Who is allowed 1 cash register: list

Let’s say right away that the law contains many small innovations on the use of cash register systems in various types of trade and forms of check transfer.

Thus, to reduce costs, some organizations and individual entrepreneurs are allowed to use one cash register that works remotely. We are talking about the following types of activities:

- trade using couriers;

- transportation of passengers and luggage by transport (including when selling tickets by drivers and conductors);

- provision of other services.

Moreover, in such cases, the right is given not to print a cash receipt on paper, but to provide the buyer (client) with the opportunity to receive it by showing a QR code (new clause 3.1 of Article 1.2 of the Law on Cash Register). Then the person reads it and identifies it.

By law, the obligation to provide a cash receipt (CSR) can be ensured by reflecting a QR code. Its structure includes:

- date and time of calculation;

- serial number of the fiscal document;

- calculation sign;

- settlement amount;

- serial number of the fiscal drive;

- fiscal sign of the document.

Also see “Current issues regarding working with online cash registers”.

Who received exemption from online cash registers for UTII

When paying to a bank account, no cash register is needed.

You can open an account here.

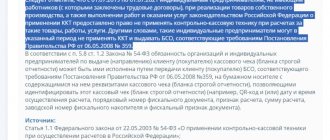

If the buyer receives a payment document on a strict reporting form, there is no need for cash register equipment. Until July 2020, forms are ordered from a printing house and filled out by hand, and then printed using automated systems.

Without a cash register, you can work in hard-to-reach areas where there is no Internet or roads. The list of such places is established by regional authorities. You cannot sell alcohol without a cash register. Alcohol sellers in hard-to-reach areas install cash registers without the Internet and check their fiscal accounts at the tax office.

Without cash registers, newspapers, lottery tickets, transport tickets, food at universities, religious items, etc. are sold.

Who was allowed not to carry a cash register with them?

New paragraphs 5.6-5.10 of Art. 1.2 of the Law on Cash Registers allows the use of cash register equipment with an online element not at the place of payment in the following cases:

- payments (except for non-cash payments via the Internet) for goods during retail and distance trading (except for services for the transportation of passengers, luggage, cargo, as well as transactions with a machine that dispenses goods and displays a QR code);

- settlements at the place of performance of work and/or provision of services that are performed outside a retail facility, retail location, building, structure, structure and their parts and/or land plot used for performance of work and/or provision of services on the basis of ownership, lease or other rights on legal grounds;

- provision of services to the public using forms approved by the federal authorities, with a QR code and/or the necessary set of details;

- payments by the driver or conductor in the vehicle cabin when selling travel documents (tickets) and coupons for travel on public transport;

- accepting payments for housing and utilities.

Who is covered by the deferment law?

Until 2021, self-employed citizens have the opportunity to decide whether they want to register as an individual entrepreneur or remain in the same status. In the first case, they will need to purchase a cash register, but in the second, they will not. You don’t have to spend money on the following individual entrepreneurs:

- Those engaged in trading through vending machines, in which one product costs no more than 100 rubles.

- Pharmacies in villages.

- Enterprises in hard-to-reach settlements included in the relevant list of regional authorities.

- Self-employed, i.e. self-employed. This option is only possible in the Moscow and Kaluga regions, as well as in Moscow.

- Retail outlets selling bottled drinking water or milk.

- Newsstands.

- Individual entrepreneur selling shoe covers at retail.

Also, cash register payments may not be used for non-cash payments if:

- Provides educational services in the field of education.

- Houses, palaces of culture and other socio-cultural institutions provide cultural services.

It turns out that most entrepreneurs, even if they already wrote checks, will have to purchase online cash registers. It doesn’t matter what exactly they do: trade, work for themselves or provide services. Even couriers who deliver goods will have to use cash registers in order to issue a receipt. The changes affected online stores, tutors and clothing manufacturers.

However, some categories were still given another deferment for CCP until 2021. These include:

- Individual entrepreneurs without employees selling goods of their own production. It does not matter whether the products are sold wholesale or retail.

- Individual entrepreneurs without employees providing services to the public. For example, photographers, tutors, nannies or programmers.

- Entrepreneurs who perform any work. For example, many individual entrepreneurs provide accounting services for companies. This category also includes small-scale custom production, repair and construction work, etc.

Important! To receive a deferment, the listed individual entrepreneurs must work for UTII or PNS and not have hired employees.

However, some concepts in the law are specified quite vaguely. For example, it is not very clear what “own-produced goods” are. And since there is no specific official definition, this issue causes a lot of discussion. For example, an individual entrepreneur makes his own ceramic mugs and then sells them. And another businessman buys finished products and prints images on them. In the second case, the individual entrepreneur will not be able to receive a deferment, since goods of own production are considered to be those produced on the territory of the entrepreneur. If the raw materials are received from another business entity, then the activities of the individual entrepreneur will be equated to trade.

New in utility bills

The law simplified the procedure for using cash register systems in the field of housing and communal services and the provision of services by resource supply organizations. This is a new edition of clause 2.1 of Art. 1.2 of the Law on CCP.

In particular, utility companies are given the right to choose from two options:

1. Instead of issuing (sending) a cash receipt, print its individual details on the payment document for the next month.

2. In the absence of document flow between utility companies and home/property owners, issue (send) a cash receipt only at the client’s request (if the request arrives no later than 3 months from the date the receipt is generated).

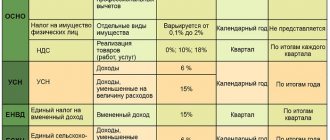

Online cash registers for individual entrepreneurs who have the right to a deferment, but combine “imputation” with another regime

Let's look at the rules for using cash registers when combining UTII with other taxation regimes using an example.

Entrepreneur without employees:

- on the “imputed market” it sells goods of its own production to individuals;

- on the simplified tax system with the object “income”, it sells imported goods to individuals and legal entities.

In relation to operations for the sale of imported goods to individuals, he is obliged to use cash register systems (Clause 7.1, Article 7 of Law No. 290-FZ). He should purchase an online cash register and start issuing cash receipts to them from 07/01/2019.

Online cash register for entrepreneurs

The adopted law also extended the period use of cash register equipment for individual entrepreneurs who meet two conditions:

1. There are no hired personnel under employment contracts.

2. Sale of goods of own production, performance of work, provision of services.

Now an online cash register for individual entrepreneurs is not required until 2021. Namely, until July 1, 2021. Art. speaks about this. 2 of the law under consideration.

KEEP IN MIND

Such individual entrepreneurs, in the event of concluding an employment contract with a person, are required to register an online cash register within 30 calendar days from the date of conclusion of such an agreement.

Cancellation of online cash registers for micro-enterprises

For the most part, microbusinesses are most concerned about the abolition of online cash registers. For entrepreneurs, taking into account the bills submitted to the State Duma, a relaxation may still follow. In any case, so far the introduced bills have not been considered or rejected by deputies. In addition, a bill on a tax deduction for those who use UTII and PSN, which will allow, albeit not completely, to reduce the costs of new cash registers, is still under consideration and has not been adopted. But for now, in order for online cash registers to be canceled for individual entrepreneurs, at least one of the bills on their abolition must be considered and adopted by the State Duma. At the moment, there is no provision for canceling online checkouts for small businesses.

Fines for breaking the law

Extending the deferment period for UTII is an important relief that allows many entrepreneurs to postpone (but not cancel) an expensive purchase. But before that, you need to carefully study the legislation and understand whether the individual entrepreneur has the right to extend the period without CCP. Otherwise, you may fall under penalties from the Federal Tax Service, which can reach 30 thousand rubles.

Penalty for lack of cash register

- If an individual entrepreneur does not have the right to defer the purchase of a cash register, but still has not purchased a cash register, then the fine will be 25% or 50% of the revenue received. In this case, the payment amount cannot be less than 10,000 rubles.

- Repeated violation, coupled with a large amount of revenue, threatens the temporary suspension of the entrepreneur.

- The absence of a paper or electronic check, depending on the situation, can cost 2 thousand rubles.

- If the cash register was purchased and registered, but does not meet the conditions specified by law, then the fine will be 1,500 - 3,000 rubles.

If the violation was recorded for the first time, the company can get off with a simple warning. But repeated non-compliance with the bill will have to be “responsible in rubles.” CCT costs a lot, but it is much easier to buy the device on time and register it.

Why is an online cash register used?

Despite the difficulties associated with the transition to new cash registers, this reform will bring many benefits to all participants. Buyers will trust sellers more, and the government will be able to track price changes and charge a fair tax. However, for a few more years, a number of individual entrepreneurs can go about their business without worrying about purchasing a cash register. These categories include enterprises without employees that sell goods of their own production or provide services to the public. In other cases, a deferment is not provided, so it is better not to postpone the purchase and register the online cash register as quickly as possible.

https://youtu.be/aOQegDoszv0

Who does this law not apply to?

Since the law on the mandatory introduction of online cash registers appeared back in 2020, this is most likely the last postponement. Most companies have already switched to new CCPs and are using them in their work. This list includes:

- online stores;

- Individual entrepreneurs selling excise goods (cigarettes, alcohol);

- IP on the simplified tax system or OSNO;

- enterprises with hired employees;

- entrepreneurs working in the field of public catering and retail sales (of goods not produced in-house).

What a cash register system looks like The

deferment does not apply to those individual entrepreneurs who have signed an employment contract with an employee or changed their field of activity. For example, if a citizen sells his educational courses through an online store, then the deferment applies to him. But if he decides to add souvenir products to the assortment or hires an employee, then he no longer falls under preferential conditions. In this case, the businessman must inform the tax office about the changes within a month, buy a cash register, register it and put it on record.

Note! For individual entrepreneurs who have employees or work under the simplified tax system or OSNO, a postponement of the implementation of cash registers is not provided.

The law provides for exemption from the need to purchase cash register equipment for the following organizations:

- working in the field of housing and communal services, security or education and providing services to the population;

- courier and transport companies, as well as those individual entrepreneurs who trade using couriers.

They were not given a full deferment, but they were allowed not to issue a separate check for a refund or advance. Instead of paper, they can show clients a QR code or send the document by email. This is especially convenient for those companies that use cloud cash registers. Installing such virtual software allows you to store all data on the server and remotely control the point of sale. A virtual online cash register is relevant for stores that engage only in online sales.

Features of deferment for online cash registers for UTII

For small businesses, purchasing an online cash register can put a significant dent in your budget. The average cost of a CCP is 20,000 rubles, and this does not take into account the costs of setting up and maintaining the device. That is why some categories of individual entrepreneurs are entitled to a deduction. Entrepreneurs on UTII or PSN who work in the field of trade or food and who purchased and registered the device before the beginning of July 2019 can apply for compensation.

Another feature of deferment is the combination of several tax regimes. If the “imputation” is combined with the simplified tax system, then you still need to purchase an online cash register. Otherwise, a violation will be recorded.

Other changes in the law

The law on online cash registers has been repeatedly supplemented and improved. The main goal of the changes was the gradual and gentle introduction of cash register systems, which would not affect business activities. The most significant amendments were adopted in 2020:

- Owners of individual vending machines are allowed to use one online cash register for several points. But at the same time, the objects of trade should not be excise goods or equipment, and a QR code should be displayed on the display after purchase.

- The cash receipt must be sent by email or SMS to the client's number. In some cases it may not be printed. Also, the cash register must save the data on the fiscal drive and send it to the tax office.

- The payment system now includes not only cash and non-cash funds, but also advances, prepayments, payments using bonuses or electronic money. That is, they are required to issue a receipt even if the buyer paid for the goods with Yandex money.

The process of switching to online cash registers

- The QR code must be displayed on the printed receipt.

- After the liquidation of the company, there is no need to deregister the online cash register: this will happen automatically.

- When making payments between individual entrepreneurs and companies, new details have been added that must be indicated on checks.

- Entrepreneurs selling tickets to cultural events, working in the transportation sector and offering certain services are allowed to create a single document that reflects all transactions for a billing period of no more than a month.

- Organizations doing business in the housing and communal services sector can issue checks only at the request of clients. However, they have the right to a deferment of up to 10 days.

The adopted changes to the Law on Online Cash Registers make the transition to a new mode of operation easier for many entrepreneurs.