What Federal Law No. 54 requires

The federal law, according to which it is no longer possible to trade without online cash registers, came into force in 2020; it provides for delays in the transition to new cash register models for some categories of entrepreneurs until 2020.

The name “ online cash register ” is not official; the new cash register was named this way because it will be connected to the Internet, thanks to which:

- information about the transaction (cash receipt) will be instantly transmitted through the operator to the tax service;

- the buyer will be able to receive a copy of the receipt by email.

IMPORTANT! Even in cases of interruptions in the Internet network, the work of the online cash register does not stop: all the data of checks punched during this period are stored in the fiscal drive and, when the network resumes operation, are transferred to their destination.

The latest edition of the CCP law requires that this device simultaneously meet all the requirements:

- records and saves data for tax purposes;

- he has a fiscal accumulator;

- generates strict reporting forms (cash receipts);

- ensures their receipt through the OFD operator to the tax office;

- If necessary, they can be printed on paper.

Sellers will have to buy a new cash register or upgrade an old one (this is not possible or advisable in all cases).

https://youtu.be/Azx1kMHIjzk

Features of using cash registers for selling goods/services via the Internet

10. Can an online store not buy/rent a cash register and still operate in accordance with 54-FZ from July 1, 2020?

Yes, there are two options:

- Use an external delivery service. If the buyer pays cash on delivery, the cash register must be used by the courier who hands over the goods.

- Use non-cash payments (Internet banking). In the case when money is transferred to the account of an online store without using a card, a cash register is not needed until July 1, 2020.

11. Can a cash register marked “F” be used for online payments?

Yes, you can. To make payments on the Internet, you can use any of the online cash registers - they allow you to generate both electronic and paper checks. For example, at ATOL cash desks you can disable the function of mandatory printing of a paper receipt and use it both at the point of delivery of goods and for payments on the Internet.

KKT ATOL 30F+

12. We have an online bookstore. There are no offline stores, no cashiers. Is it possible to use (or somehow configure) a physical cash register that would receive information from the site (remote hosting) where the user buys a product and send it to the OFD?

This is exactly how any cash register should work on the Internet in order to comply with the legal requirements for sending a check at the time of settlement. This is how the ATOL Online service functions. Everything happens automatically without the participation of an operator (cashier). The main thing is that the site’s CMS (or the payment aggregator used) is integrated with the cash register.

13. Do the provisions of Article 7, paragraph 9 of Federal Law No. 290 Federal Law dated July 3, 2016, on the possibility of not using cash register equipment until July 1, 2020, apply to online stores? It had not been used previously, and it was not contrary to the law.

This depends on which payment method you use. If payment is made using electronic means of payment without entering payment card data (for example, electronic wallets, transfer from an individual through an online bank or bank branch), then a cash register is not required until July 1, 2018.

14. Is it necessary to use an online cash register if we do not sell goods, but provide services in the form of advertising on our website? Payment for the service is possible, in particular, through payment aggregators and only by individuals.

For now, you can issue a strict reporting form (SSR). After 07/01/2018 it will be necessary to use the cash register. But in this case, it is necessary to ensure the transfer of the BSO to the buyer at the time of settlement, which is quite difficult. We recommend switching now to fiscalization of payments and sending electronic checks, which will replace BSO.

15. If our product is information business and consultations, is it necessary to use online cash registers?

Yes need. Among those who are exempt from using cash register equipment (CCT), there are no such categories of entrepreneurs.

16. Is it possible to use one cash register for an online store and a point of sale?

Yes, you can. The same cash register can send an electronic receipt to the buyer when paying for goods online, and print a paper receipt when paying at the point of sale, but this will require the appropriate software.

17. Who should issue a receipt when working through the dropshipping system?

The main rule: the cash register is used by the one who accepts payment from the buyer.

18. If we receive electronic payments in foreign currency from non-residents through payment systems (foreign), should we issue cash receipts? If yes, in what currency?

If you make payments on the territory of the Russian Federation, then you must use cash register systems. All checks are always issued only in rubles.

Can an online cash register be cheap?

Businessmen are always uncomfortable with the additional costs that need to be invested to ensure normal operation, which has already been previously established and functioning. Without experience in choosing online cash registers, without knowing the key points to pay attention to, a person will want to purchase the cheapest model in order to save money. In some cases this may be justified, but not in all.

The level of demand for online cash registers has increased several times - this is natural due to innovations in legislation. This allows a previously rather weak market segment to gain strength. New manufacturers are appearing in this area and have many different offers for consumers.

NOTE! Whatever the proposed online cash register, by default it has basic functionality that meets the requirements of Federal Law No. 54. The difference in price is determined by additional capabilities that may be required for different types of activities.

You can compare the variety of online cash register models with the recent abundance of types of mobile phones: all-in-one phones, clamshells, retractable phones, etc., but the basic capabilities were the same for everyone. The more features, the higher the price. The box office industry does not have its own iPhone. Different entrepreneurs need different types of online cash registers.

We have decided on the type of online cash register. Let's go to the store to buy something

Where to buy an online cash register is another dilemma. Only lazy people don’t sell them now - everyone wants to make money on this topic. However, it is better to buy a cash register from a specialized company that specifically deals with this issue. There are several ways you can go here:

1. Purchase from a trading company. There are several major players in the market involved in business automation. Do not get involved with small companies - you will lose time and money. If large organizations always have equipment in stock, then small ones - everything is delivered to order and very slowly. Add to this inflated prices and poor technical support - and it becomes clear why it is better to turn to serious suppliers. In a good situation, everything can take one working day - and this includes installation, connection and staff training. One of the leaders in this area is “First Bit”.

2. Purchase of fiscal data from the operator. Have you heard of this? If you haven't heard, let us know. OFD provides you with a cloud service for storing and processing cash receipts. They are sent to the tax service not directly, but through the operator’s server. There are now 21 such operators in Russia, all of them are included in the special register of the Federal Tax Service. So, fiscal data operators also sell online cash registers. Moreover, with a ready-made service agreement and - attention! registration with the tax office. Some OFDs claim that their device just needs to be plugged into a power outlet and sales can begin. The disadvantage of buying a cash register from an operator is the limited number of models. As a rule, there are two or three of them and it’s not a fact that they will suit you.

3. Purchase from a bank. Yes, banks also sell online cash registers. And often on favorable terms - in installments, at a discount, or even rented out. Ask the manager what your bank can offer - perhaps the solution will suit you. The disadvantages of buying a cash register from a bank are extended delivery times for equipment, not always prompt and comprehensive technical support, and lack of staff training in how to operate cash register equipment.

4. Buying a used cash register. A good option for those who are used to saving money. Unfortunately, more businesses in Russia are now closing than they are opening. Trade equipment needs to be attached somewhere, so advertisements for the sale of online cash registers appear on Avito and other sites. Prices, compared to new ones, may differ significantly. At the same time, there is a chance to buy a completely live device - you just need to be careful, as, in fact, when buying any used items. Sometimes you can come across an offer to rent a cash register. Whether you use it or not is up to you, but don’t forget that renting costs money that you can spend on buying your own device.

Why you need to choose a cash register carefully

If, by and large, any online cash register will perform the required functions, is the choice so important? Why should you think about the type of cash register you need and the “right” supplier? There are several pitfalls that can become serious risks for an entrepreneur who has not bothered with the selection of an online cash register:

- Missed deadlines. An unreliable supplier may deliver a cash register later than the stated time, and since it is impossible to trade without it after the period specified in the law, delays, downtime, and ultimately losses may occur in the work.

- Incorrect cash register registration. If, due to inexperience, the fiscal drive is damaged, it will have to be replaced. Due to high demand, this part is in short supply, you will have to wait for its supply, and again time is money.

- Cash desk is not available. You can enter into an agreement for the supply of a cash register, but wait for an unknown amount of time for the cash register itself, since it is not in stock. For the inspectors, the agreement does not matter: if there is no cash register, you will receive a fine.

- Wrong model. If in the course of work the entrepreneur does not find the functionality of the purchased cash register to be quite convenient and sufficient, he is unlikely to replace the expensive purchase for this reason, and will have to put up with the inconvenience for quite a long time.

Online cash registers in 2020: how it works

What is the mechanism? Any sale will be recorded: at the moment when the seller (cashier) punches the receipt, the online cash register automatically generates a fiscal sign and sends it to the fiscal data operator. This information is stored by the operator. The seller is sent a unique

check number, which takes about one and a half seconds. In parallel, the fiscal data operator transmits information about the sale to the Federal Tax Service. The intermediary operator can be a Russian company that has received appropriate permission from the state.

Having purchased an online cash register in 2020, the seller will be required to send an electronic receipt to the buyer on a smartphone or email if the consumer provides such data. At the buyer's request, the seller is also obliged to issue a paper version of the receipt, with a QR code. Having received it, the buyer will be able to verify the authenticity of the purchase data via the Internet. And also whether this information was transferred to the Federal Tax Service.

Step-by-step instructions for choosing an online cash register for an entrepreneur

- We decide on deadlines. If you need a cash register “yesterday,” that is, you belong to the category of entrepreneurs who do not have the right to work without it after July 2020, you need to purchase it immediately. Those starting in 2020 also don’t have much time. Expect a one and a half to two month wait when pre-ordering. If you have them, calmly choose a supplier. If not, give preference to those that have cash registers, which should be carefully checked.

- We choose a supplier. Should you order a cash register from a large retailer or give preference to a newcomer with more attractive conditions? You decide. The following points speak in favor of the first option:

- Established companies purchase cash registers in large quantities, so there is a greater chance of finding the goods in stock;

- large wholesalers are always a priority for manufacturers;

- For serious companies, reputation is more valuable than money.

Of the 16 companies that received OFD status in the Russian Federation, 5 are recognized as the largest “players” in this industry:

- OFD platform (Evotor);

- Taxcom;

- First OFD;

- Tier (Shtrikh-M);

- Peter-Service.

- We make a choice of an online cash register model. This is the most serious and difficult point. Below we will give recommendations on choosing a cash register for various types of entrepreneurs. Important indicators that may influence this choice: check load on a given outlet per day;

- amount of information on the check;

- whether automated accounting is maintained at this outlet (the accounting system must be compatible with the online cash register);

- reliability of the Internet point of sale;

- number of products in the assortment;

- whether alcohol is sold at the outlet (or is planned to be sold) - the cash register must be specially adapted and have a function for writing off balances.

FOR YOUR INFORMATION! Unskillful independent registration can be fraught with damage to the fiscal drive!

Generating checks

1. When paying for goods via the Internet, is there any time period during which you need to print a receipt and transfer it to the fiscal data operator (FDO).

For example, 5 minutes from the moment of payment? There should be no time delays. According to the new law, the check must be sent to the OFD immediately after it is generated.

2. Is it necessary to generate a new receipt if the buyer entered the email address and phone number with an error and noticed this after payment?

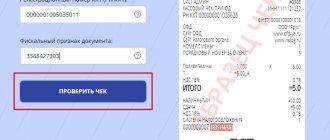

If the buyer made a mistake, then the responsibility lies with him. There is no need to generate a new check, as this will lead to it being doubled. Just tell the buyer the parameters of the receipt by which he can find it in electronic format (in the OFD, or the “Checking Cash Receipt” mobile application for Android and iOS).

3. Do I need to issue a receipt when returning goods?

According to the new rules, the return operation requires the issuance of a check. In such a situation, for the new check detail “Settlement attribute” you need to select the value “Receipt return”.

4. How to issue a check when returning something other than “same day”?

For any return, a cash receipt is issued, in which the value “Return of receipt” is selected in the “Settlement attribute” detail. In this case, the return does not have to be carried out on the same day and can be done at any cash desk of the organization (that is, not necessarily at the same one at which the sales receipt was made).

5. Is the QR code on the receipt printed automatically or do I need to enable special settings for this?

On the paper version of the receipt, the code is printed automatically, but for this you need to enable the appropriate setting at the cash register. And in case of sending an electronic check, the QR code is generated by the fiscal data operator.

6. If an organization uses a simplified taxation system, is it required to print the complete nomenclature on the receipt?

If you do not sell excisable goods and are an individual entrepreneur, you may not indicate the name and quantity of the goods on the receipt until 02/01/2021.

7. What information about the cashier, besides his full name, must be indicated on the check?

In addition to the cashier's full name, his position is indicated. In the electronic version of the check sent to the OFD, in FFD 1.05 and 1.1 formats, it is also necessary to indicate the cashier’s INN, if any. If the cash register is used in non-operator mode (payments on the Internet, payment terminals and vending), the machine number must be printed/displayed on the receipt.

8. When using an online cash register, is it necessary to keep a register of the cashier/operator?

If you use an online cash register, then you do not need to keep a log of the cashier-operator. This point is explained in the letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/5441.

9. If the agreement with the OFD does not provide for the transfer of the check to the buyer, who should transfer it: the online cash register (ATOL) or the company itself should provide for this possibility?

The company must provide for this possibility itself.

Every business has its own cash register

Depending on the specifics of the type of business activity and its volume, it makes sense to purchase one or another online cash register model, which will make work more convenient and accounting more accurate. Let's consider the nuances of choosing a cash register for different areas of business.

Small retail companies

If a company registers only 3-4 sales per day, and they need a cash register exclusively for receipts, cash register is just following the letter of the law, a necessary formality. Such entrepreneurs can purchase the most budget option: an autonomous cash register that cannot be moved and does not have a built-in modem (cable Internet or Wi-Fi). In appearance it looks like a large calculator. This model is convenient to work with outdoors, so it is applicable for markets, tents, and open pavilions: there is no touch screen that could break, the seller can interact with it even while wearing gloves.

Prices for such a cash register are in the range of 12,000 – 25,000 rubles.

Small shops

From 5 to 50 customers make purchases at such retail outlets per day, and cashiers scan the goods using a barcode. There are usually no queues in such stores, so the speed of service is not too important.

In these cases, it is more advisable to purchase an online cash register equipped with a barcode reader. It is more convenient if it has a built-in modem: if there is no Wi-Fi in the store, you can always use the mobile Internet from the phone’s SIM card. Additional functions of such cash registers: viewing sales reports, analyzing demand for goods (which are sold more, which are sold less). You can integrate such a cash register with the 1C and My Warehouse programs.

A mobile online cash register with a barcode reader and a built-in modem costs from 25,000 to 45,000 rubles.

Cafes, fast food establishments

There is a large flow of clientele in such retail outlets, and everyone wants to be served quickly. The cash register should quickly knock out 50 to 200 checks per day. It is better for such enterprises to choose equipment that has the following useful functions:

- large screen - more information will fit on it, so the cashier can quickly click on the desired type of product and issue a receipt without delay;

- compatibility with a payment terminal - if the cash register is not compatible, then card payments will be long and unpleasant for customers waiting in line (the amount and PIN code must be entered manually);

- keeping track of balances (the cashier can easily see that a product in demand is running low and can quickly notify about the need for replenishment);

- the ability to postpone the check (the cashier does not close the order until the person has left, because the client can order something else, and then the payment will occur immediately with one document).

These functions greatly simplify and speed up the work of a cashier in such establishments.

The issue price is from 25,000 to 55,000 rubles.

Online stores

The online store generates cash receipts for the ordered goods and transfers them to the courier or to the point of delivery. The client who has paid and received the goods takes the corresponding receipt. In such conditions the following will be useful:

- built-in modem (KKT will work from the mobile Internet);

- battery – independent of power sources;

- mobility;

- deferred checks (the client can book several items and then select one or more of them, so you can issue a check only for the desired item and give it to the client along with the goods);

- a cash register that combines the functions of a regular and online store - after all, the client can pay when receiving the goods at the point of issue, and not receive the goods from a courier or by mail, so there is no need to buy an additional stationary cash register.

Cash desks that can simultaneously work in online sales and retail trade cost 30,000–40,000 rubles.

What to consider when choosing

The “I’ll buy anything, as long as it’s cheaper” approach doesn’t work here, because online cash registers are not a talisman in case of checks. They make the cashier's job easier and help you earn more. There are six criteria to pay attention to.

Internet connection type

To send all data on payments at a point of sale to the Federal Tax Service, the cash register needs access to the Internet. There are suitable solutions for every type of communication.

Wired Internet

An excellent option for stationary trading. This type of connection is supported by autonomous cash registers, fiscal registrars and some smart terminals - for example, MTS Cashier 7″ Black.

Wi-Fi and mobile internet

Suitable for both mobile and stationary trading. Smart terminals are compatible with these types of communications, but for autonomous cash registers and fiscal registrars you need to purchase an additional communication module. There is no point in overpaying for traffic and speed - a tariff with 1 GB per month and 256 Kbps is enough to operate the cash register.

If everything is really sad with the Internet, buy a cash register that can work offline. Purchase data is stored in the device’s memory, and the cash register sends it to the Federal Tax Service when a connection appears.

Number of products in the store

The connection with the choice of cash register is simple. Clause 4.7 of 54-FZ states that the cash register receipt must contain the name of the product sold. For incorrect checks, the fine for officials is from 1,500 to 3,000 rubles, for a legal entity - from 5,000 to 10,000 rubles.

The store has up to 50 products

A small store will have enough capabilities of an autonomous cash register. It itself does not print the name of the product, but there is a life hack: when you add products to the checkout nomenclature, connect it to your computer and assign a code to each name. When selling, the cashier enters the code - magic, the desired name appears on the receipt.

However, the Federal Tax Service is preparing a surprise for entrepreneurs: it is planned to introduce a unified database where manufacturers will enter data on manufactured goods - a kind of analogue of the Unified State Automated Information System, but not for alcohol. Trade organizations will have to add this data to the list of goods sold, downloading them from the common database. Without connecting to the database, trading will be considered illegal.

From 2020, clothing, bed linen, shoes, tobacco products, perfumes and eau de toilette, tires and tires, and cameras are subject to mandatory labeling. Autonomous cash registers technically cannot load data according to such rules, so sooner or later they will have to be replaced with smart terminals or cash registers with a fiscal registrar.

There are more than 50 products in the store

The larger the assortment, the easier acceptance, sales and accounting should be. Smart terminals and cash registers with a fiscal registrar can do this. With an autonomous cash register, service takes longer, and cashier errors are possible.

With MTS smart terminals, you can add products to the list automatically by downloading an Excel document with the assortment. You can do it manually: you scan the barcode, the cash register finds the product in the global directory of all products entered in the MTS system, and adds it to the list. When selling products, it is convenient to search for goods by scanning a barcode, and the most popular items should be placed on the cash register panel.

Mobile or stationary cash register?

The mobile cash register operates from a battery, while the stationary one operates from the network. If a store experiences power outages, a mobile checkout is better. However, if the lights are turned off rarely and not for long, stationary cash registers with a built-in battery are also suitable: for example, “MTS Cash Desk 5″ will easily last 24 hours.

Mobile cash registers are useful for couriers and for traveling sales. Some models can accept bank cards - like MTS Kassa 5 and Litebox 5 with an acquiring terminal.

If you sell large items, a mobile checkout will make life much easier for the cashier and customers: instead of carrying bulky items to the checkout, you can scan a barcode on the sales floor.

Store traffic

Long queues may be a pleasant sight for the store owner, but they usually scare away customers. Service at the checkout should take a minimum of time. You can speed up cash transactions and the process of printing a receipt.

To avoid entering each product manually, you need a barcode scanner. It connects via USB or microUSB, so make sure that the cash register has enough connectors for a scanner, scales and a bank terminal. If you don’t want to get tangled up in wires, choose models with a built-in scanner: for example, MTS Kassa 5″, LiteBox 5, LiteBox 8 or LiteBox X. The bank terminal can be connected via Wi-Fi, which makes it more convenient for the buyer to enter the PIN code .

As for checks, here cash registers are divided into three categories:

- with low printing speed - up to 90 mm per second;

- with an average speed - from 90 to 150 mm per second;

- with high speed - from 150 mm per second.

Fast checkouts are suitable for supermarkets; for a small store, a cheaper checkout with an average printing speed will be enough.

Type of store activity

Sale of non-food products

You can choose any cash register you like - the law does not impose any additional requirements.

Sale of goods subject to veterinary control

These are meat and meat products, fish, dairy products. Here we need cash desks that support work with FSIS "Mercury". It’s very good if you can connect a scanner to the checkout: this way you can confirm the delivery of goods in the information system by simply scanning the barcode.

Large retail chains

Large stores like the Ikea chain admit several hundred people a day. In addition to the requirements for fast data entry, cash desks must also promptly print receipts so as not to delay the flow of customers. Naturally, it is important that the screen is large, the barcode scanner is fast, and the payment terminal is integrated with the cash register. If the supermarket is a grocery store, it would be good to take care of protecting the keyboard from moisture and grease that may get on it. It makes sense to order a cash register from the manufacturer that is adapted to the needs of a specific store.

It will cost from 80,000 to 250,000 rubles.

IMPORTANT INFORMATION! The price of the cash register does not include the costs of additional services, without which it will not function: connection, concluding an agreement with the OFD, registration, configuration, further maintenance.

Estimated price of online cash register in 2020

The price of an online cash register in 2020 worries many. But, first of all, not all trade organizations will have to buy them. Many modern models of cash registers provide the possibility of upgrading with the installation of the necessary software and fiscal storage. Such modernization could cost, according to preliminary data, approximately 4,000–5,000 rubles.

The price of a new cash register will depend on the specifics of the specific model. Some will cost about 17,000 - 30,000 rubles, others are cheaper. But there will also be multifunctional modern experimental models costing 30–40 thousand rubles.

You can find out in detail about the requirements for new cash registers in Article 4 of the new edition of Federal Law No. 54-FZ dated May 22, 2003. To the cost of the cash registers you will need to add the price of the contract with the fiscal data operator. Approximately, for one cash register it will be about 4,000 rubles per year.

If you register the cash register yourself, then no cash costs will be required. If you seek help from a third-party organization to obtain a cash register registration service, you will have to pay in the amount of 1,000 to 1,500 rubles. An individual entrepreneur who has never used an online cash register before will need to undergo training, which costs from 1000 to 1500 rubles.

Another cost when using a cash register is the cost of its software update (new firmware). When concluding an agreement for the maintenance of a cash register, costing about 3,000 rubles per year, the update work will be free. But purchasing the update itself will cost from 1,500 to 2,000 rubles.

Tax deductions for online cash register

Update: The deductions described below were valid for cash register purchases before July 1, 2020. In 2020, these tax deductions are no longer valid.

The costs described above for purchasing and operating an online cash register are not small. Therefore, our state decided to reduce the burden for some categories of individual entrepreneurs when purchasing a cash register.

Law No. 349-FZ dated November 27, 2017 “On Amendments to Part Two of the Tax Code of the Russian Federation” allows individual entrepreneurs to apply a tax deduction for online cash registers from January 1, 2020.

For each registered online cash register, you will be reimbursed 18,000 rubles. However, for this it is necessary to fulfill a number of conditions:

- The cash register must be included in the official register of the Federal Tax Service;

- KTT must be registered with the Federal Tax Service;

- Individual entrepreneurs on PSN or UTII in the field of retail trade or public catering, using hired labor, can receive a deduction if they registered a cash register from February 1, 2020 to July 1, 2020. Those. the purchase and registration of a cash register for this category of individual entrepreneurs in 2020 will not allow the return of 18,000 rubles spent on the purchase of the cash register;

- Individual entrepreneurs on UTII and PSN in the field of retail trade and catering without the use of hired labor, as well as in the provision of personal services (regardless of whether there are employees or not) can receive a deduction if they registered a cash register from February 1, 2020 to July 1, 2019 .

Are there any inexpensive cash registers suitable for small businesses?

Of course have. For example, the 1C:Kassa software and hardware complex consists of a stand-alone cash register and a cloud application (online service) 1C:Kassa, deployed in the 1C:Enterprise 8 via the Internet service. The 1C:Kassa complex is intended for small non-automated retail enterprises. It allows you to organize work in accordance with 54-FZ in one or more retail outlets.

The cost of a cash register with a fiscal drive is 28,000 rubles, without a fiscal drive - 22,000 rubles.

Payment aggregator: what is it, why is it needed and how to choose?

A payment aggregator is an online system that takes care of your worries about collecting and correctly distributing all payments received to you across accounts and payment services.

A good aggregator works with cash on delivery, payment systems/services, and virtual currencies. Easily and quickly streamline mutual settlements, legalize the circulation of money in accordance with the requirements of the law - all these are the tasks of the aggregator. Of course, they charge their own commission for the service; in different services the figure ranges from 3 to 5%. But if you compare the costs of working with a bank (this includes both installation and maintenance of cash registers, according to the law) and the commission of a payment aggregator, which allows you to work even without a cash register, the benefits are obvious. It’s cheaper, faster and easier to interact with the aggregator and pay for a full-fledged sufficient service than to “get in” for about 50 thousand rubles one-time. for installing the cash register, and then pay for its maintenance and, of course, pay the bank its commission.

There are now a lot of aggregators and payment acceptance services on the Russian market. First of all, I consider the “big three leaders” - the most famous, authoritative, popular and in demand:

- YANDEX.KASSA - works with Visa, MasterCard, Maestro, MIR bank cards, electronic money and banking, supports interaction with Apple Pay and Android Pay. Claims 20 payment methods for the end user. Commission - 3.5%, withdrawals twice a day.

- RBK Money - works with bank cards and transfers, DeltaPay and Euroset payment terminals, Alfa-Click Internet banking and electronic money, supports interaction with Apple Pay and the Contact money transfer system. Claims 11 payment methods for the end user. Commission - 3.9%, withdrawal of funds - the next day.

- ROBOKASSA - works with Visa, MasterCard bank cards, electronic money and online banking accounts, interacts with instant payment terminals, mobile operators and communication stores, Apple Pay and Android Pay. Claims 26 payment methods for the end user. Our partners include the aforementioned Tochka bank, i.e. through Robokassa with Tochka you can open an individual entrepreneur if necessary. Without departing, so to speak, from “Robokassa”. Commission - 3.9%, withdrawal of funds - the next day.

Let's put it this way: does a seamstress girl need to withdraw money from Yandex.Checkout twice a day? Yes, this is important: a microbusiness literally counts every penny. The option “quickly receive money from yesterday’s client to pay for material for today’s customer” is the key to constant productivity. But no less important is the client paying for the order in a conveniently located Beeline salon or through an instant payment terminal, like at Robokassa. Because both the Seamstress and the Reseller want their diverse customers to be able to pay for their orders in any convenient place. Each businessman determines his own priorities, but RBK Money is unlikely to suit all three of our businesses, because, unfortunately, it does not work with individuals.

The micro-business of a seamstress may be confused by the commission of Robokassa; it is higher than that of Yandex.Kassa; however, it is useful to know that Robokassa has a rate of 2.3% to 3.9%. As the store's turnover increases, the service commission decreases. And this is important for our third business, “Study T-shirt,” which already has a network of stores and is counting on further growth. As the business grows, it switches to a different service tariff, reducing its commission. For example, when the turnover (the sum of all payments received through the service) reaches 500 thousand rubles. per month, the “Real” tariff is used with a commission for payment by card of 2.9%, and with a turnover of more than 10 million rubles. per month - “VIP” tariff with a commission of 2.3%.

“Seamstress” and “Reseller” should also pay attention to the number of payment methods. RBK Money has only 11 of them, which significantly reduces its attractiveness (and then only when working with legal entities), in contrast to Yandex.Kassa (20) and Robokassa (the clear leader in this parameter - 26 methods) .

At the same time, cooperation with the aggregator will allow microbusinesses to save on input from 35 to 70 thousand rubles. This is exactly the cost of a new cash register, which should be provided to trade organizations. And one more thing: the costs will not end with one CCP installation - for its implementation, design and maintenance you will also have to pay from 5-7 thousand rubles. in year. And for micro-businesses, the opportunity to save on equipment and trade without breaking the law is vital. With a good aggregator, you can trade without even buying or using a cash register. That. even if you pay 3.9% of turnover, then your costs will definitely be less than the investment in interaction with the bank and less than the investment in installing and maintaining a cash register. Just the ability to work without a cash register saves a business from 40 to 100 thousand rubles. in year.

Finally, both Yandex.Kassa and RBK MONEY interact with only one settlement bank each, while Robokassa interacts with three. Why is this important for business? When the bank of “your” aggregator begins to have some problems, you, as an entrepreneur, risk losing your working capital, which is stored and serviced in the bank. No one is 146% insured against risks, disasters and other force majeure, but still, it is safer to choose someone who can switch business services from one bank to another in case of problems. We need a stable service that will not allow money to be “frozen”, because in small businesses there is already little of it.

Well, since RBK MONEY has a much smaller “window of opportunity”, both in terms of the form of an entrepreneur (only a legal entity) and in the number of payment options (half as many as others), I didn’t consider it further.

For geeks and not only: how to connect and support the system

For all three of the described entrepreneurs, who most likely have only now come to their senses and want to integrate into the legal trading system as quickly as possible, the speed and ease of connecting services is important.

And you need to pay attention to this when studying the conditions for depositing and withdrawing money offered by the aggregator. As a rule, payment acceptance begins after online registration, but withdrawal of money is possible only after receiving the original documents with “bruises” and signatures. With modern aggregators, registration is carried out online, and connection to the payment system is done quite quickly: with Yandex.Kassa within two days (the same terms for Tinkoff and Tochka), with Robokassa - within 24 hours (by the way, not waiting for receipt of documents with stamps). Even taking into account the nuances of each aggregator, the procedure for concluding an agreement is much simpler than in banking. The package of required documents is much thinner, and the connection speed is higher. Plus, each aggregator has its own useful features. At Robokassa, this is a simple registration of individual entrepreneurs in the process of work. Thanks to the aggregator’s partnership with Tochka Bank, our “Shveya” can register an individual entrepreneur in two clicks and get everything you need, as part of the Russian telecommunications giant, it facilitates the integration of the online store with Yandex sales control and analysis services, such as Yandex. Metrics" and "Yandex.Market".

And as a potential small business participant, I think I won’t lie if I say: programmers decide everything. A business of two or even ten people does not want to fuss with connection features or hire a “team of hackers” to configure and debug. There is neither money for this nor labor. Therefore, you need to choose an aggregator that will either do everything for you, or its connection will be so simple that you can do everything in two or three clicks without special knowledge. Both Yandex.Kassa and Robokassa have no problems with this. And the latter is implemented in 48 different website engines (CMS).

Of course, problems are possible even with the current level of technology development. We remember how in December 2020 there was a total failure in the operation of online cash registers, due to which both large and small businesses lost the ability to trade and report normally for several hours. Nobody wants to solve problems with services and “catch bugs” while being distracted from trading. Therefore, when choosing any form or type of integration into the “financial system in accordance with 54-FZ”, you need to pay attention to the work of support. In many payment processing services, it is not possible to reach support right away. Opinions about Yandex.Checkout support are quite varied, but there are often complaints about low response speed, lack of competence and desire to understand the intricacies. Robokassa also has dissatisfied users, but in general it has a clear interface, initially tailored for an entrepreneur who is far from IT (and therefore unadvanced). This understanding can be very useful to a novice businessman who does not have a friend like me who “cuts.” You need to plan and calculate your risks and labor costs in advance, so as not to be distracted from the actual production and trade.

Tips for choosing

Today, the market is replete with a choice of cash register devices, so you need to figure out what you should pay attention to when choosing equipment.

- Number of visitors daily. Professionals recommend choosing autonomous equipment if the flow of visitors does not exceed 100 people per day, since they perform the simplest functions: printing checks and transmitting data to the Federal Tax Service, and therefore are easy to use.

- Number of trading positions. Everything is simple here: the wider the range, the more modern equipment you will need. In terms of cost, it will be more expensive than outdated models, however, it will pay for itself twice as quickly, as it has a number of additional features.

- Taxation. Equipment is selected depending on the type of taxation.

All of the above factors undoubtedly influence the choice of an online cash register. But the most important thing is to know the law. It is he who determines whether you will be able to work on the device you purchased or whether you will have to spend a little more time replacing the equipment.

Responsibility for violation of Federal Law No. 54-FZ

Failure to comply with established obligations leads to the imposition of fines on the violator. Thus, individual entrepreneurs and legal entities selling goods at retail may be subject to sanctions in the amount of:

- 10,000 rubles if the cash register equipment they use does not comply with legal requirements within the established time frame.

- 10,000 rubles if the cash register has not passed mandatory certification.

- 10,000 rubles if the check was not sent to the buyer at his request.

- 30,000 rubles if the retail outlet operates without a new online cash register.