issue a sales receipt of a special sample. You can refuse to use cash registers, and instead of a cash receipt, issue customers other documents containing the details required by law. Continuing to use cash receipts turned out to be easier. In the original, the receipt is printed on thermal paper using a thermal printer (thermal transfer is another thing). Some people may immediately see that the paper is not the same, or that the printing principle (dot) is different. And scandals begin, loss of time, analysis, complaints. How people cheat in order to analyze what the check will look like before choosing and buying a cash register (or bypassing the tax office, but this is not legal): 1) Regular printer – 3 thousand rubles. Attach a cash register tape to the sheet. Laser printer - the entire ribbon darkens when heated. Inkjet printer - smeared with a wet finger. Calculated. The receipt is scanned, edited in a graphic editor, printed, scanned and printed - long and tedious. 2) Gray cash register, cash register – 5-15 thousand rubles. The EKLZ unit must be changed annually, this is illegal, it is difficult to find anyone who agrees. Official replacement of EKLZ in the cash register if there is paper from the tax office - 8.5 thousand rubles. Does not require registration with UTII (single flat tax, payment at a rate, regardless of turnover), change the ECLZ anyway. If a cash register is found, you may face prison. EKLZ is a secure electronic control tape (the letter “K” at the end of the name of the cash register). The check must contain the line - EKLZ + set of numbers. 3) Fax (equipped with a thermal printer) - 2.5-5 thousand rubles. The check is scanned, edited in a graphic editor, printed, scanned and printed via fax. High consumption of paper, which is also more expensive. Not everyone is suitable. You cannot quickly change the company details.4) Receipt printer – 5 – 12t. Legal, no need to hide, no registration required. Because used for UTII. The cheapest and most legal option, it doesn’t take long to set up, and quickly prints a large number of receipts. A receipt printer does not require further investment like a cash register. Cheap consumables - cash register tape, 30 rubles. If you have 2 companies, then checks can be issued with one receipt printer almost instantly to different companies! The receipt printer is connected to the computer. The driver is installed and that's it. For me the choice is obvious. Buyers want to see a receipt, they are indignant if it is not there. The cash register is a thing of the past. Everyone has the right to store a receipt printer. Payers of the single tax (UTII) have the right to punch checks on a receipt printer; these are all companies except for now Moscow (will appear in 2011). A label printer is also suitable, because... uses the principle of thermal printing. See models on the website https://1001play.ru, price from 4600 rubles. In many cases, a receipt printer (thermal printer) can replace a cash register. Does not require maintenance or registration. You can generate any type of receipt and print it. Prints on receipt tape (thermal paper). No different from a cash receipt. A receipt printer is an ideal option for an individual entrepreneur. It's just a printer. To generate a check you need some special program. 1) You can customize Microsoft Office Word, programmers in companies charge 1 thousand rubles for this. 2) There is a “Quasar Trading House”, the minimum package for the program is 30 thousand rubles. 3) All printers are connected to 1C, almost all the drivers are already installed in it, you can also generate a receipt from 1C. I think you can’t do without a 1C programmer either - 1.5 thousand rubles. Only our company gives a gift when purchasing a receipt printer - a program for generating a receipt (works only in Windows XP and older versions of Windows). And a template in Microsoft Office Word (works everywhere!) We offer a ready-made solution! Printer + program as a gift + template database + Word templates + compatibility + reliability + launch guarantee + installation assistance + assistance in creating templates. Demonstration possible. |