Draft Law No. 682709-7 on introducing amendments to Federal Law No. 54 was taken up for consideration by the State Duma on 04/05/2019. In a fairly short time, the document was adopted in 3 readings and approved by the Federation Council. On June 7, news appeared: V.V. Putin signed the law, and it comes into force with the assigned number Federal Law No. 129 and the date 06/06/2019.

The most welcome change made to this act concerns a two-year delay in the introduction of cash register equipment for entrepreneurs. In addition, the law provides for certain relaxations for the transport industry, public utilities, the educational sector and several other areas.

So, which individual entrepreneurs can hold off on using cash register terminals until 2021, and which “private traders” have the transition mechanism made easier? Are tax deductions relevant? How much has the administrative measure of liability for failure to comply with standards changed? Let's discuss this in more detail.

Cancellation of cash registers for small businesses until 2021

Law No. 129 on the application of amendments to the 54th Federal Law provides many preferences for small businesses and certain non-profit areas. Some were given a 2-year deferment, some had their cash register systems completely abolished, and for others the transition procedure itself was made easier. The original text of the document is presented on the Internet resource of the State Duma of Russia.

The transition to full-scale introduction of CCM was initially planned to be carried out in 3 doses. The first one ended on July 1, 2017. Switched to new equipment:

- large retailers on OSN and STS, who previously used cash desks with EKLZ;

- online stores that accept cash and non-cash payments;

- selling excisable products.

At the time of completion of the 2nd stage (07/01/2018), the cash desks are operated by:

- merchants on UTII and PSN in retail trade, public catering, maintaining hired staff;

- online stores that accept electronic money, cash on delivery, payment by bank receipts;

- vending, using hired employees.

The third and final stage was planned for July 1 of this year. Before the introduction of innovations, the obligation to connect online cash registers was assigned to retail trade, the public catering sector (PSN, UTII) and the vending business without the involvement of hired labor. This also applied to all individual entrepreneurs and LLCs in the service segment. Most of the merchants in these areas were counting on a deferment until the very end. On February 20, 2019, at the board of the Federal Tax Service, Minister of Finance A. Siluanov announced the need to increase the connection period for cash registers for individual entrepreneurs by one year.

Entrepreneurs counted on the speedy advancement of the minister's initiative. There were no official comments then. After 1.5 months, a bill to abolish cash registers for individual entrepreneurs until 2021 was submitted to the Duma. Its initiator was Andrei Makarov, the head of the Duma Budget Committee. At the moment, the innovations in Federal Law No. 54 have acquired legal force. What has changed in the procedure for transferring to new cash register equipment after the amendments will be discussed below.

Reasons for canceling online cash registers for individual entrepreneurs until 2021

Relaxations on the distribution of cash registers are associated with several points. This has been stated many times by many representatives of the civil service. The deferment for cash register equipment until 2021 is due to the prospect of introducing a new tax affecting “self-employed” Russians.

Experimentally, a project of such a tax is already being tested in Moscow, the Moscow and Kaluga regions, and the Republic of Tatarstan. From the beginning of 2020, a phased introduction of tax collection is planned in other regions of Russia. Those working as “private traders” will be able to independently choose the level of involvement - “self-employed” or individual entrepreneur. The need to connect cash registers will directly stem from this choice.

Which individual entrepreneurs canceled cash registers until 2021?

The expected amendments to defer cash registers until 2021 were adopted for execution on June 6, after the act of law was signed by the President. Preferences are relevant for individual workers, those who hire employees on a one-time basis, without drawing up an employment contract. In what areas is this possible:

- Providing paid services: tutoring, massage, accounting, programming. Hairdressing, excursion, legal and other services.

- Execution of work: repairmen, restorers, seamstresses, tailors, etc. - persons working for themselves.

- Sale of self-made goods: sale of your own baked goods, paintings, souvenirs, jewelry, “piece” products.

Valuable note: for the individual entrepreneurs mentioned above, the cancellation of cash registers until 2021 is valid if there are no employees registered under an employment agreement. Having hired even one employee, you will need to register the cash terminal for tax purposes within thirty days.

What will change

It’s not so much the cash registers that can be modified that are changing, but the order in which they are used.

All actions with cash register equipment (CCT) will take place through the “Taxpayer’s Personal Account” on the website of the Federal Tax Service. Here you can complete electronic registration of cash registers, post documents, and receive requests from tax authorities. They plan to expand the list of services. To access your account, you will need a qualified electronic signature. Instead of a control tape, a replaceable fiscal drive will be installed at the cash register. This is a special device for encrypting and protecting information about all calculations. They will be transmitted to the tax office in real time.

Cancellation of cash registers for individual entrepreneurs until 2021 and additional benefits in Federal Legislation

For convenience, the new nuances of Law No. 54 should be divided into 3 components: deferment, cancellation, benefits for the use of cash registers. The first group was discussed above, let's talk in more detail about the other components.

Enrollment, return of advance payments

In accordance with the current Federal Law, from July 1, 2019, owners of cash register systems who take an advance payment are required to generate 2 checks, or strict reporting forms. This should be done when crediting an advance, issuing goods, or providing a service. Clarification - if the client does not receive the paid item at the time of payment. Those who sell tickets to entertainment events (concerts, etc.), selling tickets and coupons in public transport are partially spared from this need. Those who provide online services, hosting, mobile communication services. Dealers of electronic books and computer programs. Now they do not have to transfer the 2nd check to the buyer (Federal Law No. 192 of July 3, 2018). Now it is quite enough to create a single fiscal document, including in it the calculations for crediting and repayment made during the 1st month.

Since June 6, this list has been supplemented by educational organizations, security firms, and business executives in the housing and communal services industry. The document generation period has been increased from 1 to 10 days (from the time the calculation is completed).

Payment of utility services

Organizations that collect fees for housing and utilities are now allowed to issue paper checks (CO forms). You can send them digitally only following a written request from the client (within five days of receiving such a request). If, within ninety days from the date of formation of the document, no application is received, the company’s obligations are fulfilled. Checks must be punched and handed over to the OFD no later than five days from the date of receipt of payment.

The benefit is not valid for direct payment by the client in cash or electronic money at the office of the service organization.

Who has been completely exempted from using cash register machines?

The updated regulation provides for a complete exemption from cash register equipment and the abolition of the issuance of checks for certain business segments:

- Retail sale of shoe covers using vending machines or other means. Previously, this amendment concerned the sale of periodicals in kiosks, kvass and milk from tanks, making keys and other activities listed in paragraph 2 of Art. 2 Federal Law No. 54;

- Sale of theater tickets. The option is available for those who sell tickets by hand or by tray. When trading online, you will need to send an electronic receipt to the buyer;

- Leasing by individual entrepreneurs of premises and places for cars that belong to them by law.

The listed categories receive the right not to connect online cash registers, and may not provide checks without additional conditions.

Cancellation of cash registers until 2021: who did not receive a deferment?

Despite changes in the law, the final, 3rd stage of cash reform is not cancelled. A group of private entrepreneurs who had a deferment until June 1 will have to connect cash terminals this year, as planned. The cancellation of cash registers until 2021 does not apply to:

- merchants on PSN and “imputed tax”, selling goods not made by themselves and not using the labor of hired workers;

- entrepreneurs and legal entities (OSN, simplified tax system, PSN and UTII) operating in the service sector with hired employees;

- organizing catering on UTII and PSN, where there are no hired personnel;

- vending business owners without hired employees.

According to the new law, an extension is not provided for such individual entrepreneurs. By the end of June, they must install the required cash register equipment and register it with the Federal Tax Service.

Will cash register equipment be canceled until 2021 for cooperatives and partnerships?

Before the adoption of changes to the 54th Federal Law, it was assumed that from July 1, 2019, homeowners’ associations would receive payments from individuals only using a cash register (Article No. 1 of Federal Law No. 192). This point caused some dissatisfaction among the heads of homeowners' associations and housing cooperatives. They organized an initiative group to collect votes to repeal this regulation.

The head of the Duma division responsible for housing and communal services and housing policy, Galina Khovanskaya, fully supported the side of the “utility workers” during the consideration of bill No. 682709-7. She managed to achieve success. Although online cash registers for partnerships and cooperatives were not completely abolished, additional conditions were proposed. If they are followed, installation of equipment will be optional. The list of “beneficiaries” includes:

- Homeowners' association in apartment buildings. Non-profit unions of gardeners and gardeners;

- Housing cooperative;

- Commercial and non-profit organizations providing paid services in the field of education;

- Physical education and sports institutions;

- creativity and leisure centers.

Such conditions are relevant only in the case of the provision of specialized services. Payment for them must be transferred non-cash, without direct interaction with payers. In case of personal payment in cash or electronic money at the organization’s office, the benefit will not work.

Cancellation of online cash register until 2021 in the transport industry

Cancellation of online cash register equipment until 2021 is valid for all individual entrepreneurs on UTII, PSN, OSN and simplified tax system operating in the service segment. The fundamental point is that there should be no officially hired employees. The deferment also applies to private carriers operating their own or rented cars.

In addition, the list of legal entities and individual entrepreneurs who have the ability to use cash register systems on a remote basis has been legislatively supplemented. Before the introduction of innovations, this option was available to online stores, owners of vending machines (except for those selling excisable goods) and transport with automated payment acceptance. Were added:

- peddling trade;

- Internet sales with delivery by couriers;

- public transport, etc. with ticket sales in the salon;

- service companies issuing strict reporting forms;

- work or services performed outside the office premises: repairs, cleaning, etc.;

- devices for paying for the services of car washes, shoe shines, self-service laundries, etc.

Personnel of organizations providing services that perform work on-site to the customer are no longer required to carry cash registers. Now it is enough to install one terminal in the company’s office and use it to carry out all cash transactions.

Innovations in the law do not eliminate the need to issue a check to the client and send data to the Fiscal Data Operator. However, it became optional to print checks and forms. You can do one of the following methods:

- send to tel. subscriber number or email mail a link with the check data on the Federal Tax Service or OFD website;

- show QR code from your phone, tablet, etc. — the client reads information using a mobile application. In the future, you can easily print a check from the Federal Tax Service website.

If the payer has not requested a check, the law will be considered complied with.

To provide a check to passengers, drivers and conductors can use the following options:

- transfer documents in paper or digital format if the cash register operates in a salon;

- send fiscal receipt data to the client’s phone number or email;

- show QR code;

- print a link or QR code on the ticket so that the passenger can then receive a digital receipt.

Currently, public transport organizations, taxi companies, and cargo transportation companies may not need to connect a cash terminal in every vehicle. This allows them to eliminate the significant costs associated with the implementation and maintenance of additional equipment.

Who can use remote online cash registers

According to Yulia Rusinova, previously only online stores were allowed to accept money away from the cash register, when accepting payment through a vending machine (with restrictions: only if they do not issue excisable or technically complex goods) and for transporting goods and passengers using automatic devices. Now the list has been expanded, and you can do this:

- At the place where services are provided, if it does not coincide with the premises where the cash register is installed.

- When selling tickets in transport.

- For peddling and distance selling of goods.

- In machines with built-in devices for paying for services like an automatic laundry.

- When paying for housing and communal services without using cash or presenting a bank card.

- In the service sector, if an organization is required by law to use strict reporting forms.

In addition, in each of the above cases, it is not necessary to print a paper check. It can be sent electronically by email or phone number, and also provided in the form of a QR code, with which the client reads all information about the payment. If an organization is required to provide a strict reporting form, it has the right to place details for identifying a cash receipt directly on it.

When paying for transport fares, it is possible to indicate information with which the client will receive information about payments directly on the tickets. We are talking about a link or code.

Are tax deductions relevant when renewing online KKM for UTII until 2021?

The innovations of the 54th Federal Law on Cash Systems have already gained legal force. Nowadays, small businesses are concerned about what to do with already purchased cash terminals; can they count on tax deductions in this case? The Russian Tax Service provided formal explanations in letter No. ED-4-20/7260 dated April 17, 2019. It says that if an entrepreneur used a legal extension, he is deprived of the opportunity to deduct taxes.

Tax compensation for the costs of implementing cash register systems does not exceed eighteen thousand rubles. The payment is available to entrepreneurs on PSN and UTII who do not employ hired employees. Those who issued a cash register before July 1, 2020.

If a businessman on the “imputed tax” or Patent Taxation System wants to develop and hire employees over the next two years, he is recommended to purchase and register cash register equipment now. According to the letter from the tax authorities, this is an extreme opportunity to receive a payment; an extension of this benefit is not expected. If an entrepreneur plans to switch to a tax for “self-employed” in the near future, he should use the deferment and conduct business as usual.

What technique to use

There is no need to change the cash register right away: first you need to clarify whether it will be modernized. This can be done from the manufacturer, on the Federal Tax Service website or at a technical service center.

If the device is subject to modernization, you need to buy a software upgrade kit and deregister the cash register with the Federal Tax Service. After this, you need to replace the electronic control tape with a fiscal drive, update the software, enter into an agreement with the fiscal data operator and register the device with the tax office. This will take some time, so there is no need to delay.

Cash desks that cannot be upgraded will have to be replaced. Models of the new type can be found here.

Extension of cash registers until 2021 - news on penalties

The State Duma of the Russian Federation is planning a one-year moratorium on administrative sanctions for the lack of a cash register during mutual settlements with a client. The news was announced at a meeting of the “budget and tax” committee of the Duma, preceding the second reading of bill No. 682709-7.

A. Makarov, who proposed the “freezing” of fines, noted that not all Russian regions are yet ready for the third stage of the CCP reform, so it will take some time to bring certain areas of commerce to the requirements of Federal Law No. 54.

The moratorium is valid until July 1, 2020. It concerns companies required to use cash registers in the public utilities and transport segments.

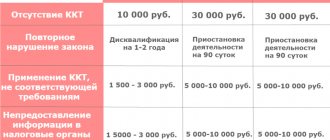

Fines and risk areas

For those who were required to switch, but never switched to online cash registers, the likelihood of being fined for violating the law increases.

The fact is that the Federal Tax Service carries out inspections and identifies risk areas. This is implemented, among other things, using the tax office’s mobile application for checking checks and additional commercial services for collecting checks and providing cashback.

These measures are aimed at increasing the vigilance of ordinary buyers and facilitating checks on the issuance of checks to consumers, as well as sending an electronic check to the Federal Tax Service. Already, the tax office checks more than 2 million checks a day.

Let me remind you that fines for non-use of cash register systems amount to up to ¾ of the settlement amount for legal entities, and half of the settlement amount for individual entrepreneurs in accordance with Article 14.5 of the Code of Administrative Offenses of the Russian Federation. And in case of repeated violation, the measure can be tightened up to the suspension of business activity for 90 days.